Key Insights

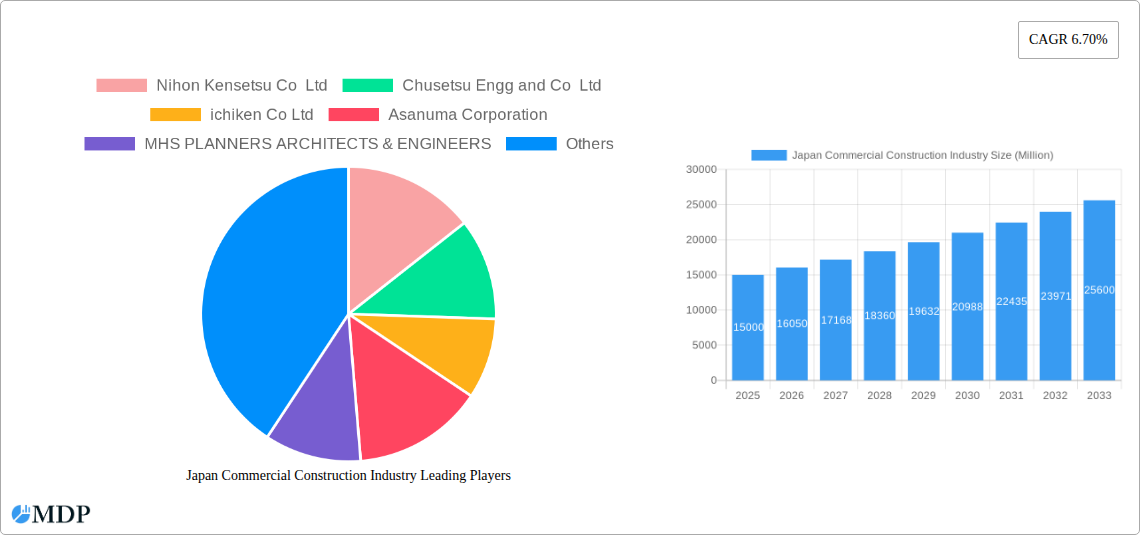

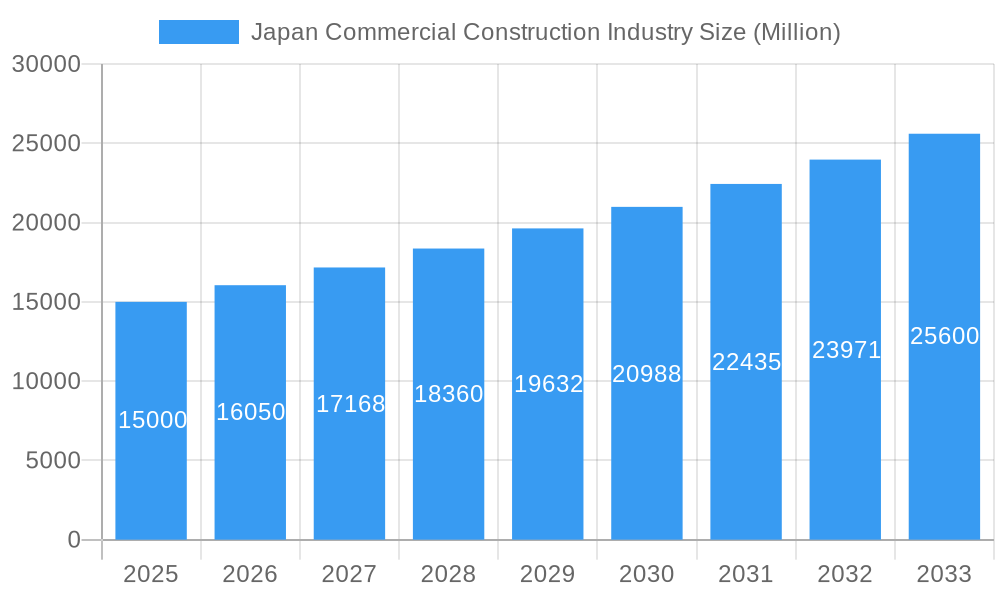

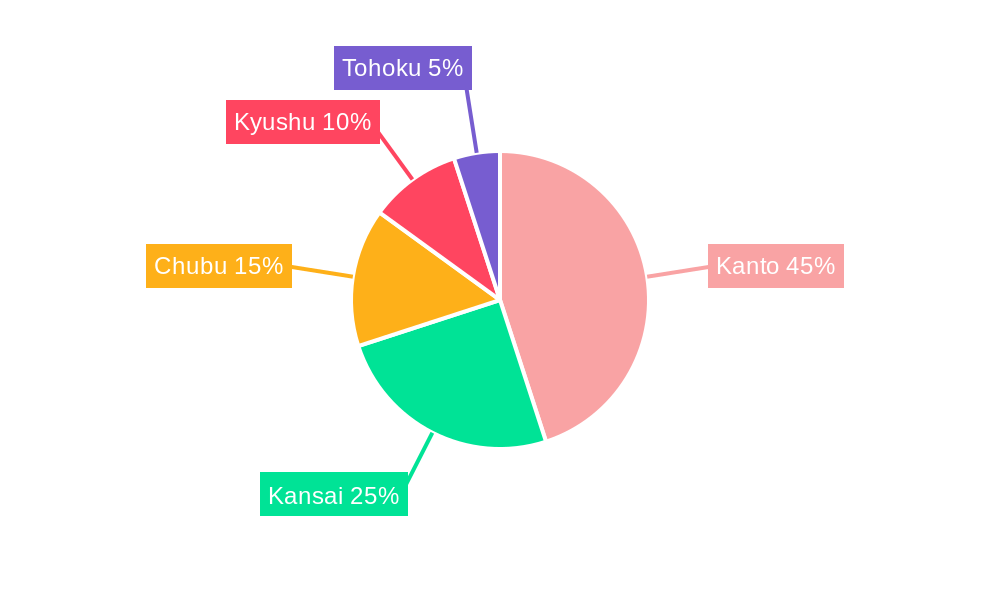

The Japanese commercial construction market, valued at approximately 107.06 billion in 2025, is projected for significant expansion with a compound annual growth rate (CAGR) of 2.91% from 2025 to 2033. This growth trajectory is propelled by escalating urbanization and population increases in key metropolitan hubs such as Tokyo, Osaka, and Nagoya, driving demand for new office spaces, retail outlets, and hospitality facilities. Government-backed infrastructure development and smart city initiatives are also key contributors. Furthermore, the continuous redevelopment of existing commercial properties and the expansion of logistics infrastructure to support the booming e-commerce sector further energize market activity. Key challenges include global economic volatility, rising material costs due to import dependencies, and the persistent risk of natural disasters. The market is segmented, with office construction dominating, followed by retail and hospitality. Leading industry participants include Nihon Kensetsu Co Ltd and Chusetsu Engg and Co Ltd, among others, often distinguished by their specialized segments or regional focus. Geographically, the Kanto region, encompassing Tokyo, commands the largest market share, followed by Kansai and Chubu. Future success will depend on the industry's capacity to adopt technological advancements like prefabrication and sustainable construction methods, while adeptly navigating global economic uncertainties and natural disaster preparedness.

Japan Commercial Construction Industry Market Size (In Billion)

The forecast period from 2025 to 2033 indicates sustained market expansion, though susceptible to economic cycles and governmental policy shifts. Continuous growth will be contingent on effective risk mitigation strategies, including addressing skilled labor shortages and balancing rapid development with environmentally responsible practices. The growing emphasis on green building certifications and energy efficiency is reshaping the competitive environment, incentivizing investment in innovative solutions and sustainable materials. A comprehensive understanding of these market dynamics is paramount for companies operating within or considering entry into Japan's vibrant commercial construction sector. Project distribution is expected to remain concentrated in major urban centers, with potential for growth in less developed areas spurred by government infrastructure projects.

Japan Commercial Construction Industry Company Market Share

Japan Commercial Construction Industry: 2019-2033 Market Report

Dive deep into the dynamic landscape of Japan's commercial construction industry with this comprehensive market report. This in-depth analysis provides a detailed overview of market size, growth drivers, key players, and future trends, offering invaluable insights for stakeholders across the construction sector. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Benefit from data-driven projections and strategic recommendations to navigate the complexities of this evolving market.

Japan Commercial Construction Industry Market Dynamics & Concentration

The Japanese commercial construction market, valued at xx Million USD in 2024, exhibits a moderately concentrated landscape. Market share is primarily held by a few large players, with smaller firms competing for niche projects. Innovation is driven by the adoption of Building Information Modeling (BIM), sustainable construction practices (green building certifications), and the integration of advanced technologies like robotics and 3D printing. Stringent building codes and regulations, including seismic and energy efficiency standards, shape the industry's development. Product substitutes, such as modular construction and prefabricated buildings, are gaining traction, challenging traditional construction methods. End-user trends indicate a growing preference for sustainable and technologically advanced commercial spaces. M&A activity in the sector is moderate, with xx major deals recorded between 2019 and 2024. This moderate M&A activity reflects a generally stable but evolving market.

- Market Concentration: High concentration among major players. Top 5 players hold approximately xx% market share.

- Innovation Drivers: BIM, sustainable construction, robotics, 3D printing.

- Regulatory Framework: Stringent building codes, seismic regulations, energy efficiency standards.

- Product Substitutes: Modular construction, prefabricated buildings.

- M&A Activity: xx major deals between 2019 and 2024.

Japan Commercial Construction Industry Industry Trends & Analysis

The Japanese commercial construction industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by robust infrastructure development initiatives, increasing urbanization, and a growing demand for modern commercial spaces. Technological disruptions, particularly in construction management software and digitalization of processes, are enhancing efficiency and productivity. Consumer preferences shift towards sustainable and smart buildings equipped with advanced technologies, creating new market opportunities. Competitive dynamics are characterized by both intense competition amongst established players and the emergence of innovative startups disrupting traditional processes. Market penetration of green building practices is steadily increasing, with xx% of new constructions achieving green building certifications in 2024.

Leading Markets & Segments in Japan Commercial Construction Industry

The Office Building Construction segment dominates the Japanese commercial construction market, driven by robust economic activity and the increasing demand for modern office spaces in major metropolitan areas like Tokyo, Osaka, and Nagoya.

- Office Building Construction:

- Key Drivers: Strong economic activity, increasing urbanization, demand for modern office spaces.

- Dominance Analysis: Highest market share among all segments, consistently high demand from both domestic and international companies. Significant investments in new office complexes and renovations.

- Retail Construction:

- Key Drivers: Growth of e-commerce, changing consumer preferences, expansion of retail chains.

- Hospitality Construction:

- Key Drivers: Increasing tourism, demand for luxury hotels and resorts, rising disposable incomes.

- Institutional Construction:

- Key Drivers: Government spending on infrastructure projects, increased demand for healthcare facilities and educational institutions.

- Other End-Users:

- Key Drivers: Diverse range of projects, including industrial facilities and specialized buildings.

Japan Commercial Construction Industry Product Developments

Recent product developments focus on prefabricated modular construction, sustainable building materials, and the integration of smart building technologies. These innovations offer faster construction times, reduced costs, improved energy efficiency, and enhanced building functionalities. The market is rapidly adopting BIM and other digital tools for streamlined project management and optimized resource allocation. This shift improves efficiency and reduces construction timelines and costs.

Key Drivers of Japan Commercial Construction Industry Growth

Several factors drive the industry’s growth. Government initiatives promoting infrastructure development, particularly in relation to the 2025 World Expo in Osaka, are a major catalyst. Furthermore, a burgeoning tourism sector necessitates new hospitality infrastructure. Lastly, technological advancements such as BIM and prefabrication are boosting efficiency and reducing costs.

Challenges in the Japan Commercial Construction Industry Market

The industry faces challenges including a shrinking workforce, escalating material costs, and supply chain disruptions. Stringent regulations and bureaucratic processes can also cause delays and increase project costs. The impact of these challenges is estimated to reduce the overall market growth by approximately xx% annually.

Emerging Opportunities in Japan Commercial Construction Industry

Opportunities exist in sustainable construction, smart building technologies, and the increasing demand for specialized facilities. Strategic partnerships between construction firms and technology providers can unlock new efficiencies and value propositions. Expansion into new markets, such as the development of commercial space infrastructure, represents further potential.

Leading Players in the Japan Commercial Construction Industry Sector

- Nihon Kensetsu Co Ltd

- Chusetsu Engg and Co Ltd

- ichiken Co Ltd

- Asanuma Corporation

- MHS PLANNERS ARCHITECTS & ENGINEERS

- Bisho Co Ltd

- Renoveru Co Ltd

- Konoike Construction Co Ltd

- TODA Corp

- Kumagai Gumi Co Ltd

Key Milestones in Japan Commercial Construction Industry Industry

- December 2022: The Yomiuri Shimbun reported that DigitalBlast, Inc. is planning to launch Japan's first commercial space station module by 2030. This presents a significant long-term opportunity for specialized construction firms.

- December 2022: The Japanese government allocated approximately 11.61 Billion USD for Self-Defense Force facility construction using construction bonds, boosting public sector projects.

Strategic Outlook for Japan Commercial Construction Industry Market

The Japanese commercial construction market presents significant long-term growth potential, driven by technological advancements, government initiatives, and a growing demand for modern and sustainable infrastructure. Strategic partnerships, investments in innovative technologies, and a focus on sustainable practices will be crucial for success in this competitive landscape. The market is poised for continued growth, driven by technological innovation and strategic investments.

Japan Commercial Construction Industry Segmentation

-

1. End-Users

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other End-Users

Japan Commercial Construction Industry Segmentation By Geography

- 1. Japan

Japan Commercial Construction Industry Regional Market Share

Geographic Coverage of Japan Commercial Construction Industry

Japan Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Government Initiatives and Policies

- 3.2.2 such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Government Mandates Pertaining to Energy Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Commercial Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-Users

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End-Users

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nihon Kensetsu Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chusetsu Engg and Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ichiken Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asanuma Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MHS PLANNERS ARCHITECTS & ENGINEERS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bisho Co Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renoveru Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Konoike Construction Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TODA Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kumagui Gumi Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nihon Kensetsu Co Ltd

List of Figures

- Figure 1: Japan Commercial Construction Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Commercial Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Commercial Construction Industry Revenue billion Forecast, by End-Users 2020 & 2033

- Table 2: Japan Commercial Construction Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Japan Commercial Construction Industry Revenue billion Forecast, by End-Users 2020 & 2033

- Table 4: Japan Commercial Construction Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Commercial Construction Industry?

The projected CAGR is approximately 2.91%.

2. Which companies are prominent players in the Japan Commercial Construction Industry?

Key companies in the market include Nihon Kensetsu Co Ltd, Chusetsu Engg and Co Ltd, ichiken Co Ltd, Asanuma Corporation, MHS PLANNERS ARCHITECTS & ENGINEERS, Bisho Co Ltd *List Not Exhaustive, Renoveru Co Ltd, Konoike Construction Co Ltd, TODA Corp, Kumagui Gumi Co Ltd.

3. What are the main segments of the Japan Commercial Construction Industry?

The market segments include End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.06 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives and Policies. such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation.

6. What are the notable trends driving market growth?

Government Mandates Pertaining to Energy Projects.

7. Are there any restraints impacting market growth?

4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2022: The Yomiuri Shimbun has discovered that a Tokyo-based startup was preparing to launch the country's first commercial space station through this initiative. Several American companies have already talked about building a space station, so DigitalBlast, Inc.'s plan to launch the first module of the station by 2030 is right on schedule.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Japan Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence