Key Insights

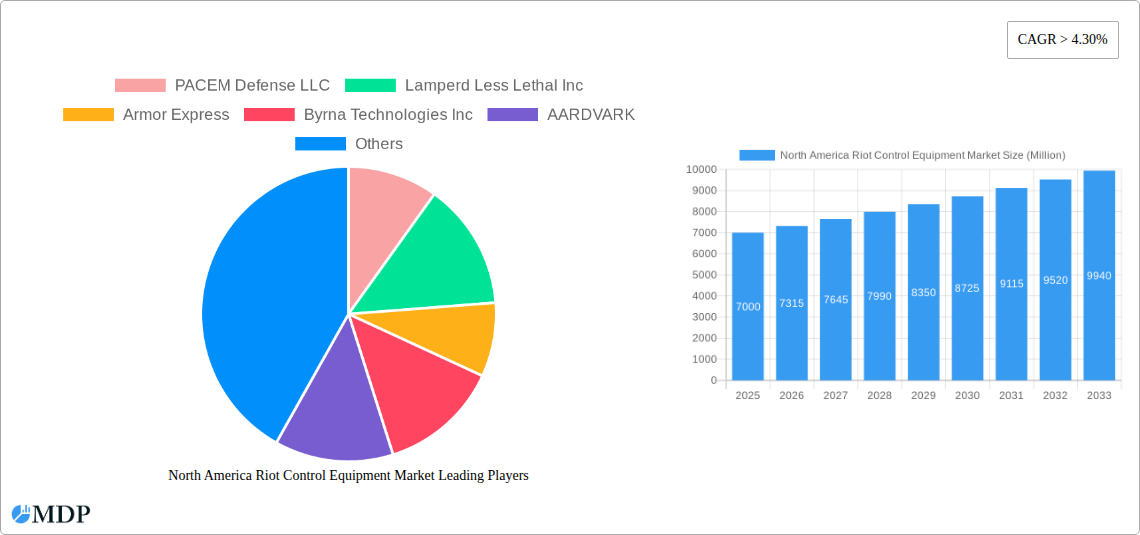

The North America Riot Control Equipment Market is poised for significant growth, projected to reach $7 billion in 2025, with a compound annual growth rate (CAGR) of 4.5% through 2033. This expansion is primarily fueled by escalating global security concerns, the increasing frequency of civil unrest, and a heightened emphasis on de-escalation tactics by law enforcement and military agencies. The demand for advanced Personnel Protection Equipment (PPE) such as ballistic vests, helmets, and protective suits is robust, driven by the need to safeguard officers in volatile situations. Simultaneously, the market for Crowd Dispersal Equipment, including non-lethal projectile launchers, tear gas, and acoustic devices, is witnessing considerable traction as authorities seek effective yet less injurious methods to manage large gatherings. Law enforcement agencies represent the largest end-user segment, closely followed by military and special forces, both seeking to enhance their operational capabilities and officer safety.

North America Riot Control Equipment Market Market Size (In Billion)

Regional dynamics indicate North America as a key market, with the United States, Canada, and Mexico demonstrating strong adoption rates for sophisticated riot control solutions. Investments in modernizing security infrastructure and training protocols further bolster market expansion. Emerging trends include the integration of smart technologies in PPE, such as real-time biometric monitoring and communication systems, and the development of more targeted and less harmful crowd dispersal agents. However, the market faces certain restraints, including stringent regulatory frameworks governing the use of certain less-lethal technologies and public scrutiny over the potential misuse of riot control equipment. Despite these challenges, the underlying drivers of increased security needs and the pursuit of effective public order management are expected to sustain the market's upward trajectory, with companies like PACEM Defense LLC, Lamperd Less Lethal Inc., and TASER Self-Defense (Axon Enterprise Inc.) at the forefront of innovation.

North America Riot Control Equipment Market Company Market Share

North America Riot Control Equipment Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a panoramic view of the North America riot control equipment market, offering critical insights into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook. Spanning the historical period of 2019-2024, with a base year of 2025 and a forecast period extending to 2033, this analysis is crucial for stakeholders seeking to navigate the evolving landscape of law enforcement and public safety technologies. The market is projected to reach $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

North America Riot Control Equipment Market Market Dynamics & Concentration

The North America riot control equipment market exhibits a moderate to high level of concentration, characterized by the presence of established global players and emerging innovators. Market share is significantly influenced by product innovation, technological advancements, and strategic partnerships. Innovation drivers include the demand for less-lethal alternatives, improved officer safety, and enhanced crowd management capabilities. Regulatory frameworks, particularly those surrounding the use of force and less-lethal technologies, play a pivotal role in shaping market access and product development. Product substitutes, such as advanced surveillance technologies and de-escalation training, exert competitive pressure, while end-user trends favor integrated solutions and connected law enforcement technologies. Mergers and acquisitions (M&A) activities are on the rise as companies seek to expand their product portfolios, geographical reach, and technological expertise. The market is anticipated to witness approximately XX M&A deals during the forecast period, reflecting a consolidation trend among key participants.

- Market Concentration: Moderate to High

- Innovation Drivers: Less-lethal technologies, officer safety, integrated solutions

- Regulatory Frameworks: Impact on product approval and deployment

- Product Substitutes: Surveillance, de-escalation training

- End-User Trends: Connected law enforcement, advanced less-lethal options

- M&A Activities: XX M&A deals projected by 2033

North America Riot Control Equipment Market Industry Trends & Analysis

The North America riot control equipment market is experiencing robust growth, driven by increasing security concerns, rising civil unrest, and the continuous need for effective crowd management solutions by law enforcement and military agencies. A significant trend is the escalating demand for advanced less-lethal technologies that minimize casualties and collateral damage while maximizing effectiveness. This includes a growing adoption of energy weapons, advanced less-lethal projectiles, and sophisticated dispersal agents. The market penetration of these advanced solutions is projected to reach XX% by 2033, underscoring their increasing importance. Technological disruptions, such as the integration of artificial intelligence (AI) for real-time threat assessment and the development of smart connected devices, are reshaping the industry. Consumer preferences are shifting towards integrated systems that offer enhanced situational awareness and interoperability, allowing for seamless communication and data sharing between devices and command centers. Competitive dynamics are intensifying, with companies focusing on research and development to introduce next-generation products that offer superior performance, safety features, and user-friendliness. The market is also influenced by the growing emphasis on officer training and the ethical deployment of riot control equipment, pushing manufacturers to develop user-friendly and accountability-focused solutions. The estimated market size for the North America riot control equipment market is projected to be $XX billion in 2025, with a projected CAGR of XX% during the forecast period. This growth is further bolstered by government procurement policies and defense spending, particularly in light of evolving geopolitical landscapes and domestic security challenges. The increasing adoption of body-worn cameras and TASER devices by law enforcement agencies, as evidenced by large-scale deployments, highlights the critical role these technologies play in modern policing and crowd control operations.

Leading Markets & Segments in North America Riot Control Equipment Market

The North America riot control equipment market is dominated by the United States, owing to its substantial law enforcement and military expenditure, coupled with a proactive approach to adopting advanced security technologies. Within the United States, law enforcement agencies represent the largest end-user segment, driven by the need to manage urban protests, civil disturbances, and public safety incidents effectively. The Personnel Protection Equipment segment, encompassing body armor, helmets, and protective shields, holds a significant market share due to its fundamental role in safeguarding officers during volatile situations.

- Dominant Region: United States

- Leading End User: Law Enforcement

- Key Segment: Personnel Protection Equipment

Detailed Dominance Analysis:

The Law Enforcement end-user segment in North America is characterized by a substantial and consistent demand for riot control equipment. This is fueled by:

- Increased Frequency of Public Gatherings: A rise in large-scale public gatherings, protests, and demonstrations necessitates effective crowd management strategies and equipment.

- Officer Safety Mandates: Stringent regulations and organizational policies emphasizing officer safety drive the procurement of advanced personal protective gear.

- Technological Adoption Rates: Law enforcement agencies in North America are generally early adopters of new technologies, including less-lethal weapons and integrated communication systems.

- Federal and State Funding: Significant government funding allocated to public safety initiatives and law enforcement modernization directly supports the market for riot control equipment.

The Personnel Protection Equipment segment's dominance is attributed to:

- Essential Officer Safety: This category forms the bedrock of officer safety, providing crucial protection against physical harm during riots and public disturbances.

- Wide Range of Products: The segment encompasses a diverse array of products, from basic riot suits to advanced ballistic vests and impact-resistant helmets, catering to varied operational needs.

- Regulatory Compliance: Manufacturers must adhere to strict safety and performance standards (e.g., NIJ standards), ensuring a high level of product reliability.

- Continuous Innovation: Ongoing research into lighter, more durable, and more protective materials drives product development and market demand.

North America Riot Control Equipment Market Product Developments

Product development in the North America riot control equipment market is focused on enhancing officer safety, increasing operational effectiveness, and minimizing civilian harm. Key innovations include the integration of smart technologies into personal protective equipment, such as real-time biometric monitoring and integrated communication systems. The development of advanced less-lethal projectiles with improved accuracy and reduced risk of injury, alongside more effective and less harmful dispersal agents, is also a significant trend. Furthermore, there is a growing emphasis on modular and customizable equipment that can be adapted to specific mission requirements, offering a competitive advantage to manufacturers.

Key Drivers of North America Riot Control Equipment Market Growth

The North America riot control equipment market is propelled by several key drivers. Increased global security concerns and the rising frequency of civil unrest and public demonstrations necessitate robust crowd management solutions. Technological advancements in less-lethal weaponry, such as advanced TASER systems and projectile launchers, are driving demand for more effective and safer alternatives to traditional force. Furthermore, government mandates and initiatives aimed at enhancing law enforcement capabilities and officer safety significantly contribute to market expansion. The growing awareness of human rights and the desire to minimize casualties during public order events further fuel the adoption of less-lethal technologies.

- Rising Security Concerns and Civil Unrest: Escalating global security threats and increased instances of public demonstrations.

- Technological Advancements: Innovations in less-lethal weaponry, smart equipment, and integrated systems.

- Officer Safety Mandates: Government and organizational focus on protecting law enforcement personnel.

- Shift Towards Less-Lethal Options: A global trend to reduce casualties and collateral damage.

Challenges in the North America Riot Control Equipment Market Market

Despite strong growth, the North America riot control equipment market faces several challenges. Stringent regulatory frameworks and approval processes for new technologies can slow down market entry and adoption. The high cost of advanced riot control equipment can be a significant barrier for smaller law enforcement agencies with limited budgets. Public perception and ethical concerns surrounding the use of force and less-lethal weapons can also create resistance and impact procurement decisions. Additionally, supply chain disruptions and geopolitical factors can affect the availability and cost of raw materials and finished products, posing a risk to market stability.

- Regulatory Hurdles: Lengthy approval processes and evolving legal frameworks.

- High Cost of Advanced Equipment: Budgetary constraints for some agencies.

- Public Perception and Ethical Concerns: Scrutiny over the use of force and less-lethal technologies.

- Supply Chain Vulnerabilities: Disruptions in raw material sourcing and manufacturing.

Emerging Opportunities in North America Riot Control Equipment Market

Emerging opportunities in the North America riot control equipment market lie in the development of integrated, smart, and data-driven solutions. The growing demand for interoperable systems that enhance communication, situational awareness, and real-time data analysis presents a significant growth avenue. Advancements in AI and machine learning for predictive policing and threat assessment can be integrated into riot control strategies. Furthermore, the increasing focus on de-escalation techniques and non-lethal incapacitation methods opens doors for innovative product development. Strategic partnerships between technology providers and public safety agencies are crucial for co-creating solutions that address evolving operational needs.

Leading Players in the North America Riot Control Equipment Market Sector

- PACEM Defense LLC

- Lamperd Less Lethal Inc

- Armor Express

- Byrna Technologies Inc

- AARDVARK

- EDI-USA

- NonLethal Technologies Inc

- Paulson Manufacturing

- TASER Self-Defense (Axon Enterprise Inc )

- Aspetto Inc

- Combined Systems Inc

- Rheinmetall AG

- Safariland LLC

Key Milestones in North America Riot Control Equipment Market Industry

- July 2022: Axon partnered with Fusus, with a vision to collectively provide holistic, mission-critical intelligence for the safety of officers, and the community. The two companies will improve operational processes for police agencies, simultaneously meeting the needs of the community.

- January 2021: Axon announced that the Los Angeles Police Department (LAPD) renewed its 5-year contract with Axon and purchased 355 Axon Body 3 cameras and 5,260 TASER 7 energy weapons. With the purchase, LAPD has 7,355 Axon body cameras and 7,530 TASER 7 energy weapons, making it the largest energy weapon deployment in the United States.

Strategic Outlook for North America Riot Control Equipment Market Market

The strategic outlook for the North America riot control equipment market is characterized by a sustained demand for advanced, integrated, and less-lethal solutions. Manufacturers will focus on leveraging technological innovations, particularly in areas like AI, IoT, and advanced materials, to develop next-generation products. Strategic partnerships and collaborations with law enforcement agencies and defense contractors will be crucial for understanding evolving operational needs and co-developing tailored solutions. Companies investing in robust R&D capabilities, with a strong emphasis on officer safety and de-escalation technologies, are poised for significant growth. Furthermore, the expansion into emerging markets and the development of cost-effective solutions for a broader range of end-users will be key to long-term market success.

North America Riot Control Equipment Market Segmentation

-

1. Product Type

- 1.1. Personnel Protection Equipment

- 1.2. Crowd Dispersal Equipment

-

2. End User

- 2.1. Law Enforcement

- 2.2. Military and Special Forces

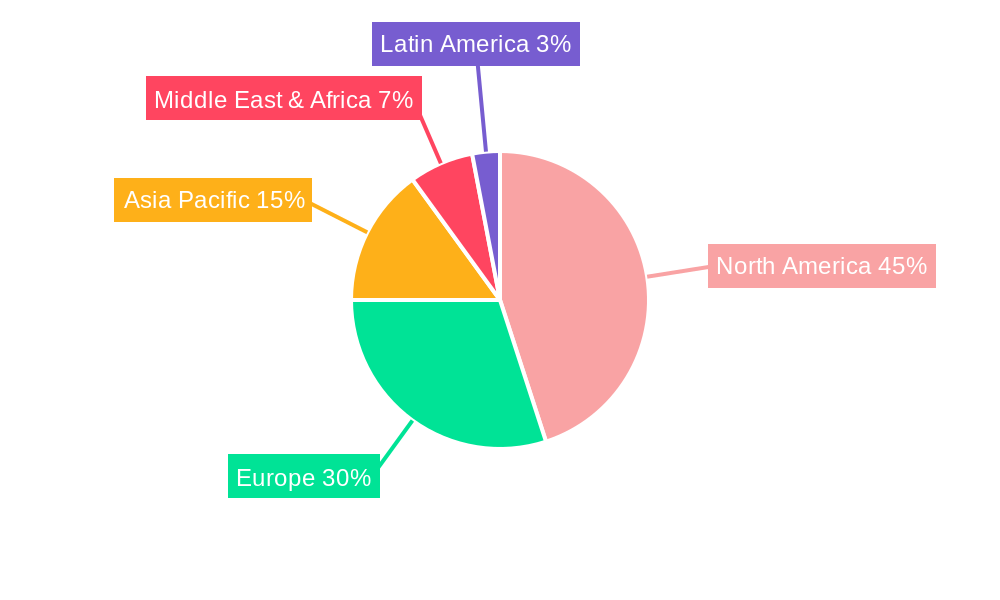

North America Riot Control Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Riot Control Equipment Market Regional Market Share

Geographic Coverage of North America Riot Control Equipment Market

North America Riot Control Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Law Enforcement Agencies are the Biggest Consumers of Riot Control Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Riot Control Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personnel Protection Equipment

- 5.1.2. Crowd Dispersal Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Law Enforcement

- 5.2.2. Military and Special Forces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PACEM Defense LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lamperd Less Lethal Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Armor Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Byrna Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AARDVARK

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EDI-USA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NonLethal Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paulson Manufacturing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TASER Self-Defense (Axon Enterprise Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aspetto Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Combined Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rheinmetall A

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Safariland LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 PACEM Defense LLC

List of Figures

- Figure 1: North America Riot Control Equipment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Riot Control Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Riot Control Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Riot Control Equipment Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: North America Riot Control Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Riot Control Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: North America Riot Control Equipment Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: North America Riot Control Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Riot Control Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Riot Control Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Riot Control Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Riot Control Equipment Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Riot Control Equipment Market?

Key companies in the market include PACEM Defense LLC, Lamperd Less Lethal Inc, Armor Express, Byrna Technologies Inc, AARDVARK, EDI-USA, NonLethal Technologies Inc, Paulson Manufacturing, TASER Self-Defense (Axon Enterprise Inc ), Aspetto Inc, Combined Systems Inc, Rheinmetall A, Safariland LLC.

3. What are the main segments of the North America Riot Control Equipment Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Law Enforcement Agencies are the Biggest Consumers of Riot Control Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: Axon partnered with Fusus, with a vision to collectively provide holistic, mission-critical intelligence for the safety of officers, and the community. The two companies will improve operational processes for police agencies, simultaneously meeting the needs of the community.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Riot Control Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Riot Control Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Riot Control Equipment Market?

To stay informed about further developments, trends, and reports in the North America Riot Control Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence