Key Insights

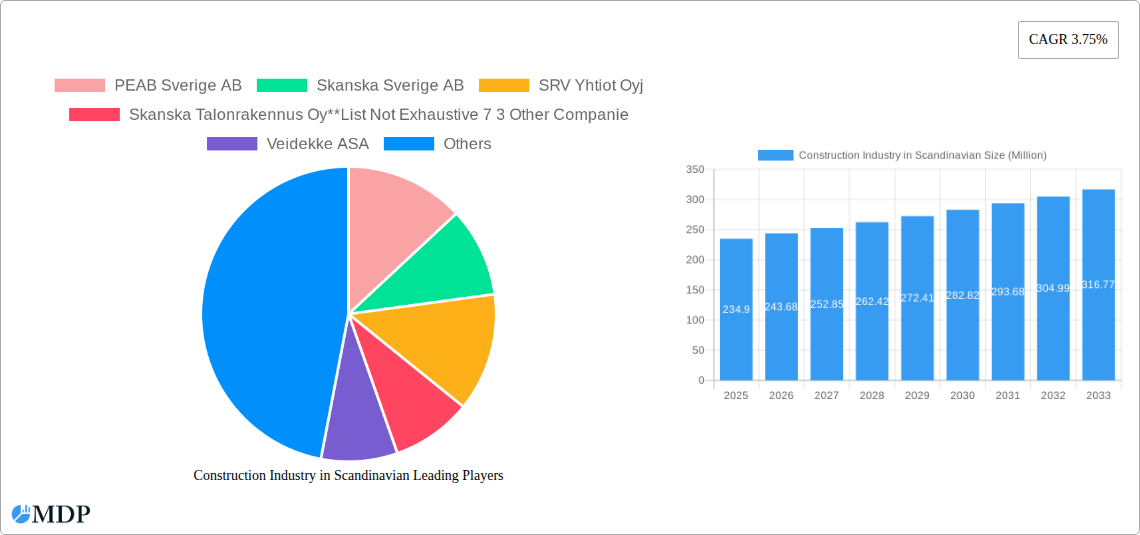

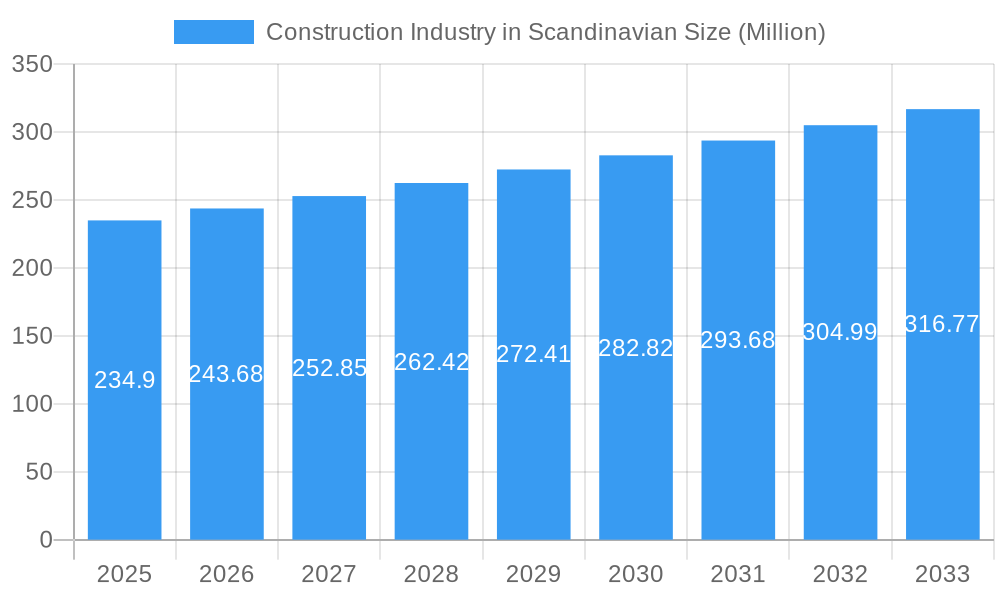

The Scandinavian construction industry is poised for steady growth, with a projected market size of USD 234.90 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.75% through 2033. This expansion is fueled by robust demand across residential, commercial, industrial, infrastructure (particularly transportation), and energy & utilities sectors. In the residential segment, factors such as a growing population, urbanization, and a sustained demand for modern housing solutions are driving new construction and renovation projects. The commercial sector benefits from ongoing business expansion, the need for updated retail spaces, and the development of modern office complexes. Industrial construction is seeing a resurgence with investments in advanced manufacturing facilities and logistics hubs, while infrastructure development, especially in transportation networks, is a critical government priority, aimed at enhancing connectivity and trade. The energy and utilities sector is also a significant contributor, with ongoing investments in renewable energy projects and the modernization of existing power grids and distribution networks.

Construction Industry in Scandinavian Market Size (In Million)

Several key trends are shaping the Scandinavian construction landscape. A prominent focus on sustainability and green building practices is evident, driven by stringent environmental regulations and increasing consumer awareness. This translates into a higher adoption of eco-friendly materials, energy-efficient designs, and circular economy principles within the industry. Digitalization and the adoption of Building Information Modeling (BIM) are transforming project planning, execution, and management, leading to improved efficiency, reduced waste, and enhanced collaboration among stakeholders. Furthermore, the industry is experiencing a shift towards modular and pre-fabricated construction methods, offering faster project completion times and cost savings. While growth is robust, the industry faces certain restraints. Labor shortages, particularly of skilled workers, continue to be a significant challenge, impacting project timelines and costs. Fluctuations in raw material prices, geopolitical uncertainties, and evolving regulatory frameworks can also pose challenges. Despite these hurdles, the strong underlying demand, coupled with technological advancements and a commitment to sustainability, positions the Scandinavian construction market for sustained and positive development.

Construction Industry in Scandinavian Company Market Share

Construction Industry in Scandinavian: Market Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Construction Industry in Scandinavian markets, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period from 2025 to 2033, this study delves into market dynamics, key trends, leading players, and future opportunities within Sweden, Norway, and Denmark. This report is essential for construction companies, investors, policymakers, and stakeholders seeking to understand the robust Nordic construction market, including its residential construction, commercial construction, industrial construction, and critical infrastructure development in transportation, energy, and utilities.

Construction Industry in Scandinavian Market Dynamics & Concentration

The Construction Industry in Scandinavian exhibits a moderately concentrated market structure, with a few dominant players holding significant market share. Key drivers of innovation include the relentless pursuit of sustainable building practices, digital transformation through BIM (Building Information Modeling), and advancements in prefabrication and modular construction. Regulatory frameworks are stringent, emphasizing environmental compliance, safety standards, and energy efficiency, which often acts as a barrier to entry but also fosters a high-quality construction ecosystem. Product substitutes, such as alternative materials and renovation technologies, are steadily gaining traction, particularly in the energy-efficient buildings segment. End-user trends are increasingly focused on smart homes, sustainable living, and resilient infrastructure, driven by a growing awareness of climate change and a demand for high-quality, long-lasting structures. Mergers and Acquisitions (M&A) activity is present, with strategic consolidations aimed at expanding market reach and acquiring specialized expertise. For instance, recent M&A deals in the Nordic region have seen major players acquiring smaller, innovative firms to integrate new technologies and services. The market share of the top five companies is estimated to be around 65%, with an average of 15 M&A deals annually over the historical period.

Construction Industry in Scandinavian Industry Trends & Analysis

The Construction Industry in Scandinavian is poised for sustained growth, driven by robust economic policies, significant government investments in infrastructure, and a strong societal commitment to sustainability. The compound annual growth rate (CAGR) for the overall market is projected at approximately 5.2% from 2025 to 2033. Technological disruptions are fundamentally reshaping the industry, with the widespread adoption of BIM, drone technology for site surveying, and the increasing use of AI for project management and predictive maintenance. Consumer preferences are shifting towards eco-friendly materials, energy-efficient designs, and smart building technologies that enhance comfort and reduce operational costs. The competitive landscape is characterized by intense rivalry among established giants and agile, niche players specializing in sustainable solutions. Market penetration of green building certifications, such as LEED and Nordic Swan Ecolabel, is high, exceeding 70% in new residential and commercial projects. The industry is also witnessing a growing demand for retrofitting and renovation projects, driven by the need to upgrade aging building stock to meet modern energy efficiency and sustainability standards. This trend is further amplified by government incentives for building renovations and the desire to reduce the carbon footprint of existing structures.

Leading Markets & Segments in Construction Industry in Scandinavian

The Construction Industry in Scandinavian demonstrates robust performance across several key segments. The Infrastructure (Transportation) sector is a dominant force, propelled by substantial government initiatives focused on upgrading and expanding road networks, high-speed rail, and public transportation systems across the region. Economic policies supporting long-term infrastructure development, coupled with the need to enhance connectivity and sustainability in transportation, are major drivers.

- Infrastructure (Transportation): Significant government investment in high-speed rail, urban public transport, and sustainable road networks across Sweden, Norway, and Denmark. The focus is on reducing travel times, improving accessibility, and promoting electric vehicle charging infrastructure.

- Residential: Strong demand for new housing, particularly in urban centers, driven by population growth and a high standard of living. An increasing emphasis on sustainable and energy-efficient homes, including passive houses and those incorporating renewable energy sources, is a key trend.

- Commercial: Growth in the commercial sector is fueled by investments in modern office spaces, retail developments, and hospitality projects, with a notable trend towards mixed-use developments that integrate living, working, and leisure spaces. Sustainability and occupant well-being are paramount.

- Industrial: The industrial construction segment is experiencing growth due to investments in logistics, manufacturing facilities, and renewable energy infrastructure, such as wind turbine installation and battery storage facilities.

- Energy and Utilities: This sector is a significant growth engine, with substantial investments in renewable energy projects, including offshore wind farms, solar energy installations, and grid modernization to accommodate a more decentralized and sustainable energy supply.

The dominance of these segments is underpinned by strategic economic policies, a proactive approach to sustainable development, and a continuous drive to modernize existing infrastructure and energy grids. The region’s commitment to climate goals further bolsters investment in these areas.

Construction Industry in Scandinavian Product Developments

Product innovations in the Construction Industry in Scandinavian are primarily focused on enhancing sustainability, efficiency, and digitalization. Advanced prefabrication and modular construction techniques are gaining significant traction, allowing for faster on-site assembly, reduced waste, and improved quality control. The integration of smart building technologies, including IoT sensors for real-time monitoring of energy consumption, occupancy, and structural integrity, is a key competitive advantage. Furthermore, the development and widespread adoption of low-carbon building materials, such as cross-laminated timber (CLT) and recycled aggregates, are transforming traditional construction practices and offering significant environmental benefits.

Key Drivers of Construction Industry in Scandinavian Growth

Several key drivers are propelling the growth of the Construction Industry in Scandinavian. Technologically, the pervasive adoption of Building Information Modeling (BIM) and digital construction platforms is streamlining project workflows and enhancing collaboration. Economically, strong government support for infrastructure projects, particularly in transportation and renewable energy, alongside healthy private sector investment, is creating a fertile ground for expansion. Regulatory frameworks that prioritize energy efficiency, sustainability, and safety are also inadvertently fostering innovation and the development of higher-value construction solutions. For example, strict emission regulations are pushing the adoption of electric construction machinery and sustainable material sourcing.

Challenges in the Construction Industry in Scandinavian Market

Despite its robust growth, the Construction Industry in Scandinavian faces several challenges. Regulatory hurdles, particularly concerning environmental impact assessments and permitting processes, can lead to project delays. Supply chain issues, including material shortages and price volatility, exacerbated by global geopolitical events, present ongoing concerns. Furthermore, intense competition among established players and the increasing demand for skilled labor, leading to wage inflation and potential project execution bottlenecks, are significant restraints. Quantifiable impacts include an estimated 10% increase in project costs due to supply chain disruptions over the past two years and a projected 5% labor cost increase annually.

Emerging Opportunities in Construction Industry in Scandinavian

Emerging opportunities in the Construction Industry in Scandinavian are numerous and significant, driven by a confluence of technological breakthroughs and strategic market shifts. The burgeoning demand for sustainable and energy-efficient buildings presents a prime avenue for growth, encouraging innovation in green building materials, smart home technologies, and retrofitting solutions for existing structures. Strategic partnerships between technology providers and construction firms are enabling the accelerated adoption of digital tools like AI-powered project management and advanced robotics for construction automation. Furthermore, the substantial investments in renewable energy infrastructure, including offshore wind farms and battery storage facilities, create substantial project pipelines. Market expansion strategies focusing on circular economy principles and the development of resilient infrastructure designed to withstand climate change impacts will also unlock substantial long-term growth potential.

Leading Players in the Construction Industry in Scandinavian Sector

- PEAB Sverige AB

- Skanska Sverige AB

- SRV Yhtiot Oyj

- Skanska Talonrakennus Oy

- Veidekke ASA

- Icop Norway

- YIT Suomi Oy

- JM AB

- NCC Sverige AB

- Obos Bbl

- Skanska Oy

- Skanska Norge AS

- 7 3 Other Companie

Key Milestones in Construction Industry in Scandinavian Industry

- 2019: Increased focus on sustainable building certifications across all Scandinavian countries.

- 2020: Major government announcements regarding significant investment in renewable energy infrastructure.

- 2021: Widespread adoption of BIM technologies becomes standard practice for large-scale projects.

- 2022: Several key mergers and acquisitions occur, consolidating market share among top players.

- 2023: Growing emphasis on modular construction and prefabrication for residential and commercial projects.

- 2024 (estimated): Significant increase in retrofitting and renovation projects for energy efficiency upgrades.

- 2025 (estimated): Launch of several large-scale smart city infrastructure projects.

Strategic Outlook for Construction Industry in Scandinavian Market

The strategic outlook for the Construction Industry in Scandinavian remains exceptionally positive, driven by a proactive commitment to sustainability, digitalization, and advanced infrastructure development. Growth accelerators include continued government investment in green energy and transportation, coupled with a strong consumer preference for energy-efficient and smart buildings. The industry's ability to embrace technological advancements, such as AI and robotics, will further enhance efficiency and reduce project timelines. Future market potential lies in the expansion of circular economy practices, the development of resilient infrastructure to combat climate change, and the continued innovation in sustainable building materials. Strategic opportunities include fostering stronger public-private partnerships and investing in upskilling the workforce to meet the demands of a technologically advanced and environmentally conscious construction sector.

Construction Industry in Scandinavian Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

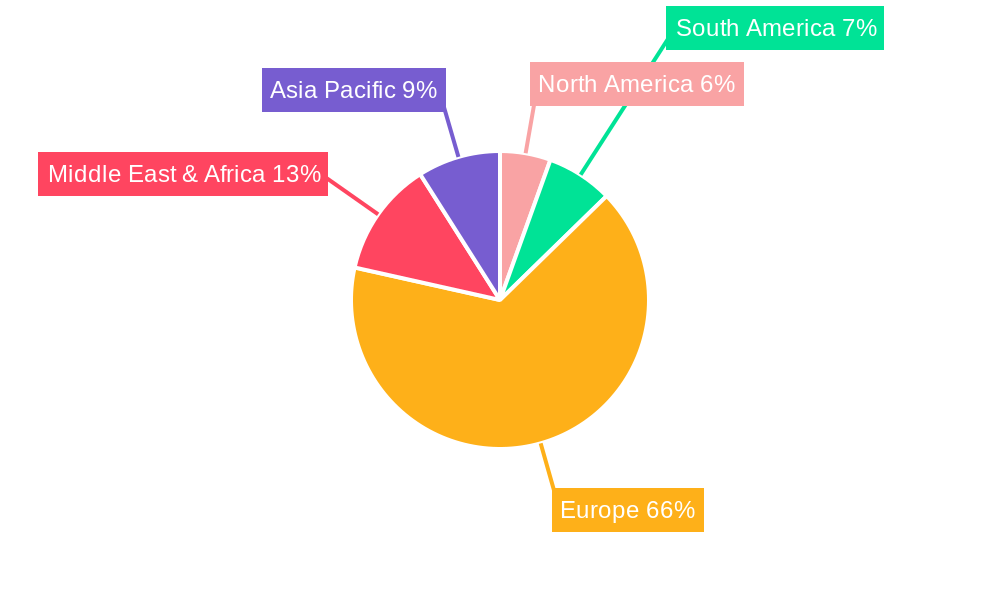

Construction Industry in Scandinavian Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Scandinavian Regional Market Share

Geographic Coverage of Construction Industry in Scandinavian

Construction Industry in Scandinavian REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and Infrastructure Development; Sustainable Construction Practices

- 3.3. Market Restrains

- 3.3.1. Labor Shortages and Costs

- 3.4. Market Trends

- 3.4.1. Ongoing Demand For Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure (Transportation)

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure (Transportation)

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure (Transportation)

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure (Transportation)

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure (Transportation)

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PEAB Sverige AB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Skanska Sverige AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SRV Yhtiot Oyj

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Skanska Talonrakennus Oy**List Not Exhaustive 7 3 Other Companie

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Veidekke ASA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Icop Norway

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 YIT Suomi Oy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JM AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NCC Sverige AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Obos Bbl

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Skanska Oy

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Skanska Norge AS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 PEAB Sverige AB

List of Figures

- Figure 1: Global Construction Industry in Scandinavian Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 3: North America Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 7: South America Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 8: South America Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 11: Europe Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 15: Middle East & Africa Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Middle East & Africa Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 19: Asia Pacific Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 20: Asia Pacific Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Global Construction Industry in Scandinavian Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 9: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 14: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 25: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 33: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Scandinavian?

The projected CAGR is approximately 3.75%.

2. Which companies are prominent players in the Construction Industry in Scandinavian?

Key companies in the market include PEAB Sverige AB, Skanska Sverige AB, SRV Yhtiot Oyj, Skanska Talonrakennus Oy**List Not Exhaustive 7 3 Other Companie, Veidekke ASA, Icop Norway, YIT Suomi Oy, JM AB, NCC Sverige AB, Obos Bbl, Skanska Oy, Skanska Norge AS.

3. What are the main segments of the Construction Industry in Scandinavian?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 234.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and Infrastructure Development; Sustainable Construction Practices.

6. What are the notable trends driving market growth?

Ongoing Demand For Infrastructure.

7. Are there any restraints impacting market growth?

Labor Shortages and Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Scandinavian," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Scandinavian report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Scandinavian?

To stay informed about further developments, trends, and reports in the Construction Industry in Scandinavian, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence