Key Insights

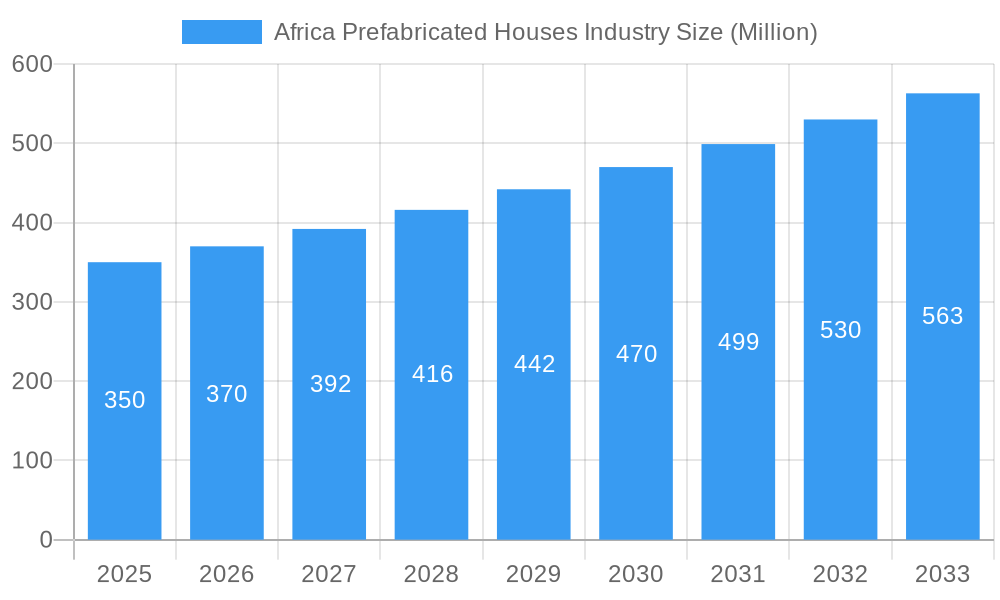

The African prefabricated housing market is experiencing significant expansion, driven by rapid urbanization, population growth, and a pressing need for affordable housing solutions. Projections indicate a Compound Annual Growth Rate (CAGR) of 7.1%, signifying substantial growth potential from the base year 2025. Key market segments include single-family and multi-family dwellings, with Nigeria, Egypt, and South Africa leading national market contributions. The increasing demand for cost-effective and rapid construction methods is accelerating the adoption of prefabricated homes, particularly in burgeoning urban centers. Additionally, government initiatives promoting affordable and sustainable construction practices are further fueling market development. Prominent companies such as Nyumba, Karmod, and Cube Modular are instrumental in shaping the industry through innovative designs, efficient production, and market expansion. While challenges such as infrastructure development, skilled labor shortages, and regulatory complexities persist in certain regions, the long-term outlook for the African prefabricated houses market remains highly positive, with robust growth anticipated across diverse segments and geographies.

Africa Prefabricated Houses Industry Market Size (In Billion)

This growth trajectory is further bolstered by increasing investments in infrastructure projects and government commitments to enhance housing affordability. The global trend towards sustainable and eco-friendly building materials is also positively influencing market expansion. Moreover, growing consumer awareness regarding the advantages of prefabricated housing—including speed, cost-effectiveness, and quality—is a significant market driver. Continuous innovation by industry players in product design and geographical reach reinforces these positive growth prospects throughout the forecast period. The estimated market size for 2025 is approximately $177.65 billion.

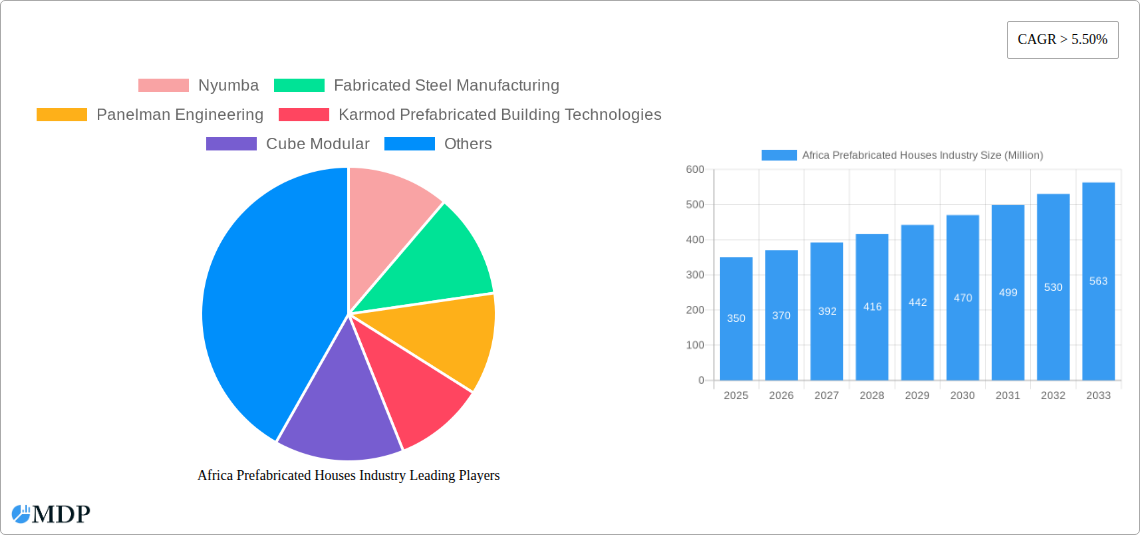

Africa Prefabricated Houses Industry Company Market Share

Africa Prefabricated Houses Market Analysis and Forecast (2025-2033)

This comprehensive report offers detailed analysis of the African prefabricated housing market, providing essential insights for investors, stakeholders, and strategic decision-makers. Covering the period 2025-2033, with a base year of 2025, the report delineates market dynamics, growth drivers, challenges, and emerging opportunities within this rapidly evolving sector. It examines key markets including Nigeria, Egypt, South Africa, and the broader Rest of Africa, with a focus on segments such as single-family and multi-family prefabricated homes. The report features in-depth analysis of leading players such as Nyumba, Karmod Prefabricated Building Technologies, and Cube Modular, among others. Actionable data, including CAGR projections and market share analysis, is provided to facilitate informed strategic planning.

Africa Prefabricated Houses Industry Market Dynamics & Concentration

The Africa Prefabricated Houses market exhibits a moderately concentrated landscape, with a few established players and several emerging entrants. Market share is largely determined by production capacity, technological advancements, and geographical reach. The market is characterized by increasing innovation, driven by the need for affordable and sustainable housing solutions. Regulatory frameworks vary across African nations, influencing construction standards and materials usage. The industry is also witnessing significant M&A activity, with an estimated xx number of deals completed between 2019 and 2024, representing a xx% increase compared to the previous five years. This consolidation is driven by the desire to expand market reach and gain access to new technologies. The primary product substitute for prefabricated houses remains traditional construction, but cost-effectiveness and speed of construction are pushing market share towards prefab solutions. End-user trends are shifting towards eco-friendly and energy-efficient designs, fueling innovation in sustainable building materials and technologies.

- Market Concentration: Moderately concentrated, with top 5 players holding an estimated xx% market share in 2024.

- Innovation Drivers: Demand for affordable housing, sustainable building materials, technological advancements in construction techniques.

- Regulatory Frameworks: Vary significantly across countries, impacting construction costs and timelines.

- Product Substitutes: Traditional construction methods remain the primary substitute.

- End-User Trends: Growing preference for energy-efficient and sustainable designs.

- M&A Activity: Estimated xx M&A deals between 2019 and 2024, indicating market consolidation.

Africa Prefabricated Houses Industry Industry Trends & Analysis

The Africa Prefabricated Houses market is experiencing robust growth, driven by rapid urbanization, increasing population, and a significant housing deficit. The CAGR is projected to be xx% between 2025 and 2033. Technological disruptions, such as the adoption of 3D printing and modular construction techniques, are accelerating production efficiency and reducing construction time. Consumer preferences are shifting towards customizable designs, energy-efficient features, and durable materials. Competitive dynamics are intensifying with the entry of new players and increased investments in the sector. Market penetration is expected to reach xx% by 2033, driven by government initiatives and increasing private sector investments. The industry is witnessing significant growth in both the single-family and multi-family segments. However, the multi-family segment is projected to experience faster growth due to the increasing demand for affordable housing in urban areas.

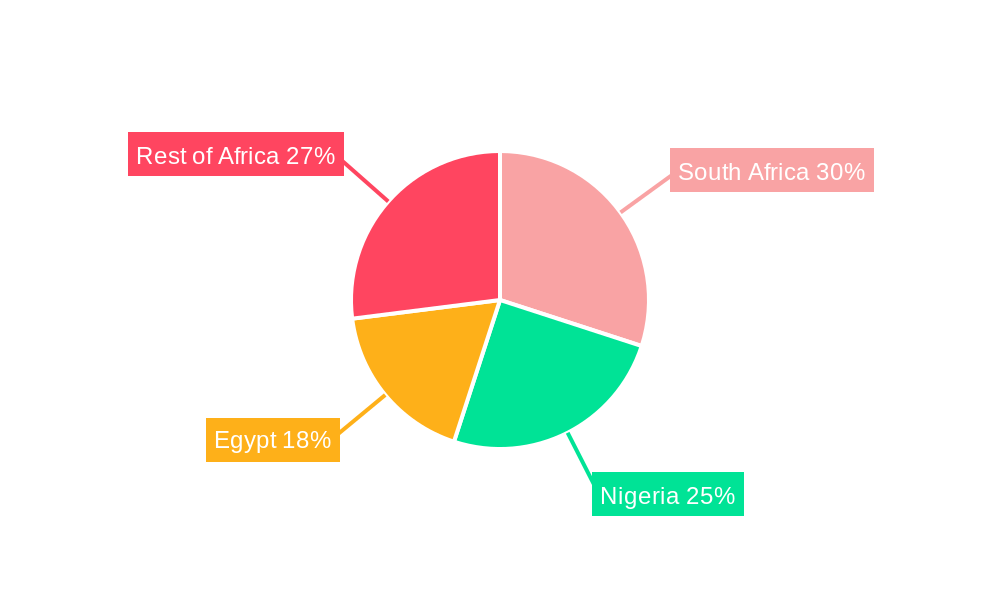

Leading Markets & Segments in Africa Prefabricated Houses Industry

Nigeria, Egypt, and South Africa are the leading markets for prefabricated houses in Africa, collectively accounting for approximately xx% of the total market value in 2024. The significant growth in these regions is attributed to several factors:

- Nigeria: Rapid urbanization, increasing population, and government initiatives to address the housing shortage.

- Egypt: Large-scale infrastructure development projects and government focus on affordable housing solutions.

- South Africa: Established construction industry, relatively developed infrastructure, and a growing middle class with increased purchasing power.

The single-family segment currently dominates the market, but the multi-family segment is expected to experience faster growth in the coming years, driven by the demand for affordable housing in urban areas.

- Dominant Region: West Africa (Nigeria)

- Dominant Country: Nigeria

- Dominant Segment: Single-family homes (currently), with multi-family experiencing faster growth.

Africa Prefabricated Houses Industry Product Developments

Recent product innovations focus on sustainable materials, modular designs, and improved energy efficiency. Prefabricated houses are increasingly incorporating renewable energy sources and smart home technologies. The competitive advantage lies in offering cost-effective, quick-to-assemble, and environmentally friendly solutions that meet the specific needs of the African market. Technological trends favor modular construction and 3D printing, offering greater design flexibility and reduced construction time.

Key Drivers of Africa Prefabricated Houses Industry Growth

Several factors are fueling the growth of the Africa Prefabricated Houses industry: rapid urbanization and population growth create a massive housing demand; government initiatives promoting affordable housing; increasing investments from private sector players; and technological advancements such as 3D printing and modular construction are streamlining the process and reducing costs.

Challenges in the Africa Prefabricated Houses Industry Market

The industry faces several challenges, including inconsistent regulatory frameworks across different African countries, limitations in the availability of skilled labor, supply chain disruptions, and intense competition among various players. These challenges can impact project timelines, increase costs, and hinder market penetration. For instance, import tariffs on building materials can significantly increase the overall cost of construction in some regions.

Emerging Opportunities in Africa Prefabricated Houses Industry

Significant opportunities exist in leveraging technological breakthroughs such as 3D printing for customized and efficient housing solutions. Strategic partnerships with local contractors and material suppliers can facilitate market expansion and overcome supply chain challenges. Focus on sustainable and energy-efficient designs can tap into the growing demand for eco-friendly housing.

Leading Players in the Africa Prefabricated Houses Industry Sector

- Nyumba

- Fabricated Steel Manufacturing

- Panelman Engineering

- Karmod Prefabricated Building Technologies

- Cube Modular

- Concretex

- Kwikspace Modular Buildings Ltd

- M Projects

- House-it Building

- Global Africa Prefabricated Building Solutions Ltd

Key Milestones in Africa Prefabricated Houses Industry Industry

- May 2023: Amsterdam-based architecture firm NLE installs a floating prefab house model in Cape Verde to explore cost-effective housing solutions.

- January 2022: Addis Ababa City Administration lays the foundation for 5,000 prefabricated houses, initiating a plan to build 2 Million houses over ten years.

Strategic Outlook for Africa Prefabricated Houses Industry Market

The Africa Prefabricated Houses industry presents significant long-term growth potential. Strategic opportunities lie in focusing on sustainable, affordable, and technologically advanced solutions tailored to local needs. Collaborations with governments and private investors are crucial to overcome existing challenges and accelerate market expansion. The industry's future depends on addressing affordability, sustainability, and local context.

Africa Prefabricated Houses Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Africa Prefabricated Houses Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Prefabricated Houses Industry Regional Market Share

Geographic Coverage of Africa Prefabricated Houses Industry

Africa Prefabricated Houses Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Shift Towards Prefab Housing due to High Pricing in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nyumba

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fabricated Steel Manufacturing

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panelman Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Karmod Prefabricated Building Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cube Modular

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Concretex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kwikspace Modular Buildings Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 M Projects**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 House-it Building

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Global Africa Prefabricated Building Solutions Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nyumba

List of Figures

- Figure 1: Africa Prefabricated Houses Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Prefabricated Houses Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Prefabricated Houses Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Africa Prefabricated Houses Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Africa Prefabricated Houses Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Africa Prefabricated Houses Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Nigeria Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: South Africa Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Egypt Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Kenya Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Ethiopia Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Morocco Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Ghana Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Algeria Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Tanzania Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ivory Coast Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Prefabricated Houses Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Africa Prefabricated Houses Industry?

Key companies in the market include Nyumba, Fabricated Steel Manufacturing, Panelman Engineering, Karmod Prefabricated Building Technologies, Cube Modular, Concretex, Kwikspace Modular Buildings Ltd, M Projects**List Not Exhaustive, House-it Building, Global Africa Prefabricated Building Solutions Ltd.

3. What are the main segments of the Africa Prefabricated Houses Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 177.65 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Shift Towards Prefab Housing due to High Pricing in Egypt.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

May 2023: A new prefab housing structure is under development by Amsterdam-based architecture firm NLE. They installed a model in Africa's Cape Verde to understand its viability's various aspects as floating houses. The idea is to reduce the overall cost emanating from land prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Prefabricated Houses Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Prefabricated Houses Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Prefabricated Houses Industry?

To stay informed about further developments, trends, and reports in the Africa Prefabricated Houses Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence