Key Insights

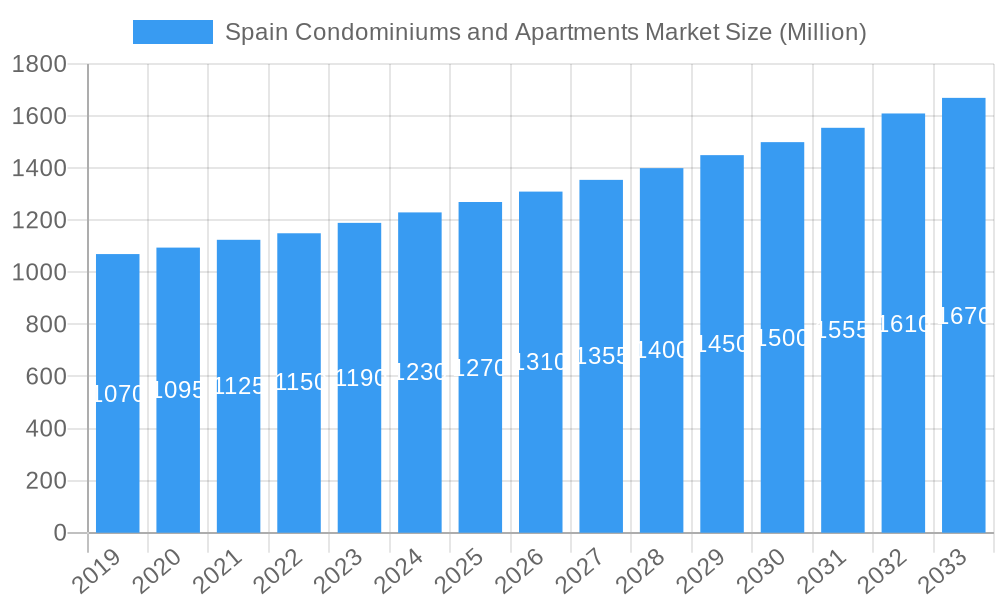

The Spanish condominiums and apartments market is poised for steady expansion, projecting a market size of USD 1.23 billion in 2024 and a Compound Annual Growth Rate (CAGR) of 3.3% from 2019 to 2033. This sustained growth is underpinned by several key drivers, including increasing urbanization, a rising demand for modern living spaces, and favorable demographic shifts. The market is experiencing a robust trend towards smaller, more efficient apartment units designed for young professionals and a growing segment of the population seeking convenient urban lifestyles. Furthermore, government initiatives aimed at promoting affordable housing and urban regeneration are providing a significant boost to the sector. Investment in infrastructure development across major cities like Madrid and Barcelona is also contributing to the attractiveness of these urban centers for apartment living.

Spain Condominiums and Apartments Market Market Size (In Billion)

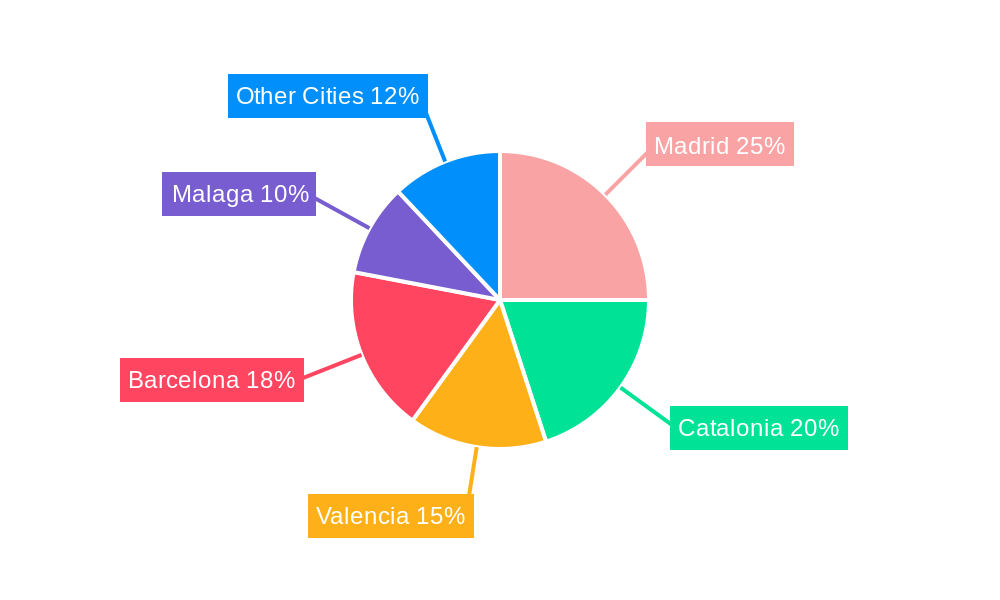

Despite the positive outlook, certain restraints need to be acknowledged. These include fluctuating construction costs, potential regulatory hurdles in certain regions, and the ongoing challenge of affordability for a segment of the population. However, the market is adapting through innovative construction methods and a focus on community-centric developments. Key segments within the market include major cities such as Madrid, Catalonia, Valencia, Barcelona, and Malaga, each presenting unique growth opportunities driven by local economic conditions and housing demand. The competitive landscape is characterized by a mix of established players and emerging developers, all striving to capture market share through product differentiation, strategic partnerships, and a commitment to quality and sustainability.

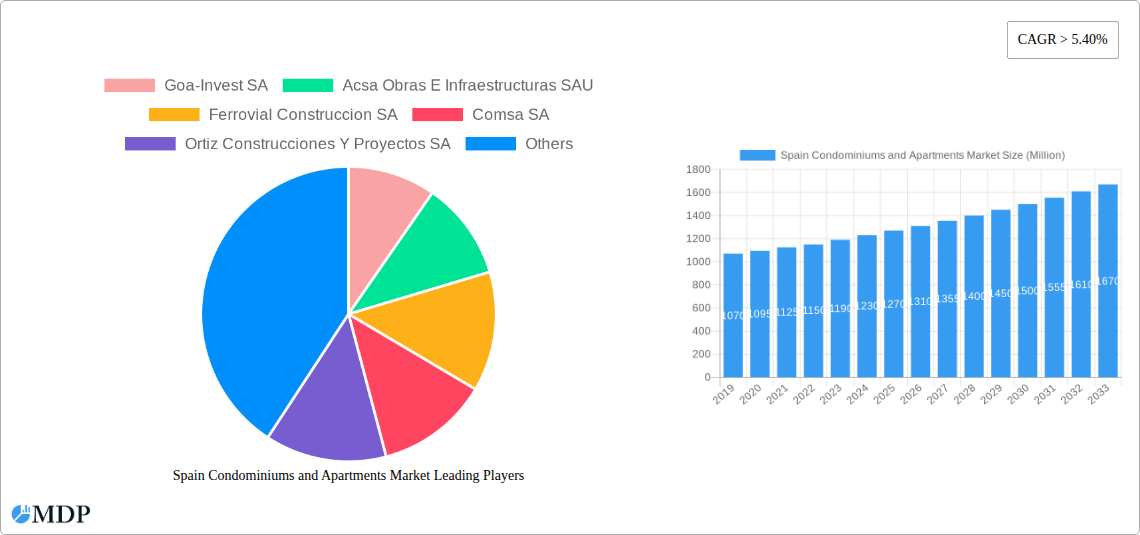

Spain Condominiums and Apartments Market Company Market Share

Spain Condominiums and Apartments Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Spain condominiums and apartments market, offering critical insights for investors, developers, and industry stakeholders. Covering the study period of 2019–2033, with a base year of 2025, this report delves into market dynamics, key trends, leading segments, and future projections. Discover the strategic imperative of investing in Spanish real estate, the burgeoning Spanish property market, and the lucrative opportunities within the Spain residential property sector. This comprehensive research equips you with actionable intelligence on Spain apartment sales, Spain condo investments, and the overall Spain real estate development market.

Spain Condominiums and Apartments Market Market Dynamics & Concentration

The Spain condominiums and apartments market is characterized by a moderate to high concentration, with several large construction firms and real estate developers holding significant market share. Innovation drivers are primarily centered around sustainable building practices, smart home technology integration, and the increasing demand for energy-efficient residential units. Regulatory frameworks, while evolving, continue to influence development through planning permissions, building codes, and foreign investment policies. Product substitutes include single-family homes, rental properties, and co-living spaces, each catering to different consumer needs and preferences. End-user trends are shifting towards smaller, more conveniently located apartments, particularly in urban centers, and a growing interest in build-to-rent (BTR) models. Mergers and acquisitions (M&A) activities are notable, as larger players seek to consolidate their market position and expand their portfolios. Recent M&A deals in the broader Spanish real estate sector, valued in the hundreds of millions of euros, indicate a healthy appetite for strategic consolidation. Market share is fragmented among top players, with the top 5 companies estimated to hold around 35-45% of the market. M&A deal counts have seen a steady increase, particularly in the last three years, reflecting a dynamic and consolidating market.

Spain Condominiums and Apartments Market Industry Trends & Analysis

The Spain condominiums and apartments market is poised for substantial growth, driven by a confluence of economic recovery, favorable demographics, and evolving lifestyle preferences. The Spanish property market is experiencing a resurgence, attracting both domestic and international buyers. The projected Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033 is an estimated 5.2%, signaling a robust expansion. This growth is fueled by a strong demand for modern, well-located residential units, particularly in key cities like Madrid and Barcelona. Technological disruptions are increasingly shaping the industry, with the integration of smart home features, sustainable construction materials, and digital platforms for property discovery and transactions becoming standard. Consumer preferences are leaning towards smaller, more efficient living spaces, often with access to shared amenities and green spaces. The rise of the build-to-rent (BTR) sector is a significant trend, addressing the growing demand for flexible and professionally managed rental accommodation. Competitive dynamics are intensifying, with both established developers and new market entrants vying for market share. Market penetration of modern condominium and apartment developments is steadily increasing, especially in urban regeneration areas and sought-after coastal regions. The overall market size is projected to reach approximately EUR 75 billion by 2033, a significant increase from its EUR 48 billion valuation in 2019.

Leading Markets & Segments in Spain Condominiums and Apartments Market

The Spain condominiums and apartments market is significantly influenced by its major urban centers and economically vibrant regions. Barcelona consistently emerges as a dominant market, driven by its status as a global tourist destination, a thriving technology hub, and a high demand for urban living. Its economic policies, heavily focused on innovation and tourism infrastructure, coupled with a robust transportation network, make it highly attractive for residential development.

- Barcelona: Characterized by high property values and a strong demand for luxury and modern apartments. Its robust tourism sector fuels the short-term rental market, indirectly impacting the long-term residential supply and demand dynamics. Infrastructure development, including public transport and city modernization projects, further enhances its appeal.

- Madrid: As the capital city, Madrid exhibits consistent demand for condominiums and apartments, driven by its position as a major business, financial, and administrative center. Its well-developed infrastructure, extensive employment opportunities, and vibrant cultural scene attract a diverse range of residents. Government initiatives aimed at urban regeneration and housing affordability also play a crucial role.

- Catalonia: Beyond Barcelona, the broader Catalonia region benefits from its economic diversity and strong industrial base. Coastal towns and cities in Catalonia are experiencing increased interest for second homes and holiday apartments, contributing to market growth. The region's focus on sustainable development and quality of life appeals to a growing segment of buyers.

- Valencia: With its appealing Mediterranean climate, growing tech sector, and relatively more affordable property prices compared to Madrid and Barcelona, Valencia is witnessing significant market expansion. Infrastructure improvements and a focus on attracting foreign investment are key drivers. The demand for apartments in Valencia is increasingly robust, particularly in its coastal areas and revitalized urban districts.

- Malaga: Benefiting from its strong tourism appeal and the presence of international companies, Malaga's property market, especially for condominiums and apartments, has seen considerable growth. The Costa del Sol continues to be a prime location for both holiday homes and permanent residences, supported by excellent infrastructure and a high quality of life.

- Other Cities: A multitude of smaller cities and developing regions across Spain are also contributing to the overall market growth. These areas often present more affordable investment opportunities and cater to a different segment of the market, including those seeking a quieter lifestyle or capitalizing on localized economic development.

The dominance of these leading markets is underpinned by strong economic fundamentals, consistent infrastructure investment, and their ability to attract both domestic and international demand for residential properties.

Spain Condominiums and Apartments Market Product Developments

Recent product developments in the Spain condominiums and apartments market focus on enhancing resident experience and sustainability. Innovations include the integration of smart home technology for energy management and security, the incorporation of biophilic design principles with more green spaces and natural light, and the use of eco-friendly building materials. Many new developments are offering modular or flexible living spaces to cater to diverse household needs. These advancements provide a competitive advantage by appealing to a growing segment of environmentally conscious and tech-savvy buyers, ensuring market fit in an increasingly discerning property landscape.

Key Drivers of Spain Condominiums and Apartments Market Growth

Several key drivers are propelling the growth of the Spain condominiums and apartments market. Economic stability and recovery are fostering increased consumer confidence and purchasing power, encouraging real estate investments. Favorable demographic trends, including a growing young professional population and an aging demographic seeking low-maintenance living, are creating sustained demand. Government initiatives promoting urban regeneration, affordable housing, and foreign investment further stimulate the market. Additionally, the burgeoning tourism sector continues to drive demand for vacation homes and short-term rental properties, indirectly boosting the condominium and apartment market. The increasing adoption of sustainable building practices and smart home technologies is also a significant growth accelerator, attracting a modern consumer base.

Challenges in the Spain Condominiums and Apartments Market Market

Despite the positive outlook, the Spain condominiums and apartments market faces several challenges. Rising construction costs due to material shortages and inflation can impact project viability and final property prices. Regulatory hurdles and lengthy planning permission processes can cause delays and increase development expenses. Limited availability of prime land in sought-after urban areas further constrains supply and drives up acquisition costs. Affordability concerns for first-time buyers, particularly in major cities, remain a persistent issue. Furthermore, economic uncertainties and potential interest rate hikes could temper buyer demand. The competitive pressure from other investment opportunities, such as the stock market, also needs to be considered, potentially diverting capital away from real estate.

Emerging Opportunities in Spain Condominiums and Apartments Market

Emerging opportunities within the Spain condominiums and apartments market lie in several strategic areas. The significant demand for build-to-rent (BTR) properties presents a substantial opportunity for developers and investors seeking stable, long-term rental income. The increasing focus on sustainable and energy-efficient developments aligns with growing environmental consciousness and offers a competitive edge. Urban regeneration projects in developing city districts present opportunities for revitalizing communities and creating modern living spaces. The digitalization of the real estate sector, including proptech solutions for sales, management, and smart living, offers avenues for innovation and operational efficiency. Furthermore, strategic partnerships between local developers and international investors can unlock new capital and expertise for large-scale projects.

Leading Players in the Spain Condominiums and Apartments Market Sector

- Goa-Invest SA

- Acsa Obras E Infraestructuras SAU

- Ferrovial Construccion SA

- Comsa SA

- Ortiz Construcciones Y Proyectos SA

- Construcciones Amenabar SA

- Avintia Proyectos Y Construcciones SL

- Altamira Santander Real Estate SA

- Arpada SA

- Constructora San Jose SA

- Norton Edificios Industriales SA

- Construcciones ACR SA

- Construcciones Rubau Sociedad Anonima

- Dragados Sociedad Anonima

Key Milestones in Spain Condominiums and Apartments Market Industry

- Oct 2022: A significant build-to-rent (BTR) cooperation was established between Layetana Living and Aviva Investors in Spain. This collaboration aims to construct a residential portfolio valued at over EUR 500 million (USD 531.20 million), securing its first development project: a 71-unit residential building in Barcelona's Sants neighborhood, with construction slated to commence at the end of 2023. This marked a substantial investment in the BTR segment, highlighting its growing importance.

- Sept 2022: Berkshire Hathaway HomeServices, a prominent global residential real estate brokerage franchise network, expanded its operations within the Valencian Community by opening a new office in Denia, directed by Maryana Kim. This represented their fourth facility opened in Spain in 2022, indicating strong growth and confidence in the Spanish residential market, particularly in key tourist and residential hubs like the Costa Blanca.

Strategic Outlook for Spain Condominiums and Apartments Market Market

The strategic outlook for the Spain condominiums and apartments market is highly positive, driven by sustained demand and a proactive approach to innovation. The market is expected to continue its upward trajectory, fueled by ongoing urbanization, the persistent appeal of Spanish lifestyle, and a growing international investor base. Key growth accelerators include further investment in sustainable and smart technologies, an expansion of the build-to-rent sector to address rental market demand, and the strategic development of underutilized urban areas. Embracing proptech solutions and fostering public-private partnerships will be crucial for navigating future challenges and capitalizing on emerging opportunities, ensuring long-term market resilience and profitability.

Spain Condominiums and Apartments Market Segmentation

-

1. City

- 1.1. Madrid

- 1.2. Catalonia

- 1.3. Valencia

- 1.4. Barcelona

- 1.5. Malaga

- 1.6. Other Cities

Spain Condominiums and Apartments Market Segmentation By Geography

- 1. Spain

Spain Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Spain Condominiums and Apartments Market

Spain Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand with signs of increased residential project developments and buyers in the market; The growing population in Bahrain is driving the luxury residential real estate sector

- 3.3. Market Restrains

- 3.3.1. The Bahrain real estate sector has been growing at a slower pace in recent years; The increased cost of credit due to higher interest rates is starting to dent demand for luxury real estate in Bahrain

- 3.4. Market Trends

- 3.4.1. Rise in International Buyers in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by City

- 5.1.1. Madrid

- 5.1.2. Catalonia

- 5.1.3. Valencia

- 5.1.4. Barcelona

- 5.1.5. Malaga

- 5.1.6. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by City

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Goa-Invest SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Acsa Obras E Infraestructuras SAU

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ferrovial Construccion SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Comsa SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ortiz Construcciones Y Proyectos SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Construcciones Amenabar SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avintia Proyectos Y Construcciones SL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Altamira Santander Real Estate SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arpada SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Constructora San Jose SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Norton Edificios Industriales SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Construcciones ACR SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Construcciones Rubau Sociedad Anonima**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Dragados Sociedad Anonima

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Goa-Invest SA

List of Figures

- Figure 1: Spain Condominiums and Apartments Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Condominiums and Apartments Market Revenue undefined Forecast, by City 2020 & 2033

- Table 2: Spain Condominiums and Apartments Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Spain Condominiums and Apartments Market Revenue undefined Forecast, by City 2020 & 2033

- Table 4: Spain Condominiums and Apartments Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Spain Condominiums and Apartments Market?

Key companies in the market include Goa-Invest SA, Acsa Obras E Infraestructuras SAU, Ferrovial Construccion SA, Comsa SA, Ortiz Construcciones Y Proyectos SA, Construcciones Amenabar SA, Avintia Proyectos Y Construcciones SL, Altamira Santander Real Estate SA, Arpada SA, Constructora San Jose SA, Norton Edificios Industriales SA, Construcciones ACR SA, Construcciones Rubau Sociedad Anonima**List Not Exhaustive, Dragados Sociedad Anonima.

3. What are the main segments of the Spain Condominiums and Apartments Market?

The market segments include City.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High demand with signs of increased residential project developments and buyers in the market; The growing population in Bahrain is driving the luxury residential real estate sector.

6. What are the notable trends driving market growth?

Rise in International Buyers in Spain.

7. Are there any restraints impacting market growth?

The Bahrain real estate sector has been growing at a slower pace in recent years; The increased cost of credit due to higher interest rates is starting to dent demand for luxury real estate in Bahrain.

8. Can you provide examples of recent developments in the market?

Oct 2022: A build-to-rent (BTR) cooperation between Layetana Living and Aviva Investors was established in Spain. According to the statement, the collaboration between Aviva and the Spanish developer Layetana will construct a more than EUR 500 million (USD 531.20 million) residential portfolio, already securing its first development project. Based on the recommendation of international real estate consultancy Knight Frank, the partnership purchased a 71-unit residential building in Barcelona's Sants neighborhood. Construction is scheduled to begin at the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Spain Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence