Key Insights

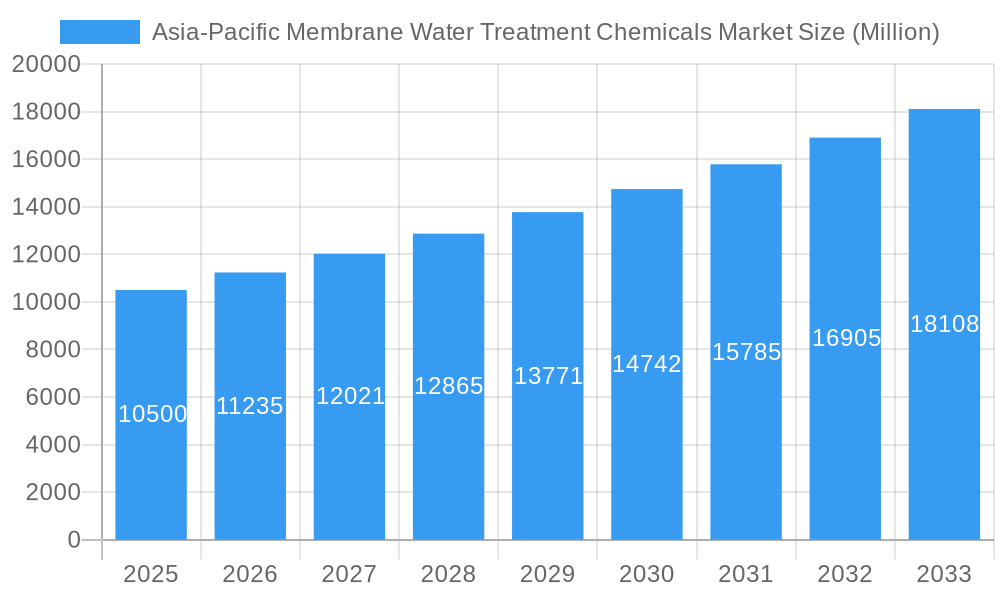

The Asia-Pacific Membrane Water Treatment Chemicals Market is poised for significant expansion, projected to exceed $10,000 million in value by 2025 and maintain a robust CAGR exceeding 7.00% throughout the forecast period of 2025-2033. This remarkable growth is primarily fueled by escalating water scarcity concerns across the region, coupled with increasingly stringent environmental regulations mandating advanced water purification and wastewater treatment solutions. The burgeoning industrial sector, particularly in sectors like Food & Beverage Processing and Healthcare, is a substantial driver, demanding high-purity water and compliant effluent discharge. Furthermore, growing urbanization and the need for safe municipal water supply are also contributing to the increased adoption of membrane technologies and the associated chemical treatments.

Asia-Pacific Membrane Water Treatment Chemicals Market Market Size (In Billion)

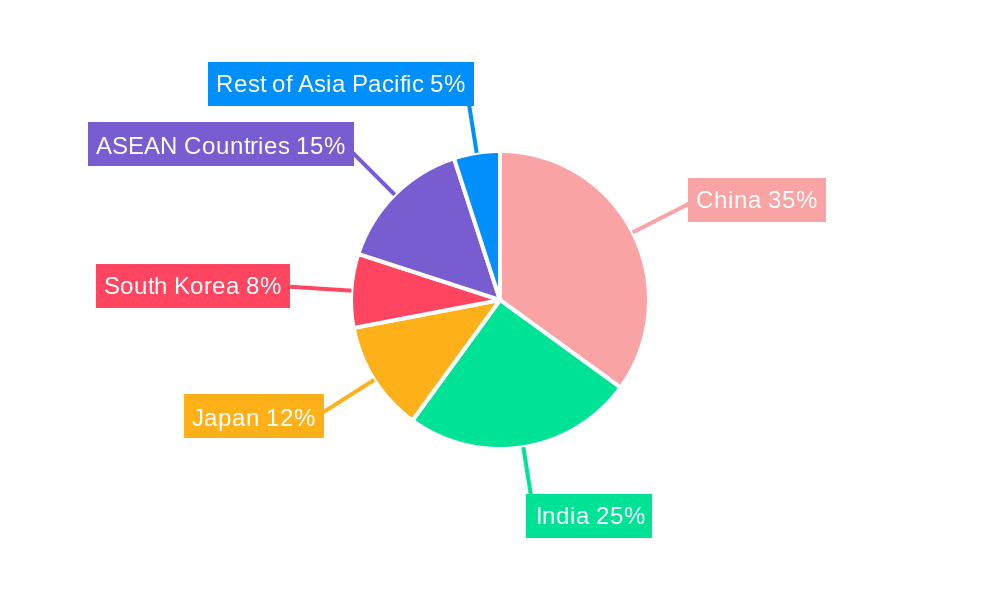

The market is characterized by a dynamic interplay of growth drivers and restraints. While rising environmental awareness and government initiatives promoting sustainable water management are positive influences, challenges such as the high initial investment cost of membrane systems and the fluctuating prices of raw materials for chemical production could present hurdles. However, technological advancements in membrane filtration and the development of more efficient and eco-friendly treatment chemicals are expected to mitigate these challenges. Key segments include Pre-treatment chemicals, essential for preventing membrane fouling, and Biological Controllers, vital for managing microbial growth. Geographically, China and India are expected to lead the market, owing to their vast populations, rapid industrialization, and substantial investments in water infrastructure. The ASEAN countries and other parts of the Asia-Pacific region are also anticipated to witness substantial growth as they prioritize water security and pollution control.

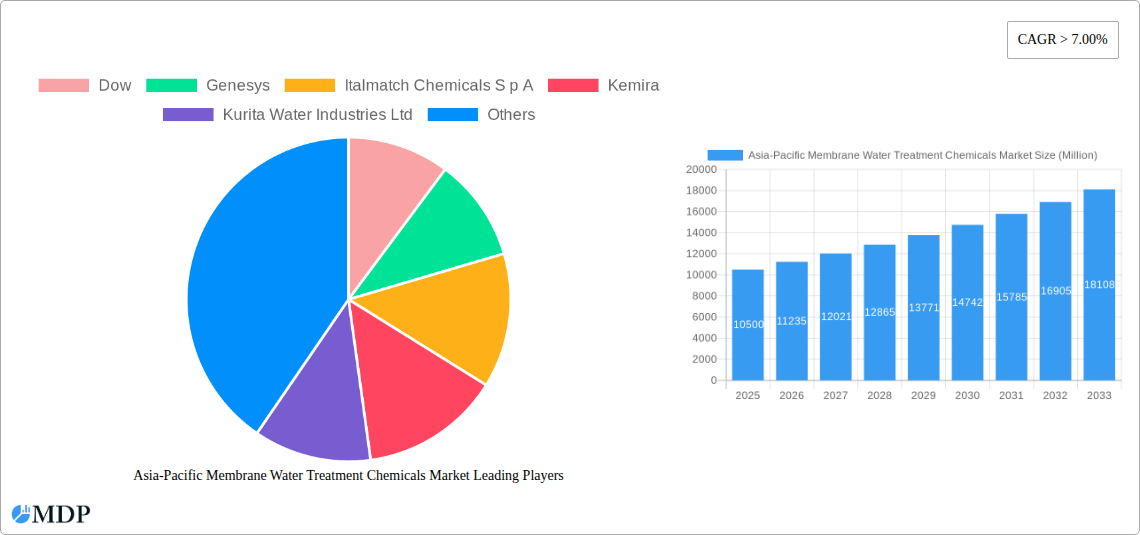

Asia-Pacific Membrane Water Treatment Chemicals Market Company Market Share

Asia-Pacific Membrane Water Treatment Chemicals Market: A Comprehensive Analysis (2019–2033)

This in-depth report provides a detailed examination of the Asia-Pacific membrane water treatment chemicals market, encompassing a study period from 2019 to 2033. With 2025 serving as both the base and estimated year, and a robust forecast period from 2025–2033, this analysis offers critical insights for industry stakeholders. Leveraging high-traffic keywords such as "membrane water treatment chemicals," "APAC water treatment," "Asia water purification," and "industrial water solutions," this report is meticulously designed to maximize search visibility and attract decision-makers within the water treatment sector.

This report delves into key segments including Chemical Type (Pre-treatment, Biological Controllers, Other Chemical Types), End-user Industry (Food & Beverage Processing, Healthcare, Municipal, Chemicals, Power, Other End-user Industries), and Geography (China, India, Japan, South Korea, ASEAN Countries, Rest of Asia-Pacific). It also meticulously tracks Industry Developments, providing a forward-looking perspective on market dynamics.

Asia-Pacific Membrane Water Treatment Chemicals Market Market Dynamics & Concentration

The Asia-Pacific membrane water treatment chemicals market exhibits a moderate to high level of concentration, with a few key global players dominating market share. Companies such as Dow, Genesys, Italmatch Chemicals S p A, Kemira, Kurita Water Industries Ltd, Solenis, Suez, and Veolia Water Solutions and Technologies are at the forefront, driving innovation and influencing market trends. The market's dynamism is fueled by increasing industrialization, stringent environmental regulations, and growing awareness regarding water scarcity and quality. Innovation drivers include the development of more efficient and sustainable chemical formulations, advanced membrane technologies, and integrated treatment solutions. Regulatory frameworks, particularly concerning wastewater discharge and chemical safety, play a crucial role in shaping product development and market entry strategies. Product substitutes, while present in some niche applications, are generally less effective or cost-prohibitive for large-scale membrane treatment. End-user trends are leaning towards performance-driven chemicals, reduced environmental impact, and operational cost efficiencies. Mergers and Acquisition (M&A) activities have been observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. The number of significant M&A deals in the historical period (2019-2024) stands at approximately 15-20, indicating strategic consolidation efforts by major entities to capture a larger market share and enhance competitive positioning.

Asia-Pacific Membrane Water Treatment Chemicals Market Industry Trends & Analysis

The Asia-Pacific membrane water treatment chemicals market is poised for substantial growth, driven by a confluence of escalating water demand, increasing industrial output, and a heightened focus on environmental sustainability. The CAGR for the forecast period (2025–2033) is projected to be a robust 6.8%, indicating a significant expansion trajectory. Urbanization and population growth across the region are placing unprecedented strain on existing water resources, necessitating advanced treatment solutions. Industrial sectors, particularly manufacturing, food and beverage, and power generation, are the primary consumers of membrane water treatment chemicals, demanding high-purity water for their processes and effective wastewater management to comply with evolving environmental mandates.

Technological disruptions are playing a pivotal role. Advancements in membrane materials, such as improved fouling resistance and higher flux rates, are indirectly boosting the demand for compatible and high-performance chemicals. The development of specialized antiscalants, coagulants, flocculants, and disinfectants tailored for specific membrane types (e.g., reverse osmosis, ultrafiltration, nanofiltration) is a key trend. Furthermore, the rise of smart water management systems, incorporating real-time monitoring and automated chemical dosing, is enhancing the efficiency and effectiveness of treatment processes, creating opportunities for chemical suppliers offering integrated solutions.

Consumer preferences, influenced by environmental consciousness and corporate social responsibility, are shifting towards greener and more sustainable chemical options. Manufacturers are responding by developing bio-based chemicals, low-toxicity formulations, and solutions that minimize sludge generation and chemical discharge. This shift is particularly pronounced in developed economies within the region like Japan and South Korea, but is gaining traction across other markets as well.

Competitive dynamics are characterized by intense price competition, product differentiation, and a strong emphasis on technical support and customer service. Companies are investing heavily in research and development to introduce novel chemistries that offer superior performance, cost-effectiveness, and environmental benefits. The market penetration of advanced membrane treatment technologies, while varying across countries, is steadily increasing, creating a larger addressable market for associated chemicals. The increasing adoption of membrane bioreactors (MBRs) for municipal and industrial wastewater treatment is also a significant growth driver.

Leading Markets & Segments in Asia-Pacific Membrane Water Treatment Chemicals Market

China stands out as the largest and most influential market within the Asia-Pacific membrane water treatment chemicals sector, driven by its massive industrial base, significant population, and ambitious environmental protection targets. The country's extensive manufacturing sector, including chemicals, textiles, and electronics, generates vast quantities of industrial wastewater requiring advanced treatment. Furthermore, China's rapid urbanization and focus on improving municipal water quality for its burgeoning population are significant demand catalysts. Economic policies aimed at industrial upgrading and stringent environmental regulations, such as the "Blue Sky" initiative, are compelling industries to invest in advanced water treatment technologies and chemicals. The robust infrastructure development, including new wastewater treatment plants, further fuels market growth.

Within Chemical Type, Pre-treatment chemicals, including coagulants, flocculants, and antiscalants, hold the largest market share. These are essential for preparing feed water for membrane processes, preventing fouling, and extending membrane lifespan. The growing demand for ultrapure water in industries like semiconductors and pharmaceuticals, coupled with the increasing use of reverse osmosis (RO) for desalination and industrial water recycling, directly boosts the consumption of these pre-treatment chemicals.

In terms of End-user Industry, Industrial applications, encompassing Chemicals, Power, and Manufacturing (including Food & Beverage), collectively represent the dominant segment. The Chemicals sector, in particular, requires large volumes of treated water for its processes and generates complex wastewater streams, driving the demand for specialized membrane treatment chemicals. The Power sector relies on membrane technology for boiler feed water and cooling tower water treatment. The Food & Beverage Processing industry utilizes membrane filtration for product purification, concentration, and wastewater treatment to meet stringent hygiene and environmental standards. The Municipal sector is also a significant and growing end-user, driven by the need to expand access to safe drinking water and improve wastewater treatment across urban and semi-urban areas.

Japan and South Korea represent mature but technologically advanced markets, characterized by high adoption rates of sophisticated membrane technologies and a strong demand for high-performance, specialized chemicals. The ASEAN Countries, with their rapidly industrializing economies and growing populations, present substantial growth opportunities. Countries like Vietnam, Indonesia, and Thailand are witnessing increasing investments in water treatment infrastructure and industrial expansion, driving the demand for membrane water treatment chemicals. The Rest of Asia-Pacific, including countries like Australia and New Zealand, contributes to the market with a focus on sustainable water management and advanced industrial applications.

Asia-Pacific Membrane Water Treatment Chemicals Market Product Developments

Product development in the Asia-Pacific membrane water treatment chemicals market is increasingly focused on enhancing performance, sustainability, and cost-effectiveness. Innovations include the development of advanced antiscalants that provide superior protection against a wider range of foulants, as well as more biodegradable and eco-friendly biocides and coagulants. Companies are investing in R&D for specialized chemical formulations that are effective at lower dosages, reducing overall chemical consumption and operational costs. The trend towards integrated solutions, where chemical suppliers offer tailored programs that combine specific chemicals with monitoring and technical support, is gaining momentum. Competitive advantages are being carved out through superior fouling control, extended membrane lifespan, and compliance with stringent environmental regulations, offering a compelling value proposition to end-users seeking optimized water treatment performance.

Key Drivers of Asia-Pacific Membrane Water Treatment Chemicals Market Growth

Several key drivers are propelling the growth of the Asia-Pacific membrane water treatment chemicals market. The escalating demand for clean water, fueled by population growth and rapid industrialization, is the primary impetus. Stringent environmental regulations concerning water quality and wastewater discharge are forcing industries to adopt advanced treatment solutions, thereby increasing the consumption of specialized chemicals. Technological advancements in membrane technology are creating a symbiotic demand for more effective and compatible chemical treatments. Furthermore, increasing investments in water infrastructure development and the growing adoption of water recycling and reuse initiatives across various sectors are significant growth accelerators. The economic development across emerging economies within the region is also contributing to increased industrial activity and, consequently, higher demand for water treatment solutions.

Challenges in the Asia-Pacific Membrane Water Treatment Chemicals Market Market

Despite the promising growth trajectory, the Asia-Pacific membrane water treatment chemicals market faces several challenges. Regulatory hurdles, including varying standards and enforcement across different countries, can complicate market entry and product approval processes. Supply chain complexities and the volatility of raw material prices can impact profitability and product availability. Intense competitive pressures, particularly from local players and price-sensitive markets, can lead to margin erosion. Moreover, the perceived high initial cost of implementing advanced membrane treatment systems, compared to conventional methods, can be a barrier to adoption in some developing economies. The availability of skilled personnel for operating and maintaining membrane systems and associated chemical dosing equipment also presents a challenge in certain regions.

Emerging Opportunities in Asia-Pacific Membrane Water Treatment Chemicals Market

Emerging opportunities in the Asia-Pacific membrane water treatment chemicals market are primarily driven by technological breakthroughs and a growing emphasis on sustainability. The development of novel, high-performance chemicals that offer enhanced fouling resistance, improved efficiency, and reduced environmental impact presents significant potential. Strategic partnerships between chemical manufacturers, membrane producers, and system integrators are creating opportunities for comprehensive water treatment solutions. Market expansion into underserved regions and emerging economies, coupled with a focus on specific industry needs like desalination and industrial water reuse, offers substantial growth prospects. The increasing adoption of smart technologies and data analytics in water management will also create demand for advanced chemical dosing and monitoring solutions.

Leading Players in the Asia-Pacific Membrane Water Treatment Chemicals Market Sector

- Dow

- Genesys

- Italmatch Chemicals S p A

- Kemira

- Kurita Water Industries Ltd

- Solenis

- Suez

- Veolia Water Solutions and Technologies

Key Milestones in Asia-Pacific Membrane Water Treatment Chemicals Market Industry

- 2019: Launch of new generation antiscalants with enhanced performance by Dow, offering superior protection against silica scaling.

- 2020: Solenis acquires Diversey's Water Technologies business, expanding its service and product offerings in the Asia-Pacific region.

- 2021: Kemira introduces a new range of bio-based coagulants, aligning with growing sustainability demands in the region.

- 2022: Kurita Water Industries Ltd announces significant investment in R&D for advanced membrane cleaning chemicals, addressing increasing fouling issues.

- 2023: Veolia Water Solutions and Technologies expands its footprint in Southeast Asia with new project wins in industrial wastewater treatment.

- 2024: Italmatch Chemicals S p A strengthens its presence in the APAC region through strategic distribution partnerships for its water treatment additives.

Strategic Outlook for Asia-Pacific Membrane Water Treatment Chemicals Market Market

The strategic outlook for the Asia-Pacific membrane water treatment chemicals market is highly positive, characterized by sustained growth and evolving market dynamics. Key growth accelerators include the increasing adoption of water reuse and recycling technologies, driven by water scarcity concerns and regulatory pressures. Manufacturers will focus on developing and marketing sustainable, eco-friendly chemical solutions to meet the growing demand for green chemistry. Strategic collaborations and M&A activities are expected to continue as companies seek to consolidate their market positions and expand their technological capabilities. The penetration of advanced membrane treatment solutions in emerging economies, coupled with the ongoing industrial development, will provide significant long-term market potential. Investing in robust R&D for specialized chemistries and offering integrated service models will be crucial for competitive advantage.

Asia-Pacific Membrane Water Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Pre-treatment

- 1.2. Biological Controllers

- 1.3. Other Chemical Types

-

2. End-user Industry

- 2.1. Food & Beverage Processing

- 2.2. Healthcare

- 2.3. Municipal

- 2.4. Chemicals

- 2.5. Power

- 2.6. Other End-user Industries

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Membrane Water Treatment Chemicals Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Membrane Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of Asia-Pacific Membrane Water Treatment Chemicals Market

Asia-Pacific Membrane Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers

- 3.4. Market Trends

- 3.4.1. Food & Beverage Processing Industry to Account for the Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Pre-treatment

- 5.1.2. Biological Controllers

- 5.1.3. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food & Beverage Processing

- 5.2.2. Healthcare

- 5.2.3. Municipal

- 5.2.4. Chemicals

- 5.2.5. Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. China Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Pre-treatment

- 6.1.2. Biological Controllers

- 6.1.3. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food & Beverage Processing

- 6.2.2. Healthcare

- 6.2.3. Municipal

- 6.2.4. Chemicals

- 6.2.5. Power

- 6.2.6. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. India Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Pre-treatment

- 7.1.2. Biological Controllers

- 7.1.3. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food & Beverage Processing

- 7.2.2. Healthcare

- 7.2.3. Municipal

- 7.2.4. Chemicals

- 7.2.5. Power

- 7.2.6. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Japan Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Pre-treatment

- 8.1.2. Biological Controllers

- 8.1.3. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food & Beverage Processing

- 8.2.2. Healthcare

- 8.2.3. Municipal

- 8.2.4. Chemicals

- 8.2.5. Power

- 8.2.6. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Pre-treatment

- 9.1.2. Biological Controllers

- 9.1.3. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food & Beverage Processing

- 9.2.2. Healthcare

- 9.2.3. Municipal

- 9.2.4. Chemicals

- 9.2.5. Power

- 9.2.6. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Pre-treatment

- 10.1.2. Biological Controllers

- 10.1.3. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food & Beverage Processing

- 10.2.2. Healthcare

- 10.2.3. Municipal

- 10.2.4. Chemicals

- 10.2.5. Power

- 10.2.6. Other End-user Industries

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Pre-treatment

- 11.1.2. Biological Controllers

- 11.1.3. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Food & Beverage Processing

- 11.2.2. Healthcare

- 11.2.3. Municipal

- 11.2.4. Chemicals

- 11.2.5. Power

- 11.2.6. Other End-user Industries

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dow

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Genesys

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Italmatch Chemicals S p A

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kemira

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kurita Water Industries Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Solenis

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Suez

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Veolia Water Solutions and Technologies*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Dow

List of Figures

- Figure 1: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 3: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 11: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 12: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 13: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 19: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 20: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 27: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 28: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 35: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 36: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 37: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 43: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 44: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 45: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 6: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 10: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 14: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 18: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 22: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 26: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Membrane Water Treatment Chemicals Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Asia-Pacific Membrane Water Treatment Chemicals Market?

Key companies in the market include Dow, Genesys, Italmatch Chemicals S p A, Kemira, Kurita Water Industries Ltd, Solenis, Suez, Veolia Water Solutions and Technologies*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Membrane Water Treatment Chemicals Market?

The market segments include Chemical Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers.

6. What are the notable trends driving market growth?

Food & Beverage Processing Industry to Account for the Fastest Growth Rate.

7. Are there any restraints impacting market growth?

; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Membrane Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Membrane Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Membrane Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Membrane Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence