Key Insights

Oman's luxury residential real estate market is projected to reach $4.78 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 9.19% from 2025 to 2033. This robust expansion is propelled by a confluence of factors, including Oman's flourishing tourism industry, a rising influx of high-net-worth individuals (HNWIs), and strategic government initiatives promoting infrastructure development and economic diversification. The nation's rich cultural heritage, breathtaking natural landscapes, and political stability further enhance its allure as a prime destination for luxury living. The market is segmented by property type, encompassing condominiums, apartments, villas, and landed houses, and by key urban centers such as Muscat, Dhofar, Musandam, and Salalah, with Muscat leading in market dominance.

Oman Luxury Residential Real Estate Market Market Size (In Billion)

Within this dynamic landscape, villas and landed houses are expected to command premium valuations. While Muscat will likely retain its market leadership, cities like Salalah and Dhofar, renowned for their tourism potential, are anticipated to witness significant growth in luxury residential development. Intense competition among developers, including prominent players like AL Mouj Muscat and Better Homes, is driving innovation in property design, amenities, and services to cater to a discerning clientele. A growing emphasis on sustainable and environmentally conscious development will also shape future projects, presenting a promising investment outlook for astute developers and investors navigating this evolving market.

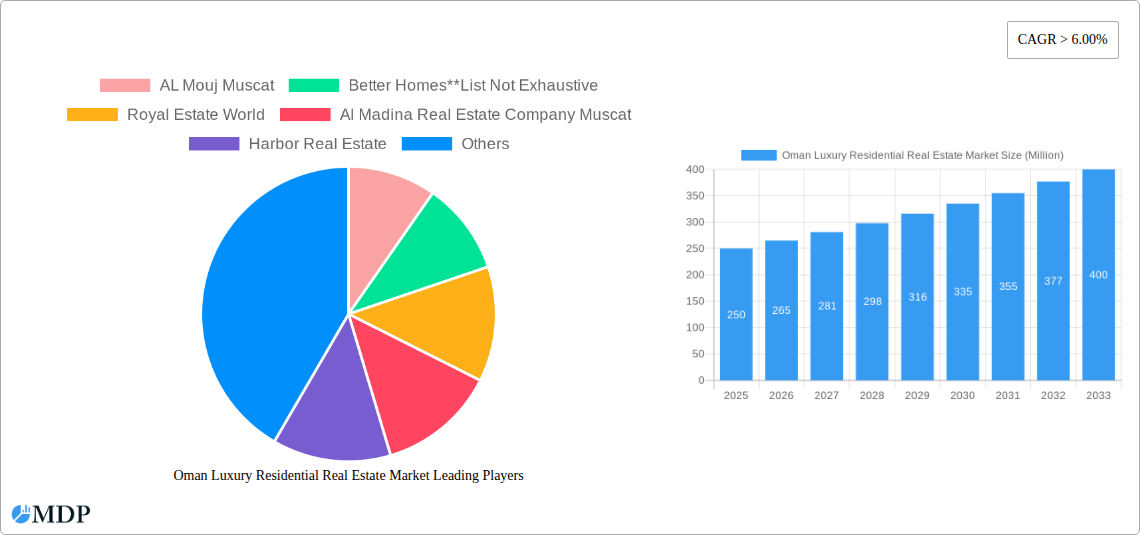

Oman Luxury Residential Real Estate Market Company Market Share

Oman Luxury Residential Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman luxury residential real estate market, offering invaluable insights for investors, developers, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. Discover key market dynamics, leading players, emerging segments, and significant industry developments shaping the future of luxury real estate in Oman.

Oman Luxury Residential Real Estate Market Dynamics & Concentration

The Oman luxury residential real estate market is characterized by a moderately concentrated landscape, with several key players vying for market share. While precise market share figures for individual companies remain proprietary, AL Mouj Muscat, Better Homes, Royal Estate World, and Al Madina Real Estate Company Muscat are considered major players. The market is driven by innovation in design and construction, catering to the increasing demand for high-end amenities and sustainable features. The regulatory framework, while supportive of investment, undergoes periodic updates impacting development timelines and approvals. Substitutes for luxury residential properties are limited, primarily encompassing high-end villas in neighboring countries. However, the segment is vulnerable to economic downturns impacting purchasing power and investor sentiment. M&A activity has been moderate over the past few years, with approximately xx deals recorded between 2019 and 2024, contributing to market consolidation and the emergence of larger players. End-user trends indicate a growing preference for sustainable, technologically advanced properties with smart home features.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Sustainable design, smart home technologies, bespoke architectural features.

- Regulatory Framework: Supportive of investment, subject to periodic updates.

- Product Substitutes: Limited, primarily high-end properties in neighboring countries.

- End-User Trends: Demand for sustainability, smart home integration, and bespoke amenities.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Oman Luxury Residential Real Estate Market Industry Trends & Analysis

The Oman luxury residential real estate market exhibits a robust growth trajectory, driven by increasing disposable incomes, government investments in infrastructure, and a growing influx of high-net-worth individuals. The market witnessed a CAGR of xx% during 2019-2024. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and smart home technologies, are revolutionizing the construction and management of luxury properties. Consumer preferences are shifting towards larger, more sustainable homes with advanced security features and integrated technology. Competitive dynamics are intensifying with new entrants and established players vying for market share through innovative product offerings and strategic partnerships. Market penetration of luxury properties remains relatively low, indicating significant untapped potential for growth, with an estimated xx% market penetration in 2024 and projected to reach xx% by 2033.

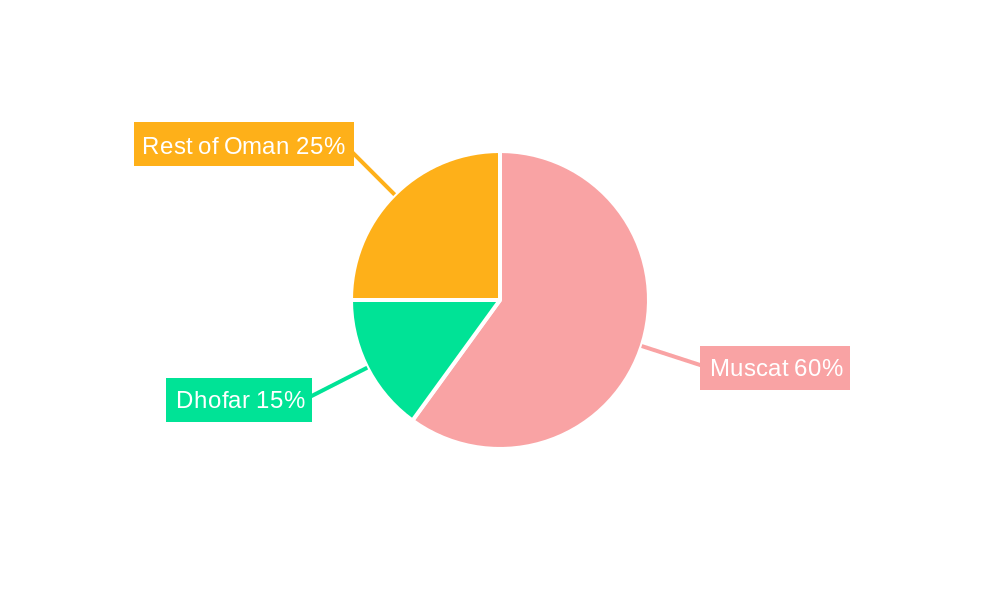

Leading Markets & Segments in Oman Luxury Residential Real Estate Market

The Muscat region remains the dominant market for luxury residential real estate in Oman, driven by robust economic activity, well-developed infrastructure, and proximity to key business centers. However, Dhofar is witnessing increasing interest, particularly with the development of new projects like Ajwaa.

By Type:

Villas and Landed Houses: This segment dominates the luxury market due to demand for larger spaces and greater privacy. The growth is propelled by a preference for exclusive gated communities and bespoke designs.

Condominiums and Apartments: This segment accounts for a smaller share of the luxury market. Growth is driven by the increasing popularity of high-rise buildings with premium amenities in prime locations.

By Key Cities:

Muscat: Dominates the luxury residential market, driven by economic activity, infrastructure, and access to amenities. Key drivers include government investments in infrastructure and a growing number of high-net-worth individuals.

Dhofar: Growing demand fueled by tourism and government initiatives to develop Salalah into a major investment hub. The Ajwaa project in Al Saada signals increasing investor interest.

Musandam, Salalah, Rest of Oman: These regions exhibit comparatively lower luxury property demand but hold potential for growth based on future infrastructure development and tourism initiatives.

Oman Luxury Residential Real Estate Market Product Developments

The luxury residential market is witnessing significant product innovations, with a focus on smart home integration, sustainable construction materials, and bespoke architectural designs. Technological advancements, such as the use of 3D printing and prefabricated construction methods, are improving efficiency and reducing construction timelines. These developments align with increasing consumer preference for energy-efficient, technologically advanced, and environmentally conscious properties, providing a significant competitive advantage to developers.

Key Drivers of Oman Luxury Residential Real Estate Market Growth

Several factors contribute to the growth of Oman's luxury residential real estate market:

- Government Initiatives: Investments in infrastructure and tourism are attracting high-net-worth individuals.

- Economic Growth: Rising disposable incomes fuel demand for luxury properties.

- Tourism Development: Increased tourism drives demand for high-end accommodations and vacation homes.

- Technological Advancements: Smart home technologies and sustainable building methods are enhancing property value and appeal.

Challenges in the Oman Luxury Residential Real Estate Market Market

The market faces some challenges, including:

- Regulatory Hurdles: Navigating regulatory approvals can be time-consuming and complex.

- Supply Chain Constraints: The availability of skilled labor and specialized materials can sometimes be a bottleneck.

- Economic Fluctuations: Global economic downturns can impact investor confidence and demand.

- Competition: Intense competition among developers necessitates unique product differentiation and effective marketing strategies. This results in a reduction of average profit margins by approximately xx% compared to the previous year.

Emerging Opportunities in Oman Luxury Residential Real Estate Market

The long-term outlook for Oman's luxury residential real estate market remains positive. Opportunities abound in strategic partnerships, sustainable development initiatives, and expansion into emerging tourism hotspots. Technological advancements, such as the adoption of virtual and augmented reality for property showings, will enhance the customer experience and drive market expansion.

Leading Players in the Oman Luxury Residential Real Estate Market Sector

- AL Mouj Muscat

- Better Homes

- Royal Estate World

- Al Madina Real Estate Company Muscat

- Harbor Real Estate

- Al-Taher Group

- Alfardan Heights

- Maysan properties SAOC

- Wujha Real Estate

- Noor Oman

Key Milestones in Oman Luxury Residential Real Estate Market Industry

April 2022: Barka Real Estate Development Company and Tibiaan Properties Company launched the integrated commercial project "Massar" in Barka, South Batinah governorate. This development signifies expansion into commercial ventures with potential knock-on effects on luxury residential development.

March 2023: Tibiaan Properties and Al Tamman Real Estate Company (Muscat Overseas Group subsidiary) signed a contract to develop "Ajwaa," a commercial development in Al Saada, Salalah. This project indicates growing investor confidence in Dhofar Governorate and signals potential spillover effects into the luxury residential sector due to increased infrastructure and amenities.

Strategic Outlook for Oman Luxury Residential Real Estate Market Market

The Oman luxury residential real estate market is poised for sustained growth, driven by increasing demand, government support, and technological innovation. Strategic partnerships between developers and international firms are predicted, further expanding market reach and enhancing the luxury housing sector. Investing in sustainable infrastructure and development projects will be critical in maximizing the long-term potential of this dynamic market and creating a strong sustainable environment for future growth. The market is projected to reach a value of xx Million by 2033.

Oman Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Muscat

- 2.2. Dhofar

- 2.3. Musandam

- 2.4. Salalh

- 2.5. Rest of Oman

Oman Luxury Residential Real Estate Market Segmentation By Geography

- 1. Oman

Oman Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Oman Luxury Residential Real Estate Market

Oman Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Supply of Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Dhofar

- 5.2.3. Musandam

- 5.2.4. Salalh

- 5.2.5. Rest of Oman

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AL Mouj Muscat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Better Homes**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Estate World

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Madina Real Estate Company Muscat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harbor Real Estate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Taher Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alfardan Heights

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maysan properties SAOC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wujha Real Estate

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Noor Oman

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AL Mouj Muscat

List of Figures

- Figure 1: Oman Luxury Residential Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Oman Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Luxury Residential Real Estate Market?

The projected CAGR is approximately 9.19%.

2. Which companies are prominent players in the Oman Luxury Residential Real Estate Market?

Key companies in the market include AL Mouj Muscat, Better Homes**List Not Exhaustive, Royal Estate World, Al Madina Real Estate Company Muscat, Harbor Real Estate, Al-Taher Group, Alfardan Heights, Maysan properties SAOC, Wujha Real Estate, Noor Oman.

3. What are the main segments of the Oman Luxury Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Supply of Residential Buildings.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

March 2023: Tibiaan Properties and Al Tamman Real Estate Company, a subsidiary of Muscat Overseas Group, signed a contract to develop and market the first commercial development of its kind in the Dhofar Governorate specifically in Al Saada area, Salalah. This project will include commercial units dedicated to various activities such as office spaces, retail spaces, restaurants, cafes, etc. This cooperation comes into place to deliver premium projects in Dhofar Governorate, where demand is rising for quality real estate projects. The project name 'Ajwaa' is an Arabic word that refers to the beautiful weather Salalah is enjoying throughout the year, thus reflecting the opportunities this project offers to investors in both corporates and individuals capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Oman Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence