Key Insights

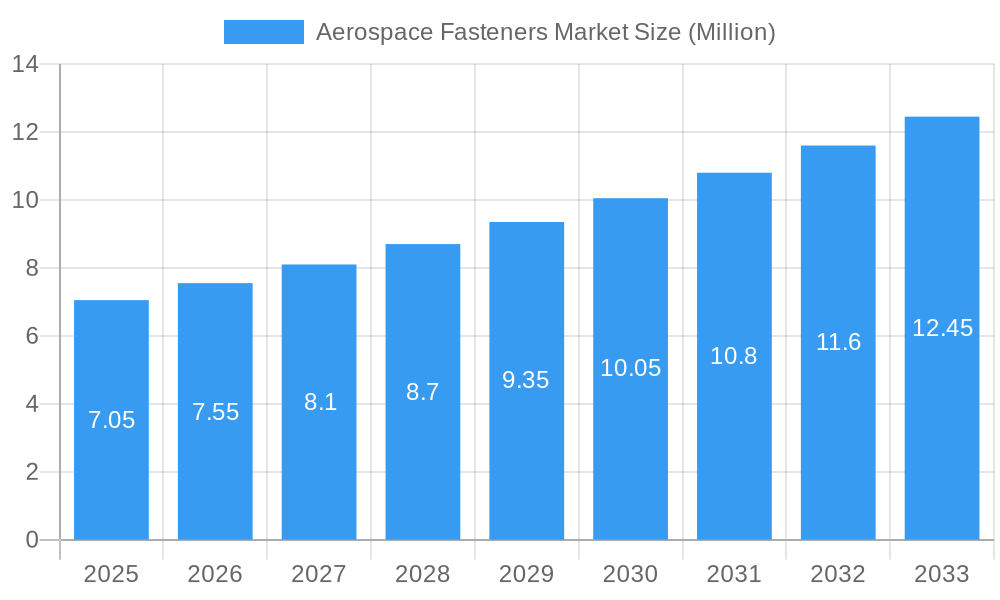

The global Aerospace Fasteners Market is projected to reach USD 6899.7 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.3%. This expansion is driven by sustained demand for commercial aircraft in emerging aviation markets and the modernization of existing fleets. Increased government investment in advanced defense capabilities fuels demand from the military aircraft segment. The general aviation sector contributes through aircraft production and maintenance needs. Key growth drivers include rising commercial aircraft production, development of advanced lightweight materials like composites and titanium for improved fuel efficiency, and stringent safety regulations necessitating high-quality, certified fasteners. Technological advancements in manufacturing further enhance fastener durability and enable specialized applications.

Aerospace Fasteners Market Market Size (In Billion)

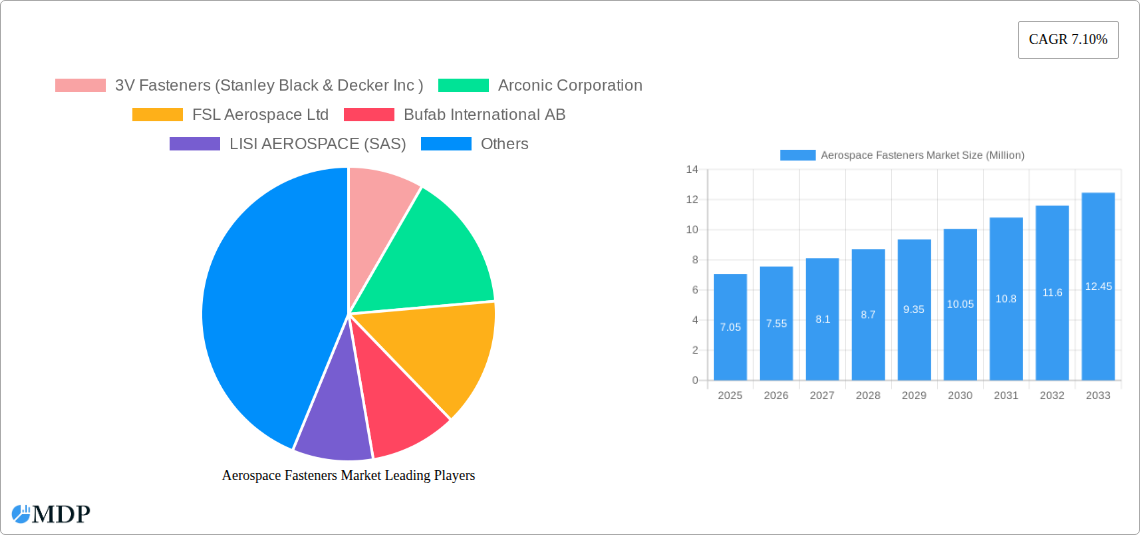

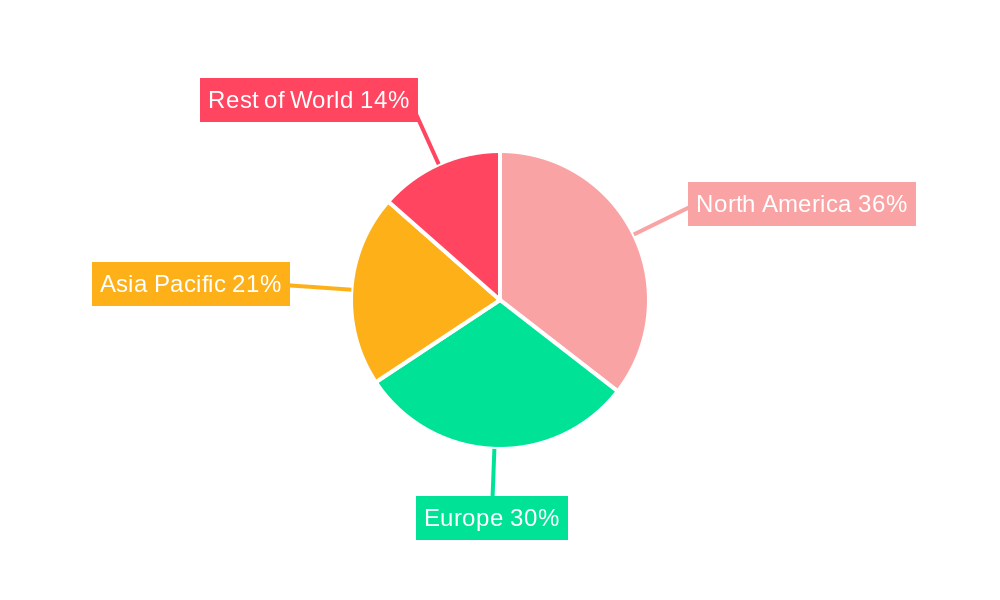

The market features a diverse material landscape. Aluminum and steel fasteners remain dominant due to cost-effectiveness. Superalloys and titanium are gaining prominence for their superior strength-to-weight ratios and corrosion resistance in critical components. Key industry players, including 3V Fasteners (Stanley Black & Decker Inc.), Arconic Corporation, and Precision Castparts Corp (Berkshire Hathaway Inc.), are focusing on product innovation and strategic collaborations. Geographically, North America and Europe lead due to the presence of major aircraft manufacturers. However, the Asia Pacific region, particularly China and India, is expected to experience the fastest growth, supported by increasing domestic air travel, government initiatives in aerospace manufacturing, and growing defense expenditure. Market challenges include fluctuating raw material prices, intense competition, and the need for continuous R&D to meet evolving aircraft design requirements. Despite these challenges, the aerospace fasteners market presents significant opportunities for stakeholders.

Aerospace Fasteners Market Company Market Share

Aerospace Fasteners Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report delves into the global Aerospace Fasteners Market, providing an exhaustive analysis of market dynamics, key trends, leading players, and future projections. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers critical insights for manufacturers, suppliers, MRO providers, and other industry stakeholders navigating this complex and evolving sector. Expect a market size of US$ XX Billion in 2025, projected to reach US$ XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Aerospace Fasteners Market Market Dynamics & Concentration

The aerospace fasteners market exhibits a moderate level of concentration, with a few key players holding significant market share. Innovation remains a critical driver, fueled by the relentless pursuit of lighter, stronger, and more durable fastening solutions that reduce aircraft weight and enhance fuel efficiency. Stringent regulatory frameworks, dictated by aviation authorities like the FAA and EASA, impose rigorous quality and safety standards, acting as both a barrier to entry for new competitors and a catalyst for continuous product improvement among established firms. Product substitutes, while present in the form of advanced bonding technologies, have yet to fully displace traditional fasteners due to reliability and repairability concerns in critical aerospace applications. End-user trends are dominated by the increasing demand for commercial aircraft to support global travel growth and the continuous modernization of military fleets. Mergers and acquisitions (M&A) activities are strategically employed by leading companies to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A deal counts have averaged XX deals per year during the historical period. Major players like Stanley Black & Decker Inc. (through 3V Fasteners) and Berkshire Hathaway Inc. (through Precision Castparts Corp) actively engage in consolidating market positions.

Aerospace Fasteners Market Industry Trends & Analysis

The aerospace fasteners industry is experiencing robust growth, driven by a confluence of factors. The escalating demand for air travel, particularly in emerging economies, fuels the production of new commercial aircraft, consequently boosting the need for a wide array of specialized fasteners. Technological advancements are revolutionizing fastener design and manufacturing processes. The integration of advanced materials like titanium alloys, superalloys, and composite materials allows for the creation of fasteners that offer superior strength-to-weight ratios, corrosion resistance, and high-temperature performance, critical for modern aircraft operating under extreme conditions. Furthermore, advancements in additive manufacturing (3D printing) are opening avenues for the production of complex, customized fasteners, reducing lead times and waste. Consumer preferences, in the context of the aerospace industry, translate to a demand for enhanced safety, reliability, and reduced operational costs. This translates to a preference for fasteners that minimize maintenance requirements and contribute to overall aircraft efficiency. Competitive dynamics within the market are characterized by intense R&D efforts, strategic partnerships between fastener manufacturers and aircraft OEMs, and a focus on delivering high-quality, certified products. The market penetration of advanced fastener solutions is steadily increasing as manufacturers embrace innovative materials and manufacturing techniques. The projected CAGR of XX% underscores the sustained upward trajectory of this vital sector.

Leading Markets & Segments in Aerospace Fasteners Market

The Commercial Aircraft segment stands as the dominant force within the aerospace fasteners market, driven by the insatiable global demand for air travel and the continuous expansion of airline fleets. Countries with significant aerospace manufacturing hubs, such as the United States and Europe, lead in both consumption and production of aerospace fasteners.

- Dominant Region: North America, propelled by the substantial presence of major aircraft manufacturers and a mature aviation ecosystem, holds the largest market share.

- Dominant Country: The United States, home to Boeing and numerous Tier-1 aerospace suppliers, dictates a significant portion of global demand.

- Dominant Application Segment: Commercial Aircraft segment is the primary revenue generator due to higher production volumes compared to military and general aviation.

- Key Drivers:

- Economic Policies: Favorable trade agreements and government incentives for aerospace manufacturing in key regions.

- Infrastructure Development: Continuous investment in airports and air traffic control systems worldwide, supporting increased flight operations.

- Passenger Growth: Rising disposable incomes and a growing middle class in emerging economies translate to higher air passenger traffic.

- Fleet Modernization: Airlines continually invest in new, fuel-efficient aircraft, driving demand for the latest fastening technologies.

- Key Drivers:

- Dominant Material Segment: Titanium and Superalloys are increasingly in demand due to their exceptional strength-to-weight ratios and high-temperature resistance, crucial for advanced aircraft designs. While Steel remains a staple, the trend is towards specialized, high-performance alloys.

- Key Drivers:

- Performance Requirements: Increasingly stringent performance demands for lighter, stronger, and more durable aircraft components.

- Fuel Efficiency Mandates: The need to reduce aircraft weight to meet fuel efficiency targets.

- Advanced Aircraft Designs: Integration of new materials into airframes and engine components necessitates compatible fasteners.

- Key Drivers:

Aerospace Fasteners Market Product Developments

Recent product developments in the aerospace fasteners market are characterized by innovations focused on enhanced performance and reduced weight. Manufacturers are actively developing fasteners utilizing advanced composite materials and proprietary alloy blends, offering superior fatigue resistance and corrosion protection. The integration of self-locking mechanisms and advanced coatings further enhances reliability and reduces the need for secondary locking devices. These innovations cater to the growing demand for lighter, more fuel-efficient aircraft and contribute to extended maintenance intervals. The competitive advantage lies in the ability to meet stringent aerospace specifications and provide bespoke solutions for complex structural applications.

Key Drivers of Aerospace Fasteners Market Growth

Several key drivers are propelling the growth of the aerospace fasteners market. The increasing global demand for air travel, leading to higher aircraft production volumes for both commercial and military sectors, is a primary catalyst. Technological advancements in material science, enabling the development of lighter, stronger, and more durable fasteners, are crucial. Furthermore, stringent safety regulations and the constant need for aircraft modernization to improve fuel efficiency and performance are driving demand for high-quality, certified aerospace fasteners. Government investments in defense and space exploration also contribute significantly to market expansion.

Challenges in the Aerospace Fasteners Market Market

Despite its growth, the aerospace fasteners market faces several challenges. The highly regulated nature of the aerospace industry imposes stringent quality control and certification processes, increasing manufacturing costs and lead times. Fluctuations in raw material prices, particularly for specialized alloys, can impact profitability. Intense competition among a consolidated player base and the risk of supply chain disruptions, exacerbated by geopolitical events, pose significant hurdles. The high cost of R&D for developing new fastener technologies also represents a substantial investment barrier.

Emerging Opportunities in Aerospace Fasteners Market

Emerging opportunities within the aerospace fasteners market are abundant. The growing adoption of additive manufacturing for producing complex, customized fasteners presents a significant avenue for innovation and cost reduction. Strategic partnerships between fastener manufacturers and aircraft OEMs are fostering collaborative development of next-generation fastening solutions tailored to evolving aircraft designs. The increasing demand for fasteners in the rapidly expanding drone and eVTOL (electric Vertical Take-Off and Landing) markets also offers substantial growth potential. Furthermore, the focus on sustainable aviation practices is driving demand for recyclable and environmentally friendly fastener materials.

Leading Players in the Aerospace Fasteners Market Sector

- 3V Fasteners (Stanley Black & Decker Inc)

- Arconic Corporation

- FSL Aerospace Ltd

- Bufab International AB

- LISI AEROSPACE (SAS)

- Precision Castparts Corp (Berkshire Hathaway Inc)

- B&B Specialties Inc

- Boeing Distribution Services Inc (The Boeing Company)

- TriMas Corporation

- TFI Aerospace Corporation

- National Aerospace Fasteners Corporation

Key Milestones in Aerospace Fasteners Market Industry

- 2021: Introduction of new lightweight titanium alloy fasteners by Arconic Corporation, enhancing fuel efficiency.

- 2022: LISI AEROSPACE secures a significant contract for fasteners in a new generation commercial aircraft program.

- 2023: Precision Castparts Corp (Berkshire Hathaway Inc) invests in advanced manufacturing technologies to expand its aerospace fastener production capacity.

- 2024: FSL Aerospace Ltd announces expansion of its product line to include high-performance superalloy fasteners for demanding aerospace applications.

- 2025 (Projected): Increased adoption of 3D printed aerospace fasteners for specialized applications begins to gain traction in prototyping and low-volume production.

Strategic Outlook for Aerospace Fasteners Market Market

The strategic outlook for the aerospace fasteners market remains exceptionally strong, driven by consistent demand from the aviation sector and continuous innovation. Key growth accelerators include the ongoing expansion of the global commercial airline fleet, the persistent need for military aircraft modernization, and the emerging markets for drones and eVTOLs. Companies that invest in advanced materials, sustainable manufacturing practices, and embrace digital technologies like additive manufacturing are well-positioned for future success. Strategic partnerships and a focus on delivering certified, high-performance fastening solutions will be critical for navigating market complexities and capitalizing on emerging opportunities.

Aerospace Fasteners Market Segmentation

-

1. Application

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation

-

2. Material

- 2.1. Aluminum

- 2.2. Steel

- 2.3. Superalloys

- 2.4. Titanium

Aerospace Fasteners Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Aerospace Fasteners Market Regional Market Share

Geographic Coverage of Aerospace Fasteners Market

Aerospace Fasteners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment is Projected to Showcase the Largest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Aluminum

- 5.2.2. Steel

- 5.2.3. Superalloys

- 5.2.4. Titanium

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Aircraft

- 6.1.2. Military Aircraft

- 6.1.3. General Aviation

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Aluminum

- 6.2.2. Steel

- 6.2.3. Superalloys

- 6.2.4. Titanium

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Aircraft

- 7.1.2. Military Aircraft

- 7.1.3. General Aviation

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Aluminum

- 7.2.2. Steel

- 7.2.3. Superalloys

- 7.2.4. Titanium

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Aircraft

- 8.1.2. Military Aircraft

- 8.1.3. General Aviation

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Aluminum

- 8.2.2. Steel

- 8.2.3. Superalloys

- 8.2.4. Titanium

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Aircraft

- 9.1.2. Military Aircraft

- 9.1.3. General Aviation

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Aluminum

- 9.2.2. Steel

- 9.2.3. Superalloys

- 9.2.4. Titanium

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aerospace Fasteners Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Aircraft

- 10.1.2. Military Aircraft

- 10.1.3. General Aviation

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Aluminum

- 10.2.2. Steel

- 10.2.3. Superalloys

- 10.2.4. Titanium

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3V Fasteners (Stanley Black & Decker Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arconic Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FSL Aerospace Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bufab International AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LISI AEROSPACE (SAS)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Precision Castparts Corp (Berkshire Hathaway Inc )

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 B&B Specialties Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boeing Distribution Services Inc (The Boeing Company)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TriMas Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TFI Aerospace Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 National Aerospace Fasteners Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 3V Fasteners (Stanley Black & Decker Inc )

List of Figures

- Figure 1: Global Aerospace Fasteners Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 3: North America Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 5: North America Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 9: Europe Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 11: Europe Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 15: Asia Pacific Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 17: Asia Pacific Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 18: Asia Pacific Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 21: Latin America Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 23: Latin America Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Latin America Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 25: Latin America Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aerospace Fasteners Market Revenue (million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Aerospace Fasteners Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Aerospace Fasteners Market Revenue (million), by Material 2025 & 2033

- Figure 29: Middle East and Africa Aerospace Fasteners Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Middle East and Africa Aerospace Fasteners Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aerospace Fasteners Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 3: Global Aerospace Fasteners Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 6: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 11: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Germany Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: France Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Russia Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 19: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: India Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: China Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Japan Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 26: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 27: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Brazil Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Aerospace Fasteners Market Revenue million Forecast, by Application 2020 & 2033

- Table 32: Global Aerospace Fasteners Market Revenue million Forecast, by Material 2020 & 2033

- Table 33: Global Aerospace Fasteners Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Egypt Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Israel Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Aerospace Fasteners Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Fasteners Market?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the Aerospace Fasteners Market?

Key companies in the market include 3V Fasteners (Stanley Black & Decker Inc ), Arconic Corporation, FSL Aerospace Ltd, Bufab International AB, LISI AEROSPACE (SAS), Precision Castparts Corp (Berkshire Hathaway Inc ), B&B Specialties Inc, Boeing Distribution Services Inc (The Boeing Company), TriMas Corporation, TFI Aerospace Corporation, National Aerospace Fasteners Corporation.

3. What are the main segments of the Aerospace Fasteners Market?

The market segments include Application, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 6899.7 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment is Projected to Showcase the Largest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Fasteners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Fasteners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Fasteners Market?

To stay informed about further developments, trends, and reports in the Aerospace Fasteners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence