Key Insights

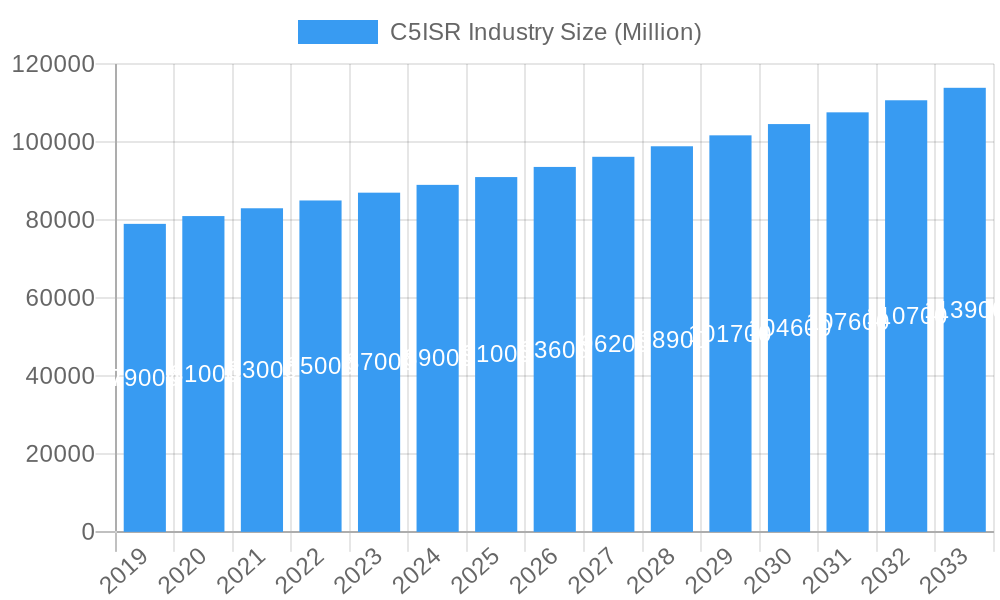

The Command, Control, Communications, Computers, Cyber, Intelligence, Surveillance, and Reconnaissance (C5ISR) market is set for significant expansion, propelled by heightened geopolitical instability, widespread adoption of cutting-edge technologies, and the crucial need for superior situational awareness in defense and security. The market, projected at $9.76 billion in 2025, is anticipated to grow at a CAGR of 12.45% through 2033. This growth is largely attributed to the persistent demand for advanced electronic warfare systems, comprehensive surveillance solutions, and robust command and control infrastructure across all operational domains. Key growth catalysts include the ever-evolving cyber threat landscape, driving the need for sophisticated cyber defense, and the integration of Artificial Intelligence (AI) and Machine Learning (ML) for expedited data processing and decision-making. Global defense modernization initiatives, especially in Asia Pacific and North America, are further accelerating market progress.

C5ISR Industry Market Size (In Billion)

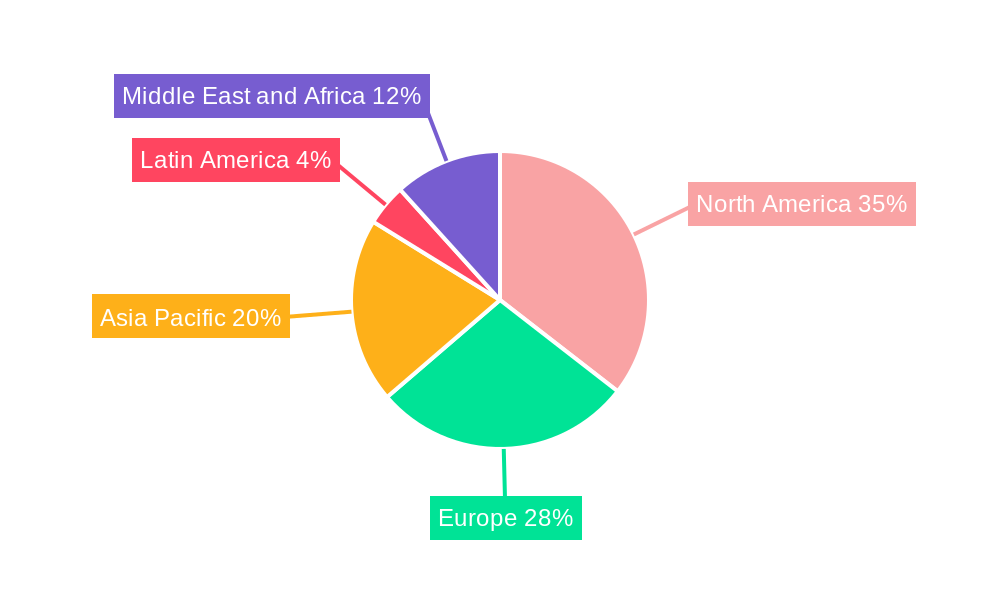

Market dynamics are shaped by continuous technological innovation and strategic investments. While growth is robust, factors such as high implementation costs and the complexity of integrating legacy systems may present challenges. However, ongoing R&D and strategic partnerships among industry leaders are pivotal in navigating these hurdles. The market segmentation reveals strong demand across Electronic Warfare, Reconnaissance and Surveillance, and Command and Control applications. Geographically, North America and Europe are expected to lead due to substantial defense expenditures and the presence of leading C5ISR technology developers. The Asia Pacific region is emerging as a significant growth driver, fueled by the rapid defense modernization in countries like China and India, alongside increasing investments in indigenous C5ISR capabilities.

C5ISR Industry Company Market Share

C5ISR Market Analysis: Enhancing Future Defense Capabilities (2019-2033)

This comprehensive C5ISR market analysis report offers an in-depth examination of the global C5ISR sector from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report provides critical insights into market trends, leading players, and strategic opportunities within this vital defense domain.

The C5ISR market is experiencing unprecedented growth, driven by escalating geopolitical tensions and the increasing demand for advanced technological solutions in defense. This report is essential for defense contractors, government agencies, investors, and technology providers seeking to understand and capitalize on the evolving landscape of modern warfare.

Key Companies Covered: Thales Group, General Dynamics Corporation, Airbus, Elbit Systems Ltd, CACI International Inc, L3 Harris Corporation, BAE Systems Plc, Cubic Corporation, Northrop Grumman Corporation, Collins Aerospace.

Key Segments Covered:

- Type: Land, Naval, Airborne

- Application: Electronic Warfare, Reconnaissance and Surveillance, Command and Control

C5ISR Industry Market Dynamics & Concentration

The C5ISR industry is characterized by a moderately concentrated market, with a few major defense contractors holding significant market share, estimated at over 70% collectively. Innovation is a primary driver, fueled by continuous R&D investments aimed at developing more integrated and intelligent C5ISR systems. Key innovation drivers include advancements in artificial intelligence (AI), machine learning (ML), cloud computing, and secure communication technologies. Regulatory frameworks, primarily governed by national defense policies and international arms control treaties, play a crucial role in shaping market access and technological development. Product substitutes are emerging in the form of commercially available technologies adapted for military use, though specialized military-grade C5ISR solutions maintain a strong advantage. End-user trends are shifting towards networked warfare, emphasizing interoperability, real-time data processing, and enhanced situational awareness. Mergers and acquisitions (M&A) activity has been steady, with an estimated 15-20 significant deals per year during the historical period, aimed at consolidating capabilities and expanding market reach. For instance, acquisitions by major players are strategically designed to integrate cutting-edge cyber capabilities or advanced sensor technologies.

C5ISR Industry Industry Trends & Analysis

The C5ISR industry is poised for significant expansion, driven by a confluence of technological advancements and evolving defense strategies. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This robust growth is primarily attributed to the increasing adoption of AI and ML in C5ISR platforms, enabling enhanced data analysis, threat detection, and decision-making capabilities. Cybersecurity is another critical trend, with a growing emphasis on securing critical C5ISR networks from sophisticated cyber threats. The rise of the Internet of Military Things (IoMT) is further fueling demand for connected and intelligent C5ISR systems that can seamlessly integrate data from various sensors and platforms. Consumer preferences, in the context of military procurement, are gravitating towards modular, scalable, and cost-effective solutions that can be rapidly upgraded and adapted to changing operational environments. Competitive dynamics are intensifying, with established defense giants fiercely competing with agile technology startups. Market penetration is deepening across all segments as nations prioritize modernizing their defense infrastructure to counter emerging threats. The integration of advanced sensor fusion techniques and the development of resilient communication networks are transforming the battlefield, providing unparalleled situational awareness and operational flexibility. Furthermore, the growing use of unmanned systems, both aerial and ground-based, necessitates sophisticated C5ISR capabilities for effective command and control. The report analyzes these trends in detail, providing actionable intelligence for strategic decision-making.

Leading Markets & Segments in C5ISR Industry

The Airborne segment is projected to lead the C5ISR industry, driven by the growing demand for advanced aerial surveillance, reconnaissance, and electronic warfare capabilities. Within this segment, nations with significant air forces and ongoing modernization programs, such as the United States, China, and several European countries, represent the dominant regional markets. The key drivers for the dominance of the Airborne C5ISR segment include:

- Technological Superiority: The inherent advantage of airborne platforms in providing broad area surveillance and rapid response to emerging threats.

- Global Geopolitical Landscape: The increasing reliance on air power for power projection and maintaining regional stability.

- Advancements in Unmanned Aerial Vehicles (UAVs): The rapid integration of sophisticated C5ISR payloads onto UAVs, reducing risk to personnel and expanding operational reach.

- Demand for Real-time Intelligence: The critical need for immediate, actionable intelligence gathered from airborne platforms to inform strategic and tactical decisions.

The Reconnaissance and Surveillance application within the Airborne segment is particularly strong. This dominance is supported by substantial government investments in next-generation surveillance aircraft, advanced sensor technologies (e.g., high-resolution imaging, SIGINT, EW payloads), and sophisticated data processing and dissemination systems. Economic policies that prioritize national security and technological advancement directly fuel this growth. Infrastructure development, particularly in terms of secure communication networks and data fusion centers, further enhances the effectiveness of airborne reconnaissance and surveillance operations. The integration of AI for automated target recognition and intelligence analysis further solidifies the dominance of this segment.

C5ISR Industry Product Developments

The C5ISR industry is witnessing a surge in product innovations focused on enhanced connectivity, autonomous capabilities, and advanced data analytics. Key developments include the integration of AI and ML for predictive maintenance and real-time threat assessment in airborne platforms. Novel electronic warfare systems are emerging with improved jamming and anti-jamming capabilities, alongside more sophisticated reconnaissance and surveillance sensors capable of operating in contested environments. Command and control systems are becoming more distributed and resilient, supporting a networked battlefield. Competitive advantages are being gained through the development of smaller, lighter, and more power-efficient C5ISR modules that can be easily integrated onto a wider range of platforms, including small UAVs and ground vehicles. The emphasis is on interoperability and seamless data sharing across different domains to achieve information superiority.

Key Drivers of C5ISR Industry Growth

The C5ISR industry's growth is propelled by several critical factors. Technologically, the relentless advancement in AI, ML, quantum computing, and sensor technology is enabling more sophisticated and effective C5ISR solutions. Economically, increased defense spending by nations worldwide, driven by rising geopolitical tensions and the need for modernization, provides a substantial funding stream. Regulatory frameworks, while sometimes complex, are increasingly geared towards facilitating the adoption of advanced C5ISR technologies to maintain a strategic edge. For example, the development of secure, high-bandwidth communication networks is a significant growth accelerator, enabling real-time data sharing and enhanced command and control capabilities across all operational domains. The report further details specific examples of how these drivers are shaping market expansion.

Challenges in the C5ISR Industry Market

Despite its robust growth, the C5ISR industry faces several significant challenges. Regulatory hurdles related to export controls and international collaborations can slow down the adoption of advanced technologies. Supply chain complexities, particularly for specialized electronic components and rare earth materials, pose a risk to timely production and delivery. Intense competitive pressures, both from established players and emerging technology companies, necessitate continuous innovation and cost optimization. Additionally, the substantial upfront investment required for developing and integrating complex C5ISR systems can be a barrier for some organizations. Quantifiable impacts include potential delays in program timelines and increased project costs, estimated to add 10-15% to overall project expenditures if not effectively managed.

Emerging Opportunities in C5ISR Industry

Emerging opportunities in the C5ISR industry are primarily driven by technological breakthroughs and strategic market expansion. The development of advanced AI algorithms for cognitive warfare and autonomous decision-making presents a significant growth catalyst. Strategic partnerships between defense contractors and specialized technology firms are fostering innovation and enabling the rapid development of next-generation C5ISR capabilities. Market expansion into developing nations seeking to modernize their defense forces also represents a substantial opportunity. Furthermore, the increasing focus on space-based C5ISR assets and the integration of cyber warfare capabilities offer new avenues for growth and market diversification. The report elaborates on specific market expansion strategies and the potential impact of emerging technologies.

Leading Players in the C5ISR Industry Sector

- Thales Group

- General Dynamics Corporation

- Airbus

- Elbit Systems Ltd

- CACI International Inc

- L3 Harris Corporation

- BAE Systems Plc

- Cubic Corporation

- Northrop Grumman Corporation

- Collins Aerospace

Key Milestones in C5ISR Industry Industry

- 2019: Launch of advanced AI-powered intelligence analysis platforms by major defense contractors.

- 2020: Significant advancements in secure quantum communication protocols relevant to C5ISR.

- 2021: Acquisition of a leading cyber security firm by a major defense conglomerate to bolster cyber C5ISR capabilities.

- 2022: Deployment of next-generation networked C5ISR systems for joint military exercises.

- 2023: Breakthroughs in multi-domain sensor fusion for enhanced battlefield awareness.

- 2024 (Q1): Announcement of a new generation of modular and scalable C5ISR solutions for UAV integration.

- 2024 (Q2): Increased R&D investment in AI-driven electronic warfare countermeasures.

Strategic Outlook for C5ISR Industry Market

The strategic outlook for the C5ISR industry market remains exceptionally strong, driven by the ongoing global imperative for enhanced national security and information superiority. Future growth will be accelerated by the widespread adoption of AI and ML across all C5ISR domains, leading to more autonomous and predictive capabilities. The continued evolution of cybersecurity threats will also necessitate continuous investment in resilient and secure C5ISR networks. Strategic opportunities lie in fostering greater interoperability between allied forces, developing integrated multi-domain C5ISR solutions, and leveraging commercial off-the-shelf (COTS) technologies where applicable to reduce costs and accelerate deployment. The industry is set to witness a paradigm shift towards intelligent, connected, and adaptive C5ISR systems that are crucial for success in future conflicts.

C5ISR Industry Segmentation

-

1. Type

- 1.1. Land

- 1.2. Naval

- 1.3. Airborne

-

2. Application

- 2.1. Electronic Warfare

- 2.2. Reconnaisance and Surveillance

- 2.3. Command and Control

C5ISR Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

C5ISR Industry Regional Market Share

Geographic Coverage of C5ISR Industry

C5ISR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Naval C5ISR Is Expected To Witness Growth During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global C5ISR Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Land

- 5.1.2. Naval

- 5.1.3. Airborne

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electronic Warfare

- 5.2.2. Reconnaisance and Surveillance

- 5.2.3. Command and Control

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America C5ISR Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Land

- 6.1.2. Naval

- 6.1.3. Airborne

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Electronic Warfare

- 6.2.2. Reconnaisance and Surveillance

- 6.2.3. Command and Control

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe C5ISR Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Land

- 7.1.2. Naval

- 7.1.3. Airborne

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Electronic Warfare

- 7.2.2. Reconnaisance and Surveillance

- 7.2.3. Command and Control

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific C5ISR Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Land

- 8.1.2. Naval

- 8.1.3. Airborne

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Electronic Warfare

- 8.2.2. Reconnaisance and Surveillance

- 8.2.3. Command and Control

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America C5ISR Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Land

- 9.1.2. Naval

- 9.1.3. Airborne

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Electronic Warfare

- 9.2.2. Reconnaisance and Surveillance

- 9.2.3. Command and Control

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa C5ISR Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Land

- 10.1.2. Naval

- 10.1.3. Airborne

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Electronic Warfare

- 10.2.2. Reconnaisance and Surveillance

- 10.2.3. Command and Control

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thales Grou

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Airbus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Elbit Systems Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CACI International Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L3 Harris Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BAE Systems Plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cubic Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Collins Aerospace

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Thales Grou

List of Figures

- Figure 1: Global C5ISR Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America C5ISR Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America C5ISR Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America C5ISR Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America C5ISR Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America C5ISR Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America C5ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe C5ISR Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe C5ISR Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe C5ISR Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe C5ISR Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe C5ISR Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe C5ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific C5ISR Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific C5ISR Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific C5ISR Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific C5ISR Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific C5ISR Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific C5ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America C5ISR Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America C5ISR Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America C5ISR Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America C5ISR Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America C5ISR Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America C5ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa C5ISR Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa C5ISR Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa C5ISR Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa C5ISR Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa C5ISR Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa C5ISR Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global C5ISR Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global C5ISR Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global C5ISR Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global C5ISR Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global C5ISR Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global C5ISR Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global C5ISR Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global C5ISR Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global C5ISR Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global C5ISR Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global C5ISR Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global C5ISR Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global C5ISR Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global C5ISR Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global C5ISR Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Mexico C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Brazil C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global C5ISR Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global C5ISR Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global C5ISR Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: South Africa C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa C5ISR Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the C5ISR Industry?

The projected CAGR is approximately 12.45%.

2. Which companies are prominent players in the C5ISR Industry?

Key companies in the market include Thales Grou, General Dynamics Corporation, Airbus, Elbit Systems Ltd, CACI International Inc, L3 Harris Corporation, BAE Systems Plc, Cubic Corporation, Northrop Grumman Corporation, Collins Aerospace.

3. What are the main segments of the C5ISR Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.76 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Naval C5ISR Is Expected To Witness Growth During The Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "C5ISR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the C5ISR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the C5ISR Industry?

To stay informed about further developments, trends, and reports in the C5ISR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence