Key Insights

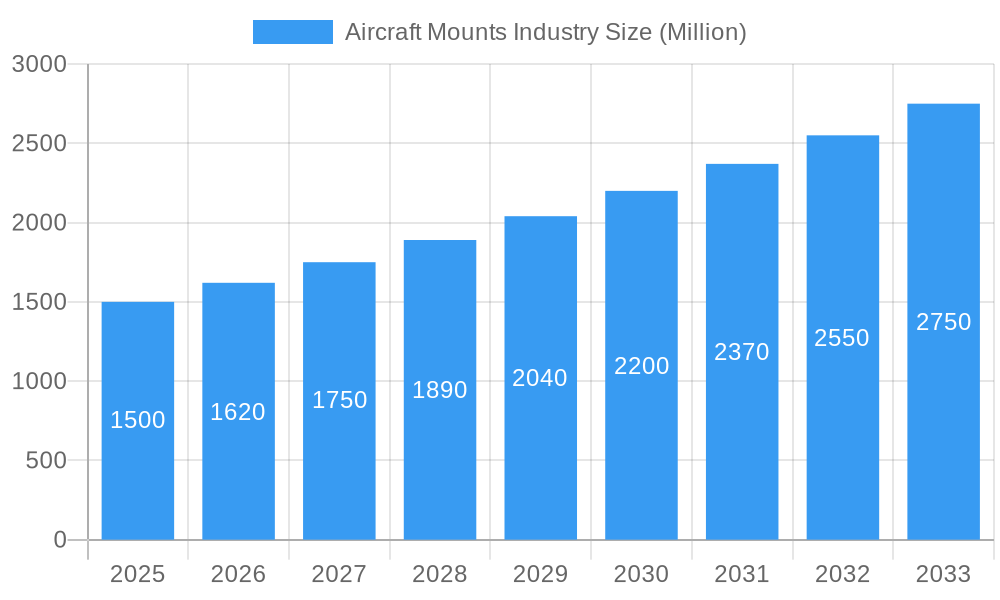

The global Aircraft Mounts Market is projected to reach $0.82 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.18% from 2025 to 2033. This expansion is driven by increasing demand for new aircraft, fueled by rising air travel and cargo volumes. The aviation industry's focus on enhancing passenger comfort and safety necessitates advanced mounting solutions for effective vibration and noise reduction. The growing fleet of narrowbody and widebody aircraft, alongside general aviation, ensures consistent demand across diverse aircraft types. Emerging economies and expanding airline networks are key contributors to this growth trajectory.

Aircraft Mounts Industry Market Size (In Million)

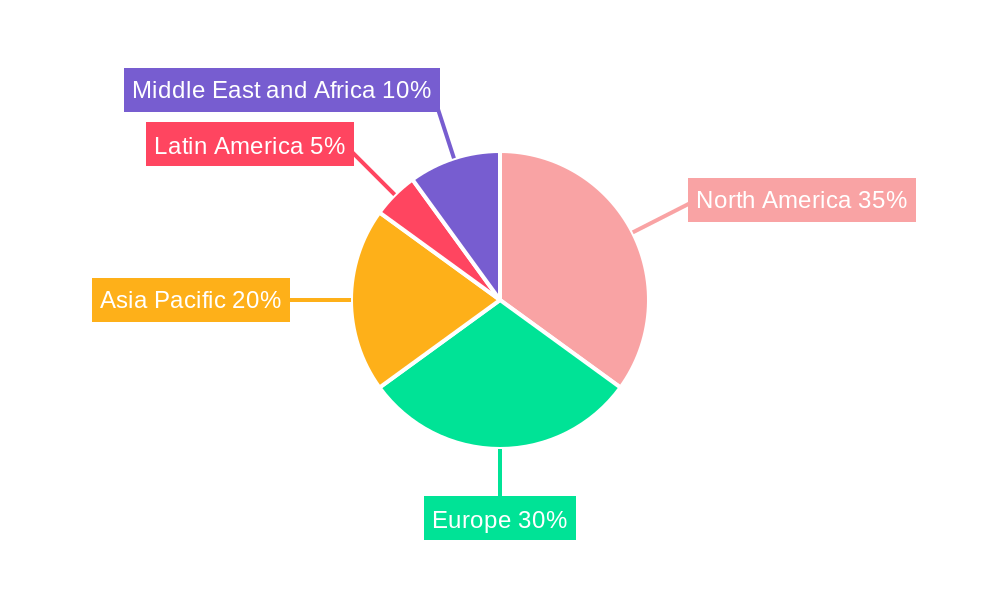

Key growth drivers include advancements in materials science, yielding lighter and more durable vibration-absorbent components. Stringent safety and performance regulations mandate high-quality, certified mounting solutions. Innovations in shock absorption technology and the integration of smart features for predictive maintenance further enhance market dynamism. Challenges include the high cost of specialized materials and manufacturing, and extended product development cycles due to stringent certification. Geographically, North America and Europe lead due to established aerospace manufacturing and significant airline operations. However, the Asia Pacific region is expected to experience the fastest growth, driven by increasing aircraft production and a burgeoning aviation sector. Primary applications include engine mounts for safe operation and interior mounts for passenger comfort and cabin integrity.

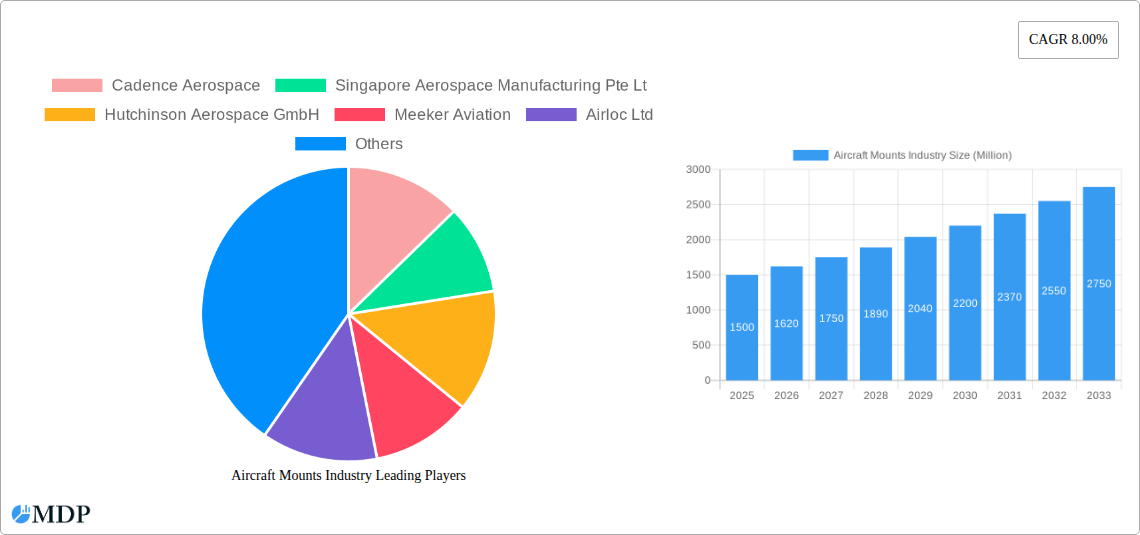

Aircraft Mounts Industry Company Market Share

This report offers an in-depth analysis of the global Aircraft Mounts Market, covering the period from 2019 to 2024, with a base year of 2025 and projecting growth through 2033. It provides insights into market trends, leading players, and strategic opportunities.

Aircraft Mounts Industry Market Dynamics & Concentration

The global Aircraft Mounts Industry exhibits moderate market concentration, with key players like Cadence Aerospace, Singapore Aerospace Manufacturing Pte Ltd, Hutchinson Aerospace GmbH, Meeker Aviation, Airloc Ltd, Lord Corporation, GMT Rubber-Metal-Technic Ltd, Shock Tech Inc, Mayday Manufacturing, and Trelleborg Group holding significant market shares. Innovation remains a critical driver, fueled by advancements in material science, vibration damping technologies, and lightweight design principles. Regulatory frameworks, particularly those set by aviation authorities like the FAA and EASA, are paramount, ensuring safety and performance standards. Product substitutes, while present in the form of generic or lower-specification components, struggle to match the stringent requirements for aerospace applications. End-user trends are increasingly influenced by the demand for fuel efficiency, reduced noise pollution, and enhanced passenger comfort, all of which are directly impacted by the performance of aircraft mounts. Mergers and acquisitions (M&A) activities, though sporadic, aim to consolidate market positions and expand technological capabilities. For instance, recent M&A deal counts indicate a strategic focus on acquiring specialized expertise in composite materials and advanced shock absorption. The market share distribution indicates that the top five players collectively control approximately 60% of the global market, underscoring the competitive landscape.

Aircraft Mounts Industry Industry Trends & Analysis

The global Aircraft Mounts Industry is poised for robust growth, driven by several interconnected factors. A primary growth driver is the sustained expansion of the global aviation sector, characterized by increasing air travel demand and the subsequent need for new aircraft production and MRO (Maintenance, Repair, and Overhaul) services. This directly translates to a higher demand for engine mounts, suspension systems, and interior/exterior mounts. Technological disruptions are continuously shaping the industry, with a significant focus on developing advanced elastomeric materials, composite mounts, and smart mounts that offer real-time performance monitoring. These innovations aim to improve durability, reduce weight, and enhance vibration isolation, leading to improved fuel efficiency and reduced maintenance costs. Consumer preferences for quieter and more comfortable cabin experiences are indirectly influencing the demand for superior interior mounts that effectively mitigate noise and vibration transmission. Competitive dynamics are characterized by a blend of established aerospace component manufacturers and specialized mount providers, all striving to innovate and secure long-term supply contracts with major aircraft OEMs. The market penetration of advanced lightweight materials for aircraft mounts is steadily increasing, projected to reach xx% by 2028. The Compound Annual Growth Rate (CAGR) for the global aircraft mounts market is estimated at xx% during the forecast period (2025–2033), reflecting the strong underlying demand and ongoing technological advancements.

Leading Markets & Segments in Aircraft Mounts Industry

North America currently dominates the global Aircraft Mounts Industry, driven by its extensive aerospace manufacturing base, high aircraft fleet size, and significant investments in R&D. Within North America, the United States represents the largest market due to the presence of major aircraft manufacturers and a thriving MRO sector. Among the application segments, engine mounts command the largest market share, owing to their critical role in aircraft propulsion and the stringent performance requirements associated with them. Suspension systems also represent a significant segment, vital for landing gear stability and overall flight control. In terms of mount type, both interior mounts and exterior mounts are experiencing consistent demand. Interior mounts are crucial for passenger comfort and cabin integrity, while exterior mounts are essential for securing various external components and ensuring aerodynamic efficiency. The aircraft type segment sees robust demand across narrowbody aircraft, widebody aircraft, and general aviation aircraft. However, the burgeoning expansion of low-cost carriers and the continued demand for passenger and cargo transport are making narrowbody aircraft a particularly strong growth area for aircraft mounts. Economic policies supporting aerospace manufacturing, coupled with substantial infrastructure investments in aviation, further bolster the demand in leading regions. The market penetration of advanced composite mounts in narrowbody aircraft applications is anticipated to grow by xx% annually due to weight reduction benefits.

Aircraft Mounts Industry Product Developments

Product developments in the Aircraft Mounts Industry are heavily focused on enhancing performance, reducing weight, and increasing durability. Innovations include the integration of advanced vibration damping materials, such as specialized elastomers and gels, to improve passenger comfort and reduce component fatigue. The development of intelligent mounts, equipped with sensors for real-time monitoring of stress and performance, is a key trend, enabling predictive maintenance and optimizing operational efficiency. Lightweight composite materials are increasingly being utilized to replace traditional metal components, contributing to fuel savings and improved aircraft performance. These product advancements offer significant competitive advantages by meeting the evolving demands for quieter, more efficient, and safer aircraft.

Key Drivers of Aircraft Mounts Industry Growth

Several key factors are propelling the growth of the Aircraft Mounts Industry. The continuous expansion of the global commercial aviation fleet, driven by increasing air passenger traffic, directly fuels the demand for new aircraft and, consequently, aircraft mounts. Advancements in material science, leading to the development of lighter, stronger, and more durable mounting solutions, are critical. Furthermore, stringent aviation safety regulations necessitate the use of high-performance mounts, ensuring reliability and longevity. The growing emphasis on noise reduction and vibration control within aircraft cabins, driven by passenger expectations for comfort, also acts as a significant growth catalyst.

Challenges in the Aircraft Mounts Industry Market

The Aircraft Mounts Industry faces several challenges that could potentially restrain its growth. Stringent and evolving regulatory compliance, particularly concerning material certifications and safety standards, can increase development costs and lead times. Supply chain disruptions, exacerbated by geopolitical uncertainties and raw material price volatility, pose a significant threat to production schedules and profitability. The high cost of R&D and specialized manufacturing equipment can also be a barrier for smaller players. Intense competition among established manufacturers and the pressure to offer cost-effective solutions without compromising quality present ongoing challenges.

Emerging Opportunities in Aircraft Mounts Industry

Catalysts for long-term growth in the Aircraft Mounts Industry lie in embracing emerging technologies and exploring new market avenues. The increasing adoption of sustainable aviation fuels and the development of electric and hybrid-electric aircraft present opportunities for novel mount designs tailored to these new propulsion systems. Strategic partnerships between mount manufacturers and aircraft OEMs can accelerate the development and integration of innovative mounting solutions. Furthermore, the growing demand for specialized mounts in the rapidly expanding business jet and regional aircraft segments offers significant market expansion potential.

Leading Players in the Aircraft Mounts Industry Sector

- Cadence Aerospace

- Singapore Aerospace Manufacturing Pte Ltd

- Hutchinson Aerospace GmbH

- Meeker Aviation

- Airloc Ltd

- Lord Corporation

- GMT Rubber-Metal-Technic Ltd

- Shock Tech Inc

- Mayday Manufacturing

- Trelleborg Group

Key Milestones in Aircraft Mounts Industry Industry

- 2019: Introduction of advanced elastomeric materials offering enhanced vibration damping.

- 2020: Major aircraft OEMs focus on lightweighting initiatives, driving demand for composite mounts.

- 2021: Increased investment in R&D for intelligent mounts with integrated sensors.

- 2022: Supply chain disruptions highlight the need for resilient sourcing strategies.

- 2023: Growing emphasis on sustainable manufacturing processes within the industry.

- 2024: Significant product launches featuring enhanced noise reduction capabilities for cabin mounts.

Strategic Outlook for Aircraft Mounts Industry Market

The strategic outlook for the Aircraft Mounts Industry remains highly promising, driven by sustained aviation sector growth and continuous technological innovation. Key growth accelerators include the ongoing development of advanced materials that offer superior performance and weight reduction, and the increasing integration of smart technologies for predictive maintenance and enhanced operational efficiency. Manufacturers that can effectively navigate regulatory landscapes, secure robust supply chains, and align their product development with emerging aircraft technologies, such as electric propulsion, will be well-positioned for long-term success. Strategic collaborations and a focus on sustainable solutions will further solidify market leadership.

Aircraft Mounts Industry Segmentation

-

1. Application

- 1.1. Suspension

- 1.2. Engine Mounts

-

2. Mount Type

- 2.1. Interior Mounts

- 2.2. Exterior Mounts

-

3. Aircraft Type

- 3.1. Narrowbody Aircraft

- 3.2. Widebody Aircraft

- 3.3. General Aviation Aircraft

Aircraft Mounts Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Aircraft Mounts Industry Regional Market Share

Geographic Coverage of Aircraft Mounts Industry

Aircraft Mounts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Exterior Mount is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Mounts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Suspension

- 5.1.2. Engine Mounts

- 5.2. Market Analysis, Insights and Forecast - by Mount Type

- 5.2.1. Interior Mounts

- 5.2.2. Exterior Mounts

- 5.3. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.3.1. Narrowbody Aircraft

- 5.3.2. Widebody Aircraft

- 5.3.3. General Aviation Aircraft

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aircraft Mounts Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Suspension

- 6.1.2. Engine Mounts

- 6.2. Market Analysis, Insights and Forecast - by Mount Type

- 6.2.1. Interior Mounts

- 6.2.2. Exterior Mounts

- 6.3. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.3.1. Narrowbody Aircraft

- 6.3.2. Widebody Aircraft

- 6.3.3. General Aviation Aircraft

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aircraft Mounts Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Suspension

- 7.1.2. Engine Mounts

- 7.2. Market Analysis, Insights and Forecast - by Mount Type

- 7.2.1. Interior Mounts

- 7.2.2. Exterior Mounts

- 7.3. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.3.1. Narrowbody Aircraft

- 7.3.2. Widebody Aircraft

- 7.3.3. General Aviation Aircraft

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aircraft Mounts Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Suspension

- 8.1.2. Engine Mounts

- 8.2. Market Analysis, Insights and Forecast - by Mount Type

- 8.2.1. Interior Mounts

- 8.2.2. Exterior Mounts

- 8.3. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.3.1. Narrowbody Aircraft

- 8.3.2. Widebody Aircraft

- 8.3.3. General Aviation Aircraft

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aircraft Mounts Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Suspension

- 9.1.2. Engine Mounts

- 9.2. Market Analysis, Insights and Forecast - by Mount Type

- 9.2.1. Interior Mounts

- 9.2.2. Exterior Mounts

- 9.3. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.3.1. Narrowbody Aircraft

- 9.3.2. Widebody Aircraft

- 9.3.3. General Aviation Aircraft

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aircraft Mounts Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Suspension

- 10.1.2. Engine Mounts

- 10.2. Market Analysis, Insights and Forecast - by Mount Type

- 10.2.1. Interior Mounts

- 10.2.2. Exterior Mounts

- 10.3. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.3.1. Narrowbody Aircraft

- 10.3.2. Widebody Aircraft

- 10.3.3. General Aviation Aircraft

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cadence Aerospace

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Singapore Aerospace Manufacturing Pte Lt

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hutchinson Aerospace GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Meeker Aviation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airloc Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lord Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GMT Rubber-Metal-Technic Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shock Tech Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mayday Manufacturing

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trelleborg Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cadence Aerospace

List of Figures

- Figure 1: Global Aircraft Mounts Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Mounts Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Aircraft Mounts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Aircraft Mounts Industry Revenue (billion), by Mount Type 2025 & 2033

- Figure 5: North America Aircraft Mounts Industry Revenue Share (%), by Mount Type 2025 & 2033

- Figure 6: North America Aircraft Mounts Industry Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 7: North America Aircraft Mounts Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 8: North America Aircraft Mounts Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Aircraft Mounts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aircraft Mounts Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Aircraft Mounts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Aircraft Mounts Industry Revenue (billion), by Mount Type 2025 & 2033

- Figure 13: Europe Aircraft Mounts Industry Revenue Share (%), by Mount Type 2025 & 2033

- Figure 14: Europe Aircraft Mounts Industry Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 15: Europe Aircraft Mounts Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Europe Aircraft Mounts Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Aircraft Mounts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aircraft Mounts Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Asia Pacific Aircraft Mounts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Aircraft Mounts Industry Revenue (billion), by Mount Type 2025 & 2033

- Figure 21: Asia Pacific Aircraft Mounts Industry Revenue Share (%), by Mount Type 2025 & 2033

- Figure 22: Asia Pacific Aircraft Mounts Industry Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 23: Asia Pacific Aircraft Mounts Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 24: Asia Pacific Aircraft Mounts Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Aircraft Mounts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Aircraft Mounts Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: Latin America Aircraft Mounts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Latin America Aircraft Mounts Industry Revenue (billion), by Mount Type 2025 & 2033

- Figure 29: Latin America Aircraft Mounts Industry Revenue Share (%), by Mount Type 2025 & 2033

- Figure 30: Latin America Aircraft Mounts Industry Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 31: Latin America Aircraft Mounts Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 32: Latin America Aircraft Mounts Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Aircraft Mounts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Aircraft Mounts Industry Revenue (billion), by Application 2025 & 2033

- Figure 35: Middle East and Africa Aircraft Mounts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Aircraft Mounts Industry Revenue (billion), by Mount Type 2025 & 2033

- Figure 37: Middle East and Africa Aircraft Mounts Industry Revenue Share (%), by Mount Type 2025 & 2033

- Figure 38: Middle East and Africa Aircraft Mounts Industry Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 39: Middle East and Africa Aircraft Mounts Industry Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 40: Middle East and Africa Aircraft Mounts Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Aircraft Mounts Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Mounts Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Aircraft Mounts Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 3: Global Aircraft Mounts Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 4: Global Aircraft Mounts Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Aircraft Mounts Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Aircraft Mounts Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 7: Global Aircraft Mounts Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 8: Global Aircraft Mounts Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Aircraft Mounts Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Aircraft Mounts Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 13: Global Aircraft Mounts Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aircraft Mounts Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Aircraft Mounts Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Aircraft Mounts Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 21: Global Aircraft Mounts Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 22: Global Aircraft Mounts Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Aircraft Mounts Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Aircraft Mounts Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 30: Global Aircraft Mounts Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 31: Global Aircraft Mounts Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Mexico Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Brazil Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Aircraft Mounts Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Global Aircraft Mounts Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 36: Global Aircraft Mounts Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 37: Global Aircraft Mounts Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa Aircraft Mounts Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Mounts Industry?

The projected CAGR is approximately 7.18%.

2. Which companies are prominent players in the Aircraft Mounts Industry?

Key companies in the market include Cadence Aerospace, Singapore Aerospace Manufacturing Pte Lt, Hutchinson Aerospace GmbH, Meeker Aviation, Airloc Ltd, Lord Corporation, GMT Rubber-Metal-Technic Ltd, Shock Tech Inc, Mayday Manufacturing, Trelleborg Group.

3. What are the main segments of the Aircraft Mounts Industry?

The market segments include Application, Mount Type, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.82 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Exterior Mount is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Mounts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Mounts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Mounts Industry?

To stay informed about further developments, trends, and reports in the Aircraft Mounts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence