Key Insights

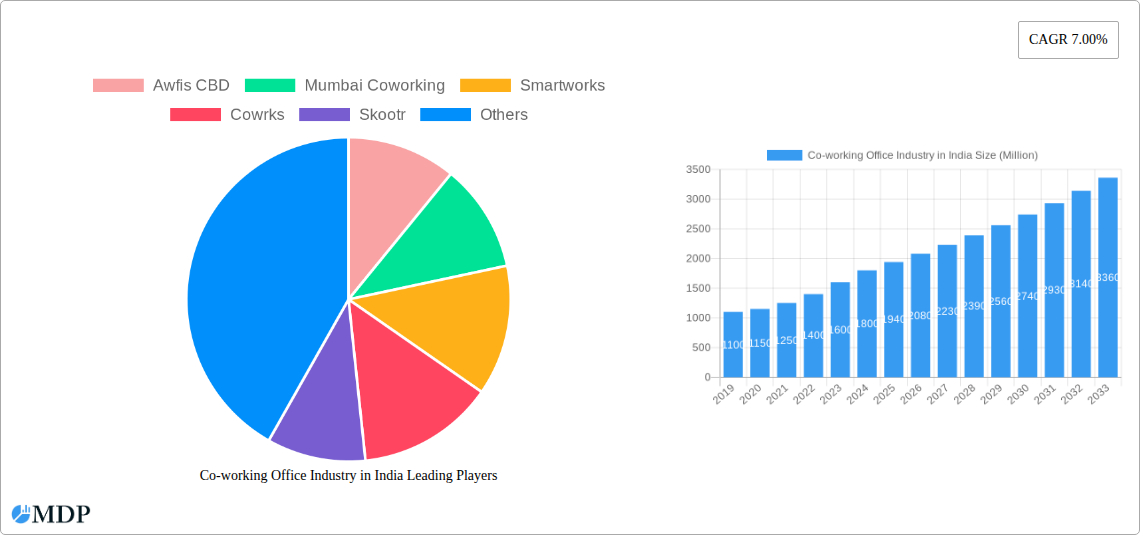

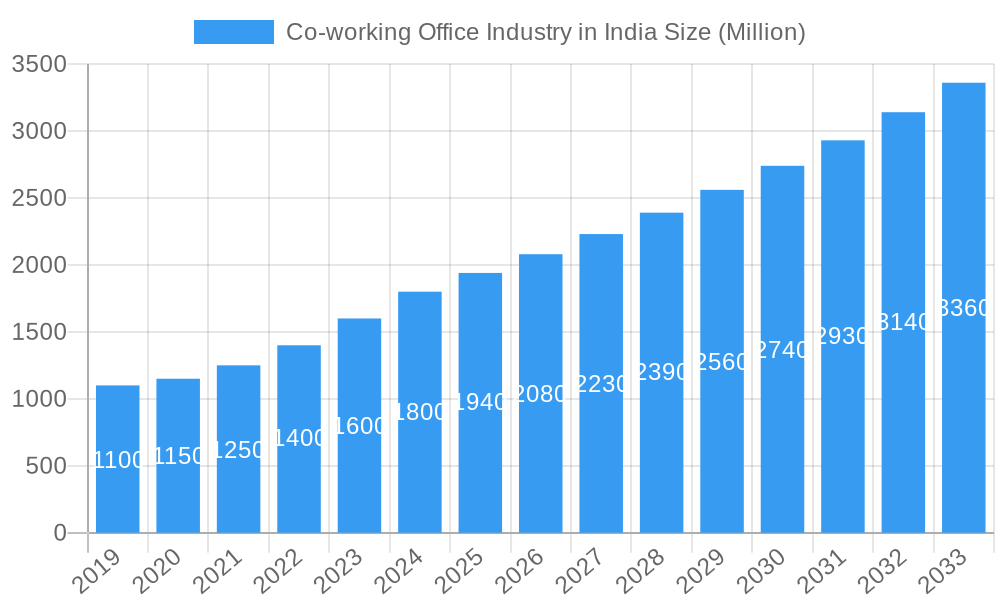

The Indian co-working office industry is poised for substantial growth, projected to reach an estimated market size of INR 1940 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.00% expected through 2033. This expansion is primarily fueled by the increasing adoption of flexible work models by businesses of all sizes, the burgeoning startup ecosystem, and the growing demand for cost-effective office solutions, especially within the Information Technology (IT and ITES), Legal Services, and BFSI sectors. The "gig economy" and the rise of remote work further amplify the need for adaptable workspaces, driving demand from personal users to large enterprises. The market is characterized by diverse offerings, including flexible managed offices and serviced offices, catering to a wide spectrum of user needs. Key metropolitan hubs like Delhi, Mumbai, and Bangalore are leading this growth, acting as epicenters for co-working adoption and innovation.

Co-working Office Industry in India Market Size (In Billion)

While the market benefits from strong growth drivers, it also faces certain restraints. The competitive landscape, with numerous players like Awfis, Smartworks, and WeWork vying for market share, necessitates continuous innovation and differentiation. Evolving occupier expectations regarding amenities, technology, and community building also present challenges for operators. However, the inherent flexibility and cost-efficiency of co-working spaces are expected to outweigh these challenges, particularly as companies continue to re-evaluate their real estate strategies post-pandemic. The expansion into smaller cities and the development of specialized co-working solutions are emerging trends that will further shape the industry's trajectory, ensuring sustained relevance and appeal for a broad user base.

Co-working Office Industry in India Company Market Share

Unlock India's Thriving Co-working Office Market: An In-Depth Report

Gain unparalleled insights into the dynamic Indian co-working office industry with this comprehensive report. Covering the forecast period of 2025–2033, with a base year of 2025, this analysis delves into market dynamics, growth drivers, key segments, leading players, and future strategic outlooks. Essential for investors, real estate developers, entrepreneurs, and industry stakeholders seeking to capitalize on the burgeoning flexible workspace revolution in India.

This report provides actionable intelligence on a market projected for significant expansion, driven by evolving work models and corporate demands. From understanding the latest industry developments and technological disruptions to identifying leading markets and investment opportunities, this analysis equips you with the knowledge to navigate and succeed in India's rapidly growing co-working sector.

Co-working Office Industry in India Market Dynamics & Concentration

The Indian co-working office industry is characterized by a dynamic market concentration, with a significant presence of key players but also room for niche operators. Innovation drivers are primarily fueled by the demand for flexible, tech-enabled workspaces and the increasing adoption of hybrid work models. Regulatory frameworks are evolving to support the growth of this sector, though clarity on certain aspects remains a focus. Product substitutes are minimal as co-working offers a unique blend of services, but traditional office leases and home office setups represent indirect competition. End-user trends show a strong shift towards demand for cost-effective, amenity-rich, and community-focused workspaces, particularly from SMEs and large corporations seeking agility. M&A activities are on the rise, reflecting consolidation and strategic expansion within the market.

- Market Share: While precise real-time market share data fluctuates, leading players hold substantial portions in key metropolitan areas.

- M&A Deal Counts: The historical period (2019–2024) witnessed a growing number of strategic partnerships and acquisitions as companies sought to expand their footprint and service offerings.

Co-working Office Industry in India Industry Trends & Analysis

The Indian co-working office industry is experiencing robust growth, propelled by several key market growth drivers. The fundamental shift towards hybrid and remote work models has made flexible office solutions highly attractive to businesses of all sizes, enabling cost optimization and enhanced employee flexibility. Technological disruptions are playing a crucial role, with advancements in smart building technology, AI-powered space management, and seamless digital connectivity becoming standard expectations for co-working spaces. Consumer preferences are increasingly leaning towards spaces that offer not just desks but also community building, networking opportunities, and a holistic work-life balance. This is driving operators to invest in premium amenities, wellness programs, and curated events. The competitive dynamics are intensifying, with established players expanding rapidly and new entrants focusing on specific niches or underserved geographies. The Information Technology (IT and ITES) sector remains a dominant user base, followed by Legal Services, BFSI, and Consulting firms, all of whom benefit from the agility and cost-efficiency offered by co-working. The penetration of co-working spaces continues to grow, particularly in Tier 1 and Tier 2 cities, as businesses recognize their strategic value beyond mere real estate.

The Compound Annual Growth Rate (CAGR) for the Indian co-working market is projected to remain strong, indicating sustained expansion and increasing market penetration as more companies embrace flexible working arrangements. This growth is further underpinned by government initiatives promoting entrepreneurship and the ease of doing business, which directly benefits the co-working sector by fostering a startup ecosystem. The evolving needs of the modern workforce, including a desire for ergonomic and well-designed spaces, are pushing operators to continuously innovate and differentiate their offerings. This includes integrating sustainable practices and offering bespoke managed office solutions tailored to specific corporate requirements.

Leading Markets & Segments in Co-working Office Industry in India

The Indian co-working office industry is dominated by a few key urban centers, with Delhi, Mumbai, and Bangalore leading the charge due to their established business ecosystems, high concentration of IT and ITES companies, and a large pool of talent. These cities consistently report higher occupancy rates and attract significant investment.

Dominant Segments:

- Type: Flexible Managed Offices are experiencing the most significant growth, offering businesses customizable space solutions with integrated management services. Serviced Offices also remain a popular choice, particularly for startups and SMEs seeking fully equipped and managed workspaces.

- By Application: Information Technology (IT and ITES) consistently forms the largest segment, driven by the sector's inherent need for agility, scalability, and access to skilled talent. Legal Services and BFSI sectors are also key adopters, seeking professional environments and cost-effective solutions. Consulting firms leverage co-working for project-based needs and client meetings.

- End User: Small Scale Companies and startups are major contributors, benefiting from the reduced capital expenditure and operational overheads. Large Scale Companies are increasingly utilizing co-working for satellite offices, overflow capacity, and flexible team spaces, recognizing the strategic advantages in managing distributed workforces. Personal users, including freelancers and remote workers, also represent a growing segment seeking professional and collaborative environments.

Key Drivers of Dominance:

- Economic Policies: Favorable government policies promoting startups and ease of doing business in these key cities have fueled demand.

- Infrastructure: Well-developed transportation networks, commercial real estate availability, and a high concentration of supporting services contribute to the dominance of these locations.

- Talent Pool: The availability of a skilled workforce, particularly in IT and allied sectors, attracts businesses to these hubs, consequently driving demand for co-working spaces.

- Investment Hubs: These cities are prime destinations for venture capital and private equity funding, creating a fertile ground for new businesses that rely on flexible workspace solutions.

Co-working Office Industry in India Product Developments

Product developments in the Indian co-working office industry are increasingly focused on creating intelligent, community-driven, and sustainable workspaces. Innovations include smart office technology for seamless booking, access control, and resource management. Many operators are now offering hybrid work solutions, combining physical office spaces with virtual support and digital collaboration tools. Competitive advantages are being built around enhanced amenities, including wellness zones, advanced cybersecurity, and personalized concierge services. The market is also seeing a rise in niche co-working concepts catering to specific industries or user groups, offering specialized facilities and networking opportunities.

Key Drivers of Co-working Office Industry in India Growth

The Indian co-working office industry's growth is propelled by several converging factors. The burgeoning startup ecosystem, supported by government initiatives and venture capital funding, creates a constant demand for flexible and scalable office solutions. The increasing adoption of hybrid and remote work models by corporations of all sizes, driven by a need for agility and cost optimization, is a significant accelerator. Technological advancements, such as smart building technology and enhanced digital connectivity, are making co-working spaces more attractive and efficient. Furthermore, the growing preference among millennials and Gen Z for collaborative work environments and a better work-life balance plays a crucial role in driving demand.

Challenges in the Co-working Office Industry in India Market

Despite robust growth, the co-working office industry in India faces certain challenges. Regulatory hurdles and inconsistencies in local bylaws can sometimes impede expansion and operational efficiency. Intense competition among a growing number of operators can lead to price wars and impact profitability, particularly in mature markets. Ensuring consistent quality of service and maintaining high occupancy rates across diverse locations can be operationally demanding. Supply chain issues, especially for fit-outs and technology integration, can also cause delays. Moreover, the ongoing evolution of work models requires continuous adaptation and investment to meet evolving end-user expectations.

Emerging Opportunities in Co-working Office Industry in India

Emerging opportunities in the Indian co-working office industry are vast and diverse. The expansion into Tier 2 and Tier 3 cities presents a significant untapped market potential, catering to the growing business activities in these regions. Strategic partnerships with real estate developers for revenue-sharing models or managed asset agreements offer a path for rapid expansion without substantial capital outlay. The increasing demand for niche co-working spaces, such as those catering specifically to healthcare professionals, creative industries, or tech startups, presents opportunities for specialized service providers. Technological breakthroughs in areas like AI-driven space optimization and personalized member experiences will further enhance value propositions.

Leading Players in the Co-working Office Industry in India Sector

- Awfis

- CBD,Mumbai Coworking

- Smartworks

- Cowrks

- Skootr

- We Work-BKC

- 91 springboard

- Goodworks

- Spring House Coworking

- Innov8

- Hive

- Indi Qube

- Stylework

- WeWork India

- [List Not Exhaustive - 63 Other Companies]

Key Milestones in Co-working Office Industry in India Industry

- April 2023: Stylework, a co-working marketplace, raised USD 2 Million at a USD 20 Million valued deal. Stylework's impressive growth and innovative approach caught the industry's attention, leading to a successful Series A1 funding of USD 2 Million at a USD 20 Million valued deal from institutional investors, including Capriglobal Holdings, QI Ventures, and some undisclosed family offices.

- February 2023: WeWork India, a co-working significant, started a new center in Pune with 1,500 desks and a 96,000-square-foot area amid rising demand for flexible office space from corporations. The new facility is located at Raheja Woods IT Tower, developed by K Raheja Corp. This is an asset-light deal, and the company has leased the entire building comprising five floors in this Kalyani Nagar property, with a desk space of 1,500. This is the company's third facility in Pune. WeWork India has a portfolio of over 6.5 Million sq. ft across 44 locations in Delhi-NCR, Mumbai, Bengaluru, Pune, and Hyderabad.

Strategic Outlook for Co-working Office Industry in India Market

The strategic outlook for the Indian co-working office market is exceptionally positive, poised for sustained growth and innovation. Future market potential lies in the continuous expansion into emerging cities and the deepening of service offerings to cater to increasingly sophisticated corporate needs. Growth accelerators will include the integration of advanced PropTech solutions for enhanced user experience and operational efficiency, alongside a strong focus on sustainability and ESG (Environmental, Social, and Governance) principles. Strategic opportunities also lie in forming deeper partnerships with large enterprises for bespoke co-creation of flexible workspace solutions, and in leveraging data analytics to optimize space utilization and member engagement. The sector is expected to witness further consolidation and the emergence of specialized players, creating a mature and diverse market landscape.

Co-working Office Industry in India Segmentation

-

1. Type

- 1.1. Flexible Managed Office

- 1.2. Serviced Office

-

2. ByApplication

- 2.1. Information Technology (IT and ITES)

- 2.2. Legal Services

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting

- 2.5. Other Services

-

3. End User

- 3.1. Personal User

- 3.2. Small Scale Company

- 3.3. Large Scale Company

- 3.4. Other End Users

-

4. Key Cities

- 4.1. Delhi

- 4.2. Mumbai

- 4.3. Bangalore

- 4.4. Other Cities

Co-working Office Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

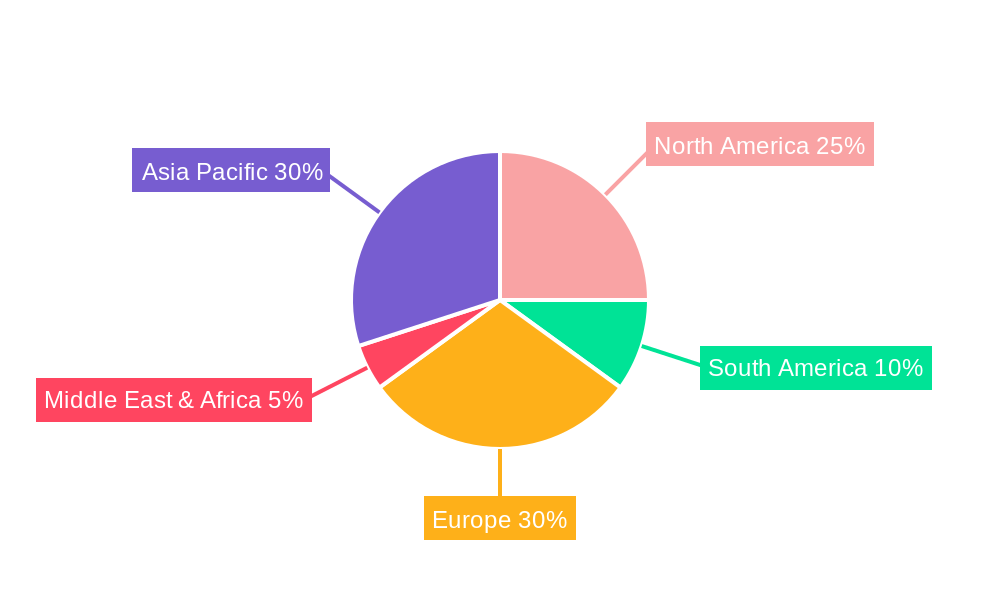

Co-working Office Industry in India Regional Market Share

Geographic Coverage of Co-working Office Industry in India

Co-working Office Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Number of Startups4.; The Development of Sustainable Co-working Spaces

- 3.3. Market Restrains

- 3.3.1 4.; A Rise in Remote Work4.; Traditional Work Culture in India

- 3.3.2 Which May Not Align Well With the Open and Collaborative Environment of Co-working Spaces

- 3.4. Market Trends

- 3.4.1. Cost Optimization is Driving the Significant Growth in the Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible Managed Office

- 5.1.2. Serviced Office

- 5.2. Market Analysis, Insights and Forecast - by ByApplication

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Legal Services

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting

- 5.2.5. Other Services

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Personal User

- 5.3.2. Small Scale Company

- 5.3.3. Large Scale Company

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Key Cities

- 5.4.1. Delhi

- 5.4.2. Mumbai

- 5.4.3. Bangalore

- 5.4.4. Other Cities

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flexible Managed Office

- 6.1.2. Serviced Office

- 6.2. Market Analysis, Insights and Forecast - by ByApplication

- 6.2.1. Information Technology (IT and ITES)

- 6.2.2. Legal Services

- 6.2.3. BFSI (Banking, Financial Services, and Insurance)

- 6.2.4. Consulting

- 6.2.5. Other Services

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Personal User

- 6.3.2. Small Scale Company

- 6.3.3. Large Scale Company

- 6.3.4. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Key Cities

- 6.4.1. Delhi

- 6.4.2. Mumbai

- 6.4.3. Bangalore

- 6.4.4. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flexible Managed Office

- 7.1.2. Serviced Office

- 7.2. Market Analysis, Insights and Forecast - by ByApplication

- 7.2.1. Information Technology (IT and ITES)

- 7.2.2. Legal Services

- 7.2.3. BFSI (Banking, Financial Services, and Insurance)

- 7.2.4. Consulting

- 7.2.5. Other Services

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Personal User

- 7.3.2. Small Scale Company

- 7.3.3. Large Scale Company

- 7.3.4. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Key Cities

- 7.4.1. Delhi

- 7.4.2. Mumbai

- 7.4.3. Bangalore

- 7.4.4. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flexible Managed Office

- 8.1.2. Serviced Office

- 8.2. Market Analysis, Insights and Forecast - by ByApplication

- 8.2.1. Information Technology (IT and ITES)

- 8.2.2. Legal Services

- 8.2.3. BFSI (Banking, Financial Services, and Insurance)

- 8.2.4. Consulting

- 8.2.5. Other Services

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Personal User

- 8.3.2. Small Scale Company

- 8.3.3. Large Scale Company

- 8.3.4. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Key Cities

- 8.4.1. Delhi

- 8.4.2. Mumbai

- 8.4.3. Bangalore

- 8.4.4. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flexible Managed Office

- 9.1.2. Serviced Office

- 9.2. Market Analysis, Insights and Forecast - by ByApplication

- 9.2.1. Information Technology (IT and ITES)

- 9.2.2. Legal Services

- 9.2.3. BFSI (Banking, Financial Services, and Insurance)

- 9.2.4. Consulting

- 9.2.5. Other Services

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Personal User

- 9.3.2. Small Scale Company

- 9.3.3. Large Scale Company

- 9.3.4. Other End Users

- 9.4. Market Analysis, Insights and Forecast - by Key Cities

- 9.4.1. Delhi

- 9.4.2. Mumbai

- 9.4.3. Bangalore

- 9.4.4. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Flexible Managed Office

- 10.1.2. Serviced Office

- 10.2. Market Analysis, Insights and Forecast - by ByApplication

- 10.2.1. Information Technology (IT and ITES)

- 10.2.2. Legal Services

- 10.2.3. BFSI (Banking, Financial Services, and Insurance)

- 10.2.4. Consulting

- 10.2.5. Other Services

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Personal User

- 10.3.2. Small Scale Company

- 10.3.3. Large Scale Company

- 10.3.4. Other End Users

- 10.4. Market Analysis, Insights and Forecast - by Key Cities

- 10.4.1. Delhi

- 10.4.2. Mumbai

- 10.4.3. Bangalore

- 10.4.4. Other Cities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Awfis CBD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mumbai Coworking

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smartworks

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cowrks

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skootr

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 We Work-BKC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 91 springboard

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goodworks

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Spring House Coworking

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Innov8-Vikhroli

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hive**List Not Exhaustive 6 3 Other Companie

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Indi Qube

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Awfis CBD

List of Figures

- Figure 1: Global Co-working Office Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 5: North America Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 6: North America Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 9: North America Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 10: North America Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 13: South America Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 15: South America Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 16: South America Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 17: South America Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 18: South America Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 19: South America Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 20: South America Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 23: Europe Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 25: Europe Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 26: Europe Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 27: Europe Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 28: Europe Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 29: Europe Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 30: Europe Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East & Africa Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 35: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 36: Middle East & Africa Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East & Africa Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 39: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 40: Middle East & Africa Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 43: Asia Pacific Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 44: Asia Pacific Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 45: Asia Pacific Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 46: Asia Pacific Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 47: Asia Pacific Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 48: Asia Pacific Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 49: Asia Pacific Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 50: Asia Pacific Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 3: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 5: Global Co-working Office Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 8: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 10: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 16: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 17: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 18: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 24: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 26: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 38: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 40: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 49: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 50: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 51: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Co-working Office Industry in India?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Co-working Office Industry in India?

Key companies in the market include Awfis CBD, Mumbai Coworking, Smartworks, Cowrks, Skootr, We Work-BKC, 91 springboard, Goodworks, Spring House Coworking, Innov8-Vikhroli, Hive**List Not Exhaustive 6 3 Other Companie, Indi Qube.

3. What are the main segments of the Co-working Office Industry in India?

The market segments include Type, ByApplication, End User, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.94 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Number of Startups4.; The Development of Sustainable Co-working Spaces.

6. What are the notable trends driving market growth?

Cost Optimization is Driving the Significant Growth in the Sector.

7. Are there any restraints impacting market growth?

4.; A Rise in Remote Work4.; Traditional Work Culture in India. Which May Not Align Well With the Open and Collaborative Environment of Co-working Spaces.

8. Can you provide examples of recent developments in the market?

April 2023: Stylework, a co-working marketplace, raised USD 2 million at a USD 20 million valued deal. Stylework's impressive growth and innovative approach caught the industry's attention, leading to a successful Series A1 funding of USD 2 million at a USD 20 million valued deal from institutional investors, including Capriglobal Holdings, QI Ventures, and some undisclosed family offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Co-working Office Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Co-working Office Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Co-working Office Industry in India?

To stay informed about further developments, trends, and reports in the Co-working Office Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence