Key Insights

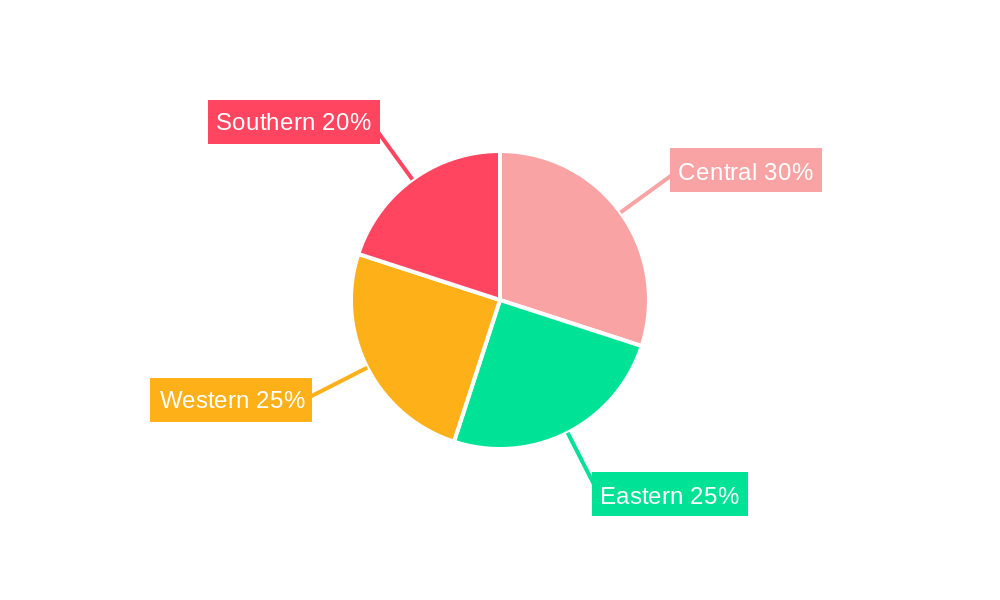

The Saudi Arabian manufactured homes market is experiencing robust expansion, fueled by rapid urbanization, escalating demand for affordable housing, and supportive government initiatives aimed at stimulating the construction sector. With a projected Compound Annual Growth Rate (CAGR) of 6.6%, the market is poised for significant growth from the base year 2025. The market segmentation, primarily divided into single-family and multi-family homes, caters to a spectrum of consumer needs. Leading companies such as Speed House Group of Companies and Red Sea International are instrumental in this growth through advancements in design, technology, and construction methodologies. Regional distribution across Central, Eastern, Western, and Southern Saudi Arabia highlights varied market penetration and substantial future growth potential in all regions. Government investments in infrastructure and favorable policies further enhance the market's attractiveness for investors and developers. The cost-effectiveness of manufactured homes compared to traditional construction significantly boosts demand, especially among younger buyers and those seeking budget-conscious housing solutions.

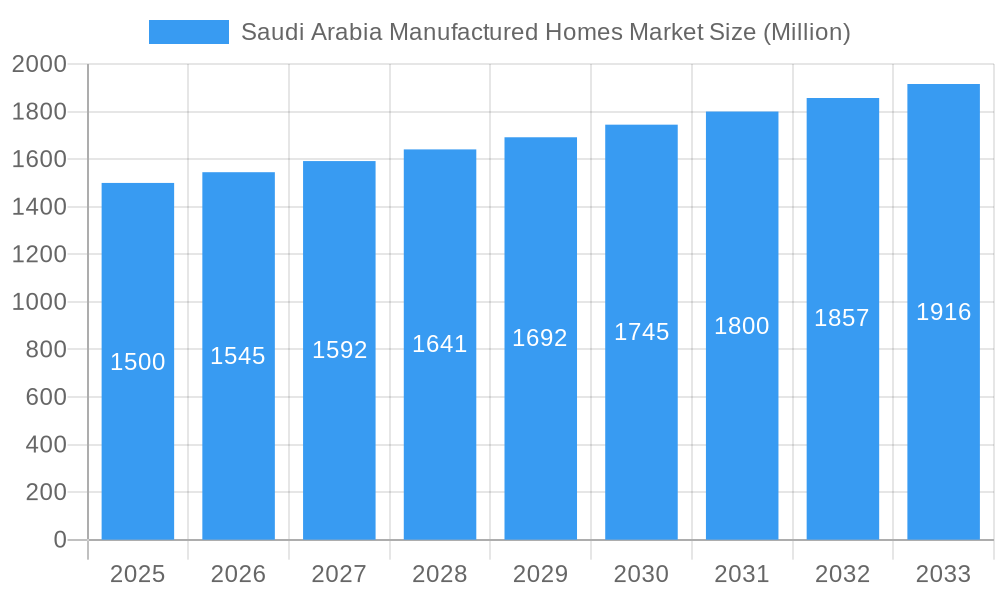

Saudi Arabia Manufactured Homes Market Market Size (In Billion)

The forecast period, spanning 2025-2033, anticipates substantial market expansion. The market size is projected to reach 1869.4 million by 2025. While precise figures for future years require ongoing analysis, the sustained CAGR of 6.6% indicates consistent and considerable growth. Factors like material costs, construction industry dynamics, and potential policy shifts warrant continuous market monitoring. The ongoing development of sustainable and technologically advanced manufactured homes will further shape the market landscape. Continued infrastructure development and population growth in Saudi Arabia present significant long-term growth prospects. The competitive environment, featuring established and emerging players, is expected to foster innovation and competitive pricing, benefiting consumers and strengthening overall market growth.

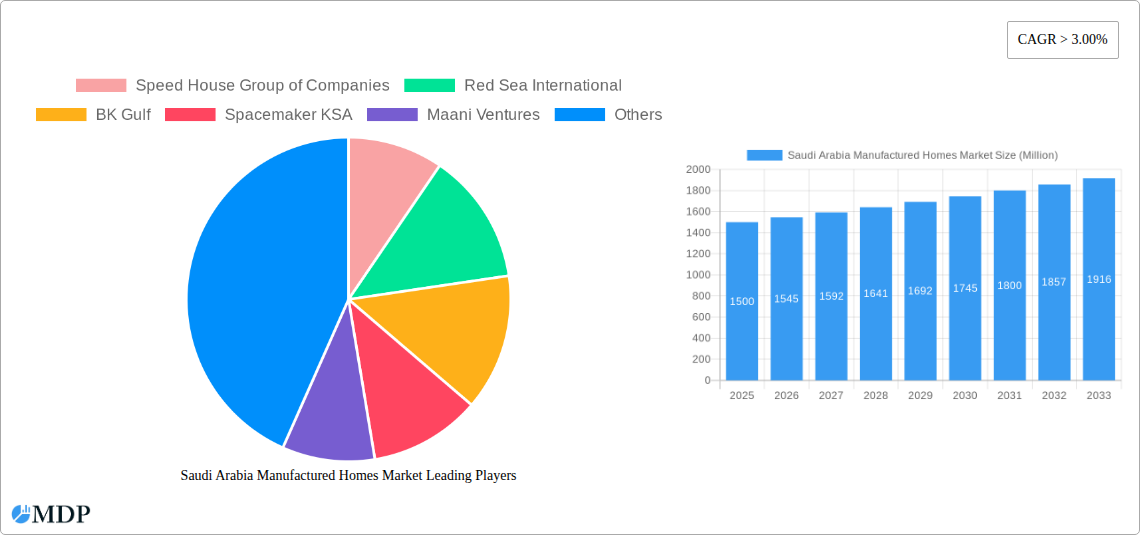

Saudi Arabia Manufactured Homes Market Company Market Share

Saudi Arabia Manufactured Homes Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Saudi Arabia manufactured homes market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. Unlock the secrets to success in this rapidly expanding sector.

Saudi Arabia Manufactured Homes Market Market Dynamics & Concentration

The Saudi Arabia manufactured homes market is experiencing significant growth, driven by several key factors. Market concentration is currently moderate, with several key players vying for market share. However, the landscape is dynamic, with ongoing mergers and acquisitions (M&A) activity reshaping the competitive landscape. The market exhibits a healthy level of innovation, as companies invest in advanced manufacturing techniques and sustainable building materials.

- Market Concentration: While precise market share figures for individual companies are unavailable, we estimate the top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: The increasing demand for affordable and sustainable housing solutions is pushing innovation in design, materials, and construction methods.

- Regulatory Framework: Government initiatives promoting affordable housing and sustainable development are creating a favorable regulatory environment.

- Product Substitutes: Traditional brick-and-mortar construction remains a significant competitor, but manufactured homes offer advantages in speed, cost-effectiveness, and design flexibility.

- End-User Trends: Growing urbanization and a young, expanding population are driving demand for housing, particularly in affordable segments.

- M&A Activities: The past five years have witnessed xx M&A deals in the Saudi Arabia manufactured homes market, indicating consolidation and increased investment.

Saudi Arabia Manufactured Homes Market Industry Trends & Analysis

The Saudi Arabia manufactured homes market is witnessing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several interconnected factors. Government support for affordable housing initiatives significantly boosts the sector's expansion, complemented by an increasing preference for cost-effective housing solutions amongst the population. Furthermore, rapid urbanization and population growth have resulted in increased demand for housing, creating a significant opportunity for the manufactured homes industry. Technological advancements in modular construction and prefabrication techniques also enhance efficiency and construction speed, accelerating market growth. Competitive dynamics are shaping the sector, with companies focusing on innovation, design flexibility, and customer service to capture market share. The market penetration rate for manufactured homes is estimated to reach xx% by 2033.

Leading Markets & Segments in Saudi Arabia Manufactured Homes Market

The demand for manufactured homes in Saudi Arabia is strong across various regions, however, data suggests the highest growth is concentrated in rapidly developing urban centers. Both single-family and multi-family manufactured homes are experiencing growth, but the single-family segment is currently leading due to affordability and individual ownership preferences.

Key Drivers for Segment Dominance:

Single-Family Homes:

- Affordability: Lower initial costs compared to traditional homes.

- Faster Construction: Reduced construction timelines, leading to quicker occupancy.

- Customization: Options for personalization and design flexibility.

Multi-Family Homes:

- Cost-Effectiveness for Developers: Economical solution for large-scale housing projects.

- Government Support: Initiatives promoting affordable multi-family housing developments.

The dominance of single-family homes is further fueled by government incentives targeting affordable housing, particularly for first-time homebuyers. This government support contributes significantly to the overall market expansion.

Saudi Arabia Manufactured Homes Market Product Developments

Recent product innovations in the Saudi Arabia manufactured homes market focus on enhancing energy efficiency, utilizing sustainable materials, and incorporating smart home technologies. These advancements provide significant competitive advantages, improving market fit and appealing to environmentally conscious consumers. The integration of renewable energy sources and advanced insulation techniques further enhances the appeal of manufactured homes.

Key Drivers of Saudi Arabia Manufactured Homes Market Growth

The Saudi Arabia manufactured homes market is propelled by several key drivers. The government's commitment to Vision 2030, focusing on affordable housing initiatives, plays a crucial role. Additionally, rapid urbanization and population growth create a substantial demand for housing solutions. Technological advancements such as prefabrication and modular construction techniques offer cost-effectiveness and speed.

Challenges in the Saudi Arabia Manufactured Homes Market Market

The market faces challenges, including the competition from traditional construction methods. Supply chain disruptions can impact construction timelines and costs, while regulatory hurdles may present obstacles to market entry for new players. Furthermore, ensuring consistent quality and building codes compliance across the industry remains an ongoing concern.

Emerging Opportunities in Saudi Arabia Manufactured Homes Market

Long-term growth opportunities stem from technological innovations, including 3D printing and advanced materials. Strategic partnerships between developers, manufacturers, and financial institutions can unlock financing options for homebuyers. Expanding into underserved rural areas presents substantial growth potential.

Leading Players in the Saudi Arabia Manufactured Homes Market Sector

- Speed House Group of Companies

- Red Sea International

- BK Gulf

- Spacemaker KSA

- Maani Ventures

- ISG Prefab

- Aldamegh Portable House Factory

- TSSC Group

- Karmod Prefabricated Technologies

- Amana

Key Milestones in Saudi Arabia Manufactured Homes Market Industry

- January 2022: Red Sea International Co. secured a SAR 60.5 million (USD 16.12 million) contract with The Red Sea Development Co. for modular units. This significant contract highlights the growing demand for manufactured housing in large-scale projects.

- December 2022: Red Sea International signed a SAR 192.01 million (USD 51.11 million) contract with the Royal Commission for AlUla (RCU) for a housing complex. This substantial deal underscores the market's potential and the confidence investors have in the sector.

Strategic Outlook for Saudi Arabia Manufactured Homes Market Market

The Saudi Arabia manufactured homes market is poised for considerable growth. The continued implementation of government initiatives, coupled with technological advancements, promises a strong future. Companies focusing on innovation, sustainability, and cost-effectiveness are well-positioned to capitalize on the numerous opportunities within this expanding sector.

Saudi Arabia Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Saudi Arabia Manufactured Homes Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Manufactured Homes Market Regional Market Share

Geographic Coverage of Saudi Arabia Manufactured Homes Market

Saudi Arabia Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Rising Construction Costs May Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Speed House Group of Companies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Red Sea International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BK Gulf

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Spacemaker KSA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maani Ventures

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ISG Prefab

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aldamegh Portable House Factory

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TSSC Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karmod Prefabricated Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amana**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Speed House Group of Companies

List of Figures

- Figure 1: Saudi Arabia Manufactured Homes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Manufactured Homes Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Saudi Arabia Manufactured Homes Market?

Key companies in the market include Speed House Group of Companies, Red Sea International, BK Gulf, Spacemaker KSA, Maani Ventures, ISG Prefab, Aldamegh Portable House Factory, TSSC Group, Karmod Prefabricated Technologies, Amana**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1869.4 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Rising Construction Costs May Drive the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

January 2022: Red Sea International Co. signed a SAR 60.5 million (USD 16.12 million) contract with The Red Sea Development Co., known as TRSDC, to design, manufacture, supply, and install three complexes in the Saudi western region. This comes in line to support the construction activities of luxury hotels on three islands in the Red Sea, Sheybarah and Ummahat Al Shaikh islands. The contract duration is 194 days. The contract consists of various types of modular units, which can be used as accommodations or offices. These units will be fully furnished to provide all the requirements for the crew working on the construction site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence