Key Insights

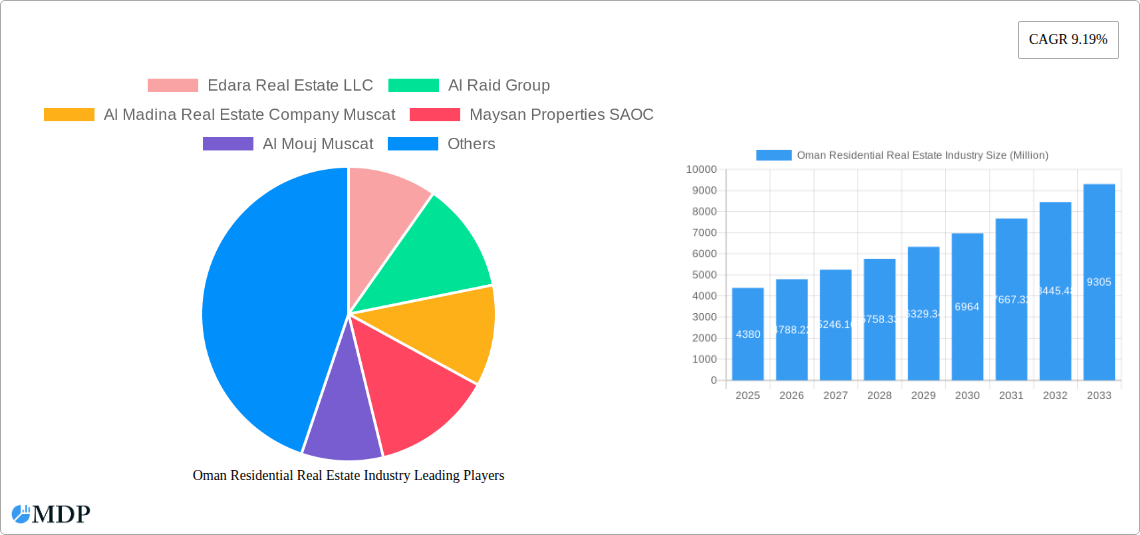

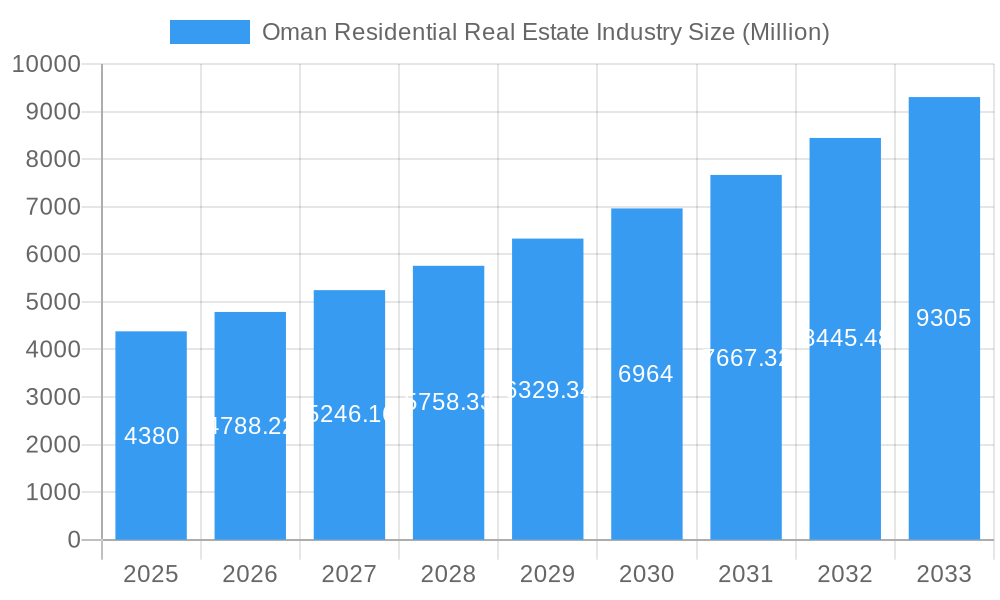

The Oman residential real estate market, valued at $4.38 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 9.19% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Oman's burgeoning population and a growing middle class are increasing demand for housing, particularly in urban centers like Muscat, Dhofar, and Musandam. Secondly, government initiatives aimed at infrastructure development and improved living standards are creating a favorable investment climate. Tourism growth also contributes positively, increasing demand for vacation homes and rental properties. Finally, low interest rates and the availability of mortgages are stimulating market activity, although this might be subject to change according to economic conditions. The market is segmented by property type (apartments & condominiums, villas & landed houses) and location, reflecting varying price points and preferences. While this positive outlook prevails, potential restraints include fluctuating oil prices, which impact overall economic stability, and the availability of construction materials. The competitive landscape is dominated by both local and international players, including Edara Real Estate LLC, Al Raid Group, and international brands like Coldwell Banker and Engel & Voelkers, creating a dynamic market with a diverse range of offerings.

Oman Residential Real Estate Industry Market Size (In Billion)

The forecast indicates continued growth through 2033, albeit potentially with some year-to-year fluctuation depending on global economic factors and government policies. The segments showing the strongest growth are likely to be apartments and condominiums in rapidly developing urban areas, driven by affordability and convenience. While villas and landed houses will remain a significant segment, their growth might be slightly moderated due to higher purchase prices and land scarcity in prime locations. Strategic investments in infrastructure and urban planning will be crucial to sustaining this positive trajectory and ensuring a balanced and sustainable development of the Omani residential real estate sector. The market's success hinges on managing these potential challenges while capitalizing on the continued growth of the Omani economy and its population.

Oman Residential Real Estate Industry Company Market Share

Oman Residential Real Estate Industry: Market Report 2019-2033

Dive deep into the lucrative Oman residential real estate market with this comprehensive report, offering invaluable insights for investors, developers, and industry stakeholders. This in-depth analysis covers the period 2019-2033, with a focus on 2025, providing a robust understanding of market dynamics, key players, and future growth potential. Expect detailed breakdowns by property type (apartments, villas), key cities (Muscat, Dhofar, Musandam), and leading companies like Al Mouj Muscat, Coldwell Banker, and Savills. Uncover emerging opportunities and challenges, and equip yourself with data-driven strategies to navigate this dynamic market. Download now and gain a competitive edge!

Oman Residential Real Estate Industry Market Dynamics & Concentration

The Oman residential real estate market, valued at approximately XX Million in 2024, exhibits a moderately concentrated landscape. Market share is predominantly held by established players like Al Mouj Muscat and Maysan Properties SAOC, while smaller firms like Edara Real Estate LLC and Wujha Real Estate contribute significantly to niche segments. The market's dynamics are shaped by several factors:

- Regulatory Frameworks: Government initiatives aimed at affordable housing and infrastructure development significantly influence market growth. Recent policy changes regarding foreign investment and land ownership have also had an impact, albeit with quantifiable effects yet to be fully established.

- Innovation Drivers: The adoption of proptech solutions, such as online property portals and virtual tours, is gradually increasing market efficiency. The use of Building Information Modeling (BIM) is also slowly gaining traction amongst larger developers. However, adoption rates remain relatively low compared to global averages.

- Product Substitutes: While limited, the availability of alternative housing solutions such as serviced apartments influences demand, particularly in the short-term rental market.

- End-User Trends: A growing preference for sustainable and technologically advanced homes is driving demand for eco-friendly construction materials and smart home features. Demand in certain segments, particularly for luxury villas, also shows notable fluctuations based on global economic trends.

- M&A Activities: The number of mergers and acquisitions within the sector in the last five years (2019-2024) stands at approximately xx deals, resulting in increased market consolidation and shifting market shares.

Oman Residential Real Estate Industry Industry Trends & Analysis

The Oman residential real estate market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of XX Million by 2033. Several factors contribute to this growth:

Market growth is driven by:

- Population Growth and Urbanization: The increasing population and the associated urbanization are fueling demand for housing, particularly in major cities like Muscat. This increase in population density, however, has put pressure on resources and resulted in the rising cost of construction materials and land.

- Government Initiatives: Government support for infrastructure development, including transportation networks and public utilities, enhances the appeal of residential areas and stimulates investment. However, bureaucratic bottlenecks and the sometimes slow implementation of these policies may affect the rate of progress.

- Economic Diversification: Efforts to diversify the economy away from oil dependence are creating new employment opportunities and attracting foreign investment, further boosting housing demand. This diversification, while promising, is not yet producing immediate impact on the real estate industry.

- Tourism Growth: The increasing number of tourists is driving demand for short-term rental accommodations, encouraging investment in the hospitality sector that has a secondary positive effect on residential properties. This positive impact varies across different segments, affecting the rental yields depending on the region and type of property.

Leading Markets & Segments in Oman Residential Real Estate Industry

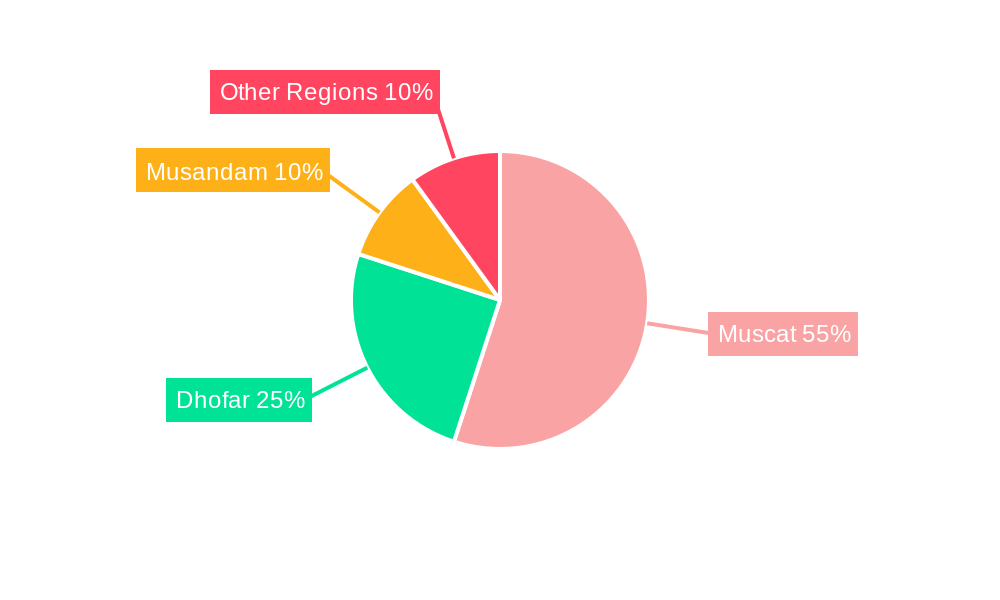

The Muscat region dominates the Oman residential real estate market, accounting for approximately xx% of the total market value in 2024. This dominance is driven by:

- Muscat:

- Key Drivers: Strong economic activity, well-developed infrastructure, and proximity to major employment centers.

- Dominance Analysis: The concentration of government offices, major companies, and educational institutions make Muscat extremely desirable for housing, thus driving up demand in all segments, especially premium properties.

- Dhofar and Musandam:

- Key Drivers: Tourism, growing popularity as a second-home destination, particularly for villas and luxury properties.

- Dominance Analysis: While experiencing significant growth, Dhofar and Musandam lag significantly behind Muscat due to their smaller population size and relatively slower pace of economic development.

Within property types, Villas and Landed Houses constitute a larger segment compared to Apartments and Condominiums, although both segments continue to witness robust growth. This is predominantly linked to cultural preferences, and the availability of land and affordability levels.

Oman Residential Real Estate Industry Product Developments

Recent innovations focus on sustainable building materials, smart home technologies (though slow adoption), and improved designs catering to modern lifestyles. While technology adoption is increasing, there is considerable room for improvement in both adoption rates and infrastructure. The market fit is steadily improving as awareness and affordability increase, especially in the premium segments.

Key Drivers of Oman Residential Real Estate Industry Growth

Key growth drivers include:

- Government investment in infrastructure: Improving transportation and utilities boosts property values and desirability.

- Economic diversification: Creating new job opportunities fuels demand for housing across all segments.

- Tourism growth: Increases demand for both short-term and long-term rental accommodations, creating a secondary boost for residential real estate.

Challenges in the Oman Residential Real Estate Industry Market

Challenges include:

- Regulatory hurdles: Bureaucratic complexities and lengthy approval processes can hinder project timelines and investment. The quantifiable impact of this results in xx Million worth of potential projects being delayed annually.

- Supply chain disruptions: Fluctuations in global material prices and availability can impact construction costs and timelines. This affects costs by an estimated xx% per project.

- Competitive pressures: A growing number of developers in specific segments are putting pressure on margins and project feasibility.

Emerging Opportunities in Oman Residential Real Estate Industry

Emerging opportunities exist in:

- Sustainable and green building: Growing environmental awareness provides a chance for developers to cater to this growing segment of the population.

- Strategic partnerships: Collaborations between local and international developers can leverage expertise and funding to scale up projects.

- Expanding into underserved markets: Focusing on affordable housing projects can address the rising needs of the broader population and tap into a previously underserved segment.

Leading Players in the Oman Residential Real Estate Industry Sector

- Edara Real Estate LLC

- Al Raid Group

- Al Madina Real Estate Company Muscat

- Maysan Properties SAOC

- Al Mouj Muscat

- Coldwell Banker

- Better Homes

- Harbor Real Estate

- Hilal Properties

- Al-Taher Group

- Abu Malak Global Enterprises Muscat

- Savills

- Wujha Real Estate

- Saraya Bandar Jissah

- Orascom Development Holding AG

- Engel & Voelkers

Key Milestones in Oman Residential Real Estate Industry Industry

- October 2022: Al Mouj Muscat launched phase 2 of Zunairah Mansions, signifying a significant investment in luxury housing and boosting the high-end segment.

- April 2022: The partnership between Oman Post, Asyad Express, and WUJHA Real Estate demonstrates the increasing interest in land development and signals further investment in the sector.

Strategic Outlook for Oman Residential Real Estate Industry Market

The Oman residential real estate market holds significant long-term growth potential. Strategic opportunities include focusing on sustainable development, leveraging technological advancements, and exploring partnerships to access new markets and funding sources. The market is poised for continued growth, driven by government initiatives, economic diversification, and evolving consumer preferences. Smart investments focusing on mid-market and affordable housing, with innovative and sustainable designs, will likely see the highest returns.

Oman Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Muscat

- 2.2. Dhofar

- 2.3. Musandam

Oman Residential Real Estate Industry Segmentation By Geography

- 1. Oman

Oman Residential Real Estate Industry Regional Market Share

Geographic Coverage of Oman Residential Real Estate Industry

Oman Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. Supply of Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Dhofar

- 5.2.3. Musandam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Edara Real Estate LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Raid Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Madina Real Estate Company Muscat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maysan Properties SAOC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Mouj Muscat

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coldwell Banker

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Better Homes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harbor Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hilal Properties

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al-Taher Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Abu Malak Global Enterprises Muscat

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Savills

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wujha Real Estate

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saraya Bandar Jissah**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Orascom Development Holding AG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Engel & Voelkers

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Edara Real Estate LLC

List of Figures

- Figure 1: Oman Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Oman Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Oman Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Oman Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Residential Real Estate Industry?

The projected CAGR is approximately 9.19%.

2. Which companies are prominent players in the Oman Residential Real Estate Industry?

Key companies in the market include Edara Real Estate LLC, Al Raid Group, Al Madina Real Estate Company Muscat, Maysan Properties SAOC, Al Mouj Muscat, Coldwell Banker, Better Homes, Harbor Real Estate, Hilal Properties, Al-Taher Group, Abu Malak Global Enterprises Muscat, Savills, Wujha Real Estate, Saraya Bandar Jissah**List Not Exhaustive, Orascom Development Holding AG, Engel & Voelkers.

3. What are the main segments of the Oman Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.38 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

Supply of Residential Buildings.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

October 2022, Al Mouj Muscat launched phase 2 of Zunairah Mansions in the Shatti District. The new phase of the mansions comes in different styles and features six opulent bedrooms with a built-up area of 933 square meters, a garage, covered parking for up to six automobiles, and roomy servant quarters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Oman Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence