Key Insights

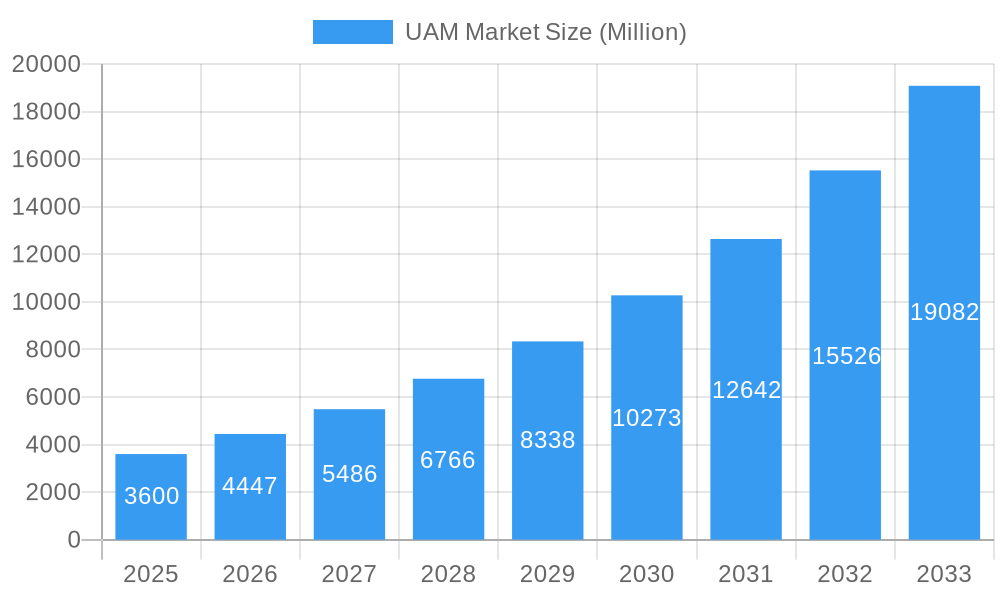

The Urban Air Mobility (UAM) market is poised for explosive growth, projected to reach a substantial market size, driven by increasing urbanization, traffic congestion, and the need for efficient transportation solutions. The 23.54% CAGR from 2019 to 2024 indicates a rapidly expanding market, with a forecasted continued expansion through 2033. Key drivers include advancements in electric vertical takeoff and landing (eVTOL) aircraft technology, supportive government regulations and investments, and growing demand for passenger transport and cargo delivery in congested urban areas. The segmentation of the market into piloted and autonomous vehicles, along with diverse applications like passenger transport and freight, indicates a diverse and dynamic market landscape. Leading players like Boeing, Airbus, and Textron are actively involved in developing and commercializing UAM solutions, further fueling market growth. While challenges remain, such as establishing robust safety regulations, addressing infrastructure requirements, and navigating public acceptance, the overall market trajectory suggests significant opportunities for innovation and investment.

UAM Market Market Size (In Billion)

Technological advancements are expected to play a critical role in shaping the future of UAM. The development of safer, more efficient, and cost-effective eVTOL aircraft, along with improvements in air traffic management systems and battery technology, are crucial for the widespread adoption of UAM. The competitive landscape is highly dynamic, with established aerospace companies and innovative startups vying for market share. Strategic partnerships, mergers, and acquisitions are likely to become increasingly common as companies strive to consolidate their positions and accelerate product development. The geographical distribution of the market is likely to be diverse, with North America and Europe leading initially due to advanced technological infrastructure and regulatory frameworks. However, rapidly developing economies in the Asia-Pacific region are expected to experience significant growth in the coming years, driven by rising urban populations and increasing disposable incomes.

UAM Market Company Market Share

This in-depth report provides a comprehensive analysis of the Urban Air Mobility (UAM) market, encompassing market dynamics, industry trends, leading players, and future opportunities. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and anyone seeking to understand the rapidly evolving UAM landscape. The market is projected to reach xx Million by 2033, presenting significant growth opportunities.

UAM Market Market Dynamics & Concentration

The UAM market is characterized by intense competition among established aerospace giants and innovative startups. Market concentration is currently moderate, with several key players holding significant shares, but the landscape is rapidly evolving due to ongoing mergers and acquisitions (M&A). Innovation is a primary driver, with companies continuously developing advanced technologies, such as electric vertical take-off and landing (eVTOL) aircraft and autonomous flight systems. Regulatory frameworks, still in their nascent stages in many regions, significantly impact market growth. Product substitutes, primarily traditional transportation methods, pose a challenge, but the unique value proposition of UAM, particularly in terms of speed and efficiency, is driving adoption. End-user trends favor increased demand for passenger transport, followed by freighter applications.

- Market Share: Leading players hold approximately xx% of the market share collectively, while fragmented smaller companies occupy the remaining xx%.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, indicating significant consolidation efforts. This trend is expected to continue, particularly as the market matures.

- Innovation Drivers: Advancements in battery technology, autonomous flight systems, and air traffic management (ATM) solutions are major drivers of innovation.

- Regulatory Frameworks: The development of standardized regulations and certification processes will be crucial for fostering market growth and ensuring safety.

UAM Market Industry Trends & Analysis

The Urban Air Mobility (UAM) market is poised for exponential growth, driven by a confluence of transformative societal and technological forces. Our analysis forecasts a robust Compound Annual Growth Rate (CAGR) of approximately XX% for the period between 2025 and 2033. This impressive trajectory is primarily fueled by the relentless march of urbanization, creating an urgent need for more efficient and sustainable urban transportation networks. Furthermore, ongoing advancements in aviation technology, particularly in the realm of electric and autonomous flight, are reshaping the very fabric of mobility.

Consumers are increasingly seeking alternatives that are not only convenient and time-saving but also environmentally conscious. This growing preference for sustainable solutions is a significant catalyst for UAM adoption. The competitive landscape is characterized by intense innovation and strategic alliances, as leading companies vie for market dominance through pioneering product development, strategic collaborations, and cutting-edge technological integrations. While current market penetration is in its nascent stages, a significant surge in adoption is anticipated as the essential infrastructure and regulatory frameworks mature and become more widespread.

Leading Markets & Segments in UAM Market

North America currently spearheads the global UAM market, a leadership position bolstered by proactive governmental support, substantial investments in research and development, and the presence of a well-established ecosystem of key industry players. Simultaneously, Europe and the Asia-Pacific region are emerging as dynamic and rapidly growing centers for UAM innovation and deployment, presenting significant future expansion opportunities.

Vehicle Type:

- Piloted: While piloted eVTOL aircraft currently represent a larger share of the market, the future trajectory strongly favors the autonomous segment. The continuous advancements in artificial intelligence and sophisticated sensor technology are paving the way for fully autonomous UAM operations.

- Autonomous: The burgeoning autonomous UAM segment is being propelled by groundbreaking developments in flight control systems, robust AI-driven navigation, and stringent safety protocols that are designed to ensure passenger and public safety in complex urban airspace.

Application:

- Passenger Transport: This remains the dominant application, driven by the unyielding demand for faster, more efficient, and less congested urban commuting solutions. UAM promises to revolutionize how people navigate their cities.

- Freighter: Although presently a smaller segment, the UAM freighter market is set for significant expansion. Its potential is particularly evident in specialized applications such as rapid last-mile delivery of goods, time-sensitive logistics, and the secure transport of high-value or sensitive cargo.

Key Drivers:

- Economic Policies: Governments worldwide are increasingly recognizing the strategic importance of UAM and are actively implementing supportive economic policies, including lucrative incentives, grants, and funding programs to accelerate market development and innovation.

- Infrastructure: The realization of UAM's full potential is intrinsically linked to the development of robust infrastructure. This includes the strategic deployment of vertiports, advanced air traffic management systems tailored for low-altitude operations, and charging or refueling facilities, all crucial for enabling widespread market adoption.

UAM Market Product Developments

The current landscape of UAM product development is characterized by an intense focus on pushing the boundaries of technological innovation and adapting to evolving market demands. Manufacturers are actively developing and refining sophisticated electric Vertical Take-Off and Landing (eVTOL) aircraft, integrating next-generation battery technologies for extended range and faster charging, enhanced safety systems that surpass current aviation standards, and increasingly advanced autonomous flight control capabilities. Beyond traditional passenger transport, innovative applications are rapidly emerging, including expedited cargo delivery networks, vital emergency medical services with rapid response capabilities, and a diverse range of specialized aerial operations tailored to specific industry needs. The competitive environment is highly dynamic, with companies differentiating their offerings through superior performance metrics, innovative design aesthetics, and the seamless integration of cutting-edge technologies.

Key Drivers of UAM Market Growth

The transformative growth of the UAM market is being propelled by a powerful synergy of interconnected factors:

- Technological Advancements: Continuous breakthroughs in critical areas such as lightweight and high-density battery technology, efficient electric propulsion systems, and sophisticated autonomous flight control algorithms are fundamental to realizing practical, safe, and economically viable UAM vehicles.

- Economic Factors: The escalating demand for more efficient and time-saving urban transportation solutions, coupled with the projected cost-effectiveness of UAM compared to traditional, ground-based transit in congested urban environments, is a significant driver for market expansion.

- Regulatory Support: The establishment of clear, supportive, and adaptive regulatory frameworks and policies by aviation authorities is paramount. These regulatory advancements are essential for fostering innovation, ensuring operational safety, and ultimately enabling the widespread deployment and acceptance of UAM services.

Challenges in the UAM Market Market

The UAM market faces several challenges:

- Regulatory hurdles: The lack of standardized regulations and certification processes can hinder market entry and adoption.

- Supply chain issues: The procurement of components and materials for UAM vehicles can pose a significant challenge, particularly considering the complexities of the technology.

- Competitive pressures: The market is highly competitive, with both established players and innovative startups vying for market share, creating intense pressure on pricing and profitability.

Emerging Opportunities in UAM Market

The UAM market presents significant long-term growth opportunities driven by continuous technological advancements, increasing urban density, and the potential for wide-scale adoption. Strategic partnerships between companies across various sectors, including aerospace, technology, and infrastructure, further foster market expansion. Expansion into new markets globally holds further opportunities.

Leading Players in the UAM Market Sector

- Textron Inc

- Hyundai Motor Group

- Joby Aero Inc

- Honeywell International Inc

- Jaunt Air Mobility Corporation

- Airbus SE

- Karem Aircraft Inc

- Guangzhou EHang Intelligent Technology Co Lt

- Safran SA

- PIPISTREL d o o

- Volocopter GmbH

- Embraer SA

- Opener Inc

- The Boeing Company

Key Milestones in UAM Market Industry

- August 2022: Geely Aerofugia unveiled a full-size demonstrator of its innovative TF-2, a five-seater eVTOL aircraft, marking a significant step in showcasing their design and engineering capabilities.

- January 2023: Geely Aerofugia successfully completed the test flight of its prototype flying car, the AE200, demonstrating progress in integrating eVTOL technology with ground-based mobility.

- February 2022: Eve UAM LLC, in collaboration with Skyports Pte Ltd and other key partners, actively engaged in developing a comprehensive Concept of Operations (CONOPS) for Advanced Air Mobility (AAM) in Japan, laying crucial groundwork for future operations.

Strategic Outlook for UAM Market Market

The UAM market shows immense potential for future growth, driven by the convergence of technological advancements and increasing demand for innovative transportation solutions. Strategic opportunities include expanding into new geographic markets, developing innovative business models, and establishing strategic partnerships to leverage complementary capabilities and expertise. The market is poised for significant expansion in the coming decade, presenting significant opportunities for investors and industry players.

UAM Market Segmentation

-

1. Vehicle Type

- 1.1. Piloted

- 1.2. Autonomous

-

2. Application

- 2.1. Passenger Transport

- 2.2. Freighter

UAM Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

UAM Market Regional Market Share

Geographic Coverage of UAM Market

UAM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Autonomous Segment is Projected to Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAM Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Piloted

- 5.1.2. Autonomous

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger Transport

- 5.2.2. Freighter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America UAM Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Piloted

- 6.1.2. Autonomous

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger Transport

- 6.2.2. Freighter

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe UAM Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Piloted

- 7.1.2. Autonomous

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger Transport

- 7.2.2. Freighter

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific UAM Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Piloted

- 8.1.2. Autonomous

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger Transport

- 8.2.2. Freighter

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Latin America UAM Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Piloted

- 9.1.2. Autonomous

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger Transport

- 9.2.2. Freighter

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa UAM Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Piloted

- 10.1.2. Autonomous

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Passenger Transport

- 10.2.2. Freighter

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai Motor Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Joby Aero Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jaunt Air Mobility Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airbus SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Karem Aircraft Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Guangzhou EHang Intelligent Technology Co Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Safran SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PIPISTREL d o o

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Volocopter GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Embraer SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Opener Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 The Boeing Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global UAM Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Latin America UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Latin America UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East and Africa UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East and Africa UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa UAM Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global UAM Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAM Market?

The projected CAGR is approximately 23.54%.

2. Which companies are prominent players in the UAM Market?

Key companies in the market include Textron Inc, Hyundai Motor Group, Joby Aero Inc, Honeywell International Inc, Jaunt Air Mobility Corporation, Airbus SE, Karem Aircraft Inc, Guangzhou EHang Intelligent Technology Co Lt, Safran SA, PIPISTREL d o o, Volocopter GmbH, Embraer SA, Opener Inc, The Boeing Company.

3. What are the main segments of the UAM Market?

The market segments include Vehicle Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Autonomous Segment is Projected to Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023, Geely Aerofugia, a subsidiary of the Chinese automaker Geely, announced that it completed the test flight of its prototype flying car AE200, taking a step closer to its goal of delivering electric vertical take-off and landing (eVTOL) vehicles to market. This company first unveiled a full-size demonstrator for its TF-2 five-seater eVTOL in August 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAM Market?

To stay informed about further developments, trends, and reports in the UAM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence