Key Insights

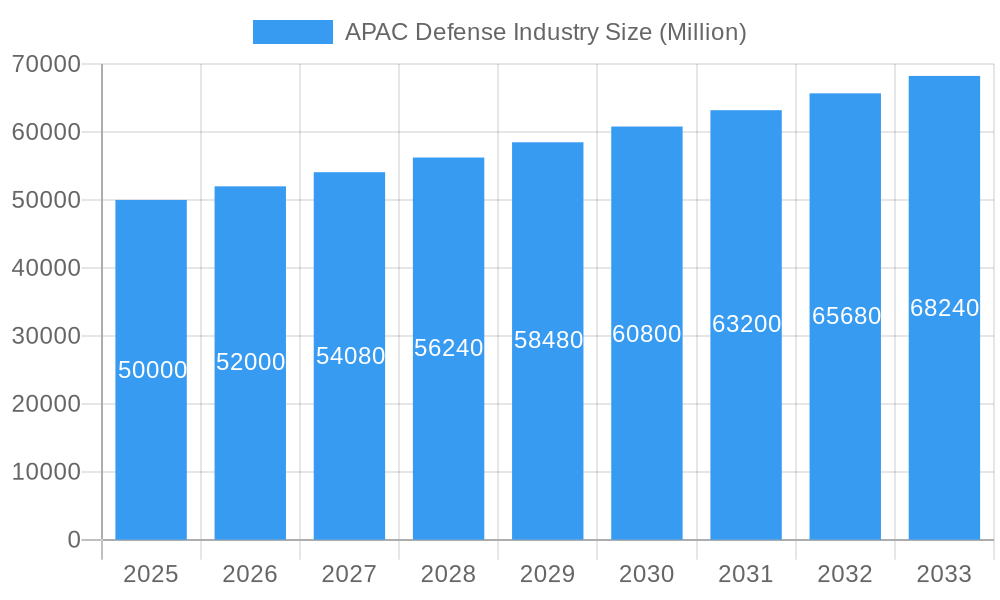

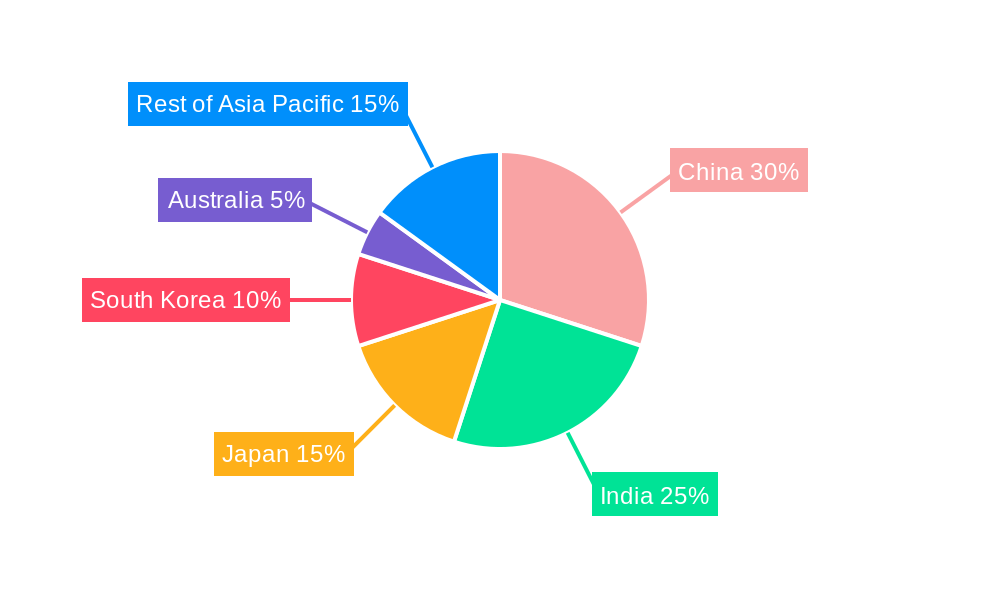

The Asia-Pacific (APAC) defense industry is experiencing robust growth, driven by escalating geopolitical tensions, modernization of armed forces, and rising defense budgets across the region. A compound annual growth rate (CAGR) exceeding 4% signifies a substantial expansion of the market, projected to reach significant value within the forecast period (2025-2033). Key drivers include the increasing need for advanced communication systems, sophisticated protection equipment (including vehicles and air-based vehicles), and enhanced personnel training programs. China, India, Japan, and South Korea are major contributors to this growth, fueled by their commitment to national security and technological advancements in military capabilities. The segments within the industry, including personnel training and protection, and the provision of various defense equipment types (communication systems, land and air-based vehicles, and weaponry), all contribute significantly to the overall market value. While specific regional breakdowns are not fully detailed, it's evident that the substantial defense budgets of nations like India and China play a large role, supplemented by the steady modernization efforts of other regional players like Japan and South Korea. The market faces certain restraints, potentially including economic fluctuations impacting government spending and supply chain complexities. However, the strategic importance placed on defense modernization in the region suggests that these challenges are unlikely to significantly impede long-term growth. The presence of major global defense contractors, alongside significant regional players, underscores the competitive yet dynamic landscape of the APAC defense industry.

APAC Defense Industry Market Size (In Billion)

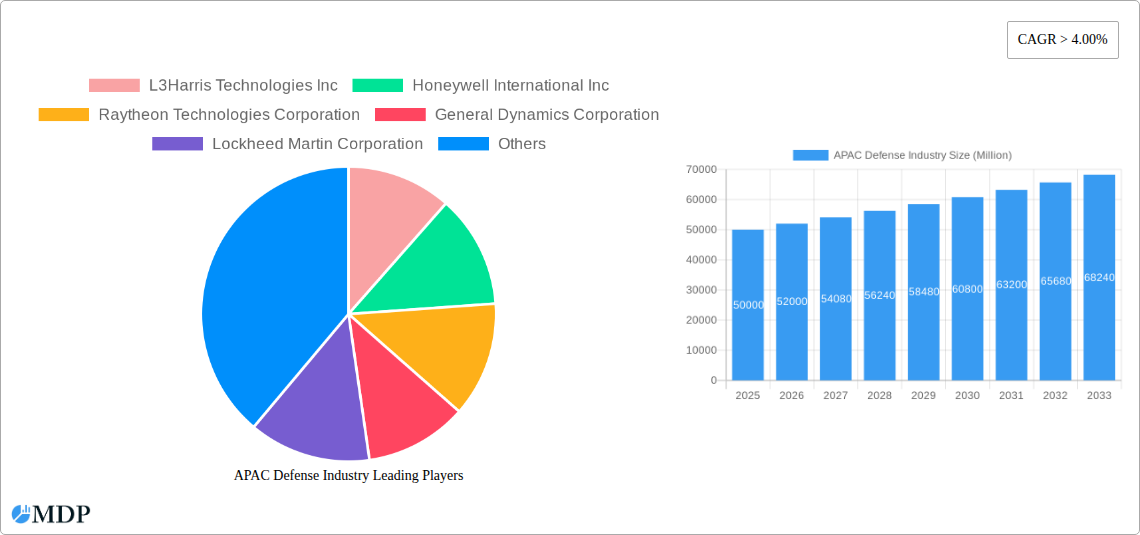

The dominance of key players like L3Harris Technologies, Honeywell, Raytheon, General Dynamics, Lockheed Martin, and several prominent regional companies (Rostec, Elbit Systems, Aviation Industry Corporation of China, Israel Aerospace Industries, and BAE Systems) indicates a high level of competition and technological innovation. This competitiveness is further fueled by ongoing investments in research and development, aiming to develop cutting-edge technologies such as artificial intelligence (AI) and autonomous systems for defense applications. While the base year for this analysis is 2025, the historical data from 2019-2024, combined with projected growth, paint a clear picture of a consistently expanding market. The forecast period of 2025-2033 presents significant opportunities for growth for both established and emerging players within the APAC defense industry. Continued geopolitical uncertainty and the continuous modernization drive within many APAC nations will likely sustain this high growth trajectory for the foreseeable future.

APAC Defense Industry Company Market Share

APAC Defense Industry Market Report: 2019-2033

Unlocking Growth Opportunities in the Thriving Asia-Pacific Defense Sector

This comprehensive report provides an in-depth analysis of the APAC defense industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a focus on the 2019-2033 period, including a base year of 2025 and a forecast period spanning 2025-2033, this report delivers critical data and actionable intelligence. The market is segmented by Armed Forces (Air Force, Army, Navy), product type (Personnel Training and Protection, Protection Equipment: Communication Systems, Vehicles), and Air-based Vehicles (Weapons and Ammunition). Key players like L3Harris Technologies Inc, Honeywell International Inc, and Raytheon Technologies Corporation are analyzed, alongside regional dynamics and emerging trends. This report is essential for strategic decision-making in this high-growth sector. The market is projected to reach xx Million by 2033.

APAC Defense Industry Market Dynamics & Concentration

The APAC defense industry is characterized by a complex interplay of factors influencing its market concentration and dynamism. Market share is highly concentrated among a few major global players and several strong regional entities. The top 5 players command approximately xx% of the market share in 2025, projected to decrease to xx% by 2033 due to increasing regional players. Innovation, driven by technological advancements and geopolitical instability, is a key driver, particularly in areas like AI-integrated systems and unmanned platforms. Stringent regulatory frameworks, varying across nations, influence market access and product development. Product substitutes are limited, with a strong emphasis on specialized equipment and technology. End-user trends reflect a shift towards more advanced, integrated systems capable of network-centric warfare. M&A activity has seen a rise in recent years, with xx major deals recorded between 2019 and 2024, creating larger, more integrated entities with increased global competitiveness. This activity is projected to continue at an average of xx deals per year during the forecast period.

- Market Concentration: Top 5 players hold xx% market share (2025), projected to xx% (2033).

- Innovation Drivers: AI, unmanned systems, network-centric warfare.

- Regulatory Frameworks: Vary significantly across APAC nations.

- M&A Activity: xx major deals (2019-2024), projected to continue at xx deals/year (2025-2033).

APAC Defense Industry Industry Trends & Analysis

The APAC defense industry is experiencing robust growth, driven by a multitude of factors. Geopolitical tensions and regional conflicts are fueling increased defense spending across the region. Technological disruptions, particularly the integration of artificial intelligence (AI) and autonomous systems, are transforming the landscape. Consumer preferences lean towards advanced, highly reliable equipment capable of interoperability with existing systems. The competitive dynamics are marked by a blend of global and regional players, with significant competition for contracts and market share. The CAGR for the industry is estimated at xx% during the forecast period (2025-2033), with market penetration projected to increase by xx% by 2033, primarily driven by modernization initiatives across various armed forces. Increased investment in R&D and the adoption of cutting-edge technologies play a critical role in driving market expansion.

Leading Markets & Segments in APAC Defense Industry

The APAC defense market displays diverse growth patterns across different segments and regions.

Dominant Segments: Air Force and Navy segments are expected to dominate due to modernization efforts and growing threat perceptions. The demand for advanced communication systems and air-based weapons and ammunition is expected to grow the fastest at xx% CAGR during the forecast period.

Key Regional Drivers:

- India: The Aatmanirbhar Bharat Abhiyan initiative significantly boosts indigenous development, driving growth in several segments.

- Australia: Significant investments in military modernization, as exemplified by the AUD 8 billion helicopter procurement.

- China: Continues to be a significant driver due to its ongoing military modernization and expansion programs.

Dominance Analysis: The dominance of specific segments and countries is driven by factors such as government budgets, geopolitical considerations, and technological advancement.

APAC Defense Industry Product Developments

Recent product innovations in the APAC defense industry are concentrated around the integration of AI, autonomous systems, and advanced communication technologies. These advancements are driving improved situational awareness, enhanced precision targeting, and more efficient resource allocation. The products exhibit competitive advantages through improved performance characteristics, reduced lifecycle costs, and enhanced interoperability. These innovations are tailored to meet specific regional needs and defense strategies, ensuring a strong market fit.

Key Drivers of APAP Defense Industry Growth

Several factors are driving growth in the APAC defense industry. Technological advancements, including AI, autonomous systems, and hypersonic weapons, are significantly enhancing defense capabilities. Economic growth in several APAC countries allows for increased defense budgets. Furthermore, evolving geopolitical dynamics and increasing regional tensions necessitate enhanced security measures. Stringent government regulations regarding the procurement and modernization of defense equipment continue to drive market growth.

Challenges in the APAC Defense Industry Market

The APAC defense industry faces various challenges. Complex regulatory environments and lengthy procurement processes can delay project implementation. Supply chain disruptions, particularly related to critical components and materials, can impact production and delivery schedules. Intense competition from both global and regional players makes winning contracts challenging. These challenges could significantly impact the market's growth trajectory if not addressed proactively. The combined impact of these challenges is estimated to constrain annual growth by xx% during the forecast period.

Emerging Opportunities in APAC Defense Industry

Significant opportunities exist in the APAC defense industry. Technological breakthroughs, particularly in areas such as AI, cyber security, and space-based defense systems, present promising avenues for growth. Strategic partnerships and joint ventures between global and regional companies are fostering innovation and market expansion. Furthermore, an increasing focus on modernization and digital transformation within APAC armed forces generates substantial demand for advanced technologies and services. This creates significant growth potential for companies providing innovative solutions that meet the evolving needs of the region’s defense sector.

Leading Players in the APAC Defense Industry Sector

- L3Harris Technologies Inc

- Honeywell International Inc

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Lockheed Martin Corporation

- Rostec

- Elbit Systems Ltd

- Northrop Grumman Corporation

- Aviation Industry Corporation of China

- Israel Aerospace Industries

- BAE Systems plc

- The Boeing Company

Key Milestones in APAC Defense Industry Industry

- May 2022: Australia announces AUD 8 billion (USD 5.5 billion) acquisition of 12 MH-60R Romeo and 29 AH-64E Apache helicopters. Deliveries to commence in 2025. This signifies a significant commitment to naval and army modernization.

- March 2022: India's Aatmanirbhar Bharat Abhiyan identifies 18 platforms for local defense industry development, including NSUASs, AI-based land robots, and long-range UAVs. This initiative emphasizes indigenous development and technological self-reliance.

Strategic Outlook for APAC Defense Industry Market

The APAC defense industry is poised for sustained growth, driven by continuous modernization efforts, rising geopolitical tensions, and technological innovation. The industry's future potential hinges on the successful integration of cutting-edge technologies, strategic partnerships, and the ability to adapt to evolving security challenges. Companies that embrace innovation, prioritize R&D, and forge strong alliances are best positioned to capture significant market share in this dynamic and rapidly expanding sector. The focus on indigenous development in key markets presents both challenges and opportunities for both domestic and international players.

APAC Defense Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

APAC Defense Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Defense Industry Regional Market Share

Geographic Coverage of APAC Defense Industry

APAC Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Air Force Segment is Anticipated to Register the Highest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America APAC Defense Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America APAC Defense Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe APAC Defense Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa APAC Defense Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific APAC Defense Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raytheon Technologies Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Dynamics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lockheed Martin Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rostec

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elbit Systems Lt

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Northrop Grumann Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aviation Industry Corporation of China

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Israel Aerospace Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BAE Systems plc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global APAC Defense Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America APAC Defense Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America APAC Defense Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America APAC Defense Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America APAC Defense Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America APAC Defense Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America APAC Defense Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America APAC Defense Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America APAC Defense Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America APAC Defense Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America APAC Defense Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America APAC Defense Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America APAC Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America APAC Defense Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America APAC Defense Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America APAC Defense Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America APAC Defense Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America APAC Defense Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America APAC Defense Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America APAC Defense Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America APAC Defense Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America APAC Defense Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America APAC Defense Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America APAC Defense Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America APAC Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe APAC Defense Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe APAC Defense Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe APAC Defense Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe APAC Defense Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe APAC Defense Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe APAC Defense Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe APAC Defense Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe APAC Defense Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe APAC Defense Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe APAC Defense Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe APAC Defense Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe APAC Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa APAC Defense Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa APAC Defense Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa APAC Defense Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa APAC Defense Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa APAC Defense Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa APAC Defense Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa APAC Defense Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa APAC Defense Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa APAC Defense Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa APAC Defense Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa APAC Defense Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa APAC Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific APAC Defense Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific APAC Defense Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific APAC Defense Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific APAC Defense Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific APAC Defense Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific APAC Defense Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific APAC Defense Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific APAC Defense Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific APAC Defense Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific APAC Defense Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific APAC Defense Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific APAC Defense Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Defense Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global APAC Defense Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global APAC Defense Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global APAC Defense Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global APAC Defense Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global APAC Defense Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global APAC Defense Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global APAC Defense Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global APAC Defense Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global APAC Defense Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global APAC Defense Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global APAC Defense Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Defense Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global APAC Defense Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global APAC Defense Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global APAC Defense Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global APAC Defense Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global APAC Defense Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global APAC Defense Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global APAC Defense Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global APAC Defense Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global APAC Defense Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global APAC Defense Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global APAC Defense Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global APAC Defense Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global APAC Defense Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global APAC Defense Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global APAC Defense Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global APAC Defense Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global APAC Defense Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global APAC Defense Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global APAC Defense Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global APAC Defense Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global APAC Defense Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global APAC Defense Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global APAC Defense Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific APAC Defense Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Defense Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the APAC Defense Industry?

Key companies in the market include L3Harris Technologies Inc, Honeywell International Inc, Raytheon Technologies Corporation, General Dynamics Corporation, Lockheed Martin Corporation, Rostec, Elbit Systems Lt, Northrop Grumann Corporation, Aviation Industry Corporation of China, Israel Aerospace Industries, BAE Systems plc, The Boeing Company.

3. What are the main segments of the APAC Defense Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Air Force Segment is Anticipated to Register the Highest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

May 2022: The government of Australia announced that it would acquire 12 new MH-60R Romeo maritime helicopters and 29 AH-64E Apache Armed Reconnaissance helicopters for its army and navy. The aircraft deliveries will start in 2025 and will cost a combined total of more than AUD 8 billion (USD 5.5 billion)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Defense Industry?

To stay informed about further developments, trends, and reports in the APAC Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence