Key Insights

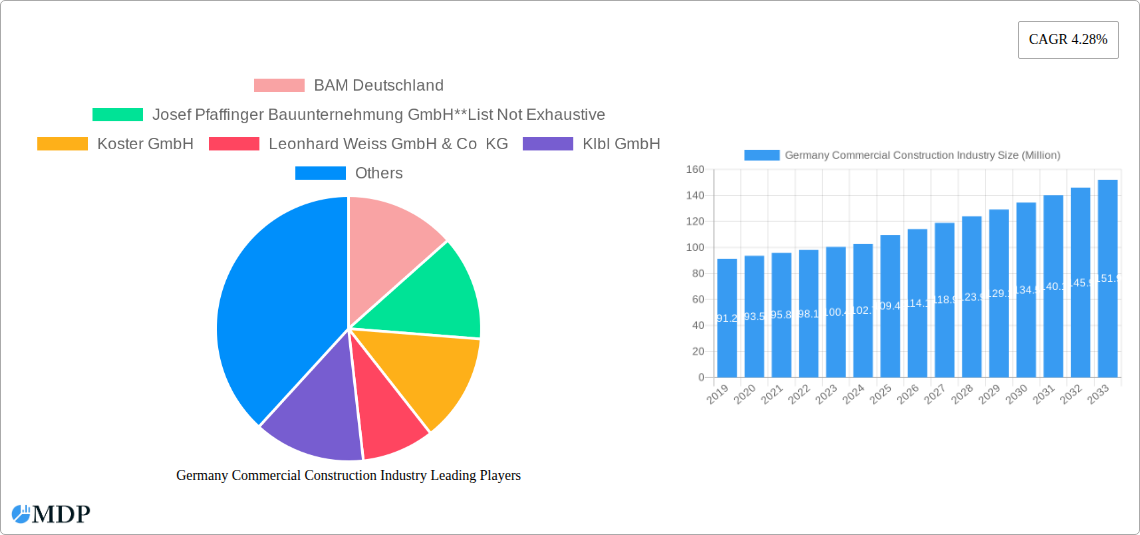

The German commercial construction industry is poised for steady growth, projected to reach approximately USD 109.49 million in 2025 with a Compound Annual Growth Rate (CAGR) of 4.28% through 2033. This expansion is underpinned by robust economic activity and significant investment across various sectors. Key drivers fueling this growth include the ongoing demand for modern office spaces, the continuous development of retail infrastructure to adapt to evolving consumer habits, and the expansion of the hospitality sector, particularly in urban centers and tourist destinations. Furthermore, substantial public and private investments in institutional construction, such as healthcare facilities and educational institutions, are contributing to the market's upward trajectory. The sector is also experiencing a notable trend towards sustainable and energy-efficient building practices, driven by stringent environmental regulations and increasing client preference for green credentials. The adoption of advanced construction technologies and digital solutions is also a significant trend, enhancing project efficiency and reducing overall costs.

Germany Commercial Construction Industry Market Size (In Million)

Despite the positive outlook, certain restraints could impact the pace of growth. These include potential labor shortages in skilled trades, rising raw material costs that can affect project budgets, and the complex regulatory landscape that may introduce delays. However, the market is resilient, with companies like Strabag AG, Leonhard Weiss GmbH & Co KG, and BAM Deutschland actively innovating and adapting to these challenges. The diverse segments within commercial construction, including office buildings, retail spaces, hospitality, and institutional projects, offer a broad base for sustained development. Germany’s strong industrial base and strategic location within Europe position its commercial construction sector for continued relevance and growth, with a particular focus on innovation, sustainability, and addressing the evolving needs of businesses and the public.

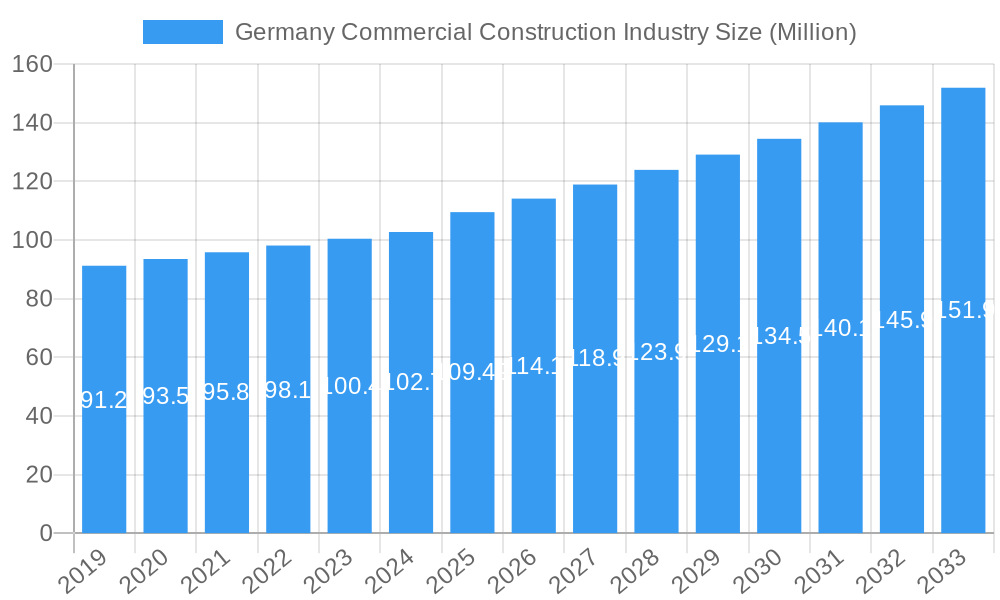

Germany Commercial Construction Industry Company Market Share

Germany Commercial Construction Industry Market Report: Growth, Trends, and Key Players (2019–2033)

This comprehensive report delivers an in-depth analysis of the Germany Commercial Construction Industry, providing critical insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019–2033, a base year of 2025, and a detailed forecast period from 2025–2033, this report examines historical trends, current market conditions, and future projections. We delve into market dynamics, segmentation, technological innovations, key drivers, challenges, and emerging opportunities, offering actionable intelligence to inform strategic decision-making. The German construction market is a significant economic powerhouse, driven by robust demand across various commercial segments. This report leverages high-traffic keywords such as "Germany construction industry," "commercial real estate Germany," "building construction Germany," and "construction market trends Germany" to ensure maximum visibility and attract industry professionals.

Germany Commercial Construction Industry Market Dynamics & Concentration

The Germany Commercial Construction Industry exhibits a moderate to high degree of market concentration, with several large, established players dominating significant portions of the market share. Innovation is driven by a growing emphasis on sustainable building practices, digitalization in project management, and the adoption of modular construction techniques. Regulatory frameworks, while robust, are continuously evolving to promote energy efficiency and safety standards. Product substitutes are limited within core construction services but can emerge in the form of alternative materials or pre-fabricated solutions. End-user trends are shifting towards flexible workspace designs, experiential retail environments, and eco-friendly hospitality options. Mergers and acquisitions (M&A) activity is a notable driver of consolidation and market expansion, with companies seeking to enhance their capabilities and market reach. The German construction sector is characterized by a strong commitment to quality and innovation.

- Market Concentration: Dominated by a few key players, but with room for specialized and regional firms.

- Innovation Drivers: Sustainability, BIM (Building Information Modeling), prefabrication, smart building technologies.

- Regulatory Frameworks: Stringent environmental and building codes, evolving energy efficiency standards.

- Product Substitutes: Rise of modular construction and advanced material alternatives.

- End-User Trends: Demand for flexible office spaces, sustainable retail, and modern hospitality.

- M&A Activities: Ongoing consolidation to gain market share and technological advantages.

Germany Commercial Construction Industry Industry Trends & Analysis

The Germany Commercial Construction Industry is poised for sustained growth, driven by a combination of economic resilience and a growing demand for modern commercial spaces. The German construction market forecast indicates a positive trajectory, with key growth drivers including government infrastructure spending, foreign investment, and a revitalized demand for office, retail, and hospitality spaces. Technological disruptions are rapidly reshaping the industry, with the widespread adoption of Building Information Modeling (BIM) enhancing project planning, execution, and lifecycle management. Artificial intelligence (AI) and the Internet of Things (IoT) are being integrated to improve efficiency, safety, and predictive maintenance. Consumer preferences are increasingly prioritizing sustainability, energy efficiency, and smart building features, influencing design and material choices. Competitive dynamics are intensifying, with a focus on digital transformation, cost-efficiency, and the ability to deliver complex, integrated projects. The German commercial construction market is adapting to new demands, reflecting a shift towards intelligent and sustainable building solutions.

The Compound Annual Growth Rate (CAGR) for the Germany Commercial Construction Industry is projected to be robust, reflecting strong underlying demand and ongoing investment. Market penetration of digital technologies is accelerating, with companies investing in software solutions for project management, supply chain optimization, and worker safety. The institutional construction segment, encompassing healthcare and educational facilities, is experiencing steady growth, supported by public investment and demographic shifts. Retail construction is evolving, with a focus on creating engaging in-store experiences and seamless integration with online platforms. Office building construction is adapting to hybrid work models, emphasizing flexible layouts and collaborative spaces. Hospitality construction is seeing renewed interest, particularly in the budget and mid-range hotel segments, driven by tourism recovery and expansion plans. The overall German building construction market is demonstrating resilience and adaptability.

Leading Markets & Segments in Germany Commercial Construction Industry

The Germany Commercial Construction Industry is characterized by a diverse range of segments, each contributing significantly to the overall market value. While a definitive ranking requires granular data, analysis suggests strong performance across multiple categories.

Office Building Construction: This segment remains a cornerstone of the German commercial construction landscape.

- Key Drivers: Demand for modern, sustainable, and flexible office spaces to accommodate evolving work models; corporate expansion and relocation projects; government incentives for green building.

- Dominance Analysis: Cities like Berlin, Munich, Frankfurt, and Hamburg are major hubs for office development, driven by their strong economic bases and international business presence. The focus is on energy-efficient designs, smart building technology integration, and adaptable floor plans to support hybrid work environments.

Retail Construction: The retail sector is undergoing a transformation, with construction reflecting new consumer behaviors.

- Key Drivers: The need for experiential retail spaces, omnichannel integration, and the renovation of existing retail infrastructure.

- Dominance Analysis: While e-commerce poses challenges, construction in this segment focuses on creating attractive and convenient physical retail environments. This includes shopping mall upgrades, standalone flagship stores, and the development of mixed-use retail spaces integrated with residential or office components.

Hospitality Construction: The hospitality sector is rebounding, with significant investment in new hotel development and renovations.

- Key Drivers: Growing tourism, business travel recovery, and expansion plans by major hotel chains seeking to increase their footprint in key German markets.

- Dominance Analysis: Cities with strong tourism appeal and major business centers are seeing increased activity. The trend favors budget-friendly and mid-scale hotels, along with specialized boutique accommodations. Sustainable design and guest experience are paramount.

Institutional Construction: This segment includes healthcare, education, and government facilities.

- Key Drivers: Public investment in healthcare infrastructure upgrades and expansion, modernization of educational institutions, and the development of government buildings.

- Dominance Analysis: Consistent demand is driven by demographic needs and governmental planning. Projects often involve long-term development cycles and adherence to strict regulatory and functional requirements.

Other Types: This broad category encompasses warehouses, logistics centers, industrial facilities, and specialized commercial buildings.

- Key Drivers: Growth in e-commerce driving demand for logistics and warehousing; expansion of industrial manufacturing; and specialized infrastructure projects.

- Dominance Analysis: The growth of e-commerce has significantly boosted demand for modern, large-scale logistics and warehouse facilities, particularly in strategically located industrial zones.

Germany Commercial Construction Industry Product Developments

The Germany Commercial Construction Industry is witnessing a surge in product developments focused on enhancing efficiency, sustainability, and building performance. Innovations include advanced modular construction systems that expedite project timelines and reduce waste, as well as the integration of smart building technologies, such as IoT sensors for real-time energy management and predictive maintenance. High-performance insulation materials and energy-generating facade elements are becoming more prevalent, contributing to the decarbonization of buildings. Furthermore, digital platforms and software solutions are streamlining project management, design, and collaboration among stakeholders, offering significant competitive advantages in project delivery and cost control.

Key Drivers of Germany Commercial Construction Industry Growth

The growth of the Germany Commercial Construction Industry is propelled by several key factors. Economically, a stable and robust German economy, coupled with significant foreign direct investment, fuels demand for new and renovated commercial spaces. Technologically, the increasing adoption of Building Information Modeling (BIM), artificial intelligence, and advanced construction materials are driving efficiency and innovation. Regulatory support, particularly for sustainable and energy-efficient buildings through incentives and stricter environmental codes, is a major catalyst. The ongoing demand for modern office spaces, the expansion of the logistics sector due to e-commerce growth, and the revitalization of the hospitality industry are also significant economic drivers.

Challenges in the Germany Commercial Construction Industry Market

Despite its growth, the Germany Commercial Construction Industry faces several challenges. A persistent shortage of skilled labor remains a significant restraint, impacting project timelines and costs. Supply chain disruptions and rising material costs, exacerbated by global economic factors, continue to exert pressure on profitability. Navigating complex and evolving regulatory frameworks, particularly concerning environmental standards and building permits, can also lead to delays and increased administrative burdens. Intense competition among a multitude of players, from large corporations to smaller specialized firms, adds to the market pressure, requiring continuous innovation and cost-efficiency to maintain a competitive edge.

Emerging Opportunities in Germany Commercial Construction Industry

The Germany Commercial Construction Industry is ripe with emerging opportunities. The growing emphasis on sustainability and climate neutrality presents a significant opportunity for companies specializing in green building technologies, energy-efficient retrofits, and the use of recycled or low-carbon materials. The ongoing digital transformation of the construction sector creates demand for innovative software solutions, AI-driven project management tools, and drone-based surveying and monitoring services. The expansion of logistics and warehousing facilities to support the booming e-commerce sector, particularly in strategically advantageous locations, offers substantial growth potential. Furthermore, the increasing demand for adaptable and flexible commercial spaces, catering to evolving work and retail trends, presents opportunities for innovative design and construction approaches.

Leading Players in the Germany Commercial Construction Industry Sector

- BAM Deutschland

- Josef Pfaffinger Bauunternehmung GmbH

- Koster GmbH

- Leonhard Weiss GmbH & Co KG

- Klbl GmbH

- Strabag AG

- AUG PRIEN Bauunternehmung (GmbH & Co KG)

- Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- Gottlob Brodbeck GmbH & Co KG

- Dechant hoch- und ingenieurbau gmbh

Key Milestones in Germany Commercial Construction Industry Industry

- August 2023: Gutersloh-based Schuttflix, a German digital marketplace and delivery platform for bulk construction supplies, announced securing EUR 45 Million (USD 47.37 Million) in funding. This investment will fuel technology enhancement, market expansion, service diversification, partnerships, talent acquisition, marketing, customer support, and sustainability initiatives within the construction sector.

- April 2023: Premier Inn, a major UK hotel chain, signaled its intent to expand its budget brand in Germany, potentially through mergers and acquisitions.

- March 2, 2023: Premier Inn acquired six hotels in Germany, comprising approximately 900 rooms, for refurbishment and rebranding. This acquisition increased their operational hotels in Germany to 51, with around 9,000 rooms. The company plans to add an estimated 1,000 to 1,500 rooms in Germany within the next year, aligning with its UK expansion plans, and has a multi-year development pipeline for an additional 5,000 rooms in Germany.

Strategic Outlook for Germany Commercial Construction Industry Market

The strategic outlook for the Germany Commercial Construction Industry is promising, driven by a continued focus on digitalization and sustainability. Growth accelerators include the increasing integration of smart technologies and AI to optimize project management and enhance building performance, along with a strong push towards net-zero buildings and circular economy principles. The government's ongoing investment in infrastructure and its commitment to energy transition will continue to provide a stable foundation for new construction projects. Strategic partnerships between traditional construction firms and technology providers are expected to foster innovation and create new service offerings. Furthermore, the potential for M&A activities will continue to shape the market landscape, driving consolidation and enhancing the capabilities of leading players to address complex, large-scale projects.

Germany Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other Types

Germany Commercial Construction Industry Segmentation By Geography

- 1. Germany

Germany Commercial Construction Industry Regional Market Share

Geographic Coverage of Germany Commercial Construction Industry

Germany Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Green buildings is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Commercial Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BAM Deutschland

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koster GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leonhard Weiss GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Klbl GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Strabag AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AUG PRIEN Bauunternehmung (GmbH & Co KG)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gottlob Brodbeck GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dechant hoch- und ingenieurbau gmbh

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BAM Deutschland

List of Figures

- Figure 1: Germany Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Commercial Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Commercial Construction Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Germany Commercial Construction Industry?

Key companies in the market include BAM Deutschland, Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive, Koster GmbH, Leonhard Weiss GmbH & Co KG, Klbl GmbH, Strabag AG, AUG PRIEN Bauunternehmung (GmbH & Co KG), Goldbeck Ost GmbH Niederlassung Sachsen-Plauen, Gottlob Brodbeck GmbH & Co KG, Dechant hoch- und ingenieurbau gmbh.

3. What are the main segments of the Germany Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Increasing Investments in Green buildings is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2023: Gutersloh-based Schuttflix, a German digital marketplace and delivery platform for bulk construction supplies, announced that it had secured EUR 45 million (USD 47.37 million) in a fresh round of funding. Schuttflix says it will use the funds to enhance its technology, expand into new markets, diversify services, form partnerships, attract top talent, invest in marketing, prioritize customer support, and contribute to sustainability efforts in the construction sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Germany Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence