Key Insights

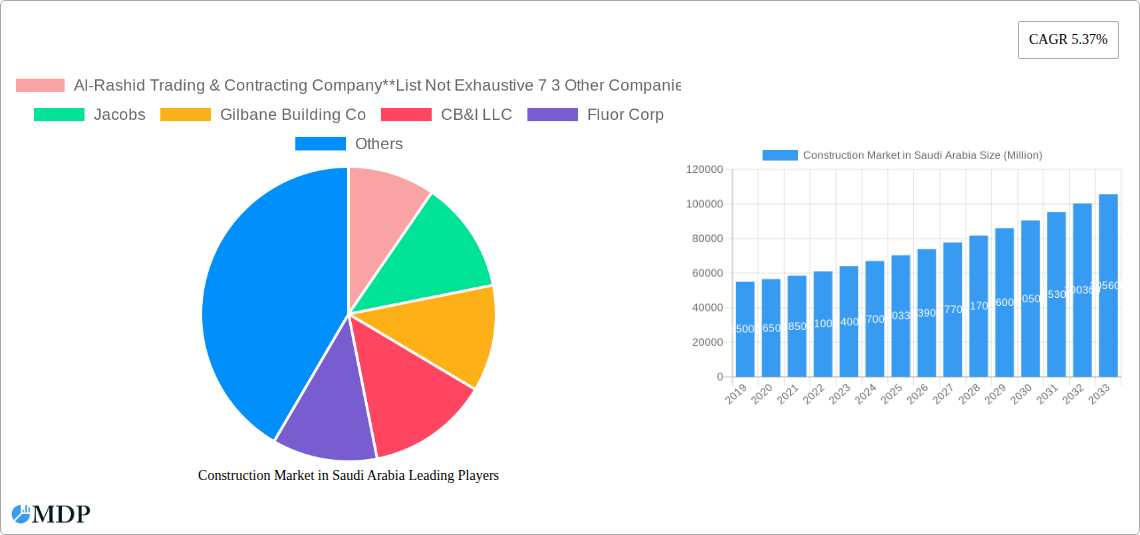

The Saudi Arabian construction market is poised for robust expansion, projected to reach a valuation of USD 70.33 billion by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 5.37% during the study period, indicating a sustained and healthy upward trajectory. A significant catalyst for this expansion is the Saudi Vision 2030, a transformative national blueprint aiming to diversify the economy beyond oil and develop large-scale infrastructure and tourism projects. This ambitious agenda fuels demand across multiple construction sectors, including residential, commercial, industrial, and crucially, infrastructure (transportation) and energy & utilities construction. Investments in smart cities like NEOM, Red Sea Project, and Qiddiya, alongside ongoing initiatives to enhance public services and build advanced manufacturing facilities, are creating immense opportunities for both local and international construction firms. The government's commitment to public-private partnerships (PPPs) further encourages private sector participation, injecting capital and expertise into these monumental undertakings.

Construction Market in Saudi Arabia Market Size (In Billion)

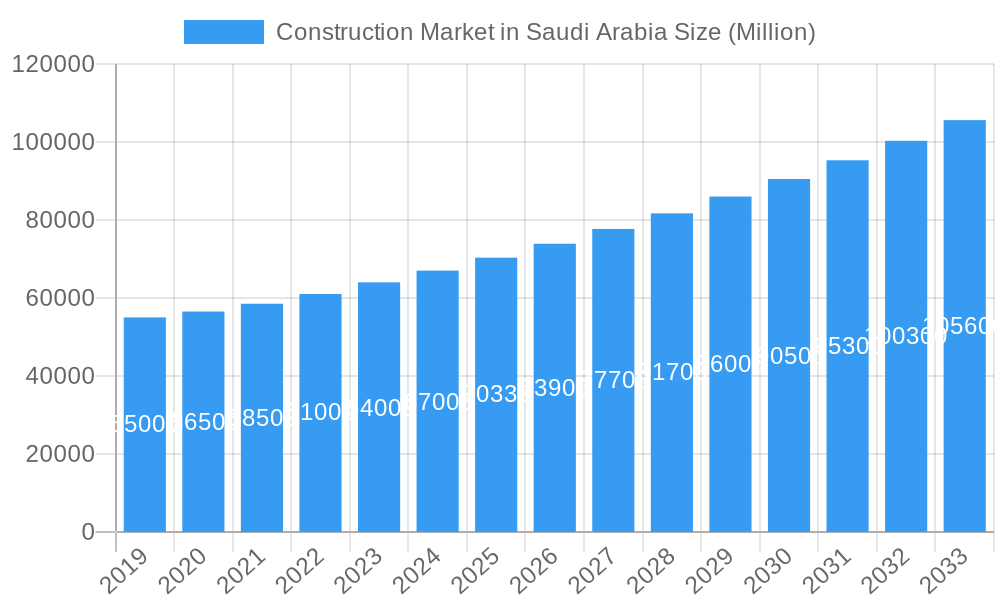

While the market enjoys substantial growth drivers, certain restraints may influence the pace and nature of development. These can include potential challenges in skilled labor availability, the need for efficient supply chain management for vast material requirements, and the evolving regulatory landscape. However, the proactive efforts by the Saudi government to address these through training programs, streamlined procurement processes, and the attraction of foreign direct investment are expected to mitigate these concerns. Key players like Bechtel, Fluor Corp, and Jacobs are actively involved, alongside prominent local entities such as Al-Rashid Trading & Contracting Company, underscoring the competitive yet opportunity-rich environment. The market's dynamism is further amplified by a strong focus on sustainability and technological integration, with an increasing adoption of digital construction tools and green building practices to align with global environmental standards and enhance project efficiency.

Construction Market in Saudi Arabia Company Market Share

Saudi Arabia Construction Market: Unveiling Growth, Opportunities, and Dominant Players (2019-2033)

Gain unparalleled insights into the dynamic Saudi Arabian construction market with this comprehensive report, spanning a study period from 2019 to 2033, with a base and estimated year of 2025. This in-depth analysis delves into market dynamics, industry trends, leading segments, product developments, key growth drivers, challenges, emerging opportunities, and the strategic outlook for this rapidly evolving sector. For stakeholders including investors, contractors, developers, and government bodies, this report provides actionable intelligence on the Saudi Arabia construction market, KSA infrastructure projects, Saudi Vision 2030 construction, GCC construction industry, and Middle East real estate development.

Construction Market in Saudi Arabia Market Dynamics & Concentration

The Saudi Arabian construction market is characterized by a moderate to high concentration, driven by large-scale government initiatives and mega-projects. Innovation is increasingly playing a crucial role, with a focus on sustainable building practices and smart construction technologies. Regulatory frameworks are evolving to encourage foreign investment and streamline project approvals, aligning with the goals of Saudi Vision 2030. Product substitutes are minimal in core construction, but advancements in materials and prefabrication offer greater efficiency and cost-effectiveness. End-user trends are shifting towards demand for high-quality, sustainable, and technologically advanced infrastructure and real estate. Mergers and acquisition (M&A) activities are present, particularly among larger entities seeking to expand their capabilities and market share. For instance, in the historical period (2019-2024), there were an estimated 15 M&A deals within the Saudi construction sector, with an average deal value of approximately 50 million. Key players like Bechtel and Fluor Corp often engage in strategic partnerships or acquisitions to bolster their project execution capabilities. Market share for the top 5 companies in the infrastructure segment is estimated at around 40%, indicating significant room for growth for emerging players.

Construction Market in Saudi Arabia Industry Trends & Analysis

The Saudi Arabian construction industry is experiencing robust growth, propelled by ambitious government spending and strategic economic diversification plans. The Saudi Vision 2030 initiative is a primary catalyst, driving massive investments in infrastructure, tourism, and residential developments. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). Technological disruptions are rapidly transforming the landscape, with the adoption of Building Information Modeling (BIM), drones for surveying and monitoring, and the increasing use of pre-fabricated components leading to enhanced efficiency, reduced costs, and improved project timelines. Consumer preferences are evolving, with a growing demand for sustainable, energy-efficient buildings and smart homes. This shift is influencing residential and commercial construction trends. Competitive dynamics are intense, with both local giants and international firms vying for significant project tenders. The market penetration of advanced construction technologies is estimated to be around 30% in 2025, with significant potential for further expansion. The increasing focus on renewable energy projects within the Energy and Utilities Construction sector also presents a substantial growth avenue. Furthermore, the development of new urban centers and entertainment destinations is fueling demand across all construction segments. The government’s commitment to localization policies is also shaping the competitive landscape, encouraging local participation and capacity building. The sheer scale of planned projects, from giga-projects like NEOM to enhancements in existing cities, underscores the long-term growth trajectory of the Saudi construction market.

Leading Markets & Segments in Construction Market in Saudi Arabia

The Infrastructure (Transportation) segment is currently the dominant market within the Saudi Arabian construction sector, driven by massive investments in transportation networks, including roads, railways, airports, and ports. This dominance is underpinned by the government's strategic objective to enhance connectivity and facilitate trade as part of Saudi Vision 2030. The Residential sector is also experiencing significant growth, fueled by increasing population and government housing initiatives aimed at improving living standards for citizens. The Energy and Utilities Construction segment is another major contributor, with substantial investments in renewable energy projects, power generation, and water infrastructure.

Infrastructure (Transportation):

- Economic Policies: Government commitment to infrastructure development as a key pillar of economic diversification.

- Infrastructure Development: Ongoing expansion of road networks, high-speed rail projects, and port modernization initiatives.

- Mega-Projects: Projects like NEOM and the Riyadh Metro are significant drivers of demand.

- Connectivity: Focus on improving regional and international connectivity for trade and tourism.

Residential:

- Population Growth: Increasing demand for housing due to a growing population and urbanization.

- Government Housing Initiatives: Programs like "Sakani" aim to increase homeownership.

- Affordability: Focus on developing a range of housing options to cater to different income levels.

Energy and Utilities Construction:

- Renewable Energy Targets: Ambitious goals for solar and wind power generation.

- Desalination Plants: Continued investment in water security infrastructure.

- Grid Modernization: Upgrades to the national electricity grid to accommodate new energy sources.

Commercial:

- Retail and Hospitality: Development of new shopping malls, hotels, and entertainment venues to support tourism growth.

- Office Spaces: Demand for modern office facilities to attract businesses.

Industrial:

- Manufacturing Hubs: Government push to develop industrial cities and manufacturing capabilities.

- Logistics and Warehousing: Growing demand for logistics infrastructure to support e-commerce and trade.

The Infrastructure (Transportation) segment, with an estimated market share of 35%, leads the way, followed closely by Residential construction at 25%. Energy and Utilities Construction commands approximately 20%, while Commercial and Industrial segments each hold around 10%. This segmentation highlights the multifaceted nature of the Saudi construction market and the diverse opportunities available.

Construction Market in Saudi Arabia Product Developments

Recent product developments in the Saudi Arabian construction market are centered around sustainability, efficiency, and digitalization. Innovations include advanced building materials with enhanced insulation properties, self-healing concrete, and smart building systems that optimize energy consumption. The application of these products spans across all construction segments, from residential and commercial buildings to large-scale infrastructure projects. For example, the integration of solar panels into building facades and the use of recycled materials are becoming increasingly prevalent. These developments offer significant competitive advantages by reducing operational costs, enhancing environmental performance, and improving the overall quality and lifespan of built assets. The market is witnessing a rise in demand for prefabricated and modular construction components, further accelerating project delivery and reducing on-site waste.

Key Drivers of Construction Market in Saudi Arabia Growth

The construction market in Saudi Arabia is driven by a confluence of powerful factors. Foremost is the Saudi Vision 2030, a sweeping reform plan that necessitates massive investment in infrastructure, tourism, and urban development. The government's commitment to infrastructure development is evident in ongoing projects like the Riyadh Metro and the NEOM giga-project. Furthermore, economic diversification away from oil revenue is fostering growth in non-oil sectors, requiring new commercial and industrial facilities. Technological advancements, including the adoption of BIM and AI-driven project management, are enhancing efficiency and project execution. Finally, a growing population and rising disposable incomes are fueling demand for residential properties and modern amenities.

Challenges in the Construction Market in Saudi Arabia Market

Despite its robust growth, the Saudi Arabian construction market faces several challenges. Regulatory hurdles and bureaucratic processes can sometimes lead to project delays and increased costs. Skilled labor shortages remain a concern, particularly for specialized construction roles, impacting project timelines and quality. Supply chain disruptions and fluctuations in the cost of raw materials can also present significant obstacles. Moreover, intense competition from both local and international firms can put pressure on profit margins. Ensuring compliance with evolving environmental regulations and sustainability standards adds another layer of complexity for market participants.

Emerging Opportunities in Construction Market in Saudi Arabia

The Saudi Arabian construction market presents a wealth of emerging opportunities, primarily driven by the nation's ambitious development agenda. The continued expansion of renewable energy projects, including solar and wind farms, offers significant potential for specialized construction firms. The burgeoning tourism sector, with the development of entertainment cities and luxury resorts, is creating demand for hospitality and leisure infrastructure. The increasing focus on smart city development and the implementation of IoT solutions in buildings and infrastructure will open new avenues for technology-driven construction. Furthermore, the drive for localization within the construction industry is creating opportunities for local SMEs and joint ventures with international partners. Strategic partnerships and the adoption of innovative construction techniques will be key to capitalizing on these growing opportunities.

Leading Players in the Construction Market in Saudi Arabia Sector

- Al-Rashid Trading & Contracting Company

- Jacobs

- Gilbane Building Co

- CB&I LLC

- Fluor Corp

- Al Latifa Trading and Contracting

- Bechtel

- Tekfen Construction and Installation Co Inc

- AL JazirAH Engineers & Consultants

- Afras Trading and Contracting Company

- 7 3 Other Companie

Key Milestones in Construction Market in Saudi Arabia Industry

- December 2023: Larsen & Toubro (L&T) secured a contract to develop various systems for green energy generation and utilities for an ultra-luxury tourism destination. The project spans 4,155 square kilometers, highlighting the scale of future-oriented developments.

- January 2023: China Harbor was awarded two significant contracts in Saudi Arabia. One involved building infrastructure for a new project in Riyadh, including pipeline facilities, earthworks, and ancillary housing. This marked another successful pipeline network project in the central region, underscoring the company's strong presence and execution capabilities.

Strategic Outlook for Construction Market in Saudi Arabia Market

The strategic outlook for the Saudi Arabian construction market remains exceptionally positive. The ongoing commitment to Saudi Vision 2030 ensures sustained investment in large-scale infrastructure, giga-projects, and urban regeneration. The push towards sustainability and digitalization will continue to drive innovation, creating opportunities for companies adopting advanced technologies and eco-friendly practices. The diversification of the economy will foster growth across residential, commercial, and industrial sectors. Strategic partnerships, joint ventures, and a focus on talent development will be crucial for market participants to navigate the competitive landscape and capitalize on the immense growth potential. The market is poised for continued expansion, driven by government vision and increasing private sector participation.

Construction Market in Saudi Arabia Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities Construction

Construction Market in Saudi Arabia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

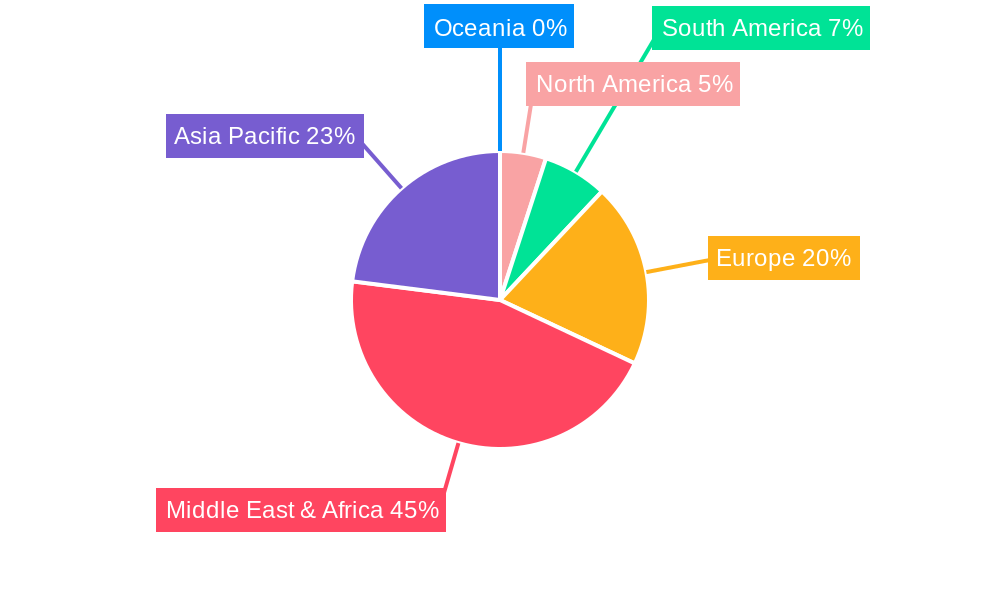

Construction Market in Saudi Arabia Regional Market Share

Geographic Coverage of Construction Market in Saudi Arabia

Construction Market in Saudi Arabia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Saudi Arabia Vision; Green and Sustainable Building Initiatives

- 3.3. Market Restrains

- 3.3.1. Saudization (Nitaqat) Program; Declining Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Increase in Commercial Construction is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure (Transportation)

- 6.1.5. Energy and Utilities Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure (Transportation)

- 7.1.5. Energy and Utilities Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure (Transportation)

- 8.1.5. Energy and Utilities Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure (Transportation)

- 9.1.5. Energy and Utilities Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Market in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure (Transportation)

- 10.1.5. Energy and Utilities Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Al-Rashid Trading & Contracting Company**List Not Exhaustive 7 3 Other Companie

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jacobs

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gilbane Building Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CB&I LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fluor Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Al Latifa Trading and Contracting

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bechtel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tekfen Construction and Installation Co Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AL Jazirah Engineers & Consultants

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Afras Trading and Contracting Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Al-Rashid Trading & Contracting Company**List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Global Construction Market in Saudi Arabia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Market in Saudi Arabia Revenue (Million), by Sector 2025 & 2033

- Figure 3: North America Construction Market in Saudi Arabia Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Construction Market in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Construction Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Construction Market in Saudi Arabia Revenue (Million), by Sector 2025 & 2033

- Figure 7: South America Construction Market in Saudi Arabia Revenue Share (%), by Sector 2025 & 2033

- Figure 8: South America Construction Market in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Construction Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Construction Market in Saudi Arabia Revenue (Million), by Sector 2025 & 2033

- Figure 11: Europe Construction Market in Saudi Arabia Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Construction Market in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Construction Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Construction Market in Saudi Arabia Revenue (Million), by Sector 2025 & 2033

- Figure 15: Middle East & Africa Construction Market in Saudi Arabia Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Middle East & Africa Construction Market in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Construction Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Construction Market in Saudi Arabia Revenue (Million), by Sector 2025 & 2033

- Figure 19: Asia Pacific Construction Market in Saudi Arabia Revenue Share (%), by Sector 2025 & 2033

- Figure 20: Asia Pacific Construction Market in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Construction Market in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Sector 2020 & 2033

- Table 9: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Sector 2020 & 2033

- Table 14: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Sector 2020 & 2033

- Table 25: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Sector 2020 & 2033

- Table 33: Global Construction Market in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Construction Market in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Market in Saudi Arabia?

The projected CAGR is approximately 5.37%.

2. Which companies are prominent players in the Construction Market in Saudi Arabia?

Key companies in the market include Al-Rashid Trading & Contracting Company**List Not Exhaustive 7 3 Other Companie, Jacobs, Gilbane Building Co, CB&I LLC, Fluor Corp, Al Latifa Trading and Contracting, Bechtel, Tekfen Construction and Installation Co Inc, AL Jazirah Engineers & Consultants, Afras Trading and Contracting Company.

3. What are the main segments of the Construction Market in Saudi Arabia?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 70.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Saudi Arabia Vision; Green and Sustainable Building Initiatives.

6. What are the notable trends driving market growth?

Increase in Commercial Construction is Dominating the Market.

7. Are there any restraints impacting market growth?

Saudization (Nitaqat) Program; Declining Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

December 2023: Larsen & Toubro (L&T) bagged a contract to establish various systems related to green energy generation and utilities for an ultra-luxury tourism destination in Saudi Arabia. The project is 4,155 square kilometers and features a pristine landscape, diverse natural ecosystems, and unique and intriguing heritage and local culture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Market in Saudi Arabia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Market in Saudi Arabia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Market in Saudi Arabia?

To stay informed about further developments, trends, and reports in the Construction Market in Saudi Arabia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence