Key Insights

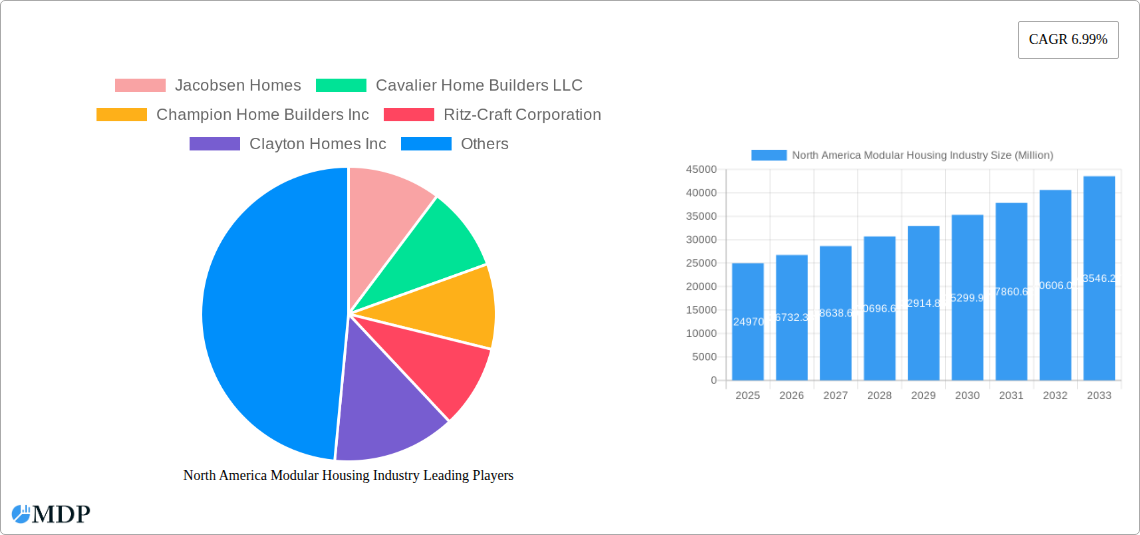

The North American modular housing market, valued at $24.97 billion in 2025, is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.99% from 2025 to 2033. This robust expansion is driven by several key factors. Increasing demand for affordable and sustainable housing options is a primary driver, particularly in urban areas facing housing shortages and rising land costs. The quicker construction timelines and reduced labor costs associated with modular construction offer significant advantages over traditional methods, attracting both builders and consumers. Furthermore, advancements in modular building technology are leading to improved energy efficiency and higher-quality finishes, enhancing the desirability of modular homes. The market segmentation reveals a strong preference for single-family units, although multi-family modular construction is also experiencing growth, driven by the need for efficient apartment complexes and affordable housing solutions. The United States constitutes the largest market within North America, followed by Canada and Mexico, reflecting the varying levels of housing demand and infrastructure development in each country. However, potential restraints include regulatory hurdles related to building codes and zoning regulations, as well as challenges in overcoming consumer perceptions of modular housing as being inferior to traditionally built homes.

North America Modular Housing Industry Market Size (In Billion)

The leading companies in this sector, including Jacobsen Homes, Clayton Homes, and others, are constantly innovating to address these challenges and capitalize on market opportunities. They are focusing on design flexibility, customization options, and marketing strategies to overcome consumer perceptions. The forecast period of 2025-2033 suggests a considerable expansion, driven by continuing urbanization, growing demand for sustainable housing, and the inherent efficiencies of modular construction. The competitive landscape is dynamic, with established players and new entrants vying for market share. The market’s future success will hinge on addressing regulatory barriers, fostering public awareness of the benefits of modular housing, and continuing advancements in design and technology. This will pave the way for widespread adoption and further propel market growth throughout North America.

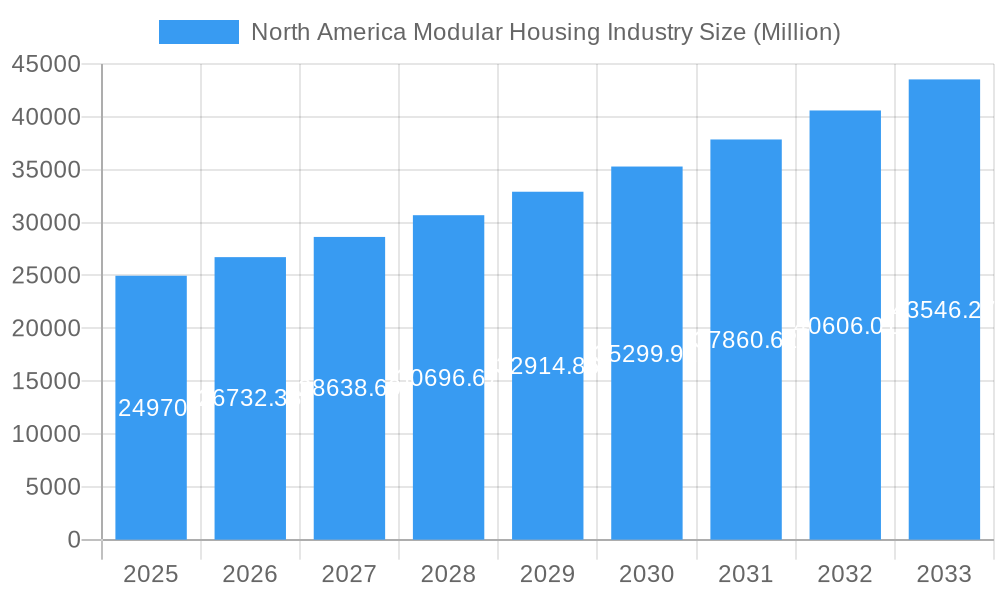

North America Modular Housing Industry Company Market Share

North America Modular Housing Industry Report: 2019-2033

Uncover the booming potential of the North American modular housing market with this comprehensive report, providing a detailed analysis of market dynamics, key players, and future growth opportunities. This in-depth study covers the period from 2019 to 2033, with a focus on the year 2025, offering valuable insights for investors, industry stakeholders, and businesses seeking to capitalize on this rapidly evolving sector.

North America Modular Housing Industry Market Dynamics & Concentration

The North American modular housing market, valued at $xx Million in 2024, is experiencing significant growth driven by several factors. Market concentration is moderate, with several large players dominating, while a fragmented landscape of smaller regional builders also exists. Key industry players like Clayton Homes, Jacobsen Homes, and Champion Home Builders hold significant market share, estimated at xx% collectively in 2025. Innovation, primarily in construction technology and materials, is a crucial driver, alongside evolving regulatory frameworks aimed at promoting sustainable and affordable housing. Product substitutes, such as traditional construction methods, face increasing competition due to modular housing's speed, cost-effectiveness, and environmental benefits. End-user trends show a growing preference for sustainable and energy-efficient housing options. Mergers and acquisitions (M&A) activity is increasing, with notable deals such as the Volumetric Building Companies (VBC) and Polcom Group merger in 2022, signifying consolidation and technological advancements. The number of M&A deals increased by xx% between 2021 and 2022.

- Market Concentration: Moderate, with leading players controlling xx% of the market.

- Innovation Drivers: Technological advancements in modular construction techniques and materials.

- Regulatory Frameworks: Increasingly supportive policies promoting sustainable and affordable housing.

- Product Substitutes: Traditional construction methods face growing competition.

- End-User Trends: Rising demand for sustainable and energy-efficient housing.

- M&A Activity: Increasing consolidation and technological integration through strategic mergers.

North America Modular Housing Industry Industry Trends & Analysis

The North American modular housing industry is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by several key factors. Increasing urbanization and population growth fuels the demand for affordable and rapidly deployable housing solutions. Technological disruptions, including advancements in prefabrication, 3D printing, and sustainable materials, are revolutionizing the industry. Consumer preferences are shifting towards customized, energy-efficient, and sustainable housing, which modular construction readily accommodates. Competitive dynamics are evolving with larger companies focusing on consolidation through acquisitions while smaller businesses specialize in niche markets or innovative designs. Market penetration of modular homes is expected to reach xx% by 2033, up from xx% in 2024. This growth is further fueled by government incentives promoting sustainable building practices and efforts to address the housing affordability crisis.

Leading Markets & Segments in North America Modular Housing Industry

The United States remains the dominant market for modular housing in North America, accounting for approximately xx% of the total market value in 2025. This dominance is driven by several key factors:

- United States: Strong economic growth, significant government investments in infrastructure, and a large and diverse housing market.

- Canada: Growing urbanization and government support for green building initiatives are propelling market growth.

- Mexico: The Mexican market shows potential but lags behind the US and Canada due to regulatory hurdles and infrastructure limitations.

By Type: The single-family segment currently holds the largest market share, although multi-family construction is showing significant growth potential. Multi-family’s expansion is driven by increased demand for rental housing in urban areas, where modular construction offers speed and efficiency.

North America Modular Housing Industry Product Developments

Recent product innovations in the modular housing sector demonstrate a strong focus on enhancing design flexibility, energy efficiency, and sustainability. The introduction of smart home technology integration, advanced prefabrication techniques, and the use of sustainable materials like cross-laminated timber are shaping the industry. This translates into reduced construction time, lower costs, and improved environmental performance, making modular homes a more attractive option for both builders and consumers.

Key Drivers of North America Modular Housing Industry Growth

Several key factors are driving the growth of the North American modular housing industry:

- Technological Advancements: Innovations in design, materials, and construction techniques.

- Economic Factors: Rising demand for affordable housing and government incentives for sustainable construction.

- Regulatory Support: Policies encouraging the adoption of modular construction methods. For example, some states offer tax incentives for using prefabricated homes.

Challenges in the North America Modular Housing Industry Market

Despite its growth, the modular housing industry faces several challenges. Regulatory hurdles regarding building codes and zoning regulations can hinder wider adoption. Supply chain disruptions and material price volatility impact construction costs and project timelines. Competition from traditional construction methods and ensuring skilled labor for assembly and installation presents ongoing challenges for the industry.

Emerging Opportunities in North America Modular Housing Industry

The future of the North American modular housing market holds significant growth opportunities. Technological breakthroughs, such as 3D printing and advanced automation, promise further cost reductions and improved efficiency. Strategic partnerships between modular housing builders and technology companies will unlock new innovations and accelerate market expansion. Government initiatives focused on affordable housing and sustainable development present significant long-term growth catalysts for the industry.

Leading Players in the North America Modular Housing Industry Sector

- Jacobsen Homes

- Cavalier Home Builders LLC

- Champion Home Builders Inc

- Ritz-Craft Corporation

- Clayton Homes Inc

- Lindal Cedar Homes

- Sunshine Homes Inc

- Skyline Corporation

- Triple M Housing Ltd

- Nobility Homes Inc

- Perrin Construction Co Inc

Key Milestones in North America Modular Housing Industry Industry

- April 2022: Clayton Homes launches its CrossMod single-section home, expanding affordable housing options.

- January 2022: Volumetric Building Companies (VBC) merges with Polcom Group, creating a leading player in multifamily modular construction.

Strategic Outlook for North America Modular Housing Industry Market

The North American modular housing market presents significant long-term growth potential. Continued technological innovation, coupled with supportive government policies and rising demand for sustainable and affordable housing, will drive market expansion. Strategic partnerships, focusing on supply chain optimization and technological integration, will be crucial for companies to maintain a competitive edge and capitalize on the emerging opportunities within this dynamic industry. The market is poised for significant expansion over the forecast period, presenting attractive prospects for investors and industry participants alike.

North America Modular Housing Industry Segmentation

-

1. Type

- 1.1. Single-family

- 1.2. Multi-family

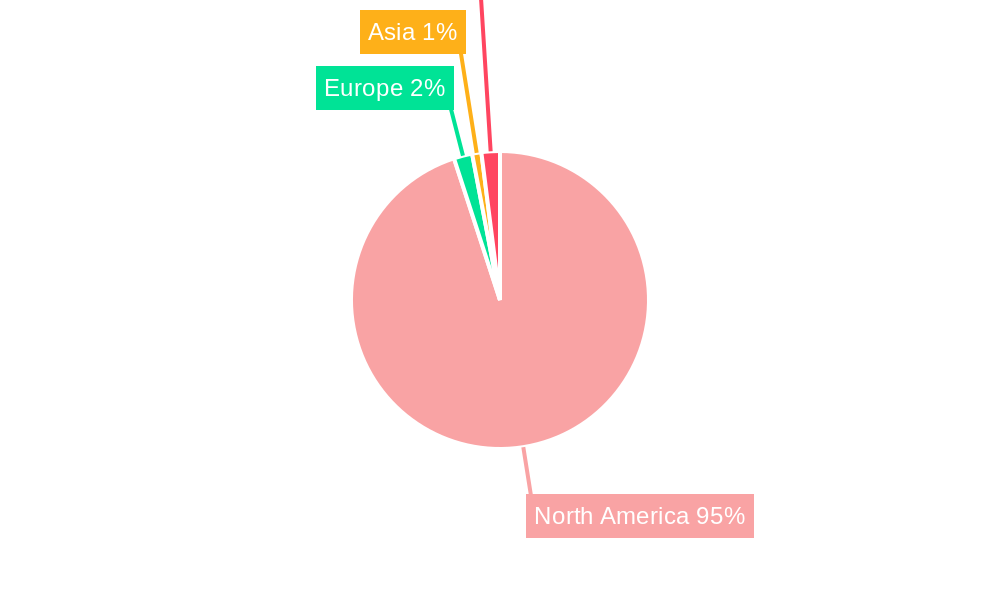

North America Modular Housing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Modular Housing Industry Regional Market Share

Geographic Coverage of North America Modular Housing Industry

North America Modular Housing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for prefab buildings; Surge in demand from residential segment

- 3.3. Market Restrains

- 3.3.1. Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas

- 3.4. Market Trends

- 3.4.1. Increase in Prefabricated Housing Market in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Modular Housing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-family

- 5.1.2. Multi-family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jacobsen Homes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cavalier Home Builders LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Champion Home Builders Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ritz-Craft Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Clayton Homes Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lindal Cedar Homes**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunshine Homes Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Skyline Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Triple M Housing Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nobility Homes Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Perrin Construction Co Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Jacobsen Homes

List of Figures

- Figure 1: North America Modular Housing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Modular Housing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Modular Housing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Modular Housing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Modular Housing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: North America Modular Housing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Modular Housing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Modular Housing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Modular Housing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Modular Housing Industry?

The projected CAGR is approximately 6.99%.

2. Which companies are prominent players in the North America Modular Housing Industry?

Key companies in the market include Jacobsen Homes, Cavalier Home Builders LLC, Champion Home Builders Inc, Ritz-Craft Corporation, Clayton Homes Inc, Lindal Cedar Homes**List Not Exhaustive, Sunshine Homes Inc, Skyline Corporation, Triple M Housing Ltd, Nobility Homes Inc, Perrin Construction Co Inc.

3. What are the main segments of the North America Modular Housing Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for prefab buildings; Surge in demand from residential segment.

6. What are the notable trends driving market growth?

Increase in Prefabricated Housing Market in North America.

7. Are there any restraints impacting market growth?

Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas.

8. Can you provide examples of recent developments in the market?

April 2022: Clayton Homes, a national builder of both off-site and on-site homes, showed off its first single-section CrossMod home at the Manufactured Housing Institute's Congress & Expo. This gives another group of homebuyers and locations a new affordable housing option.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Modular Housing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Modular Housing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Modular Housing Industry?

To stay informed about further developments, trends, and reports in the North America Modular Housing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence