Key Insights

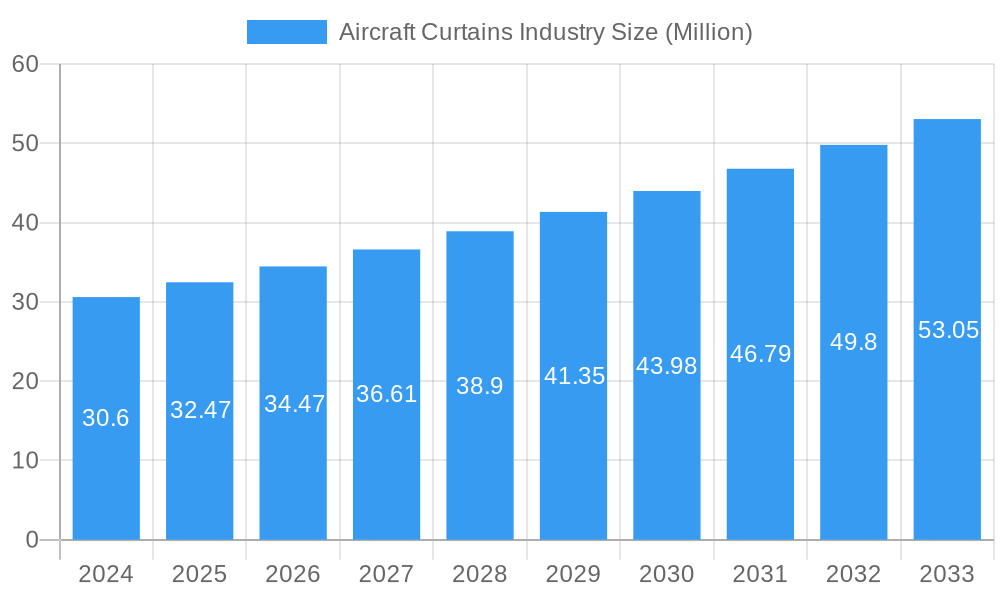

The global Aircraft Curtains Industry is poised for significant growth, projected to reach USD 30.6 million in 2024 and expand at a robust CAGR of 6.2% through 2033. This upward trajectory is primarily fueled by the increasing demand for enhanced passenger comfort and cabin aesthetics in both commercial and military aviation sectors. As airlines and aircraft manufacturers continuously strive to offer premium travel experiences, the importance of high-quality, functional, and visually appealing cabin and window curtains is amplified. Technological advancements in flame-retardant, sound-dampening, and aesthetically versatile materials are further driving innovation and adoption within the market. The growing global fleet size, coupled with increasing air travel post-pandemic, directly correlates with the demand for new aircraft installations and the replacement of existing cabin interiors.

Aircraft Curtains Industry Market Size (In Million)

The market segmentation reveals a substantial opportunity within the Commercial Aircraft segment, driven by fleet expansions and upgrade cycles. General Aviation also presents a steady demand, while Military Aircraft offer niche but consistent requirements for specialized curtain solutions. Key trends shaping the industry include the integration of smart fabrics with integrated lighting or information displays, a focus on sustainable and lightweight materials, and customizable designs to meet diverse airline branding needs. Despite the positive outlook, certain factors may present challenges, such as stringent regulatory compliance for materials, fluctuating raw material costs, and the competitive landscape among manufacturers. Nevertheless, with a projected market size and sustained growth rate, the Aircraft Curtains Industry is an attractive sector for investment and innovation.

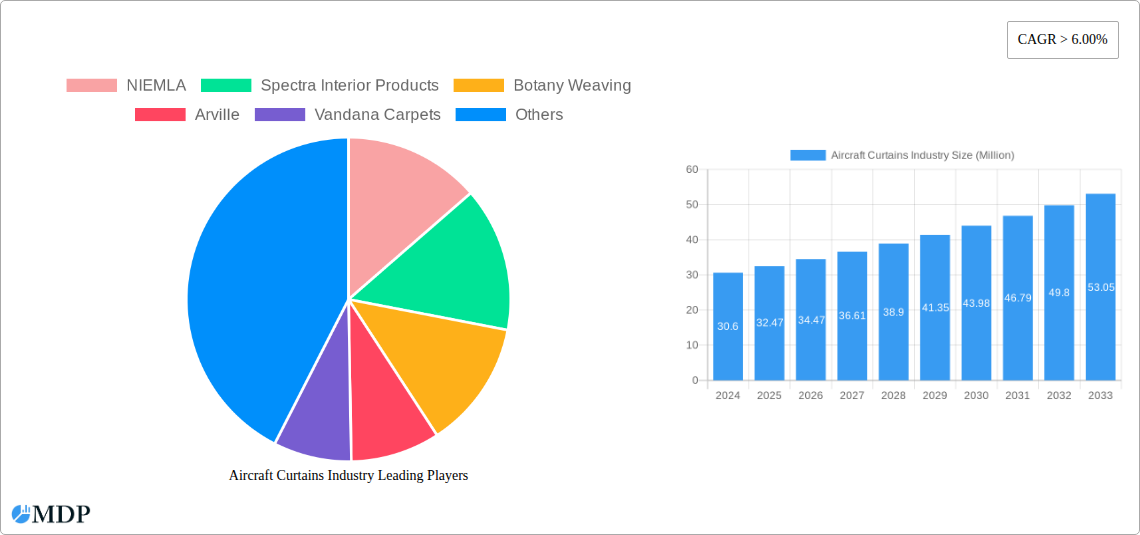

Aircraft Curtains Industry Company Market Share

Unlock the Future of Aviation Interiors: Comprehensive Report on the Aircraft Curtains Market (2019-2033)

Dive deep into the dynamic global Aircraft Curtains Industry with this authoritative report. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights for stakeholders seeking to navigate this high-growth sector. Explore market dynamics, key trends, leading segments, and strategic opportunities within the global aviation interiors market. This report is your essential guide to understanding market concentration, innovation drivers, end-user demands, and competitive landscapes, offering actionable intelligence for strategic decision-making.

Aircraft Curtains Industry Market Dynamics & Concentration

The Aircraft Curtains Industry exhibits a moderate level of market concentration, with a few key players holding significant market share, estimated to be around 40% in 2025. Innovation drivers are primarily focused on enhancing flame retardancy, reducing weight, improving acoustic insulation, and incorporating advanced aesthetic features. Regulatory frameworks, such as those from the FAA and EASA, play a crucial role in dictating material safety and performance standards, influencing product development and market entry. Product substitutes, while limited in their direct application, include alternative cabin partitioning solutions and advancements in transparent materials that could potentially reduce the reliance on traditional curtains. End-user trends are heavily influenced by the demand for premium cabin experiences in commercial aviation, the need for robust and functional solutions in military aircraft, and the growing demand for customized interiors in general aviation. Mergers and acquisitions (M&A) activities are strategic, with an estimated 5 significant deals in the historical period (2019-2024) aimed at expanding product portfolios and geographical reach. The increasing passenger comfort expectations and the drive for lightweight, durable materials are key forces shaping market dynamics.

- Market Concentration: Moderate, with top 5 players estimated to hold 40% market share in 2025.

- Innovation Drivers: Flame retardancy, weight reduction, acoustic insulation, aesthetic appeal, smart materials.

- Regulatory Frameworks: FAA, EASA, and other aviation authorities' safety and performance mandates.

- Product Substitutes: Advanced cabin partitioning, innovative transparent materials.

- End-User Trends: Premium cabin experience (Commercial), durability & functionality (Military), customization (General Aviation).

- M&A Activities: Approximately 5 significant deals in the historical period (2019-2024) for portfolio expansion and market consolidation.

Aircraft Curtains Industry Industry Trends & Analysis

The Aircraft Curtains Industry is projected for robust growth, driven by an anticipated Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025–2033). Market penetration is steadily increasing, fueled by the continuous expansion of global aviation fleets and the ongoing demand for cabin retrofits and upgrades. Technological disruptions are a significant factor, with advancements in material science leading to the development of lighter, more sustainable, and highly functional aircraft curtains. The integration of smart features, such as adjustable opacity and integrated lighting, is also emerging as a key trend. Consumer preferences are evolving towards enhanced passenger comfort, personalized cabin environments, and a strong emphasis on sustainability and eco-friendly materials. This is pushing manufacturers to invest in research and development for innovative solutions. Competitive dynamics within the industry are characterized by fierce competition on price, quality, and technological innovation. Companies are increasingly focusing on building strong relationships with aircraft manufacturers and maintenance, repair, and overhaul (MRO) providers to secure long-term contracts. The growing emphasis on fuel efficiency is also driving demand for lightweight curtain solutions that contribute to reduced aircraft weight and improved fuel economy. Furthermore, the increasing number of aircraft deliveries worldwide, coupled with the need to replace aging fleets, represents a substantial opportunity for market expansion. The rising disposable incomes globally are also indirectly contributing to increased air travel, thereby boosting the demand for aircraft interiors, including curtains. The industry is witnessing a trend towards modular and easily replaceable curtain systems, simplifying maintenance and reducing downtime for airlines.

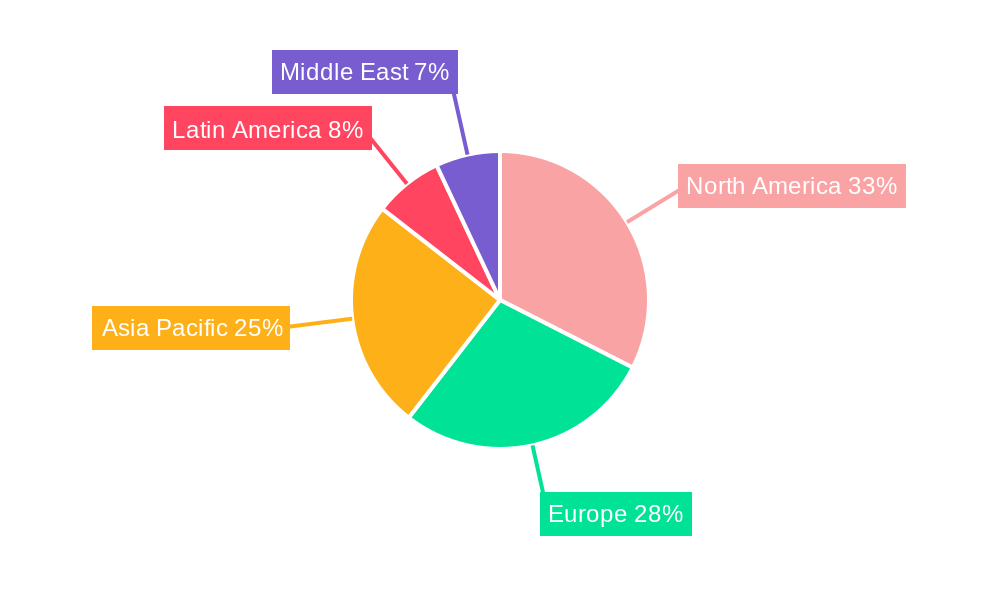

Leading Markets & Segments in Aircraft Curtains Industry

The Commercial Aircraft segment is the dominant force within the Aircraft Curtains Industry, accounting for an estimated 75% of the market share in 2025. This dominance is attributed to the substantial global fleet size and the continuous expansion of air travel, particularly in emerging economies. Within this segment, Cabin Curtains are the leading product type, reflecting their integral role in defining passenger privacy, ambiance, and cabin segmentation. North America and Europe currently lead in terms of market value, driven by the presence of major aircraft manufacturers and established airlines with high fleet utilization rates. However, the Asia-Pacific region is witnessing the fastest growth, propelled by a burgeoning middle class, increased air travel connectivity, and significant investments in aviation infrastructure.

Dominant End User: Commercial Aircraft.

- Key Drivers: Expanding global air travel, increasing passenger comfort expectations, fleet modernization programs, growing demand for premium cabin experiences.

- Dominance Analysis: The sheer volume of commercial aircraft deliveries and the continuous need for cabin refreshes and retrofits in this segment far surpass those in military and general aviation, making it the primary revenue generator for aircraft curtain manufacturers. Airlines are increasingly investing in aesthetically pleasing and functional cabin interiors to enhance passenger satisfaction and brand differentiation.

Dominant Product Type: Cabin Curtains.

- Key Drivers: Essential for passenger privacy, cabin ambiance, and segmentation across different classes (e.g., economy, business, first class).

- Dominance Analysis: Cabin curtains are a universal requirement across all commercial aircraft, serving multiple functional and aesthetic purposes. They are critical for creating distinct zones within the cabin, managing light, and offering passengers a sense of personal space.

Leading Regions: North America and Europe.

- Key Drivers: Presence of major OEMs (Boeing, Airbus), established MRO infrastructure, high fleet utilization, stringent regulatory compliance, and a mature aviation market.

- Dominance Analysis: These regions have historically been at the forefront of aviation development and innovation, hosting the headquarters of major aircraft manufacturers and a significant portion of the global airline fleet. This translates to substantial ongoing demand for aircraft interior components.

Fastest Growing Region: Asia-Pacific.

- Key Drivers: Rapid economic growth, expanding middle class, increasing disposable incomes, government investments in aviation infrastructure, and the emergence of new low-cost carriers and full-service airlines.

- Dominance Analysis: The burgeoning demand for air travel in countries like China, India, and Southeast Asian nations is driving new aircraft orders and necessitating the outfitting of new fleets, creating a significant growth runway for the aircraft curtains market in this region.

Aircraft Curtains Industry Product Developments

Innovations in aircraft curtains are increasingly focused on ultra-lightweight, sustainable, and advanced material compositions, offering superior flame retardancy and acoustic insulation properties. Products are being developed with enhanced durability and resistance to wear and tear, crucial for long service lives. The trend towards personalized cabin aesthetics is driving the development of curtains with a wider range of customizable colors, patterns, and textures. Furthermore, smart curtains with integrated features like adjustable opacity and ambient lighting are emerging, enhancing passenger experience and cabin functionality. These developments provide competitive advantages by meeting evolving airline and passenger demands for comfort, safety, and aesthetics.

Key Drivers of Aircraft Curtains Industry Growth

The Aircraft Curtains Industry is propelled by several key growth drivers. The continuous expansion of the global commercial aircraft fleet, driven by increasing passenger traffic and fleet modernization, directly fuels demand for new aircraft interiors, including curtains. Technological advancements in material science, leading to lighter, more durable, and flame-retardant materials, are crucial for meeting stringent aviation safety standards and improving fuel efficiency. Regulatory mandates for enhanced safety features, such as improved fire resistance, also necessitate the adoption of advanced curtain solutions. The growing emphasis on passenger comfort and cabin aesthetics by airlines to differentiate themselves in a competitive market is another significant growth catalyst.

Challenges in the Aircraft Curtains Industry Market

Despite robust growth prospects, the Aircraft Curtains Industry faces several challenges. Stringent and evolving regulatory compliance regarding material safety and flame retardancy can increase development costs and lead times. Fluctuations in raw material prices, particularly for specialized technical textiles, can impact profit margins. Supply chain disruptions, as seen in recent global events, can affect production timelines and delivery schedules. Intense competition among manufacturers, often leading to price pressures, also poses a significant challenge. Furthermore, the high cost of research and development for advanced materials can be a barrier for smaller players.

Emerging Opportunities in Aircraft Curtains Industry

Emerging opportunities in the Aircraft Curtains Industry lie in the growing demand for sustainable and eco-friendly materials, driven by airlines' corporate social responsibility initiatives and passenger preferences. The increasing adoption of lightweight and advanced composite materials presents a significant growth avenue. Strategic partnerships with aircraft manufacturers (OEMs) and Maintenance, Repair, and Overhaul (MRO) providers offer opportunities for long-term contracts and market penetration. The expansion of aviation infrastructure in emerging markets, particularly in Asia-Pacific and the Middle East, presents substantial new market potential for aircraft curtain suppliers. The development of smart and interactive curtain solutions catering to enhanced passenger experience is another key opportunity.

Leading Players in the Aircraft Curtains Industry Sector

- NIEMLA

- Spectra Interior Products

- Botany Weaving

- Arville

- Vandana Carpets

- Lantal

- EPSILON AEROSPAC

- ABC International

- Fu-Chi Innovation Technology Co Ltd

- FELLFAB

- Industrial Neotex SA

- ACM Aircraft Cabin Modification GmbH

- Belgraver aircraft interiors

Key Milestones in Aircraft Curtains Industry Industry

- 2019: Increased focus on ultra-lightweight materials to improve fuel efficiency across major manufacturers.

- 2020: Introduction of enhanced flame-retardant technologies in response to evolving safety regulations.

- 2021: Rise in demand for aesthetically customized curtains driven by airline branding efforts.

- 2022: Expansion of sustainable and recycled material options in curtain manufacturing.

- 2023: Development of smart curtain technologies with adjustable opacity and integrated lighting.

- 2024: Strategic partnerships formed between curtain manufacturers and major aircraft OEMs to secure supply chains.

Strategic Outlook for Aircraft Curtains Industry Market

The strategic outlook for the Aircraft Curtains Industry is characterized by sustained growth and innovation. Key growth accelerators include the increasing demand for sustainable and lightweight materials, driven by environmental concerns and fuel efficiency mandates. The continuous evolution of passenger expectations for comfort and personalized cabin experiences will fuel innovation in smart and aesthetically advanced curtain solutions. Strategic opportunities lie in expanding market reach in rapidly developing aviation regions and forging stronger collaborations with OEMs and MRO providers. Companies focusing on technological differentiation, superior product performance, and compliance with evolving regulations are poised for significant success in the coming years.

Aircraft Curtains Industry Segmentation

-

1. End User

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation

-

2. Type

- 2.1. Cabin Curtains

- 2.2. Window Curtains

Aircraft Curtains Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Egypt

- 6.3. Rest of Middle East

Aircraft Curtains Industry Regional Market Share

Geographic Coverage of Aircraft Curtains Industry

Aircraft Curtains Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment Is Anticipated to Grow with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cabin Curtains

- 5.2.2. Window Curtains

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Commercial Aircraft

- 6.1.2. Military Aircraft

- 6.1.3. General Aviation

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cabin Curtains

- 6.2.2. Window Curtains

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Commercial Aircraft

- 7.1.2. Military Aircraft

- 7.1.3. General Aviation

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cabin Curtains

- 7.2.2. Window Curtains

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Commercial Aircraft

- 8.1.2. Military Aircraft

- 8.1.3. General Aviation

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cabin Curtains

- 8.2.2. Window Curtains

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Commercial Aircraft

- 9.1.2. Military Aircraft

- 9.1.3. General Aviation

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cabin Curtains

- 9.2.2. Window Curtains

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Commercial Aircraft

- 10.1.2. Military Aircraft

- 10.1.3. General Aviation

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cabin Curtains

- 10.2.2. Window Curtains

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. United Arab Emirates Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End User

- 11.1.1. Commercial Aircraft

- 11.1.2. Military Aircraft

- 11.1.3. General Aviation

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Cabin Curtains

- 11.2.2. Window Curtains

- 11.1. Market Analysis, Insights and Forecast - by End User

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 NIEMLA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Spectra Interior Products

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Botany Weaving

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Arville

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Vandana Carpets

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Lantal

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 EPSILON AEROSPAC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ABC International

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fu-Chi Innovation Technology Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 FELLFAB

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Industrial Neotex SA

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 ACM Aircraft Cabin Modification GmbH

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Belgraver aircraft interiors

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 NIEMLA

List of Figures

- Figure 1: Global Aircraft Curtains Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 3: North America Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 9: Europe Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: Europe Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: Asia Pacific Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Asia Pacific Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 17: Asia Pacific Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 21: Latin America Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Latin America Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 23: Latin America Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 27: Middle East Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 28: Middle East Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 33: United Arab Emirates Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: United Arab Emirates Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: United Arab Emirates Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: United Arab Emirates Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: United Arab Emirates Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 2: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Aircraft Curtains Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 5: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 17: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: Brazil Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Mexico Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 31: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Egypt Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Curtains Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Aircraft Curtains Industry?

Key companies in the market include NIEMLA, Spectra Interior Products, Botany Weaving, Arville, Vandana Carpets, Lantal, EPSILON AEROSPAC, ABC International, Fu-Chi Innovation Technology Co Ltd, FELLFAB, Industrial Neotex SA, ACM Aircraft Cabin Modification GmbH, Belgraver aircraft interiors.

3. What are the main segments of the Aircraft Curtains Industry?

The market segments include End User, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment Is Anticipated to Grow with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Curtains Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Curtains Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Curtains Industry?

To stay informed about further developments, trends, and reports in the Aircraft Curtains Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence