Key Insights

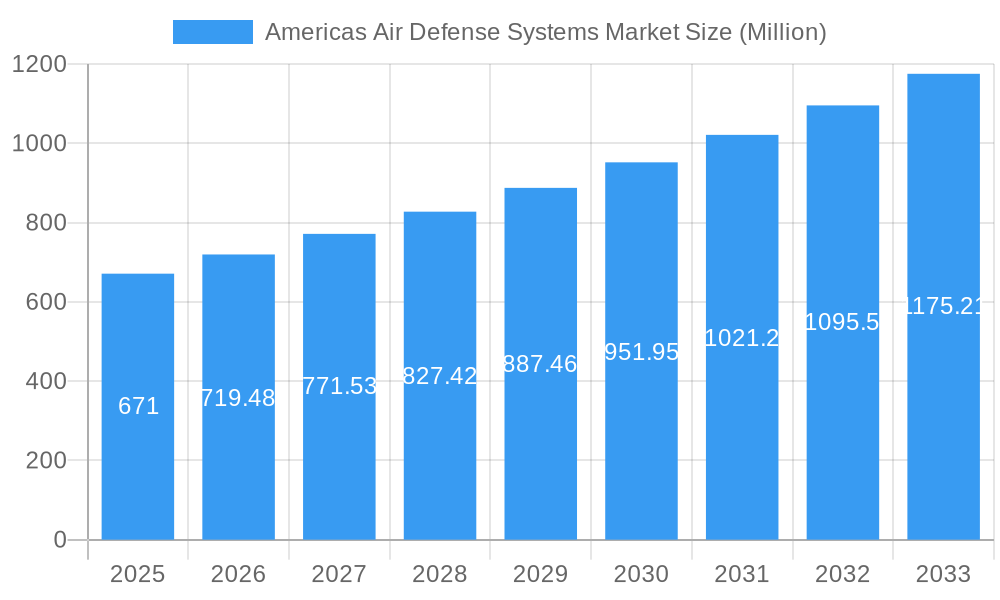

The Americas Air Defense Systems Market is poised for significant expansion, projected to reach a substantial valuation by 2033. With a robust Compound Annual Growth Rate (CAGR) of 7.25%, this market is driven by escalating geopolitical tensions, the increasing threat perception from sophisticated aerial and missile attacks, and the continuous advancement in defense technologies. Nations across the Americas are prioritizing the modernization of their air defense capabilities to safeguard national airspace, critical infrastructure, and military assets. This includes investments in integrated systems capable of detecting, tracking, and intercepting a wide range of threats, from low-flying drones to long-range ballistic missiles. The growing emphasis on layered defense architectures, which combine various interceptors and sensors, further fuels market growth.

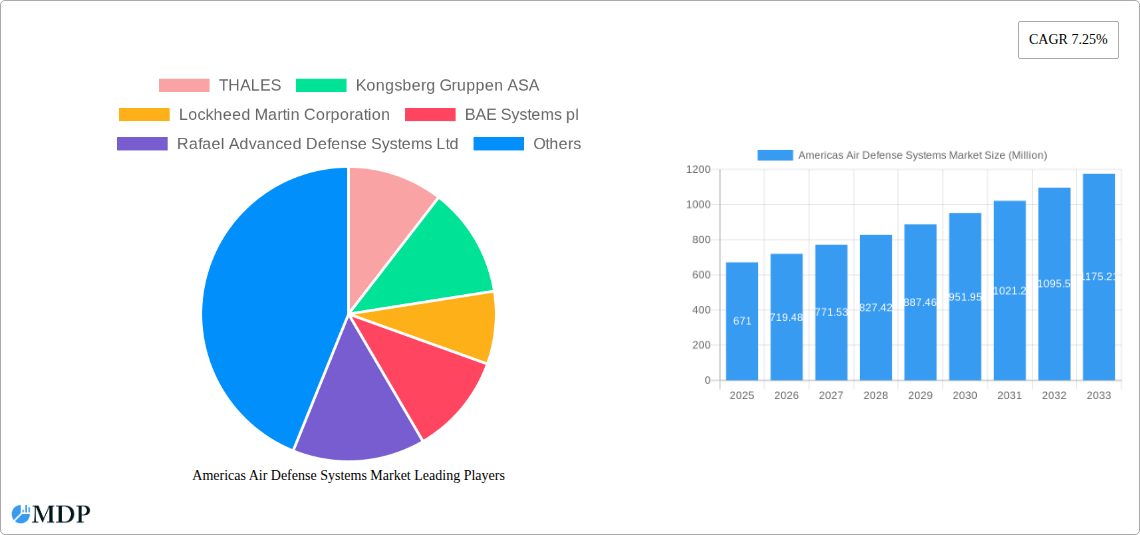

Americas Air Defense Systems Market Market Size (In Million)

Key trends shaping the Americas Air Defense Systems Market include the integration of artificial intelligence and machine learning for enhanced threat analysis and response, the development of directed energy weapons as a complementary or alternative interceptor technology, and the increasing demand for advanced command and control (C2) systems that enable seamless coordination of defense assets. Furthermore, the persistent need to counter evolving threats from both state and non-state actors necessitates continuous innovation and deployment of next-generation air defense solutions. While the market exhibits strong growth potential, potential restraints may include significant procurement costs, the complexity of integrating new systems with legacy infrastructure, and evolving regulatory landscapes. However, the overarching imperative of national security and regional stability is expected to outweigh these challenges, propelling sustained investment and development in this critical defense sector.

Americas Air Defense Systems Market Company Market Share

This in-depth market research report provides a critical analysis of the Americas Air Defense Systems Market, offering unparalleled insights into market dynamics, industry trends, leading players, and future projections. Covering the historical period from 2019–2024 and forecasting through 2033, with a base year of 2025, this report is an indispensable resource for defense contractors, government agencies, investors, and strategic planners seeking to understand the evolving landscape of air defense in North and South America.

The report delves into crucial segments including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Furthermore, it highlights significant Industry Developments and offers a Strategic Outlook for the Americas Air Defense Systems Market. With a focus on high-traffic keywords such as "air defense systems," "missile defense," "radar technology," "North America air defense," "South America defense," and "military modernization," this report is optimized for maximum search visibility and engagement among industry stakeholders.

The estimated market size for the Americas Air Defense Systems Market is valued at $xx Million for the base year 2025 and is projected to reach $xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period.

Americas Air Defense Systems Market Market Dynamics & Concentration

The Americas Air Defense Systems Market is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share. Key innovation drivers include the relentless pursuit of advanced threat detection capabilities, enhanced missile interception technologies, and integrated network-centric defense solutions. Regulatory frameworks are stringent, driven by national security imperatives and international arms control treaties, influencing procurement cycles and technological adoption. Product substitutes are limited, with existing air defense systems often being upgraded rather than entirely replaced, though advancements in drone defense offer a nascent competitive threat. End-user trends are heavily influenced by geopolitical tensions, national security strategies, and the increasing sophistication of aerial threats, including hypersonic missiles and unmanned aerial vehicles (UAVs). Mergers and acquisitions (M&A) activities are strategic, often aimed at consolidating technological expertise, expanding product portfolios, and securing lucrative government contracts. For instance, the number of M&A deals within the broader defense sector has seen a consistent rise, indicating a trend towards consolidation and strategic partnerships.

Americas Air Defense Systems Market Industry Trends & Analysis

The Americas Air Defense Systems Market is experiencing robust growth, fueled by escalating geopolitical uncertainties and a widespread commitment to modernizing national defense capabilities across both North and South America. The CAGR of this dynamic market is estimated at xx% from 2025 to 2033. A primary growth driver is the continuous evolution of aerial threats, necessitating constant innovation in detection, tracking, and engagement systems. This includes the proliferation of advanced fighter jets, sophisticated cruise missiles, and the growing menace of drone swarms and hypersonic weaponry. Consequently, there is a significant push towards integrating artificial intelligence (AI) and machine learning (ML) into air defense platforms for faster threat assessment and response times. The demand for multi-layered defense systems, encompassing short-range, medium-range, and long-range capabilities, is also on the rise. Consumer preferences, within the context of government procurement, are shifting towards networked solutions that offer interoperability and seamless integration across different defense branches and allied forces. Technological disruptions are evident in the development of directed energy weapons (DEWs) and advanced electronic warfare (EW) capabilities that complement traditional missile-based defense. Market penetration of next-generation radar systems, such as AESA (Active Electronically Scanned Array) radars, is increasing due to their superior performance and adaptability. Competitive dynamics are intense, with major defense corporations vying for substantial government contracts through technological superiority, cost-effectiveness, and proven reliability. The ongoing need for border security and protection against rogue state actors further propels the market forward.

Leading Markets & Segments in Americas Air Defense Systems Market

The United States unequivocally dominates the Americas Air Defense Systems Market, driven by its substantial defense budget, advanced technological prowess, and a constant state of vigilance against diverse aerial threats. This dominance is evident across all key segments.

- Production Analysis: The U.S. is the primary production hub, accounting for an estimated xx% of global air defense system production value. Key drivers include extensive research and development (R&D) investments, a well-established industrial base, and robust government funding for domestic defense manufacturing.

- Consumption Analysis: The U.S. defense sector represents the largest consumer, with an estimated xx% of the market's consumption value. Factors contributing to this include strategic military modernization programs, homeland defense initiatives, and the need to maintain air superiority in a complex global security environment.

- Import Market Analysis (Value & Volume): While the U.S. is a net exporter, other nations in the Americas, particularly Canada and Brazil, represent significant import markets. For instance, Canada's reliance on foreign suppliers for advanced air defense systems makes it a key import destination, with an estimated import value of $xx Million in 2025. Economic policies and the absence of robust domestic production capabilities drive these import trends.

- Export Market Analysis (Value & Volume): The United States leads in exports, with an estimated export value of $xx Million in 2025. Its advanced Patriot and THAAD systems, among others, are sought after by allied nations. South American nations like Brazil and Colombia also engage in exports, though on a smaller scale, primarily in areas like radar and electronic warfare components.

- Price Trend Analysis: Price trends are dictated by technological complexity, system capabilities, and contract volumes. Advanced systems like the Patriot PAC-3 MSE command premium prices, reflecting their cutting-edge technology and effectiveness. The average unit price for a medium-range air defense system is estimated at $xx Million, while long-range systems can exceed $xxx Million. Factors such as inflation, raw material costs, and evolving threat landscapes influence these price trends.

Americas Air Defense Systems Market Product Developments

The Americas Air Defense Systems Market is witnessing a rapid evolution in product development, driven by the need for enhanced threat response and integrated defense strategies. Innovations are focused on developing next-generation radar systems with improved tracking accuracy and longer ranges, advanced missile interceptors capable of engaging faster and more evasive targets, and sophisticated command and control (C2) systems that leverage AI for real-time threat assessment. The integration of directed energy weapons for close-in protection and the development of counter-drone capabilities are also significant trends. These developments aim to provide a multi-layered defense umbrella, offering superior protection against a widening spectrum of aerial threats and maintaining a competitive edge in the global defense market.

Key Drivers of Americas Air Defense Systems Market Growth

The growth of the Americas Air Defense Systems Market is primarily propelled by several interconnected factors. Geopolitical tensions and the rise of sophisticated aerial threats, including advanced fighter jets, ballistic missiles, and unmanned aerial vehicles (UAVs), necessitate continuous modernization of defense capabilities. Government initiatives and significant defense budgets allocated to national security and military modernization programs across North and South America are crucial growth accelerators. Technological advancements in radar, missile technology, and artificial intelligence are driving the demand for state-of-the-art air defense systems. Furthermore, strategic partnerships and collaborations between defense manufacturers and governments foster innovation and market expansion.

Challenges in the Americas Air Defense Systems Market Market

Despite its growth trajectory, the Americas Air Defense Systems Market faces several challenges. The high cost of advanced air defense systems and their associated maintenance and operational expenses can be a significant barrier for some nations, particularly in South America. Stringent regulatory frameworks and lengthy procurement processes, though necessary for security, can slow down market entry and deployment. Supply chain vulnerabilities and the reliance on specific components or raw materials can also pose risks. Moreover, the competitive landscape is intense, with established players and emerging technologies creating pressure on pricing and market share. The continuous need for R&D to keep pace with evolving threats also adds to the financial burden.

Emerging Opportunities in Americas Air Defense Systems Market

Emerging opportunities in the Americas Air Defense Systems Market are multifaceted, offering significant long-term growth potential. The increasing adoption of integrated air and missile defense (IAMD) systems, which combine multiple defense layers for comprehensive protection, presents a substantial market. The growing threat from drones and the need for effective counter-drone solutions are opening up new segments within the market. Technological breakthroughs in areas like directed energy weapons (DEWs) and advanced electronic warfare (EW) are creating new product categories and enhancing existing ones. Strategic partnerships and technology transfer agreements between leading defense corporations and regional players in South America offer avenues for market expansion and local industrial development. Furthermore, the ongoing modernization of air forces and ground forces across the Americas continues to drive demand for advanced air defense capabilities.

Leading Players in the Americas Air Defense Systems Market Sector

- THALES

- Kongsberg Gruppen ASA

- Lockheed Martin Corporation

- BAE Systems pl

- Rafael Advanced Defense Systems Ltd

- RTX Corporation

- Israel Aerospace Industries Ltd

- Leonardo S p A

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

Key Milestones in Americas Air Defense Systems Market Industry

- September 2023: Switzerland awarded a contract to Lockheed Martin Corporation to deliver its Patriot Advanced Capability-3 (PAC-3) missile and related support equipment. PAC-3 MSE is expected to bolster Switzerland’s Patriot ground-based air defense system as a part of the Switzerland Air Force’s Air2030 program.

- January 2023: The Canadian Ministry of Defense (MoD) awarded a contract to Lockheed Martin Corporation to deliver 88 F-35s for USD 14.2 billion. The first F-35s are expected to be delivered in 2026, with a fully operational fleet between 2032 and 2034.

Strategic Outlook for Americas Air Defense Systems Market Market

The strategic outlook for the Americas Air Defense Systems Market remains highly positive, driven by a sustained demand for advanced air defense solutions and a clear commitment to national security. Future growth will likely be fueled by the continued integration of AI and ML for enhanced threat detection and response, the development of more agile and resilient air defense networks, and the ongoing evolution of counter-drone technologies. Emphasis will be placed on interoperability and network-centric warfare, enabling seamless collaboration between different defense assets and allied forces. Strategic partnerships, joint ventures, and technology licensing will continue to be critical for market expansion, particularly for companies seeking to enter or strengthen their presence in the South American defense landscape. The persistent global security challenges and the imperative to safeguard airspace will ensure a robust and evolving market for air defense systems in the Americas for the foreseeable future.

Americas Air Defense Systems Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Americas Air Defense Systems Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Air Defense Systems Market Regional Market Share

Geographic Coverage of Americas Air Defense Systems Market

Americas Air Defense Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Air-based Segment is Expected to Grow with the Highest CAGR during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Air Defense Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THALES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kongsberg Gruppen ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BAE Systems pl

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rafael Advanced Defense Systems Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RTX Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Israel Aerospace Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leonardo S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Northrop Grumman Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saab AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Boeing Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 THALES

List of Figures

- Figure 1: Americas Air Defense Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Americas Air Defense Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Americas Air Defense Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Americas Air Defense Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Americas Air Defense Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Americas Air Defense Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Americas Air Defense Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Americas Air Defense Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Americas Air Defense Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Americas Air Defense Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Americas Air Defense Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Americas Air Defense Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Americas Air Defense Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Americas Air Defense Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Brazil Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Colombia Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Peru Americas Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Air Defense Systems Market?

The projected CAGR is approximately 7.25%.

2. Which companies are prominent players in the Americas Air Defense Systems Market?

Key companies in the market include THALES, Kongsberg Gruppen ASA, Lockheed Martin Corporation, BAE Systems pl, Rafael Advanced Defense Systems Ltd, RTX Corporation, Israel Aerospace Industries Ltd, Leonardo S p A, Northrop Grumman Corporation, Saab AB, The Boeing Company.

3. What are the main segments of the Americas Air Defense Systems Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.71 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Air-based Segment is Expected to Grow with the Highest CAGR during the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2023: Switzerland awarded a contract to Lockheed Martin Corporation to deliver its Patriot Advanced Capability-3 (PAC-3) missile and related support equipment. PAC-3 MSE is expected to bolster Switzerland’s Patriot ground-based air defense system as a part of the Switzerland Air Force’s Air2030 program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Air Defense Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Air Defense Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Air Defense Systems Market?

To stay informed about further developments, trends, and reports in the Americas Air Defense Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence