Key Insights

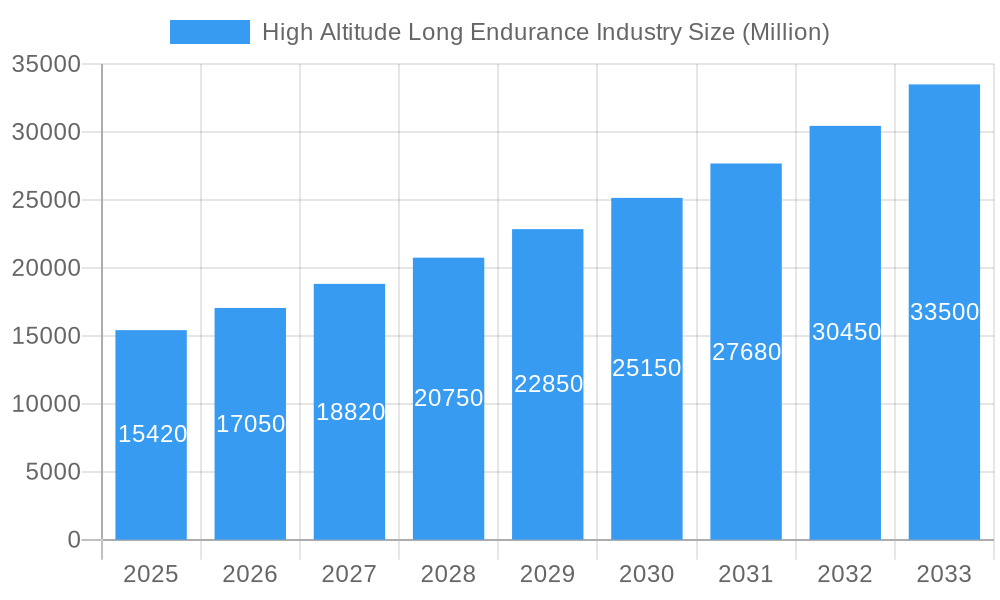

The High Altitude Long Endurance (HALE) market is poised for substantial growth, driven by its critical role in surveillance, communication, and environmental monitoring. The market is projected to reach a significant $15.42 billion by 2025, reflecting a robust 10.56% CAGR during the study period of 2019-2033. This upward trajectory is fueled by increasing demand for persistent aerial platforms that offer cost-effectiveness and extended operational capabilities compared to traditional satellites and manned aircraft. Key drivers include the escalating need for advanced intelligence, surveillance, and reconnaissance (ISR) capabilities by defense and security agencies worldwide, alongside the burgeoning interest in HALE for commercial applications such as broadband internet delivery, disaster management, and precision agriculture. The technological evolution in stratospheric balloons, airships, and Unmanned Aerial Vehicles (UAVs) is further accelerating adoption, with continuous innovations enhancing payload capacities, flight durations, and operational autonomy.

High Altitude Long Endurance Industry Market Size (In Billion)

While the market presents a promising outlook, certain restraints may influence its pace. These include stringent regulatory frameworks governing airspace usage and operational altitudes, the significant initial investment required for R&D and deployment of HALE systems, and the challenges associated with maintaining continuous operations in extreme stratospheric conditions. Nevertheless, the inherent advantages of HALE platforms, such as their ability to loiter over specific areas for extended periods, provide persistent connectivity, and offer a flexible and adaptable solution for various applications, are expected to outweigh these challenges. Prominent companies like Thales, Airbus SE, and Northrop Grumman Corporation are heavily investing in developing cutting-edge HALE technologies, further shaping the competitive landscape and pushing the boundaries of what's possible in this dynamic sector. The market's segmentation by technology, with stratospheric balloons, airships, and UAVs all playing distinct roles, highlights a diverse and evolving ecosystem catering to a wide array of end-user needs.

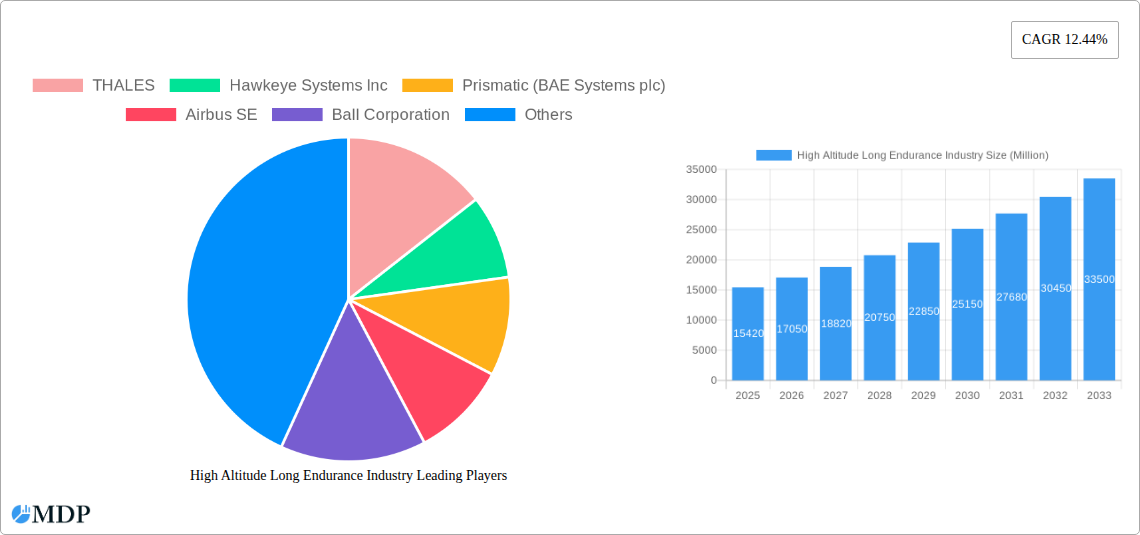

High Altitude Long Endurance Industry Company Market Share

High Altitude Long Endurance Industry: Unlocking Persistent Global Connectivity and Surveillance

This comprehensive report provides an in-depth analysis of the High Altitude Long Endurance (HALE) industry, exploring its dynamic market, technological advancements, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this report offers critical insights for industry stakeholders, investors, and policymakers seeking to navigate this rapidly evolving sector. We delve into the intricate market dynamics, analyze key industry trends, identify leading markets and segments, and highlight product developments, growth drivers, challenges, and emerging opportunities. With projected market values in the billions, this report is an essential guide to understanding the global HALE ecosystem, from stratospheric balloons and airships to advanced Uncrewed Aerial Vehicles (UAVs).

High Altitude Long Endurance Industry Market Dynamics & Concentration

The High Altitude Long Endurance (HALE) industry is characterized by a moderate to high concentration, driven by significant R&D investments and the need for specialized manufacturing capabilities. Key innovation drivers include advancements in solar power, battery technology, lightweight materials, and autonomous navigation systems, enabling longer flight times and greater operational flexibility. Regulatory frameworks, while still developing, are crucial for HALE operations, particularly concerning airspace management and payload certifications, with international bodies and national aviation authorities playing pivotal roles. Product substitutes, such as traditional satellite constellations and terrestrial communication networks, exist but often lack the persistent, close-proximity coverage and cost-effectiveness offered by HALE platforms in specific applications. End-user trends point towards increasing demand for continuous aerial surveillance, remote sensing, broadband internet connectivity, and disaster management support, particularly from defense, telecommunications, and environmental monitoring sectors. Merger and acquisition (M&A) activities, while not yet at peak levels, are anticipated to increase as the market matures and larger aerospace and defense companies seek to integrate HALE capabilities into their portfolios. Current M&A deal counts are in the low double digits annually, with an estimated total deal value exceeding one billion. Market share distribution shows a growing influence of specialized HALE developers alongside established aerospace giants.

High Altitude Long Endurance Industry Industry Trends & Analysis

The High Altitude Long Endurance (HALE) industry is poised for exponential growth, fueled by a confluence of technological breakthroughs and escalating demand for persistent aerial solutions. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% over the forecast period, reaching a market size estimated to be in the tens of billions by 2033. This expansion is primarily driven by the increasing need for global connectivity in underserved regions, enhanced surveillance and reconnaissance capabilities for defense and security applications, and sophisticated environmental monitoring solutions. Technological disruptions, including the miniaturization of sensors, advancements in AI-powered autonomous systems, and the development of highly efficient solar-electric propulsion, are enabling the creation of HALE platforms with unprecedented endurance and operational flexibility. Consumer preferences are evolving to demand seamless, high-speed internet access regardless of location, driving the adoption of HALE as a complementary solution to terrestrial infrastructure. Competitive dynamics are intensifying, with established aerospace players investing heavily in R&D and new entrants disrupting the market with innovative designs and business models. Market penetration is still in its early stages, with significant opportunities for growth across various sectors. The trend towards longer endurance, greater payload capacity, and improved cost-effectiveness of HALE systems will continue to shape market penetration and adoption rates, with initial market penetration projected to reach xx% by 2025.

Leading Markets & Segments in High Altitude Long Endurance Industry

The High Altitude Long Endurance (HALE) industry's dominance is increasingly being asserted by Unmanned Aerial Vehicles (UAVs), specifically High-Altitude Pseudo-Satellites (HAPS), which offer unparalleled flexibility and cost-effectiveness compared to traditional satellites. This segment is experiencing robust growth, driven by a combination of economic policies favoring technological innovation and significant infrastructure investments by governments and private entities in advanced aerial technologies.

UAVs (HAPS): This segment is leading the market due to its ability to provide persistent aerial coverage at altitudes of 60,000 to 90,000 feet, operating above conventional air traffic and weather patterns.

- Key Drivers:

- Defense and Security: Continuous intelligence, surveillance, and reconnaissance (ISR) capabilities, border monitoring, and communication relays.

- Telecommunications: Bridging the digital divide by providing broadband internet access to remote and underserved areas, offering a more agile and cost-effective alternative to satellite deployments.

- Environmental Monitoring: Long-term data collection for climate change research, agricultural monitoring, disaster response, and mapping.

- Technological Advancements: Improvements in solar power efficiency, battery technology, lightweight composite materials, and AI-driven autonomous flight control systems.

- Regulatory Support: Evolving regulatory frameworks that are gradually facilitating the operation of HALE UAVs in national airspace.

- Key Drivers:

Airships: While traditionally associated with slower speeds, modern airships are being re-envisioned for long-endurance applications, offering unique advantages in terms of payload capacity and hovering capabilities.

- Key Drivers:

- Persistent Surveillance and Communication: Ideal for long-duration observation missions and acting as communication nodes in remote locations.

- Cargo Transport: Potential for transporting large or sensitive cargo to areas with limited infrastructure.

- Research and Development: Ongoing efforts to improve propulsion, control, and structural integrity.

- Key Drivers:

Stratospheric Balloons: These platforms are gaining traction for scientific research, atmospheric monitoring, and as deployable communication hubs due to their cost-effectiveness and ability to reach extreme altitudes.

- Key Drivers:

- Scientific Missions: Hosting scientific instruments for atmospheric research and astronomical observation.

- Cost-Effective Deployment: Lower development and launch costs compared to other HALE platforms.

- Payload Flexibility: Ability to carry a range of scientific and communication payloads.

- Key Drivers:

The dominance of UAVs is further underscored by significant investments from major aerospace companies and substantial government contracts for ISR and communication solutions. The projected market share for the UAV segment is estimated to exceed xx% by 2033, with a market value anticipated to reach billions.

High Altitude Long Endurance Industry Product Developments

Recent product developments in the High Altitude Long Endurance (HALE) industry are showcasing remarkable advancements in flight duration and operational capabilities. BAE Systems plc's PHASA-35 solar-powered HAPS achieved a stratosphere flight above 66,000 ft, aiming for year-long endurance as a pseudo-satellite. Concurrently, Mira Aerospace's ApusDuo HAPS completed a 10.5-hour test flight, reaching 16,686 m with a substantial payload. These innovations highlight a clear trend towards persistent aerial platforms that can offer continuous surveillance, communication, and data collection services, directly competing with and complementing traditional satellite capabilities at a potentially lower cost and with greater flexibility. The competitive advantage lies in their ability to operate closer to the ground, providing higher resolution data and lower latency communication.

Key Drivers of High Altitude Long Endurance Industry Growth

The High Altitude Long Endurance (HALE) industry's growth is propelled by several critical factors. Technological advancements in solar power, battery technology, lightweight materials, and AI are enabling longer flight durations and higher payload capacities. Economic factors, including the increasing demand for global broadband connectivity in underserved regions and the cost-effectiveness of HALE platforms compared to traditional satellites, are significant growth accelerators. Regulatory support, with evolving frameworks to accommodate these novel aerial systems, is crucial for wider adoption. For instance, the potential to provide internet access to billions of people globally, coupled with sophisticated defense applications, creates a massive market opportunity.

Challenges in the High Altitude Long Endurance Industry Market

Despite its promising growth, the High Altitude Long Endurance (HALE) industry faces several significant challenges. Regulatory hurdles remain a primary concern, with complexities in airspace management, certification processes, and international coordination hindering rapid deployment. Supply chain issues for specialized components and advanced materials can also lead to production delays and increased costs. Furthermore, intense competitive pressures from established aerospace players and emerging technology companies necessitate continuous innovation and cost optimization. The high initial investment required for R&D and manufacturing also poses a barrier for smaller entities. The estimated impact of these challenges could delay market maturation by up to xx%.

Emerging Opportunities in High Altitude Long Endurance Industry

Emerging opportunities in the High Altitude Long Endurance (HALE) industry are vast and ripe for exploitation. Technological breakthroughs in energy harvesting, battery storage, and autonomous systems are continually pushing the boundaries of endurance and capability, opening doors for entirely new applications. Strategic partnerships between technology developers, telecommunication providers, and government agencies are crucial for developing integrated solutions and accelerating market adoption. The expansion into new geographical markets, particularly in developing nations seeking to bridge the digital divide, represents a significant growth catalyst. Furthermore, the development of standardized operational protocols and regulatory frameworks will pave the way for large-scale deployment and commercial viability, with projected market expansion leading to an estimated value increase of billions.

Leading Players in the High Altitude Long Endurance Industry Sector

- THALES

- Hawkeye Systems Inc

- Prismatic (BAE Systems plc)

- Airbus SE

- Ball Corporation

- RosAeroSystems

- AeroVironment Inc

- Parrot Drone SA

- Northrop Grumman Corporation

Key Milestones in High Altitude Long Endurance Industry Industry

- July 2023: BAE Systems plc successfully launched its High-Altitude Pseudo-Satellite (HAPS) Uncrewed Aerial System (UAS) PHASA-35 solar-powered drone into the stratosphere, reaching an altitude of over 66,000 ft (20,000 m). The US Army Space and Missile Defense Command Technical Center sponsored the recent test. PHASA-35 aims to create an uncrewed aircraft that can remain aloft for a year at a time, circling over a wide area above the weather and air traffic where it can act as a pseudo-satellite.

- July 2023: Mira Aerospace completed a test flight of its new high altitude pseudo satellite (HAPS) platform. During the 10-and-a-half-hour test flight with a 3.6 kg payload, the ApusDuo UAS reached altitudes of 16,686 m. The ApsDuo HAPS includes a wingspan of 15 m (49.2 ft) and a maximum take-off weight of 95 lb (43 kg).

These milestones underscore the rapid progress in HALE technology, particularly in achieving extended stratospheric endurance and validating the pseudo-satellite concept, significantly impacting market perception and investment potential.

Strategic Outlook for High Altitude Long Endurance Industry Market

The strategic outlook for the High Altitude Long Endurance (HALE) industry is exceptionally positive, with significant growth accelerators in place. Continued investment in advanced materials, renewable energy integration, and AI-driven autonomy will further enhance platform capabilities, driving down operational costs and expanding application horizons. The increasing demand for ubiquitous connectivity and persistent surveillance from both commercial and defense sectors provides a robust market foundation. Strategic collaborations and strategic partnerships will be pivotal in addressing regulatory challenges and facilitating market entry. The future trajectory points towards HALE platforms becoming integral components of global communication networks, advanced intelligence gathering, and environmental monitoring systems, contributing billions to the global economy.

High Altitude Long Endurance Industry Segmentation

-

1. Technology

- 1.1. Stratospheric Balloons

- 1.2. Airships

- 1.3. UAVs

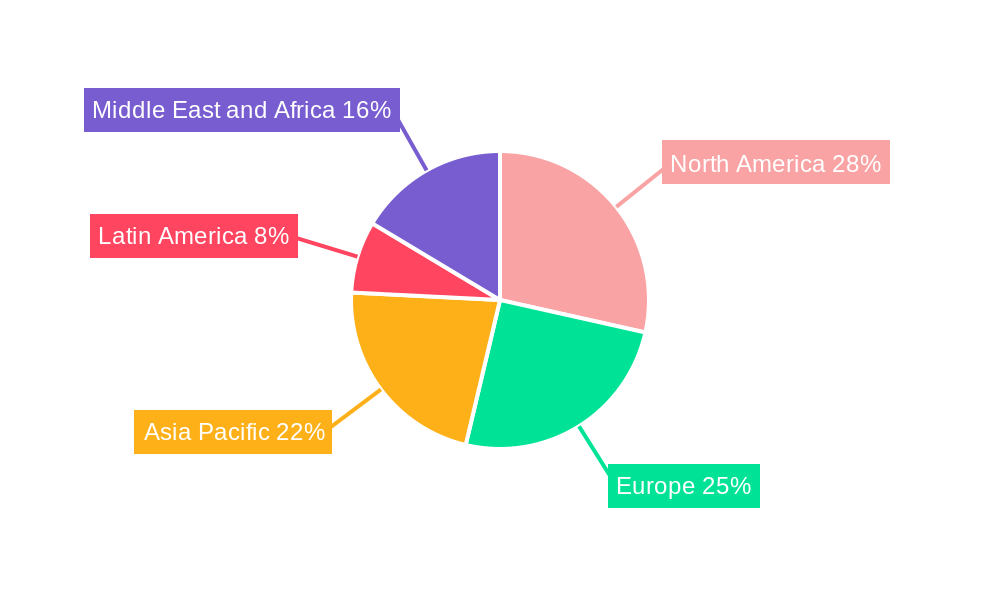

High Altitude Long Endurance Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Turkey

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

High Altitude Long Endurance Industry Regional Market Share

Geographic Coverage of High Altitude Long Endurance Industry

High Altitude Long Endurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Airships Segment to Hold Largest Market Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Altitude Long Endurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stratospheric Balloons

- 5.1.2. Airships

- 5.1.3. UAVs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America High Altitude Long Endurance Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stratospheric Balloons

- 6.1.2. Airships

- 6.1.3. UAVs

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe High Altitude Long Endurance Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stratospheric Balloons

- 7.1.2. Airships

- 7.1.3. UAVs

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific High Altitude Long Endurance Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stratospheric Balloons

- 8.1.2. Airships

- 8.1.3. UAVs

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America High Altitude Long Endurance Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stratospheric Balloons

- 9.1.2. Airships

- 9.1.3. UAVs

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa High Altitude Long Endurance Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Stratospheric Balloons

- 10.1.2. Airships

- 10.1.3. UAVs

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hawkeye Systems Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Prismatic (BAE Systems plc)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ball Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RosAeroSystems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AeroVironment Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Parrot Drone SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Global High Altitude Long Endurance Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America High Altitude Long Endurance Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 3: North America High Altitude Long Endurance Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America High Altitude Long Endurance Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America High Altitude Long Endurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe High Altitude Long Endurance Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 7: Europe High Altitude Long Endurance Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 8: Europe High Altitude Long Endurance Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe High Altitude Long Endurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific High Altitude Long Endurance Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 11: Asia Pacific High Altitude Long Endurance Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Asia Pacific High Altitude Long Endurance Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific High Altitude Long Endurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America High Altitude Long Endurance Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 15: Latin America High Altitude Long Endurance Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Latin America High Altitude Long Endurance Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America High Altitude Long Endurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa High Altitude Long Endurance Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 19: Middle East and Africa High Altitude Long Endurance Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Middle East and Africa High Altitude Long Endurance Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa High Altitude Long Endurance Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 4: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: France High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Germany High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 15: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: China High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: India High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: South Korea High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 22: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: Brazil High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Mexico High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Global High Altitude Long Endurance Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: Saudi Arabia High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Arab Emirates High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Turkey High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa High Altitude Long Endurance Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Altitude Long Endurance Industry?

The projected CAGR is approximately 10.56%.

2. Which companies are prominent players in the High Altitude Long Endurance Industry?

Key companies in the market include THALES, Hawkeye Systems Inc, Prismatic (BAE Systems plc), Airbus SE, Ball Corporation, RosAeroSystems, AeroVironment Inc, Parrot Drone SA, Northrop Grumman Corporation.

3. What are the main segments of the High Altitude Long Endurance Industry?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Airships Segment to Hold Largest Market Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2023: BAE Systems plc successfully launched its High-Altitude Pseudo-Satellite (HAPS) Uncrewed Aerial System (UAS) PHASA-35 solar-powered drone into the stratosphere, reaching an altitude of over 66,000 ft (20,000 m). The US Army Space and Missile Defense Command Technical Center sponsored the recent test. PHASA-35 aims to create an uncrewed aircraft that can remain aloft for a year at a time, circling over a wide area above the weather and air traffic where it can act as a pseudo-satellite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Altitude Long Endurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Altitude Long Endurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Altitude Long Endurance Industry?

To stay informed about further developments, trends, and reports in the High Altitude Long Endurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence