Key Insights

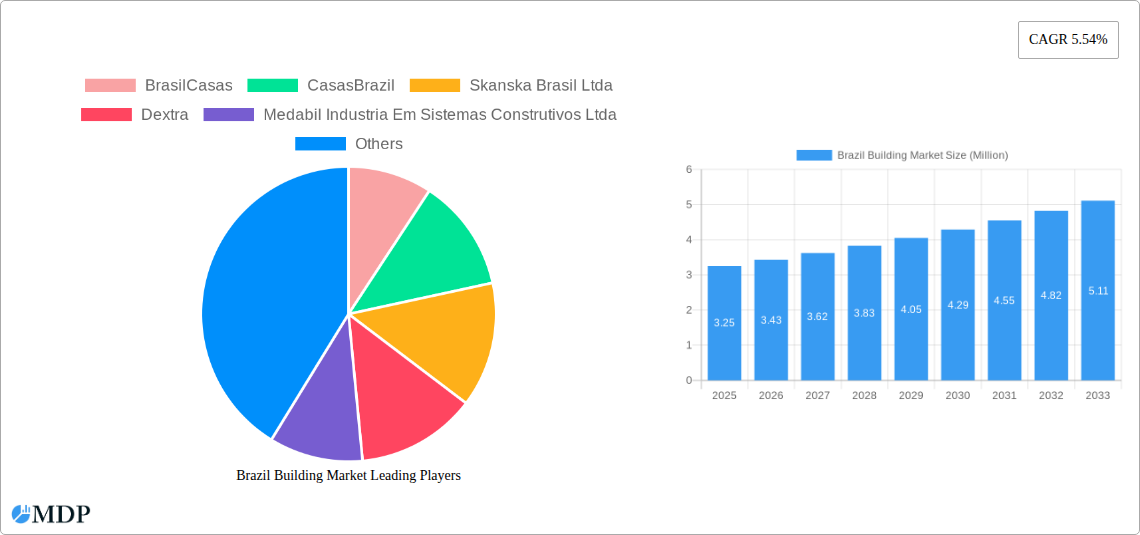

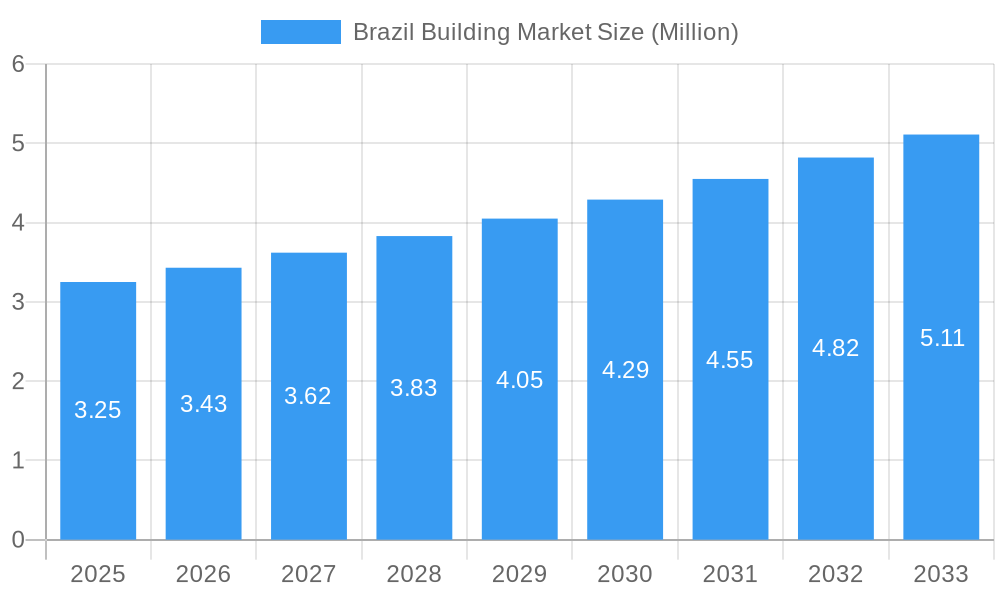

The Brazil Building Market is poised for significant expansion, projected to reach approximately USD 3.25 million by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.54% throughout the forecast period of 2025-2033. Key drivers fueling this expansion include increasing urbanization, government initiatives aimed at boosting infrastructure development, and a rising demand for both residential and commercial construction. The residential sector, in particular, is experiencing a surge due to a growing middle class and a need for modern housing solutions. Furthermore, the commercial segment is benefiting from increased foreign investment and the expansion of various industries, necessitating new office spaces, retail outlets, and hospitality facilities. The market's dynamism is further amplified by ongoing trends such as the adoption of sustainable building practices, the integration of smart home technologies, and a greater preference for prefabricated and modular construction methods, which offer efficiency and cost-effectiveness.

Brazil Building Market Market Size (In Million)

Despite the promising outlook, the Brazil Building Market faces certain restraints that could temper its growth. These include fluctuations in the prices of raw materials like concrete, glass, and metal, which can impact project budgets and timelines. Economic instability and political uncertainties can also deter investment and slow down the pace of construction projects. However, the market is actively segmenting to cater to diverse needs, with concrete and timber materials showing strong demand due to their affordability and versatility in various applications. The residential and commercial segments are expected to lead the charge, supported by innovative solutions from companies like BrasilCasas, Skanska Brasil Ltda, and Medabil Industria Em Sistemas Construtivos Ltda. The continuous drive for innovation and adaptation to market challenges, coupled with a clear understanding of regional demands within Brazil, will be crucial for sustained success in this evolving market landscape.

Brazil Building Market Company Market Share

Brazil Building Market: Comprehensive Analysis and Growth Forecast (2019-2033)

This in-depth report offers a strategic overview of the dynamic Brazil Building Market, exploring key segments, innovation drivers, and future growth trajectories. Leveraging high-traffic keywords like "Brazil construction market," "building materials Brazil," "residential construction Brazil," and "commercial construction Brazil," this analysis is essential for investors, developers, manufacturers, and policymakers seeking to capitalize on the burgeoning opportunities within this vital sector. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report provides a robust, data-driven perspective on market dynamics, industry trends, and leading players. Discover the potential of concrete, glass, metal, and timber applications, and understand the critical impact of emerging technologies and regulatory shifts on Brazil's building landscape.

Brazil Building Market Market Dynamics & Concentration

The Brazil Building Market is characterized by a moderately concentrated landscape, with a few key players holding significant market share, estimated at approximately 65% for the top five entities. Innovation drivers are primarily fueled by the demand for sustainable construction solutions, advancements in material science, and the increasing adoption of digital technologies in project management and execution. Regulatory frameworks, while evolving, continue to influence project approvals and building standards. Product substitutes, such as pre-fabricated components and alternative materials, are gaining traction, presenting both competition and opportunities for diversification. End-user trends highlight a growing preference for energy-efficient, smart homes, and eco-friendly commercial spaces. Merger and acquisition (M&A) activities, with an estimated XX M&A deals recorded between 2019 and 2024, are indicative of strategic consolidation and expansion efforts within the industry.

Brazil Building Market Industry Trends & Analysis

The Brazil Building Market is poised for significant expansion, driven by a confluence of factors including robust economic recovery, increased government investment in infrastructure projects, and a growing middle class with enhanced purchasing power for residential properties. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected at xx%, reflecting a strong upward trend. Technological disruptions are reshaping the industry, with the adoption of Building Information Modeling (BIM), pre-fabrication techniques, and advanced construction machinery accelerating project timelines and improving cost-efficiency. Consumer preferences are leaning towards modern, sustainable, and technologically integrated living and working spaces, pushing developers to incorporate smart home features and eco-friendly materials. Competitive dynamics are intensifying, with both domestic and international companies vying for market share, leading to increased innovation and a focus on value-added services. Market penetration of advanced construction technologies is still in its nascent stages but is expected to grow rapidly, especially in urban centers, contributing to overall market growth and efficiency gains.

Leading Markets & Segments in Brazil Building Market

The Residential application segment is a dominant force within the Brazil Building Market, driven by ongoing urbanization and a persistent housing deficit across the country. Economic policies supporting affordable housing initiatives and government subsidies play a crucial role in bolstering demand within this segment. The Concrete material type continues to be the bedrock of construction in Brazil due to its durability, cost-effectiveness, and widespread availability, making it a significant contributor to market value.

Key Drivers for Residential Dominance:

- Increasing urbanization rates, particularly in major metropolitan areas like São Paulo and Rio de Janeiro.

- Government initiatives and financing programs aimed at reducing the housing deficit.

- Growing middle-class population with increased disposable income for homeownership.

- Demand for modern and sustainable housing solutions.

Dominance Analysis of Concrete: Concrete's inherent strength, versatility, and long lifespan make it the preferred material for a vast majority of construction projects, from foundations to structural elements. Its local availability and established supply chains further solidify its leading position. The extensive use of concrete in both residential and commercial applications underpins its substantial market share.

The Commercial application segment also represents a substantial market share, fueled by private sector investments in retail spaces, offices, and hospitality. The Metal building material type is experiencing a notable surge in demand due to its lightweight properties, speed of construction, and aesthetic appeal in modern architectural designs, particularly in commercial and industrial projects.

Key Drivers for Commercial Dominance:

- Growth in the services sector and increased demand for office spaces.

- Expansion of retail chains and shopping malls.

- Investment in tourism and hospitality infrastructure.

- Development of industrial parks and logistics centers.

Dominance Analysis of Metal: Metal structures offer significant advantages in terms of faster erection times, design flexibility, and potential for modular construction, making them increasingly attractive for commercial developers. The rising trend towards sustainable and energy-efficient buildings further favors the use of metal, which can often incorporate recycled content and be fully recyclable.

Brazil Building Market Product Developments

Recent product developments in the Brazil Building Market are focused on enhancing sustainability, efficiency, and smart integration. Innovations in high-performance concrete, self-healing materials, and advanced insulation technologies are gaining traction, driven by environmental regulations and consumer demand for energy-efficient buildings. The application of modular and pre-fabricated construction techniques is expanding, offering faster build times and reduced on-site waste. Furthermore, the integration of smart home technologies and IoT solutions into building materials and systems is becoming a key competitive advantage, catering to the evolving needs of modern consumers.

Key Drivers of Brazil Building Market Growth

Several key drivers are propelling the growth of the Brazil Building Market. Technologically, the increasing adoption of BIM, AI-powered project management, and advanced robotics is enhancing productivity and reducing project costs. Economically, a stable inflation rate and positive GDP growth forecast are encouraging investment in new construction projects. Regulatory factors, such as streamlined permitting processes and incentives for green building certifications, are also playing a significant role in stimulating market expansion.

Challenges in the Brazil Building Market Market

Despite its growth potential, the Brazil Building Market faces several challenges. Regulatory hurdles, including complex permitting and licensing procedures, can lead to project delays and increased costs. Supply chain disruptions, particularly for specialized imported materials, can impact project timelines and material availability. Furthermore, intense competition among a large number of players can lead to price wars and pressure on profit margins. Access to skilled labor also remains a concern in certain regions, potentially hindering the pace of development.

Emerging Opportunities in Brazil Building Market

Emerging opportunities in the Brazil Building Market are abundant, driven by technological breakthroughs and strategic market expansion. The growing demand for sustainable and green building solutions presents significant opportunities for companies specializing in eco-friendly materials and energy-efficient designs. Strategic partnerships between technology providers and construction firms are fostering innovation in areas like smart cities and advanced infrastructure development. Furthermore, the untapped potential in underdeveloped regions and the ongoing need for urban regeneration projects offer substantial avenues for market growth and investment.

Leading Players in the Brazil Building Market Sector

- BrasilCasas

- CasasBrazil

- Skanska Brasil Ltda

- Dextra

- Medabil Industria Em Sistemas Construtivos Ltda

- The Cassol Pre-Fabricados

- Studio Arthur Casas

- Brasmerc

- Martifier Group

- Siscobras

- Impresa Modular

Key Milestones in Brazil Building Market Industry

- January 2023: Modularis, a Brazilian modular construction company, demonstrated its innovative construction technology in residential construction with a 75-unit mixed-use development. Eight months from construction start to end is a fast time frame for this project, set to open in May 2023. The project will consist of two concrete floors with commercial space and 11 levels of modular apartments, with the entire project expected to be completed by year's end. This mid-rise development serves as a "showcase" for Modularis, aiming to increase awareness of modular construction technology in Brazil's residential sector.

- December 2022: PhP Ventures Acquisition Corp and Modulex Modular Buildings Plc announced a definitive agreement for a business combination. Modulex, a leading UK-based ConstrucTech company, designs, manufactures, and installs 3D Volumetric Steel modular buildings. Leveraging cutting-edge technologies like AI, Blockchain, and IoT, Modulex aims to meet the growing demand for housing and infrastructure in developed and emerging markets while optimizing cost efficiencies.

Strategic Outlook for Brazil Building Market Market

The strategic outlook for the Brazil Building Market is highly promising, fueled by a sustained demand for housing and infrastructure coupled with increasing adoption of advanced construction technologies. Growth accelerators include government support for infrastructure development, private sector investment in commercial and residential projects, and the continued integration of sustainable building practices. Opportunities for market expansion lie in leveraging modular construction, embracing digitalization for enhanced efficiency, and focusing on the development of smart and eco-friendly building solutions to cater to evolving consumer preferences. The market is well-positioned for robust and sustained growth.

Brazil Building Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Brazil Building Market Segmentation By Geography

- 1. Brazil

Brazil Building Market Regional Market Share

Geographic Coverage of Brazil Building Market

Brazil Building Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure Investments; Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry

- 3.3. Market Restrains

- 3.3.1. Limited Adaptability during Construction

- 3.4. Market Trends

- 3.4.1. Opportunities in Residential & Infrastructure Sectors to Boost the Prefabricated market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Building Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BrasilCasas

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CasasBrazil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Skanska Brasil Ltda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dextra

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medabil Industria Em Sistemas Construtivos Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Cassol Pre-Fabricados

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Studio Arthur Casas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Brasmerc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Martifier Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siscobras

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Impresa Modular **List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BrasilCasas

List of Figures

- Figure 1: Brazil Building Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Building Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Building Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Brazil Building Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Brazil Building Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil Building Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Brazil Building Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Brazil Building Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Building Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Brazil Building Market?

Key companies in the market include BrasilCasas, CasasBrazil, Skanska Brasil Ltda, Dextra, Medabil Industria Em Sistemas Construtivos Ltda, The Cassol Pre-Fabricados, Studio Arthur Casas, Brasmerc, Martifier Group, Siscobras, Impresa Modular **List Not Exhaustive.

3. What are the main segments of the Brazil Building Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure Investments; Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry.

6. What are the notable trends driving market growth?

Opportunities in Residential & Infrastructure Sectors to Boost the Prefabricated market.

7. Are there any restraints impacting market growth?

Limited Adaptability during Construction.

8. Can you provide examples of recent developments in the market?

January 2023: Modularis is a Brazilian modular construction company specializing in using innovative construction technology in residential construction. Eight months from construction start to end is a fast time frame for a 75-unit mixed-use development. The project, set to open in May 2023, will consist of two concrete floors with commercial space and 11 levels of modular apartments. The entire project is expected to be completed by the year’s end. According to Modularis, this mid-rise development will serve as a “showcase” for the company and increase awareness of using modular construction technology in Brazil’s residential construction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Building Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Building Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Building Market?

To stay informed about further developments, trends, and reports in the Brazil Building Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence