Key Insights

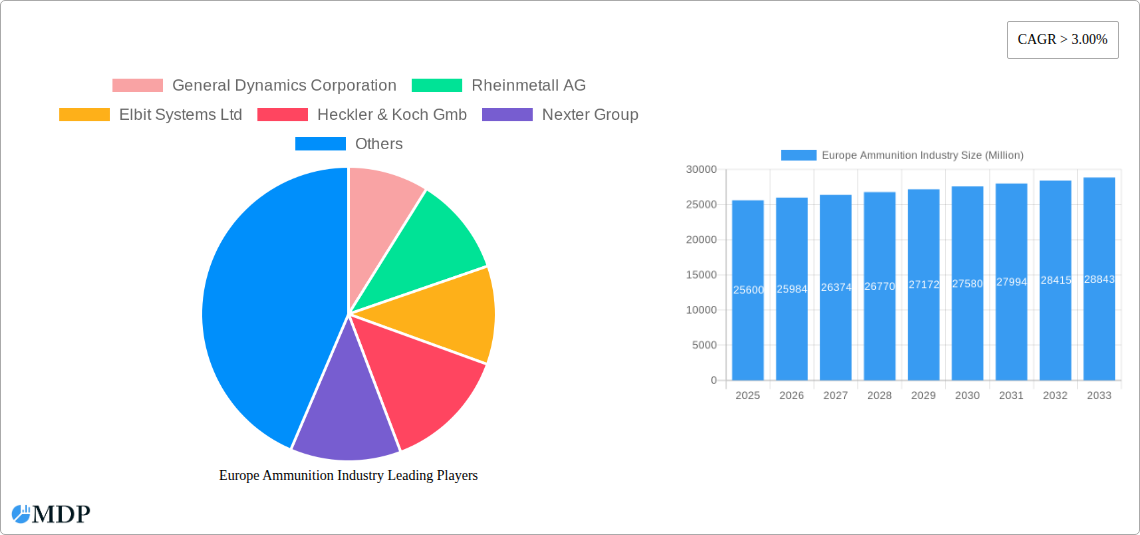

The European Ammunition Industry is poised for steady growth, projected to reach a market size of $25.6 billion by 2025, with a CAGR of 1.5% over the forecast period of 2025-2033. This moderate expansion is primarily driven by increasing geopolitical tensions and evolving defense modernization programs across the continent. The persistent need for replenishing military inventories, coupled with the ongoing development and procurement of advanced weaponry, are key factors fueling demand. Furthermore, the rise in internal security concerns and the demand for law enforcement ammunition contribute to market stability. Strategic investments in R&D for next-generation ammunition, including precision-guided munitions and environmentally friendly alternatives, are also shaping market dynamics. The industry is characterized by a focus on enhancing operational effectiveness, ensuring interoperability within NATO standards, and addressing the logistical complexities of ammunition supply chains.

Europe Ammunition Industry Market Size (In Billion)

The European Ammunition Industry faces a nuanced landscape influenced by both growth drivers and restraining factors. While the demand for conventional ammunition remains robust, the industry is also navigating evolving regulatory frameworks and the increasing emphasis on sustainable manufacturing practices. Geopolitical instability, particularly in Eastern Europe, serves as a significant stimulant, prompting governments to bolster their defense capabilities and, consequently, their ammunition stockpiles. However, budget constraints within some European nations and the high cost of advanced ammunition technologies can act as moderating influences. The market segmentation reveals significant activity across production, consumption, and international trade, with substantial import and export volumes shaping regional supply and demand. Key players, including General Dynamics Corporation, Rheinmetall AG, and BAE Systems plc, are actively engaged in innovation and strategic partnerships to maintain their competitive edge.

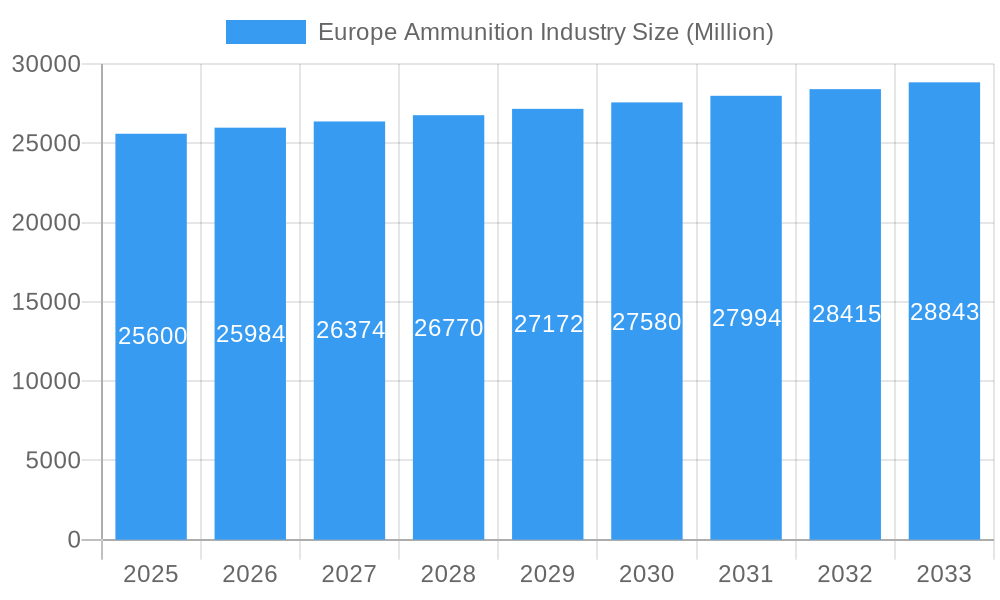

Europe Ammunition Industry Company Market Share

Europe Ammunition Industry: Market Dynamics, Trends, and Strategic Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Europe Ammunition Industry, a critical sector supporting defense, law enforcement, and sporting applications. Spanning from 2019 to 2033, with a base and estimated year of 2025, this study provides actionable insights into market dynamics, consumption patterns, import/export landscapes, pricing trends, and future growth trajectories. Leveraging high-traffic keywords such as "defense ammunition market Europe," "military ammunition manufacturers," "40mm ammunition contract," "120mm mortar ammunition," and "European defense spending," this report is meticulously designed for industry stakeholders, investors, policymakers, and procurement professionals seeking to understand and capitalize on the evolving European ammunition landscape. The estimated market size for the Europe Ammunition Industry is projected to reach $30 billion by 2033.

Europe Ammunition Industry Market Dynamics & Concentration

The Europe Ammunition Industry is characterized by a moderate to high market concentration, with a few key players dominating significant portions of the market share. Innovation drivers include the continuous demand for advanced munitions with enhanced lethality, precision, and reduced collateral damage, fueled by evolving geopolitical landscapes and modern warfare doctrines. Regulatory frameworks, primarily driven by national defense policies and international arms control agreements like the Wassenaar Arrangement, significantly influence market access and product development. Product substitutes, while limited in direct military applications, can include alternative less-lethal options for law enforcement or advancements in electronic warfare that reduce reliance on physical projectiles. End-user trends are dominated by governmental defense procurement, with increasing emphasis on interoperability within NATO, modernization of existing arsenals, and the development of next-generation ammunition capabilities. Mergers and Acquisitions (M&A) activities are a notable aspect, with approximately 15-20 significant M&A deals observed within the historical period (2019-2024), indicating consolidation and strategic expansion among leading companies. The market share of the top five players is estimated to be around 60%.

Europe Ammunition Industry Industry Trends & Analysis

The Europe Ammunition Industry is experiencing robust growth, driven by several interconnected factors. A primary growth driver is the heightened geopolitical tension and increased defense spending across European nations, particularly in response to recent global conflicts. This has led to a significant surge in demand for a wide range of ammunition calibers, from small arms to artillery. Technological disruptions are playing a pivotal role, with a strong emphasis on the development of smart munitions, guided projectiles, and novel propellant technologies. These innovations aim to enhance accuracy, range, and effectiveness, while also addressing environmental concerns through the development of eco-friendlier materials and manufacturing processes. Consumer preferences, largely dictated by government procurement agencies, are shifting towards higher-quality, more sophisticated ammunition that offers superior performance and reliability. This includes a growing demand for caseless ammunition, directed-energy weapons integration, and advanced countermeasures. The competitive dynamics are intense, with established players continually investing in R&D and manufacturing capacity to meet demand and secure long-term contracts. The Compound Annual Growth Rate (CAGR) for the Europe Ammunition Industry is estimated to be approximately 6.5% during the forecast period (2025–2033). Market penetration of advanced ammunition types is steadily increasing, estimated to reach 40% by 2030. The industry is also witnessing a rise in collaborative efforts and joint ventures to share R&D costs and leverage specialized expertise, particularly in areas like explosive materials and guidance systems.

Leading Markets & Segments in Europe Ammunition Industry

The Europe Ammunition Industry exhibits significant regional and segment-specific variations.

Production Analysis:

- Dominant Region: Central and Western Europe, specifically countries with strong defense manufacturing bases like Germany, France, the United Kingdom, and Sweden, lead in ammunition production.

- Key Drivers:

- Established defense industrial complexes: Decades of experience and investment in advanced manufacturing capabilities.

- Governmental support and long-term procurement contracts: Consistent demand from national defense forces.

- Technological innovation and R&D investment: Focus on developing next-generation ammunition.

- Skilled workforce: Availability of specialized engineers and technicians.

- Dominance Analysis: Germany, through companies like Rheinmetall AG, holds a substantial share in the production of a wide array of calibers, including artillery, mortar, and small arms ammunition. France, with Nexter Group, is a significant producer of artillery and tank ammunition. The United Kingdom, represented by BAE Systems plc, is also a major player, particularly in naval and artillery systems.

Consumption Analysis:

- Dominant End-User: Military and defense organizations within NATO and EU member states represent the largest consumers.

- Key Drivers:

- Geopolitical security concerns: Increased threat perceptions driving higher defense readiness.

- Modernization programs: Upgrading existing arsenals and acquiring new weapon systems.

- Operational deployments: Ammunition consumption during training exercises and active missions.

- Interoperability initiatives: Standardization of ammunition types within allied forces.

- Dominance Analysis: Poland, the Baltic states, and Eastern European NATO members are showing accelerated consumption growth due to their proximity to current geopolitical hotspots. Western European nations continue to be significant consumers driven by long-term modernization efforts.

Import Market Analysis (Value & Volume):

- Dominant Importers: Countries lacking extensive indigenous production capabilities or requiring specialized ammunition types.

- Key Drivers:

- Specialized caliber requirements: Sourcing niche ammunition not readily produced domestically.

- Technological superiority: Importing advanced ammunition from leading global manufacturers.

- Rapid fulfillment of urgent needs: Supplementing domestic production during high demand periods.

- Strategic alliances and defense partnerships: Facilitating imports from allied nations.

- Dominance Analysis: Countries like Italy, Spain, and smaller EU nations often import specific calibers or technologically advanced munitions. The import market value is estimated to be around $8 billion in 2025.

Export Market Analysis (Value & Volume):

- Dominant Exporters: Nations with robust defense industries and competitive pricing strategies.

- Key Drivers:

- Global defense market demand: Serving international military customers.

- Cost-effectiveness: Offering competitive pricing for high-volume production.

- Technological leadership: Exporting advanced and specialized ammunition.

- Strong diplomatic and trade relationships: Facilitating international sales.

- Dominance Analysis: Germany, the United Kingdom, and France are significant exporters of ammunition. The export market value is estimated to be around $12 billion in 2025.

Price Trend Analysis:

- Dominant Trend: Upward price trend driven by raw material costs, increased demand, and R&D investment.

- Key Drivers:

- Rising raw material prices: Increased costs for metals, propellants, and explosives.

- Supply chain disruptions: Impact on production and logistics costs.

- Demand surge: Increased demand outstripping supply capacity.

- Inflationary pressures: General economic factors affecting manufacturing costs.

- Dominance Analysis: The price of high-velocity and specialized ammunition variants is experiencing a steeper increase compared to standard calibers.

Europe Ammunition Industry Product Developments

The Europe Ammunition Industry is witnessing a surge in product development focused on enhanced precision, reduced collateral damage, and increased lethality. Innovations include the integration of smart fuzes for multi-option detonation (point, delay, proximity, airburst), advanced guidance systems for artillery shells and missiles, and the development of insensitive munitions (IM) that are safer to handle and store. There's a growing emphasis on developing more environmentally friendly ammunition, including biodegradable components and reduced toxic residue. Furthermore, companies are exploring modular ammunition designs that can be adapted for different roles and platforms, enhancing operational flexibility. Competitive advantages are derived from superior accuracy, extended range, enhanced effectiveness against hardened targets, and improved safety features.

Key Drivers of Europe Ammunition Industry Growth

The Europe Ammunition Industry is propelled by a confluence of strategic and economic factors. Increased geopolitical instability and renewed focus on national defense capabilities across Europe represent a primary driver, leading to substantial increases in procurement budgets. The ongoing modernization of military hardware and weapon systems necessitates a corresponding upgrade in ammunition stockpiles and the adoption of advanced calibers. Furthermore, the growing demand for precision-guided munitions (PGMs) and smart ammunition from both NATO and individual European nations, aiming to enhance operational effectiveness and minimize collateral damage, is a significant catalyst. Technological advancements in material science and propellants are also enabling the development of more capable and efficient ammunition, further stimulating demand.

Challenges in the Europe Ammunition Industry Market

Despite robust growth prospects, the Europe Ammunition Industry faces several significant challenges. Stringent regulatory frameworks and export controls imposed by national governments and international bodies can create hurdles for market access and global sales. Supply chain volatility and the rising cost of raw materials, particularly metals and chemical precursors for propellants, directly impact production costs and lead times. The limited manufacturing capacity and the long lead times for scaling up production can lead to supply shortfalls during periods of acute demand. Moreover, intense competition from established global players and emerging domestic manufacturers puts pressure on pricing and market share. The inherent long development cycles and high R&D investment requirements for advanced munitions also pose a challenge.

Emerging Opportunities in Europe Ammunition Industry

Emerging opportunities in the Europe Ammunition Industry are largely driven by technological advancements and strategic partnerships. The development and widespread adoption of next-generation smart munitions with advanced targeting and artificial intelligence capabilities present a significant growth avenue. Collaborations between defense contractors and technology firms are fostering innovation in areas like autonomous munitions and directed-energy weapon integration. Furthermore, the increasing emphasis on interoperability within NATO and EU defense initiatives is creating opportunities for manufacturers who can supply standardized ammunition that fits a range of allied weapon systems. The growing demand for eco-friendly and insensitive munitions due to regulatory pressures and safety concerns also opens new market segments. Strategic partnerships focused on joint R&D, shared manufacturing facilities, and co-marketing efforts are crucial for capitalizing on these opportunities and expanding market reach.

Leading Players in the Europe Ammunition Industry Sector

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- Heckler & Koch GmbH

- Nexter Group

- Nammo AS

- Denel PMP

- BAE Systems plc

- ROSTEC

- Saab AB

Key Milestones in Europe Ammunition Industry Industry

- December 2022: A European NATO customer entered into a contract with Rheinmetall to supply a maximum of 300,000 rounds of 40mm ammunition, consisting of LV (low velocity) and HV (high velocity) variants. The contract includes a first call-off of approximately 75,000 cartridges, highlighting continued demand for medium-caliber ammunition.

- January 2022: The German Bundeswehr signed a contract with Rheinmetall AG to modernize its mortar systems and provide 120mm mortar ammunition. The contract is worth approximately EUR 27 million (USD 30 million) and will be completed by 2023, underscoring the strategic importance of mortar systems and their ammunition in modern defense.

Strategic Outlook for Europe Ammunition Industry Market

The Europe Ammunition Industry is poised for sustained growth, driven by a dynamic interplay of geopolitical necessity and technological advancement. The strategic outlook emphasizes the increasing demand for high-precision, intelligent munitions that offer superior battlefield effectiveness with reduced collateral damage. Manufacturers who can demonstrate agility in scaling production, adapt to evolving end-user requirements, and invest in innovative technologies like AI-driven targeting and advanced propellants will be best positioned for success. Furthermore, fostering strong collaborative partnerships within NATO and the EU will be crucial for securing long-term procurement contracts and ensuring interoperability across allied forces. The development of environmentally sustainable ammunition solutions is also emerging as a key strategic imperative. The market will likely see further consolidation and specialization as companies strive to enhance their competitive edge and meet the complex demands of modern defense.

Europe Ammunition Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Ammunition Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Ammunition Industry Regional Market Share

Geographic Coverage of Europe Ammunition Industry

Europe Ammunition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Military to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rheinmetall AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elbit Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heckler & Koch Gmb

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nexter Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nammo AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Denel PMP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BAE Systems plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ROSTEC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saab AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Europe Ammunition Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Ammunition Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Ammunition Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Ammunition Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Ammunition Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Ammunition Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Ammunition Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Ammunition Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Europe Ammunition Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Ammunition Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Ammunition Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Ammunition Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Ammunition Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Ammunition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ammunition Industry?

The projected CAGR is approximately 8.64%.

2. Which companies are prominent players in the Europe Ammunition Industry?

Key companies in the market include General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, Heckler & Koch Gmb, Nexter Group, Nammo AS, Denel PMP, BAE Systems plc, ROSTEC, Saab AB.

3. What are the main segments of the Europe Ammunition Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Military to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

December 2022: A European NATO customer entered into a contract with Rheinmetall to supply a maximum of 300,000 rounds of 40mm ammunition, consisting of LV (low velocity) and HV (high velocity) variants. The contract includes a first call-off of approximately 75,000 cartridges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ammunition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ammunition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ammunition Industry?

To stay informed about further developments, trends, and reports in the Europe Ammunition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence