Key Insights

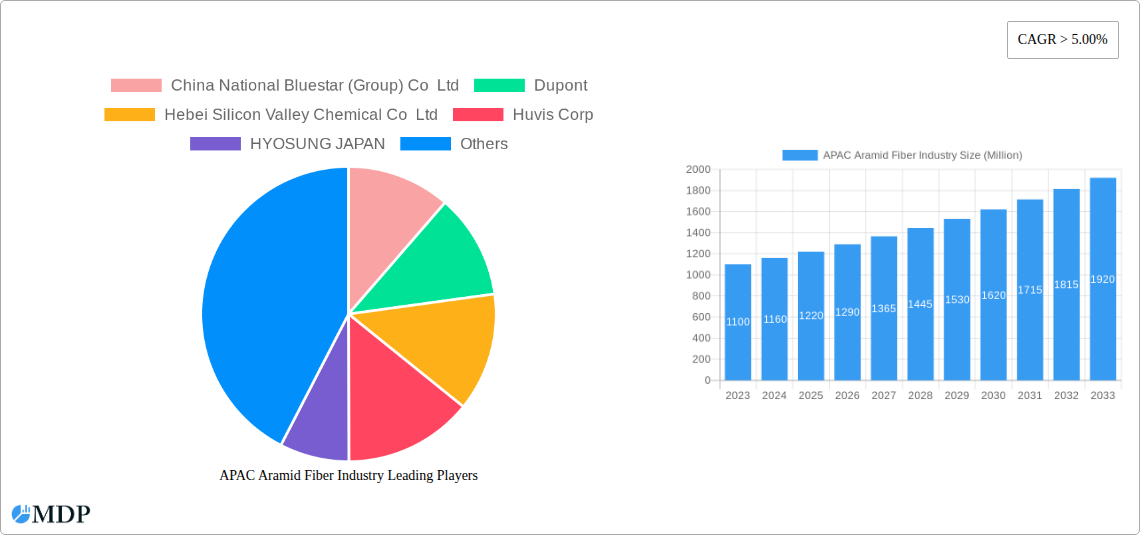

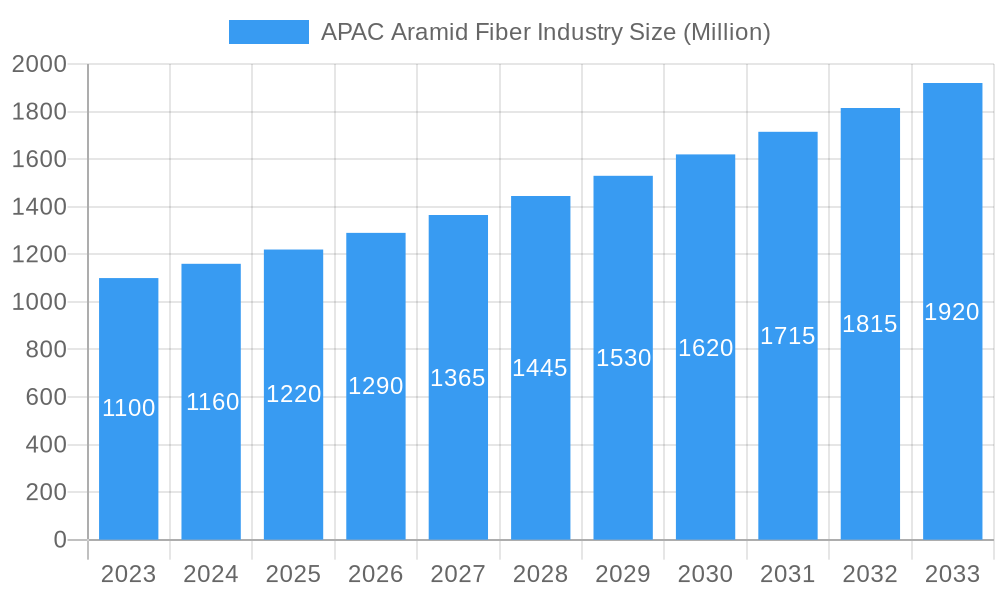

The APAC Aramid Fiber industry is poised for robust growth, projected to reach approximately USD 1.22 billion by 2025. This expansion is driven by a compound annual growth rate (CAGR) exceeding 5.00%, indicating sustained demand across various sectors. Key product types like Para-aramid and Meta-aramid fibers are central to this market surge, offering exceptional strength-to-weight ratios and thermal resistance. These properties make them indispensable in demanding applications within the Aerospace and Defense sector, where lightweight yet high-strength materials are critical for aircraft and protective gear. The Automotive industry is increasingly adopting aramid fibers for lightweighting vehicles to improve fuel efficiency and for enhanced safety components. Furthermore, the Electrical and Electronics sector benefits from the dielectric strength and thermal stability of aramid fibers in applications like insulation and high-performance cables. The Sporting Goods industry also utilizes these advanced materials for their superior performance and durability in equipment such as tennis rackets, protective gear, and sailcloth.

APAC Aramid Fiber Industry Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates continued upward momentum for the APAC Aramid Fiber market, largely fueled by the region's burgeoning industrial base and increasing investment in advanced materials. China, India, and Japan are expected to be prominent growth engines within the Asia-Pacific region, with significant contributions from South Korea, Malaysia, and Thailand. Emerging trends include the development of more sustainable and eco-friendly aramid fiber production methods, alongside innovative applications in areas like construction and industrial textiles. While the market demonstrates strong growth potential, certain restraints may emerge, such as the fluctuating costs of raw materials and the high initial investment required for advanced manufacturing facilities. Nevertheless, the inherent advantages of aramid fibers in performance and safety are expected to outweigh these challenges, ensuring a dynamic and expanding market landscape driven by leading players like DuPont, Teijin Aramid, and Toray Industries Inc.

APAC Aramid Fiber Industry Company Market Share

APAC Aramid Fiber Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

Dive deep into the dynamic APAC Aramid Fiber Industry with this exhaustive report. Covering the study period from 2019–2033, with 2025 as the base and estimated year, this analysis provides unparalleled insights into market trends, competitive landscapes, and future growth trajectories. We meticulously examine market size, segmentation by product type (Para-aramid, Meta-aramid) and end-user industries (Aerospace and Defense, Automotive, Electrical and Electronics, Sporting Goods, Other), and geographical dominance across Asia-Pacific, including China, India, Japan, South Korea, Malaysia, Thailand, Indonesia, and Vietnam. Discover the strategic moves of key players like China National Bluestar (Group) Co Ltd, Dupont, Hebei Silicon Valley Chemical Co Ltd, Huvis Corp, HYOSUNG JAPAN, KERMEL, Kolon Industries Inc, Shanghai J&S New Materials Co ltd, Teijin Aramid, TORAY INDUSTRIES INC, X-FIPER New Material Co Ltd, and Yantai Tayho Advanced Materials Co Ltd. This report is essential for industry stakeholders seeking to leverage high-traffic keywords for maximum search visibility.

APAC Aramid Fiber Industry Market Dynamics & Concentration

The APAC Aramid Fiber Industry exhibits a moderate to high market concentration, with a few key global players holding significant market share. Innovation drivers are primarily fueled by the demand for high-performance materials in burgeoning sectors like aerospace and defense, automotive lightweighting, and advanced electronics. Regulatory frameworks, while evolving, are largely supportive of material innovation that enhances safety and efficiency. Product substitutes such as carbon fiber and high-strength steel present competitive challenges, necessitating continuous advancements in aramid fiber properties. End-user trends are shifting towards increased sustainability, enhanced durability, and specialized functionalities, driving R&D investments. M&A activities in this sector are strategic, focusing on consolidating market positions, acquiring advanced technologies, and expanding geographical reach. For instance, in the historical period (2019-2024), there were an estimated xx M&A deal counts as companies sought to strengthen their competitive edge. Market share for the leading players, such as Teijin Aramid and Dupont, is estimated to be in the range of xx% to xx% each.

APAC Aramid Fiber Industry Industry Trends & Analysis

The APAC Aramid Fiber Industry is poised for substantial market growth, driven by several interconnected factors. The escalating demand for lightweight yet incredibly strong materials in the aerospace and defense sector for aircraft components, bulletproof vests, and protective gear is a primary catalyst. Concurrently, the automotive industry's push towards electrification and fuel efficiency is accelerating the adoption of aramid fibers in tires, hoses, and structural components for weight reduction and enhanced safety. The electrical and electronics industry is increasingly integrating aramid fibers for their excellent dielectric properties and thermal resistance in cables, circuit boards, and advanced insulation. The sporting goods sector also sees a steady uptake for its application in high-performance equipment like tennis rackets, skis, and protective gear, where strength-to-weight ratio is paramount.

Technological disruptions are continuously refining aramid fiber production processes, leading to improved performance characteristics and cost efficiencies. This includes advancements in polymerization techniques and fiber spinning technologies that yield materials with superior tensile strength, heat resistance, and chemical stability. Consumer preferences are increasingly aligning with products that offer enhanced safety, durability, and performance, directly benefiting the adoption of aramid fiber-based solutions. The competitive dynamics within the APAC region are characterized by both intense rivalry among established global players and the emergence of strong regional manufacturers, particularly from China, investing heavily in R&D and production capacity. The Compound Annual Growth Rate (CAGR) for the APAC Aramid Fiber Industry is projected to be xx% during the forecast period (2025–2033). Market penetration in key end-user segments is expected to reach xx% by 2033.

Leading Markets & Segments in APAC Aramid Fiber Industry

The Para-aramid segment is the dominant force within the APAC Aramid Fiber Industry, driven by its superior tensile strength and stiffness, making it indispensable for high-performance applications. Its dominance is most pronounced in the Aerospace and Defense and Automotive end-user industries. In Aerospace and Defense, the demand for lightweighting in aircraft structures, rotor blades, and composite armor for military vehicles fuels significant growth, with China and Japan leading in adoption due to robust defense spending and advanced manufacturing capabilities. Economic policies in these nations, focused on indigenous defense manufacturing, further bolster this demand.

In the Automotive sector, the increasing focus on electric vehicles (EVs) and stringent fuel efficiency regulations across countries like China and South Korea are driving the adoption of para-aramid fibers in EV battery casings, tires, and structural reinforcements. Infrastructure development projects, particularly high-speed rail networks in China and India, also contribute to the demand for aramid fibers in critical components requiring high tensile strength and durability. The Electrical and Electronics sector, particularly in manufacturing hubs like South Korea and Taiwan, sees a significant demand for para-aramid in high-performance cables and specialized electronic components where thermal management and electrical insulation are critical.

The Meta-aramid segment, while smaller, is crucial for applications requiring excellent heat resistance and flame retardancy. Its primary market lies in the Protective Apparel segment (included in 'Other En'), crucial for firefighters, industrial workers, and military personnel, with China and India being significant consumers due to large industrial workforces and expanding safety regulations. The Geography of China stands out as the single largest market within the Asia-Pacific region, owing to its vast manufacturing base across all key end-user industries and substantial government support for advanced materials development. The Rest of Asia-Pacific, encompassing countries like Malaysia and Thailand, also demonstrates promising growth due to increasing industrialization and foreign investment.

APAC Aramid Fiber Industry Product Developments

Recent product developments in the APAC Aramid Fiber Industry are characterized by a focus on enhancing specific performance attributes. Innovations include the development of aramid fibers with improved flame retardancy for advanced protective textiles, higher tensile strength for next-generation aerospace composites, and enhanced chemical resistance for demanding automotive and industrial applications. Researchers are also exploring novel fiber architectures and surface treatments to improve adhesion in composite materials, thereby unlocking new application potential in areas like advanced sporting equipment and medical devices. These technological advancements are directly responsive to market demands for lighter, stronger, and more durable materials, solidifying the competitive advantage of aramid fibers.

Key Drivers of APAC Aramid Fiber Industry Growth

The APAC Aramid Fiber Industry's growth is propelled by several key factors. Technologically, the continuous innovation in fiber manufacturing processes leading to superior performance characteristics such as exceptional tensile strength, thermal stability, and chemical resistance is a significant driver. Economically, the booming automotive sector, particularly the surge in electric vehicle production and the global push for lightweighting, directly translates to increased demand for aramid fibers in tires, structural components, and battery systems. Furthermore, robust investments in the aerospace and defense sector across the region, driven by geopolitical considerations and national security initiatives, are creating substantial market opportunities. Regulatory factors, such as stricter safety standards in various end-user industries, also encourage the adoption of high-performance protective materials like aramid fibers.

Challenges in the APAC Aramid Fiber Industry Market

Despite its strong growth prospects, the APAC Aramid Fiber Industry faces several challenges. High production costs compared to conventional materials can be a significant barrier to widespread adoption in price-sensitive applications. Stringent and varying regulatory hurdles across different countries for material certification and safety compliance can slow down market entry and expansion. Supply chain disruptions, as evidenced by global events, can impact the availability and cost of raw materials, affecting production timelines and profitability. Intense competitive pressures from established players and emerging low-cost alternatives also necessitate continuous innovation and cost optimization strategies.

Emerging Opportunities in APAC Aramid Fiber Industry

Emerging opportunities in the APAC Aramid Fiber Industry are ripe for exploitation. Technological breakthroughs in areas like recycling and sustainable production of aramid fibers can address environmental concerns and open up new markets. The increasing adoption of advanced composites in renewable energy infrastructure, such as wind turbine blades, presents a substantial growth avenue. Strategic partnerships between aramid fiber manufacturers and end-user industries can foster tailored solutions and accelerate market penetration. Furthermore, the expanding market for smart textiles and wearable technology offers novel applications for aramid fibers due to their durability and unique electrical properties.

Leading Players in the APAC Aramid Fiber Industry Sector

- China National Bluestar (Group) Co Ltd

- Dupont

- Hebei Silicon Valley Chemical Co Ltd

- Huvis Corp

- HYOSUNG JAPAN

- KERMEL

- Kolon Industries Inc

- Shanghai J&S New Materials Co ltd

- Teijin Aramid

- TORAY INDUSTRIES INC

- X-FIPER New Material Co Ltd

- Yantai Tayho Advanced Materials Co Ltd

Key Milestones in APAC Aramid Fiber Industry Industry

The recent developments pertaining to the major players in the market are being covered in the complete study. Examples of key milestones include:

- 2023/XX: Teijin Aramid announces investment in expanding its production capacity for para-aramid fibers to meet growing demand in Asia.

- 2022/XX: Dupont showcases new aramid fiber grades with enhanced thermal stability for advanced automotive applications.

- 2021/XX: Kolon Industries Inc inaugurates a new research and development center focused on next-generation meta-aramid fibers.

- 2020/XX: China National Bluestar (Group) Co Ltd expands its domestic production of aramid fibers, aiming to capture a larger share of the local market.

- 2019/XX: TORAY INDUSTRIES INC develops a proprietary process for producing ultra-high molecular weight aramid fibers for aerospace applications.

Strategic Outlook for APAC Aramid Fiber Industry Market

The strategic outlook for the APAC Aramid Fiber Industry is characterized by sustained growth driven by technological advancements and expanding application areas. The focus will be on developing specialized aramid fibers tailored to specific end-user needs, such as enhanced fire resistance for protective gear and improved impact absorption for automotive safety. The industry is expected to witness increased investment in sustainable production methods and recycling technologies to align with global environmental mandates. Strategic collaborations and vertical integration will be crucial for players to strengthen their market position and navigate the evolving competitive landscape, ensuring continued market expansion and innovation.

APAC Aramid Fiber Industry Segmentation

-

1. Product Type

- 1.1. Para-aramid

- 1.2. Meta-aramid

-

2. End-user Industry

- 2.1. Aerospace and Defense

- 2.2. Automotive

- 2.3. Electrical and Electronics

- 2.4. Sporting Goods

- 2.5. Other En

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Malaysia

- 3.1.6. Thailand

- 3.1.7. Indonesia

- 3.1.8. Vietnam

- 3.1.9. Rest of Asia-Pacific

-

3.1. Asia-Pacific

APAC Aramid Fiber Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

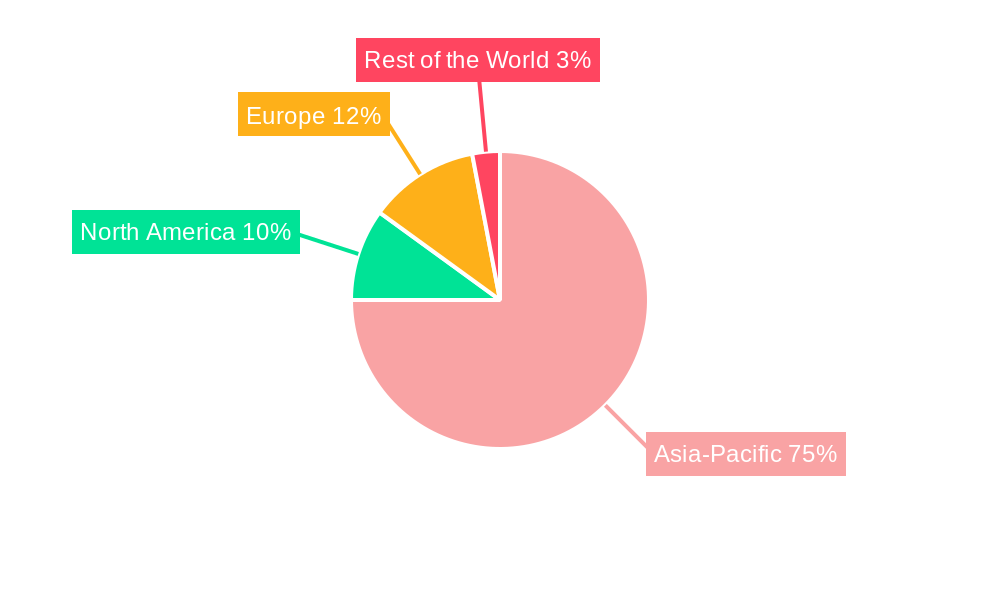

APAC Aramid Fiber Industry Regional Market Share

Geographic Coverage of APAC Aramid Fiber Industry

APAC Aramid Fiber Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increase in Demand for Light Weight Materials in Automotive Industry; The Rising Defense Expenditure of India and China; The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials

- 3.3. Market Restrains

- 3.3.1. The Increase in Demand for Light Weight Materials in Automotive Industry; The Rising Defense Expenditure of India and China; The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense End-User Industry to Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Aramid Fiber Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Para-aramid

- 5.1.2. Meta-aramid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace and Defense

- 5.2.2. Automotive

- 5.2.3. Electrical and Electronics

- 5.2.4. Sporting Goods

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Malaysia

- 5.3.1.6. Thailand

- 5.3.1.7. Indonesia

- 5.3.1.8. Vietnam

- 5.3.1.9. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China National Bluestar (Group) Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dupont

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hebei Silicon Valley Chemical Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huvis Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HYOSUNG JAPAN

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KERMEL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kolon Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai J&S New Materials Co ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Teijin Aramid

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TORAY INDUSTRIES INC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 X-FIPER New Material Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Yantai Tayho Advanced Materials Co Ltd *List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 China National Bluestar (Group) Co Ltd

List of Figures

- Figure 1: Global APAC Aramid Fiber Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global APAC Aramid Fiber Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific APAC Aramid Fiber Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: Asia Pacific APAC Aramid Fiber Industry Volume (Billion), by Product Type 2025 & 2033

- Figure 5: Asia Pacific APAC Aramid Fiber Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Asia Pacific APAC Aramid Fiber Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: Asia Pacific APAC Aramid Fiber Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific APAC Aramid Fiber Industry Volume (Billion), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific APAC Aramid Fiber Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific APAC Aramid Fiber Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific APAC Aramid Fiber Industry Revenue (Million), by Geography 2025 & 2033

- Figure 12: Asia Pacific APAC Aramid Fiber Industry Volume (Billion), by Geography 2025 & 2033

- Figure 13: Asia Pacific APAC Aramid Fiber Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 14: Asia Pacific APAC Aramid Fiber Industry Volume Share (%), by Geography 2025 & 2033

- Figure 15: Asia Pacific APAC Aramid Fiber Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Asia Pacific APAC Aramid Fiber Industry Volume (Billion), by Country 2025 & 2033

- Figure 17: Asia Pacific APAC Aramid Fiber Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Aramid Fiber Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Aramid Fiber Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Aramid Fiber Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global APAC Aramid Fiber Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global APAC Aramid Fiber Industry Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global APAC Aramid Fiber Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Aramid Fiber Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global APAC Aramid Fiber Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global APAC Aramid Fiber Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global APAC Aramid Fiber Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global APAC Aramid Fiber Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Global APAC Aramid Fiber Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global APAC Aramid Fiber Industry Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 13: Global APAC Aramid Fiber Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global APAC Aramid Fiber Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Aramid Fiber Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global APAC Aramid Fiber Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Japan APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Malaysia APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Malaysia APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Thailand APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Thailand APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Vietnam APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Vietnam APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific APAC Aramid Fiber Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific APAC Aramid Fiber Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Aramid Fiber Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the APAC Aramid Fiber Industry?

Key companies in the market include China National Bluestar (Group) Co Ltd, Dupont, Hebei Silicon Valley Chemical Co Ltd, Huvis Corp, HYOSUNG JAPAN, KERMEL, Kolon Industries Inc, Shanghai J&S New Materials Co ltd, Teijin Aramid, TORAY INDUSTRIES INC, X-FIPER New Material Co Ltd, Yantai Tayho Advanced Materials Co Ltd *List Not Exhaustive.

3. What are the main segments of the APAC Aramid Fiber Industry?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.22 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increase in Demand for Light Weight Materials in Automotive Industry; The Rising Defense Expenditure of India and China; The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials.

6. What are the notable trends driving market growth?

Aerospace and Defense End-User Industry to Dominated the Market.

7. Are there any restraints impacting market growth?

The Increase in Demand for Light Weight Materials in Automotive Industry; The Rising Defense Expenditure of India and China; The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Aramid Fiber Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Aramid Fiber Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Aramid Fiber Industry?

To stay informed about further developments, trends, and reports in the APAC Aramid Fiber Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence