Key Insights

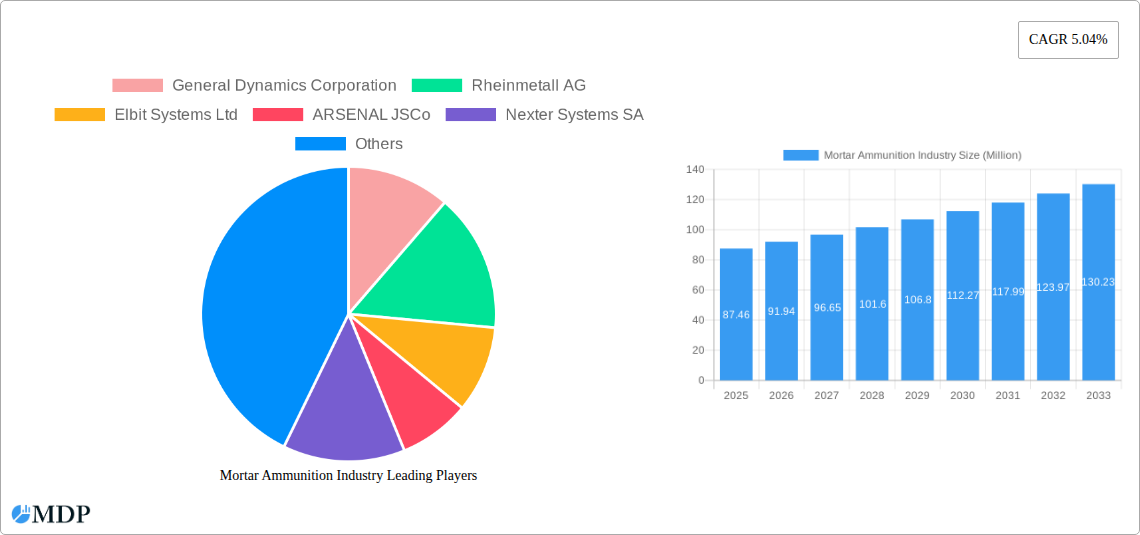

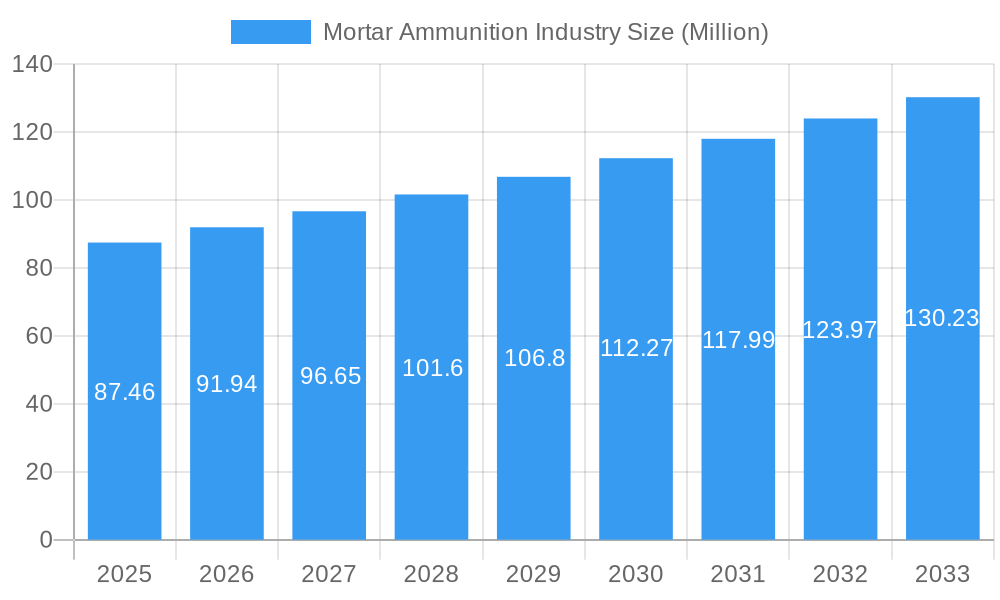

The global mortar ammunition market is poised for robust growth, projected to reach an estimated USD 87.46 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.04% during the forecast period of 2025-2033. This expansion is fueled by a confluence of geopolitical factors, increasing defense spending across key regions, and the continuous need for modern and effective indirect fire support systems by armed forces worldwide. The market is characterized by ongoing advancements in mortar shell technology, including enhanced precision, extended range, and the integration of smart fuzes for improved target engagement capabilities. These innovations are critical for military operations requiring adaptability and accuracy in diverse combat environments. The demand for mortar ammunition is intrinsically linked to global security imperatives, including counter-terrorism operations, regional conflicts, and the modernization of national defense arsenals.

Mortar Ammunition Industry Market Size (In Million)

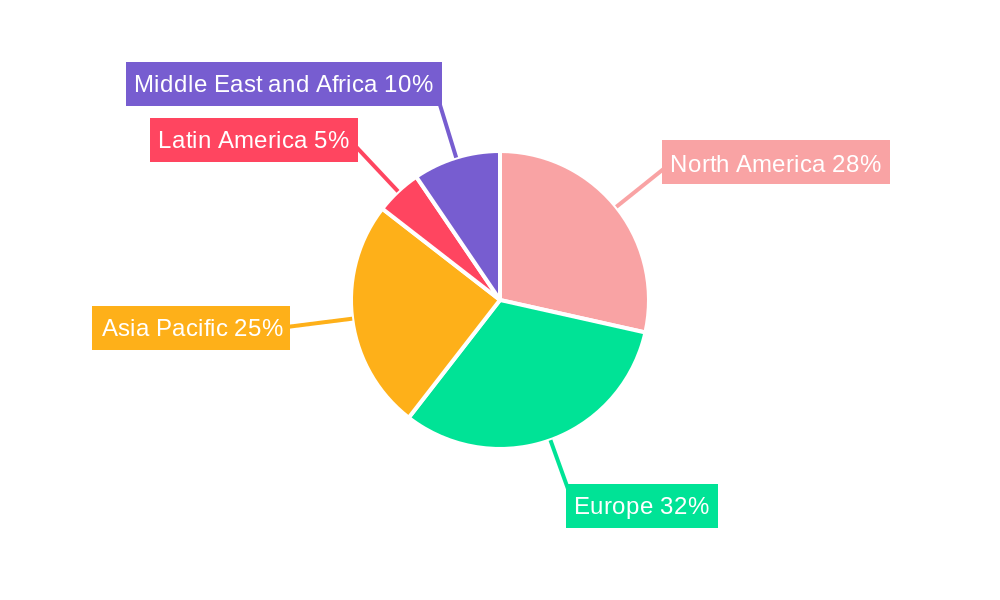

The market's growth trajectory is further shaped by evolving operational doctrines and the increasing adoption of advanced artillery systems by major global powers. The segmentation by caliber type – Light, Medium, and Heavy – highlights varying demands based on tactical requirements and platform integration. While specific drivers and restraints were not detailed, it can be logically inferred that escalating regional tensions, the ongoing threat landscape, and the cyclical nature of defense procurement are significant growth catalysts. Conversely, budget constraints, the development of alternative battlefield technologies, and stringent regulatory frameworks governing arms exports could present moderating influences. Leading global defense manufacturers such as General Dynamics Corporation, Rheinmetall AG, and BAE Systems PLC are at the forefront of innovation and supply, catering to the diverse needs of the international market. Regional dynamics, with North America and Europe expected to maintain significant market shares due to established defense industries and active military engagements, will be crucial in shaping the overall market performance.

Mortar Ammunition Industry Company Market Share

Dive deep into the dynamic Mortar Ammunition Industry with our latest, in-depth market analysis. This report provides crucial insights for industry stakeholders, defense contractors, government agencies, and investors navigating the global landscape of mortar systems and their vital ammunitions. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report offers detailed forecasts and historical data, ensuring you have the most up-to-date intelligence. Explore market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and the strategic outlook of this critical defense sector.

Mortar Ammunition Industry Market Dynamics & Concentration

The global Mortar Ammunition Industry exhibits a moderate to high market concentration, with a few dominant players controlling significant market share. Key innovation drivers include the ongoing modernization of defense forces worldwide, the demand for enhanced precision-guided munitions, and advancements in propellants and fusing technologies. Regulatory frameworks, particularly export controls and national defense procurement policies, significantly influence market access and growth. Product substitutes, such as advanced artillery systems, pose a limited threat due to the distinct tactical roles and cost-effectiveness of mortar systems. End-user trends are characterized by increasing demand for lightweight, man-portable mortars for special operations and asymmetric warfare scenarios, alongside a continued need for heavy caliber ammunition for sustained indirect fire support. Mergers and acquisitions (M&A) are strategic tools for consolidation and technology acquisition. While specific M&A deal counts vary annually, the trend indicates a drive towards enhancing production capacity and expanding product portfolios. For instance, General Dynamics Corporation and Rheinmetall AG often lead in strategic acquisitions to bolster their defense offerings. The market share distribution is dynamic, with major defense manufacturers holding substantial portions based on their production capabilities and existing defense contracts.

Mortar Ammunition Industry Industry Trends & Analysis

The Mortar Ammunition Industry is experiencing robust growth, driven by escalating geopolitical tensions and a global surge in defense spending. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be approximately 5.8% from 2025 to 2033. This growth is underpinned by several key market expansion drivers. Foremost among these is the continuous need for modernizing armed forces, particularly in response to evolving threat landscapes and the requirement for effective indirect fire support capabilities. Technological disruptions are playing a pivotal role, with innovations in precision-guided mortar munitions (PGMs) offering enhanced accuracy and reduced collateral damage, thereby increasing their appeal for modern warfare. Developments in smart fusing, advanced explosives, and eco-friendlier propellant formulations are also shaping the industry. Consumer preferences, driven by military end-users, are shifting towards lighter, more portable systems for infantry units and special forces, as well as specialized ammunition for urban combat and counter-insurgency operations. Simultaneously, the demand for heavy-caliber ammunition for sustained battlefield support remains strong. Competitive dynamics are intense, with established defense giants vying for lucrative government contracts. Market penetration is high in developed nations with advanced defense infrastructures, but significant growth potential exists in emerging economies undergoing military modernization. The strategic importance of maintaining secure and diversified supply chains for critical defense materiel is also a paramount trend influencing industry strategies and investment.

Leading Markets & Segments in Mortar Ammunition Industry

The Heavy caliber segment dominates the Mortar Ammunition Industry, largely driven by its crucial role in providing sustained indirect fire support for large-scale military operations. This dominance is further amplified by the North American market, which consistently represents the largest regional segment. Key drivers for this regional and segmental dominance include:

- Robust Defense Budgets and Modernization Programs: Nations like the United States maintain significant defense expenditures, funding continuous upgrades and procurement of heavy mortar ammunition to maintain operational superiority and address evolving threats.

- Extensive Military Infrastructure and Training: The presence of well-established military bases, extensive training exercises, and large standing armies in North America necessitate a substantial and readily available supply of heavy mortar rounds for effective force projection and combat readiness.

- Technological Advancement and R&D Investment: Leading companies based in North America, such as General Dynamics Corporation, are at the forefront of developing advanced heavy mortar ammunition, including precision-guided variants, further solidifying their market leadership.

- Geopolitical Imperatives and Global Security Commitments: The strategic importance of maintaining a strong deterrence posture and engaging in multinational security operations often requires the deployment of heavy artillery and mortar systems, thus driving demand for corresponding ammunition.

- Economic Policies Supporting Domestic Defense Manufacturing: Favorable government policies that encourage domestic production and R&D in the defense sector ensure a stable supply chain and foster innovation within the heavy mortar ammunition segment in North America.

While light and medium caliber mortars are crucial for different tactical scenarios, the sheer volume and strategic necessity of heavy caliber ammunition in conventional warfare and large-scale deployments solidify its leading position within the global Mortar Ammunition Industry.

Mortar Ammunition Industry Product Developments

Product developments in the Mortar Ammunition Industry are heavily focused on enhancing lethality, precision, and operational effectiveness. Innovations include the integration of advanced fusing systems for variable impact and proximity detonation, alongside improvements in warhead design for increased penetration and blast effects. Precision-guided mortar projectiles (PGMPs) are a significant trend, offering unparalleled accuracy and reduced collateral damage, a key competitive advantage in modern combat theaters. Furthermore, there's a growing emphasis on developing smart ammunition that can communicate with command systems for real-time targeting adjustments. The market fit for these advancements is evident in the increasing demand for cost-effective precision munitions that minimize logistical footprints while maximizing tactical impact.

Key Drivers of Mortar Ammunition Industry Growth

Several key factors are propelling the growth of the Mortar Ammunition Industry. Geopolitical instability and ongoing conflicts worldwide are primary accelerators, necessitating robust defense spending and replenishment of existing ammunition stocks. Technological advancements, particularly in precision-guided munitions (PGMs) and smart fusing, are driving demand for more sophisticated and effective ammunition solutions. Government initiatives to modernize military arsenals and enhance national defense capabilities also play a crucial role. Furthermore, the increasing prevalence of asymmetric warfare and urban combat scenarios highlights the enduring tactical value of mortar systems and their associated ammunition, driving a consistent demand.

Challenges in the Mortar Ammunition Industry Market

The Mortar Ammunition Industry faces several significant challenges. Stringent and complex international regulatory frameworks, including export controls and arms embargoes, can hinder market access and create logistical hurdles. Supply chain disruptions, exacerbated by geopolitical events and the reliance on specialized raw materials, pose a continuous threat to production timelines and cost stability. The high cost of research and development for advanced munitions, coupled with fluctuating government defense budgets, can impact investment decisions. Moreover, intense competition among a concentrated number of established players and the emergence of new market entrants can exert downward pressure on pricing and profit margins, requiring companies to constantly innovate and optimize production.

Emerging Opportunities in Mortar Ammunition Industry

Emerging opportunities in the Mortar Ammunition Industry are being catalyzed by several factors. The ongoing global push for military modernization and the perceived need for enhanced defense capabilities in an uncertain geopolitical climate present significant growth potential. Technological breakthroughs in areas such as additive manufacturing for rapid prototyping and production, as well as the development of more environmentally friendly propellants, offer avenues for innovation and cost reduction. Strategic partnerships and collaborations between established defense contractors and technology firms are opening new markets and enabling the development of next-generation mortar ammunition systems. Furthermore, increasing defense spending in emerging economies undergoing military upgrades presents a substantial opportunity for market expansion.

Leading Players in the Mortar Ammunition Industry Sector

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- ARSENAL JSCo

- Nexter Systems SA

- Hanwha Corporation

- Denel SOC Ltd

- BAE Systems PLC

- Hirtenberger Defence Systems GmbH & Co KG

- Nammo AS

- Singapore Technologies Engineering Ltd

- Mechanical and Chemical Industry Company (MKEK)

- Saab AB

Key Milestones in Mortar Ammunition Industry Industry

- April 2024: Rheinmetall was awarded a significant contract by Spanish authorities to supply 104,000 mortar projectiles in various caliber sizes (60 mm, 81 mm, and 120 mm), with delivery anticipated by the end of 2025, highlighting a substantial increase in order volumes for key European defense contractors.

- November 2023: Rheinmetall received a critical order from the German government to supply Ukraine with approximately 100,000 rounds of 120 mm mortar ammunition. This order, part of a broader EUR 400 million military aid package, underscores the ongoing demand for mortar munitions in active conflict zones and the direct impact of geopolitical events on market dynamics.

Strategic Outlook for Mortar Ammunition Industry Market

The strategic outlook for the Mortar Ammunition Industry remains exceptionally strong, driven by sustained global defense spending and the critical need for modern, effective indirect fire support. The industry is poised for continued growth, with a focus on innovation in precision-guided munitions and smart technologies. Companies that can effectively navigate complex regulatory environments, secure robust supply chains, and invest in advanced manufacturing capabilities will be best positioned for success. Strategic alliances and an emphasis on meeting the evolving demands of military end-users, particularly in light of asymmetric threats and urban warfare, will be crucial growth accelerators. The long-term market potential is significant, fueled by ongoing geopolitical realignments and the persistent requirement for robust national defense.

Mortar Ammunition Industry Segmentation

-

1. Caliber Type

- 1.1. Light

- 1.2. Medium

- 1.3. Heavy

Mortar Ammunition Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Mortar Ammunition Industry Regional Market Share

Geographic Coverage of Mortar Ammunition Industry

Mortar Ammunition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Heavy Caliber Segment is Expected to Witness the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Caliber Type

- 5.1.1. Light

- 5.1.2. Medium

- 5.1.3. Heavy

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Caliber Type

- 6. North America Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Caliber Type

- 6.1.1. Light

- 6.1.2. Medium

- 6.1.3. Heavy

- 6.1. Market Analysis, Insights and Forecast - by Caliber Type

- 7. Europe Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Caliber Type

- 7.1.1. Light

- 7.1.2. Medium

- 7.1.3. Heavy

- 7.1. Market Analysis, Insights and Forecast - by Caliber Type

- 8. Asia Pacific Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Caliber Type

- 8.1.1. Light

- 8.1.2. Medium

- 8.1.3. Heavy

- 8.1. Market Analysis, Insights and Forecast - by Caliber Type

- 9. Latin America Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Caliber Type

- 9.1.1. Light

- 9.1.2. Medium

- 9.1.3. Heavy

- 9.1. Market Analysis, Insights and Forecast - by Caliber Type

- 10. Middle East and Africa Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Caliber Type

- 10.1.1. Light

- 10.1.2. Medium

- 10.1.3. Heavy

- 10.1. Market Analysis, Insights and Forecast - by Caliber Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Dynamics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rheinmetall AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elbit Systems Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ARSENAL JSCo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nexter Systems SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hanwha Corporatio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Denel SOC Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BAE Systems PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hirtenberger Defence Systems GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nammo AS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Singapore Technologies Engineering Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mechanical and Chemical Industry Company (MKEK)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Saab AB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Mortar Ammunition Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 3: North America Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 4: North America Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 7: Europe Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 8: Europe Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 11: Asia Pacific Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 12: Asia Pacific Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 15: Latin America Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 16: Latin America Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 19: Middle East and Africa Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 20: Middle East and Africa Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 2: Global Mortar Ammunition Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 4: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 8: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 14: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 21: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Mexico Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Latin America Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 25: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: United Arab Emirates Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Africa Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mortar Ammunition Industry?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Mortar Ammunition Industry?

Key companies in the market include General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, ARSENAL JSCo, Nexter Systems SA, Hanwha Corporatio, Denel SOC Ltd, BAE Systems PLC, Hirtenberger Defence Systems GmbH & Co KG, Nammo AS, Singapore Technologies Engineering Ltd, Mechanical and Chemical Industry Company (MKEK), Saab AB.

3. What are the main segments of the Mortar Ammunition Industry?

The market segments include Caliber Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.46 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Heavy Caliber Segment is Expected to Witness the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2024: Rheinmetall was awarded a contract by the Spanish authorities to supply 104,000 mortar projectiles in various caliber sizes, including 60 mm, 81 mm, and 120 mm, by the end of 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mortar Ammunition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mortar Ammunition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mortar Ammunition Industry?

To stay informed about further developments, trends, and reports in the Mortar Ammunition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence