Key Insights

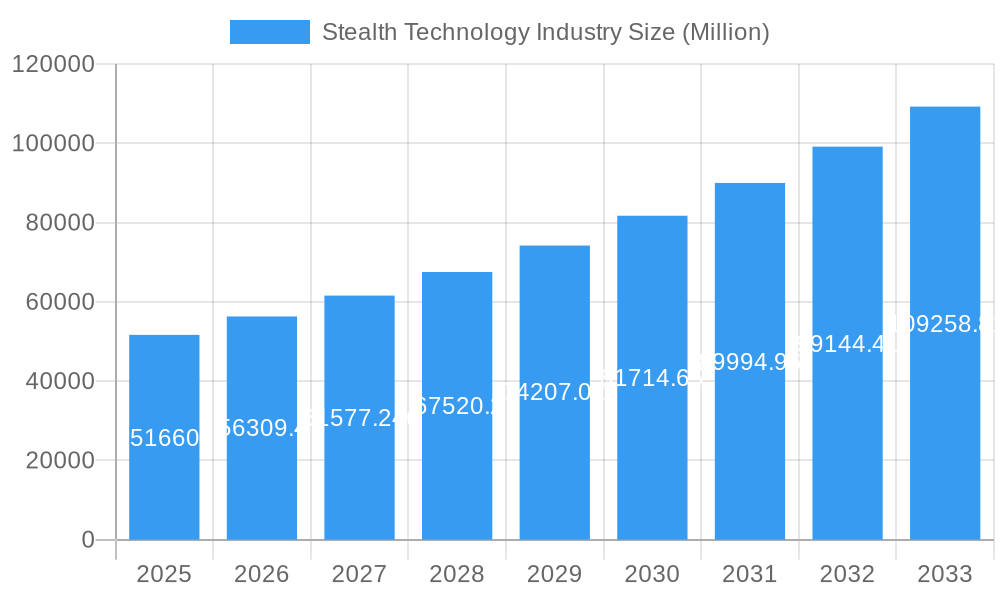

The global Stealth Technology market is poised for significant expansion, projected to reach an estimated $51.66 billion by 2025, driven by a 9% compound annual growth rate (CAGR) throughout the forecast period. This robust growth is propelled by escalating geopolitical tensions and a persistent demand for advanced military capabilities across nations. Governments worldwide are heavily investing in the development and integration of stealth technologies to enhance the survivability and effectiveness of their defense systems, particularly in the face of evolving aerial and maritime threats. The increasing adoption of stealth in unmanned aerial vehicles (UAVs) and naval platforms further fuels market demand. Key industry players are actively engaged in research and development to innovate and offer next-generation solutions that offer superior radar, infrared, and acoustic signature reduction.

Stealth Technology Industry Market Size (In Billion)

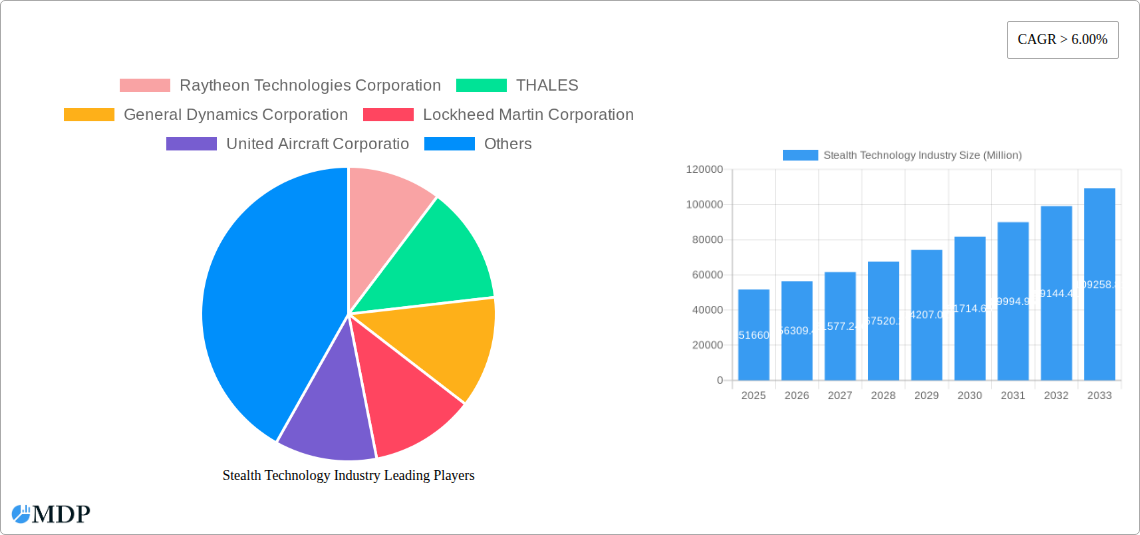

The market is characterized by a strong emphasis on platform diversification, with Aerial, Marine, and Terrestrial segments all witnessing substantial growth. The Aerial segment, historically dominant, continues to benefit from the development of advanced fighter jets and bombers. However, the Marine segment is experiencing rapid acceleration due to the strategic importance of stealth in naval operations, enabling covert surveillance and engagement. Emerging applications in terrestrial defense, such as stealth vehicles and equipment, are also gaining traction. Major contributors to this dynamic market include industry giants like Raytheon Technologies Corporation, THALES, General Dynamics Corporation, Lockheed Martin Corporation, and BAE Systems plc, among others. These companies are spearheading technological advancements and securing significant defense contracts, shaping the competitive landscape and driving market expansion.

Stealth Technology Industry Company Market Share

Unlocking Global Dominance: The Stealth Technology Industry Report 2024-2033

This comprehensive report provides an in-depth analysis of the global Stealth Technology Industry, a critical sector driven by advanced defense capabilities and rapid technological innovation. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this analysis offers unparalleled insights into market dynamics, key players, and future trends. Explore the multi-billion dollar opportunities within aerial, marine, and terrestrial stealth platforms, driven by significant government investments and evolving geopolitical landscapes. This report is essential for defense contractors, aerospace manufacturers, government agencies, and strategic investors seeking to capitalize on the burgeoning stealth technology market, projected to reach over $50 billion by 2033.

Stealth Technology Industry Market Dynamics & Concentration

The Stealth Technology Industry is characterized by a high degree of concentration among a select group of leading defense contractors. Innovation drivers include the constant pursuit of enhanced battlefield survivability, reduced radar cross-section (RCS), and advanced sensor evasion capabilities. Regulatory frameworks are stringent, primarily driven by national security interests and export controls, limiting widespread adoption outside of sovereign defense programs. Product substitutes are limited, with incremental improvements in traditional sensor detection and countermeasures being the primary alternatives rather than outright replacements for stealth platforms. End-user trends are dominated by military forces seeking decisive technological advantages, with a growing emphasis on network-centric warfare and unmanned systems integration. Merger and acquisition (M&A) activities, while less frequent due to the specialized nature of the industry, are significant, often involving strategic consolidation to acquire cutting-edge intellectual property and market share. For example, the past five years have seen an estimated 5-7 major M&A deals in the advanced defense materials and sensor evasion technologies sub-sectors, with deal values often exceeding $1 billion. Market share is closely held, with the top 5 players commanding over 70% of the global stealth technology market.

Stealth Technology Industry Industry Trends & Analysis

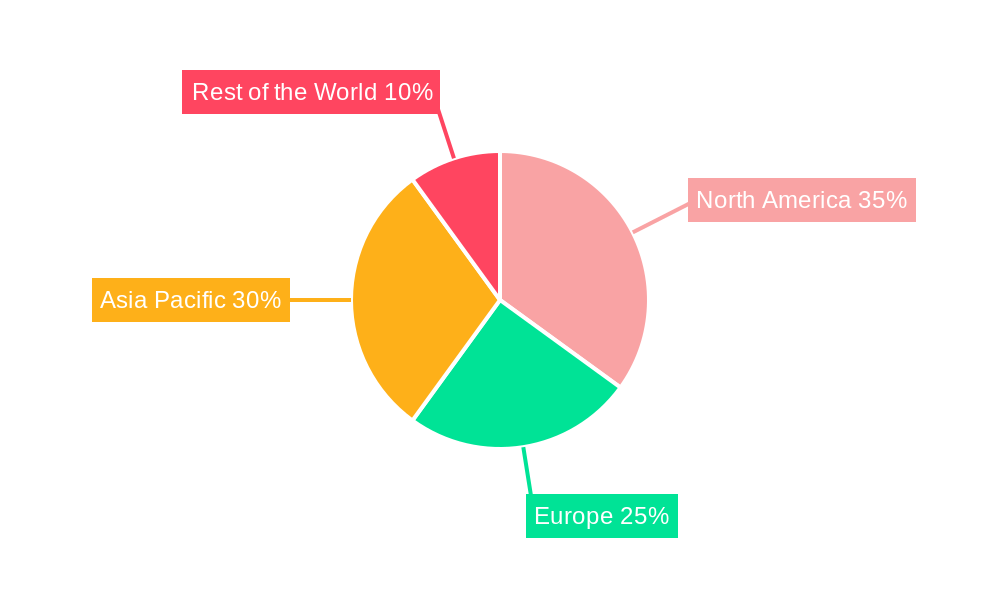

The global Stealth Technology Industry is poised for robust growth, driven by an escalating demand for advanced defense solutions across aerial, marine, and terrestrial platforms. Market growth drivers are multifaceted, stemming from ongoing geopolitical tensions, the continuous need for military modernization, and the significant R&D investments by major defense powers. Technological disruptions, such as advancements in metamaterials, advanced coatings, and low-observable electronic warfare systems, are continuously reshaping the landscape, offering enhanced evasion capabilities. Consumer preferences, in this context, are dictated by stringent military requirements for superior performance, reduced detectability, and increased operational flexibility. The competitive dynamics are intense, with nations and corporations vying for technological supremacy. The Compound Annual Growth Rate (CAGR) for the stealth technology market is projected to be approximately 6.5% over the forecast period, reaching an estimated valuation exceeding $50 billion by 2033. Market penetration is highest in North America and Europe but is rapidly expanding in the Asia-Pacific region due to growing regional security concerns and increased defense spending. The development of fifth and sixth-generation combat aircraft, featuring highly integrated stealth capabilities, is a prime example of this trend. The increasing integration of AI and machine learning into stealth platforms to optimize evasion tactics and enhance situational awareness further underscores the rapid evolution of this sector. The global market size for stealth technology is estimated to be in excess of $25 billion in the base year of 2025, with significant potential for further expansion.

Leading Markets & Segments in Stealth Technology Industry

The Aerial Platform segment dominates the global Stealth Technology Industry, driven by the critical role of stealth in achieving air superiority and conducting long-range strike missions. Regions like North America, particularly the United States, lead in terms of market share due to substantial defense budgets and a long-standing commitment to developing and deploying advanced stealth aircraft. Key drivers in this region include the continuous modernization of fighter jet fleets, the development of next-generation bomber programs, and the integration of stealth capabilities into unmanned aerial vehicles (UAVs). The economic policies supporting robust defense spending, coupled with extensive infrastructure for research, development, and manufacturing of advanced aerospace technologies, solidify North America's leading position.

In terms of specific countries, the United States stands out as the paramount market. This dominance is fueled by ongoing programs like the F-22 Raptor, F-35 Lightning II, and the B-21 Raider bomber, all of which are at the forefront of stealth design and application. The market penetration of stealth technology in the US aerial defense sector is exceptionally high.

The Marine Platform segment is the second-largest contributor, with significant advancements in submarine technology being a key indicator. The United Kingdom's initiative to build four Dreadnought Class submarines, replacing the Vanguard Class and incorporating advanced stealth features for Trident D5 missile deployment, exemplifies this trend. Economic policies in allied nations prioritize the maintenance of strategic deterrence, which heavily relies on the undetectable nature of modern submarines.

The Terrestrial Platform segment, while smaller in comparison, is experiencing steady growth. This includes the integration of stealth characteristics into ground vehicles, such as advanced radar-absorbent materials and minimized thermal signatures for enhanced survivability in contested environments. Economic policies aimed at modernizing land forces and improving soldier protection are driving investment in this segment. Infrastructure developments supporting sophisticated electronic warfare and sensor integration are also crucial.

Stealth Technology Industry Product Developments

Product developments in the Stealth Technology Industry are primarily focused on enhancing the undetectable nature of platforms and improving their operational effectiveness. This includes the creation of advanced radar-absorbent materials (RAM) and coatings that significantly reduce radar cross-section (RCS). Innovations also encompass the design of low-observable airframes, optimized for minimizing acoustic and infrared signatures. Furthermore, the integration of advanced electronic warfare systems and cognitive electronic countermeasures contributes to superior evasion capabilities. Competitive advantages are derived from achieving higher levels of stealth across multiple spectrums, enabling greater operational freedom and mission success.

Key Drivers of Stealth Technology Industry Growth

The growth of the Stealth Technology Industry is propelled by several critical factors. Technologically, the persistent need to counter increasingly sophisticated enemy detection systems fuels continuous innovation in low-observable materials and designs. Economically, significant government defense budgets allocated towards military modernization and the acquisition of advanced combat capabilities are a primary driver. Regulatory factors, while stringent, also indirectly support growth by creating demand for specialized, high-security defense technologies. Geopolitical tensions and the ongoing global arms race further necessitate the development and deployment of stealth platforms for strategic advantage and deterrence.

Challenges in the Stealth Technology Industry Market

Despite its growth trajectory, the Stealth Technology Industry faces several significant challenges. Regulatory hurdles, particularly stringent export controls and intellectual property protection laws, can limit market expansion and international collaboration. Supply chain issues for rare earth materials and specialized components used in advanced stealth manufacturing can lead to production delays and increased costs. Competitive pressures from nations investing heavily in counter-stealth technologies, such as advanced radar systems and infrared search and track (IRST) systems, necessitate continuous R&D investment to maintain a technological edge. The high cost of developing and acquiring stealth platforms also presents a barrier, limiting adoption to nations with substantial defense budgets.

Emerging Opportunities in Stealth Technology Industry

Emerging opportunities in the Stealth Technology Industry are being catalyzed by technological breakthroughs and strategic market expansion. The development of adaptive stealth technologies that can dynamically adjust their signatures based on the threat environment presents a significant advancement. Strategic partnerships between defense contractors and research institutions are fostering the exploration of novel materials and design principles. Furthermore, the growing demand for stealth capabilities in unmanned systems, both aerial and maritime, offers substantial market expansion potential. Increased investments in multi-domain operations and the concept of "invisible warfare" further highlight the long-term growth prospects driven by the need for covert reconnaissance and strike capabilities.

Leading Players in the Stealth Technology Industry Sector

- Raytheon Technologies Corporation

- THALES

- General Dynamics Corporation

- Lockheed Martin Corporation

- United Aircraft Corporation

- Chengdu Aircraft Industrial Group Ltd

- Leonardo S p A

- SAAB AB

- BAE Systems plc

- Hindustan Aeronautics Limited

- Northrop Grumman Corporation

- The Boeing Company

Key Milestones in Stealth Technology Industry Industry

- November 2021: The United Kingdom announced the construction of four Dreadnought Class submarines, a significant modernization of its submarine fleet, incorporating advanced stealth features and armed with Trident D5 missiles.

- February 2023: DRDO (India) announced the completion of the development of the Advanced Medium Combat Aircraft (AMCA) fifth-generation stealth, multirole combat aircraft for the Indian Air Force, awaiting critical design review. The AMCA Mark 1 will feature 5.5 generation technologies, with the Mark 2 incorporating sixth-generation technology upgrades.

Strategic Outlook for Stealth Technology Industry Market

The strategic outlook for the Stealth Technology Industry market is exceptionally positive, driven by a persistent global demand for advanced defense capabilities. Growth accelerators include ongoing technological advancements in metamaterials and low-observable technologies, coupled with significant government investments in military modernization programs worldwide. The increasing integration of artificial intelligence and machine learning into stealth platforms to enhance operational efficiency and evasion tactics will further boost market potential. Strategic opportunities lie in expanding applications for unmanned stealth systems and developing counter-stealth technologies, creating a dual-pronged growth trajectory. The continuous evolution of geopolitical landscapes ensures a sustained need for the superior battlefield advantage that stealth technology provides, positioning the market for sustained, multi-billion dollar expansion through 2033.

Stealth Technology Industry Segmentation

-

1. Platform

- 1.1. Aerial

- 1.2. Marine

- 1.3. Terrestrial

Stealth Technology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Russia

- 2.4. Germany

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Stealth Technology Industry Regional Market Share

Geographic Coverage of Stealth Technology Industry

Stealth Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Land Segment is Expected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Aerial

- 5.1.2. Marine

- 5.1.3. Terrestrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Aerial

- 6.1.2. Marine

- 6.1.3. Terrestrial

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Aerial

- 7.1.2. Marine

- 7.1.3. Terrestrial

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Pacific Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Aerial

- 8.1.2. Marine

- 8.1.3. Terrestrial

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Rest of the World Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Aerial

- 9.1.2. Marine

- 9.1.3. Terrestrial

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Raytheon Technologies Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 THALES

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Dynamics Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lockheed Martin Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 United Aircraft Corporatio

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chengdu Aircraft Industrial Group Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Leonardo S p A

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAAB AB

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 BAE Systems plc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hindustan Aeronautics Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Northrop Grumman Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Boeing Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Raytheon Technologies Corporation

List of Figures

- Figure 1: Global Stealth Technology Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 3: North America Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 7: Europe Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 8: Europe Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 11: Asia Pacific Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Asia Pacific Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 15: Rest of the World Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Rest of the World Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 2: Global Stealth Technology Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 4: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 8: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: France Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Russia Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Germany Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 15: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: China Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Japan Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: India Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: South Korea Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 22: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stealth Technology Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Stealth Technology Industry?

Key companies in the market include Raytheon Technologies Corporation, THALES, General Dynamics Corporation, Lockheed Martin Corporation, United Aircraft Corporatio, Chengdu Aircraft Industrial Group Ltd, Leonardo S p A, SAAB AB, BAE Systems plc, Hindustan Aeronautics Limited, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the Stealth Technology Industry?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Land Segment is Expected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, the United Kingdom announced that four Dreadnought Class submarines are being built to replace the current fleet of Vanguard Class boats. The submarines will be armed with Trident D5 missiles and incorporate a number of new stealth features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stealth Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stealth Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stealth Technology Industry?

To stay informed about further developments, trends, and reports in the Stealth Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence