Key Insights

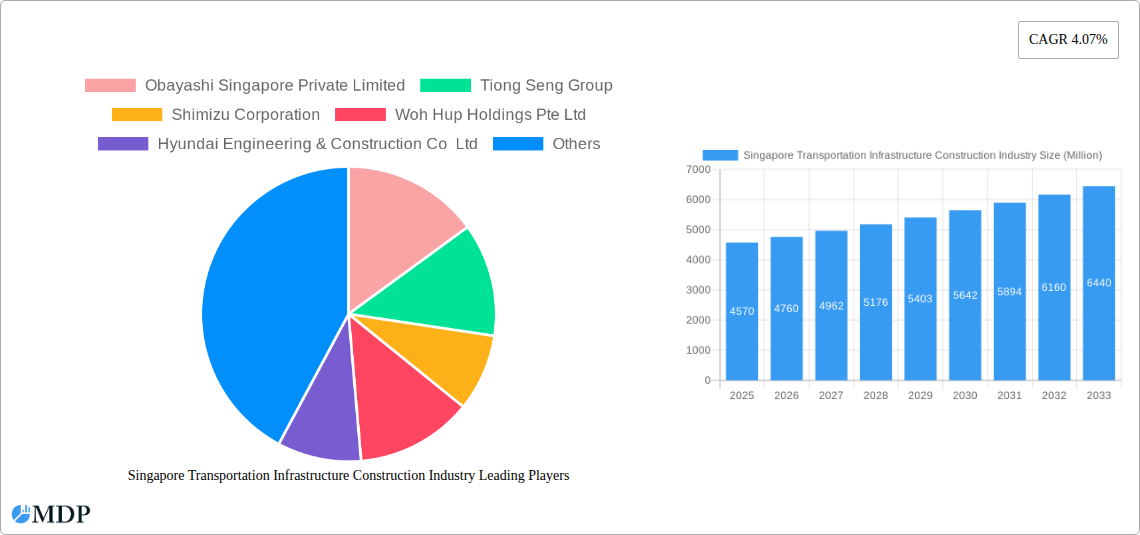

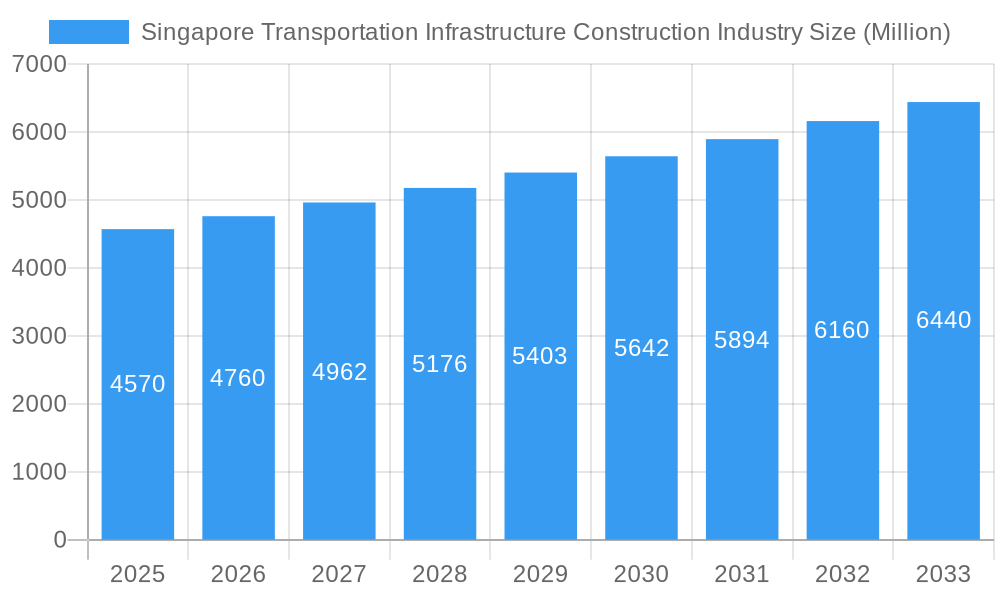

The Singapore Transportation Infrastructure Construction industry, valued at $4.57 billion in 2025, is projected to experience robust growth, driven by the nation's ongoing urbanization, commitment to sustainable development, and strategic investments in enhancing connectivity. The 4.07% CAGR (Compound Annual Growth Rate) from 2025 to 2033 indicates a steady expansion, primarily fueled by government initiatives focused on expanding and modernizing its road, rail, air, and port infrastructure. This includes projects aimed at improving public transportation networks, developing smart city technologies, and increasing the resilience of infrastructure against climate change impacts. Key segments, such as roadways and railways, are expected to witness significant growth, driven by increasing population density and the need for efficient mass transit systems. Competitive pressures are evident among major players like Obayashi Singapore Private Limited, Tiong Seng Group, and Shimizu Corporation, leading to innovative construction methods and a focus on cost-effectiveness. While potential restraints could include material cost fluctuations and labor shortages, the strong government support and consistent investment in infrastructure development suggest a positive outlook for the industry in the forecast period.

Singapore Transportation Infrastructure Construction Industry Market Size (In Billion)

The substantial growth trajectory is further supported by Singapore's strategic location as a major hub for trade and commerce in Southeast Asia. This necessitates continuous upgrades to its transportation infrastructure to maintain its competitive edge and handle increasing cargo volumes. The industry's segmentation across different modes of transport (roadways, railways, airways, ports, and inland waterways) presents opportunities for specialized contractors and further fuels sector diversification. While specific data on segment-wise breakdown isn't provided, we can anticipate that roadways and railways will be dominant segments given Singapore’s focus on efficient urban mobility and its robust logistics sector. The forecast period of 2025-2033 paints a picture of sustained expansion, driven by both organic growth and government-led projects.

Singapore Transportation Infrastructure Construction Industry Company Market Share

Singapore Transportation Infrastructure Construction Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Singapore transportation infrastructure construction industry, offering crucial insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market dynamics, key players, and future trends shaping this vital sector. It leverages high-impact keywords like "Singapore infrastructure," "transportation construction," "market analysis," and "RTS Link" to maximize search engine visibility. The report uses USD Million for all financial values.

Singapore Transportation Infrastructure Construction Industry Market Dynamics & Concentration

The Singapore transportation infrastructure construction market exhibits a high degree of concentration, with a few large players dominating the landscape. Major players such as Obayashi Singapore Private Limited, Tiong Seng Group, Shimizu Corporation, Woh Hup Holdings Pte Ltd, Hyundai Engineering & Construction Co Ltd, Koh Brothers Building & Civil Engineering Contractor Pte Ltd, and CSC Holdings Limited account for a significant market share, estimated at xx%. However, several other companies, including Daelim Industrial Co Ltd, Lum Chang Holdings Limited, and Jurong Engineering Limited, contribute to the overall market activity.

- Market Concentration: High, with top players holding xx% market share (2025).

- Innovation Drivers: Government initiatives promoting technological advancements and sustainable construction practices.

- Regulatory Framework: Stringent regulations ensuring quality, safety, and environmental compliance. This framework influences the cost and complexity of projects.

- Product Substitutes: Limited direct substitutes; focus is on efficiency and innovation within existing materials and methods.

- End-User Trends: Growing demand for integrated transportation systems and sustainable infrastructure solutions.

- M&A Activities: A moderate level of merger and acquisition activity, with xx deals recorded between 2019 and 2024. Consolidation is expected to continue to increase efficiency and scale.

Singapore Transportation Infrastructure Construction Industry Industry Trends & Analysis

The Singapore transportation infrastructure construction industry is experiencing robust growth driven by several factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, fueled by increasing urbanization, rising population, and the government's commitment to enhancing connectivity. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and advanced construction technologies, are boosting productivity and efficiency. Consumer preferences are shifting towards sustainable and environmentally friendly infrastructure projects, prompting increased investment in green building materials and technologies. Intense competition among leading players encourages innovation and cost optimization, further benefiting consumers and the overall economy. Market penetration of new technologies like prefabricated modular construction is projected to reach xx% by 2033.

Leading Markets & Segments in Singapore Transportation Infrastructure Construction Industry

Within the Singapore transportation infrastructure sector, the Railways segment holds a dominant position. This dominance is driven by several key factors:

- Government Policies: Significant investments in expanding and upgrading the MRT network, as evidenced by projects like the Cross Island Line.

- Infrastructure Needs: A rapidly growing population necessitates efficient and reliable mass transit systems.

- Economic Growth: Strong economic growth fuels demand for efficient transport links to support businesses and commuters.

The Roadways sector also contributes significantly but shows a comparatively slower growth rate compared to the Railways segment. Airways and Ports & Inland Waterways, while important components of the transportation infrastructure, contribute a smaller percentage to the overall market value.

Singapore Transportation Infrastructure Construction Industry Product Developments

The industry showcases significant product innovations focused on enhancing efficiency, sustainability, and safety. This includes the increased adoption of Building Information Modeling (BIM) for improved project management and reduced construction errors; the use of prefabricated modular construction to accelerate project completion; and the integration of smart technologies, like sensors and IoT devices for real-time monitoring and maintenance optimization. The market is trending toward sustainable building materials and eco-friendly construction processes, aligning with global sustainability goals.

Key Drivers of Singapore Transportation Infrastructure Construction Industry Growth

Growth is propelled by several factors:

- Government Investment: Large-scale infrastructure projects funded by the government.

- Technological Advancements: Adoption of innovative construction techniques and materials.

- Economic Growth: Continued economic expansion fuels demand for improved infrastructure.

- Population Growth: Increased population necessitates enhanced transportation capacity.

Challenges in the Singapore Transportation Infrastructure Construction Industry Market

The industry faces challenges, including:

- Land Scarcity: Limited land availability increases project costs and complexity.

- Labor Shortages: Competition for skilled labor can impact project timelines and budgets.

- Regulatory Compliance: Stringent regulations necessitate careful planning and adherence, adding to project costs. This results in approximately xx Million USD in additional project expenses annually.

Emerging Opportunities in Singapore Transportation Infrastructure Construction Industry

Emerging opportunities include:

- Smart Transportation Systems: Integration of smart technologies for improved traffic management and efficiency.

- Sustainable Infrastructure: Demand for green building materials and environmentally conscious construction.

- Public-Private Partnerships (PPPs): Collaborative ventures between public and private sectors to accelerate project development.

Leading Players in the Singapore Transportation Infrastructure Construction Industry Sector

- Obayashi Singapore Private Limited

- Tiong Seng Group

- Shimizu Corporation

- Woh Hup Holdings Pte Ltd

- Hyundai Engineering & Construction Co Ltd

- Koh Brothers Building & Civil Engineering Contractor Pte Ltd

- CSC Holdings Limited

- Daelim Industrial Co Ltd

- Lum Chang Holdings Limited

- Jurong Engineering Limited

Key Milestones in Singapore Transportation Infrastructure Construction Industry Industry

- April 2023: Siemens Mobility wins USD 333.65 Million contract for Cross Island Line signaling system and platform screen doors, signifying a move towards higher automation in Singapore's rail network.

- July 2023: RTS Link between Johor Bahru and Singapore reaches 41% completion, highlighting progress in cross-border connectivity and expected operationalization by 2026. This project is predicted to boost economic activity by xx Million USD annually.

Strategic Outlook for Singapore Transportation Infrastructure Construction Industry Market

The Singapore transportation infrastructure construction industry is poised for continued growth, driven by sustained government investment, technological advancements, and a commitment to building a smart and sustainable nation. Strategic opportunities lie in leveraging technology to enhance efficiency, embracing sustainable practices, and participating in public-private partnerships to deliver high-quality infrastructure projects that meet the needs of a growing and dynamic population. The market is expected to reach xx Million USD by 2033.

Singapore Transportation Infrastructure Construction Industry Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airways

- 1.4. Ports and Inland Waterways

Singapore Transportation Infrastructure Construction Industry Segmentation By Geography

- 1. Singapore

Singapore Transportation Infrastructure Construction Industry Regional Market Share

Geographic Coverage of Singapore Transportation Infrastructure Construction Industry

Singapore Transportation Infrastructure Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase In Tourism Industry4.; Sustainability and Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Financial Constraints4.; High Maintenance and Keep Up

- 3.4. Market Trends

- 3.4.1. Metro Expansion in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Obayashi Singapore Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tiong Seng Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shimizu Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Woh Hup Holdings Pte Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Engineering & Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koh Brothers Building & Civil Engineering Contractor Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CSC Holdings Limited**List Not Exhaustive 6 3 Other Companies (Overview/Key Information

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daelim Industrial Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lum Chang Holdings Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jurong Engineering Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Obayashi Singapore Private Limited

List of Figures

- Figure 1: Singapore Transportation Infrastructure Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Transportation Infrastructure Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Transportation Infrastructure Construction Industry?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Singapore Transportation Infrastructure Construction Industry?

Key companies in the market include Obayashi Singapore Private Limited, Tiong Seng Group, Shimizu Corporation, Woh Hup Holdings Pte Ltd, Hyundai Engineering & Construction Co Ltd, Koh Brothers Building & Civil Engineering Contractor Pte Ltd, CSC Holdings Limited**List Not Exhaustive 6 3 Other Companies (Overview/Key Information, Daelim Industrial Co Ltd, Lum Chang Holdings Limited, Jurong Engineering Limited.

3. What are the main segments of the Singapore Transportation Infrastructure Construction Industry?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.57 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase In Tourism Industry4.; Sustainability and Environmental Concerns.

6. What are the notable trends driving market growth?

Metro Expansion in the Country.

7. Are there any restraints impacting market growth?

4.; Financial Constraints4.; High Maintenance and Keep Up.

8. Can you provide examples of recent developments in the market?

April 2023: Siemens Mobility has been awarded a contract by the Singapore Land Transport Authority (LTA) to provide a signaling system (CBTC) and full-height platform screen doors (PSD) for the Cross Island Line (CRL). The order is worth approximately USD 333.65 million. The signaling system will feature Siemens Mobility’s Trainguard CBTC solution, modern interlocking Westrace MKII, and Automatic Train Supervision (ATS) Rail9k to support the maximum grade of automation, GoA 4, and allow fully unattended train operation along around 50 kilometers of track and 21 stations of CRL1, CRL2 and Punggol Extension.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Transportation Infrastructure Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Transportation Infrastructure Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Transportation Infrastructure Construction Industry?

To stay informed about further developments, trends, and reports in the Singapore Transportation Infrastructure Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence