Key Insights

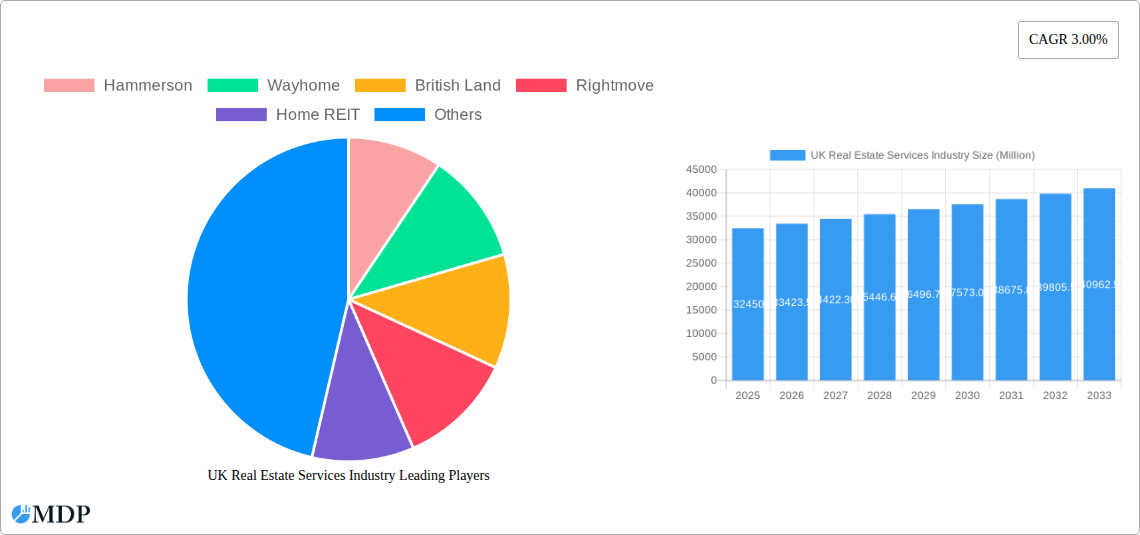

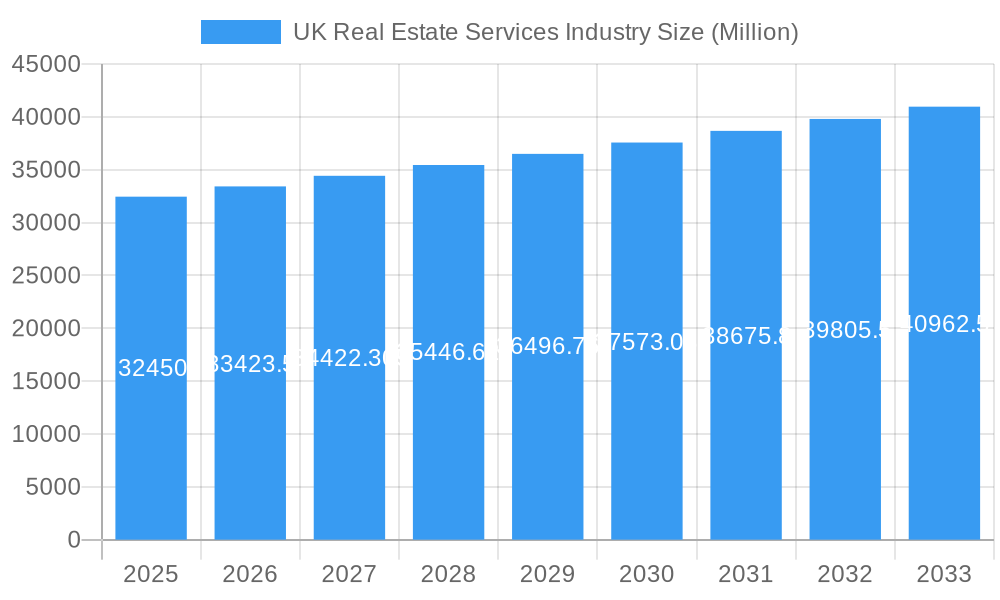

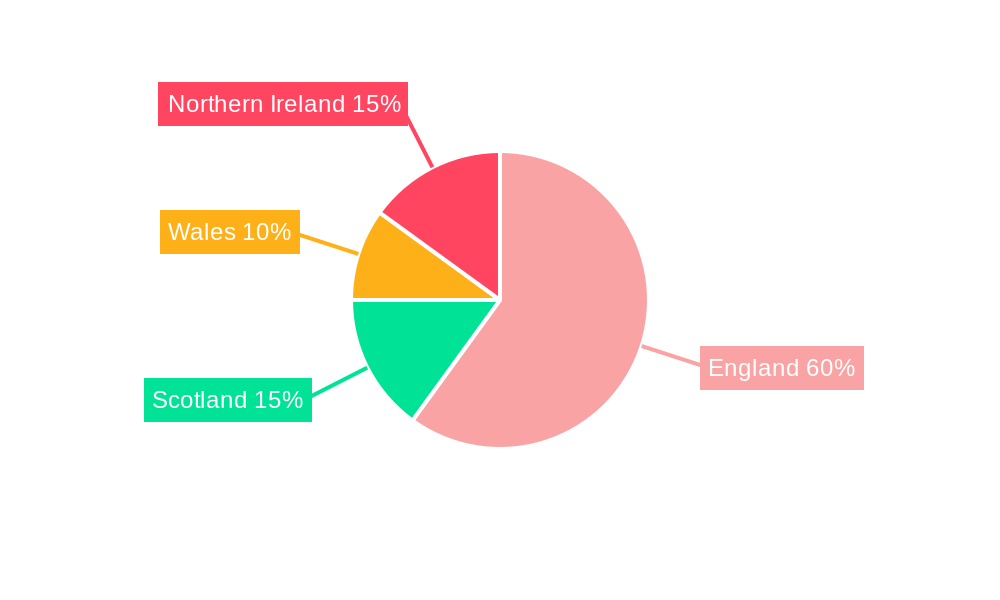

The UK real estate services industry, valued at £32.45 billion in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 3.00% from 2025 to 2033. This growth is driven by several factors. Increasing urbanization and population growth in major UK cities fuel demand for residential properties, stimulating property management and valuation services. The ongoing expansion of the commercial real estate sector, driven by investments in infrastructure and technology hubs, further contributes to market expansion. Moreover, evolving consumer preferences towards flexible work arrangements and a heightened emphasis on sustainability in property development are shaping market trends. Government initiatives promoting affordable housing and regeneration projects also influence the industry's trajectory. However, economic uncertainties, interest rate fluctuations, and potential regulatory changes pose challenges and could act as restraints on growth. The market is segmented by property type (residential, commercial, other) and service type (property management, valuation, other services). Key players include Hammerson, Wayhome, British Land, Rightmove, and others, competing across various segments and geographical regions. The regional breakdown shows significant activity across England, Scotland, Wales, and Northern Ireland, with London likely dominating the market share due to its concentrated economic activity and high property values. The long-term outlook remains positive, though careful consideration of macroeconomic conditions and evolving industry dynamics will be crucial for sustained growth.

UK Real Estate Services Industry Market Size (In Billion)

The residential segment is expected to remain the largest contributor to the market, owing to consistent demand for housing. The commercial segment's growth is likely to be influenced by the performance of various economic sectors. Within services, property management and valuation are significant revenue drivers, while the “other services” segment might encompass areas like property development consulting, real estate investment trusts (REITs) services, and specialized property-related legal and financial advice. The analysis suggests a robust market with potential for further expansion, particularly in emerging areas like sustainable property development and PropTech solutions. Further growth will depend on effective strategies to address the challenges identified above and adapt to emerging market trends.

UK Real Estate Services Industry Company Market Share

This comprehensive report provides an in-depth analysis of the UK real estate services industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, leading players, emerging trends, and future growth potential. The report leverages extensive data analysis to provide actionable intelligence and strategic recommendations. Millions are used for all values.

UK Real Estate Services Industry Market Dynamics & Concentration

The UK real estate services market, valued at £xx million in 2024, is characterized by moderate concentration, with a few large players dominating specific segments. Market share is largely fragmented across various service providers and property types. However, consolidation is a recurring theme, driven by M&A activity and the pursuit of economies of scale. The regulatory framework, including planning permissions and environmental regulations, significantly influences market dynamics. Substitutes, such as alternative investment options, exert competitive pressure. End-user trends, like increasing demand for sustainable and technologically advanced properties, shape innovation and investment strategies.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: The number of M&A deals in the period 2019-2024 totalled xx, with an average deal value of £xx million.

- Innovation Drivers: Technological advancements, such as PropTech solutions, and changing consumer preferences are driving innovation.

- Regulatory Frameworks: Planning regulations and environmental legislation impact development timelines and costs.

- Product Substitutes: Alternative investment classes compete for investor capital.

- End-user Trends: Demand for sustainable and technologically advanced properties is growing.

UK Real Estate Services Industry Industry Trends & Analysis

The UK real estate services industry is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several key factors. Firstly, a persistent housing shortage, particularly in desirable urban areas, continues to drive demand. Secondly, the increasing popularity of purpose-built rental accommodation reflects changing lifestyle preferences and a growing tenant base. Technological disruptions, such as the rise of PropTech platforms, are transforming how properties are marketed, managed, and valued. These platforms streamline processes, enhance efficiency, and offer new revenue streams. Consumer preferences are evolving, with a greater emphasis on sustainability, smart home technology, and flexible living arrangements. Competitive dynamics are shaped by mergers, acquisitions, and the entry of new players, particularly in the PropTech sector. Market penetration of PropTech solutions is estimated to reach xx% by 2033.

Leading Markets & Segments in UK Real Estate Services Industry

The residential segment constitutes the largest portion of the UK real estate services market, driven by strong population growth and a continuing housing shortage. London and the South East remain dominant regions due to high property values and strong demand. Commercial real estate, particularly in prime city centre locations, also shows significant activity, although its growth is subject to economic fluctuations and office space utilization trends.

Key Drivers for Residential Segment Dominance:

- Strong population growth in urban areas.

- Housing shortage, especially in major cities.

- Increasing demand for rental properties.

- Government policies aimed at stimulating housing development (with qualifications).

Key Drivers for Commercial Segment:

- Demand for prime office space in central London and other major cities.

- Growth of the tech and finance sectors.

- Government investment in infrastructure projects.

Service Segment Dominance: Property management services represent the largest portion of the service sector, driven by the need for efficient and reliable property administration. Valuation services, vital for transactions and financing, also contribute significantly.

UK Real Estate Services Industry Product Developments

Recent product innovations focus on streamlining processes, enhancing efficiency, and improving the overall customer experience. This includes the development of sophisticated property management software, AI-powered valuation tools, and virtual tours. These advancements enhance competitiveness by improving operational efficiency, reducing costs, and providing added value to clients. The integration of technologies, such as blockchain and the Internet of Things (IoT), is expected to further reshape the sector in the coming years, allowing for improved transparency, security, and efficiency in transactions and property management.

Key Drivers of UK Real Estate Services Industry Growth

Several factors drive the growth of the UK real estate services industry. These include:

- Technological Advancements: PropTech solutions are increasing efficiency and market access.

- Economic Growth: Positive economic conditions generally lead to increased investment in real estate.

- Government Policies: Policies supporting housing development and infrastructure projects contribute.

- Urbanization: Population growth in cities creates greater housing demand.

Challenges in the UK Real Estate Services Industry Market

The UK real estate services market faces several challenges:

- Regulatory Hurdles: Complex planning permissions and environmental regulations can delay projects.

- Supply Chain Disruptions: Material shortages and construction delays can increase costs and reduce availability.

- Economic Uncertainty: Economic downturns can impact investor confidence and property demand.

- Competition: Intense competition, particularly in the PropTech space, exists.

Emerging Opportunities in UK Real Estate Services Industry

The UK real estate services market offers considerable opportunities for growth, particularly in areas such as:

- Sustainable Development: Demand for eco-friendly properties offers considerable opportunity.

- PropTech Integration: Adoption of advanced technologies can improve efficiencies and client experience.

- Serviced Accommodation: Growth in short-term and flexible housing solutions.

- International Investment: Attracting international investment in UK real estate.

Leading Players in the UK Real Estate Services Industry Sector

- Hammerson

- Wayhome

- British Land

- Rightmove

- Home REIT

- Bridgewater Housing Association Ltd

- Shaftesbury PLC

- Berkeley Group Holdings PLC

- Derwent London

- Tritax Big Box Reit PLC

- Capital & Counties Properties PLC

- Sanctuary Housing Association

- Unite Group PLC

Key Milestones in UK Real Estate Services Industry Industry

- November 2022: JLL reports £10 billion (USD 12.73 billion) annual investment in UK living real estate in Q3 2022, highlighting strong investor interest in purpose-built rental properties.

- January 2023: Acquisition of UK Sotheby's International Realty by the Dubai branch of Sotheby's, signaling international interest and consolidation within the luxury market segment.

Strategic Outlook for UK Real Estate Services Industry Market

The UK real estate services industry presents a promising outlook for continued growth, driven by sustained population growth, increasing urbanization, and the ongoing demand for high-quality residential and commercial properties. Strategic opportunities abound in embracing technological advancements, focusing on sustainable development, and catering to evolving consumer preferences. The industry will likely see further consolidation as larger players acquire smaller firms, leading to increased market concentration. Successfully navigating regulatory challenges and adapting to changing market dynamics will be crucial for success in this dynamic and evolving sector.

UK Real Estate Services Industry Segmentation

-

1. Property type

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Property Types

-

2. Service

- 2.1. Property Management

- 2.2. Valuation

- 2.3. Other Services

UK Real Estate Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Real Estate Services Industry Regional Market Share

Geographic Coverage of UK Real Estate Services Industry

UK Real Estate Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements in Infrastructure and New Development; Population Growth and Demographic Changes

- 3.3. Market Restrains

- 3.3.1. Housing Shortages; Increasing Awareness towards Environmental Issues

- 3.4. Market Trends

- 3.4.1. Increasing in the United Kingdom House Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Property Management

- 5.2.2. Valuation

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property type

- 6. North America UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Property type

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Property Types

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Property Management

- 6.2.2. Valuation

- 6.2.3. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Property type

- 7. South America UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Property type

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Property Types

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Property Management

- 7.2.2. Valuation

- 7.2.3. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Property type

- 8. Europe UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Property type

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Property Types

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Property Management

- 8.2.2. Valuation

- 8.2.3. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Property type

- 9. Middle East & Africa UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Property type

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Property Types

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Property Management

- 9.2.2. Valuation

- 9.2.3. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Property type

- 10. Asia Pacific UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Property type

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Property Types

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Property Management

- 10.2.2. Valuation

- 10.2.3. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Property type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hammerson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wayhome

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 British Land

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rightmove

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Home REIT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bridgewater Housing Association Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shaftesbury PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berkeley Group Holdings PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Derwent London

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tritax Big Box Reit PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Capital & Counties Properties PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sanctuary Housing Association

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Unite Group PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Hammerson

List of Figures

- Figure 1: Global UK Real Estate Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 3: North America UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 4: North America UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 5: North America UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 9: South America UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 10: South America UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 11: South America UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: South America UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 15: Europe UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 16: Europe UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 17: Europe UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 21: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 22: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 23: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 24: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 27: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 28: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 29: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 2: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Global UK Real Estate Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 5: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 11: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 17: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 29: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 30: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 38: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 39: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Real Estate Services Industry?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the UK Real Estate Services Industry?

Key companies in the market include Hammerson, Wayhome, British Land, Rightmove, Home REIT, Bridgewater Housing Association Ltd, Shaftesbury PLC, Berkeley Group Holdings PLC, Derwent London, Tritax Big Box Reit PLC, Capital & Counties Properties PLC, Sanctuary Housing Association, Unite Group PLC.

3. What are the main segments of the UK Real Estate Services Industry?

The market segments include Property type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Improvements in Infrastructure and New Development; Population Growth and Demographic Changes.

6. What are the notable trends driving market growth?

Increasing in the United Kingdom House Prices.

7. Are there any restraints impacting market growth?

Housing Shortages; Increasing Awareness towards Environmental Issues.

8. Can you provide examples of recent developments in the market?

January 2023: United Kingdom Sotheby's Property Business Acquired by the Dubai Branch of Sotheby's. UK Sotheby International Realty was previously owned by Robin Paterson, who sold the business to his business partner and affiliate, George Azar. George Azar currently holds and operates Sotheby's Dubai and the MENA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Real Estate Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Real Estate Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Real Estate Services Industry?

To stay informed about further developments, trends, and reports in the UK Real Estate Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence