Key Insights

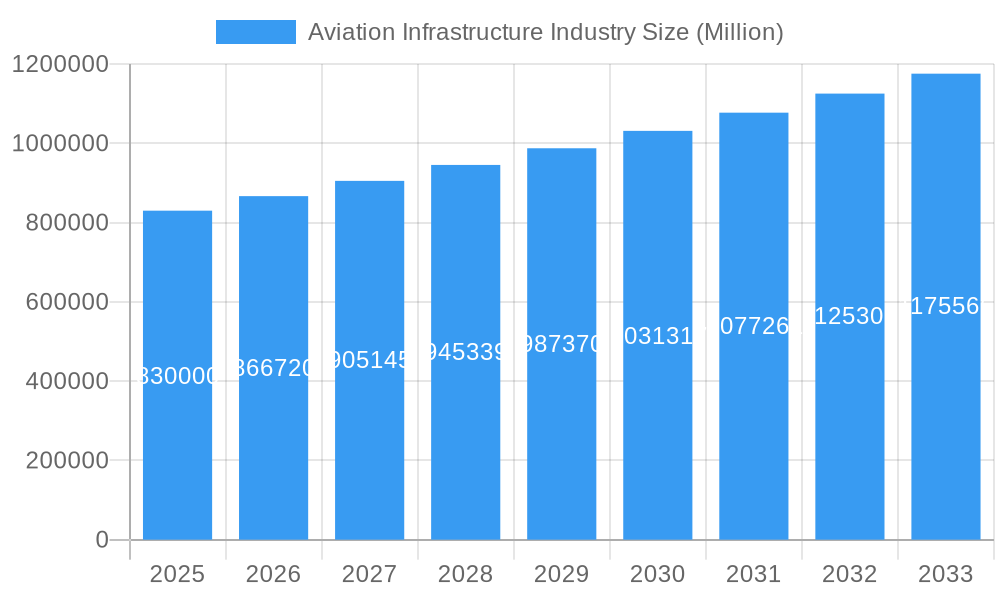

The global Aviation Infrastructure market is poised for substantial growth, projected to reach an estimated $0.83 million in value by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 4.40% from 2019 to 2033. This robust expansion is driven by a confluence of factors, including the persistent increase in global air passenger traffic, the imperative need for modernization of aging airport facilities, and significant investments in new airport construction and expansion projects worldwide. Governments and private entities are actively channeling resources into enhancing airport capacity and efficiency to accommodate the burgeoning demand for air travel and cargo services. Emerging economies, in particular, are showcasing significant development in their aviation infrastructure to support economic growth and connectivity. The strategic importance of aviation infrastructure in facilitating trade, tourism, and global connectivity underpins this upward trajectory.

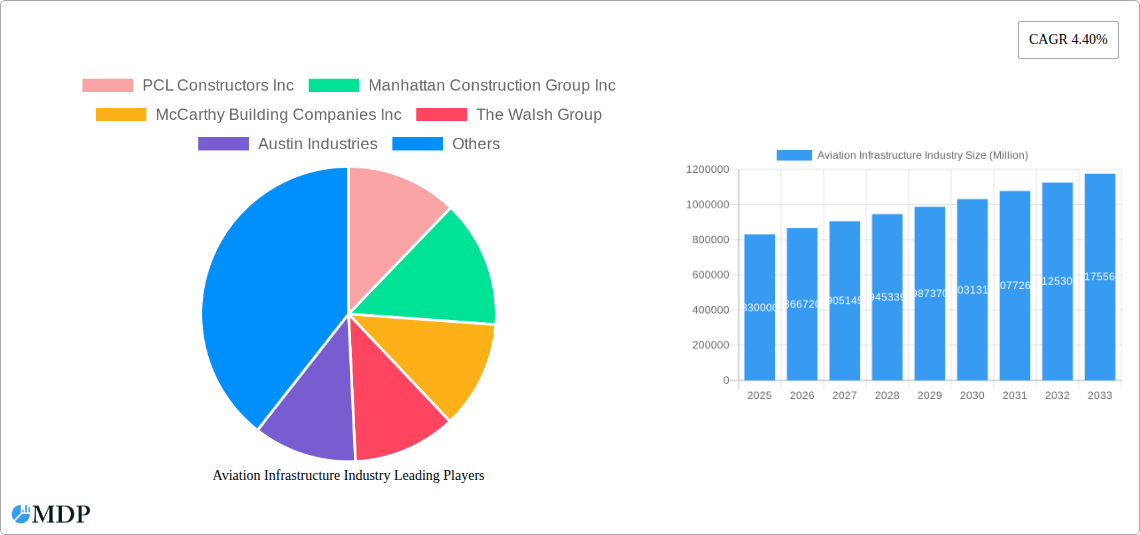

Aviation Infrastructure Industry Market Size (In Billion)

The market is segmented across various airport types and infrastructure components, offering diverse opportunities for stakeholders. Commercial airports represent a significant share, driven by increasing passenger and cargo volumes. Military airports are also a key segment, necessitating advanced infrastructure for defense operations. General aviation airports, while smaller in scale, contribute to the overall ecosystem. Within infrastructure types, terminals, control towers, taxiways, runways, aprons, and hangars are all critical elements undergoing continuous development and upgrades. Leading companies in this space are actively involved in large-scale projects, demonstrating a competitive landscape focused on innovation, sustainability, and efficient project execution. The market's growth is further supported by technological advancements in air traffic management, sustainable airport designs, and enhanced passenger experience solutions.

Aviation Infrastructure Industry Company Market Share

Here is an SEO-optimized and engaging report description for the Aviation Infrastructure Industry:

Report Title: Aviation Infrastructure Industry Market: Global Analysis and Forecast (2019-2033)

Report Description:

Unlock the future of global aviation with this comprehensive analysis of the Aviation Infrastructure Industry. Spanning the Study Period 2019–2033, with a Base Year of 2025 and an Estimated Year of 2025, this report provides critical insights into market dynamics, key trends, and future growth trajectories. Dive deep into the construction, expansion, and modernization of vital airport components, including Terminals, Control Towers, Taxiways and Runways, Aprons, and Hangars. The report meticulously analyzes the Commercial Airport, Military Airport, and General Aviation Airport segments, offering a granular view of market penetration and investment opportunities.

This report is an indispensable resource for Construction Companies such as PCL Constructors Inc, Manhattan Construction Group Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hill International Inc, The Sundt Companies Inc, Hensel Phelps, Royal BAM Group NV, Turner Construction Company, J E Dunn Construction Company, Skanska, BIC Contracting LLC, TAV Construction, AECOM, ALEC Engineering and Contracting, and more. Understand the competitive landscape, identify leading players, and grasp the innovative technologies shaping the airport development and aerodrome construction sectors. With detailed market segmentation, historical analysis (2019–2024), and a robust Forecast Period (2025–2033), this report equips stakeholders with the data necessary for strategic decision-making in this rapidly evolving aerospace infrastructure market.

Aviation Infrastructure Industry Market Dynamics & Concentration

The Aviation Infrastructure Industry is characterized by a moderate to high concentration, with a select group of major engineering and construction firms dominating significant global projects. Leading players like AECOM, Royal BAM Group NV, and Skanska often engage in joint ventures for large-scale airport developments, contributing to a dynamic M&A landscape. Over the Study Period 2019–2033, an estimated 250+ M&A deals are anticipated, driven by the pursuit of technological expertise, market access, and economies of scale. Innovation drivers include the integration of sustainable construction materials, advanced air traffic management systems, and the adoption of digital twins for project lifecycle management. Regulatory frameworks, such as stringent safety standards and environmental impact assessments, play a crucial role in project approvals and execution. While direct product substitutes are limited for core aviation infrastructure, advancements in logistics and alternative transportation methods could indirectly influence demand over the long term. End-user trends favor increased passenger capacity, enhanced passenger experience, and improved operational efficiency, fueling investment in terminal expansions and modern runway systems. The market share of the top five companies is estimated to be around 55%, showcasing the significant influence of established giants in securing major contracts, particularly for Commercial Airport and Military Airport upgrades.

Aviation Infrastructure Industry Industry Trends & Analysis

The Aviation Infrastructure Industry is experiencing robust growth, propelled by increasing global air passenger traffic and the imperative to modernize aging airport facilities. The CAGR for this sector is projected to be approximately 6.5% during the Forecast Period 2025–2033. This expansion is significantly driven by the demand for larger, more efficient Terminals at Commercial Airports, designed to accommodate growing passenger volumes and evolving travel needs. Furthermore, the continuous advancement of aircraft technology necessitates the upgrading of Taxiways and Runways to handle larger and heavier aircraft, as well as the construction of advanced Aprons and Hangars for maintenance and operational support.

Technological disruptions are profoundly reshaping the industry. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is optimizing airport operations, from baggage handling to security screening, while also improving construction planning and execution. The adoption of Building Information Modeling (BIM) and drone technology is enhancing project precision, safety, and efficiency, reducing construction timelines and costs. Consumer preferences are increasingly shifting towards sustainable and eco-friendly airport designs, leading to a rise in the development of green infrastructure, including solar-powered facilities and advanced water management systems. Competitive dynamics are intense, with a focus on companies that can deliver integrated solutions encompassing design, construction, and technological integration. Market penetration of smart airport technologies is expected to reach 40% by 2030, further differentiating market leaders. The ongoing geopolitical landscape also influences the development of Military Airports and associated infrastructure, with defense spending contributing to market expansion in specific regions. The General Aviation Airport segment, while smaller, is also witnessing growth fueled by private aviation and business travel.

Leading Markets & Segments in Aviation Infrastructure Industry

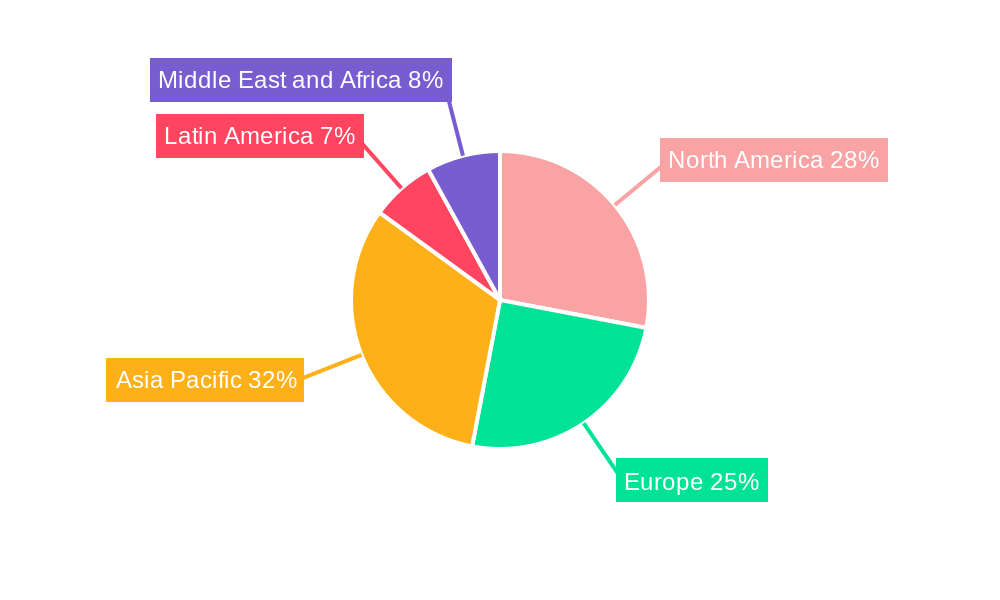

The Commercial Airport segment stands as the dominant market within the Aviation Infrastructure Industry, driven by escalating global air travel demand and the need for enhanced passenger experiences. Within this segment, Terminals represent the largest and most critical infrastructure type, with significant ongoing investment in expansion and modernization projects worldwide. The Asia-Pacific region is projected to lead market growth, propelled by rapid economic development, burgeoning middle classes, and a substantial pipeline of new airport projects and upgrades. Countries such as China, India, and Southeast Asian nations are investing billions in expanding their aviation capacity to support trade, tourism, and connectivity.

- Key Drivers for Terminal Dominance:

- Increasing Passenger Traffic: Global passenger numbers are projected to reach over 10 Billion by 2035, necessitating larger and more efficient terminal facilities.

- Enhanced Passenger Experience: Demand for improved amenities, faster processing times, and seamless travel journeys drives terminal innovations.

- Retail and Commercial Integration: Terminals are increasingly becoming hubs for retail, dining, and other commercial activities, requiring larger footprints.

- Technological Advancements: Integration of biometrics, AI-powered check-in, and smart baggage systems requires sophisticated terminal infrastructure.

The Taxiway and Runway segment also commands significant attention, particularly in regions with aging airfields or those requiring upgrades to accommodate next-generation aircraft. Economic policies supporting aviation sector growth and investments in national infrastructure development are key drivers for this segment. For instance, the United States, with its extensive network of airports, continues to see substantial investments in runway rehabilitation and expansion. Similarly, the Apron and Hangar segments are crucial for operational efficiency and aircraft maintenance, with ongoing investments to support fleet expansion and new aircraft types. Military Airports also represent a substantial market, driven by national security concerns and defense budgets, leading to the construction of specialized runways, command centers, and support facilities. The Control Tower segment, while smaller in terms of overall project value, is critical for air traffic management and safety, with ongoing upgrades to incorporate advanced radar and communication systems.

Aviation Infrastructure Industry Product Developments

Product developments in the Aviation Infrastructure Industry are increasingly focused on sustainability, efficiency, and technological integration. Innovations in modular construction techniques are accelerating the deployment of airport facilities, reducing on-site disruption and project timelines. Advanced materials, such as high-strength, lightweight composites, are being utilized in the construction of terminals and hangars, offering improved durability and reduced environmental impact. Furthermore, the integration of smart technologies, including IoT sensors for real-time monitoring of structural integrity and energy consumption, is enhancing operational efficiency and predictive maintenance. The development of advanced air traffic control systems and runway lighting solutions are also key areas of innovation, aiming to improve safety and capacity. These advancements provide competitive advantages by enabling faster project completion, lower lifecycle costs, and enhanced operational performance for airports.

Key Drivers of Aviation Infrastructure Industry Growth

The Aviation Infrastructure Industry is experiencing significant growth, fueled by a confluence of powerful drivers. A primary catalyst is the sustained increase in global air passenger traffic, which consistently necessitates the expansion and modernization of existing airport facilities to accommodate higher volumes. Technological advancements play a crucial role; the integration of AI, automation, and sustainable construction practices allows for more efficient, safer, and environmentally responsible project execution. Economic policies that prioritize infrastructure development and trade connectivity, particularly in emerging economies, are also powerful growth accelerators. Furthermore, national security imperatives are driving substantial investment in military airport infrastructure. For example, the ongoing demand for upgraded runways and enhanced air traffic control systems at military installations worldwide directly contributes to market expansion.

Challenges in the Aviation Infrastructure Industry Market

Despite robust growth, the Aviation Infrastructure Industry faces several significant challenges. Regulatory hurdles and lengthy approval processes for large-scale projects can cause considerable delays and cost overruns. Supply chain disruptions, exacerbated by global events, can impact the availability of critical materials and equipment, leading to project timelines being extended. Intense competition among established construction firms and the emergence of new players can lead to price pressures and impact profit margins. Furthermore, the substantial upfront capital investment required for major infrastructure projects can be a barrier, particularly for smaller entities. The environmental impact of construction and operations, including noise pollution and carbon emissions, also presents ongoing challenges, necessitating innovative and sustainable solutions that can add to project costs.

Emerging Opportunities in Aviation Infrastructure Industry

Emerging opportunities in the Aviation Infrastructure Industry are largely driven by the global push towards sustainability and the integration of advanced digital technologies. The development of net-zero emission airports, incorporating renewable energy sources and advanced waste management systems, presents a significant growth area. The increasing adoption of smart airport concepts, leveraging AI, IoT, and big data analytics for optimized operations, passenger flow management, and predictive maintenance, offers substantial potential. Strategic partnerships between construction firms, technology providers, and airport authorities are crucial for developing and implementing these innovative solutions. Furthermore, the growing demand for specialized infrastructure for electric Vertical Take-Off and Landing (eVTOL) aircraft and urban air mobility (UAM) presents a nascent yet rapidly evolving market segment with considerable long-term growth potential.

Leading Players in the Aviation Infrastructure Industry Sector

- PCL Constructors Inc

- Manhattan Construction Group Inc

- McCarthy Building Companies Inc

- The Walsh Group

- Austin Industries

- Hill International Inc

- The Sundt Companies Inc

- Hensel Phelps

- Royal BAM Group NV

- Turner Construction Company

- J E Dunn Construction Company

- Skanska

- BIC Contracting LLC

- TAV Construction

- AECOM

- ALEC Engineering and Contracting

Key Milestones in Aviation Infrastructure Industry Industry

- 2019: Launch of sustainability initiatives by major construction firms, focusing on reduced carbon footprints in airport projects.

- 2020: Increased adoption of digital tools like BIM for enhanced project planning and execution amid global travel disruptions.

- 2021: Significant government investment announcements for airport modernization and infrastructure upgrades in key global markets.

- 2022: Advancements in modular construction techniques leading to faster terminal and hangar development.

- 2023: Growing focus on cybersecurity for airport infrastructure, with new protocols and technologies being implemented.

- 2024: Emergence of pilot projects for eVTOL landing infrastructure at select commercial airports.

Strategic Outlook for Aviation Infrastructure Industry Market

The strategic outlook for the Aviation Infrastructure Industry is highly positive, driven by the ongoing recovery and projected growth in global air travel. Key growth accelerators include a continued emphasis on sustainable construction practices and the widespread integration of smart technologies to enhance operational efficiency and passenger experience. Strategic opportunities lie in focusing on resilience against climate change and extreme weather events through robust infrastructure design. Furthermore, the development of infrastructure to support emerging aviation technologies, such as eVTOLs, will be a significant driver of future market potential. Companies that can offer integrated solutions, encompassing advanced engineering, innovative construction methodologies, and cutting-edge digital integration, will be best positioned for success in this dynamic and expanding sector.

Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

Aviation Infrastructure Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of Aviation Infrastructure Industry

Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. North America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Europe Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Asia Pacific Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 8.1.1. Commercial Airport

- 8.1.2. Military Airport

- 8.1.3. General Aviation Airport

- 8.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.2.1. Terminal

- 8.2.2. Control Tower

- 8.2.3. Taxiway and Runway

- 8.2.4. Apron

- 8.2.5. Hangar

- 8.2.6. Other Infrastructure Types

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 9. Latin America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 9.1.1. Commercial Airport

- 9.1.2. Military Airport

- 9.1.3. General Aviation Airport

- 9.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.2.1. Terminal

- 9.2.2. Control Tower

- 9.2.3. Taxiway and Runway

- 9.2.4. Apron

- 9.2.5. Hangar

- 9.2.6. Other Infrastructure Types

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 10. Middle East and Africa Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 10.1.1. Commercial Airport

- 10.1.2. Military Airport

- 10.1.3. General Aviation Airport

- 10.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 10.2.1. Terminal

- 10.2.2. Control Tower

- 10.2.3. Taxiway and Runway

- 10.2.4. Apron

- 10.2.5. Hangar

- 10.2.6. Other Infrastructure Types

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PCL Constructors Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Manhattan Construction Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McCarthy Building Companies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Walsh Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Austin Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hill International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Sundt Companies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hensel Phelps

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Royal BAM Group NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Turner Construction Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 J E Dunn Construction Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Skanska

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BIC Contracting LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TAV Construction

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AECOM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ALEC Engineering and Contracting

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 PCL Constructors Inc

List of Figures

- Figure 1: Global Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: North America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: North America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: North America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: North America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Europe Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Europe Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Europe Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Europe Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 15: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 16: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 17: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 18: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 21: Latin America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 22: Latin America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Latin America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Latin America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 27: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 28: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 29: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 30: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 10: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 11: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 17: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 18: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 25: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 26: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 30: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 31: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Infrastructure Industry?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Aviation Infrastructure Industry?

Key companies in the market include PCL Constructors Inc, Manhattan Construction Group Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hill International Inc, The Sundt Companies Inc, Hensel Phelps, Royal BAM Group NV, Turner Construction Company, J E Dunn Construction Company, Skanska, BIC Contracting LLC, TAV Construction, AECOM, ALEC Engineering and Contracting.

3. What are the main segments of the Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence