Key Insights

The construction market in the UAE is poised for robust expansion, projected to reach a significant valuation and experience sustained growth. This upward trajectory is driven by a confluence of factors, including ambitious government initiatives focused on economic diversification and infrastructure development, coupled with a burgeoning population fueling demand for residential and commercial spaces. The ongoing commitment to large-scale projects, particularly in the tourism, entertainment, and real estate sectors, are primary catalysts. Furthermore, the UAE's strategic position as a global hub for business and trade continues to attract substantial foreign investment, directly stimulating construction activities. The market is characterized by a dynamic evolution, with increasing emphasis on sustainable building practices, smart city technologies, and advanced construction methodologies to enhance efficiency and environmental performance.

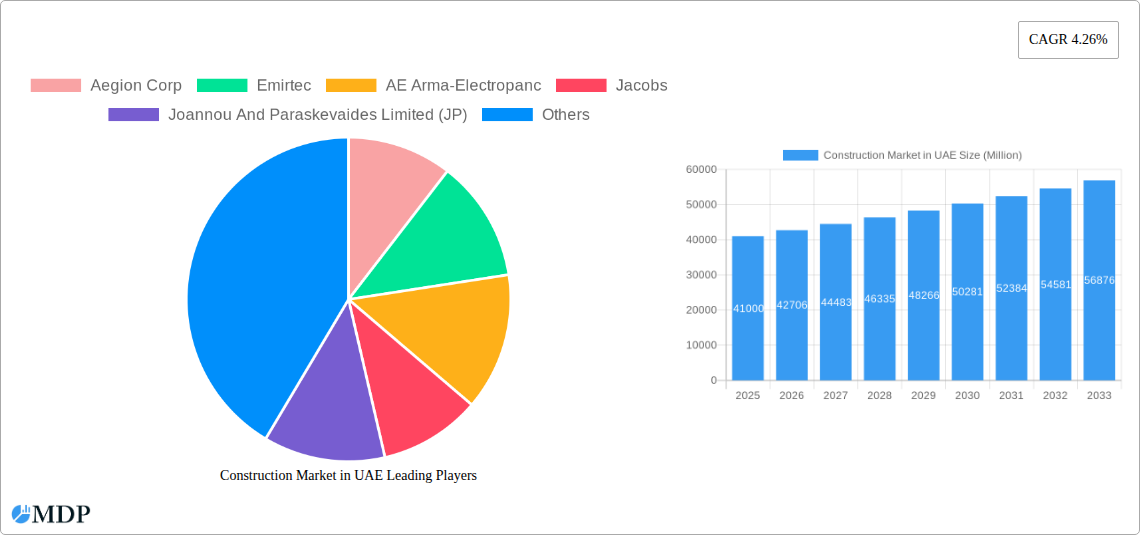

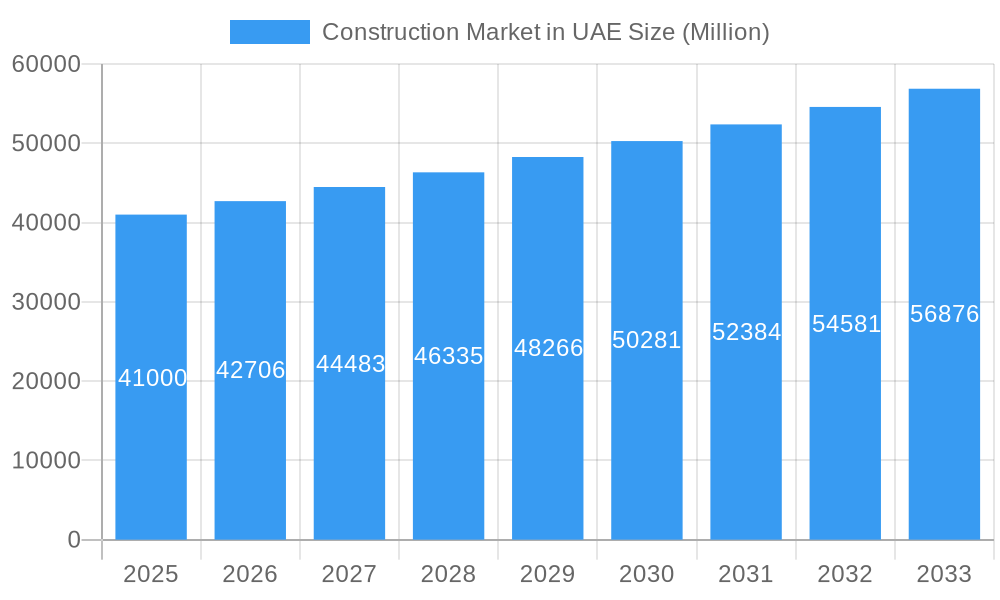

Construction Market in UAE Market Size (In Billion)

The market's growth will be shaped by distinct segment dynamics. The Commercial Construction sector is expected to witness considerable activity, driven by the development of new retail, hospitality, and office spaces. Residential Construction will remain a cornerstone, responding to housing demands from both local populations and expatriates. The Infrastructure (Transportation) Construction segment will see sustained investment in enhancing connectivity and logistical capabilities, including airport expansions, road networks, and public transportation systems. While Industrial Construction may experience fluctuations tied to specific economic sectors, the Energy and Utilities Construction segment will remain vital, supporting the nation's energy transition and infrastructure resilience. Emerging trends like modular construction and the integration of Building Information Modeling (BIM) are expected to further optimize project delivery and operational efficiency. However, potential challenges such as fluctuating material costs and evolving regulatory landscapes will need careful navigation by market participants.

Construction Market in UAE Company Market Share

Unveiling the Future of UAE Construction: A Comprehensive Market Analysis (2019-2033)

Gain unparalleled insights into the dynamic UAE construction market with this in-depth report. Spanning a critical study period from 2019 to 2033, with a base year of 2025 and a robust forecast period of 2025-2033, this analysis delves deep into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the key players shaping the Middle East construction sector. Essential for real estate developers, contractors, investors, government bodies, and material suppliers, this report provides actionable intelligence to navigate and capitalize on the burgeoning Dubai construction and Abu Dhabi construction landscapes.

Construction Market in UAE Market Dynamics & Concentration

The UAE construction market exhibits a dynamic interplay of drivers and constraints, with significant concentration observed among major players. Innovation, particularly in sustainable building practices and smart city technologies, is a key differentiator. Regulatory frameworks, including stringent building codes and environmental standards, are continuously evolving, influencing project execution and material selection. While direct product substitutes are limited in core construction, advancements in prefabrication and modular construction offer alternative delivery models. End-user trends are increasingly leaning towards high-quality, energy-efficient, and technologically advanced spaces, driving demand in the commercial construction UAE and residential construction UAE segments. Merger and acquisition (M&A) activities, though moderate, signify consolidation and strategic expansion by leading entities. For instance, the market share of top 5 companies is estimated at 45%, with an average of 15 M&A deals annually in the historical period (2019-2024).

Construction Market in UAE Industry Trends & Analysis

The construction industry in UAE is poised for significant expansion, driven by ambitious government initiatives and a burgeoning population. The UAE infrastructure construction segment, particularly in transportation, is a major growth engine, fueled by ongoing projects like the expansion of Dubai Metro and the development of new road networks. Technological disruptions are revolutionizing project management and execution, with the adoption of Building Information Modeling (BIM), artificial intelligence (AI) for predictive maintenance, and advanced robotics. Consumer preferences are shifting towards sustainable and green buildings, influencing material choices and design aesthetics. The competitive landscape is characterized by intense rivalry, with both international and local firms vying for lucrative contracts. The UAE construction market size is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period (2025-2033). Market penetration of sustainable construction practices is expected to reach 70% by 2030. The report forecasts the overall UAE construction market value to reach approximately 300 Billion AED by 2033.

Leading Markets & Segments in Construction Market in UAE

The construction market in UAE is characterized by the dominance of specific segments and regions, driven by economic diversification and strategic development plans.

Infrastructure (Transportation) Construction: This segment is a primary growth driver, propelled by the UAE's commitment to developing world-class transportation networks. Key drivers include:

- Government investment: Significant budgetary allocations towards expanding airports, seaports, and road connectivity.

- Tourism and trade focus: The need to support a growing tourism sector and facilitate international trade.

- Urban development: Projects like the Dubai Metro expansion and new highway construction are vital for urban mobility.

- Economic policies: Favorable policies encouraging foreign investment in infrastructure development.

Commercial Construction: Experiencing robust growth, this segment is fueled by the expansion of business hubs, retail spaces, and hospitality projects.

- Economic diversification: Initiatives to attract international businesses and foster new industries.

- Retail sector growth: Development of new malls, entertainment venues, and mixed-use commercial complexes.

- Hospitality demand: Continued investment in hotels and resorts to support tourism.

Residential Construction: Driven by population growth and a desire for high-quality living, this segment remains a cornerstone of the UAE real estate market.

- Population influx: A continuously growing expatriate and local population requiring housing.

- Affordability and luxury: A dual demand for both affordable housing solutions and premium residential developments.

- Lifestyle trends: Increasing demand for smart homes and community-centric living.

Energy and Utilities Construction: This segment is witnessing significant activity due to the UAE's focus on renewable energy and infrastructure upgrades.

- Renewable energy targets: Ambitious goals for solar and other renewable energy projects.

- Power generation and distribution: Investment in upgrading and expanding power grids.

- Water and wastewater management: Development of advanced infrastructure for efficient resource management.

Industrial Construction: While a smaller segment, it is poised for growth with the UAE's push towards industrial diversification and manufacturing capabilities.

The dominance of Infrastructure (Transportation) Construction is evident in the substantial government spending and the transformative impact of these projects on the nation's connectivity and economic viability. The continued development of key hubs like Dubai and Abu Dhabi further solidifies their leading positions within the UAE construction sector.

Construction Market in UAE Product Developments

Product developments in the UAE construction market are increasingly focused on sustainability, smart technology, and efficiency. Innovations in prefabricated and modular building components are gaining traction, offering faster construction times and reduced waste. The adoption of advanced materials, such as self-healing concrete and high-performance insulation, enhances durability and energy efficiency. Smart building technologies, integrating IoT devices for building management systems, are becoming standard in premium developments. These advancements provide competitive advantages by meeting evolving client demands for environmentally conscious and technologically sophisticated structures.

Key Drivers of Construction Market in UAE Growth

The UAE construction market is propelled by a confluence of powerful growth drivers. Government vision and investment in mega-projects, such as Expo 2020 legacies and future urban developments, create substantial demand. Economic diversification initiatives are attracting foreign investment and fostering new industries, leading to increased commercial and industrial construction. A rapidly growing population, fueled by expatriate inflows, continuously drives demand for residential construction. Furthermore, the UAE's commitment to sustainability and the adoption of green building practices are creating opportunities for innovative and eco-friendly construction solutions.

Challenges in the Construction Market in UAE Market

Despite its robust growth, the UAE construction market faces several challenges. Intense competition among a large number of local and international players can lead to price wars and reduced profit margins. Fluctuations in raw material prices, particularly steel and cement, can impact project budgets and timelines. Regulatory complexities and lengthy approval processes can sometimes create hurdles for project commencement. Labor availability and skill shortages, especially in specialized areas, can also pose a constraint on project execution speed and quality.

Emerging Opportunities in Construction Market in UAE

Emerging opportunities in the UAE construction market are largely driven by technological advancements and strategic governmental foresight. The push towards digitalization and the adoption of BIM, AI, and IoT in construction are creating new avenues for efficiency and innovation. Strategic partnerships between local and international firms are fostering knowledge transfer and enhancing project capabilities. The increasing focus on sustainability presents significant opportunities in green building technologies, renewable energy infrastructure, and retrofitting existing structures. Market expansion into untapped niche segments and the development of smart, resilient infrastructure will further fuel long-term growth.

Leading Players in the Construction Market in UAE Sector

The UAE construction sector is home to a diverse range of leading companies, including:

- Aegion Corp

- Emirtec

- AE Arma-Electropanc

- Jacobs

- Joannou And Paraskevaides Limited (JP)

- Sobha Engineering & Contracting LLC

- ACC Arabian Construction Company

- CB&I LLC

- Fluor Corp

- Consolidated Contractors Group

- Arabtec Constructions LLC

- Bechtel

- Al Futtaim Carillion

- Abu Dhabi National Energy Co PJSC

- 7 3 Other Companies (List Not Exhaustive)

Key Milestones in Construction Market in UAE Industry

- 2019-2024 (Historical Period): Significant recovery and growth post-Expo 2020 preparations, with a surge in residential and commercial project completions. Increased adoption of BIM technology across major projects.

- 2025 (Base & Estimated Year): Stabilization of market activity, with a focus on completing ongoing mega-projects and initiating new sustainable development initiatives. Increased investment in renewable energy infrastructure.

- 2026: Launch of new government initiatives focusing on smart city development and digital transformation in construction.

- 2027: Anticipated rise in demand for retrofitting existing buildings for energy efficiency and sustainability.

- 2028-2030: Continued expansion of infrastructure projects, including transportation networks and utilities, to support population growth and economic diversification.

- 2031-2033 (Forecast Period): Sustained growth driven by ongoing urban development, technological integration, and a strong emphasis on sustainable construction practices. Increased M&A activity as companies seek to consolidate and expand their market presence.

Strategic Outlook for Construction Market in UAE Market

The strategic outlook for the UAE construction market is exceptionally positive, driven by a clear vision for sustainable development and economic resilience. Continued government investment in mega-infrastructure and ambitious diversification strategies will sustain demand. The integration of cutting-edge technologies, such as AI and smart building solutions, presents a significant growth accelerator. Strategic partnerships and a focus on green construction practices will be crucial for competitive advantage. The market is well-positioned to attract further foreign investment and lead in the adoption of innovative construction methodologies.

Construction Market in UAE Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

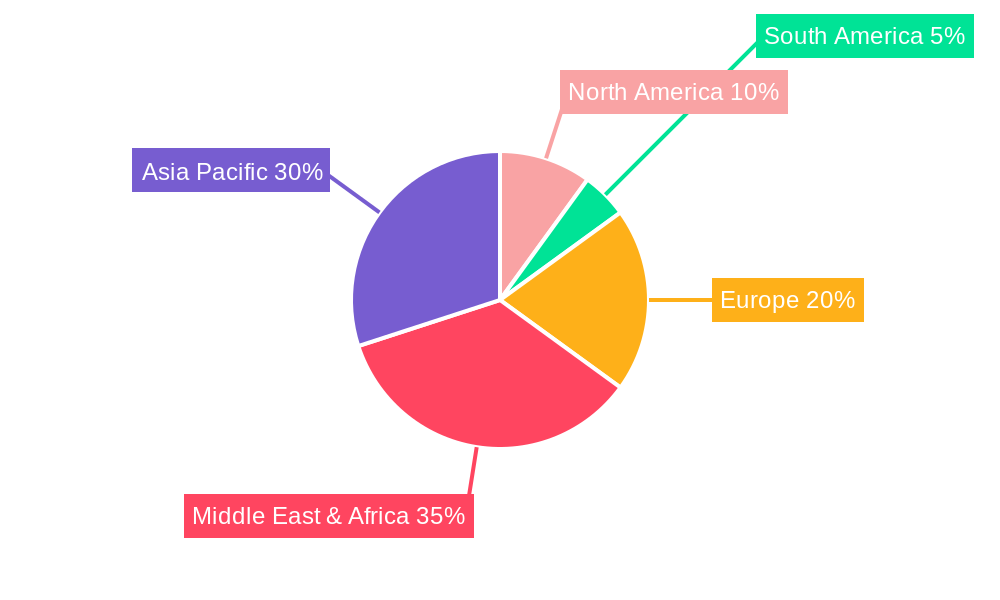

Construction Market in UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Market in UAE Regional Market Share

Geographic Coverage of Construction Market in UAE

Construction Market in UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Demand for Commercial Spaces; Smart Cities and Sustainable Development

- 3.3. Market Restrains

- 3.3.1. Economic Vulnerability to Oil Price Fluctuations

- 3.4. Market Trends

- 3.4.1. Rise in Demand from the Tourism Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Market in UAE Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Market in UAE Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Market in UAE Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Market in UAE Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Market in UAE Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Market in UAE Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aegion Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emirtec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AE Arma-Electropanc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jacobs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Joannou And Paraskevaides Limited (JP)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sobha Engineering & Contracting LLC**List Not Exhaustive 7 3 Other Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACC Arabian Construction Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CB&I LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fluor Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Consolidated Contractors Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arabtec Constructions LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bechtel

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Al Futtaim Carillion

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Abu Dhabi National Energy Co PJSC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Aegion Corp

List of Figures

- Figure 1: Global Construction Market in UAE Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Market in UAE Revenue (Million), by Sector 2025 & 2033

- Figure 3: North America Construction Market in UAE Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Construction Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Construction Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Construction Market in UAE Revenue (Million), by Sector 2025 & 2033

- Figure 7: South America Construction Market in UAE Revenue Share (%), by Sector 2025 & 2033

- Figure 8: South America Construction Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Construction Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Construction Market in UAE Revenue (Million), by Sector 2025 & 2033

- Figure 11: Europe Construction Market in UAE Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Construction Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Construction Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Construction Market in UAE Revenue (Million), by Sector 2025 & 2033

- Figure 15: Middle East & Africa Construction Market in UAE Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Middle East & Africa Construction Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Construction Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Construction Market in UAE Revenue (Million), by Sector 2025 & 2033

- Figure 19: Asia Pacific Construction Market in UAE Revenue Share (%), by Sector 2025 & 2033

- Figure 20: Asia Pacific Construction Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Construction Market in UAE Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Market in UAE Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Global Construction Market in UAE Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Construction Market in UAE Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Global Construction Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Construction Market in UAE Revenue Million Forecast, by Sector 2020 & 2033

- Table 9: Global Construction Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Construction Market in UAE Revenue Million Forecast, by Sector 2020 & 2033

- Table 14: Global Construction Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Construction Market in UAE Revenue Million Forecast, by Sector 2020 & 2033

- Table 25: Global Construction Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Construction Market in UAE Revenue Million Forecast, by Sector 2020 & 2033

- Table 33: Global Construction Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Construction Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Market in UAE?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Construction Market in UAE?

Key companies in the market include Aegion Corp, Emirtec, AE Arma-Electropanc, Jacobs, Joannou And Paraskevaides Limited (JP), Sobha Engineering & Contracting LLC**List Not Exhaustive 7 3 Other Companie, ACC Arabian Construction Company, CB&I LLC, Fluor Corp, Consolidated Contractors Group, Arabtec Constructions LLC, Bechtel, Al Futtaim Carillion, Abu Dhabi National Energy Co PJSC.

3. What are the main segments of the Construction Market in UAE?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 41 Million as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Commercial Spaces; Smart Cities and Sustainable Development.

6. What are the notable trends driving market growth?

Rise in Demand from the Tourism Sector.

7. Are there any restraints impacting market growth?

Economic Vulnerability to Oil Price Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Market in UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Market in UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Market in UAE?

To stay informed about further developments, trends, and reports in the Construction Market in UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence