Key Insights

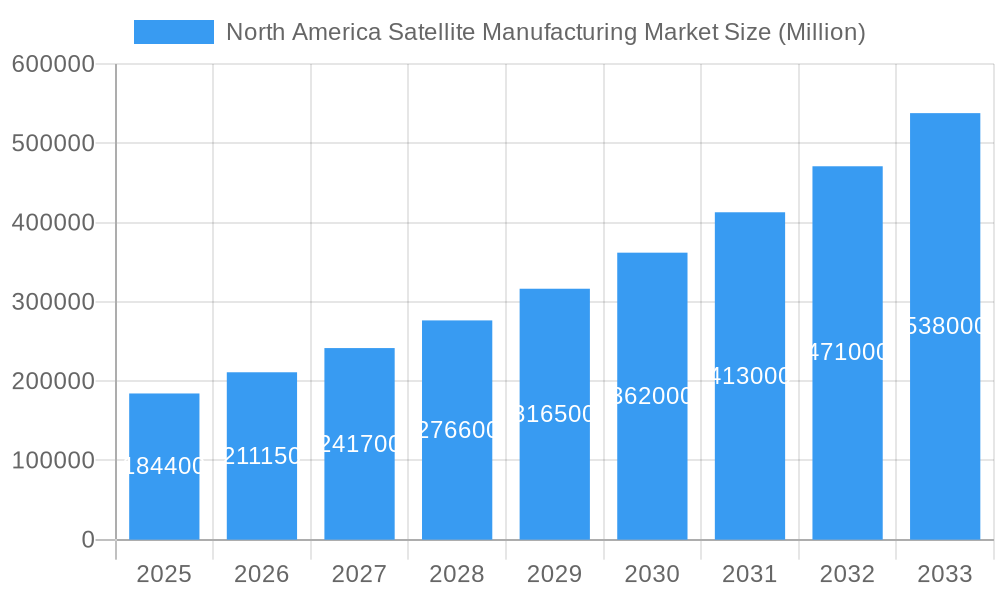

The North American satellite manufacturing market is poised for substantial expansion, driven by escalating demand across diverse applications. With an estimated market size of $184.4 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 14.4%, this sector is experiencing robust growth. Key drivers fueling this surge include the increasing adoption of satellites for advanced communication networks, the burgeoning Earth observation sector supporting environmental monitoring and resource management, and the critical role of navigation systems for both commercial and military operations. The continuous evolution of satellite technology, coupled with significant investments in space exploration and commercial space ventures, is creating a highly dynamic market environment. Furthermore, the rising prevalence of small satellite constellations, particularly those falling within the 10-100 kg and 100-500 kg mass categories, is democratizing access to space and fostering innovation, thereby contributing significantly to market value.

North America Satellite Manufacturing Market Market Size (In Billion)

The market is segmented by various critical components and technologies, highlighting areas of significant investment and development. Propulsion systems, including electric and liquid fuel technologies, are crucial for satellite maneuverability and extended mission durations. Satellite bus and subsystems, solar arrays, and structures also represent substantial market segments. The dominant orbit class is expected to be Low Earth Orbit (LEO), driven by the proliferation of mega-constellations. End-user segments are broadly divided into Commercial, Military & Government, and Others, with commercial applications demonstrating particularly strong growth potential. Major players like Space Exploration Technologies Corp, Lockheed Martin Corporation, and Maxar Technologies Inc. are at the forefront of innovation, investing heavily in research and development to meet the evolving needs of this rapidly expanding industry. The North American region, encompassing the United States, Canada, and Mexico, is a primary hub for these developments, benefiting from a strong ecosystem of government agencies, private companies, and research institutions.

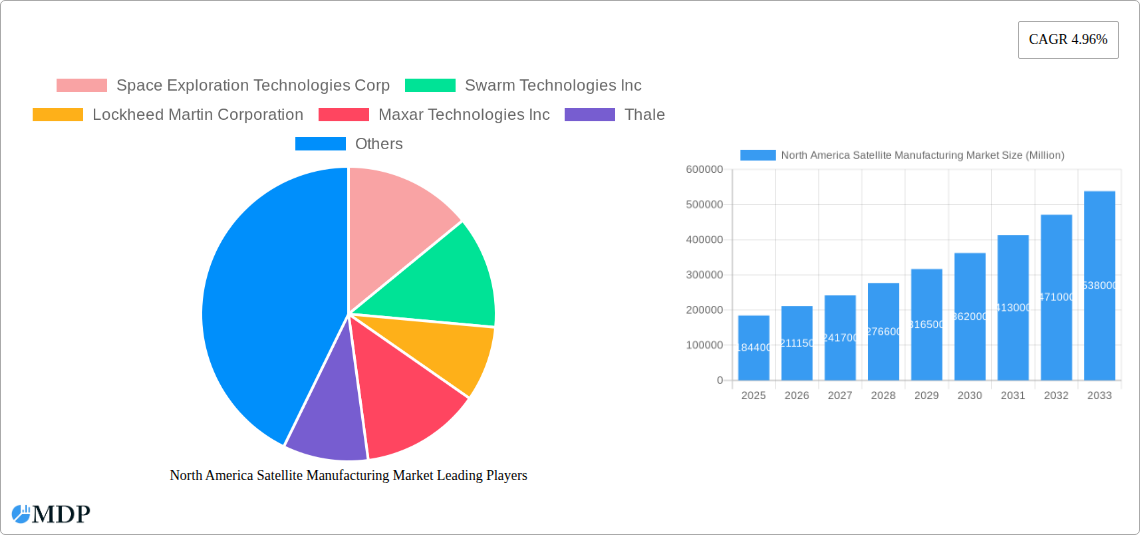

North America Satellite Manufacturing Market Company Market Share

This comprehensive report delves into the dynamic North America Satellite Manufacturing Market, providing in-depth analysis and actionable insights from 2019 to 2033. Explore the accelerating growth, technological advancements, and evolving landscape shaping the future of space exploration and terrestrial applications. Discover key market drivers, prevailing challenges, and emerging opportunities that will define the trajectory of satellite manufacturing across the continent.

North America Satellite Manufacturing Market Market Dynamics & Concentration

The North America satellite manufacturing market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Space Exploration Technologies Corp, Lockheed Martin Corporation, Maxar Technologies Inc, and Northrop Grumman Corporation are key entities driving innovation and production. The market's growth is propelled by continuous technological advancements in miniaturization, propulsion systems, and sensor technologies, alongside robust demand from commercial and government sectors. Regulatory frameworks, particularly those governed by agencies like the FCC and FAA, play a crucial role in shaping market entry and operational standards. The emergence of low-cost launch services and CubeSats has lowered barriers to entry, fostering increased competition and innovation. Product substitutes, such as advanced terrestrial communication networks, are present but largely complementary rather than direct replacements for satellite services. End-user trends show a significant shift towards commercial applications, including broadband internet, Earth observation data services, and IoT connectivity. Mergers and acquisition (M&A) activities are moderate, often driven by companies seeking to expand their capabilities, acquire specialized technologies, or consolidate market positions. For instance, strategic acquisitions of smaller innovative firms by larger aerospace giants are observed, aimed at integrating cutting-edge solutions and expanding their service portfolios.

North America Satellite Manufacturing Market Industry Trends & Analysis

The North America Satellite Manufacturing Market is poised for significant expansion, driven by an insatiable demand for connectivity, sophisticated Earth observation data, and enhanced national security capabilities. The overall market is projected to witness a compound annual growth rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth is fueled by several key trends. Firstly, the increasing proliferation of Low Earth Orbit (LEO) constellations for global broadband internet access, spearheaded by companies like Space Exploration Technologies Corp and Swarm Technologies Inc, is a major growth catalyst. These constellations require mass production of smaller, more agile satellites, significantly impacting manufacturing processes and supply chains. Secondly, the demand for high-resolution Earth observation data for applications ranging from precision agriculture and climate monitoring to urban planning and disaster management is escalating. Companies like Planet Labs Inc and Capella Space Corp are at the forefront of this trend, leveraging advanced imaging technologies and efficient manufacturing to deliver invaluable insights.

Technological disruptions are profoundly reshaping the industry. The development of more efficient electric and hybrid propulsion systems, coupled with advancements in satellite bus and subsystem design, are enabling the creation of smaller, more cost-effective satellites without compromising performance. The increased use of modular designs and additive manufacturing techniques (3D printing) is streamlining production cycles and reducing costs. Consumer preferences are evolving towards faster, more reliable, and ubiquitous connectivity, directly translating into a greater need for satellite-based solutions. Furthermore, national security initiatives and the growing importance of space-based intelligence, surveillance, and reconnaissance (ISR) are driving significant investment in military and government satellite programs. Competitive dynamics are intensifying, with a blend of established aerospace giants and nimble startups vying for market share. This competitive landscape fosters rapid innovation and a continuous drive for cost optimization and performance enhancement. Market penetration of advanced satellite services is steadily increasing across various sectors, indicating a growing reliance on space-based infrastructure.

Leading Markets & Segments in North America Satellite Manufacturing Market

The North America Satellite Manufacturing Market is predominantly driven by the United States, which accounts for the largest share of manufacturing capabilities, research and development, and end-user demand. Within the U.S., regions with strong aerospace and technology hubs, such as California, Texas, and Florida, are leading in satellite manufacturing activities.

Application:

- Communication: This segment is a dominant force, fueled by the escalating demand for global broadband internet, cellular backhaul, and enterprise connectivity. The proliferation of LEO constellations for internet services, alongside established GEO satellite systems for broadcasting and telecommunications, underscores its significance.

- Earth Observation: A rapidly growing segment, driven by the increasing need for high-resolution imagery for applications in agriculture, environmental monitoring, urban planning, defense, and resource management.

- Navigation: While established, this segment continues to be crucial for defense, commercial aviation, and emerging autonomous vehicle technologies.

- Space Observation: Primarily driven by scientific research and national defense, this segment focuses on telescopes and surveillance satellites.

- Others: Encompasses a broad range of niche applications, including scientific research, weather monitoring, and in-orbit servicing.

Satellite Mass:

- Below 10 Kg (CubeSats and Nanosatellites): This category is experiencing the most rapid growth, driven by cost-effectiveness and ease of deployment for constellations and specific missions.

- 10-100kg: A significant segment for specialized scientific payloads, advanced Earth observation, and communication missions.

- 100-500kg: Caters to more complex communication satellites, larger Earth observation platforms, and certain defense applications.

- 500-1000kg: Typically for high-capacity communication satellites and sophisticated research platforms.

- Above 1000kg: Primarily for large communication satellites, advanced military platforms, and specialized scientific missions.

Orbit Class:

- LEO (Low Earth Orbit): Dominant for communication constellations due to lower latency and reduced launch costs.

- GEO (Geostationary Orbit): Continues to be vital for broadcasting, traditional telecommunications, and weather monitoring due to its fixed position relative to Earth.

- MEO (Medium Earth Orbit): Primarily utilized for navigation satellite systems like GPS and Galileo.

- Eliptical: Used for specific scientific missions and Earth observation requiring coverage of polar regions.

End User:

- Commercial: The largest and fastest-growing segment, encompassing telecommunications, broadcasting, Earth observation data providers, and emerging space-based internet services.

- Military & Government: A crucial and consistently funded segment, driving demand for intelligence, surveillance, reconnaissance, communication, and navigation satellites for defense and public safety.

- Other: Includes academic institutions, research organizations, and non-profit entities.

Satellite Subsystem:

- Satellite Bus & Subsystems: The core structural and functional components, representing a significant portion of manufacturing expenditure.

- Solar Array & Power Hardware: Essential for providing power to satellites, with continuous innovation in efficiency and reliability.

- Propulsion Hardware and Propellant: Crucial for orbit control, station-keeping, and maneuvering.

- Structures, Harness & Mechanisms: Underpin the physical integrity and operational functionality of the satellite.

Propulsion Tech:

- Electric Propulsion: Gaining significant traction due to its high specific impulse and fuel efficiency, particularly for LEO constellations.

- Liquid Fuel Propulsion: Still vital for high-thrust maneuvers and primary propulsion for larger satellites.

- Gas-based Propulsion: Used for smaller satellites and attitude control.

North America Satellite Manufacturing Market Product Developments

Product developments in the North America satellite manufacturing market are characterized by a relentless pursuit of miniaturization, enhanced capabilities, and cost reduction. The trend towards building increasingly sophisticated nanosatellites and CubeSats for communication and Earth observation applications is a key focus. Companies are developing highly integrated satellite buses, advanced sensor payloads, and more efficient power systems. Innovations in electric propulsion are enabling longer mission durations and greater orbital maneuverability for smaller platforms. Furthermore, advancements in software-defined satellites are allowing for greater flexibility and adaptability in orbit, enhancing their functionality and lifespan. These developments are driven by the need to meet the growing demand for ubiquitous connectivity, precise geospatial data, and enhanced national security capabilities, all while striving for greater affordability and faster deployment cycles.

Key Drivers of North America Satellite Manufacturing Market Growth

The North America satellite manufacturing market's growth is propelled by several interconnected factors. The burgeoning demand for global broadband internet, particularly in underserved regions, is a primary driver, pushing the development and deployment of large LEO constellations. Advances in miniaturization and launch technology have significantly reduced the cost of putting satellites into orbit, making space more accessible for commercial entities and research institutions. Increasing government investment in defense, national security, and scientific exploration further fuels the market, creating demand for sophisticated communication, intelligence, and observation satellites. The expanding applications of Earth observation data across various industries, including agriculture, environmental monitoring, and urban planning, are also significant growth accelerators.

Challenges in the North America Satellite Manufacturing Market Market

Despite robust growth, the North America satellite manufacturing market faces several hurdles. The increasingly complex regulatory landscape, encompassing spectrum allocation, orbital debris mitigation, and international agreements, can pose significant compliance challenges and lengthen development timelines. Supply chain vulnerabilities, particularly for specialized components and raw materials, can lead to production delays and cost overruns. Intense competition, especially in the LEO satellite segment, is driving down prices, putting pressure on profit margins for manufacturers. The high upfront capital investment required for satellite development and manufacturing, coupled with the long lead times for product development and launch, presents a considerable financial risk for companies. Furthermore, the growing issue of orbital debris necessitates stricter manufacturing standards and the development of end-of-life disposal solutions, adding to development complexities and costs.

Emerging Opportunities in North America Satellite Manufacturing Market

Emerging opportunities in the North America satellite manufacturing market are abundant, driven by technological innovation and evolving market needs. The burgeoning in-orbit servicing and manufacturing sector presents a significant growth avenue, offering services like satellite refueling, repair, and even on-orbit assembly. The development of next-generation satellite constellations with enhanced capabilities, such as advanced AI-powered data processing onboard, is creating new market niches. The increasing demand for secure and resilient satellite communication for critical infrastructure and governmental applications is another major opportunity. Furthermore, the exploration of space resources and the potential for lunar and Martian missions offer long-term growth prospects for advanced satellite manufacturing technologies. Strategic partnerships between established players and innovative startups, as well as collaborations with terrestrial technology providers, will be crucial for capitalizing on these opportunities.

Leading Players in the North America Satellite Manufacturing Market Sector

- Space Exploration Technologies Corp

- Swarm Technologies Inc

- Lockheed Martin Corporation

- Maxar Technologies Inc

- Thales Alenia Space

- Planet Labs Inc

- Northrop Grumman Corporation

- Spire Global Inc

- Capella Space Corp

Key Milestones in North America Satellite Manufacturing Market Industry

- December 2023: Planet Labs has built 12 Dove nanosatellites for Planet. These satellites are launched from Vostochny Cosmodrome.

- November 2023: Thales Alenia Space signed a contract with Inmarsat for the construction of Inmarsat-5 satellite. The satellite was launched aboard Ariane-5ECA.

- July 2023: Planet Labs has built 48 Dove satellites. These satellites are launched from Baikonur Cosmodrome.

Strategic Outlook for North America Satellite Manufacturing Market Market

The strategic outlook for the North America satellite manufacturing market is highly optimistic, driven by sustained innovation and expanding applications. Future growth will be characterized by the continued dominance of LEO constellations for communication services, the increasing sophistication of Earth observation platforms, and the integration of advanced technologies like AI and machine learning into satellite systems. Companies will focus on optimizing manufacturing processes for high-volume production, developing more sustainable and environmentally conscious satellite designs, and exploring novel propulsion and power solutions. Strategic partnerships and collaborations will be key to navigating the competitive landscape and capitalizing on emerging opportunities in areas such as in-orbit servicing, space resource utilization, and advanced national security capabilities. The market's trajectory will be shaped by its ability to adapt to evolving regulatory frameworks, mitigate supply chain risks, and deliver cost-effective, high-performance solutions to a diverse global customer base.

North America Satellite Manufacturing Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. Eliptical

- 3.2. GEO

- 3.3. LEO

- 3.4. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

-

5. Satellite Subsystem

- 5.1. Propulsion Hardware and Propellant

- 5.2. Satellite Bus & Subsystems

- 5.3. Solar Array & Power Hardware

- 5.4. Structures, Harness & Mechanisms

-

6. Propulsion Tech

- 6.1. Electric

- 6.2. Gas based

- 6.3. Liquid Fuel

North America Satellite Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

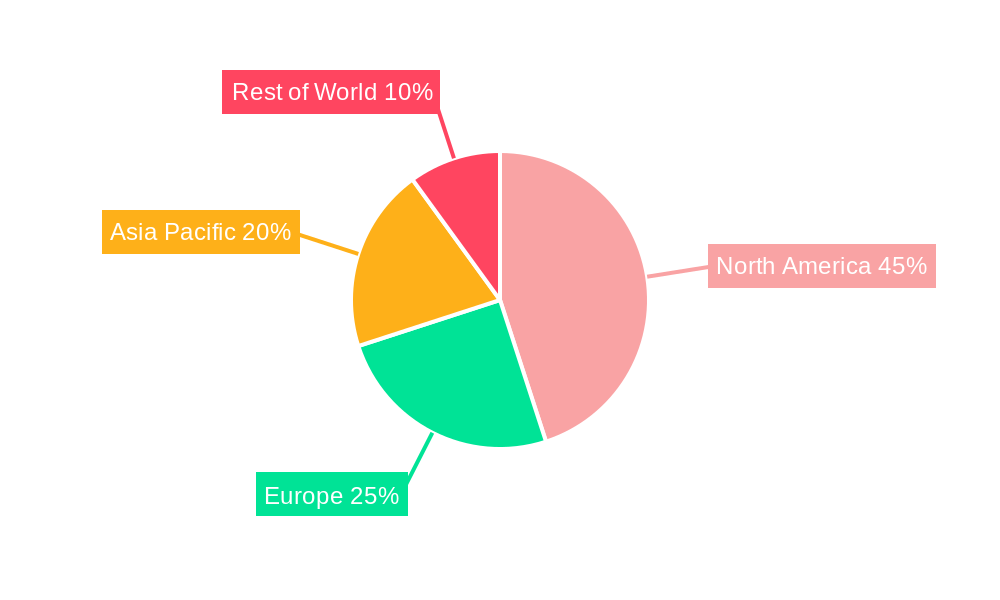

North America Satellite Manufacturing Market Regional Market Share

Geographic Coverage of North America Satellite Manufacturing Market

North America Satellite Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Satellite Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. Eliptical

- 5.3.2. GEO

- 5.3.3. LEO

- 5.3.4. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.5.1. Propulsion Hardware and Propellant

- 5.5.2. Satellite Bus & Subsystems

- 5.5.3. Solar Array & Power Hardware

- 5.5.4. Structures, Harness & Mechanisms

- 5.6. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.6.1. Electric

- 5.6.2. Gas based

- 5.6.3. Liquid Fuel

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Swarm Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maxar Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thale

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Planet Labs Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Northrop Grumman Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Spire Global Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Capella Space Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Satellite Manufacturing Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Satellite Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Satellite Manufacturing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: North America Satellite Manufacturing Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 3: North America Satellite Manufacturing Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 4: North America Satellite Manufacturing Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 5: North America Satellite Manufacturing Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 6: North America Satellite Manufacturing Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 7: North America Satellite Manufacturing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: North America Satellite Manufacturing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: North America Satellite Manufacturing Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 10: North America Satellite Manufacturing Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 11: North America Satellite Manufacturing Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: North America Satellite Manufacturing Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 13: North America Satellite Manufacturing Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 14: North America Satellite Manufacturing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States North America Satellite Manufacturing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Satellite Manufacturing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Satellite Manufacturing Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Satellite Manufacturing Market?

The projected CAGR is approximately 14.4%.

2. Which companies are prominent players in the North America Satellite Manufacturing Market?

Key companies in the market include Space Exploration Technologies Corp, Swarm Technologies Inc, Lockheed Martin Corporation, Maxar Technologies Inc, Thale, Planet Labs Inc, Northrop Grumman Corporation, Spire Global Inc, Capella Space Corp.

3. What are the main segments of the North America Satellite Manufacturing Market?

The market segments include Application, Satellite Mass, Orbit Class, End User, Satellite Subsystem, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: Planet Labs has built 12 Dove nanosatellites for Planet. These satellites are launched from Vostochny Cosmodrome.November 2023: Thales Alenia Space signed a contract with Inmarsat for the construction of Inmarsat-5 satellite. The satellite was launched aboard Ariane-5ECAJuly 2023: Planet Labs has built 48 Dove satellites. These satellites are launched from Baikonur Cosmodrome.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Satellite Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Satellite Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Satellite Manufacturing Market?

To stay informed about further developments, trends, and reports in the North America Satellite Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence