Key Insights

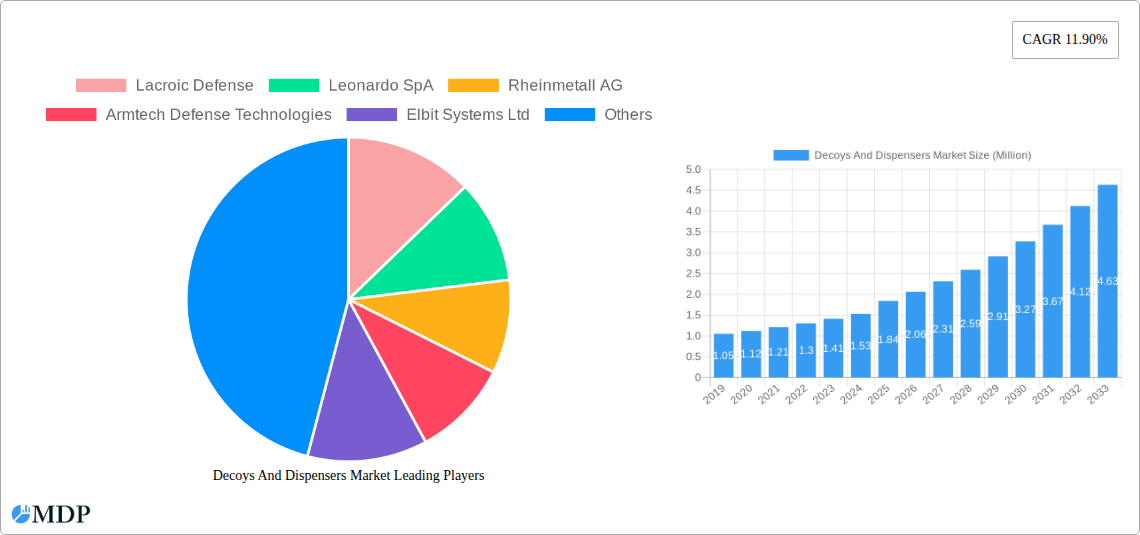

The Decoys and Dispensers Market is poised for significant expansion, driven by escalating geopolitical tensions and the increasing adoption of advanced defense technologies. The market is estimated at 1.84 Billion in the base year of 2025, with a projected Compound Annual Growth Rate (CAGR) of 11.90% through 2033. This robust growth is fueled by the continuous need for sophisticated countermeasures to protect military assets, particularly aircraft, from evolving threats such as advanced missile systems and radar detection. Key drivers include the modernization of air forces worldwide, significant investments in defense R&D, and the growing demand for unmanned aerial vehicles (UAVs) that require specialized electronic warfare (EW) capabilities. Emerging trends such as the integration of artificial intelligence (AI) and machine learning (ML) into decoy systems for enhanced threat identification and response, alongside the development of multi-spectral decoys capable of evading a broader range of sensors, are shaping the market's trajectory.

Decoys And Dispensers Market Market Size (In Million)

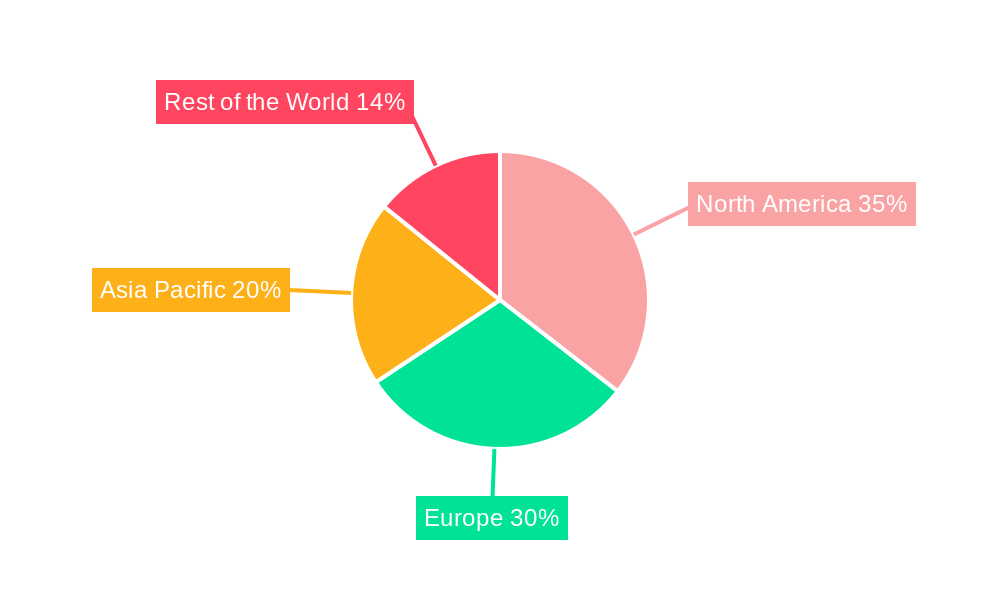

However, the market faces certain restraints, including the high cost of advanced decoy systems and the stringent regulatory frameworks governing their development and deployment. Nevertheless, the increasing focus on survivability and operational effectiveness in contested environments is expected to outweigh these challenges. The market is segmented into Pyrotechnic, Pyrophoric, and Others, with Pyrotechnic decoys holding a significant share due to their proven effectiveness and cost-efficiency. In terms of application, Fixed-wing Aircraft currently dominate, but Rotary-wing Aircraft and Unmanned Aircraft Vehicles are anticipated to witness substantial growth as their operational envelopes expand and their vulnerability to threats increases. Geographically, North America and Europe are leading markets, owing to substantial defense budgets and established technological expertise, while the Asia Pacific region is emerging as a high-growth market driven by increasing defense expenditures and regional security concerns.

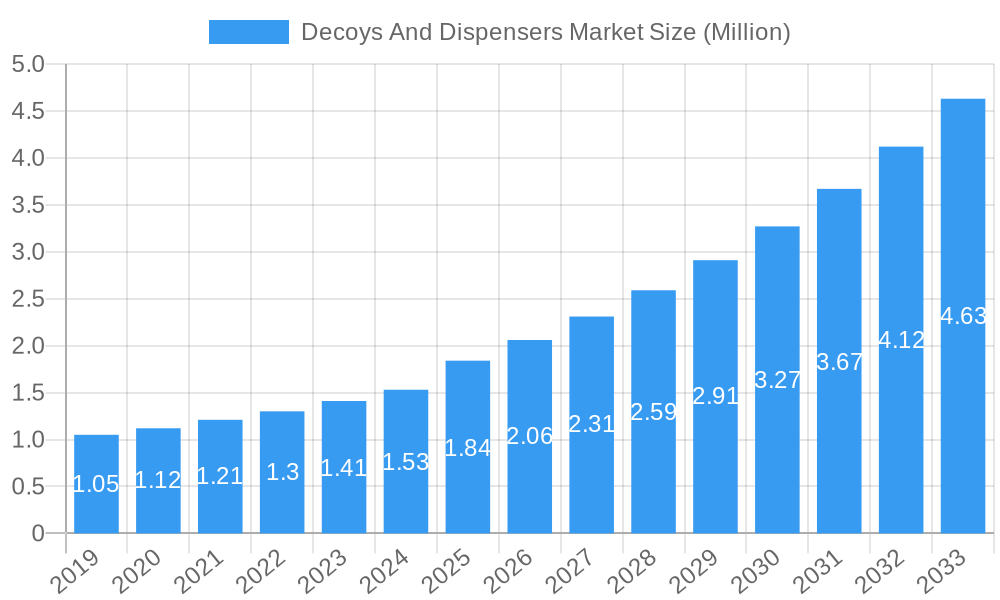

Decoys And Dispensers Market Company Market Share

Unveiling the Global Decoys and Dispensers Market: A Comprehensive Industry Report (2019-2033)

This in-depth report provides an exhaustive analysis of the Decoys and Dispensers Market, a critical segment within the global defense and aerospace industry. With unparalleled insights into market dynamics, trends, and future projections, this report is an indispensable resource for defense contractors, government agencies, strategic planners, and investors seeking to understand and capitalize on this rapidly evolving sector. The study encompasses a comprehensive Study Period: 2019–2033, with Base Year: 2025 and Estimated Year: 2025, followed by a robust Forecast Period: 2025–2033, building upon Historical Period: 2019–2024 data.

Decoys And Dispensers Market Market Dynamics & Concentration

The global Decoys and Dispensers Market exhibits a moderately concentrated landscape, with key players like Leonardo SpA, Rheinmetall AG, BAE Systems PLC, and Elbit Systems Ltd holding significant market share, estimated at over 60% collectively. Innovation drivers are primarily fueled by the relentless pursuit of advanced electronic warfare (EW) capabilities and the increasing integration of artificial intelligence (AI) into countermeasure systems. Regulatory frameworks, particularly those from NATO and individual national defense bodies, significantly influence product development and procurement cycles, demanding high standards for interoperability and effectiveness. Product substitutes, such as advanced jamming techniques and passive detection systems, pose a growing challenge, pushing manufacturers to continually enhance their decoy and dispenser technologies. End-user trends are marked by a strong demand for lightweight, modular, and multi-functional systems, capable of countering a broader spectrum of airborne and ground-based threats. Mergers and acquisitions (M&A) activities, though not as frequent as in broader defense sectors, are strategic, often aimed at consolidating technological expertise or expanding product portfolios. Recent M&A deal counts have averaged approximately 2-3 significant transactions annually, with a total estimated deal value in the hundreds of millions. The market is projected to reach a valuation of over $XX Billion by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 5.2%.

Decoys And Dispensers Market Industry Trends & Analysis

The Decoys and Dispensers Market is experiencing robust growth, driven by escalating geopolitical tensions and the modernization of air forces worldwide. The increasing deployment of unmanned aerial vehicles (UAVs) in both military and civilian applications presents a substantial growth driver, necessitating the development of specialized countermeasures. Technologically, the industry is witnessing a paradigm shift towards smart decoys that can adapt their behavior in real-time to adversarial threats, employing AI and machine learning to mimic authentic signatures with greater fidelity. Advancements in materials science are enabling the creation of lighter, more durable, and stealthier decoy systems. Consumer preferences, though guided by defense procurement policies, are leaning towards cost-effective solutions that offer a high return on investment in terms of threat mitigation. The competitive dynamics are characterized by intense R&D investment and a focus on building strong relationships with defense ministries. Market penetration is steadily increasing as nations prioritize enhanced survivability for their aerial assets. The global market size for Decoys and Dispensers is estimated to be around $XX Billion in 2025, with a projected expansion to over $XX Billion by 2033, exhibiting a steady CAGR of 5.2% during the forecast period. Key trends include the miniaturization of decoy systems for integration into smaller platforms and the development of networked decoy solutions for coordinated defense. The increasing emphasis on electronic warfare capabilities as a primary deterrent is further propelling the demand for sophisticated decoys and dispensers.

Leading Markets & Segments in Decoys And Dispensers Market

The North America region, particularly the United States, dominates the Decoys and Dispensers Market. This is attributable to significant defense spending, a robust defense industrial base, and ongoing military modernization programs. Within North America, the United States accounts for an estimated 65% of regional market share. Economic policies that prioritize technological superiority and national security are primary drivers. Infrastructure development, encompassing advanced research facilities and testing ranges, further solidifies its leading position.

Dominant Segments:

- Type: Pyrotechnic Decoys: These remain a cornerstone of the market due to their proven effectiveness and relatively lower cost. They are widely deployed across various aircraft platforms.

- Application: Fixed-wing Aircraft: These aircraft, ranging from fighter jets to large transport planes, represent the largest application segment due to their critical role in modern military operations and their inherent vulnerability to advanced threats.

Key Drivers for Dominance:

- Continuous Modernization of Air Fleets: Nations are consistently upgrading their fighter jets and bombers, necessitating the integration of advanced countermeasures.

- Threat Evolution: The increasing sophistication of enemy air defense systems drives the demand for more advanced and diverse decoy solutions.

- Government Procurement Policies: Favorable defense budgets and strategic procurement initiatives in leading nations consistently fuel market growth.

- Technological Advancements: Ongoing research and development in EW and countermeasure technologies contribute to sustained demand.

The Pyrotechnic decoy segment, valued at approximately $X Billion in 2025, is expected to grow at a CAGR of 4.8% through 2033. The Fixed-wing Aircraft application segment, estimated at $Y Billion in 2025, is projected to expand at a CAGR of 5.5%. The European market follows North America, driven by initiatives like the European Defence Fund and ongoing naval and air force modernization. Asia-Pacific is emerging as a high-growth region due to increasing defense expenditures by countries like India and China.

Decoys And Dispensers Market Product Developments

Product development in the Decoys and Dispensers Market is characterized by a strong focus on enhancing survivability and operational effectiveness. Innovations include the introduction of advanced pyrotechnic flares with multi-spectral signatures to counter a wider range of infrared (IR) seekers. Smart dispensers are being developed to intelligently dispense countermeasures based on real-time threat assessment. The integration of AI enables decoys to exhibit more realistic behaviors, increasing their effectiveness against sophisticated missile threats. Competitive advantages are gained through superior payload capacity, faster deployment times, and reduced collateral effects. The market is witnessing a trend towards miniaturization, allowing for integration into smaller platforms like drones and even missiles themselves.

Key Drivers of Decoys And Dispensers Market Growth

The growth of the Decoys and Dispensers Market is primarily propelled by escalating geopolitical instability and the subsequent surge in global defense spending. The continuous evolution of airborne threats, including advanced missile systems, necessitates the deployment of sophisticated countermeasures. Technological advancements in electronic warfare (EW) are driving demand for intelligent decoys that can adapt to evolving threats. Furthermore, the increasing integration of unmanned aerial vehicles (UAVs) into military operations creates a new segment for specialized decoy and dispenser systems. Government mandates for aircraft survivability and the modernization of aging air fleets also significantly contribute to market expansion. The market is projected to reach $XX Billion by 2033, with a CAGR of 5.2%.

Challenges in the Decoys And Dispensers Market Market

Despite robust growth, the Decoys and Dispensers Market faces several challenges. Stringent regulatory compliance and lengthy certification processes can impede product development and market entry. The high cost associated with research, development, and production of advanced countermeasure systems can be a barrier, particularly for smaller defense contractors. Supply chain vulnerabilities, exacerbated by geopolitical factors, can lead to production delays and increased costs. Moreover, the ongoing development of advanced threat detection and engagement systems by adversarial nations continuously necessitates the innovation and adaptation of decoy technologies, creating a perpetual arms race dynamic.

Emerging Opportunities in Decoys And Dispensers Market

Emerging opportunities in the Decoys and Dispensers Market are largely driven by the rapid adoption of advanced technologies and evolving military doctrines. The increasing use of AI and machine learning in EW systems presents a significant opportunity for developing intelligent and adaptive decoys. The growing demand for countermeasures for unmanned aerial vehicles (UAVs) and drones opens up new market segments. Strategic partnerships between established defense primes and specialized technology firms are crucial for synergistic development. Furthermore, the expansion of defense capabilities in emerging economies, particularly in the Asia-Pacific region, presents substantial untapped market potential for decoy and dispenser solutions.

Leading Players in the Decoys And Dispensers Market Sector

- Lacroix Defense

- Leonardo SpA

- Rheinmetall AG

- Armtech Defense Technologies

- Elbit Systems Ltd

- Chemring Group PLC

- TARA Aerospace RD

- BAE Systems PLC

- Mil-Spec Industries Corporation

- ROSOBORONEXPORT

Key Milestones in Decoys And Dispensers Market Industry

- 2019: Introduction of next-generation spectral flares with enhanced IR countermeasure capabilities by multiple leading manufacturers.

- 2020: Significant increase in R&D investment in AI-powered smart decoys by major defense companies in response to evolving threat landscapes.

- 2021: Launch of lightweight, modular dispenser systems designed for integration into next-generation fighter aircraft.

- 2022: Increased focus on developing countermeasures for drone swarms and emerging unmanned threats.

- 2023: Several strategic collaborations announced between EW specialists and AI firms to develop advanced electronic countermeasures.

- 2024: Growing emphasis on interoperability and networked decoy capabilities for coordinated defense operations.

Strategic Outlook for Decoys And Dispensers Market Market

The strategic outlook for the Decoys and Dispensers Market is exceptionally positive, driven by persistent geopolitical uncertainties and the continuous modernization of global defense forces. The integration of artificial intelligence and machine learning into countermeasure systems will be a key growth accelerator, leading to more sophisticated and adaptive decoys. The burgeoning demand for solutions tailored to unmanned aerial vehicles (UAVs) will open new avenues for innovation and market expansion. Strategic partnerships and collaborations will be crucial for pooling expertise and resources to address complex threat environments. Furthermore, the sustained growth in defense budgets across key regions will continue to fuel investment in advanced survivability technologies, ensuring a robust future for the market. The market is poised for continued expansion, reaching over $XX Billion by 2033.

Decoys And Dispensers Market Segmentation

-

1. Type

- 1.1. Pyrotechnic

- 1.2. Pyrophoric

- 1.3. Others

-

2. Application

- 2.1. Fixed-wing Aircraft

- 2.2. Rotary-wing Aircraft

- 2.3. Unmanned Aircraft Vehicles

Decoys And Dispensers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Decoys And Dispensers Market Regional Market Share

Geographic Coverage of Decoys And Dispensers Market

Decoys And Dispensers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Fixed Wing Aircraft is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Decoys And Dispensers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pyrotechnic

- 5.1.2. Pyrophoric

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fixed-wing Aircraft

- 5.2.2. Rotary-wing Aircraft

- 5.2.3. Unmanned Aircraft Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Decoys And Dispensers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pyrotechnic

- 6.1.2. Pyrophoric

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fixed-wing Aircraft

- 6.2.2. Rotary-wing Aircraft

- 6.2.3. Unmanned Aircraft Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Decoys And Dispensers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pyrotechnic

- 7.1.2. Pyrophoric

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fixed-wing Aircraft

- 7.2.2. Rotary-wing Aircraft

- 7.2.3. Unmanned Aircraft Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Decoys And Dispensers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pyrotechnic

- 8.1.2. Pyrophoric

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fixed-wing Aircraft

- 8.2.2. Rotary-wing Aircraft

- 8.2.3. Unmanned Aircraft Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Decoys And Dispensers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pyrotechnic

- 9.1.2. Pyrophoric

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fixed-wing Aircraft

- 9.2.2. Rotary-wing Aircraft

- 9.2.3. Unmanned Aircraft Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lacroic Defense

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Leonardo SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rheinmetall AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Armtech Defense Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Elbit Systems Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chemring Group PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 TARA Aerospace RD

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BAE Systems PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mil-Spec Industries Corporatio

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ROSOBORONEXPORT

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lacroic Defense

List of Figures

- Figure 1: Global Decoys And Dispensers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Decoys And Dispensers Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Decoys And Dispensers Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Decoys And Dispensers Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Decoys And Dispensers Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Decoys And Dispensers Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Decoys And Dispensers Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Decoys And Dispensers Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Decoys And Dispensers Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Decoys And Dispensers Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Decoys And Dispensers Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Decoys And Dispensers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Decoys And Dispensers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Decoys And Dispensers Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Decoys And Dispensers Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Decoys And Dispensers Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Decoys And Dispensers Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Decoys And Dispensers Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Decoys And Dispensers Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Decoys And Dispensers Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Decoys And Dispensers Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Decoys And Dispensers Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Decoys And Dispensers Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Decoys And Dispensers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Decoys And Dispensers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Decoys And Dispensers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Decoys And Dispensers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Decoys And Dispensers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Decoys And Dispensers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Decoys And Dispensers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Decoys And Dispensers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Decoys And Dispensers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Decoys And Dispensers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Decoys And Dispensers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Decoys And Dispensers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Decoys And Dispensers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Decoys And Dispensers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Decoys And Dispensers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Decoys And Dispensers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Decoys And Dispensers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Decoys And Dispensers Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Decoys And Dispensers Market?

The projected CAGR is approximately 11.90%.

2. Which companies are prominent players in the Decoys And Dispensers Market?

Key companies in the market include Lacroic Defense, Leonardo SpA, Rheinmetall AG, Armtech Defense Technologies, Elbit Systems Ltd, Chemring Group PLC, TARA Aerospace RD, BAE Systems PLC, Mil-Spec Industries Corporatio, ROSOBORONEXPORT.

3. What are the main segments of the Decoys And Dispensers Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.84 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Fixed Wing Aircraft is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Decoys And Dispensers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Decoys And Dispensers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Decoys And Dispensers Market?

To stay informed about further developments, trends, and reports in the Decoys And Dispensers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence