Key Insights

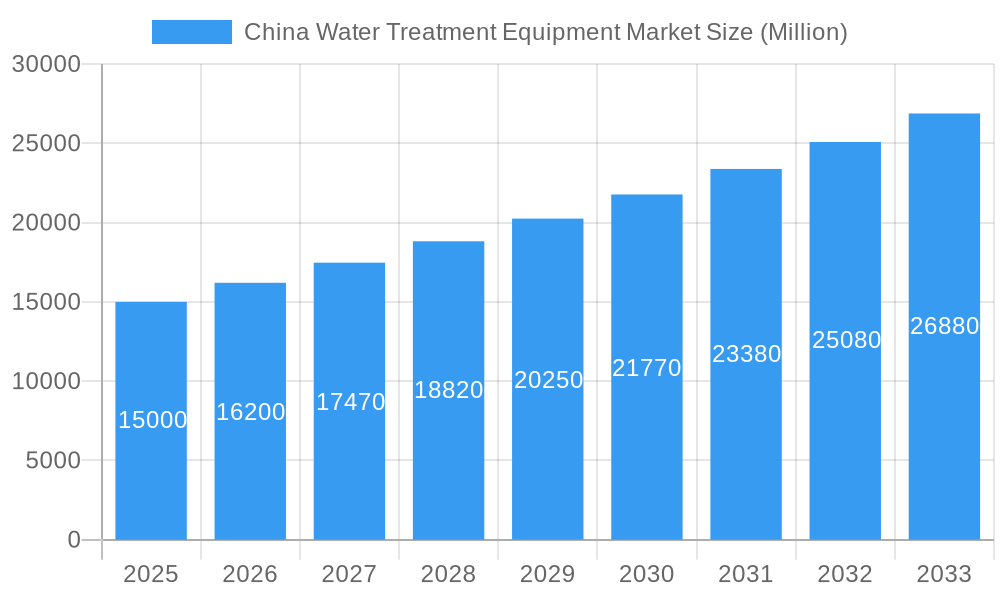

The China water treatment equipment market is projected for significant expansion, reaching a market size of $14.07 billion by 2025. The market is anticipated to grow at a robust CAGR of 8.54% from 2025 to 2033, driven by stringent environmental regulations and escalating industrialization. Growing awareness of water scarcity and waterborne diseases further stimulates demand for advanced water treatment solutions across municipal, industrial, and commercial sectors. Key market trends include the adoption of membrane filtration, smart water management systems, and sustainable, energy-efficient technologies. Despite initial investment challenges, the imperative for improved water quality and resource management ensures sustained market growth.

China Water Treatment Equipment Market Market Size (In Billion)

The market is segmented by equipment type and end-user industry. Leading international and domestic players are investing in R&D to enhance product offerings and market presence. China's dominant position is attributed to its vast population, rapid industrial growth, and strong government focus on environmental protection, creating a favorable investment climate.

China Water Treatment Equipment Market Company Market Share

A dynamic competitive landscape featuring multinational corporations and local enterprises drives innovation and enhances the accessibility of water treatment solutions. Future growth will be shaped by technological advancements, supportive government policies for water infrastructure, and the evolving demands of end-user industries. The emphasis on sustainability and digital integration will continue to define the market's trajectory, presenting substantial opportunities for investment and development.

China Water Treatment Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the burgeoning China Water Treatment Equipment Market, providing invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a meticulous study period spanning from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unveils the market's dynamics, trends, and future potential. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period. This report covers key players such as Aquatech, Ecolab, Chengdu Xingrong Environment Co Ltd, and more, offering a granular view of the competitive landscape. Maximize your understanding of this critical market and gain a competitive edge with this essential resource.

China Water Treatment Equipment Market Market Dynamics & Concentration

The China water treatment equipment market is characterized by a moderately concentrated landscape, with a dynamic interplay between established domestic manufacturers and prominent international corporations actively competing for market share. Market concentration is estimated to be around 60-65% in 2025, with the top five leading players collectively holding approximately 45-50% of the total market value. A significant driver of market evolution is continuous innovation, particularly in cutting-edge membrane technologies (e.g., advanced RO, UF, and MBR) and sophisticated intelligent automation and IoT integration. This innovation surge is strongly propelled by robust government initiatives dedicated to promoting water conservation, enhancing water quality, and enforcing stringent environmental protection measures. The market is also significantly shaped by increasingly stringent regulatory frameworks, including progressively tighter effluent discharge standards, which are compelling businesses and municipalities to adopt more advanced and sustainable treatment solutions. While product substitutes, such as traditional chemical treatments, continue to present a competitive challenge, the overarching long-term trend clearly favors the adoption of advanced equipment solutions due to their demonstrably superior operational efficiency, environmental sustainability, and cost-effectiveness over their lifecycle.

End-user trends are increasingly pointing towards a higher adoption of customized and integrated solutions meticulously tailored to meet the unique and specific requirements of diverse industrial sectors. While the Municipal water treatment segment continues to represent the largest portion of the market, substantial growth is anticipated in the industrial sector, with notable expansion expected in the Food and Beverage, chemical processing, and pharmaceutical industries. Mergers and acquisitions (M&A) activity has been a notable feature of the market in recent years, with approximately 25-30 M&A deals recorded between 2019 and 2024. This activity reflects a strategic consolidation trend, where larger, well-established players are actively pursuing acquisitions of smaller, innovative companies to expand their product portfolios, enhance their technological capabilities, and broaden their geographic reach across the vast Chinese market.

- Market Share: Top 5 players hold approximately 45-50% in 2025.

- M&A Activity: Approximately 25-30 deals between 2019 and 2024.

- Key Innovation Drivers: Advanced membrane technology, intelligent automation, and comprehensive IoT integration for smart water management.

- Regulatory Impact: Increasingly strict effluent discharge standards are a significant catalyst for the demand for advanced water treatment equipment and solutions.

China Water Treatment Equipment Market Industry Trends & Analysis

The China water treatment equipment market is experiencing robust growth, driven by several interconnected factors. Increasing industrialization and urbanization are placing immense pressure on water resources, necessitating advanced treatment solutions. Government regulations promoting water conservation and environmental sustainability are creating a favorable regulatory environment. Technological advancements, such as the development of more efficient and cost-effective membrane technologies and automation systems, are further stimulating market growth. Consumer preferences are shifting towards environmentally friendly and energy-efficient solutions.

The competitive dynamics are intense, with both domestic and international companies vying for market share. Price competition is a significant factor, but the trend is toward value-based competition, emphasizing superior performance, reliability, and after-sales service. The market is expected to witness continued consolidation, with larger companies acquiring smaller players to expand their reach and product offerings. The market exhibits a strong growth trajectory, with a projected CAGR of xx% from 2025 to 2033. Market penetration is relatively high in the municipal sector but has significant growth potential in other end-user industries.

Leading Markets & Segments in China Water Treatment Equipment Market

The Municipal segment continues to be the dominant force in the China water treatment equipment market, accounting for approximately 35-40% of the total market value in 2025. This segment's dominance is largely attributed to substantial and ongoing government investment in the development and modernization of critical water infrastructure, ensuring access to safe and clean water for a growing urban population. The Food and Beverage sector is exhibiting significant growth potential, driven by increasingly stringent hygiene and food safety standards that necessitate advanced water purification and wastewater treatment processes. Within the equipment types, Treatment Equipment, encompassing a broad range of technologies, currently holds the largest market share, reflecting the widespread adoption of established water purification methodologies across various industries. However, a notable shift towards more advanced and specialized equipment is anticipated as regulations tighten and sustainability becomes a higher priority.

- Dominant Segment: Municipal (35-40% market share in 2025)

- Fastest-Growing Segment: Food and Beverage, driven by demand for high-purity water and stringent wastewater compliance.

- Key Drivers for Municipal Segment: Continuous government investment in water infrastructure, evolving water quality regulations, and increasing urbanization.

- Key Drivers for Food and Beverage Segment: Stringent hygiene and safety regulations, rising consumer demand for high-quality processed foods and beverages, and the need for efficient wastewater management.

- Key Drivers for Treatment Equipment: Broad applicability across diverse end-user industries, technological maturity, and cost-effectiveness for many standard water treatment applications.

China Water Treatment Equipment Market Product Developments

Recent product innovations in the China water treatment equipment market are primarily focused on a trifecta of critical objectives: enhancing operational efficiency, significantly reducing energy consumption, and achieving higher levels of treated water quality. Remarkable advancements in membrane technology, including next-generation reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF) membranes, are enabling the design and deployment of more effective, compact, and energy-efficient treatment systems. The seamless integration of Internet of Things (IoT) devices and sophisticated automation systems is a transformative trend, substantially improving real-time operational monitoring, predictive maintenance capabilities, and overall system performance. These technological advancements are not only creating new and lucrative market opportunities but are also pivotal in enhancing the competitiveness and sustainability credentials of existing market players.

Key Drivers of China Water Treatment Equipment Market Growth

Several factors contribute to the market's robust growth trajectory. Firstly, the government's emphasis on environmental protection and water resource management creates a favorable regulatory environment. Secondly, rapid urbanization and industrialization drive demand for efficient and reliable water treatment solutions. Thirdly, technological advancements in membrane technology and automation systems are enhancing the effectiveness and affordability of water treatment.

Challenges in the China Water Treatment Equipment Market Market

The market faces challenges, including high initial investment costs for advanced treatment technologies. Supply chain disruptions can also impact the availability and pricing of raw materials and components. Intense competition from both domestic and international players puts downward pressure on prices.

Emerging Opportunities in China Water Treatment Equipment Market

The China water treatment equipment market is brimming with several promising and high-potential emerging opportunities. The rapidly growing adoption of advanced treatment technologies, such as Membrane Bioreactors (MBRs) for efficient wastewater treatment and Advanced Oxidation Processes (AOPs) for tackling recalcitrant pollutants, presents significant avenues for growth. Fostering strategic partnerships between innovative technology providers and key end-users across various industrial sectors can serve as a powerful catalyst to accelerate market penetration and technology adoption. Furthermore, strategic expansion into underserved regions, particularly in inland areas and smaller cities, and the diligent development of highly customized and specialized solutions for niche market applications, such as high-purity water for electronics manufacturing or specialized treatment for pharmaceutical wastewater, will undoubtedly unlock new and substantial growth frontiers for market participants.

Leading Players in the China Water Treatment Equipment Market Sector

- Aquatech

- Ecolab

- Chengdu Xingrong Environment Co Ltd

- Beijing Enterprises Water (China) Investment Co Ltd

- Kurita Water Industries Ltd

- Beijing Urban Drainage Group Co Ltd

- Evoqua Water Technologies LLC

- IDE Technologies

- Beijing Capital Co Ltd

- SUEZ

- DuPont

- Organo Corporation

- Anhui Guozhen Environment Protection Technology

- Veolia

- SafBon

- Chongqing Water Group Co Ltd

Key Milestones in China Water Treatment Equipment Market Industry

- 2020: The Chinese government introduced significantly stricter national effluent discharge standards, compelling industries to invest in advanced treatment solutions.

- 2022: A leading global player launched a breakthrough in membrane technology, offering dramatically improved water purification efficiency and reduced energy requirements.

- 2023: A major consolidation event occurred with the merger of two prominent domestic water treatment companies, signaling an increasing trend towards market consolidation and enhanced capabilities.

- 2024: The government intensified its promotion of smart water management systems, encouraging the adoption of digital solutions for enhanced water resource control and optimization.

Strategic Outlook for China Water Treatment Equipment Market Market

The China water treatment equipment market is poised for sustained growth, driven by robust demand from the municipal and industrial sectors. Strategic partnerships, technological innovation, and effective regulatory frameworks will be critical for capturing market share and achieving long-term success. Companies focusing on developing energy-efficient and environmentally friendly solutions will be best positioned to capitalize on emerging opportunities.

China Water Treatment Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Treatment Equipment

- 1.1.1. Oil/Water Separation

- 1.1.2. Suspended Solids Removal

- 1.1.3. Dissolved Solids Removal

- 1.1.4. Biological Treatment/Nutrient and Metals Recovery

- 1.1.5. Disinfection/Oxidation

- 1.1.6. Others

- 1.2. Process Control Equipment & Pumps

-

1.1. Treatment Equipment

-

2. End-user Industry

- 2.1. Municipal

- 2.2. Food and Beverage

- 2.3. Pulp and Paper

- 2.4. Oil and Gas

- 2.5. Healthcare

- 2.6. Poultry and Aquaculture

- 2.7. Chemical

- 2.8. Other End-user Industries

China Water Treatment Equipment Market Segmentation By Geography

- 1. China

China Water Treatment Equipment Market Regional Market Share

Geographic Coverage of China Water Treatment Equipment Market

China Water Treatment Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Industrial Sector; Increasing Regulations for Water and Wastewater Treatment; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost of Technology; Other Restraints

- 3.4. Market Trends

- 3.4.1. Treatment Equipment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Water Treatment Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Treatment Equipment

- 5.1.1.1. Oil/Water Separation

- 5.1.1.2. Suspended Solids Removal

- 5.1.1.3. Dissolved Solids Removal

- 5.1.1.4. Biological Treatment/Nutrient and Metals Recovery

- 5.1.1.5. Disinfection/Oxidation

- 5.1.1.6. Others

- 5.1.2. Process Control Equipment & Pumps

- 5.1.1. Treatment Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Municipal

- 5.2.2. Food and Beverage

- 5.2.3. Pulp and Paper

- 5.2.4. Oil and Gas

- 5.2.5. Healthcare

- 5.2.6. Poultry and Aquaculture

- 5.2.7. Chemical

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aquatech

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecolab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chengdu Xingrong Environment Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beijing Enterprises Water (China) Investment Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kurita Water Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beijing Urban Drainage Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evoqua Water Technologies LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDE Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Capital Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SUEZ

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DuPont

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Organo Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Anhui Guozhen Environment Protection Technology

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Veolia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SafBon

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Chongqing Water Group Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Aquatech

List of Figures

- Figure 1: China Water Treatment Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Water Treatment Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Water Treatment Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 2: China Water Treatment Equipment Market Volume K Units Forecast, by Equipment Type 2020 & 2033

- Table 3: China Water Treatment Equipment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: China Water Treatment Equipment Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: China Water Treatment Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Water Treatment Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: China Water Treatment Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 8: China Water Treatment Equipment Market Volume K Units Forecast, by Equipment Type 2020 & 2033

- Table 9: China Water Treatment Equipment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: China Water Treatment Equipment Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 11: China Water Treatment Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Water Treatment Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Water Treatment Equipment Market?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the China Water Treatment Equipment Market?

Key companies in the market include Aquatech, Ecolab, Chengdu Xingrong Environment Co Ltd, Beijing Enterprises Water (China) Investment Co Ltd, Kurita Water Industries Ltd, Beijing Urban Drainage Group Co Ltd, Evoqua Water Technologies LLC, IDE Technologies, Beijing Capital Co Ltd, SUEZ, DuPont, Organo Corporation, Anhui Guozhen Environment Protection Technology, Veolia, SafBon, Chongqing Water Group Co Ltd.

3. What are the main segments of the China Water Treatment Equipment Market?

The market segments include Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Industrial Sector; Increasing Regulations for Water and Wastewater Treatment; Other Drivers.

6. What are the notable trends driving market growth?

Treatment Equipment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost of Technology; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Water Treatment Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Water Treatment Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Water Treatment Equipment Market?

To stay informed about further developments, trends, and reports in the China Water Treatment Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence