Key Insights

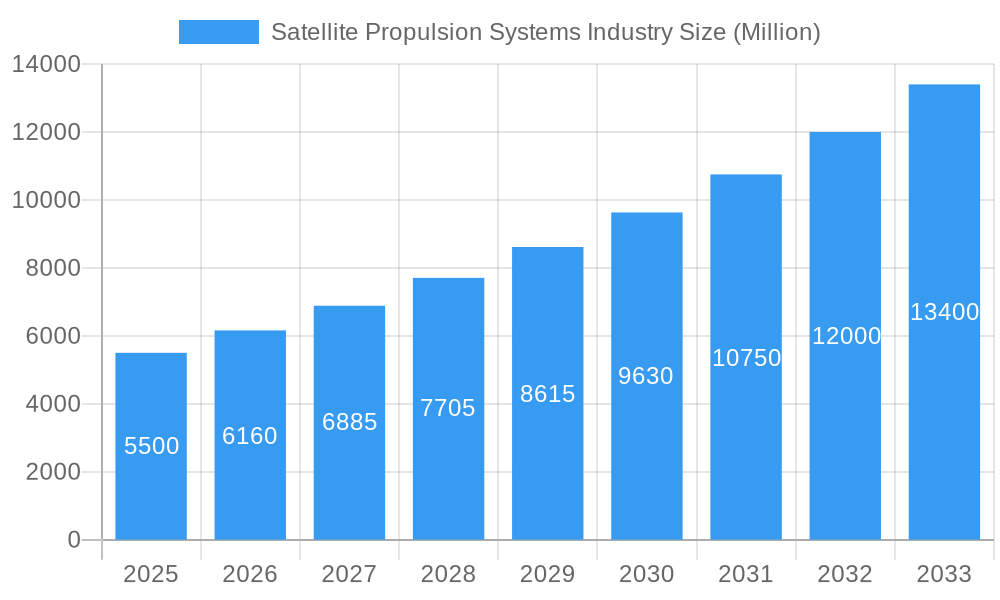

The Satellite Propulsion Systems market is poised for substantial expansion, projected to reach an impressive XX Million USD by 2025, with a robust Compound Annual Growth Rate (CAGR) of 11.90% anticipated between 2025 and 2033. This vigorous growth is primarily fueled by the escalating demand for satellite deployment across various sectors, including telecommunications, Earth observation, and defense. The burgeoning NewSpace economy, characterized by a surge in commercial satellite launches and constellation development, acts as a significant accelerant. Furthermore, advancements in propulsion technologies, particularly the increasing adoption of electric propulsion systems like Hall-effect thrusters and ion thrusters, are driving innovation and efficiency, contributing to market expansion. These electric systems offer superior fuel efficiency and longer operational lifespans compared to traditional chemical propulsion methods, making them increasingly attractive for a wide range of satellite missions. The development of miniaturized and more powerful propulsion solutions is also a key trend, catering to the growing market for small satellites and CubeSats.

Satellite Propulsion Systems Industry Market Size (In Billion)

Despite the optimistic outlook, the market faces certain restraints that warrant attention. High development and manufacturing costs associated with advanced propulsion systems can pose a barrier to entry for smaller players and impact overall affordability. Stringent regulatory frameworks and the need for extensive testing and certification processes for space-qualified components also contribute to extended development timelines and increased expenditure. Nonetheless, the relentless drive for enhanced satellite capabilities, such as longer mission durations, greater maneuverability, and more precise orbital control, continues to propel investment in research and development for next-generation propulsion solutions. Innovations in areas like advanced chemical propulsion, hybrid systems, and electric propulsion technologies, along with a growing focus on sustainable and cost-effective solutions, are expected to shape the future landscape of the satellite propulsion systems industry, ensuring its continued growth and evolution.

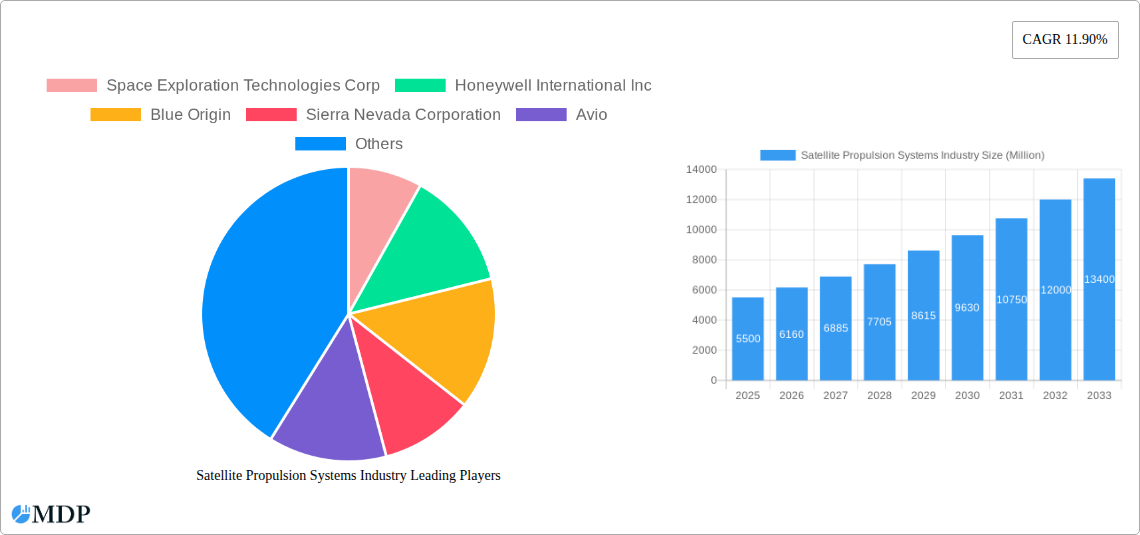

Satellite Propulsion Systems Industry Company Market Share

Unlock critical insights into the rapidly evolving Satellite Propulsion Systems Industry with our comprehensive market analysis. This report, spanning from 2019 to 2033 with a base year of 2025, delivers actionable intelligence for stakeholders seeking to navigate the complex landscape of satellite propulsion technologies. Dive deep into market dynamics, key trends, leading segments, and strategic opportunities shaping the future of space exploration and connectivity.

Satellite Propulsion Systems Industry Market Dynamics & Concentration

The Satellite Propulsion Systems Industry exhibits a moderate to high level of market concentration, driven by the significant capital investment, advanced technological expertise, and stringent regulatory approvals required for entry. Key innovation drivers include the persistent demand for increased satellite longevity, enhanced maneuverability, and reduced operational costs. Technological advancements in electric propulsion, particularly Hall thrusters and ion engines, are significantly influencing market dynamics by offering higher specific impulse and lower propellant mass. Regulatory frameworks, such as those governed by the International Telecommunication Union (ITU) and national space agencies, play a crucial role in dictating satellite orbits, deorbiting strategies, and the use of space, indirectly influencing propulsion system requirements. Product substitutes are limited within the core propulsion function, with the primary competition arising from advancements within different propulsion technologies (e.g., transitioning from chemical to electric propulsion). End-user trends are dominated by the burgeoning commercial satellite market, including constellations for broadband internet, Earth observation, and IoT connectivity, as well as increased government and defense satellite deployments. Mergers and Acquisition (M&A) activities, though not always publicly disclosed, are strategic plays to acquire specialized technologies, expand customer bases, and consolidate market share. For instance, a significant M&A in the historical period saw a major aerospace conglomerate acquire a specialized electric propulsion developer, bolstering its integrated satellite solutions. The estimated market share of leading players is concentrated, with the top 5 companies holding approximately 60% of the global market in 2025. The number of significant M&A deals in the historical period (2019-2024) is estimated at 15.

Satellite Propulsion Systems Industry Industry Trends & Analysis

The Satellite Propulsion Systems Industry is experiencing robust growth, propelled by several interconnected trends. The escalating demand for satellite constellations, driven by the global need for ubiquitous internet connectivity, advanced Earth observation data, and the Internet of Things (IoT) services, is a primary growth driver. This surge in demand necessitates more efficient, reliable, and cost-effective propulsion solutions to deploy, maintain, and maneuver a vast number of satellites. Technological disruptions are predominantly centered around the advancement and wider adoption of electric propulsion systems. These systems, offering significantly higher specific impulse compared to traditional chemical propulsion, enable longer mission durations and greater payload capacity by reducing propellant mass. Innovations in electric propulsion include improved thruster designs, higher power processing units, and the development of novel propellants. The compound annual growth rate (CAGR) for the Satellite Propulsion Systems Industry is projected to be approximately 12.5% during the forecast period (2025–2033). Consumer preferences, in the context of satellite operators, are shifting towards propulsion systems that offer a balance of performance, reliability, and cost-efficiency. This includes a growing appetite for electric propulsion solutions that can reduce launch costs and extend satellite lifespans, thereby increasing the return on investment for constellation operators. Competitive dynamics are characterized by intense innovation and strategic partnerships. Established aerospace giants are investing heavily in R&D and acquiring smaller, agile companies specializing in niche propulsion technologies. New market entrants, often startups backed by venture capital, are also contributing to the competitive landscape with disruptive technologies. Market penetration of electric propulsion systems is projected to grow from approximately 40% in 2025 to over 65% by 2033, displacing a significant portion of the market share historically held by chemical propulsion. The increasing complexity and operational demands of modern satellite missions, such as complex orbital maneuvers and debris mitigation, further fuel the demand for sophisticated and versatile propulsion systems.

Leading Markets & Segments in Satellite Propulsion Systems Industry

The Electric Propulsion segment is poised to dominate the Satellite Propulsion Systems Industry throughout the forecast period (2025–2033). This dominance is driven by the inherent advantages of electric propulsion, including its high specific impulse, which translates to significantly lower propellant mass requirements and thus reduced launch costs. This is particularly crucial for the deployment of large satellite constellations where cost optimization is paramount. Economic policies worldwide are increasingly favoring the expansion of space-based services, from global internet access to advanced Earth observation, directly benefiting the adoption of efficient propulsion technologies. Infrastructure development in terms of ground support and manufacturing capabilities for electric propulsion components is also expanding rapidly.

- Key Drivers for Electric Propulsion Dominance:

- Cost-Effectiveness: Reduced propellant mass directly translates to lower launch expenses, a critical factor for commercial constellation operators.

- Extended Mission Lifetimes: High specific impulse allows satellites to perform more maneuvers or maintain orbit for longer durations, maximizing the return on investment.

- Precision Maneuvering: Electric thrusters offer precise control, essential for complex orbital maneuvers, collision avoidance, and station-keeping.

- Technological Advancements: Continuous innovation in Hall thrusters, ion engines, and pulsed plasma thrusters is improving performance and reliability.

While Electric Propulsion takes the lead, Liquid Fuel propulsion systems will continue to hold a significant market share, particularly for applications requiring high thrust for rapid orbital changes or primary propulsion during launch phases. These systems offer a higher thrust-to-weight ratio compared to electric propulsion, making them indispensable for certain mission profiles.

- Key Drivers for Liquid Fuel Propulsion:

- High Thrust Capability: Essential for rapid orbit insertion, large orbital maneuvers, and primary stage propulsion in launch vehicles.

- Mature Technology: Decades of development and operational experience ensure high reliability for critical mission phases.

- Versatility: Can be configured for various propellants (hypergolic, cryogenic, storable) to suit specific mission requirements.

Gas-based propulsion systems, while a smaller segment, will remain relevant for specific niche applications, such as attitude control and small satellite maneuvers where simplicity and lower power requirements are prioritized.

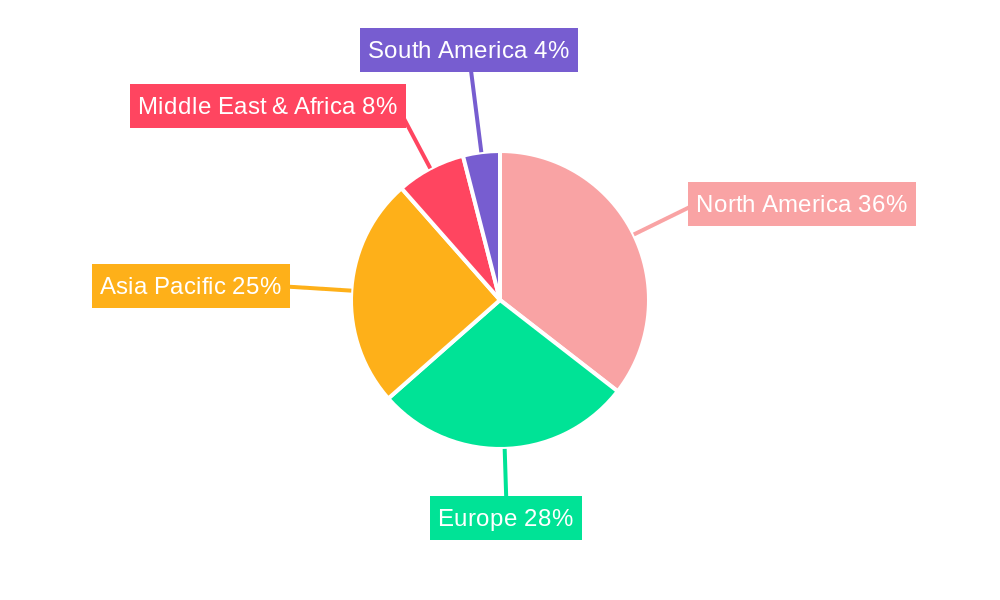

The North American region, particularly the United States, is expected to be the leading market for satellite propulsion systems. This is due to the substantial presence of major satellite manufacturers, commercial space companies, and government space agencies. Significant government investments in space programs, coupled with a thriving private sector focused on satellite constellations, are driving substantial demand. Countries like China and those within the European Union are also significant and growing markets, fueled by national space initiatives and increasing commercial space activities. The dominance of the Electric Propulsion segment within these leading markets is a clear indicator of the industry's trajectory.

Satellite Propulsion Systems Industry Product Developments

Recent product developments in the Satellite Propulsion Systems Industry highlight a strong push towards enhanced efficiency and extended mission capabilities. Innovations in electric propulsion continue to emerge, with companies focusing on higher power thrusters, improved propellant utilization, and miniaturized power processing units for small satellites. Liquid fuel systems are seeing advancements in bi-propellant and mono-propellant technologies, offering improved performance and reduced toxicity. These developments are directly driven by the need for more agile and longer-lasting satellites. Competitive advantages are being gained through advancements that enable faster maneuverability, greater thrust efficiency, and increased operational lifespan, making satellites more versatile and cost-effective for a wider range of applications, from Earth observation to deep space exploration.

Key Drivers of Satellite Propulsion Systems Industry Growth

The Satellite Propulsion Systems Industry's growth is primarily fueled by several interconnected factors. Technologically, the relentless advancement and increasing adoption of electric propulsion systems are key. Their high specific impulse and efficiency reduce propellant mass, leading to lower launch costs and extended satellite lifetimes, which are critical for the proliferation of large satellite constellations. Economically, the burgeoning commercial space sector, particularly the demand for global broadband internet, Earth observation data, and IoT connectivity, is creating unprecedented demand for satellites and, consequently, their propulsion systems. Regulatory factors, such as international agreements on space debris mitigation, are also driving innovation towards more efficient and controllable propulsion systems for deorbiting and advanced maneuverability. The increasing number of government-funded space missions for scientific research and national security also contributes significantly.

Challenges in the Satellite Propulsion Systems Industry Market

Despite the robust growth, the Satellite Propulsion Systems Industry faces several significant challenges. High development and manufacturing costs for advanced propulsion systems, particularly electric thrusters and complex liquid fuel engines, can be a barrier to entry and a constraint on widespread adoption, especially for smaller satellite operators. Regulatory hurdles and lengthy approval processes for new technologies and propellants can slow down innovation and market entry. Supply chain disruptions, exacerbated by global geopolitical events, can impact the availability of critical components and raw materials, leading to production delays and increased costs. Intense competition among established players and emerging startups puts pressure on profit margins, requiring continuous innovation and cost optimization. Furthermore, the environmental impact of propellants and the challenges associated with space debris mitigation are increasing concerns that will necessitate the development of more sustainable and responsible propulsion solutions.

Emerging Opportunities in Satellite Propulsion Systems Industry

The Satellite Propulsion Systems Industry is ripe with emerging opportunities, largely driven by technological breakthroughs and evolving market demands. The development of next-generation electric propulsion technologies, such as advanced Hall thrusters, nested Hall thrusters, and electrodeless propulsion systems, promises even higher efficiencies and greater thrust capabilities, opening new avenues for mission design. In-orbit servicing and refueling capabilities represent a significant opportunity, requiring adaptable and modular propulsion systems that can support these complex operations. The increasing trend towards miniaturization and standardization of satellite components also presents an opportunity for propulsion system manufacturers to develop compact, high-performance, and cost-effective solutions for small satellites (smallsats) and cubesats. Strategic partnerships between propulsion system providers and satellite manufacturers, as well as launch service providers, are crucial for streamlining development and deployment. Furthermore, the exploration of sustainable and eco-friendly propellants is an emerging area that could lead to new market segments and regulatory advantages.

Leading Players in the Satellite Propulsion Systems Industry Sector

- Space Exploration Technologies Corp

- Honeywell International Inc

- Blue Origin

- Sierra Nevada Corporation

- Avio

- Moog Inc

- Ariane Group

- OHB SE

- Sitael S p A

- Thales Alenia Space

- Northrop Grumman Corporation

- IHI Corporation

Key Milestones in Satellite Propulsion Systems Industry Industry

- December 2023: NASA awarded Blue Origin a NASA Launch Services II Indefinite Delivery Indefinite Quantity (IDIQ) contract to launch planetary, Earth observation, exploration, and scientific satellites for the agency aboard New Glenn, Blue Origin's orbital reusable launch vehicle. This contract signifies significant validation for Blue Origin's launch capabilities and its potential impact on scientific and commercial satellite deployment.

- February 2023: NASA's Launch Services Program (LSP) awarded Blue Origin the Escape and Plasma Acceleration and Dynamics Explorers (ESCAPADE) contract. Under the contract Blue Origin will provide its New Glenn reusable technology for the mission. This highlights the increasing role of reusable launch vehicles in enabling scientific missions and underscores the integration of propulsion systems with broader launch strategies.

- February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite. This collaboration emphasizes the growing global adoption of electric propulsion for geostationary orbit satellites and showcases Thales Alenia Space's expertise in delivering advanced electric propulsion solutions for critical national space programs.

Strategic Outlook for Satellite Propulsion Systems Industry Market

The strategic outlook for the Satellite Propulsion Systems Industry is overwhelmingly positive, characterized by sustained growth and transformative innovation. The continued expansion of commercial satellite constellations for broadband, Earth observation, and IoT services will remain a primary growth accelerator. Emphasis will be placed on developing propulsion systems that offer enhanced operational flexibility, longer lifetimes, and reduced costs. The increasing demand for in-orbit servicing, assembly, and manufacturing (ISAM) will spur the development of modular, adaptable, and highly precise propulsion solutions. Furthermore, advancements in electric propulsion, including higher power densities and novel propellant technologies, will continue to drive market share gains. Strategic partnerships and potential consolidations within the industry will shape the competitive landscape, favoring companies that can offer integrated solutions and demonstrate technological leadership. The industry's future success will also hinge on its ability to address sustainability concerns and develop more environmentally conscious propulsion options.

Satellite Propulsion Systems Industry Segmentation

-

1. Propulsion Tech

- 1.1. Electric

- 1.2. Gas based

- 1.3. Liquid Fuel

Satellite Propulsion Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Satellite Propulsion Systems Industry Regional Market Share

Geographic Coverage of Satellite Propulsion Systems Industry

Satellite Propulsion Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The growing interest of governments and private players in space exploration have fueled the expansion of this market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Propulsion Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.1.1. Electric

- 5.1.2. Gas based

- 5.1.3. Liquid Fuel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6. North America Satellite Propulsion Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6.1.1. Electric

- 6.1.2. Gas based

- 6.1.3. Liquid Fuel

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7. South America Satellite Propulsion Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7.1.1. Electric

- 7.1.2. Gas based

- 7.1.3. Liquid Fuel

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8. Europe Satellite Propulsion Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8.1.1. Electric

- 8.1.2. Gas based

- 8.1.3. Liquid Fuel

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9. Middle East & Africa Satellite Propulsion Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9.1.1. Electric

- 9.1.2. Gas based

- 9.1.3. Liquid Fuel

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10. Asia Pacific Satellite Propulsion Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10.1.1. Electric

- 10.1.2. Gas based

- 10.1.3. Liquid Fuel

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Exploration Technologies Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blue Origin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sierra Nevada Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avio

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Moog Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ariane Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OHB SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sitael S p A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thale

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 IHI Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global Satellite Propulsion Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Satellite Propulsion Systems Industry Revenue (Million), by Propulsion Tech 2025 & 2033

- Figure 3: North America Satellite Propulsion Systems Industry Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 4: North America Satellite Propulsion Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Satellite Propulsion Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Satellite Propulsion Systems Industry Revenue (Million), by Propulsion Tech 2025 & 2033

- Figure 7: South America Satellite Propulsion Systems Industry Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 8: South America Satellite Propulsion Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Satellite Propulsion Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Satellite Propulsion Systems Industry Revenue (Million), by Propulsion Tech 2025 & 2033

- Figure 11: Europe Satellite Propulsion Systems Industry Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 12: Europe Satellite Propulsion Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Satellite Propulsion Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Satellite Propulsion Systems Industry Revenue (Million), by Propulsion Tech 2025 & 2033

- Figure 15: Middle East & Africa Satellite Propulsion Systems Industry Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 16: Middle East & Africa Satellite Propulsion Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Satellite Propulsion Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Satellite Propulsion Systems Industry Revenue (Million), by Propulsion Tech 2025 & 2033

- Figure 19: Asia Pacific Satellite Propulsion Systems Industry Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 20: Asia Pacific Satellite Propulsion Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Satellite Propulsion Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 2: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 4: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 9: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 14: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 25: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 33: Global Satellite Propulsion Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Satellite Propulsion Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Propulsion Systems Industry?

The projected CAGR is approximately 11.90%.

2. Which companies are prominent players in the Satellite Propulsion Systems Industry?

Key companies in the market include Space Exploration Technologies Corp, Honeywell International Inc, Blue Origin, Sierra Nevada Corporation, Avio, Moog Inc, Ariane Group, OHB SE, Sitael S p A, Thale, Northrop Grumman Corporation, IHI Corporation.

3. What are the main segments of the Satellite Propulsion Systems Industry?

The market segments include Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The growing interest of governments and private players in space exploration have fueled the expansion of this market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: NASA awarded Blue Origin a NASA Launch Services II Indefinite Delivery Indefinite Quantity (IDIQ) contract to launch planetary, Earth observation, exploration, and scientific satellites for the agency aboard New Glenn, Blue Origin's orbital reusable launch vehicle.February 2023: NASA's Launch Services Program (LSP) awarded Blue Origin the Escape and Plasma Acceleration and Dynamics Explorers (ESCAPADE) contract. Under the contract Blue Origin will provide its New Glenn reusable technology for the mission.February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Propulsion Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Propulsion Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Propulsion Systems Industry?

To stay informed about further developments, trends, and reports in the Satellite Propulsion Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence