Key Insights

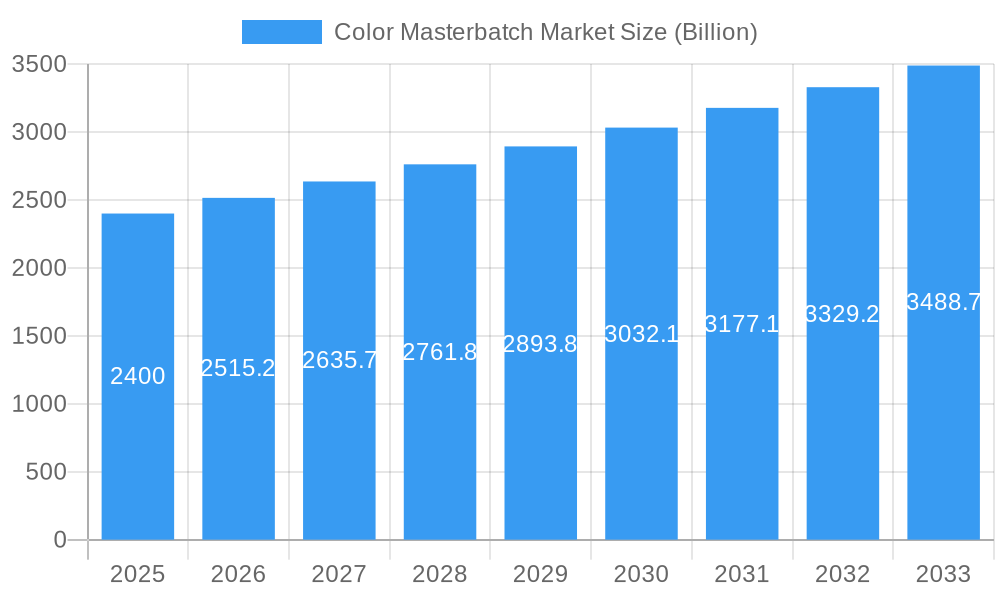

The global Color Masterbatch Market is poised for significant expansion, projected to reach approximately $2.4 billion in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 4.8% through 2033. This robust growth trajectory is fueled by increasing demand across diverse end-user industries, most notably packaging and building & construction, which leverage color masterbatches for aesthetic appeal, brand differentiation, and product identification. The automotive sector also contributes substantially, utilizing colored plastics for interior and exterior components. Furthermore, the burgeoning demand for vibrant and consistent coloration in consumer goods, coupled with advancements in masterbatch technology enabling enhanced durability and specialized effects, are key drivers propelling market value. Emerging economies, particularly in the Asia Pacific region, are expected to be major contributors to this growth due to rapid industrialization and a rising middle class with increasing purchasing power.

Color Masterbatch Market Market Size (In Billion)

Despite the overall positive outlook, certain factors could influence the market's trajectory. The rising cost of raw materials, including pigments and polymers, may present a restraint. However, ongoing innovations in sustainable and eco-friendly masterbatch solutions, alongside the development of high-performance colorants with improved lightfastness and heat resistance, are expected to mitigate these challenges and open up new avenues for market penetration. The market's segmentation by type reveals a strong presence of White and Black Masterbatches, followed by Colour Masterbatches, indicating their widespread application. The dominance of Polypropylene and Polyethylene as primary polymers underscores their versatility and cost-effectiveness in masterbatch formulations. Strategic collaborations, research and development in novel colorant technologies, and expansion into untapped geographical regions by key players will be crucial for capitalizing on the immense opportunities within the Color Masterbatch Market.

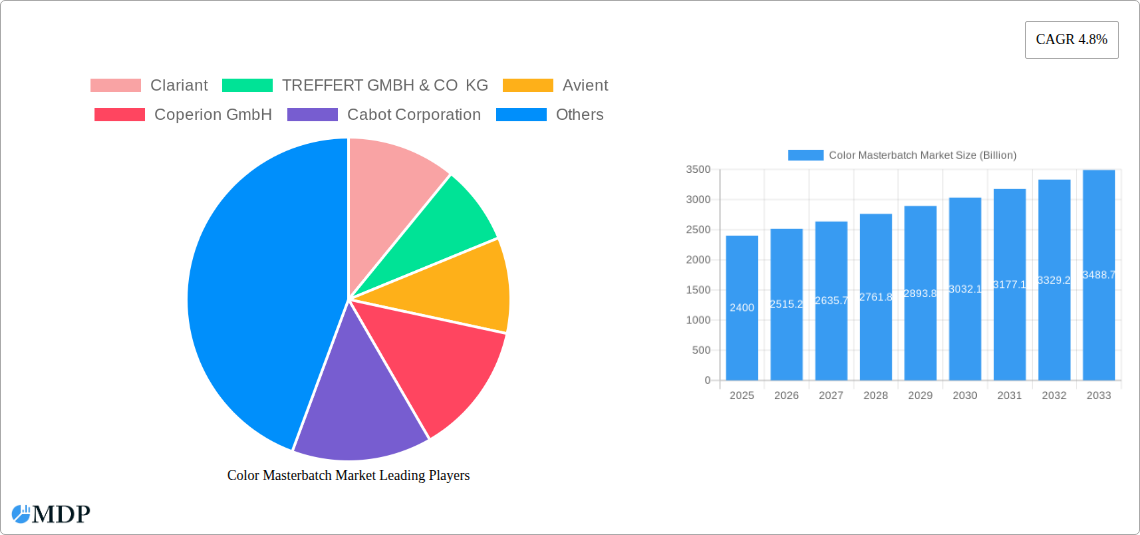

Color Masterbatch Market Company Market Share

Here's an SEO-optimized and engaging report description for the Color Masterbatch Market, meticulously crafted for maximum search visibility and stakeholder attraction, incorporating all requested details without modification.

Color Masterbatch Market: Comprehensive Industry Analysis and Forecast (2019–2033)

Unlocking the vibrant future of color in plastics! This definitive report offers an in-depth exploration of the global Color Masterbatch Market, a critical component driving innovation and aesthetics across myriad industries. Delving into the period from 2019–2033, with a detailed focus on the Base Year of 2025 and a robust Forecast Period of 2025–2033, this analysis provides unparalleled insights into market dynamics, growth trajectories, and emerging opportunities. Discover how advancements in White Masterbatch, Black Masterbatch, Colour Masterbatch, Additive Masterbatch, and Special Effect Masterbatch are shaping the Polypropylene, Polyethylene, High Impact Polystyrene, Polyvinyl Chloride, and Polyethylene Terephthalate sectors. Understand the critical role of color masterbatches in key end-user industries including Building & Construction, Packaging, Automotive & Transportation, Electric & Electronic, Consumer Goods, Agriculture, and niche segments like Healthcare and Textile.

This comprehensive market study is essential for manufacturers, suppliers, R&D professionals, investors, and strategic planners seeking to capitalize on the evolving landscape of color masterbatch solutions. Gain actionable intelligence to navigate competitive pressures, identify market gaps, and drive sustainable growth in this dynamic sector.

Color Masterbatch Market Market Dynamics & Concentration

The Color Masterbatch Market exhibits a moderately consolidated landscape, characterized by the presence of both global giants and specialized regional players. Innovation serves as a primary driver, with continuous research and development focused on enhancing color vibrancy, consistency, and processing efficiency, alongside the creation of novel special effect masterbatches that cater to evolving aesthetic demands. Regulatory frameworks, particularly concerning environmental impact and food contact safety, are increasingly influencing product formulations and manufacturing processes, necessitating adherence to stringent standards. Product substitutes, such as liquid colorants or direct pigmentations, exist but often lack the ease of handling, consistency, and cost-effectiveness offered by masterbatches for high-volume applications. End-user trends are heavily influenced by consumer demand for visually appealing and durable products, particularly in packaging, automotive, and consumer goods, driving the need for sophisticated color solutions. Merger and acquisition (M&A) activities are moderate, primarily driven by companies seeking to expand their geographical reach, technological capabilities, or product portfolios. For instance, strategic acquisitions allow larger entities to integrate specialized expertise and gain market share. Key market players are actively pursuing strategies to increase their market share through technological advancements and the expansion of their product offerings in high-demand segments.

Color Masterbatch Market Industry Trends & Analysis

The Color Masterbatch Market is poised for significant expansion, driven by a confluence of robust growth drivers and transformative technological disruptions. The escalating demand for aesthetically appealing and functionally superior plastic products across a multitude of end-user industries is a primary catalyst. From vibrant packaging that captures consumer attention to sophisticated interior components in automobiles, the role of color is paramount in product differentiation and brand identity. The Packaging segment, in particular, continues to be a dominant force, propelled by the growth of the e-commerce sector and the increasing consumer preference for eye-catching product presentation. Furthermore, advancements in polymer science and processing technologies are enabling the development of high-performance color masterbatches that offer enhanced UV resistance, heat stability, and chemical inertness, thereby expanding their applicability in demanding environments like the Automotive & Transportation and Electric & Electronic sectors. The push towards sustainable solutions is also creating new avenues for growth, with an increasing focus on masterbatches that are compatible with recycled plastics and bio-based polymers. This trend is encouraging innovation in color formulations that can maintain their integrity and performance even when incorporated with post-consumer recycled materials. Consumer preferences are evolving rapidly, with a growing inclination towards personalized and unique color palettes, pushing manufacturers to offer a wider spectrum of shades and special effect options, including metallic, pearlescent, and matte finishes. The competitive dynamics within the market are characterized by a blend of global leaders and agile regional players, all striving to meet the diverse and evolving needs of their clientele. Companies are investing heavily in R&D to develop innovative color solutions that not only enhance visual appeal but also offer functional benefits, such as improved light blocking or antimicrobial properties. The CAGR for the Color Masterbatch Market is projected to be strong, reflecting the sustained demand and ongoing technological advancements. Market penetration is deep across major economies, with emerging markets showing significant growth potential due to industrialization and rising disposable incomes. The pursuit of higher value-added products and solutions, rather than just commodity-based offerings, is a key trend shaping the strategic direction of leading companies in this space.

Leading Markets & Segments in Color Masterbatch Market

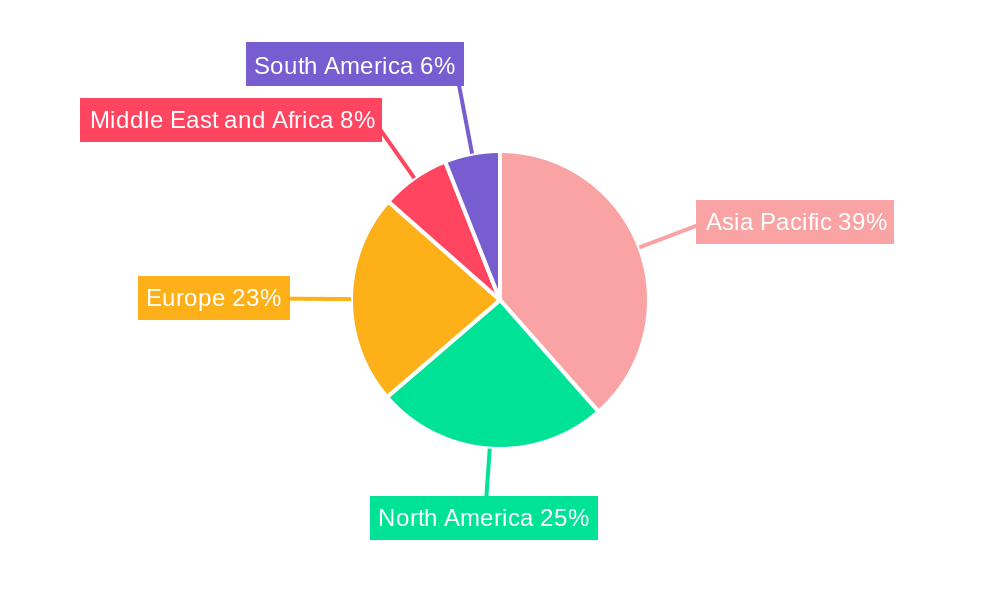

The Color Masterbatch Market is spearheaded by dominant regions and segments driven by specific economic, technological, and demand-side factors.

Dominant Region: Asia Pacific currently leads the Color Masterbatch Market, largely fueled by rapid industrialization, a burgeoning manufacturing base, and significant investments in sectors like packaging and automotive across countries like China, India, and Southeast Asian nations. Favorable government policies supporting manufacturing growth and infrastructure development further bolster this dominance.

Dominant Segments:

Type:

- Colour Masterbatch: This segment holds the largest market share due to its broad applicability across almost all end-user industries for aesthetic enhancement and product identification. The demand for a vast array of vibrant and consistent colors drives its widespread adoption.

- White Masterbatch: Essential for opacity, brightness, and as a base for other colors, white masterbatch is crucial for applications ranging from packaging films to consumer goods and building materials, contributing significantly to market volume.

- Black Masterbatch: Widely used for UV protection, opacity, and aesthetic appeal in products like agricultural films, automotive parts, and electrical cables, black masterbatch commands a substantial market share.

Polymer:

- Polyethylene (PE) and Polypropylene (PP): These commodity polymers represent the largest share due to their extensive use in packaging (films, bottles), consumer goods, and agricultural applications. The flexibility and cost-effectiveness of PE and PP make them ideal substrates for color masterbatches.

- Polyvinyl Chloride (PVC): A significant segment driven by applications in building and construction (pipes, profiles, flooring) and medical devices, where color plays a crucial role in identification and aesthetics.

End-User:

- Packaging: This is the largest end-user segment, encompassing flexible and rigid packaging for food and beverages, consumer goods, and industrial products. The need for shelf appeal, brand differentiation, and product protection makes color masterbatches indispensable.

- Building & Construction: Significant demand arises from applications such as pipes, window profiles, siding, roofing membranes, and flooring, where color contributes to both aesthetics and functional identification.

- Automotive & Transportation: Color masterbatches are vital for interior and exterior components, including dashboards, bumpers, trim, and lighting, enhancing vehicle aesthetics and brand appeal.

Key Drivers for Dominance:

- Economic Policies: Pro-growth manufacturing policies and trade agreements in regions like Asia Pacific boost production and consumption of plastics, thereby driving masterbatch demand.

- Infrastructure Development: Growing investments in construction and infrastructure projects globally, especially in developing economies, directly translate to increased demand for PVC and PE-based color masterbatches.

- Consumer Trends: The increasing disposable income and demand for visually appealing consumer goods, electronics, and automotive interiors worldwide are pushing the adoption of a wider range of colors and special effects.

- Technological Advancements: Innovations in masterbatch formulations that offer enhanced performance characteristics (e.g., UV stability, scratch resistance) broaden their applicability in demanding sectors.

Color Masterbatch Market Product Developments

Recent product developments in the Color Masterbatch Market focus on enhanced performance and sustainability. Cabot Corporation's launch of PLASBLAK XP6801D black masterbatch, a SAN-based formulation, addresses the styrenics market's need for superior color and mechanical properties without compromise. Avient Corporation's capacity expansion at its Vietnam plant signifies a strategic move to improve speed-to-market and customer service for unique color solutions, reflecting a trend towards localized production and specialized offerings. These innovations aim to provide processors with masterbatches that offer improved dispersion, higher color strength, and better thermal stability, enabling the creation of sophisticated and visually striking plastic products across diverse applications.

Key Drivers of Color Masterbatch Market Growth

The Color Masterbatch Market is propelled by several pivotal growth drivers. The escalating demand for visually appealing and differentiated plastic products across diverse industries, particularly packaging and automotive, is paramount. Technological advancements enabling the development of high-performance masterbatches with enhanced properties such as UV resistance and heat stability further fuel growth. The increasing adoption of recycled plastics, coupled with a growing emphasis on sustainable color solutions, is creating new opportunities for innovation. Furthermore, favorable government initiatives promoting manufacturing and infrastructure development in emerging economies are contributing to a sustained increase in the consumption of colored plastic goods.

Challenges in the Color Masterbatch Market Market

Despite robust growth, the Color Masterbatch Market faces several significant challenges. Stringent environmental regulations and evolving compliance requirements for certain pigments and additives can impact product formulations and increase R&D costs. Volatility in raw material prices, particularly for pigments and polymers, can affect profit margins and pricing stability. Intense competition among numerous players, both global and regional, leads to price pressures, especially in commoditized segments. Supply chain disruptions, as witnessed in recent years, can lead to delays and increased operational costs. Furthermore, the demand for highly customized and specialized color solutions requires significant investment in R&D and production flexibility, which can be a barrier for smaller market participants.

Emerging Opportunities in Color Masterbatch Market

The Color Masterbatch Market is ripe with emerging opportunities. The growing trend towards sustainable plastics and the increasing use of recycled materials present a significant opportunity for developing specialized masterbatches that are compatible with these substrates while maintaining color integrity and performance. The expansion of the electric vehicle (EV) market is driving demand for specialized masterbatches with enhanced flame retardancy and specific aesthetic requirements for EV components. Furthermore, the rise of smart packaging and the demand for functional masterbatches that offer properties like antimicrobial protection or enhanced barrier capabilities are opening new avenues for innovation and market penetration. Strategic partnerships between masterbatch manufacturers and polymer producers or end-users can foster the development of tailored solutions for niche applications.

Leading Players in the Color Masterbatch Market Sector

- Clariant

- TREFFERT GMBH & CO KG

- Avient

- Coperion GmbH

- Cabot Corporation

- Hubron International

- Americhem

- Ochre Media Pvt Ltd

- Tosaf

- Ampacet Corporation

- ALOK MASTERBATCHES PVT LTD

- BARS-

Key Milestones in Color Masterbatch Market Industry

- November 2020: Cabot Corporation launched PLASBLAK XP6801D black masterbatch, a unique styrene-acrylonitrile (SAN)-based formulation that meets the needs of the styrenics market without the usual trade-off between color and mechanical properties.

- January 2021: Avient Corporation completed an extension of its current color concentrate production capacity at its Vietnam plant in Binh Duong. The move will improve speed-to-market and service level for local customers seeking unique color solutions to enhance the aesthetics and appeal of high-quality end products.

Strategic Outlook for Color Masterbatch Market Market

The Color Masterbatch Market is set for continued robust growth, driven by an increasing demand for high-performance and aesthetically pleasing plastic products. Strategic opportunities lie in the development of sustainable masterbatch solutions compatible with recycled and bio-based polymers, aligning with global environmental consciousness. The expanding applications in electric vehicles and advanced packaging solutions will necessitate specialized masterbatches with unique functionalities, such as enhanced thermal management and UV protection. Companies that invest in advanced R&D, focus on customer-centric product development, and expand their global footprint, particularly in emerging markets, are well-positioned to capitalize on future market potential. Strategic collaborations and acquisitions will remain crucial for consolidating market presence and acquiring new technologies.

Color Masterbatch Market Segmentation

-

1. Type

- 1.1. White Masterbatch

- 1.2. Black Masterbatch

- 1.3. Colour Masterbatch

- 1.4. Additive Masterbatch

- 1.5. Special Effect Masterbatch

-

2. Polymer

- 2.1. Polypropylene

- 2.2. Polyethylene

- 2.3. High Impact Polystyrene

- 2.4. Polyvinyl Chloride

- 2.5. Polyethylene Terephthalate

- 2.6. Others

-

3. End-User

- 3.1. Building & Construction

- 3.2. Packaging

- 3.3. Automotive & Transportation

- 3.4. Electric & Electronic

- 3.5. Consumer Goods

- 3.6. Agriculture

- 3.7. Others (Healthcare, Textile, etc.)

Color Masterbatch Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Argentina

- 4.2. Brazil

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Color Masterbatch Market Regional Market Share

Geographic Coverage of Color Masterbatch Market

Color Masterbatch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand in Plastic packaging Industry; Increasing Demand of Plastic in Automotive Industry

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Price; Strict Environmental Regulations

- 3.4. Market Trends

- 3.4.1. Packaging Segment Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Color Masterbatch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. White Masterbatch

- 5.1.2. Black Masterbatch

- 5.1.3. Colour Masterbatch

- 5.1.4. Additive Masterbatch

- 5.1.5. Special Effect Masterbatch

- 5.2. Market Analysis, Insights and Forecast - by Polymer

- 5.2.1. Polypropylene

- 5.2.2. Polyethylene

- 5.2.3. High Impact Polystyrene

- 5.2.4. Polyvinyl Chloride

- 5.2.5. Polyethylene Terephthalate

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Building & Construction

- 5.3.2. Packaging

- 5.3.3. Automotive & Transportation

- 5.3.4. Electric & Electronic

- 5.3.5. Consumer Goods

- 5.3.6. Agriculture

- 5.3.7. Others (Healthcare, Textile, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Color Masterbatch Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. White Masterbatch

- 6.1.2. Black Masterbatch

- 6.1.3. Colour Masterbatch

- 6.1.4. Additive Masterbatch

- 6.1.5. Special Effect Masterbatch

- 6.2. Market Analysis, Insights and Forecast - by Polymer

- 6.2.1. Polypropylene

- 6.2.2. Polyethylene

- 6.2.3. High Impact Polystyrene

- 6.2.4. Polyvinyl Chloride

- 6.2.5. Polyethylene Terephthalate

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Building & Construction

- 6.3.2. Packaging

- 6.3.3. Automotive & Transportation

- 6.3.4. Electric & Electronic

- 6.3.5. Consumer Goods

- 6.3.6. Agriculture

- 6.3.7. Others (Healthcare, Textile, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Color Masterbatch Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. White Masterbatch

- 7.1.2. Black Masterbatch

- 7.1.3. Colour Masterbatch

- 7.1.4. Additive Masterbatch

- 7.1.5. Special Effect Masterbatch

- 7.2. Market Analysis, Insights and Forecast - by Polymer

- 7.2.1. Polypropylene

- 7.2.2. Polyethylene

- 7.2.3. High Impact Polystyrene

- 7.2.4. Polyvinyl Chloride

- 7.2.5. Polyethylene Terephthalate

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Building & Construction

- 7.3.2. Packaging

- 7.3.3. Automotive & Transportation

- 7.3.4. Electric & Electronic

- 7.3.5. Consumer Goods

- 7.3.6. Agriculture

- 7.3.7. Others (Healthcare, Textile, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Color Masterbatch Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. White Masterbatch

- 8.1.2. Black Masterbatch

- 8.1.3. Colour Masterbatch

- 8.1.4. Additive Masterbatch

- 8.1.5. Special Effect Masterbatch

- 8.2. Market Analysis, Insights and Forecast - by Polymer

- 8.2.1. Polypropylene

- 8.2.2. Polyethylene

- 8.2.3. High Impact Polystyrene

- 8.2.4. Polyvinyl Chloride

- 8.2.5. Polyethylene Terephthalate

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Building & Construction

- 8.3.2. Packaging

- 8.3.3. Automotive & Transportation

- 8.3.4. Electric & Electronic

- 8.3.5. Consumer Goods

- 8.3.6. Agriculture

- 8.3.7. Others (Healthcare, Textile, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Color Masterbatch Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. White Masterbatch

- 9.1.2. Black Masterbatch

- 9.1.3. Colour Masterbatch

- 9.1.4. Additive Masterbatch

- 9.1.5. Special Effect Masterbatch

- 9.2. Market Analysis, Insights and Forecast - by Polymer

- 9.2.1. Polypropylene

- 9.2.2. Polyethylene

- 9.2.3. High Impact Polystyrene

- 9.2.4. Polyvinyl Chloride

- 9.2.5. Polyethylene Terephthalate

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Building & Construction

- 9.3.2. Packaging

- 9.3.3. Automotive & Transportation

- 9.3.4. Electric & Electronic

- 9.3.5. Consumer Goods

- 9.3.6. Agriculture

- 9.3.7. Others (Healthcare, Textile, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Color Masterbatch Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. White Masterbatch

- 10.1.2. Black Masterbatch

- 10.1.3. Colour Masterbatch

- 10.1.4. Additive Masterbatch

- 10.1.5. Special Effect Masterbatch

- 10.2. Market Analysis, Insights and Forecast - by Polymer

- 10.2.1. Polypropylene

- 10.2.2. Polyethylene

- 10.2.3. High Impact Polystyrene

- 10.2.4. Polyvinyl Chloride

- 10.2.5. Polyethylene Terephthalate

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Building & Construction

- 10.3.2. Packaging

- 10.3.3. Automotive & Transportation

- 10.3.4. Electric & Electronic

- 10.3.5. Consumer Goods

- 10.3.6. Agriculture

- 10.3.7. Others (Healthcare, Textile, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Clariant

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TREFFERT GMBH & CO KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Avient

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Coperion GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cabot Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hubron International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Americhem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ochre Media Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tosaf

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ampacet Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ALOK MASTERBATCHES PVT LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BARS-

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Clariant

List of Figures

- Figure 1: Global Color Masterbatch Market Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: Global Color Masterbatch Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Color Masterbatch Market Revenue (Billion), by Type 2025 & 2033

- Figure 4: Asia Pacific Color Masterbatch Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Color Masterbatch Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Color Masterbatch Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Color Masterbatch Market Revenue (Billion), by Polymer 2025 & 2033

- Figure 8: Asia Pacific Color Masterbatch Market Volume (K Tons), by Polymer 2025 & 2033

- Figure 9: Asia Pacific Color Masterbatch Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 10: Asia Pacific Color Masterbatch Market Volume Share (%), by Polymer 2025 & 2033

- Figure 11: Asia Pacific Color Masterbatch Market Revenue (Billion), by End-User 2025 & 2033

- Figure 12: Asia Pacific Color Masterbatch Market Volume (K Tons), by End-User 2025 & 2033

- Figure 13: Asia Pacific Color Masterbatch Market Revenue Share (%), by End-User 2025 & 2033

- Figure 14: Asia Pacific Color Masterbatch Market Volume Share (%), by End-User 2025 & 2033

- Figure 15: Asia Pacific Color Masterbatch Market Revenue (Billion), by Country 2025 & 2033

- Figure 16: Asia Pacific Color Masterbatch Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: Asia Pacific Color Masterbatch Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Color Masterbatch Market Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Color Masterbatch Market Revenue (Billion), by Type 2025 & 2033

- Figure 20: North America Color Masterbatch Market Volume (K Tons), by Type 2025 & 2033

- Figure 21: North America Color Masterbatch Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: North America Color Masterbatch Market Volume Share (%), by Type 2025 & 2033

- Figure 23: North America Color Masterbatch Market Revenue (Billion), by Polymer 2025 & 2033

- Figure 24: North America Color Masterbatch Market Volume (K Tons), by Polymer 2025 & 2033

- Figure 25: North America Color Masterbatch Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 26: North America Color Masterbatch Market Volume Share (%), by Polymer 2025 & 2033

- Figure 27: North America Color Masterbatch Market Revenue (Billion), by End-User 2025 & 2033

- Figure 28: North America Color Masterbatch Market Volume (K Tons), by End-User 2025 & 2033

- Figure 29: North America Color Masterbatch Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: North America Color Masterbatch Market Volume Share (%), by End-User 2025 & 2033

- Figure 31: North America Color Masterbatch Market Revenue (Billion), by Country 2025 & 2033

- Figure 32: North America Color Masterbatch Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Color Masterbatch Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Color Masterbatch Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Color Masterbatch Market Revenue (Billion), by Type 2025 & 2033

- Figure 36: Europe Color Masterbatch Market Volume (K Tons), by Type 2025 & 2033

- Figure 37: Europe Color Masterbatch Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe Color Masterbatch Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe Color Masterbatch Market Revenue (Billion), by Polymer 2025 & 2033

- Figure 40: Europe Color Masterbatch Market Volume (K Tons), by Polymer 2025 & 2033

- Figure 41: Europe Color Masterbatch Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 42: Europe Color Masterbatch Market Volume Share (%), by Polymer 2025 & 2033

- Figure 43: Europe Color Masterbatch Market Revenue (Billion), by End-User 2025 & 2033

- Figure 44: Europe Color Masterbatch Market Volume (K Tons), by End-User 2025 & 2033

- Figure 45: Europe Color Masterbatch Market Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Europe Color Masterbatch Market Volume Share (%), by End-User 2025 & 2033

- Figure 47: Europe Color Masterbatch Market Revenue (Billion), by Country 2025 & 2033

- Figure 48: Europe Color Masterbatch Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe Color Masterbatch Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Color Masterbatch Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Color Masterbatch Market Revenue (Billion), by Type 2025 & 2033

- Figure 52: South America Color Masterbatch Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: South America Color Masterbatch Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Color Masterbatch Market Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Color Masterbatch Market Revenue (Billion), by Polymer 2025 & 2033

- Figure 56: South America Color Masterbatch Market Volume (K Tons), by Polymer 2025 & 2033

- Figure 57: South America Color Masterbatch Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 58: South America Color Masterbatch Market Volume Share (%), by Polymer 2025 & 2033

- Figure 59: South America Color Masterbatch Market Revenue (Billion), by End-User 2025 & 2033

- Figure 60: South America Color Masterbatch Market Volume (K Tons), by End-User 2025 & 2033

- Figure 61: South America Color Masterbatch Market Revenue Share (%), by End-User 2025 & 2033

- Figure 62: South America Color Masterbatch Market Volume Share (%), by End-User 2025 & 2033

- Figure 63: South America Color Masterbatch Market Revenue (Billion), by Country 2025 & 2033

- Figure 64: South America Color Masterbatch Market Volume (K Tons), by Country 2025 & 2033

- Figure 65: South America Color Masterbatch Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Color Masterbatch Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Color Masterbatch Market Revenue (Billion), by Type 2025 & 2033

- Figure 68: Middle East and Africa Color Masterbatch Market Volume (K Tons), by Type 2025 & 2033

- Figure 69: Middle East and Africa Color Masterbatch Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Color Masterbatch Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Color Masterbatch Market Revenue (Billion), by Polymer 2025 & 2033

- Figure 72: Middle East and Africa Color Masterbatch Market Volume (K Tons), by Polymer 2025 & 2033

- Figure 73: Middle East and Africa Color Masterbatch Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 74: Middle East and Africa Color Masterbatch Market Volume Share (%), by Polymer 2025 & 2033

- Figure 75: Middle East and Africa Color Masterbatch Market Revenue (Billion), by End-User 2025 & 2033

- Figure 76: Middle East and Africa Color Masterbatch Market Volume (K Tons), by End-User 2025 & 2033

- Figure 77: Middle East and Africa Color Masterbatch Market Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Middle East and Africa Color Masterbatch Market Volume Share (%), by End-User 2025 & 2033

- Figure 79: Middle East and Africa Color Masterbatch Market Revenue (Billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Color Masterbatch Market Volume (K Tons), by Country 2025 & 2033

- Figure 81: Middle East and Africa Color Masterbatch Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Color Masterbatch Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Color Masterbatch Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 2: Global Color Masterbatch Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Color Masterbatch Market Revenue Billion Forecast, by Polymer 2020 & 2033

- Table 4: Global Color Masterbatch Market Volume K Tons Forecast, by Polymer 2020 & 2033

- Table 5: Global Color Masterbatch Market Revenue Billion Forecast, by End-User 2020 & 2033

- Table 6: Global Color Masterbatch Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 7: Global Color Masterbatch Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 8: Global Color Masterbatch Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Color Masterbatch Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 10: Global Color Masterbatch Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Global Color Masterbatch Market Revenue Billion Forecast, by Polymer 2020 & 2033

- Table 12: Global Color Masterbatch Market Volume K Tons Forecast, by Polymer 2020 & 2033

- Table 13: Global Color Masterbatch Market Revenue Billion Forecast, by End-User 2020 & 2033

- Table 14: Global Color Masterbatch Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 15: Global Color Masterbatch Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 16: Global Color Masterbatch Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: India Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: India Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: China Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 20: China Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: South Korea Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Global Color Masterbatch Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 28: Global Color Masterbatch Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: Global Color Masterbatch Market Revenue Billion Forecast, by Polymer 2020 & 2033

- Table 30: Global Color Masterbatch Market Volume K Tons Forecast, by Polymer 2020 & 2033

- Table 31: Global Color Masterbatch Market Revenue Billion Forecast, by End-User 2020 & 2033

- Table 32: Global Color Masterbatch Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 33: Global Color Masterbatch Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 34: Global Color Masterbatch Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 35: United States Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 36: United States Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Canada Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 38: Canada Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Mexico Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 40: Mexico Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Global Color Masterbatch Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 42: Global Color Masterbatch Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Global Color Masterbatch Market Revenue Billion Forecast, by Polymer 2020 & 2033

- Table 44: Global Color Masterbatch Market Volume K Tons Forecast, by Polymer 2020 & 2033

- Table 45: Global Color Masterbatch Market Revenue Billion Forecast, by End-User 2020 & 2033

- Table 46: Global Color Masterbatch Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 47: Global Color Masterbatch Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 48: Global Color Masterbatch Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Germany Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Germany Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: France Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 54: France Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Italy Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 56: Italy Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Global Color Masterbatch Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 60: Global Color Masterbatch Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 61: Global Color Masterbatch Market Revenue Billion Forecast, by Polymer 2020 & 2033

- Table 62: Global Color Masterbatch Market Volume K Tons Forecast, by Polymer 2020 & 2033

- Table 63: Global Color Masterbatch Market Revenue Billion Forecast, by End-User 2020 & 2033

- Table 64: Global Color Masterbatch Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 65: Global Color Masterbatch Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 66: Global Color Masterbatch Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 67: Argentina Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 68: Argentina Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Brazil Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 70: Brazil Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Rest of South America Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Global Color Masterbatch Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 74: Global Color Masterbatch Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 75: Global Color Masterbatch Market Revenue Billion Forecast, by Polymer 2020 & 2033

- Table 76: Global Color Masterbatch Market Volume K Tons Forecast, by Polymer 2020 & 2033

- Table 77: Global Color Masterbatch Market Revenue Billion Forecast, by End-User 2020 & 2033

- Table 78: Global Color Masterbatch Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 79: Global Color Masterbatch Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 80: Global Color Masterbatch Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 81: South Africa Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 82: South Africa Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: Saudi Arabia Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 84: Saudi Arabia Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Color Masterbatch Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Color Masterbatch Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Color Masterbatch Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Color Masterbatch Market?

Key companies in the market include Clariant, TREFFERT GMBH & CO KG, Avient, Coperion GmbH, Cabot Corporation, Hubron International, Americhem, Ochre Media Pvt Ltd, Tosaf, Ampacet Corporation, ALOK MASTERBATCHES PVT LTD, BARS-.

3. What are the main segments of the Color Masterbatch Market?

The market segments include Type, Polymer, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.4 Billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand in Plastic packaging Industry; Increasing Demand of Plastic in Automotive Industry.

6. What are the notable trends driving market growth?

Packaging Segment Dominates the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Price; Strict Environmental Regulations.

8. Can you provide examples of recent developments in the market?

In November 2020, Cabot Corporation launched PLASBLAK XP6801D black masterbatch, a unique styrene-acrylonitrile (SAN)-based formulation that meets the needs of the styrenics market without the usual trade-off between color and mechanical properties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Color Masterbatch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Color Masterbatch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Color Masterbatch Market?

To stay informed about further developments, trends, and reports in the Color Masterbatch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence