Key Insights

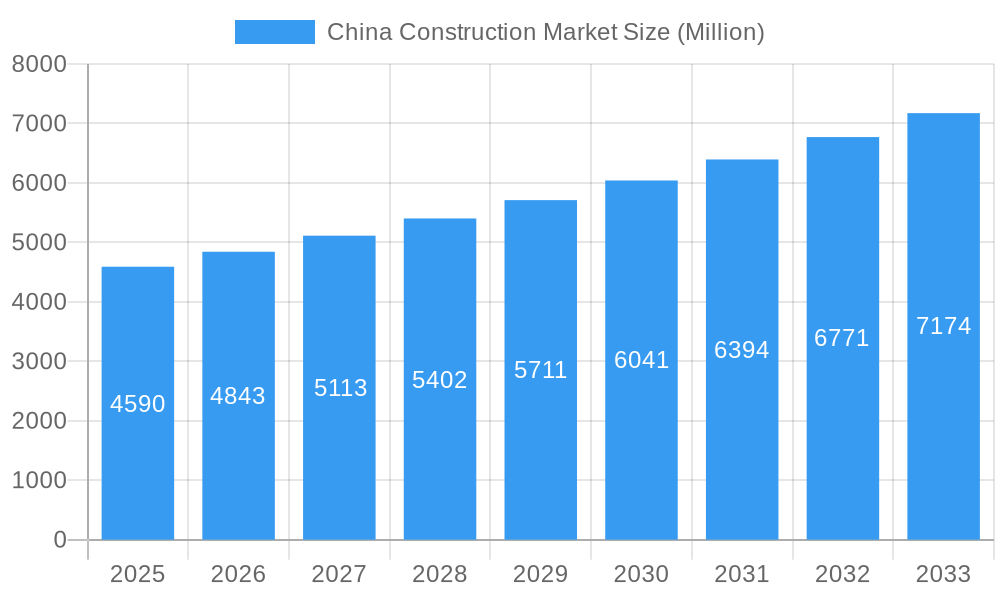

The China construction market, valued at $4.59 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.07% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant government investment in infrastructure projects, particularly within transportation (high-speed rail, roads, and ports) and energy & utilities (renewable energy installations and grid modernization), is a major catalyst. Secondly, rapid urbanization and a burgeoning middle class are driving demand for residential and commercial construction, leading to substantial growth in these sectors. Thirdly, China's ongoing commitment to sustainable development initiatives is creating opportunities for green building technologies and environmentally friendly construction practices. However, the market faces certain constraints. Fluctuations in the global economy, material price volatility, and potential labor shortages could temper growth. Effective regulatory frameworks and sustainable procurement policies will be crucial to mitigate these risks and maintain a steady growth trajectory.

China Construction Market Market Size (In Billion)

The market is segmented by sector, with infrastructure (transportation) and residential construction representing the largest segments. Key players in this dynamic market include state-owned enterprises such as China State Construction Engineering, China Communications Construction Company, and China Railway Group, alongside other significant players. These companies are leveraging advanced technologies, such as Building Information Modeling (BIM) and prefabrication, to enhance efficiency and competitiveness. The competitive landscape is characterized by both intense competition and collaboration, as companies seek to secure lucrative projects and consolidate their market share. Looking ahead, the continued focus on infrastructure development, urbanization, and sustainable building practices will be vital for sustaining the impressive growth projected for the Chinese construction market in the coming years. Foreign investment, while potentially present, is likely to remain a relatively minor factor in the market's overall size due to the dominance of state-owned enterprises.

China Construction Market Company Market Share

China Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China construction market, covering market dynamics, industry trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis to project a market size of xx Million by 2033, presenting a compelling outlook for those seeking to capitalize on the booming opportunities within the Chinese construction sector.

China Construction Market Market Dynamics & Concentration

The China construction market, valued at xx Million in 2024, exhibits a complex interplay of factors influencing its growth and concentration. Market share is significantly consolidated amongst several large state-owned enterprises (SOEs). While precise market share figures for individual companies fluctuate yearly, China State Construction Engineering, China Railway Group, and China Communications Construction Company consistently maintain substantial leadership positions. The intense competition among these giants has led to a focus on large-scale projects and strategic partnerships.

- Market Concentration: High, with SOEs dominating.

- Innovation Drivers: Government investment in infrastructure, technological advancements (e.g., BIM, prefabrication), and a growing emphasis on sustainable construction practices.

- Regulatory Frameworks: Stringent regulations impacting environmental protection, safety standards, and project approvals. Recent reforms aim to streamline processes but regulatory uncertainty remains a challenge.

- Product Substitutes: Limited direct substitutes exist, however, the market is influenced by the cost-effectiveness of alternative construction materials and methodologies.

- End-User Trends: A shift towards high-quality, sustainable, and technologically advanced buildings in both residential and commercial sectors.

- M&A Activities: The number of significant M&A deals in the China construction sector averaged xx per year during the 2019-2024 historical period, with a predicted increase to xx per year in the coming decade due to the ongoing consolidation among large players.

China Construction Market Industry Trends & Analysis

The China construction market demonstrates robust growth, driven by sustained urbanization, robust infrastructure development, and government initiatives promoting both housing and industrial expansion. The Compound Annual Growth Rate (CAGR) during the 2019-2024 historical period was xx%, and a CAGR of xx% is projected for the forecast period (2025-2033). This growth is significantly influenced by several key trends:

- Technological Disruptions: Increasing adoption of Building Information Modeling (BIM), prefabrication techniques, and digital construction methods are driving efficiency gains and enhancing project delivery.

- Consumer Preferences: A rising demand for sustainable and energy-efficient buildings, coupled with increasing disposable income, fuels the expansion of higher-end residential and commercial projects.

- Competitive Dynamics: Intense competition, particularly among large SOEs, shapes pricing strategies and innovation drives. Smaller firms specialize in niche sectors and rely on partnerships with larger entities.

- Market Penetration of New Technologies: BIM adoption is showing a steady increase, with penetration levels expected to reach xx% by 2033, resulting in improved efficiency and reduced project timelines.

Leading Markets & Segments in China Construction Market

The infrastructure (transportation) sector exhibits substantial dominance within the China construction market, propelled by consistent government investment in high-speed rail networks, road expansions, and port modernizations. Residential construction remains significant, especially in expanding urban centers.

Key Drivers of Infrastructure Dominance:

- Massive government investment in national infrastructure projects.

- The need to facilitate efficient transportation and logistics within rapidly expanding urban areas.

- Initiatives focusing on connecting remote regions to the national economic network.

Residential Sector Growth: Driven by continuous urbanization and a growing middle class seeking improved housing quality.

Commercial Sector Trends: Increasing demand for modern office spaces, retail complexes, and hospitality infrastructure in major cities.

Industrial Sector Dynamics: Growth linked to industrial expansion and technological upgrades in manufacturing hubs.

Energy and Utilities Sector: Significant opportunities in renewable energy infrastructure development, driven by the nation's commitment to carbon reduction targets.

China Construction Market Product Developments

Product innovation in the China construction market centers on improving efficiency, sustainability, and safety. This involves adopting prefabricated construction methods, advanced materials (e.g., high-strength concrete, sustainable building materials), and integrating digital technologies for project management and monitoring. These innovations offer competitive advantages by reducing construction times, lowering costs, and enhancing overall project quality.

Key Drivers of China Construction Market Growth

The China construction market is propelled by several key growth drivers:

- Government Investment: Massive infrastructure development projects and supportive policies stimulating both public and private sector investments.

- Urbanization: Rapid urbanization continues to fuel the need for new housing, commercial spaces, and infrastructure.

- Technological Advancements: The adoption of BIM and advanced construction methods enhances efficiency and reduces costs.

Challenges in the China Construction Market Market

The China construction market faces several challenges:

- Regulatory Hurdles: Complex permitting processes, environmental regulations, and bureaucratic procedures can create significant delays and increased costs.

- Supply Chain Disruptions: Fluctuations in material prices and potential supply chain bottlenecks can impact project costs and timelines.

- Intense Competition: The highly competitive landscape necessitates constant innovation and efficient cost management.

Emerging Opportunities in China Construction Market

Emerging opportunities lie in:

- Green Building Technologies: Growing demand for sustainable and energy-efficient construction creates lucrative opportunities for eco-friendly materials and technologies.

- Strategic Partnerships: Collaborations between domestic and international companies facilitate technology transfer and market expansion.

- Expanding into Rural Areas: The government's rural revitalization strategy presents opportunities for infrastructure development in less-developed regions.

Leading Players in the China Construction Market Sector

- China National Chemical Engineering

- China Metallurgical Group

- China State Construction Engineering

- China Communications Construction Company

- China Railway Group

- China Railway Construction

- China Energy Engineering Corporation

- Shanghai Construction Group

- China Petroleum Engineering Corporation

- Power Construction Corporation of China

Key Milestones in China Construction Market Industry

- December 2023: China-based construction firms win prestigious ENR Global Best Projects Awards for the Lamu Port Berth 1-3 Project (Airport and Port category) and the Peljesac Bridge (Bridge and Tunnel category), demonstrating their global competitiveness.

- July 2023: The Shaoxing Metro Line 2, constructed by CRCC, opens, showcasing advancements in automated and driverless subway systems and bolstering the Hangzhou Asian Games infrastructure.

Strategic Outlook for China Construction Market Market

The China construction market presents immense long-term growth potential, driven by ongoing urbanization, robust infrastructure development, and technological advancements. Strategic partnerships, investment in green technologies, and expansion into underserved markets will be crucial for companies seeking to capitalize on these opportunities. The focus on sustainable and technologically advanced projects will continue to shape the market landscape, presenting significant potential for those who can successfully navigate the regulatory environment and intense competition.

China Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastruture (Transportation)

- 1.5. Energy and Utilities

China Construction Market Segmentation By Geography

- 1. China

China Construction Market Regional Market Share

Geographic Coverage of China Construction Market

China Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Increase in Output value of China Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastruture (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China National Chemical Engineering

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Metallurgical Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China State Construction Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Communications Construction Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Railway Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Railway Construction

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Energy Engineering Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Construction Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Petroleum Engineering Corporation**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Power Construction Corporation of China

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China National Chemical Engineering

List of Figures

- Figure 1: China Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Construction Market Share (%) by Company 2025

List of Tables

- Table 1: China Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: China Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: China Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Construction Market?

The projected CAGR is approximately 5.07%.

2. Which companies are prominent players in the China Construction Market?

Key companies in the market include China National Chemical Engineering, China Metallurgical Group, China State Construction Engineering, China Communications Construction Company, China Railway Group, China Railway Construction, China Energy Engineering Corporation, Shanghai Construction Group, China Petroleum Engineering Corporation**List Not Exhaustive, Power Construction Corporation of China.

3. What are the main segments of the China Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Increase in Output value of China Construction Industry.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

December 2023: Recently, "Engineering News-Record" (ENR), one of the world's most authoritative academic journals in engineering and construction, announced the winners of the 2023 Global Best Projects Awards. I received awards for two projects. The Lamu Port Berth 1-3 Project was honored with the Award of Merit in the Airport and Port category, while the Peljesac Bridge and its access roads in Croatia received the Award of Merit in the Bridge and Tunnel category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Construction Market?

To stay informed about further developments, trends, and reports in the China Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence