Key Insights

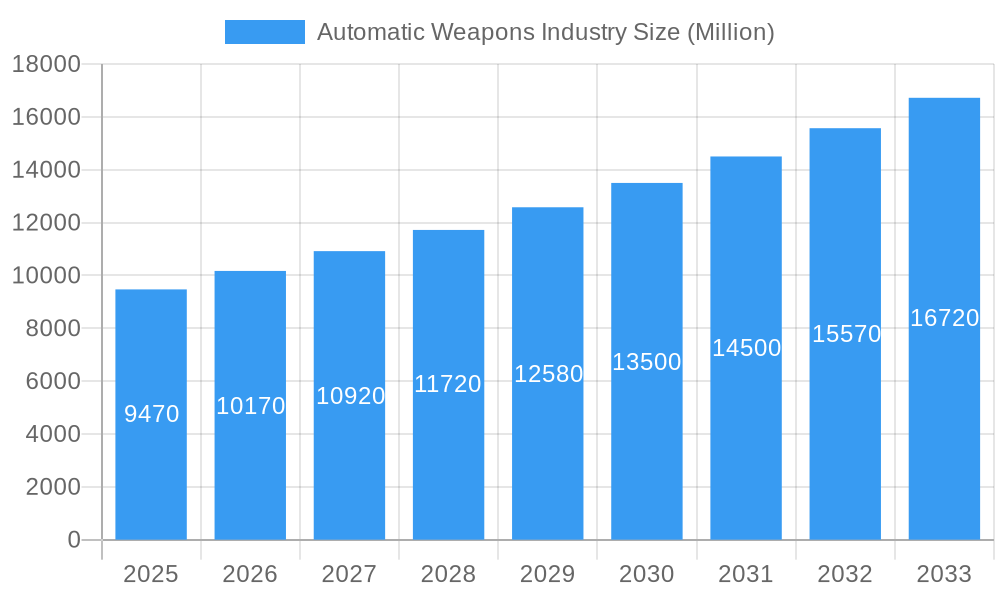

The global automatic weapons market is poised for significant expansion, projected to reach an estimated 9.47 billion USD by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.50% anticipated over the forecast period of 2025-2033. This growth is primarily fueled by escalating geopolitical tensions and an increasing demand for advanced defense capabilities across various regions. Nations are prioritizing the modernization of their military arsenals to counter emerging threats, driving investment in sophisticated automatic weapon systems. Key drivers include the continuous innovation in firearms technology, leading to the development of lighter, more accurate, and versatile weapons. The rising prevalence of asymmetric warfare and the need for effective crowd control measures also contribute to sustained market demand. Furthermore, technological advancements such as smart targeting systems, reduced recoil technology, and enhanced lethality are making modern automatic weapons more appealing to defense forces worldwide.

Automatic Weapons Industry Market Size (In Billion)

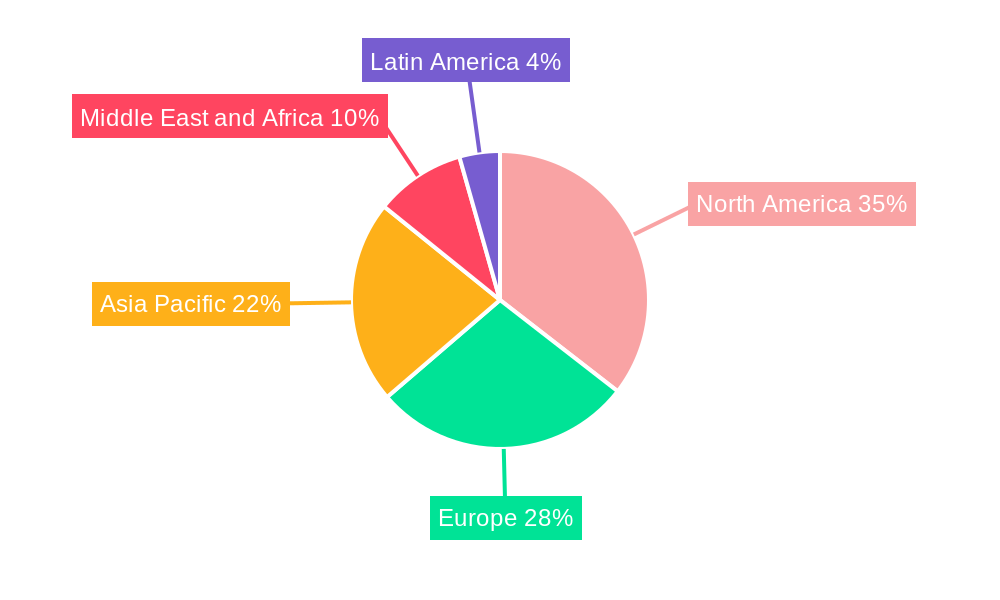

The market is segmented across diverse weapon types and platforms, reflecting the multifaceted nature of modern warfare. The "Type" segment includes Automatic Rifles, Machine Guns, Automatic Launchers, Automatic Cannons, and Gatling Guns, each catering to specific operational needs. Similarly, the "Platform" segment encompasses Land, Airborne, and Naval applications, highlighting the adaptability of these weapon systems. Geographically, North America, particularly the United States, is expected to lead the market due to substantial defense budgets and ongoing military modernization programs. Asia Pacific, driven by countries like China and India, is also a rapidly growing region, witnessing increased defense spending and domestic manufacturing capabilities. Restrains such as stringent export regulations and the high cost of advanced weapon systems may pose challenges, but the overarching trend of defense modernization and the pursuit of technological superiority are expected to propel the market forward. Leading companies such as Heckler & Koch GmbH, General Dynamics Corporation, Rheinmetall AG, and BAE Systems plc are at the forefront of innovation and market development.

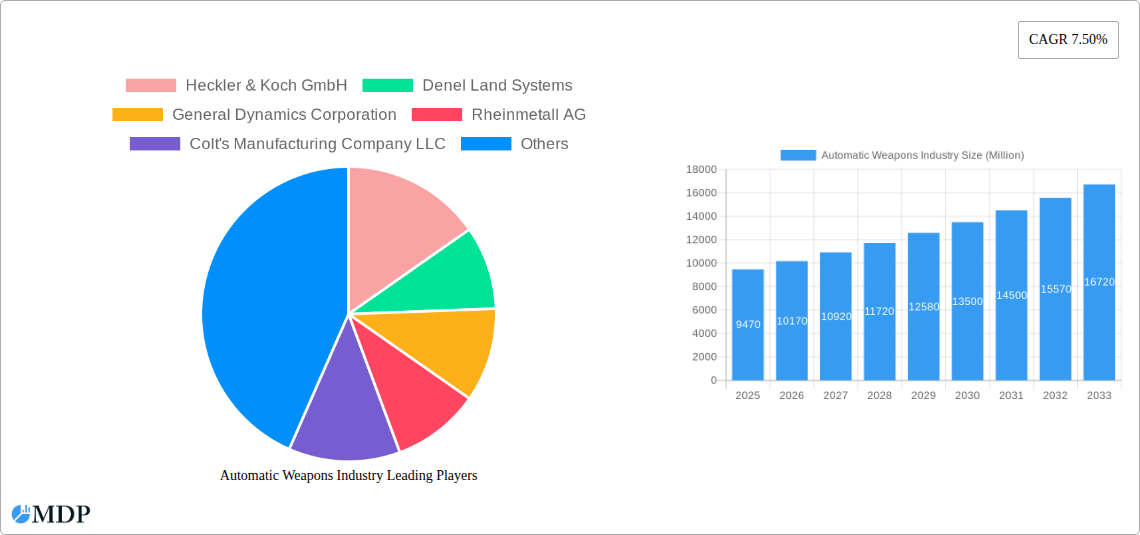

Automatic Weapons Industry Company Market Share

Automatic Weapons Industry Market Dynamics & Concentration

The automatic weapons industry is characterized by a moderate to high concentration, with a few major global players dominating significant market share, estimated at over 60% in 2025. Innovation is primarily driven by advancements in materials science for lighter and more durable components, enhanced lethality, and improved ergonomic designs. Defense spending globally, coupled with geopolitical tensions, acts as a primary innovation driver. Regulatory frameworks, including strict export controls and national manufacturing policies, significantly influence market access and competition. While direct product substitutes are limited in military applications, advancements in non-lethal technologies and drone warfare present indirect competitive pressures. End-user trends indicate a growing demand for modular weapon systems adaptable to various operational environments and a preference for weapons with reduced logistical footprints. Mergers and acquisitions (M&A) activity, while not at peak levels, remains a strategic tool for market consolidation and capability expansion, with an estimated XX M&A deals in the historical period (2019-2024). Key M&A drivers include the acquisition of niche technologies and the expansion into new geographic markets.

Automatic Weapons Industry Industry Trends & Analysis

The global automatic weapons market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period (2025–2033). This expansion is fueled by escalating global defense expenditures, increasing regional security concerns, and the continuous need for modernized military arsenals. Technological disruptions are at the forefront, with a surge in the development of smart weapons featuring integrated targeting systems, advanced ammunition, and enhanced interoperability. The pursuit of lighter, more adaptable firearms, such as the evolution of the M240L medium machine gun with its titanium receivers, highlights a key consumer preference for improved performance without compromising portability. Consumer demand is increasingly shaped by modularity, allowing for rapid configuration changes to suit diverse battlefield scenarios. Competitive dynamics are intensifying, with established players like General Dynamics Corporation, Rheinmetall AG, and BAE Systems plc facing challenges from agile innovators and state-backed enterprises such as UkrOboronProm. The market penetration of advanced automatic weapon systems is steadily increasing across major military powers, driven by the perceived tactical advantages they offer in modern warfare. Furthermore, the demand for automatic launchers and cannons is rising due to their strategic importance in both offensive and defensive operations. The increasing adoption of smart technologies and artificial intelligence in weapon systems signifies a significant shift in market preferences and competitive landscapes.

Leading Markets & Segments in Automatic Weapons Industry

The automatic weapons market is dominated by Land platform applications, accounting for an estimated 75% of the total market value in 2025. This dominance is underpinned by the persistent global requirement for infantry support weapons, armored vehicle armament, and artillery systems. Within the Type segment, Machine Guns represent the largest category, driven by their versatility across various combat roles and the ongoing procurement cycles by numerous national militaries. The Automatic Rifle segment also holds substantial market share due to its widespread adoption as a primary individual weapon for soldiers.

Key drivers for the dominance of the Land platform include:

- Geopolitical Instability: Persistent regional conflicts and territorial disputes necessitate robust land-based defense capabilities.

- Military Modernization Programs: National armies worldwide are investing heavily in upgrading their infantry and vehicle-mounted weapon systems.

- Counter-Terrorism Operations: The ongoing global fight against terrorism requires versatile and reliable automatic weapons for close-quarters combat and force protection.

The North America region, primarily driven by the United States, is the largest market for automatic weapons, contributing over 35% of global sales in 2025. This is attributed to substantial defense budgets, continuous technological advancement, and a strong domestic defense industrial base. The Asia-Pacific region is emerging as a significant growth market due to increasing defense spending by countries like China and India, driven by regional security concerns and military expansion. The Europe region remains a stable and significant market, characterized by high technological adoption and collaborative defense initiatives.

Automatic Weapons Industry Product Developments

Recent product developments in the automatic weapons industry highlight a strong focus on enhancing lethality, reducing weight, and improving user ergonomics. Innovations such as Israel Weapon Industries' NG7 "Negev" light machine gun demonstrate the trend towards modularity and adaptability, with its 7.62x51mm NATO caliber and widespread international adoption. The US Army's contract with FN America for the M240L medium machine gun, featuring titanium receivers for a 18% weight reduction, underscores the demand for lighter, more manageable weapons without compromising performance. These advancements cater to evolving battlefield needs, emphasizing increased soldier effectiveness and operational flexibility.

Key Drivers of Automatic Weapons Industry Growth

The automatic weapons industry growth is primarily propelled by escalating global geopolitical tensions and the subsequent increase in defense spending by nations worldwide. Continuous military modernization programs, aimed at equipping armed forces with advanced and reliable weaponry, further fuel demand. Technological advancements in materials science, enabling lighter and more durable weapon systems, alongside innovations in precision targeting and modular design, are critical growth catalysts. Regulatory policies that support domestic defense manufacturing and procurement also contribute to market expansion.

Challenges in the Automatic Weapons Industry Market

Significant challenges within the automatic weapons industry include stringent international arms control regulations and export restrictions that can limit market access. The complex and lengthy procurement cycles of government defense contracts pose a hurdle to rapid market entry and revenue generation. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs. Furthermore, intense competition from established global players and emerging manufacturers creates pricing pressures and demands continuous innovation to maintain market share.

Emerging Opportunities in Automatic Weapons Industry

Emerging opportunities in the automatic weapons industry lie in the development and integration of smart weapon systems that incorporate AI and advanced targeting capabilities, enhancing battlefield situational awareness and precision. The growing demand for customized and modular weapon solutions adaptable to specific mission requirements presents a significant market segment. Strategic partnerships between defense contractors and technology firms can accelerate innovation in areas like advanced materials and cyber-resilient weapon platforms. Furthermore, expanding into emerging markets with increasing defense budgets and modernizing military forces offers substantial long-term growth potential.

Leading Players in the Automatic Weapons Industry Sector

- Heckler & Koch GmbH

- Denel Land Systems

- General Dynamics Corporation

- Rheinmetall AG

- Colt's Manufacturing Company LLC

- UkrOboronProm

- Sig Sauer Inc

- Israel Weapon Industries (IWI) Ltd

- Singapore Technologies Engineering Ltd

- BAE Systems plc

- Northrop Grumman Corporation

- FN HERSTAL (Herstal Group)

Key Milestones in Automatic Weapons Industry Industry

- March 2023: The Estonian Defense Investment Centre awarded an order to Israel's IWI for the supply of 1,000 NG7 "Negev" light machine weapon systems to the Estonian Army. The "Negevv" machine guns, expected for delivery by the end of 2023, will replace existing MG3 and KSP-58 machine guns. The NEGEV 7.62 LMG, a NATO 7.62x51mm caliber weapon, is widely used globally, highlighting continued demand for reliable light machine guns.

- February 2022: The US Army awarded FN America a USD 49 million contract to supply M240L medium machine guns and titanium receivers. This contract emphasizes the ongoing trend towards weight reduction in weapon systems, with the M240L being approximately 18% lighter than its predecessor, the M240B, while maintaining essential performance and durability.

Strategic Outlook for Automatic Weapons Industry Market

The strategic outlook for the automatic weapons industry is marked by sustained growth, driven by a confluence of persistent geopolitical complexities and significant defense modernization efforts across the globe. The industry is expected to see accelerated adoption of advanced technologies, including intelligent targeting systems and modular weapon designs, which will enhance combat effectiveness and soldier survivability. Opportunities for strategic expansion lie in forging deeper collaborations with technology providers to develop next-generation weaponry and in capitalizing on the increasing defense outlays in emerging economies. The focus on lightweight, adaptable, and interoperable weapon systems will remain paramount, shaping future product development and market competitiveness.

Automatic Weapons Industry Segmentation

-

1. Type

- 1.1. Automatic Rifle

- 1.2. Machine Gun

- 1.3. Automatic launchers

- 1.4. Automatic Cannon

- 1.5. Gatling Gun

-

2. Platform

- 2.1. Land

- 2.2. Airborne

- 2.3. Naval

Automatic Weapons Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Automatic Weapons Industry Regional Market Share

Geographic Coverage of Automatic Weapons Industry

Automatic Weapons Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Land Segment to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automatic Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Automatic Rifle

- 5.1.2. Machine Gun

- 5.1.3. Automatic launchers

- 5.1.4. Automatic Cannon

- 5.1.5. Gatling Gun

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Land

- 5.2.2. Airborne

- 5.2.3. Naval

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automatic Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Automatic Rifle

- 6.1.2. Machine Gun

- 6.1.3. Automatic launchers

- 6.1.4. Automatic Cannon

- 6.1.5. Gatling Gun

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Land

- 6.2.2. Airborne

- 6.2.3. Naval

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automatic Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Automatic Rifle

- 7.1.2. Machine Gun

- 7.1.3. Automatic launchers

- 7.1.4. Automatic Cannon

- 7.1.5. Gatling Gun

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Land

- 7.2.2. Airborne

- 7.2.3. Naval

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automatic Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Automatic Rifle

- 8.1.2. Machine Gun

- 8.1.3. Automatic launchers

- 8.1.4. Automatic Cannon

- 8.1.5. Gatling Gun

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Land

- 8.2.2. Airborne

- 8.2.3. Naval

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Automatic Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Automatic Rifle

- 9.1.2. Machine Gun

- 9.1.3. Automatic launchers

- 9.1.4. Automatic Cannon

- 9.1.5. Gatling Gun

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Land

- 9.2.2. Airborne

- 9.2.3. Naval

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automatic Weapons Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Automatic Rifle

- 10.1.2. Machine Gun

- 10.1.3. Automatic launchers

- 10.1.4. Automatic Cannon

- 10.1.5. Gatling Gun

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Land

- 10.2.2. Airborne

- 10.2.3. Naval

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Heckler & Koch GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Denel Land Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rheinmetall AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colt's Manufacturing Company LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 UkrOboronProm

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sig Sauer Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Israel Weapon Industries (IWI) Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Singapore Technologies Engineering Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BAE Systems plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FN HERSTAL (Herstal Group)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Heckler & Koch GmbH

List of Figures

- Figure 1: Global Automatic Weapons Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automatic Weapons Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Automatic Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automatic Weapons Industry Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Automatic Weapons Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Automatic Weapons Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automatic Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automatic Weapons Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Automatic Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Automatic Weapons Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe Automatic Weapons Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe Automatic Weapons Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automatic Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automatic Weapons Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Automatic Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Automatic Weapons Industry Revenue (Million), by Platform 2025 & 2033

- Figure 17: Asia Pacific Automatic Weapons Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 18: Asia Pacific Automatic Weapons Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automatic Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Automatic Weapons Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Automatic Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Automatic Weapons Industry Revenue (Million), by Platform 2025 & 2033

- Figure 23: Latin America Automatic Weapons Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Latin America Automatic Weapons Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Automatic Weapons Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automatic Weapons Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Automatic Weapons Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Automatic Weapons Industry Revenue (Million), by Platform 2025 & 2033

- Figure 29: Middle East and Africa Automatic Weapons Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Middle East and Africa Automatic Weapons Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automatic Weapons Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automatic Weapons Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Automatic Weapons Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Automatic Weapons Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automatic Weapons Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Automatic Weapons Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global Automatic Weapons Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Automatic Weapons Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Automatic Weapons Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 11: Global Automatic Weapons Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Automatic Weapons Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Automatic Weapons Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 19: Global Automatic Weapons Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Automatic Weapons Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Automatic Weapons Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 27: Global Automatic Weapons Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automatic Weapons Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Automatic Weapons Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 32: Global Automatic Weapons Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Automatic Weapons Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automatic Weapons Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Automatic Weapons Industry?

Key companies in the market include Heckler & Koch GmbH, Denel Land Systems, General Dynamics Corporation, Rheinmetall AG, Colt's Manufacturing Company LLC, UkrOboronProm, Sig Sauer Inc, Israel Weapon Industries (IWI) Ltd, Singapore Technologies Engineering Ltd, BAE Systems plc, Northrop Grumman Corporation, FN HERSTAL (Herstal Group).

3. What are the main segments of the Automatic Weapons Industry?

The market segments include Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Land Segment to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: the Estonian Defense Investment Centre awarded an order to Israel's IWI for the supply of 1,000 NG7 "Negev" light machine weapon systems to the Estonian Army. The "Negevv" machine guns, which are expected to be delivered towards the end of 2023, will take over from MG3 and KSP-58 machines that are already in use. NEGEV 7.62 LMG is a NATO 7.62x51mm Light machine gun, which is used by many countries worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automatic Weapons Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automatic Weapons Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automatic Weapons Industry?

To stay informed about further developments, trends, and reports in the Automatic Weapons Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence