Key Insights

The North American transportation infrastructure construction market is expanding, driven by increasing urbanization, critical infrastructure upgrades, and government investment in sustainable transit solutions. The market, valued at $153.4 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% through 2033. This growth is supported by significant investments in road, rail, and air transportation projects across the United States, Canada, and Mexico. Roadways currently represent the largest market share, necessitating continuous expansion, maintenance, and improvements to manage escalating traffic. However, substantial investments in high-speed rail and railway network modernization are propelling the growth of the rail sector. The expanding e-commerce industry further fuels demand for efficient logistics, thereby increasing investment in transportation infrastructure. While regulatory complexities and volatile material costs present challenges, the long-term outlook remains strong, particularly with a focus on green technologies and resilient infrastructure designs. Leading companies, including L&T Construction, Bechtel Corporation, and Kiewit Corporation, are well-positioned to leverage this growth by securing large-scale projects and adopting advanced technologies for enhanced efficiency.

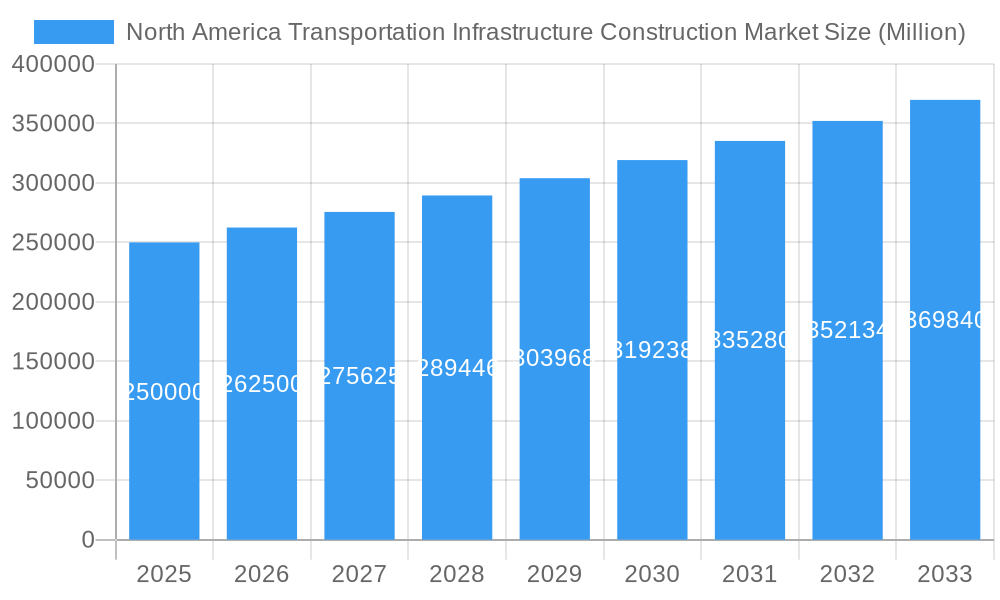

North America Transportation Infrastructure Construction Market Market Size (In Billion)

The United States leads the North American market, followed by Canada and Mexico. The "Rest of North America" segment offers opportunities for specialized contractors. Market segmentation by transportation mode reveals a dynamic interplay of growth factors. While roadways maintain dominance, the railway sector shows significant potential due to high-speed rail investments and a focus on efficient freight movement. The maritime transportation segment is also growing, driven by port expansions and the increasing importance of international trade. The aviation sector, though smaller, is anticipated to see steady growth from airport modernization and expansions to accommodate rising passenger and cargo volumes. Market competition is intense, with global corporations and regional firms actively pursuing contracts.

North America Transportation Infrastructure Construction Market Company Market Share

North America Transportation Infrastructure Construction Market Analysis and Forecast (2025-2033)

This report delivers a comprehensive analysis of the North America transportation infrastructure construction market from 2025 to 2033. It provides critical insights into market dynamics, industry trends, key players, and future growth opportunities, enabling stakeholders to effectively navigate this evolving sector. The report details market segmentation by mode (roadways, railways, maritime, airways) and by country (United States, Canada, Mexico, Rest of North America). With a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for businesses aiming to capitalize on the significant opportunities within the North American transportation infrastructure construction market.

North America Transportation Infrastructure Construction Market Market Dynamics & Concentration

The North American transportation infrastructure construction market is characterized by a moderate level of concentration, with several large players holding significant market share. However, the market also exhibits a considerable degree of fragmentation due to the presence of numerous regional and specialized contractors. Market share analysis reveals that the top five players collectively account for approximately xx% of the market, while the remaining share is distributed among numerous smaller firms. Innovation drivers include advancements in construction technologies, such as Building Information Modeling (BIM), automation, and sustainable materials, leading to increased efficiency and reduced environmental impact. The regulatory landscape plays a crucial role, with government regulations impacting project approvals, safety standards, and environmental compliance. Product substitutes, such as improved maintenance strategies, are present but have limited impact due to the long-term nature of infrastructure projects. End-user trends indicate increasing demand for resilient and sustainable infrastructure solutions, driven by concerns about climate change and extreme weather events. M&A activity in the sector has been moderate, with approximately xx deals recorded in the past five years. The average deal size stands at USD xx Million. This trend is expected to increase driven by the need for enhanced operational efficiency and technological capabilities.

North America Transportation Infrastructure Construction Market Industry Trends & Analysis

The North American transportation infrastructure construction market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing government investments in infrastructure development, driven by the need to modernize aging infrastructure and accommodate growing transportation demands. Technological disruptions, such as the adoption of 3D printing and advanced materials, are enhancing construction efficiency and reducing costs. Consumer preferences are increasingly aligned with sustainable infrastructure solutions, resulting in a higher demand for eco-friendly materials and construction practices. The market exhibits strong competitive dynamics, with companies continuously striving to improve their operational efficiency, expand their service offerings, and secure lucrative government contracts. Market penetration of advanced construction technologies remains moderate, however, it is expected to increase significantly as the technological advancements become more cost-effective and widely accessible.

Leading Markets & Segments in North America Transportation Infrastructure Construction Market

The United States dominates the North American transportation infrastructure construction market, driven by significant government spending on infrastructure projects and a robust economy.

Key Drivers for the United States:

- Substantial Federal and State Government funding for infrastructure projects.

- Large-scale urban development projects leading to an increased demand for transportation infrastructure.

- Rapid growth of the e-commerce sector, which increases the need for efficient transportation networks.

Key Drivers for Canada:

- Significant investments in public transportation projects in major urban centers.

- Growing focus on improving the connectivity and efficiency of the Trans-Canada Highway system.

- Continued emphasis on sustainable transportation and infrastructure development.

The Roadways segment constitutes the largest share of the market, followed by Railways and Marine Transportation.

- Roadways: High demand for road construction and maintenance projects to expand and improve transportation networks, particularly in rapidly growing urban areas.

- Railways: Government initiatives to modernize and expand railway networks contribute to this segment's significant share.

- Marine Transportation: Development of port infrastructure and related facilities is a key driver in this segment.

- Airways: Investments in airport infrastructure and expansion contribute to this segment's growth.

Mexico and the Rest of North America also contribute significantly to the overall market size, with ongoing infrastructure development initiatives contributing to the regional growth.

North America Transportation Infrastructure Construction Market Product Developments

Recent advancements in construction materials, such as high-performance concrete and sustainable composites, are enhancing the durability and lifespan of infrastructure projects. The adoption of Building Information Modeling (BIM) and other digital technologies is streamlining the design, construction, and management processes, optimizing efficiency, and reducing costs. These innovations offer significant competitive advantages to companies that adopt them early, enabling them to deliver projects faster, at lower costs, and with higher quality. This is driving companies to focus on research and development to maintain a competitive edge.

Key Drivers of North America Transportation Infrastructure Construction Market Growth

The North American transportation infrastructure construction market is driven by several key factors, including significant government investments in infrastructure development programs such as the Infrastructure Investment and Jobs Act in the United States, the growing demand for efficient and sustainable transportation systems, advancements in construction technologies, and the increasing need to modernize aging infrastructure. These factors collectively contribute to the market's sustained growth, making it an attractive sector for investment and expansion.

Challenges in the North America Transportation Infrastructure Construction Market Market

The industry faces several challenges, including regulatory hurdles related to environmental approvals and permitting processes, often leading to project delays. Supply chain disruptions, exacerbated by global events, impact material costs and project timelines. Intense competition among numerous construction firms puts downward pressure on pricing and profit margins. These factors collectively impact the overall project profitability and timely completion, creating significant challenges for stakeholders.

Emerging Opportunities in North America Transportation Infrastructure Construction Market

The market presents several emerging opportunities, particularly in the adoption of sustainable and innovative construction materials and technologies. Strategic partnerships between construction firms and technology providers are creating new opportunities for efficiency and innovation. The ongoing focus on improving resilience and sustainability in infrastructure projects presents further opportunities for companies that invest in eco-friendly solutions. The potential for expanding into new regional markets within North America and abroad provides ample opportunity for future expansion.

Leading Players in the North America Transportation Infrastructure Construction Market Sector

- L&T Construction

- Kraemer North America

- Bechtel Corporation

- CK Hutchison Holdings Limited

- ACS Actividades de Construccin y Servicios SA

- Kiewit Corporation

- Balfour Beatty

- OBRASCON HUARTE LAIN SA (OHLA)

- BOUYGUES CONSTRUCTION SA

- VINCI Construction

- GLOBALVIA Inversiones SAU

Key Milestones in North America Transportation Infrastructure Construction Market Industry

- February 2021: The United States and Canada announced plans to invest significantly in transport infrastructure development, including pipeline projects. This signaled a major push towards improving and expanding existing infrastructure networks.

- August 2021: The Ministry of Transportation and Infrastructure announced a USD 837 Million Trans-Canada highway widening project between Alberta and B.C., creating thousands of jobs and boosting economic activity in the region. This demonstrated a commitment to improving cross-country connectivity and enhancing road safety.

Strategic Outlook for North America Transportation Infrastructure Construction Market Market

The North American transportation infrastructure construction market is poised for continued growth driven by sustained government investment, technological advancements, and increasing demand for sustainable solutions. Companies that strategically invest in innovation, adopt sustainable practices, and build strong relationships with governmental agencies will be well-positioned to capitalize on the numerous opportunities presented by this dynamic and expanding market. This necessitates a robust strategic approach focused on leveraging technological advancements and adapting to changing regulatory landscapes.

North America Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Marine Transportation

- 1.4. Airways

North America Transportation Infrastructure Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of North America Transportation Infrastructure Construction Market

North America Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land Availability4.; Economic Uncertainties

- 3.4. Market Trends

- 3.4.1. Increasing Infrastructure Activities in the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Marine Transportation

- 5.1.4. Airways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 L&T Construction*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kraemer North America

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bechtel Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CK Hutchison Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ACS Actividades de Construccin y Servicios SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kiewit Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Balfour Beatty

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OBRASCON HUARTE LAIN SA (OHLA)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BOUYGUES CONSTRUCTION SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VINCI Construction

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GLOBALVIA Inversiones SAU

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 L&T Construction*List Not Exhaustive

List of Figures

- Figure 1: North America Transportation Infrastructure Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 2: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 4: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Transportation Infrastructure Construction Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the North America Transportation Infrastructure Construction Market?

Key companies in the market include L&T Construction*List Not Exhaustive, Kraemer North America, Bechtel Corporation, CK Hutchison Holdings Limited, ACS Actividades de Construccin y Servicios SA, Kiewit Corporation, Balfour Beatty, OBRASCON HUARTE LAIN SA (OHLA), BOUYGUES CONSTRUCTION SA, VINCI Construction, GLOBALVIA Inversiones SAU.

3. What are the main segments of the North America Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 153.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy.

6. What are the notable trends driving market growth?

Increasing Infrastructure Activities in the United States.

7. Are there any restraints impacting market growth?

4.; Limited Land Availability4.; Economic Uncertainties.

8. Can you provide examples of recent developments in the market?

August 2021: The Ministry of Transportation and Infrastructure announced a USD 837 million Trans-Canada highway widening project between Alberta and B.C. This project involves the construction of bridges and the widening of two lanes highways to four lanes, creating more than 1,200 direct jobs and 700 indirect jobs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the North America Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence