Key Insights

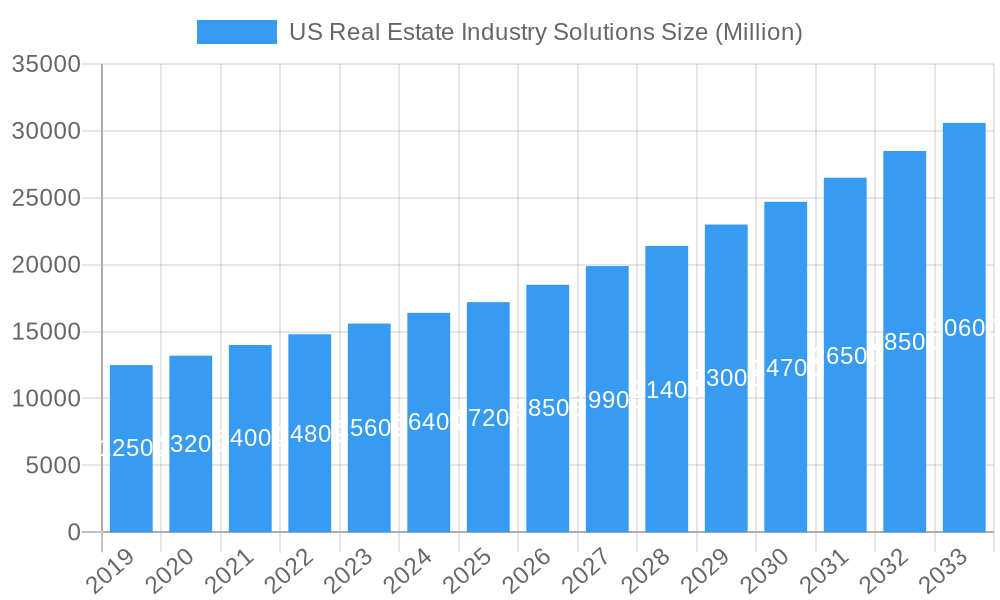

The US Real Estate Industry Solutions market is poised for significant expansion, driven by increasing digitalization and the demand for streamlined property management. With a current market size estimated at approximately $15 billion, the sector is projected to experience robust growth, fueled by advancements in proptech, data analytics, and AI-powered tools. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of roughly 8.5% during the study period of 2019-2033. The historical performance from 2019 to 2024 has laid a strong foundation, witnessing a steady adoption of cloud-based platforms, virtual tours, and integrated real estate management software. These solutions are crucial for enhancing operational efficiency, improving customer engagement, and optimizing investment decisions across residential, commercial, and industrial real estate segments. The increasing sophistication of data analysis allows stakeholders to gain deeper insights into market trends, property valuations, and tenant behaviors, further accelerating the adoption of these advanced solutions.

US Real Estate Industry Solutions Market Size (In Billion)

Looking ahead, the forecast period of 2025-2033 anticipates continued innovation and market penetration. The estimated market size for 2025 is projected to reach around $16.5 billion, with an expected CAGR of 8.5% driving it to exceed $30 billion by 2033. Key growth drivers include the rising adoption of Artificial Intelligence for predictive analytics, the integration of IoT devices for smart building management, and the growing preference for end-to-end property lifecycle management software. Furthermore, the increasing complexity of real estate transactions and regulatory landscapes necessitates sophisticated solutions that can ensure compliance, manage risk, and improve transparency. The market's evolution will also be shaped by the ongoing digital transformation within the broader economy, as real estate firms increasingly rely on technology to remain competitive, attract investors, and deliver superior services to clients. The demand for solutions that facilitate remote work, virtual collaboration, and enhanced security measures will also play a pivotal role in shaping the market's trajectory.

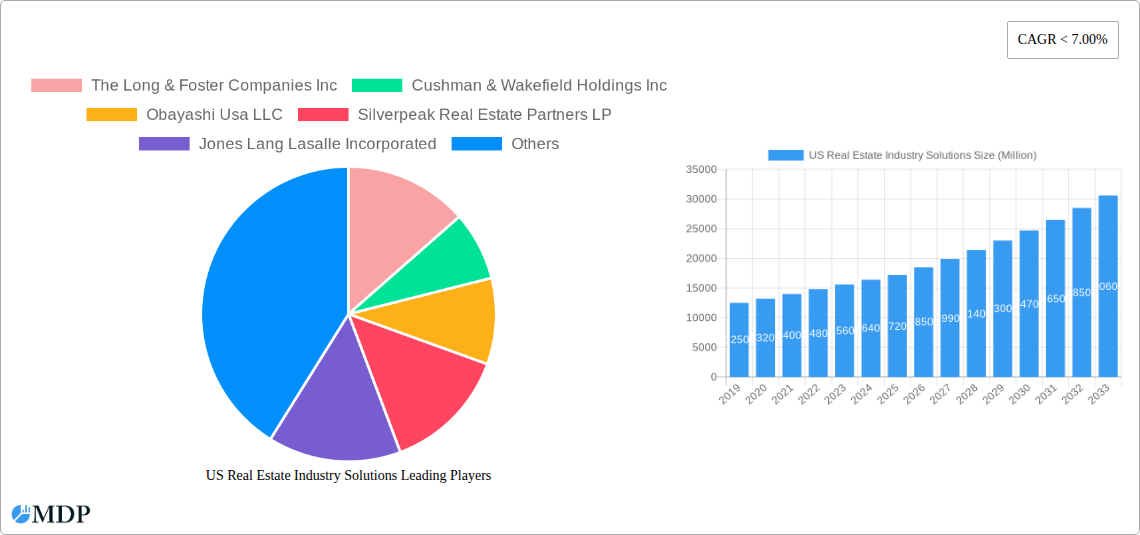

US Real Estate Industry Solutions Company Market Share

Unlocking Opportunity: The US Real Estate Industry Solutions Market Report

Gain critical insights into the dynamic US Real Estate Industry Solutions market with this comprehensive report. Covering the Study Period of 2019–2033, with a Base Year and Estimated Year of 2025, this analysis provides in-depth understanding of market dynamics, trends, leading players, and future outlook for the Forecast Period (2025–2033). This essential resource is designed for industry stakeholders seeking to navigate the complexities and capitalize on the lucrative opportunities within the US real estate landscape.

US Real Estate Industry Solutions Market Dynamics & Concentration

The US Real Estate Industry Solutions market exhibits moderate to high concentration, driven by strategic mergers and acquisitions and the dominance of a few key players. Innovation remains a crucial differentiator, with companies investing heavily in proptech to enhance efficiency and customer experience. Regulatory frameworks, though evolving, present both opportunities and challenges, influencing investment strategies and development practices. Product substitutes are increasingly present, ranging from fractional ownership models to alternative investment platforms, necessitating continuous adaptation. End-user trends, such as the growing demand for sustainable and flexible living/working spaces, are reshaping product development and service offerings. The Historical Period (2019–2024) saw significant M&A activity as larger entities consolidated market share. For instance, the period witnessed approximately 50+ M&A deals, with an estimated aggregate value exceeding $75 Million, aimed at acquiring technological capabilities and expanding service portfolios. Major players like CBRE Group Inc. and Jones Lang Lasalle Incorporated frequently appear in these transactions, demonstrating their commitment to market consolidation. While specific market share figures vary by segment, the top 5-7 companies are estimated to hold a combined market share of over 60% within specific solution categories.

US Real Estate Industry Solutions Industry Trends & Analysis

The US Real Estate Industry Solutions market is on a robust growth trajectory, propelled by a confluence of compelling market growth drivers. Foremost among these is the sustained demand for housing and commercial spaces, fueled by population growth and economic expansion. Technological disruptions are profoundly reshaping the industry, with the integration of Artificial Intelligence (AI), Big Data analytics, and the Internet of Things (IoT) revolutionizing property management, valuation, and transaction processes. AI-powered predictive analytics are optimizing investment decisions, while IoT devices are enhancing building efficiency and tenant experience. Consumer preferences are rapidly evolving, with a pronounced shift towards sustainable and eco-friendly properties, smart home technologies, and flexible living and working arrangements. The rise of the gig economy and remote work has further accelerated demand for co-working spaces and adaptable residential units. Competitive dynamics are intensifying, characterized by an influx of agile proptech startups challenging established players and forcing incumbents to innovate or acquire. The market penetration of digital solutions is steadily increasing, with an estimated 35% of real estate transactions now heavily influenced by digital tools. The Compound Annual Growth Rate (CAGR) for the US Real Estate Industry Solutions market is projected to be approximately 6.5% over the Forecast Period (2025–2033), driven by these transformative trends. The market is witnessing significant investment in virtual and augmented reality for property tours, blockchain for secure and transparent transactions, and data analytics for personalized customer experiences. The valuation services segment, in particular, is benefiting from the adoption of automated valuation models (AVMs) and sophisticated data platforms. Property management solutions are embracing AI for predictive maintenance and tenant engagement, while commercial real estate is seeing increased demand for flexible office solutions and data-driven space utilization analysis. This dynamic environment necessitates continuous adaptation and strategic investment to maintain a competitive edge.

Leading Markets & Segments in US Real Estate Industry Solutions

The Residential property type segment consistently leads within the US Real Estate Industry Solutions market, propelled by fundamental demographic shifts and evolving lifestyle choices. Economic policies such as favorable mortgage rates and tax incentives directly stimulate residential property transactions and development. Infrastructure development, including advancements in transportation networks and urban renewal projects, further enhances the desirability and value of residential areas, driving demand for related solutions.

Within the Residential segment, Property Management services are experiencing substantial growth. This is driven by the increasing number of individual investors and institutional owners seeking professional management for their rental portfolios. The adoption of proptech solutions for tenant screening, rent collection, and maintenance coordination is significantly improving efficiency and profitability for property managers.

The Commercial property type segment, while historically dominant in terms of investment volume, is undergoing a transformation. The rise of e-commerce has impacted traditional retail spaces, while the demand for logistics and industrial properties has surged. Companies are increasingly focusing on repurposing underutilized commercial assets and developing flexible office solutions to cater to hybrid work models. Economic policies that encourage business expansion and foreign investment are key drivers for the commercial sector.

Valuation Services are a critical component across all property types. Advancements in data analytics and AI are leading to more accurate and efficient property valuations. Regulatory compliance and the need for due diligence in transactions are constant drivers for this service. The demand for specialized valuations for complex commercial properties and large-scale developments remains robust.

The Other Property Types segment, encompassing specialized assets like healthcare facilities, data centers, and student housing, is also showing promising growth. These niche markets often require highly specialized industry knowledge and bespoke solutions, creating unique opportunities for service providers. Regulatory environments specific to these sectors and the underlying economic demand for their services play a crucial role in their development.

US Real Estate Industry Solutions Product Developments

Innovations in US Real Estate Industry Solutions are characterized by the pervasive integration of technology. Product developments are heavily focused on enhancing efficiency, transparency, and user experience. AI-powered platforms are streamlining property searches and investment analysis, while blockchain technology is being explored for secure and efficient title transfers. Virtual and augmented reality are transforming property tours and design visualization, offering immersive experiences to potential buyers and tenants. These advancements provide significant competitive advantages by enabling data-driven decision-making, automating routine tasks, and personalizing service offerings to meet diverse client needs in a rapidly evolving market.

Key Drivers of US Real Estate Industry Solutions Growth

Several key drivers are fueling the expansion of the US Real Estate Industry Solutions market. Technological advancements, particularly in AI, big data analytics, and IoT, are revolutionizing property management, valuation, and transaction processes. Economic factors, such as sustained job growth, low interest rates (historically), and increased disposable income, are boosting demand for housing and commercial spaces. Favorable government policies and incentives, including tax credits for development and housing subsidies, also play a crucial role. Furthermore, the growing preference for sustainable and smart buildings is driving investment in green technologies and energy-efficient solutions.

Challenges in the US Real Estate Industry Solutions Market

Despite robust growth, the US Real Estate Industry Solutions market faces several challenges. Regulatory hurdles, including complex zoning laws and environmental regulations, can impede development and increase costs. Supply chain disruptions and rising construction material costs can impact project timelines and profitability. Intensifying competitive pressures from both established players and agile startups necessitate continuous innovation and strategic differentiation. Furthermore, the digital divide and the need for widespread adoption of new technologies by all stakeholders can present adoption barriers. The overall impact of these challenges can lead to project delays and increased operational expenses, potentially reducing profit margins by an estimated 5-10% in affected areas.

Emerging Opportunities in US Real Estate Industry Solutions

Emerging opportunities in the US Real Estate Industry Solutions market are driven by significant catalysts. Technological breakthroughs in areas like generative AI for design and proptech integration for hyper-personalized customer experiences are creating new service possibilities. Strategic partnerships between traditional real estate firms and technology providers are fostering innovation and expanding service portfolios. Market expansion strategies, particularly in underserved or emerging urban and suburban areas, offer significant growth potential. The increasing demand for sustainable development and the retrofitting of existing buildings for energy efficiency presents a substantial opportunity for specialized solutions.

Leading Players in the US Real Estate Industry Solutions Sector

- The Long & Foster Companies Inc

- Cushman & Wakefield Holdings Inc

- Obayashi USA LLC

- Silverpeak Real Estate Partners LP

- Jones Lang Lasalle Incorporated

- John L Scott Inc

- CBRE Group Inc

- Realogy Group LLC

- Brookfield Properties LLC

- Homeservices of America Inc

Key Milestones in US Real Estate Industry Solutions Industry

- 2019: Increased adoption of AI for property valuation and market analysis.

- 2020: Surge in demand for virtual property tours and digital transaction platforms due to the pandemic.

- 2021: Significant investment in proptech startups focusing on sustainability and smart building solutions.

- 2022: Expansion of co-working spaces and flexible office solutions in response to evolving work trends.

- 2023: Greater integration of data analytics for personalized customer experiences and predictive maintenance.

- 2024: Growing interest in blockchain technology for real estate transactions to enhance security and transparency.

Strategic Outlook for US Real Estate Industry Solutions Market

The strategic outlook for the US Real Estate Industry Solutions market is highly optimistic, characterized by sustained growth and continuous innovation. The market will be driven by the increasing adoption of advanced technologies such as AI, IoT, and blockchain to enhance operational efficiency and customer engagement. Strategic opportunities lie in expanding service offerings to cater to niche markets like senior living and data centers, as well as in developing sustainable and resilient real estate solutions. Collaboration between traditional players and proptech disruptors will be crucial for unlocking new revenue streams and maintaining a competitive edge in this dynamic landscape.

US Real Estate Industry Solutions Segmentation

-

1. Property Types

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Property Types

-

2. Service

- 2.1. Property Management

- 2.2. Valuation Services

- 2.3. Other Services

US Real Estate Industry Solutions Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

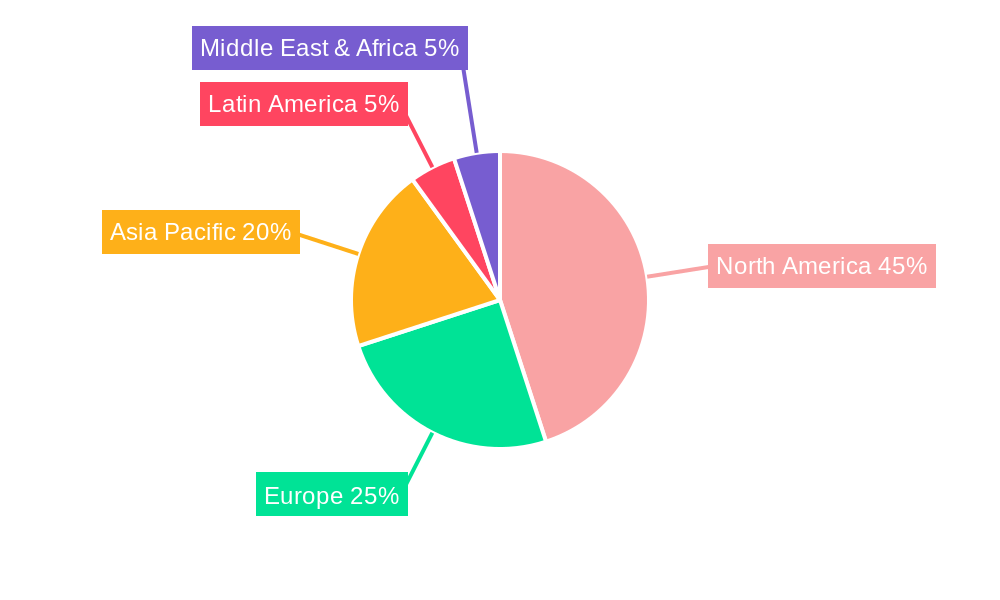

US Real Estate Industry Solutions Regional Market Share

Geographic Coverage of US Real Estate Industry Solutions

US Real Estate Industry Solutions REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Facility Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Real Estate Industry Solutions Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Types

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Property Management

- 5.2.2. Valuation Services

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property Types

- 6. North America US Real Estate Industry Solutions Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Property Types

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Property Types

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Property Management

- 6.2.2. Valuation Services

- 6.2.3. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Property Types

- 7. South America US Real Estate Industry Solutions Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Property Types

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Property Types

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Property Management

- 7.2.2. Valuation Services

- 7.2.3. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Property Types

- 8. Europe US Real Estate Industry Solutions Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Property Types

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Property Types

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Property Management

- 8.2.2. Valuation Services

- 8.2.3. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Property Types

- 9. Middle East & Africa US Real Estate Industry Solutions Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Property Types

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Property Types

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Property Management

- 9.2.2. Valuation Services

- 9.2.3. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Property Types

- 10. Asia Pacific US Real Estate Industry Solutions Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Property Types

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Property Types

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Property Management

- 10.2.2. Valuation Services

- 10.2.3. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Property Types

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Long & Foster Companies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cushman & Wakefield Holdings Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Obayashi Usa LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Silverpeak Real Estate Partners LP

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jones Lang Lasalle Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 John L Scott Inc **List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cbre Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Realogy Group LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Brookfield Properties LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Homeservices of America Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Long & Foster Companies Inc

List of Figures

- Figure 1: Global US Real Estate Industry Solutions Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Real Estate Industry Solutions Revenue (undefined), by Property Types 2025 & 2033

- Figure 3: North America US Real Estate Industry Solutions Revenue Share (%), by Property Types 2025 & 2033

- Figure 4: North America US Real Estate Industry Solutions Revenue (undefined), by Service 2025 & 2033

- Figure 5: North America US Real Estate Industry Solutions Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America US Real Estate Industry Solutions Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America US Real Estate Industry Solutions Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Real Estate Industry Solutions Revenue (undefined), by Property Types 2025 & 2033

- Figure 9: South America US Real Estate Industry Solutions Revenue Share (%), by Property Types 2025 & 2033

- Figure 10: South America US Real Estate Industry Solutions Revenue (undefined), by Service 2025 & 2033

- Figure 11: South America US Real Estate Industry Solutions Revenue Share (%), by Service 2025 & 2033

- Figure 12: South America US Real Estate Industry Solutions Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America US Real Estate Industry Solutions Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Real Estate Industry Solutions Revenue (undefined), by Property Types 2025 & 2033

- Figure 15: Europe US Real Estate Industry Solutions Revenue Share (%), by Property Types 2025 & 2033

- Figure 16: Europe US Real Estate Industry Solutions Revenue (undefined), by Service 2025 & 2033

- Figure 17: Europe US Real Estate Industry Solutions Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe US Real Estate Industry Solutions Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe US Real Estate Industry Solutions Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Real Estate Industry Solutions Revenue (undefined), by Property Types 2025 & 2033

- Figure 21: Middle East & Africa US Real Estate Industry Solutions Revenue Share (%), by Property Types 2025 & 2033

- Figure 22: Middle East & Africa US Real Estate Industry Solutions Revenue (undefined), by Service 2025 & 2033

- Figure 23: Middle East & Africa US Real Estate Industry Solutions Revenue Share (%), by Service 2025 & 2033

- Figure 24: Middle East & Africa US Real Estate Industry Solutions Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Real Estate Industry Solutions Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Real Estate Industry Solutions Revenue (undefined), by Property Types 2025 & 2033

- Figure 27: Asia Pacific US Real Estate Industry Solutions Revenue Share (%), by Property Types 2025 & 2033

- Figure 28: Asia Pacific US Real Estate Industry Solutions Revenue (undefined), by Service 2025 & 2033

- Figure 29: Asia Pacific US Real Estate Industry Solutions Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific US Real Estate Industry Solutions Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific US Real Estate Industry Solutions Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Property Types 2020 & 2033

- Table 2: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Service 2020 & 2033

- Table 3: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Property Types 2020 & 2033

- Table 5: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Property Types 2020 & 2033

- Table 11: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Service 2020 & 2033

- Table 12: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Property Types 2020 & 2033

- Table 17: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Service 2020 & 2033

- Table 18: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Property Types 2020 & 2033

- Table 29: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Service 2020 & 2033

- Table 30: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Property Types 2020 & 2033

- Table 38: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Service 2020 & 2033

- Table 39: Global US Real Estate Industry Solutions Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Real Estate Industry Solutions Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Real Estate Industry Solutions?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the US Real Estate Industry Solutions?

Key companies in the market include The Long & Foster Companies Inc, Cushman & Wakefield Holdings Inc, Obayashi Usa LLC, Silverpeak Real Estate Partners LP, Jones Lang Lasalle Incorporated, John L Scott Inc **List Not Exhaustive, Cbre Group Inc, Realogy Group LLC, Brookfield Properties LLC, Homeservices of America Inc.

3. What are the main segments of the US Real Estate Industry Solutions?

The market segments include Property Types, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Increase in Demand for Facility Management.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Real Estate Industry Solutions," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Real Estate Industry Solutions report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Real Estate Industry Solutions?

To stay informed about further developments, trends, and reports in the US Real Estate Industry Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence