Key Insights

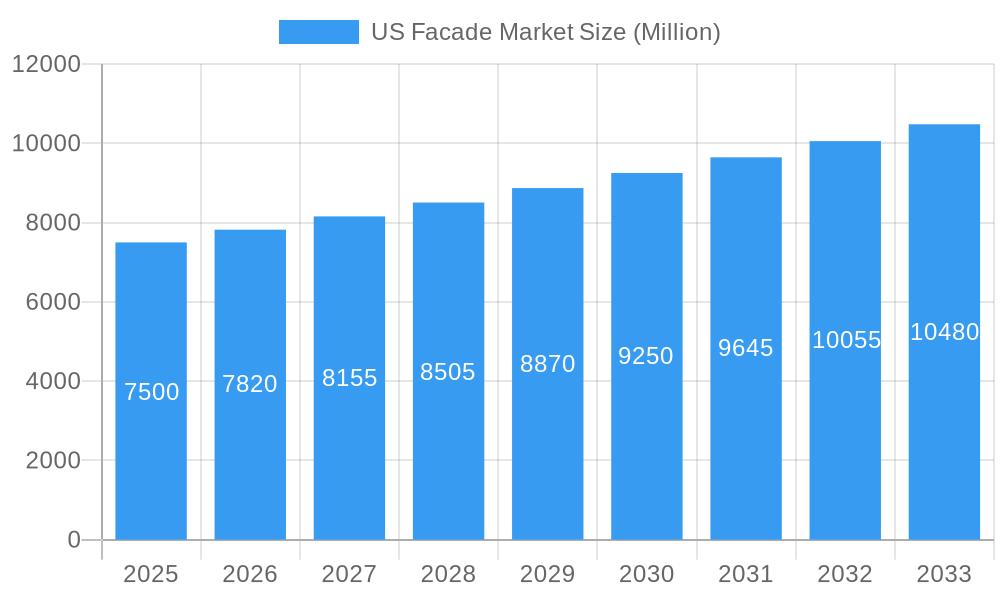

The US facade market is projected for significant growth, estimated at $45.1 billion by 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. Key drivers include rising new construction in commercial and residential sectors, a strong focus on energy-efficient designs, and advancements in facade materials that enhance durability, aesthetics, and performance. Demand for ventilated facades is increasing due to superior thermal regulation and moisture management, aligning with sustainability goals and building codes. Urbanization and the need for modernizing older buildings also contribute to market expansion. Innovations in glass and metal composites further shape the market.

US Facade Market Market Size (In Billion)

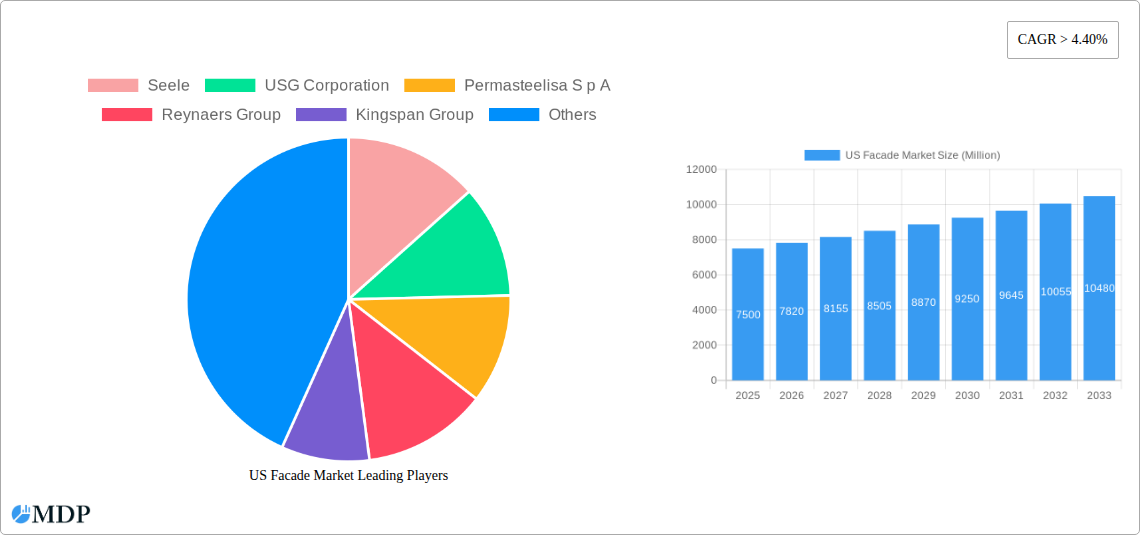

Challenges include the initial high cost of advanced facade systems, potential skilled labor shortages for installation, and evolving regulatory landscapes. However, material innovation, modular construction, and training programs are mitigating these factors. Ventilated facades lead the market, with glass and metal being favored materials. The commercial sector, encompassing offices, retail, and hospitality, is a major driver, alongside residential construction demanding aesthetic and energy-efficient exteriors. Leading companies like Seele, USG Corporation, Permasteelisa S p A, Reynaers Group, and Kingspan Group are pivotal in this evolving market.

US Facade Market Company Market Share

US Facade Market: Growth Analysis, Trends, and Forecasts (2025–2033)

This comprehensive analysis of the US Facade Market covers the period from 2025 to 2033, with a base year of 2025. It details market size, segmentation by type (Ventilated, Non-Ventilated, Others), material (Glass, Metal, Plastic and Fibres, Stones, Others), and end-users (Commercial, Residential, Others). Strategic insights into key players such as Seele, USG Corporation, Permasteelisa S p A, Reynaers Group, and Kingspan Group are provided. This report is essential for stakeholders in the US facade construction sector seeking to understand and capitalize on emerging opportunities.

US Facade Market Market Dynamics & Concentration

The US Facade Market is characterized by a moderate to high concentration, with a few dominant players influencing innovation and pricing strategies. Key innovation drivers include advancements in material science leading to more sustainable and energy-efficient facade solutions, alongside the increasing demand for aesthetic versatility. Regulatory frameworks, particularly those related to building codes, energy efficiency standards (e.g., LEED, BREEAM), and fire safety, play a crucial role in shaping product development and market entry. The emergence of new building technologies and design trends also fuels innovation. Product substitutes, while present in the form of traditional construction methods, are increasingly being outpaced by modern facade systems that offer superior performance and quicker installation times. End-user trends are heavily influenced by a growing emphasis on sustainability, occupant comfort, and the desire for modern, visually appealing architectural designs. Mergers and acquisitions (M&A) activities are significant in the sector, driven by the pursuit of market share, technological integration, and geographical expansion. Recent M&A deal counts indicate a trend towards consolidation as larger entities acquire smaller, specialized firms to enhance their product portfolios and service offerings. Market share distribution is dynamic, with leading companies continuously striving to capture greater portions of this expanding market.

US Facade Market Industry Trends & Analysis

The US Facade Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025–2033. This robust expansion is underpinned by several key market growth drivers. The increasing pace of urbanization and the continuous need for new commercial and residential construction projects are fundamental to this upward trajectory. Furthermore, a significant portion of the market is driven by the extensive renovation and retrofitting of existing buildings, aimed at improving energy efficiency, structural integrity, and aesthetic appeal. Technological disruptions are playing a transformative role, with the integration of smart facade technologies that offer dynamic shading, energy generation capabilities (photovoltaic facades), and advanced building management systems. The development of novel materials, such as high-performance insulated panels, advanced glazing technologies, and sustainable composite materials, is also a major trend, offering enhanced thermal insulation, durability, and design flexibility. Consumer preferences are increasingly leaning towards facades that not only provide structural integrity but also contribute to environmental sustainability and occupant well-being. This includes a demand for natural light, improved air quality, and visually pleasing aesthetics. The competitive dynamics within the market are intense, with manufacturers and installers vying for projects through innovation, cost-effectiveness, and superior service. Market penetration for advanced facade systems is steadily increasing as awareness of their long-term benefits, including reduced operational costs and enhanced property value, grows among developers and building owners. The base year of 2025 signifies a strong foundation for this growth, with projections indicating sustained demand throughout the forecast horizon.

Leading Markets & Segments in US Facade Market

The US Facade Market exhibits distinct leadership across various segments, driven by a confluence of economic policies, infrastructure development, and evolving consumer demands.

Dominant Region: The Commercial end-user segment is a dominant force within the US facade market. This is largely propelled by significant investments in office buildings, retail spaces, and hospitality projects, all of which require sophisticated and aesthetically pleasing facade solutions. The economic policies that encourage business expansion and urban regeneration directly fuel demand in this sector. Infrastructure development, including the construction of new business districts and the revitalization of existing commercial hubs, further amplifies the need for high-quality facade systems. The growth in e-commerce has also led to increased demand for modern warehousing and logistics facilities, which often incorporate advanced facade designs for operational efficiency and branding.

Dominant Segment by Material: Glass remains a leading material in the US facade market, particularly in the commercial sector. Its inherent ability to maximize natural light, coupled with advancements in energy-efficient glazing (e.g., low-emissivity coatings, insulated glass units), makes it an ideal choice for modern architectural designs. The aesthetic appeal of glass, offering transparency and a sense of openness, aligns with contemporary architectural trends. Key drivers for glass facade dominance include:

- Architectural Aesthetics: The ability to create sleek, modern, and transparent building envelopes.

- Energy Efficiency: Developments in advanced glazing technology significantly reduce heat gain and loss, contributing to lower energy bills.

- Natural Light Maximization: Enhances occupant comfort and reduces the need for artificial lighting, contributing to sustainability goals.

- Technological Advancements: Innovations in structural glazing, curtain wall systems, and fire-rated glass further expand its applications.

Dominant Segment by Type: Ventilated facades are experiencing significant growth and adoption. This system, which incorporates an air gap between the outer cladding and the building's insulation, offers superior thermal performance, moisture management, and acoustic insulation. The increasing emphasis on sustainable building practices and occupant comfort directly drives the demand for ventilated facade solutions.

- Improved Thermal Performance: The air gap helps to mitigate thermal bridging and improve insulation effectiveness.

- Moisture Control: Ventilation helps to prevent the buildup of moisture within the wall assembly, reducing the risk of mold and rot.

- Enhanced Building Durability: Better moisture management leads to a longer lifespan for the building structure.

- Acoustic Benefits: The air gap can also contribute to improved sound insulation.

- Aesthetic Versatility: Ventilated systems can accommodate a wide range of cladding materials, offering significant design flexibility.

US Facade Market Product Developments

Product developments in the US Facade Market are increasingly focused on enhancing sustainability, performance, and aesthetics. Innovations include the integration of photovoltaic panels directly into facade cladding, generating renewable energy while serving as a protective layer. Advanced composite materials are being developed that offer superior strength-to-weight ratios, durability, and resistance to environmental factors, often with a reduced carbon footprint. Smart glazing technologies that dynamically adjust transparency and solar heat gain are becoming more prevalent, optimizing indoor climate control and reducing energy consumption. The development of prefabricated facade systems is also gaining traction, enabling faster installation, improved quality control, and reduced on-site waste, offering competitive advantages in project delivery timelines and cost-effectiveness.

Key Drivers of US Facade Market Growth

Several key factors are propelling the growth of the US Facade Market. The ongoing need for new construction and the substantial volume of building renovations are fundamental drivers. A significant catalyst is the increasing regulatory push towards energy-efficient buildings, mandating better insulation and performance standards that favor modern facade systems. Economic growth and increased investment in commercial and residential real estate development directly translate to higher demand for facade materials and installation services. Furthermore, the growing awareness and preference for sustainable and aesthetically pleasing building designs are influencing architects and developers to opt for advanced facade solutions that offer both environmental benefits and visual appeal. Technological advancements in materials science and manufacturing processes are also making facades more durable, cost-effective, and versatile.

Challenges in the US Facade Market Market

Despite robust growth, the US Facade Market faces several challenges. Regulatory hurdles, including evolving building codes and stringent permitting processes, can create delays and increase project costs. Supply chain disruptions and volatility in the prices of raw materials, particularly metals and glass, can impact profitability and project timelines. Intense competition from a fragmented market and the pressure to offer competitive pricing can squeeze margins for manufacturers and installers. Furthermore, the skilled labor shortage for specialized facade installation presents a significant operational challenge, potentially impacting project execution quality and speed. The upfront cost of advanced facade systems, while offering long-term savings, can also be a barrier for some developers.

Emerging Opportunities in US Facade Market

Emerging opportunities in the US Facade Market are ripe for exploration. The growing demand for high-performance, energy-efficient buildings is a primary catalyst, driving innovation in smart facades and sustainable materials. Technological breakthroughs in areas like self-healing materials and advanced insulation will create new product categories and market niches. Strategic partnerships between material manufacturers, facade system suppliers, and construction firms can lead to integrated solutions and streamlined project delivery. Market expansion into underserved regions and the increasing focus on retrofitting older buildings present significant growth avenues. The rise of modular construction also opens doors for prefabricated facade solutions, offering faster installation and cost efficiencies.

Leading Players in the US Facade Market Sector

- Seele

- USG Corporation

- Permasteelisa S p A

- Reynaers Group

- Kingspan Group

- Louisiana Pacific Corporation

- Guardian Industries

- New Hudson Facades

- Georgia-Pacific L L C

- Sky Facade Inc

- Elemex® Inc

- Alphacladding

- GAMCO CORPORATION

Key Milestones in US Facade Market Industry

- November 2022: LP Building Solutions (LP) revealed plans for a second production line at its SmartSide® facility in Houlton, Maine. Post-ramp-up, this line is expected to generate 340 million square feet annually and create over 100 new local jobs, enhancing production capacity for facade components.

- April 2022: The town of Mocksville initiated a facade incentive grant program to renovate and restore commercial buildings in its Central Business District. Grants, capped at USD 1,500 or 50% of project cost, aim to encourage facade improvements, boosting local business aesthetics and economic vitality.

Strategic Outlook for US Facade Market Market

The strategic outlook for the US Facade Market is exceptionally positive, driven by sustained demand for new construction and an accelerating trend in building retrofitting. Growth accelerators include the continued integration of smart technologies for energy management and occupant comfort, alongside the development and adoption of increasingly sustainable and circular economy-aligned facade materials. The focus on achieving higher energy efficiency standards in buildings will remain a key driver, favoring advanced facade systems. Strategic opportunities lie in developing prefabricated and modular facade solutions to address labor shortages and improve construction efficiency. Furthermore, exploring niche markets for specialized facade applications and strengthening partnerships across the construction value chain will be crucial for capturing future market potential and ensuring long-term success.

US Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastic and Fibres

- 2.4. Stones

- 2.5. Others

-

3. End Users

- 3.1. Commercial

- 3.2. Residential

- 3.3. Others

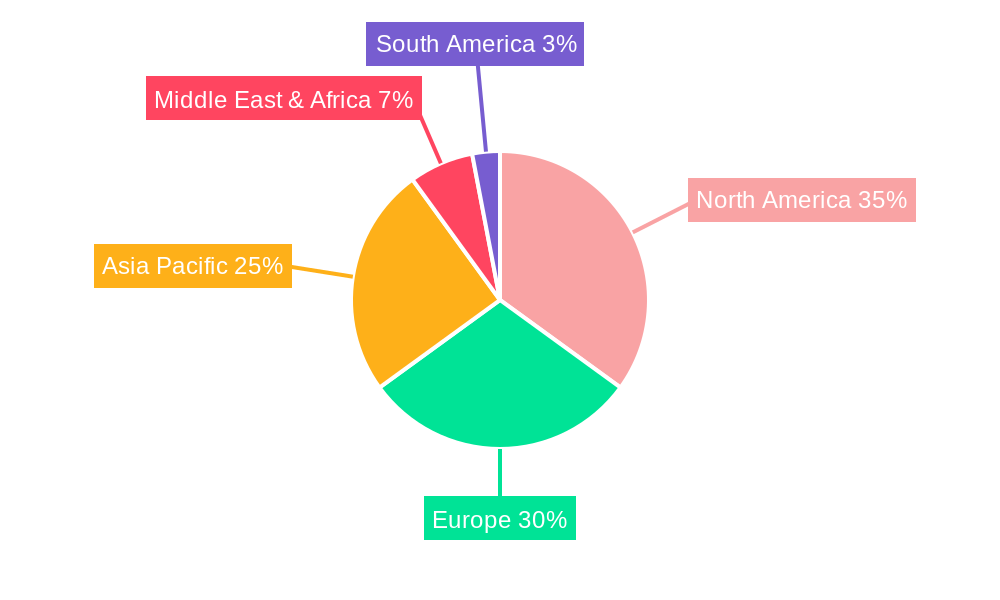

US Facade Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Facade Market Regional Market Share

Geographic Coverage of US Facade Market

US Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Glass Facades are Witnessing a Rise in Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Facade Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastic and Fibres

- 5.2.4. Stones

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Facade Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ventilated

- 6.1.2. Non-Ventilated

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Glass

- 6.2.2. Metal

- 6.2.3. Plastic and Fibres

- 6.2.4. Stones

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Commercial

- 6.3.2. Residential

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Facade Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ventilated

- 7.1.2. Non-Ventilated

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Glass

- 7.2.2. Metal

- 7.2.3. Plastic and Fibres

- 7.2.4. Stones

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Commercial

- 7.3.2. Residential

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Facade Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ventilated

- 8.1.2. Non-Ventilated

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Glass

- 8.2.2. Metal

- 8.2.3. Plastic and Fibres

- 8.2.4. Stones

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Commercial

- 8.3.2. Residential

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Facade Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ventilated

- 9.1.2. Non-Ventilated

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Glass

- 9.2.2. Metal

- 9.2.3. Plastic and Fibres

- 9.2.4. Stones

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Commercial

- 9.3.2. Residential

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Facade Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ventilated

- 10.1.2. Non-Ventilated

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Glass

- 10.2.2. Metal

- 10.2.3. Plastic and Fibres

- 10.2.4. Stones

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Commercial

- 10.3.2. Residential

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Seele

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 USG Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Permasteelisa S p A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Reynaers Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kingspan Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Louisiana Pacific Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Guardian Industries

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 New Hudson Facades

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Georgia-Pacific L L C

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sky Facade Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Elemex® Inc **List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Alphacladding

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GAMCO CORPORATION

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Seele

List of Figures

- Figure 1: Global US Facade Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Facade Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America US Facade Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Facade Market Revenue (billion), by Material 2025 & 2033

- Figure 5: North America US Facade Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America US Facade Market Revenue (billion), by End Users 2025 & 2033

- Figure 7: North America US Facade Market Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America US Facade Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America US Facade Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Facade Market Revenue (billion), by Type 2025 & 2033

- Figure 11: South America US Facade Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America US Facade Market Revenue (billion), by Material 2025 & 2033

- Figure 13: South America US Facade Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: South America US Facade Market Revenue (billion), by End Users 2025 & 2033

- Figure 15: South America US Facade Market Revenue Share (%), by End Users 2025 & 2033

- Figure 16: South America US Facade Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America US Facade Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Facade Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe US Facade Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe US Facade Market Revenue (billion), by Material 2025 & 2033

- Figure 21: Europe US Facade Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe US Facade Market Revenue (billion), by End Users 2025 & 2033

- Figure 23: Europe US Facade Market Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Europe US Facade Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe US Facade Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Facade Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East & Africa US Facade Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa US Facade Market Revenue (billion), by Material 2025 & 2033

- Figure 29: Middle East & Africa US Facade Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Middle East & Africa US Facade Market Revenue (billion), by End Users 2025 & 2033

- Figure 31: Middle East & Africa US Facade Market Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East & Africa US Facade Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Facade Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Facade Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Asia Pacific US Facade Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific US Facade Market Revenue (billion), by Material 2025 & 2033

- Figure 37: Asia Pacific US Facade Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Asia Pacific US Facade Market Revenue (billion), by End Users 2025 & 2033

- Figure 39: Asia Pacific US Facade Market Revenue Share (%), by End Users 2025 & 2033

- Figure 40: Asia Pacific US Facade Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Facade Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global US Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Global US Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: Global US Facade Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global US Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global US Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Global US Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: Global US Facade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global US Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global US Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 14: Global US Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 15: Global US Facade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global US Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global US Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 21: Global US Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 22: Global US Facade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global US Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 34: Global US Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 35: Global US Facade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global US Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 43: Global US Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 44: Global US Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 45: Global US Facade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Facade Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the US Facade Market?

Key companies in the market include Seele, USG Corporation, Permasteelisa S p A, Reynaers Group, Kingspan Group, Louisiana Pacific Corporation, Guardian Industries, New Hudson Facades, Georgia-Pacific L L C, Sky Facade Inc, Elemex® Inc **List Not Exhaustive, Alphacladding, GAMCO CORPORATION.

3. What are the main segments of the US Facade Market?

The market segments include Type, Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Glass Facades are Witnessing a Rise in Adoption.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

November 2022: The newly renovated SmartSide® facility in Houlton, Maine, will get a second line, according to plans revealed by LP Building Solutions (LP). Following ramp-up, the second line will generate 340 million square feet annually and create more than 100 new jobs in the neighborhood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Facade Market?

To stay informed about further developments, trends, and reports in the US Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence