Key Insights

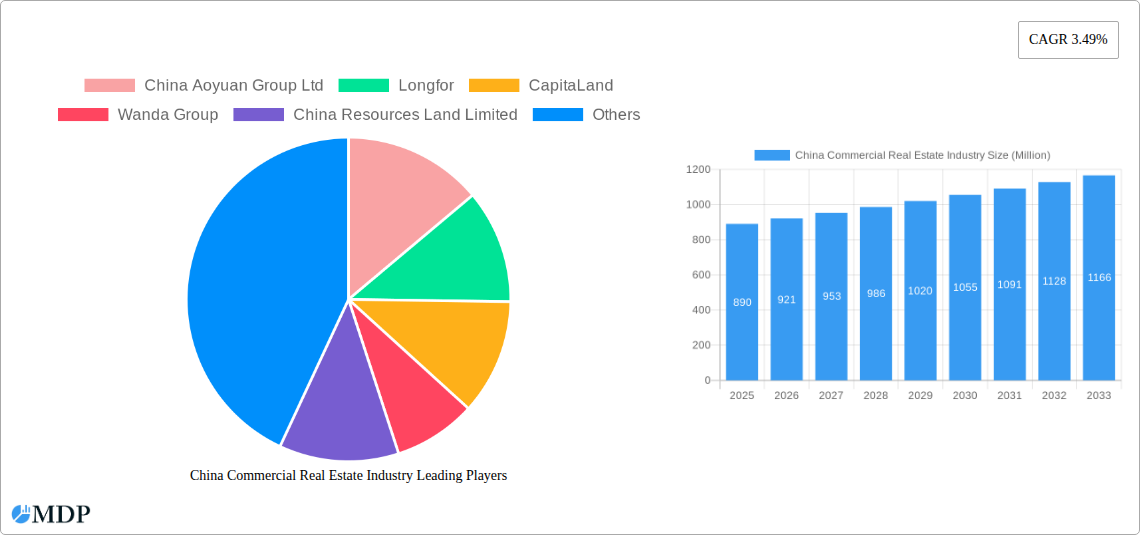

The China Commercial Real Estate Industry is poised for steady growth, with a projected market size of $0.89 billion in 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 3.49% during the forecast period of 2025-2033. This expansion is driven by several key factors, including the nation's ongoing urbanization, a growing middle class with increasing disposable income, and the government's strategic initiatives to foster economic development and attract foreign investment. The sector encompasses diverse segments such as Office, Retail, Industrial (Logistics), and Hospitality, each contributing to the overall market dynamics. The Industrial (Logistics) segment, in particular, is anticipated to witness significant growth, fueled by the robust expansion of e-commerce and the need for efficient supply chain infrastructure. Similarly, the Hospitality sector is expected to rebound strongly as domestic and international travel resumes, supported by a burgeoning tourism industry and a greater emphasis on experiential consumption.

China Commercial Real Estate Industry Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. These include evolving regulatory landscapes, increasing construction costs, and potential economic slowdowns. However, these challenges are being actively addressed through innovative business models and technological advancements. Key players like China Aoyuan Group Ltd, Longfor, CapitaLand, Wanda Group, and China Resources Land Limited are strategically investing in prime locations and diversifying their portfolios to mitigate risks and capitalize on emerging opportunities. The focus on sustainable development and smart building technologies is also becoming increasingly prominent, reflecting a shift towards environmentally conscious and technologically advanced real estate solutions. The China commercial real estate market's resilience and adaptability, coupled with supportive government policies, are expected to sustain its growth trajectory, offering attractive investment prospects for stakeholders.

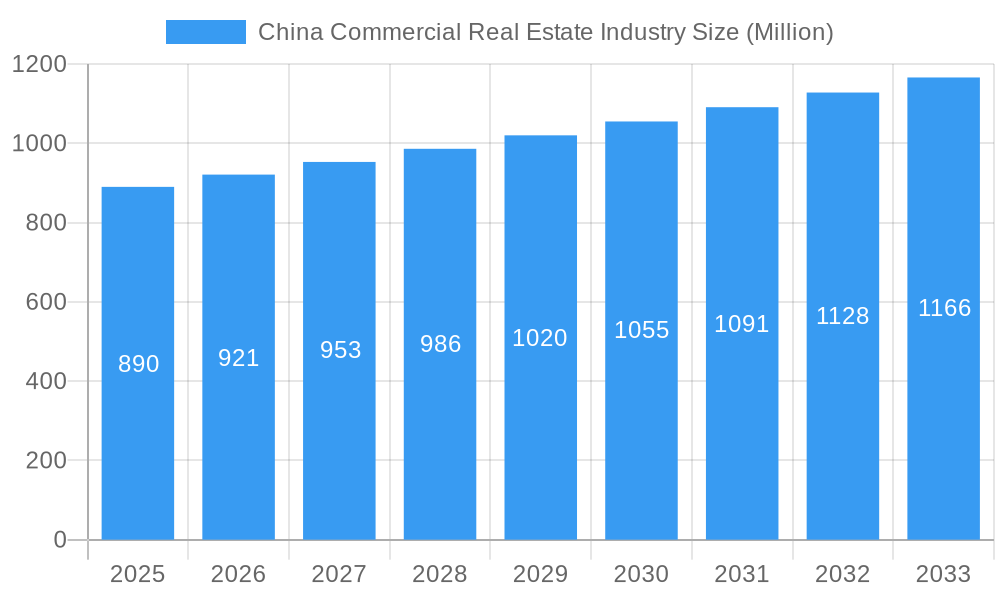

China Commercial Real Estate Industry Company Market Share

Unlocking Opportunities: China Commercial Real Estate Industry Report 2019-2033

Dive deep into the dynamic landscape of China's commercial real estate market with this comprehensive industry analysis. Spanning 2019–2033, with a base year of 2025, this report offers unparalleled insights into market dynamics, investment trends, and future growth trajectories. Discover actionable strategies for navigating one of the world's most significant and evolving real estate sectors, from office towers to logistics hubs. This report analyzes key segments including Office, Retail, Industrial (Logistics), and Hospitality, identifying opportunities for investors, developers, and stakeholders.

China Commercial Real Estate Industry Market Dynamics & Concentration

The China commercial real estate market exhibits a moderate to high concentration, with a few major developers dominating significant portions of the market share. Innovation drivers are primarily centered around sustainable development, smart building technologies, and the integration of mixed-use spaces to cater to evolving urban lifestyles. Regulatory frameworks, while becoming more structured, continue to influence market access, foreign investment, and development standards, with recent policies aiming to stabilize the property market. Product substitutes, such as the rise of co-working spaces and e-commerce impacting retail footprints, are compelling traditional players to adapt. End-user trends are increasingly focused on experiential retail, flexible office solutions, and efficient logistics infrastructure driven by a burgeoning digital economy. Mergers and acquisition (M&A) activities remain a key strategy for consolidation and market expansion, with an estimated XXX major deals in the historical period. Notable M&A activities and strategic partnerships are reshaping the competitive landscape.

China Commercial Real Estate Industry Industry Trends & Analysis

The China commercial real estate industry is poised for significant growth, driven by rapid urbanization, a burgeoning middle class, and continued economic expansion. The market is projected to experience a Compound Annual Growth Rate (CAGR) of XX% over the forecast period of 2025–2033. Technological disruptions, including the adoption of AI in property management, the integration of IoT for smart buildings, and the rise of PropTech solutions, are fundamentally transforming how commercial properties are designed, managed, and utilized. Consumer preferences are shifting towards sustainable and green buildings, flexible workspace solutions that cater to hybrid work models, and experiential retail environments that offer more than just transactional shopping. The competitive dynamics are intensifying, with established players like China Aoyuan Group Ltd, Longfor, CapitaLand, Wanda Group, China Resources Land Limited, Sun Hung Kai Properties Limited, Henderson Land Development Company Limited, Greenland Business Group, Wharf Real Estate Investment Company Limited, and Prologis adapting their strategies to capture market share. Emerging players and specialized funds are also making their mark, particularly in niche sectors like logistics and data centers. Market penetration for advanced building technologies and sustainable practices is steadily increasing, driven by both regulatory mandates and market demand.

Leading Markets & Segments in China Commercial Real Estate Industry

The Office segment continues to be a dominant force within the China commercial real estate industry, driven by the nation's robust economic growth and the presence of major corporate hubs. Key drivers for its dominance include favorable economic policies that encourage business establishment and expansion, significant infrastructure development in tier-1 and tier-2 cities, and a growing demand for high-quality, flexible office spaces. The Pearl River Delta and Yangtze River Delta regions, encompassing cities like Shanghai, Beijing, Shenzhen, and Guangzhou, represent the leading markets, attracting substantial investment and talent. While the Retail segment faces evolving consumer habits with the rise of e-commerce, it remains critical, with a growing emphasis on experiential retail and mixed-use developments that integrate shopping with entertainment and lifestyle amenities. The Industrial (Logistics) segment is experiencing unprecedented growth, fueled by the rapid expansion of e-commerce, a complex global supply chain, and the demand for efficient warehousing and distribution networks. Government support for advanced manufacturing and technological innovation further bolsters this sector. The Hospitality segment is recovering and adapting, with a focus on diversified offerings catering to both business and leisure travelers, and an increasing demand for branded residences and serviced apartments.

China Commercial Real Estate Industry Product Developments

Product innovations in China's commercial real estate sector are increasingly focused on sustainability, technology integration, and user experience. Developers are prioritizing green building certifications, energy-efficient designs, and the incorporation of smart technologies such as IoT sensors for building management, advanced security systems, and intelligent climate control. The rise of flexible office solutions, including co-working spaces and adaptable layouts, addresses the evolving needs of businesses. Mixed-use developments are gaining traction, seamlessly blending residential, retail, office, and hospitality components to create vibrant urban ecosystems. These developments offer competitive advantages by providing convenience, enhanced amenity offerings, and a higher quality of life for occupants, while also appealing to investors seeking diversified income streams.

Key Drivers of China Commercial Real Estate Industry Growth

Several key factors are propelling the growth of China's commercial real estate industry. Economically, rapid urbanization and the expansion of the middle class continue to fuel demand for various commercial property types. Technologically, advancements in PropTech, smart building solutions, and sustainable construction methods are enhancing property value and operational efficiency. Regulatory frameworks, while evolving, are increasingly supportive of foreign investment and the development of high-quality, sustainable assets. Government initiatives promoting economic development and urban renewal also play a significant role.

Challenges in the China Commercial Real Estate Industry Market

Despite strong growth potential, the China commercial real estate market faces several challenges. Regulatory hurdles and evolving property laws can create uncertainty for investors and developers. Supply chain disruptions and rising construction material costs can impact project timelines and profitability. Intense competitive pressures from both domestic and international players require continuous innovation and strategic differentiation. Furthermore, market volatility and shifts in consumer demand necessitate agility and a keen understanding of evolving end-user needs. The estimated impact of these challenges on market growth is approximately XX%.

Emerging Opportunities in China Commercial Real Estate Industry

Emerging opportunities in China's commercial real estate market are driven by several catalysts. Technological breakthroughs in artificial intelligence and big data analytics are enabling more efficient property management and investment strategies. Strategic partnerships between developers, technology providers, and financial institutions are unlocking new avenues for growth and innovation. Market expansion into new and emerging cities, alongside the revitalization of older urban areas, presents significant potential. The growing demand for specialized assets, such as logistics and warehousing facilities, data centers, and green buildings, offers lucrative investment prospects for astute investors.

Leading Players in the China Commercial Real Estate Industry Sector

- China Aoyuan Group Ltd

- Longfor

- CapitaLand

- Wanda Group

- China Resources Land Limited

- Sun Hung Kai Properties Limited

- Henderson Land Development Company Limited

- Greenland Business Group

- Wharf Real Estate Investment Company Limited

- Prologis

- Seazen Holdings Co Ltd

- Powerlong Real Estate Holdings Limited

Key Milestones in China Commercial Real Estate Industry Industry

- May 2023: The Beijing Suning Life Plaza mixed-use complex was purchased from Suning for approximately USD 400 million by CapitaLand Investment Private Fund, with assistance from Cushman & Wakefield's Greater China Capital Markets division. This transaction highlights continued investor confidence in prime mixed-use assets.

- April 2023: AIA invested US$1.3 billion into a Shanghai office-retail complex, and Ping An paid about US$7 billion for industrial and office assets in Shanghai and Beijing. These substantial investments by insurers underscore the enduring appeal of mainland China properties as an attractive asset class, even amidst a property market downturn.

Strategic Outlook for China Commercial Real Estate Industry Market

The strategic outlook for China's commercial real estate market remains robust, characterized by a continued focus on sustainable development, technological integration, and the creation of resilient, mixed-use environments. Future market potential lies in capitalizing on the ongoing urbanization trends, the evolving demands of a digitally connected population, and the government's commitment to high-quality economic growth. Strategic opportunities include further investment in advanced logistics infrastructure to support supply chain efficiency, the development of smart and green buildings to meet environmental standards and tenant preferences, and the expansion into emerging cities with significant growth potential. Collaboration between public and private sectors will be crucial in navigating regulatory landscapes and fostering innovation for long-term market success.

China Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial (Logistics)

- 1.4. Hospitality

China Commercial Real Estate Industry Segmentation By Geography

- 1. China

China Commercial Real Estate Industry Regional Market Share

Geographic Coverage of China Commercial Real Estate Industry

China Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Foreign Investments driving the market; Implementation of government policies driving the market

- 3.3. Market Restrains

- 3.3.1. Oversupply of commercial real estate; Increasing property prices affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Technology and Innovation Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial (Logistics)

- 5.1.4. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Aoyuan Group Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Longfor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CapitaLand

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wanda Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Resources Land Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sun Hung Kai Properties Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Henderson Land Development Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Greenland Business Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wharf Real Estate Investment Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prologis**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Seazen Holdings Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Powerlong Real Estate Holdings Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 China Aoyuan Group Ltd

List of Figures

- Figure 1: China Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: China Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Commercial Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: China Commercial Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Commercial Real Estate Industry?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the China Commercial Real Estate Industry?

Key companies in the market include China Aoyuan Group Ltd, Longfor, CapitaLand, Wanda Group, China Resources Land Limited, Sun Hung Kai Properties Limited, Henderson Land Development Company Limited, Greenland Business Group, Wharf Real Estate Investment Company Limited, Prologis**List Not Exhaustive, Seazen Holdings Co Ltd, Powerlong Real Estate Holdings Limited.

3. What are the main segments of the China Commercial Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Foreign Investments driving the market; Implementation of government policies driving the market.

6. What are the notable trends driving market growth?

Technology and Innovation Driving the Market.

7. Are there any restraints impacting market growth?

Oversupply of commercial real estate; Increasing property prices affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

May 2023: The Beijing Suning Life Plaza mixed-use complex was recently purchased from Suning for about USD 400 million by CapitaLand Investment Private Fund with the help of Cushman & Wakefield's Greater China Capital Markets division.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the China Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence