Key Insights

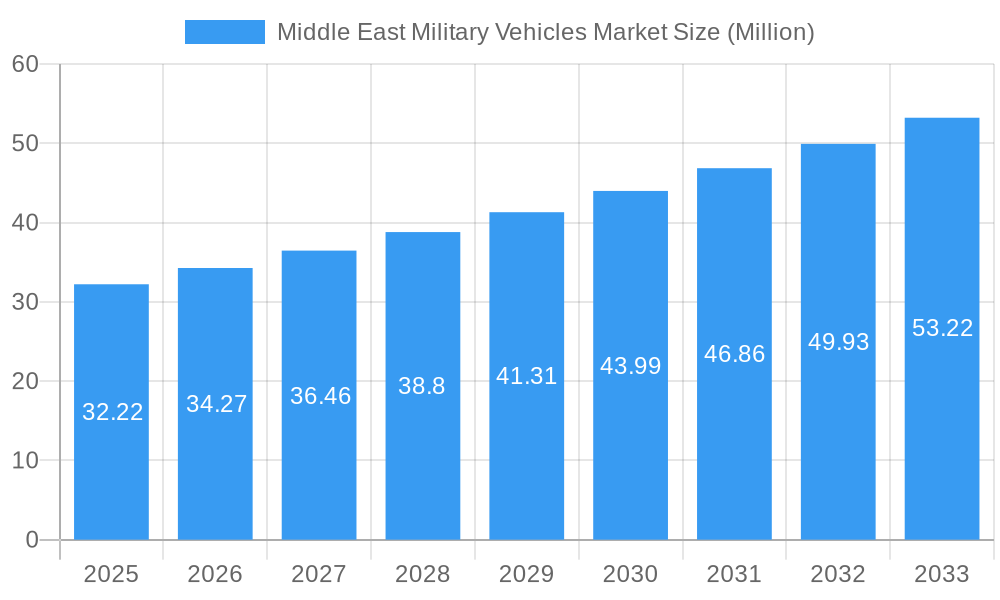

The Middle East Military Vehicles Market is poised for significant expansion, projected to reach approximately USD 32.22 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.30% anticipated throughout the forecast period of 2025-2033. This growth is fundamentally driven by escalating geopolitical tensions and the continuous need for enhanced national security across the region. Nations like Saudi Arabia and the United Arab Emirates are actively investing in modernizing their defense arsenals, prioritizing advanced armored personnel carriers, combat vehicles, and tactical support vehicles to counter evolving threats. The increasing adoption of smart technologies, including AI-powered targeting systems, advanced communication suites, and enhanced survivability features, is also a key trend shaping the market. Furthermore, the focus on domestic defense manufacturing and strategic partnerships is fostering a dynamic environment for both local and international players, stimulating innovation and the development of specialized defense solutions tailored to the unique operational environments of the Middle East.

Middle East Military Vehicles Market Market Size (In Million)

Despite the strong growth trajectory, the market faces certain restraints that could influence its pace. High procurement costs for sophisticated military vehicles, coupled with economic fluctuations and varying defense budgets across different nations, present a considerable challenge. The complex regulatory landscape and stringent import/export policies can also impede the seamless flow of advanced military hardware. Nevertheless, the unwavering commitment of Middle Eastern countries to bolstering their defense capabilities, evident in substantial budgetary allocations and strategic acquisitions, is expected to outweigh these restraints. The market is segmented across production, consumption, import, export, and price trends, offering a comprehensive view of its intricate dynamics. Key industry players, including global giants and emerging regional manufacturers, are actively engaged in research and development, focusing on lighter, more agile, and technologically superior vehicles that can perform effectively in the diverse terrains of the Middle East, from arid deserts to urban environments.

Middle East Military Vehicles Market Company Market Share

Gain unparalleled insights into the dynamic Middle East Military Vehicles Market with our comprehensive report. This in-depth analysis, covering the period from 2019 to 2033, with a base and estimated year of 2025, provides crucial intelligence on market size, segmentation, competitive landscape, and future projections. Explore critical segments including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. This report is an essential resource for defense manufacturers, government procurement agencies, investors, and industry stakeholders seeking to understand and capitalize on the evolving defense procurement strategies and technological advancements in the region.

The Middle East military vehicles market is a high-growth sector driven by escalating geopolitical tensions, modernization programs, and significant defense spending across key nations. Our report delves into the intricacies of this market, offering data-backed projections and strategic recommendations.

Middle East Military Vehicles Market Dynamics & Concentration

The Middle East Military Vehicles Market is characterized by a moderate to high concentration, with a few dominant players holding significant market share, particularly in armored vehicles and advanced aerospace platforms. Innovation drivers are primarily fueled by the demand for advanced protection systems, enhanced mobility, networked warfare capabilities, and platform modernization to counter evolving threats. Regulatory frameworks are stringent, involving extensive vetting processes, localization requirements, and international arms embargoes that can influence procurement decisions. Product substitutes exist, particularly in niche segments, where older but functional platforms may be upgraded rather than replaced. End-user trends are increasingly focused on multi-role vehicles, unmanned systems integration, and vehicles with superior ISR (Intelligence, Surveillance, and Reconnaissance) capabilities. Mergers and acquisitions (M&A) activities, while less frequent than in some other mature defense markets, are strategically aimed at acquiring specialized technologies or expanding regional footprints. The estimated market share of key players varies significantly by sub-segment, with Oshkosh Corporation and BAE Systems plc holding strong positions in wheeled military vehicles, while companies like Dassault Aviation SA and Lockheed Martin Corporation lead in advanced aircraft. M&A deal counts are moderate, often involving technology acquisitions or joint ventures for local production.

Middle East Military Vehicles Market Industry Trends & Analysis

The Middle East Military Vehicles Market is experiencing robust growth, driven by a confluence of geopolitical imperatives and significant defense modernization initiatives across the region. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be a significant XX%, reflecting sustained demand for a wide array of military hardware. This growth is underpinned by escalating regional security concerns, including border protection, counter-terrorism operations, and power projection, which necessitate the procurement of sophisticated and versatile military vehicles. Technological disruptions are profoundly shaping the market, with an increasing emphasis on artificial intelligence (AI) integration for autonomous capabilities, advanced sensor technologies for enhanced situational awareness, and next-generation armor solutions for superior protection against modern threats. Consumer preferences, dictated by defense ministries and armed forces, are shifting towards multi-role platforms that offer flexibility and reduce logistical burdens. This includes a growing interest in modular designs that can be reconfigured for various mission profiles, from troop transport and reconnaissance to combat engineering and direct fire support. Furthermore, the demand for lightweight, high-mobility vehicles capable of operating in diverse terrains, from arid deserts to mountainous regions, remains a constant. The competitive dynamics are intensifying, with both established global defense giants and emerging regional manufacturers vying for lucrative contracts. Companies are increasingly forming strategic partnerships and joint ventures to leverage local manufacturing capabilities, comply with industrial participation requirements, and access new markets. The market penetration of advanced technologies, such as directed energy weapons and advanced electronic warfare systems integrated into military vehicles, is also on an upward trajectory. Cybersecurity for connected vehicles is becoming a critical consideration, further influencing procurement decisions and R&D efforts. The overall trend points towards a market that is not only expanding in volume but also rapidly advancing in technological sophistication.

Leading Markets & Segments in Middle East Military Vehicles Market

The Middle East Military Vehicles Market exhibits distinct leadership across various segments and geographies, driven by unique economic policies, infrastructure development, and strategic priorities.

Production Analysis: Saudi Arabia and the United Arab Emirates are emerging as significant hubs for military vehicle production, driven by Vision 2030 and similar national transformation plans aimed at diversifying economies and building domestic defense industrial capabilities. These nations are actively pursuing technology transfer agreements and local manufacturing initiatives.

Consumption Analysis: The primary consumers of military vehicles in the Middle East remain the core GCC nations, including Saudi Arabia, the UAE, and Qatar, alongside other key defense spenders like Israel and Egypt. Their high defense budgets and ongoing modernization programs fuel a consistent demand for a broad spectrum of vehicles.

Import Market Analysis (Value & Volume): The import market is dominated by the procurement of highly specialized and technologically advanced platforms, including main battle tanks, advanced armored personnel carriers, and sophisticated combat aircraft. Israel, Saudi Arabia, and the UAE consistently rank among the largest importers by value, driven by their strategic alliances and need for cutting-edge military hardware. The volume of imports is substantial, reflecting the scale of modernization efforts.

Export Market Analysis (Value & Volume): Turkey has established itself as a formidable exporter of armored vehicles, with companies like FNSS Savunma Sistemleri A Ş and BMC Otomotiv Sanayi ve Ticaret A Ş securing significant international orders. Its competitive pricing and ability to meet diverse requirements have propelled its export growth. Other nations are increasingly looking to develop their export capabilities for niche products.

Price Trend Analysis: Price trends are influenced by factors such as technological complexity, volume of order, contract duration, and localization commitments. Advanced, technologically superior vehicles command premium prices, while mass-produced armored personnel carriers tend to have more competitive pricing structures. Geopolitical events and global supply chain disruptions can also introduce volatility into price trends.

The dominance of certain segments, such as armored vehicles, is directly linked to the prevailing security threats and strategic doctrines of regional powers. Economic policies that encourage local content and defense industrialization are crucial drivers for manufacturing leadership. Infrastructure development, particularly in terms of testing grounds and manufacturing facilities, plays a vital role in supporting domestic production capabilities.

Middle East Military Vehicles Market Product Developments

Product development in the Middle East Military Vehicles Market is heavily influenced by the need for enhanced survivability, operational flexibility, and network-centric warfare capabilities. Key innovations focus on integrating advanced active protection systems (APS) and passive armor technologies for superior ballistic and mine protection. There is a growing emphasis on modular vehicle designs that allow for rapid reconfiguration to adapt to diverse mission requirements, from troop transport and reconnaissance to combat support and logistics. The integration of AI-powered systems for autonomous navigation, target recognition, and combat management is a significant trend. Furthermore, advancements in propulsion systems, hybrid electric drives, and lightweight materials are aimed at improving mobility, reducing fuel consumption, and enhancing the operational range of these vehicles. Cybersecurity features are also becoming integral to new product developments, safeguarding critical data and communication systems.

Key Drivers of Middle East Military Vehicles Market Growth

Several key drivers are propelling the growth of the Middle East Military Vehicles Market. Geopolitical instability and ongoing regional conflicts necessitate continuous modernization of armed forces, leading to increased defense spending and procurement of advanced military vehicles. Government initiatives promoting defense industrialization and indigenization, such as Saudi Arabia's Vision 2030, encourage local production and technology transfer, fostering market expansion. The demand for enhanced border security and counter-terrorism capabilities drives the acquisition of specialized armored vehicles. Furthermore, technological advancements in areas like artificial intelligence, advanced sensors, and active protection systems are creating new market opportunities for sophisticated and high-value platforms. Strategic alliances and international defense cooperation agreements also play a crucial role in shaping procurement decisions and driving market growth.

Challenges in the Middle East Military Vehicles Market Market

Despite robust growth, the Middle East Military Vehicles Market faces several challenges. Stringent regulatory frameworks and complex procurement processes can lead to lengthy acquisition cycles and potential delays. Geopolitical tensions and regional instability can create unpredictable demand patterns and complicate long-term planning. Supply chain disruptions, exacerbated by global events, can impact production schedules and increase costs for critical components. Intense competition among both established global players and emerging regional manufacturers also puts pressure on pricing and market share. Furthermore, the high cost of advanced military technologies and the need for extensive training and maintenance support present significant financial and logistical hurdles for some nations.

Emerging Opportunities in Middle East Military Vehicles Market

Emerging opportunities in the Middle East Military Vehicles Market are centered around technological innovation and strategic partnerships. The increasing demand for unmanned ground vehicles (UGVs) and autonomous systems presents a significant growth avenue, with potential applications in reconnaissance, logistics, and hazardous operations. Investments in upgrading existing fleets with modern sensor suites, communication systems, and defensive capabilities offer substantial opportunities for MRO (Maintenance, Repair, and Overhaul) providers and technology integrators. The growing emphasis on cybersecurity for connected military platforms is also creating a niche market for specialized solutions. Furthermore, countries are actively seeking opportunities for technology transfer and joint ventures to build domestic defense industrial capacities, fostering collaborations between international suppliers and local entities. The development of next-generation combat vehicles with enhanced survivability and network integration capabilities also represents a key area for future growth.

Leading Players in the Middle East Military Vehicles Market Sector

- Abu Dhabi Ship Building Co

- Dassault Aviation SA

- FNSS Savunma Sistemleri A Ş

- Oshkosh Corporation

- Lockheed Martin Corporation

- Rostec

- Airbus SE

- Naval Group

- Patria Group

- Fincantieri S p A

- Denel SOC Ltd

- Saudi Arabian Military Industries (SAMI)

- IAI

- BMC Otomotiv Sanayi ve Ticaret A Ş

- Leonardo S p A

- BAE Systems plc

- The Boeing Company

Key Milestones in Middle East Military Vehicles Market Industry

- October 2023: The Estonian Centre for Defence Investments awarded contracts to Turkish manufacturers Otokar and Nurol Makina to purchase roughly 230 armored vehicles for a total of about USD 211 million.

- June 2022: Israel awarded a USD 28 million contract to IAI for the purchase of hundreds of combat vehicles for the country’s special forces.

Strategic Outlook for Middle East Military Vehicles Market Market

The strategic outlook for the Middle East Military Vehicles Market remains highly positive, driven by sustained geopolitical imperatives and continuous defense modernization efforts. The market is expected to witness a significant surge in demand for advanced combat vehicles, including main battle tanks, infantry fighting vehicles, and armored personnel carriers, equipped with cutting-edge technologies such as AI, active protection systems, and enhanced C4ISR capabilities. Strategic partnerships and joint ventures between international defense manufacturers and regional entities will likely intensify, focusing on technology transfer and localized production to meet industrial participation goals. The growing emphasis on unmanned systems, including unmanned ground vehicles (UGVs) and armed drones, presents a significant growth accelerator, offering enhanced operational effectiveness and reduced risk to personnel. Furthermore, the market will see increased investments in upgrading existing platforms, creating a robust demand for MRO services and modernization solutions.

Middle East Military Vehicles Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East Military Vehicles Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Military Vehicles Market Regional Market Share

Geographic Coverage of Middle East Military Vehicles Market

Middle East Military Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Armored Vehicles Segment to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Military Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abu Dhabi Ship Building Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Aviation SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FNSS Savunma Sistemleri A Ş

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oshkosh Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rostec

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Airbus SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Naval Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Patria Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fincantieri S p A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Denel SOC Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Saudi Arabian Military Industries (SAMI)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 IAI

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 BMC Otomotiv Sanayi ve Ticaret A Ş

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Leonardo S p A

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 BAE Systems plc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 The Boeing Company

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Abu Dhabi Ship Building Co

List of Figures

- Figure 1: Middle East Military Vehicles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Military Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Military Vehicles Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East Military Vehicles Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East Military Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East Military Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East Military Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East Military Vehicles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East Military Vehicles Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East Military Vehicles Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East Military Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East Military Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East Military Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East Military Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Military Vehicles Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Middle East Military Vehicles Market?

Key companies in the market include Abu Dhabi Ship Building Co, Dassault Aviation SA, FNSS Savunma Sistemleri A Ş, Oshkosh Corporation, Lockheed Martin Corporation, Rostec, Airbus SE, Naval Group, Patria Group, Fincantieri S p A, Denel SOC Ltd, Saudi Arabian Military Industries (SAMI), IAI, BMC Otomotiv Sanayi ve Ticaret A Ş, Leonardo S p A, BAE Systems plc, The Boeing Company.

3. What are the main segments of the Middle East Military Vehicles Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.22 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Armored Vehicles Segment to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

In October 2023, the Estonian Centre for Defence Investments awarded contracts to Turkish manufacturers Otokar and Nurol Makina to purchase roughly 230 armored vehicles for a total of about USD 211 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Military Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Military Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Military Vehicles Market?

To stay informed about further developments, trends, and reports in the Middle East Military Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence