Key Insights

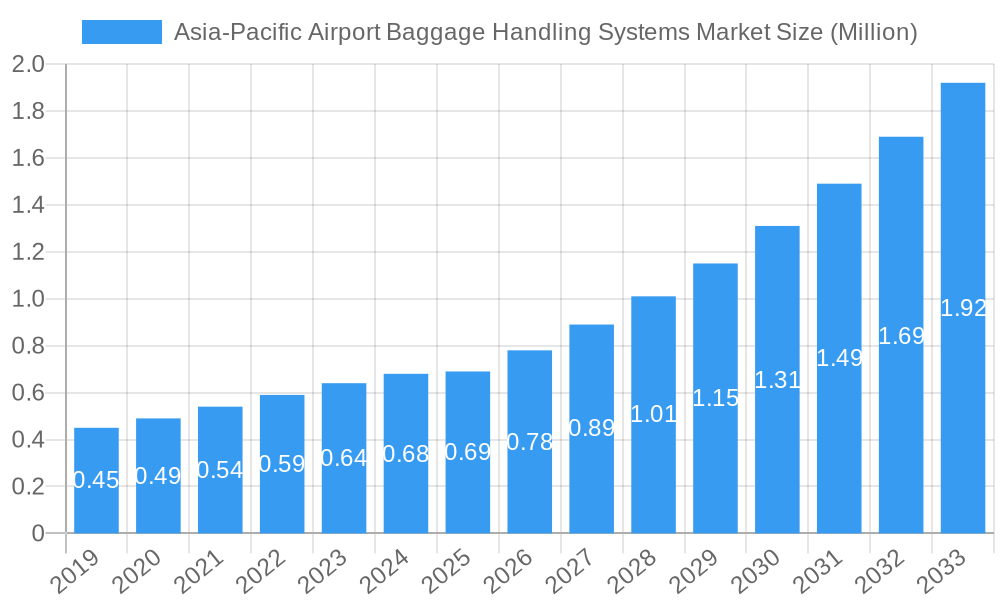

The Asia-Pacific Airport Baggage Handling Systems Market is poised for substantial growth, driven by the burgeoning air travel sector across the region. With an estimated market size of 0.69 Million in the base year of 2025, the market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 12.82% during the forecast period of 2025-2033. This impressive expansion is fueled by a confluence of factors, including the continuous development of airport infrastructure, increasing passenger traffic, and the rising demand for advanced and efficient baggage handling solutions. Emerging economies, particularly China and India, are at the forefront of this growth, investing heavily in modernizing their airports to accommodate larger passenger volumes and enhance the overall travel experience. The adoption of automation, AI-powered sorting systems, and integrated security technologies are key trends shaping the market, aiming to reduce mishandling of baggage, improve security, and streamline operations. Furthermore, the emphasis on passenger convenience and the need to optimize operational efficiency in the face of growing passenger numbers are compelling airlines and airport authorities to upgrade their existing baggage handling systems. The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers, all vying for a larger market share through innovation and strategic partnerships.

Asia-Pacific Airport Baggage Handling Systems Market Market Size (In Million)

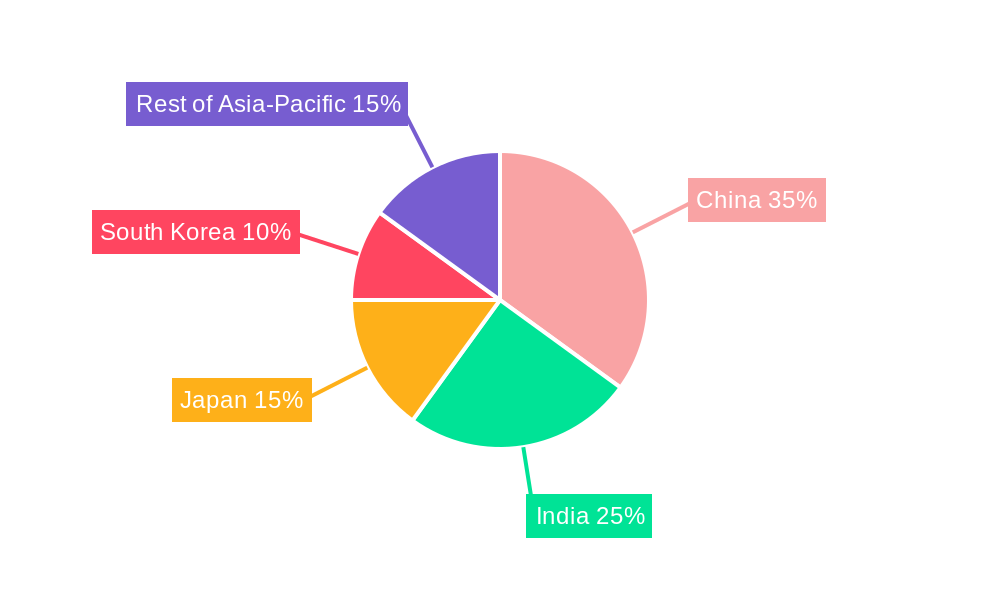

The market segmentation reveals a diverse demand across different airport capacities. Airports with capacities ranging from up to 15 million passengers to those exceeding 40 million passengers are all contributing to the market's growth, albeit with varying needs for system sophistication and capacity. Geographically, China and India are expected to dominate the market due to their rapid economic development and escalating aviation demands. Japan and South Korea, with their established aviation industries, will also play a significant role, focusing on technological advancements and operational excellence. The "Rest of Asia-Pacific" region, encompassing nations like Indonesia, Thailand, and Vietnam, presents significant untapped potential as these economies continue to grow and invest in aviation infrastructure. While the growth trajectory is strong, the market may encounter certain restraints such as the high initial investment cost of advanced systems and the need for skilled personnel for maintenance and operation. However, the long-term benefits of enhanced efficiency, improved passenger satisfaction, and stringent security compliance are expected to outweigh these challenges, ensuring sustained market expansion.

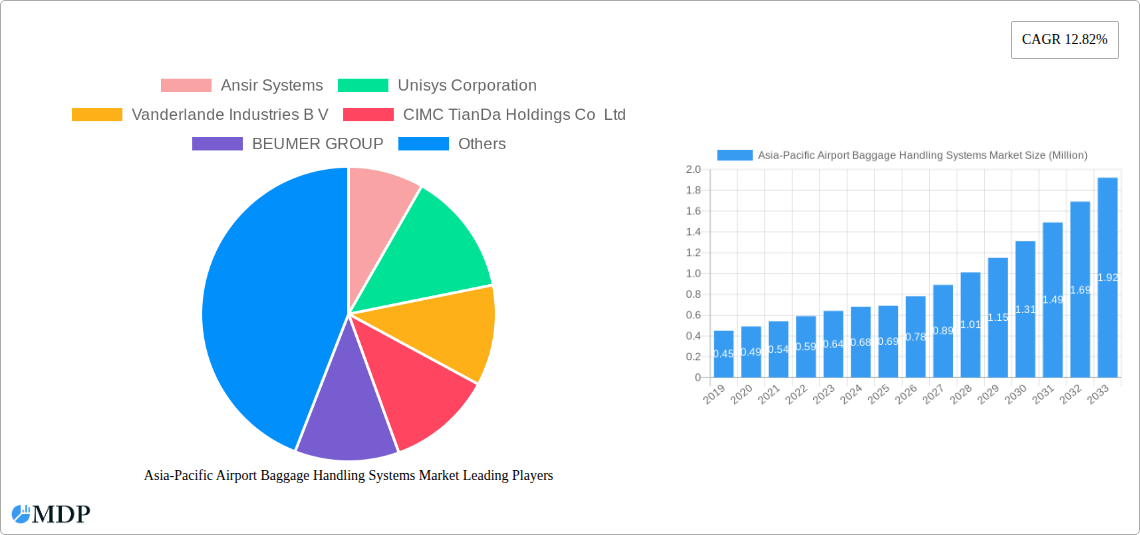

Asia-Pacific Airport Baggage Handling Systems Market Company Market Share

This comprehensive report delves into the dynamic Asia-Pacific airport baggage handling systems market, a critical sector driving efficiency and passenger experience in one of the world's fastest-growing aviation hubs. Our in-depth analysis covers the Asia-Pacific airport baggage handling market size, airport baggage system trends, and Baggage Handling System (BHS) technology from 2019 to 2033, with a specific focus on the base year 2025 and a detailed forecast period of 2025–2033. We provide actionable insights into market dynamics, key players, and emerging opportunities, making this an indispensable resource for airport operators, BHS manufacturers, aviation authorities, and investment firms.

The report meticulously examines the market segmentation by airport capacity, including up to 15 million, 15 to 25 million, 25 to 40 million, and more than 40 million passengers, as well as by geography, with dedicated analysis for China, India, Japan, South Korea, and the Rest of Asia-Pacific. Discover how burgeoning air traffic, technological advancements in baggage screening systems, and the demand for advanced baggage handling solutions are shaping the future of airport operations.

Asia-Pacific Airport Baggage Handling Systems Market Market Dynamics & Concentration

The Asia-Pacific airport baggage handling systems market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. Innovation is a key driver, fueled by the relentless pursuit of enhanced operational efficiency, reduced error rates, and improved passenger throughput. Leading companies are investing heavily in research and development for intelligent baggage handling solutions and airport baggage security systems. Regulatory frameworks, while varying across countries, are increasingly emphasizing safety, security, and sustainability, influencing system design and implementation. Product substitutes, such as manual handling in smaller facilities or simplified conveyor systems, exist but are increasingly being phased out in favor of automated and sophisticated solutions. End-user trends are heavily influenced by the passenger experience, with airports prioritizing speed, accuracy, and seamless baggage transfer. Mergers and acquisitions (M&A) activities are prevalent as companies seek to expand their technological capabilities, geographical reach, and customer base. For instance, the market has seen a number of strategic alliances and acquisitions aimed at consolidating market presence and acquiring cutting-edge technologies. The market share distribution indicates that companies with a strong portfolio of Baggage Handling System (BHS) technology and a proven track record in large-scale airport projects are at the forefront.

Asia-Pacific Airport Baggage Handling Systems Market Industry Trends & Analysis

The Asia-Pacific airport baggage handling systems market is experiencing robust growth, driven by several interconnected factors that are fundamentally reshaping air travel infrastructure. The escalating passenger traffic across the region, particularly in emerging economies, necessitates continuous upgrades and expansion of existing airport facilities, directly translating into increased demand for advanced baggage handling systems. Technological disruptions are at the forefront of this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into BHS is enabling predictive maintenance, optimizing routing, and minimizing mishandling. Automated baggage handling systems are becoming the norm, featuring sophisticated sorting mechanisms, advanced tracking technologies like RFID, and seamless integration with airport-wide IT infrastructure. Consumer preferences are increasingly leaning towards a frictionless travel experience, where swift and secure baggage handling plays a pivotal role. Passengers expect minimal delays and a high degree of confidence in the safety of their luggage. This has pushed airport operators to invest in state-of-the-art baggage screening systems and baggage claim solutions. Competitive dynamics are intense, with major players vying for lucrative airport contracts through innovation, cost-effectiveness, and comprehensive service offerings. The market penetration of automated BHS is steadily increasing, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.8% over the forecast period. This growth is underpinned by significant investments in new airport construction and terminal expansions across key markets like China and India. The emphasis on baggage security technology and the need to comply with evolving international aviation security standards further propel the adoption of advanced BHS.

Leading Markets & Segments in Asia-Pacific Airport Baggage Handling Systems Market

The Asia-Pacific airport baggage handling systems market showcases significant regional variations and segment dominance. China consistently emerges as the leading market, driven by its massive domestic and international air travel volume and its proactive approach to infrastructure development. The sheer scale of passenger traffic, often exceeding more than 40 million annually for its major hubs, mandates the deployment of highly advanced and high-capacity baggage handling systems. Economic policies supporting aviation growth and substantial government investment in airport modernization are key drivers for this dominance. India represents another rapidly growing segment, with its expanding economy and increasing disposable income fueling a surge in air travel. Airports in India, catering to passenger capacities ranging from 15 to 25 million and 25 to 40 million, are undergoing significant upgrades, creating substantial demand for new and improved baggage handling solutions. Infrastructure development initiatives and a focus on enhancing passenger experience are paramount.

Dominant Regions & Countries:

- China: Leads due to massive passenger volumes and substantial government investment in airport infrastructure. Its large airports frequently fall into the "More than 40 million" passenger capacity category.

- India: Demonstrates rapid growth, driven by economic expansion and increasing air travel. This translates to significant demand in the "15 to 25 million" and "25 to 40 million" passenger capacity segments.

- Japan & South Korea: These mature markets are characterized by continuous upgrades and the adoption of cutting-edge technologies in their established hubs, often within the "25 to 40 million" and "More than 40 million" passenger capacity segments, focusing on efficiency and automation.

- Rest of Asia-Pacific: This encompasses diverse markets like Southeast Asia and Oceania, where rapid urbanization and increasing tourism are driving demand for new airport constructions and expansions, catering to various airport capacities.

Dominant Segments by Airport Capacity:

- More than 40 million: This segment, largely represented by major international hubs in China and Japan, demands the most sophisticated and high-throughput baggage handling systems, including advanced sorting, tracking, and security technologies.

- 25 to 40 million: Airports in this category are increasingly investing in scalable and efficient BHS to manage growing passenger numbers, often opting for modular systems that can be expanded.

- 15 to 25 million: This segment, prevalent in rapidly developing economies, is seeing a strong push for modern, automated systems to replace outdated infrastructure and improve operational efficiency.

- Up to 15 million: While representing smaller capacities, there is still a demand for reliable and cost-effective BHS, with a growing interest in automated solutions to enhance passenger experience even at smaller airports.

Asia-Pacific Airport Baggage Handling Systems Market Product Developments

Product development in the Asia-Pacific airport baggage handling systems market is intensely focused on enhancing speed, accuracy, and security. Innovations include intelligent sorting systems that leverage AI for optimized routing, reducing mishandling and improving efficiency. Advanced baggage tracking technologies, such as RFID and computer vision, are being integrated to provide real-time location data and improve visibility throughout the handling process. Furthermore, the development of modular and scalable BHS allows airports to adapt to fluctuating passenger volumes and future expansion needs. The emphasis on advanced baggage screening systems is also a significant trend, with manufacturers incorporating next-generation X-ray scanners and explosive detection systems to meet stringent security regulations. These developments aim to provide a seamless and secure passenger journey, crucial for the competitive advantage of airports.

Key Drivers of Asia-Pacific Airport Baggage Handling Systems Market Growth

The Asia-Pacific airport baggage handling systems market is propelled by several critical growth drivers. Foremost among these is the escalating volume of air passenger traffic across the region, necessitating continuous upgrades and expansions of airport infrastructure. Technological advancements, particularly in automation, AI, and IoT, are driving the adoption of more sophisticated and efficient baggage handling solutions. The increasing focus on enhancing passenger experience, which includes faster baggage claim and reduced mishandling, is a significant impetus. Moreover, stringent aviation security regulations worldwide mandate the implementation of advanced baggage screening and handling technologies. Government initiatives aimed at modernizing aviation infrastructure and promoting tourism also play a crucial role in stimulating market growth.

Challenges in the Asia-Pacific Airport Baggage Handling Systems Market Market

Despite the strong growth trajectory, the Asia-Pacific airport baggage handling systems market faces several challenges. High initial investment costs for advanced BHS can be a significant barrier, especially for smaller airports or those in developing economies. The complexity of integrating new systems with existing airport infrastructure requires meticulous planning and execution, often leading to extended project timelines. Furthermore, the availability of skilled personnel for the installation, operation, and maintenance of sophisticated BHS can be a constraint in certain regions. Evolving security standards and the need for continuous upgrades to comply with them add to the operational costs. Intense competition among global and local players can also lead to price pressures, impacting profit margins for manufacturers.

Emerging Opportunities in Asia-Pacific Airport Baggage Handling Systems Market

Emerging opportunities within the Asia-Pacific airport baggage handling systems market are ripe for exploration. The rapid expansion of secondary and tertiary airports across the region presents a significant growth avenue for scalable and cost-effective BHS solutions. The increasing adoption of smart airport concepts is creating demand for integrated BHS that can communicate seamlessly with other airport systems, enhancing overall operational intelligence. Strategic partnerships between BHS providers and airlines, as well as airport authorities, can foster tailored solutions and accelerate market penetration. The development of sustainable and energy-efficient BHS technologies aligns with global environmental goals and presents a competitive advantage. Furthermore, the growing demand for enhanced baggage security and traceability solutions offers opportunities for innovation in tracking and screening technologies.

Leading Players in the Asia-Pacific Airport Baggage Handling Systems Market Sector

- Ansir Systems

- Unisys Corporation

- Vanderlande Industries B V

- CIMC TianDa Holdings Co Ltd

- BEUMER GROUP

- Leonardo S p A

- Daifuku Co Ltd

- SITA

- G&S Airport Conveyor

- Siemens Logistics GmbH

Key Milestones in Asia-Pacific Airport Baggage Handling Systems Market Industry

- February 2023: Aena selected Siemens Logistics to operate and maintain the baggage handling systems at Adolfo Suárez Madrid-Barajas Airport in Spain (MAD). The service contract was signed for five years and includes technical support for 140 kilometers of conveyor systems, tray, and belt technology, demonstrating a strong trend towards long-term operational and maintenance contracts for BHS providers.

- January 2023: Kyzylorda Airport in Kazakhstan signed a contract with Alstef Group to design and deploy the baggage handling system (BHS) at its new terminal. Under the contract, the company will install the outbound and inbound systems. The outbound system includes check-in conveyors, along with a collector conveyor, an outbound conveyor system with Automatic Tag Readers (ATR integration), X-ray screening integration, and others. The inbound system includes a reclaim carousel with a feed line, fire doors, and an out-of-gauge roller deck, highlighting the comprehensive nature of BHS deployment in new airport infrastructure.

Strategic Outlook for Asia-Pacific Airport Baggage Handling Systems Market Market

The strategic outlook for the Asia-Pacific airport baggage handling systems market is exceptionally promising, driven by sustained passenger growth and the continuous push for operational excellence. Investments in smart airport technologies, including AI-powered predictive maintenance and automated baggage tracking, will be crucial for future success. Collaboration between technology providers, airport operators, and airlines will foster innovation and ensure the seamless integration of BHS into the broader airport ecosystem. Focusing on modular and scalable solutions will cater to the diverse needs of airports across the region, from major international hubs to rapidly developing regional airports. The emphasis on sustainable practices and energy efficiency in BHS design will also become a key differentiator, aligning with global environmental objectives and enhancing the long-term viability of market participants.

Asia-Pacific Airport Baggage Handling Systems Market Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 to 25 million

- 1.3. 25 to 40 million

- 1.4. More than 40 million

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia-Pacific Airport Baggage Handling Systems Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Airport Baggage Handling Systems Market Regional Market Share

Geographic Coverage of Asia-Pacific Airport Baggage Handling Systems Market

Asia-Pacific Airport Baggage Handling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. More than 40 Million Segment is Projected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 to 25 million

- 5.1.3. 25 to 40 million

- 5.1.4. More than 40 million

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. China Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6.1.1. Up to 15 million

- 6.1.2. 15 to 25 million

- 6.1.3. 25 to 40 million

- 6.1.4. More than 40 million

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7. India Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7.1.1. Up to 15 million

- 7.1.2. 15 to 25 million

- 7.1.3. 25 to 40 million

- 7.1.4. More than 40 million

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8. Japan Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8.1.1. Up to 15 million

- 8.1.2. 15 to 25 million

- 8.1.3. 25 to 40 million

- 8.1.4. More than 40 million

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9. South Korea Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9.1.1. Up to 15 million

- 9.1.2. 15 to 25 million

- 9.1.3. 25 to 40 million

- 9.1.4. More than 40 million

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10. Rest of Asia Pacific Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10.1.1. Up to 15 million

- 10.1.2. 15 to 25 million

- 10.1.3. 25 to 40 million

- 10.1.4. More than 40 million

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ansir Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unisys Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vanderlande Industries B V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CIMC TianDa Holdings Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BEUMER GROUP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Leonardo S p A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Daifuku Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SITA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 G&S Airport Conveyo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Siemens Logistics GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ansir Systems

List of Figures

- Figure 1: Asia-Pacific Airport Baggage Handling Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Airport Baggage Handling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 5: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 8: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 11: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 14: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 17: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Airport Baggage Handling Systems Market?

The projected CAGR is approximately 12.82%.

2. Which companies are prominent players in the Asia-Pacific Airport Baggage Handling Systems Market?

Key companies in the market include Ansir Systems, Unisys Corporation, Vanderlande Industries B V, CIMC TianDa Holdings Co Ltd, BEUMER GROUP, Leonardo S p A, Daifuku Co Ltd, SITA, G&S Airport Conveyo, Siemens Logistics GmbH.

3. What are the main segments of the Asia-Pacific Airport Baggage Handling Systems Market?

The market segments include Airport Capacity, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

More than 40 Million Segment is Projected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Aena selected Siemens Logistics to operate and maintain the baggage handling systems at Adolfo Suárez Madrid-Barajas Airport in Spain (MAD). The service contract was signed for five years and includes technical support for 140 kilometers of conveyor systems, tray, and belt technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Airport Baggage Handling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Airport Baggage Handling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Airport Baggage Handling Systems Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Airport Baggage Handling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence