Key Insights

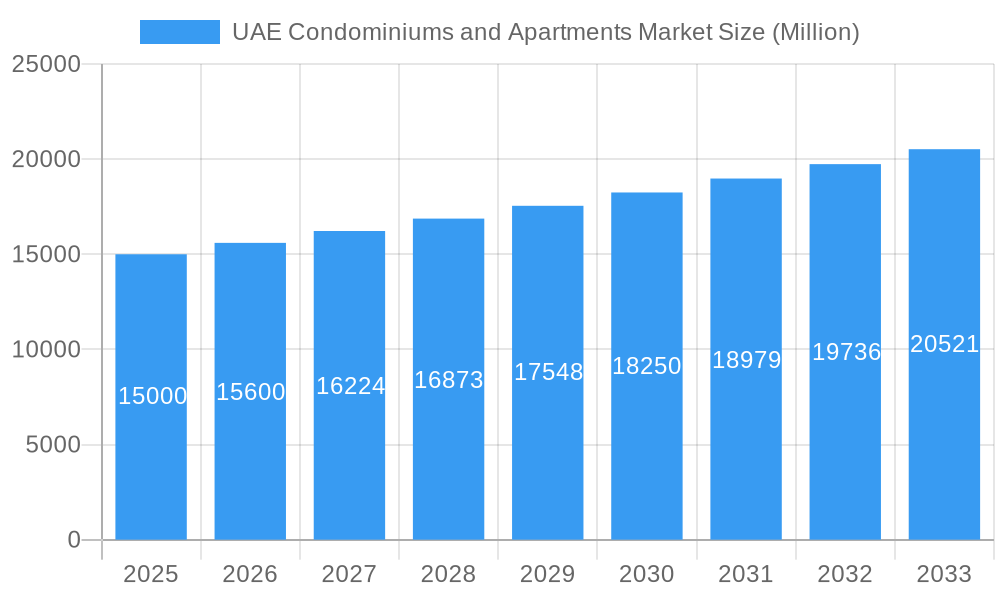

The United Arab Emirates (UAE) condominiums and apartments market, including major cities such as Dubai, Abu Dhabi, and Sharjah, is poised for significant expansion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 6.82% from 2025 to 2033, the market size is estimated at 19.63 billion by the base year 2025. This growth is propelled by strategic government initiatives attracting foreign investment and boosting tourism, coupled with a rising population, a strong economy, and increasing disposable incomes driving demand for premium residential properties. The increasing preference for luxury apartments and condominiums in prime locations with advanced amenities further supports this positive market trend. Despite potential economic fluctuations and material cost variations, the long-term outlook remains robust, underpinned by ongoing infrastructure development and the UAE's enduring appeal for living and investment.

UAE Condominiums and Apartments Market Market Size (In Billion)

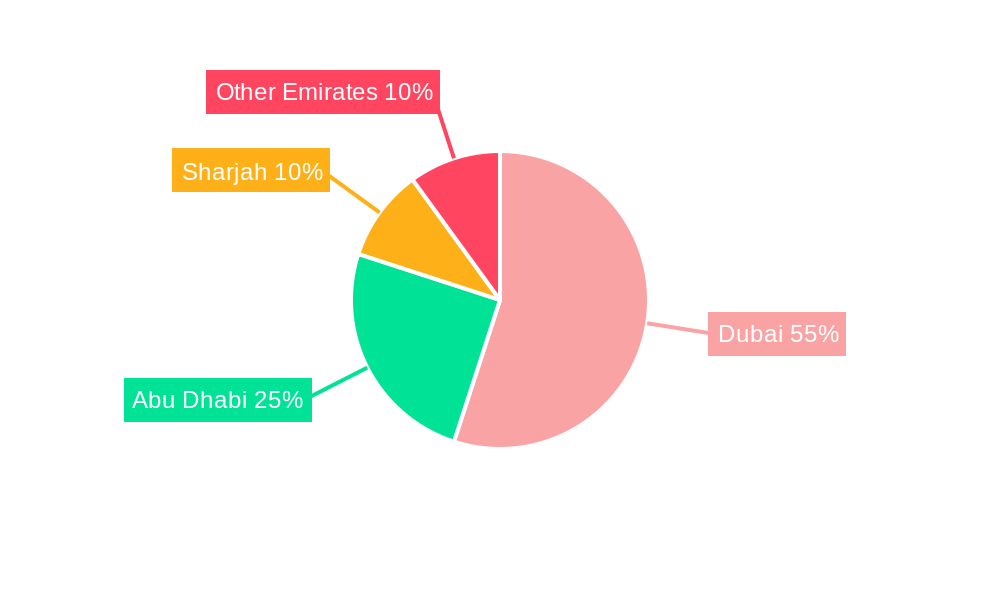

Geographically, Dubai leads the market share due to its established infrastructure and diversified economic base. Leading developers like Emaar Properties, Damac Properties, and Nakheel Properties are instrumental in shaping the market through innovative projects and strategic expansion. The UAE's economic diversification beyond oil is attracting a broader spectrum of high-net-worth individuals and professionals, escalating the demand for premium residential spaces. Future market growth will likely be influenced by the successful implementation of Expo 2020 legacy projects and the proliferation of smart city initiatives, enhancing property appeal and value. A commitment to sustainable development and green building practices also contributes to the attractiveness of new residential offerings.

UAE Condominiums and Apartments Market Company Market Share

UAE Condominiums and Apartments Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE condominiums and apartments market, offering invaluable insights for investors, developers, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities within the dynamic UAE real estate landscape. The report covers key cities including Dubai, Abu Dhabi, and Sharjah, focusing on leading players such as Emaar Properties, Damac Properties, Nakheel Properties, and many more.

UAE Condominiums and Apartments Market Dynamics & Concentration

The UAE condominiums and apartments market exhibits a moderately concentrated structure, with a few major players holding significant market share. Emaar Properties, Damac Properties, and Nakheel Properties, among others, dominate the landscape, driving significant market activity. However, the market also displays a considerable presence of smaller, specialized developers catering to niche segments.

Market Concentration Metrics:

- Market share of top 5 players: xx% (estimated)

- Number of M&A deals (2019-2024): xx

- Average deal size (USD Million): xx

Innovation Drivers:

- Sustainable building technologies (e.g., green building certifications)

- Smart home integration and automation

- Innovative architectural designs and amenities

- Focus on luxury and high-end finishes

Regulatory Frameworks:

- Government initiatives promoting real estate investment

- Regulations governing building codes and safety standards

- Policies impacting foreign investment in the property sector

Product Substitutes:

- Villas and townhouses

- Serviced apartments

End-User Trends:

- Growing demand for luxury apartments

- Increased preference for sustainable and eco-friendly properties

- Shift towards smaller, more efficient living spaces in urban areas

M&A Activities: The UAE has witnessed a significant number of mergers and acquisitions in recent years, driven by consolidation and expansion strategies among developers. This has resulted in increased market concentration and reshaping of the competitive landscape.

UAE Condominiums and Apartments Market Industry Trends & Analysis

The UAE condominiums and apartments market has experienced robust growth in recent years, driven by factors such as a burgeoning population, strong economic growth, and increasing foreign investment. The market is characterized by a diverse range of properties, from affordable units to high-end luxury apartments. Technological advancements, changing consumer preferences, and intense competition are shaping the market's trajectory.

The market demonstrates a significant compound annual growth rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration of smart home technologies is steadily increasing, with approximately xx% of new developments incorporating these features.

Consumer preferences are evolving towards sustainable and technologically advanced properties, with a growing focus on amenities and lifestyle offerings. The competitive landscape is dynamic, with established developers constantly innovating and expanding their portfolios to cater to the changing needs of the market. This includes strategic partnerships and collaborations to introduce new concepts and improve operational efficiency.

Leading Markets & Segments in UAE Condominiums and Apartments Market

Dubai overwhelmingly dominates the UAE condominiums and apartments market, followed by Abu Dhabi and Sharjah.

Dubai's Dominance:

- Key Drivers:

- Strong economic growth and diversification

- Extensive infrastructure development

- Significant foreign investment

- Attractive lifestyle and amenities

- Government initiatives promoting tourism and real estate investment

Dubai's status as a global hub for business and tourism significantly contributes to the high demand for residential properties. Its well-established infrastructure, diverse economy, and high quality of life make it a highly attractive location for both local and international residents.

Abu Dhabi & Sharjah:

While Dubai takes the lead, Abu Dhabi and Sharjah represent significant secondary markets, with their own unique growth drivers shaped by their respective economic strengths and developmental initiatives. These cities benefit from government investments in infrastructure and the overall growth of the UAE economy.

UAE Condominiums and Apartments Market Product Developments

The UAE condominiums and apartments market is witnessing a surge in innovation, with developers increasingly incorporating smart home technologies, sustainable building materials, and advanced architectural designs. This includes features such as smart lighting and security systems, energy-efficient appliances, and sustainable water management systems. The integration of these technologies aims to enhance the overall living experience, while also catering to environmentally conscious consumers. Furthermore, the market is witnessing a growing trend of incorporating unique amenities and lifestyle offerings to differentiate projects and attract buyers.

Key Drivers of UAE Condominiums and Apartments Market Growth

Several factors fuel the growth of the UAE condominiums and apartments market. Strong economic growth, supported by robust government spending on infrastructure and diversification initiatives, attracts foreign investment and boosts demand. Government policies promoting real estate development, favorable visa regulations for investors, and the overall appeal of the UAE as a desirable place to live all play a crucial role. Furthermore, the continued development of tourism and related industries contributes to a sustained demand for rental and ownership accommodations.

Challenges in the UAE Condominiums and Apartments Market

Despite the positive outlook, the market faces challenges. Regulatory hurdles and variations in building codes across emirates can impact development timelines and costs. Supply chain disruptions and fluctuations in material prices can impact profitability. Intense competition among developers requires strategic differentiation and innovative marketing to attract buyers.

Emerging Opportunities in UAE Condominiums and Apartments Market

The long-term outlook for the UAE condominiums and apartments market remains positive. Opportunities abound in sustainable construction, smart home technology integration, and catering to the growing demand for luxury and specialized living spaces. Strategic partnerships between developers and technology companies can further accelerate innovation and create new market segments. Expansion into emerging markets and the development of integrated communities offer significant potential for growth.

Leading Players in the UAE Condominiums and Apartments Market Sector

- The First Group

- Damac Properties

- Azizi Developments

- Select Group

- Emaar Properties

- Omniyat

- Meydan

- Nakheel Properties

- Sobha Realty

- MAG Property Development

- Dubai Properties

- Deyaar Properties

- Meraas

- Arada

- Aldar

Key Milestones in UAE Condominiums and Apartments Market Industry

October 2022: Damac Properties launched the Chic Tower in Dubai Business Bay, a luxury residential project featuring interiors designed by De Grisogono, reflecting the growing demand for high-end properties. This highlights the ongoing focus on luxury and premium developments.

November 2022: Nakheel PJSC secured AED 17 billion (USD 4.6 billion) in financing, demonstrating investor confidence and signaling significant upcoming development activity in Dubai, particularly related to Dubai Islands and other large-scale waterfront projects. This indicates substantial investment and expansion plans in the market.

Strategic Outlook for UAE Condominiums and Apartments Market Market

The UAE condominiums and apartments market is poised for continued growth, driven by ongoing economic diversification, infrastructure development, and government support for the real estate sector. Strategic investments in sustainable building practices, technological integration, and the creation of innovative living spaces will define future market success. The focus on attracting high-net-worth individuals and catering to specific lifestyle preferences will continue to drive demand and shape the market's evolution.

UAE Condominiums and Apartments Market Segmentation

-

1. Key Cities

- 1.1. Dubai

- 1.2. Abu Dhabi

- 1.3. Sharjah

UAE Condominiums and Apartments Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Condominiums and Apartments Market Regional Market Share

Geographic Coverage of UAE Condominiums and Apartments Market

UAE Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending on the Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Materials and Labor Shortages

- 3.4. Market Trends

- 3.4.1. Luxury Apartment Prices Set to Witness a Steep Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Dubai

- 5.1.2. Abu Dhabi

- 5.1.3. Sharjah

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. North America UAE Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Key Cities

- 6.1.1. Dubai

- 6.1.2. Abu Dhabi

- 6.1.3. Sharjah

- 6.1. Market Analysis, Insights and Forecast - by Key Cities

- 7. South America UAE Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Key Cities

- 7.1.1. Dubai

- 7.1.2. Abu Dhabi

- 7.1.3. Sharjah

- 7.1. Market Analysis, Insights and Forecast - by Key Cities

- 8. Europe UAE Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Key Cities

- 8.1.1. Dubai

- 8.1.2. Abu Dhabi

- 8.1.3. Sharjah

- 8.1. Market Analysis, Insights and Forecast - by Key Cities

- 9. Middle East & Africa UAE Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Key Cities

- 9.1.1. Dubai

- 9.1.2. Abu Dhabi

- 9.1.3. Sharjah

- 9.1. Market Analysis, Insights and Forecast - by Key Cities

- 10. Asia Pacific UAE Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Key Cities

- 10.1.1. Dubai

- 10.1.2. Abu Dhabi

- 10.1.3. Sharjah

- 10.1. Market Analysis, Insights and Forecast - by Key Cities

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The First Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Damac Properties

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Azizi Developments

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Select Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emaar Properties

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Omniyat

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Meydan**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nakheel Properties

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sobha Realty

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MAG Property Development

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dubai Properties

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Deyaar Properties

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Meraas

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Arada

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Aldar

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 The First Group

List of Figures

- Figure 1: Global UAE Condominiums and Apartments Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UAE Condominiums and Apartments Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 3: North America UAE Condominiums and Apartments Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 4: North America UAE Condominiums and Apartments Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UAE Condominiums and Apartments Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UAE Condominiums and Apartments Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 7: South America UAE Condominiums and Apartments Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 8: South America UAE Condominiums and Apartments Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UAE Condominiums and Apartments Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UAE Condominiums and Apartments Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 11: Europe UAE Condominiums and Apartments Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 12: Europe UAE Condominiums and Apartments Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UAE Condominiums and Apartments Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UAE Condominiums and Apartments Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 15: Middle East & Africa UAE Condominiums and Apartments Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 16: Middle East & Africa UAE Condominiums and Apartments Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UAE Condominiums and Apartments Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UAE Condominiums and Apartments Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 19: Asia Pacific UAE Condominiums and Apartments Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 20: Asia Pacific UAE Condominiums and Apartments Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UAE Condominiums and Apartments Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 2: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 4: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 9: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 14: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 25: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 33: Global UAE Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UAE Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Condominiums and Apartments Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the UAE Condominiums and Apartments Market?

Key companies in the market include The First Group, Damac Properties, Azizi Developments, Select Group, Emaar Properties, Omniyat, Meydan**List Not Exhaustive, Nakheel Properties, Sobha Realty, MAG Property Development, Dubai Properties, Deyaar Properties, Meraas, Arada, Aldar.

3. What are the main segments of the UAE Condominiums and Apartments Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending on the Commercial Construction.

6. What are the notable trends driving market growth?

Luxury Apartment Prices Set to Witness a Steep Growth.

7. Are there any restraints impacting market growth?

Materials and Labor Shortages.

8. Can you provide examples of recent developments in the market?

October 2022: Damac Properties unveiled a luxury residential project in Dubai's Business Bay, featuring interiors designed by Swiss jeweller De Grisogono, to meet growing demand in the prime market. The 41-storey Chic Tower will include studios, as well as one and two-bedroom apartments. It plans to add three and four-bedroom apartments with 'hydroponic walls and sky pools' at a later stage. Chic Tower will also feature amenities such as seven baths, a beauty bar, and sky gyms. Damac did not disclose the total cost of the project or the construction schedule.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the UAE Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence