Key Insights

The Colombia lubricants market is projected for significant expansion, with an estimated market size of 574.5 million in 2024. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% through 2033. This robust growth is underpinned by several key drivers. The expanding automotive sector, particularly commercial vehicles and transportation, is a primary demand generator. Increased infrastructure development and industrial activity further propel market expansion, necessitating a consistent supply of high-performance lubricants for machinery and equipment. Additionally, growing awareness of the benefits of effective lubrication for optimizing vehicle and equipment longevity and efficiency, alongside the adoption of advanced lubricant formulations, are key growth catalysts. Government initiatives promoting eco-friendly lubricants are also shaping the market, encouraging innovation in sustainable product offerings. Intense competition among leading players, including TERPEL, Shell, and Chevron, fosters innovation and competitive pricing, ultimately benefiting end-users.

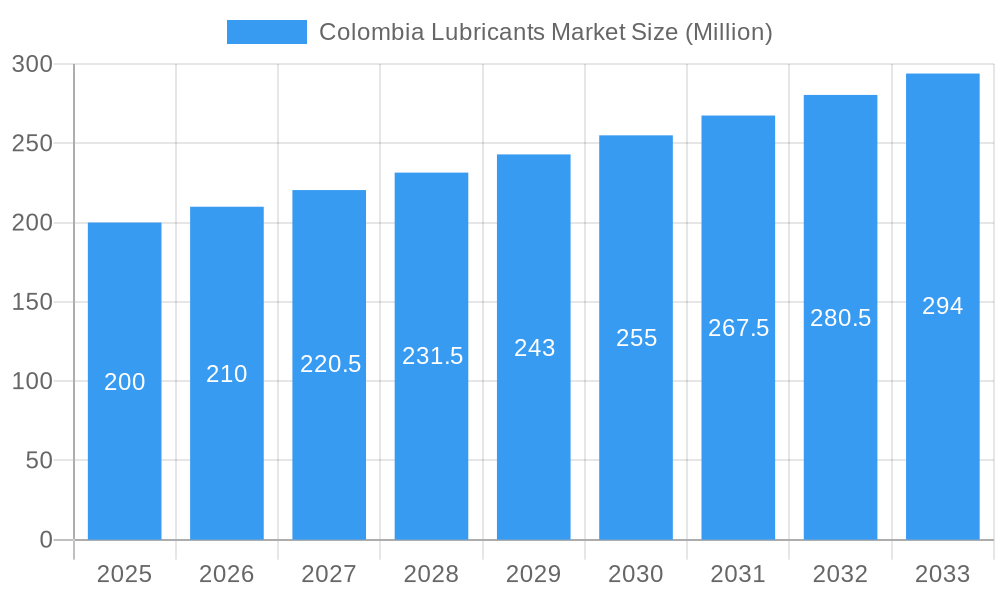

Colombia Lubricants Market Market Size (In Million)

Despite a favorable outlook, the market faces potential challenges. Volatility in crude oil prices directly affects lubricant production costs and final pricing. Economic uncertainties within Colombia could moderate growth forecasts, as could potential disruptions to supply chains. Nevertheless, the long-term trajectory for the Colombian lubricants market remains positive, driven by sustained economic development and the increasing integration of advanced machinery across diverse industries. Market segmentation is anticipated to encompass automotive lubricants (passenger cars, heavy-duty diesel), industrial lubricants, and specialized formulations, with regional demand concentrated in major urban and industrial centers.

Colombia Lubricants Market Company Market Share

Colombia Lubricants Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Colombia lubricants market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on the base year 2025, this report unveils the market's dynamics, trends, and future prospects. Discover key players, emerging opportunities, and challenges shaping this dynamic sector. Our analysis encompasses market sizing, segmentation, competitive landscape, and key growth drivers, empowering you to navigate the complexities of the Colombian lubricants market with confidence.

Colombia Lubricants Market Market Dynamics & Concentration

The Colombia lubricants market is characterized by a dynamic and evolving landscape. Key players are actively engaged in a strategic competition for market share, driven by significant factors such as relentless technological innovation in lubricant formulations, the increasing stringency of regulatory frameworks with a pronounced focus on environmental sustainability, and the widespread adoption of advanced lubricant technologies across a spectrum of end-user sectors. The market faces both challenges and opportunities through product substitution, prominently influenced by the emergence and growing acceptance of bio-based lubricants and high-performance synthetic oils. End-user trends, particularly the sustained growth of the automotive sector and the robust expansion of industrial manufacturing, exert a substantial influence on overall market demand. Mergers and acquisitions (M&A) activity, while moderate, reflects a strategic realignment and consolidation within the sector. A notable example of aggressive expansion plans is Shell's strategic re-entry into the Colombian market through its partnership with Biomax SA in January 2022, signaling a commitment to capturing a larger market footprint.

- Market Concentration: The top 5 players collectively hold approximately xx% of the market share, indicating a moderately concentrated competitive environment.

- M&A Activity (2019-2024): A total of xx merger and acquisition deals have been recorded within this period, reflecting strategic consolidation and market repositioning.

- Innovation Drivers: A significant focus is placed on developing lubricants that enhance energy efficiency, promote sustainability through bio-lubricant development, and offer improved performance characteristics under diverse operating conditions.

- Regulatory Landscape: Evolving environmental regulations are playing a crucial role in shaping lubricant formulations, dictating disposal methods, and promoting the use of more eco-friendly alternatives.

- Product Substitution: The increasing adoption and acceptance of advanced synthetic and bio-based lubricants are presenting a notable challenge to traditional mineral oil-based products, driving product evolution.

- End-User Trends: The demand for lubricants is significantly boosted by the sustained growth in the automotive, industrial manufacturing, and agricultural sectors, each with specific lubricant requirements.

Colombia Lubricants Market Industry Trends & Analysis

The Colombian lubricants market is experiencing robust and consistent growth, fueled by a combination of expanding vehicle ownership, the continuous expansion of industrial activities, and significant improvements in national infrastructure. Technological advancements are a key catalyst, particularly the introduction of high-performance lubricants and highly specialized formulations designed to meet the exacting demands of niche applications, thereby reshaping the market's competitive landscape. Consumer preferences are demonstrably shifting towards lubricants that are not only eco-friendly but also offer superior quality and extended drain intervals, leading to reduced maintenance costs and greater operational efficiency. The competitive dynamics within the market are characterized by intense rivalry among established, long-standing players and the strategic emergence of new, agile market entrants. This heightened competition serves as a powerful engine for innovation, simultaneously driving price competitiveness and ultimately benefiting the end-users with better product offerings and value.

- CAGR (2025-2033): The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033.

- Market Penetration: Lubricant market penetration has reached xx% in key segments, indicating substantial adoption and a solid foundation for further growth.

- Market Growth Drivers: Key drivers propelling market expansion include sustained economic growth, substantial infrastructure development projects, a continuous rise in vehicle sales, and the ongoing expansion of industrial sectors.

- Technological Disruptions: The industry is witnessing significant technological disruptions, most notably the increasing adoption of advanced lubricant technologies such as premium synthetic oils and innovative biolubricants.

- Consumer Preferences: There is a clear and growing demand for lubricants that offer high-performance capabilities coupled with a strong emphasis on environmental friendliness and sustainability.

- Competitive Dynamics: The market is characterized by intense rivalry among established industry leaders and a dynamic influx of emerging new entrants, fostering innovation and competitive pricing.

Leading Markets & Segments in Colombia Lubricants Market

The Colombian lubricants market is predominantly driven by the automotive sector, which accounts for the largest share of overall consumption. Growth in this segment is fueled by rising vehicle sales and a growing middle class. Other key segments include industrial, agricultural, and marine applications. Geographic dominance is concentrated in urban and industrial centers where economic activity is concentrated.

- Key Drivers (Automotive Segment):

- Strong economic growth in urban areas.

- Increasing vehicle ownership rates.

- Development of improved road infrastructure.

- Key Drivers (Industrial Segment):

- Growth in manufacturing and construction sectors.

- Expansion of industrial plants and operations.

- Demand for high-performance industrial lubricants.

Colombia Lubricants Market Product Developments

Recent product developments in the Colombian lubricants market unequivocally highlight a strong and consistent trend towards the creation and adoption of sustainable and high-performance lubricant solutions. Innovations are prominently featured in the introduction of bio-based lubricants, meticulously engineered to minimize environmental impact while delivering exceptional performance. Concurrently, enhanced synthetic oils are being developed, offering superior protection and operational efficiency even under the most extreme operating conditions. These significant advancements are directly catering to the burgeoning demand for eco-friendly products while simultaneously contributing to improved operational efficiency and overall cost-effectiveness for end-users.

Key Drivers of Colombia Lubricants Market Growth

The Colombian lubricants market is experiencing robust growth, propelled by a powerful combination of factors. These include sustained and strong economic growth across the nation, a significant surge in industrialization activities, a steady increase in vehicle ownership, and proactive government initiatives aimed at promoting and accelerating infrastructure development. Furthermore, the implementation of increasingly stringent environmental regulations is acting as a critical catalyst, driving relentless innovation towards the development and adoption of more sustainable and environmentally responsible lubricant formulations.

Challenges in the Colombia Lubricants Market Market

The market faces challenges including fluctuations in crude oil prices, supply chain disruptions, and intense competition from both domestic and international players. The regulatory environment, while promoting sustainability, also adds complexity to operations. These factors can impact profitability and market access.

Emerging Opportunities in Colombia Lubricants Market

Significant opportunities exist in expanding into niche segments, such as specialized industrial lubricants, renewable energy applications, and the growing demand for high-performance automotive lubricants. Strategic partnerships and collaborations can unlock new market access and technological advancements.

Leading Players in the Colombia Lubricants Market Sector

- TERPEL

- Shell plc

- Chevron Corporation

- Biomax

- Petromil S A S

- Petrobras

- Saudi Arabian Oil Co

- TotalEnergies

- BP p l c

- Gulf Oil International

- Motul

- Primax

- *List Not Exhaustive

Key Milestones in Colombia Lubricants Market Industry

- January 2022: Shell re-entered the Colombian fuel retail sector via Biomax SA, aiming to establish 250 Shell-branded stations nationwide. This significantly impacts market competition and distribution networks.

- February 2023: Gulf Oil's multi-year partnership with Williams Racing enhances brand visibility and strengthens its position in high-performance lubricants. This signifies a move toward marketing and brand recognition in the performance-lubricant sector.

Strategic Outlook for Colombia Lubricants Market Market

The Colombian lubricants market presents a landscape rich with significant growth potential, largely attributable to ongoing economic expansion, continuous infrastructure development, and escalating demand across a diverse range of industrial and consumer sectors. Companies that strategically prioritize innovation, embed sustainability into their core operations, and forge strong, strategic partnerships are best positioned to effectively capitalize on emerging market opportunities and achieve sustained, long-term success. The future trajectory of market growth will hinge on the industry's ability to adeptly navigate evolving regulatory changes, effectively manage potential supply chain vulnerabilities, and consistently meet the ever-changing consumer preferences for lubricants that offer both high-performance capabilities and a strong commitment to environmental stewardship.

Colombia Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Transmission And Gear Oils

- 1.3. Hydraulic Fluid

- 1.4. Metalworking Fluid

- 1.5. Greases

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive

- 2.3. Heavy Equipment

- 2.4. Metallurgy And Metalworking

- 2.5. Other End-user Industries

Colombia Lubricants Market Segmentation By Geography

- 1. Colombia

Colombia Lubricants Market Regional Market Share

Geographic Coverage of Colombia Lubricants Market

Colombia Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Automotive and Transportation Sectors; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Expanding Automotive and Transportation Sectors; Other Drivers

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Transmission And Gear Oils

- 5.1.3. Hydraulic Fluid

- 5.1.4. Metalworking Fluid

- 5.1.5. Greases

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive

- 5.2.3. Heavy Equipment

- 5.2.4. Metallurgy And Metalworking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TERPEL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shell plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Biomax

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petromil S A S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petrobras

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saudi Arabian Oil Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BP p l c

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gulf Oil International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Motul

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Primax*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 TERPEL

List of Figures

- Figure 1: Colombia Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Colombia Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Colombia Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Colombia Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Colombia Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Colombia Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Colombia Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Lubricants Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Colombia Lubricants Market?

Key companies in the market include TERPEL, Shell plc, Chevron Corporation, Biomax, Petromil S A S, Petrobras, Saudi Arabian Oil Co, TotalEnergies, BP p l c, Gulf Oil International, Motul, Primax*List Not Exhaustive.

3. What are the main segments of the Colombia Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 574.5 million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Automotive and Transportation Sectors; Other Drivers.

6. What are the notable trends driving market growth?

Automotive Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Expanding Automotive and Transportation Sectors; Other Drivers.

8. Can you provide examples of recent developments in the market?

February 2023: Gulf has signed a multi-year partnership with the historic Williams Racing team for the 2023 Formula 1 season and beyond.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Lubricants Market?

To stay informed about further developments, trends, and reports in the Colombia Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence