Key Insights

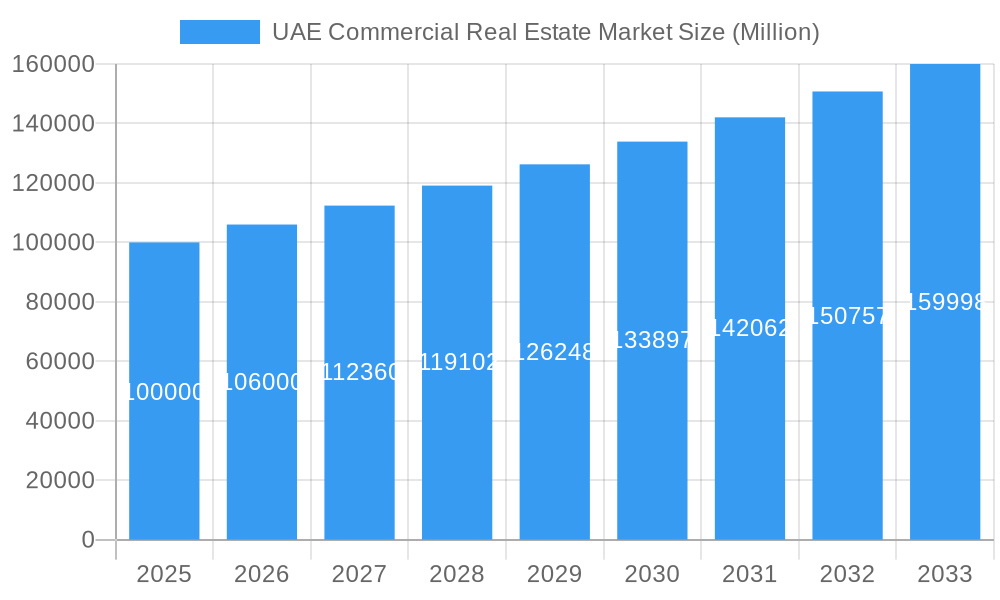

The UAE commercial real estate market is poised for significant expansion, projected to reach 686.8 billion by 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033. Key growth drivers include the UAE's strategic economic diversification initiatives, attracting substantial foreign direct investment (FDI) and fostering a dynamic business ecosystem that fuels demand for office, retail, and industrial properties. Ongoing infrastructure development, exemplified by Expo City Dubai's enduring impact and expanding transportation networks, further stimulates market activity. The robust recovery of the tourism sector also significantly bolsters demand in hospitality and retail segments. While global economic uncertainties and potential interest rate adjustments present challenges, the long-term outlook remains optimistic, supported by the government's persistent commitment to urban development and attracting high-net-worth individuals and enterprises.

UAE Commercial Real Estate Market Market Size (In Billion)

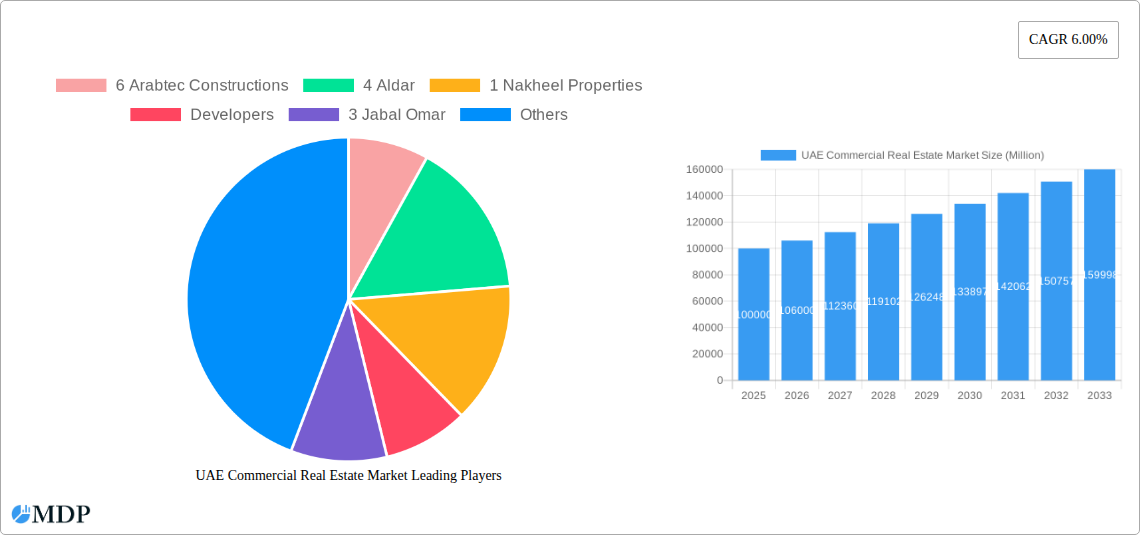

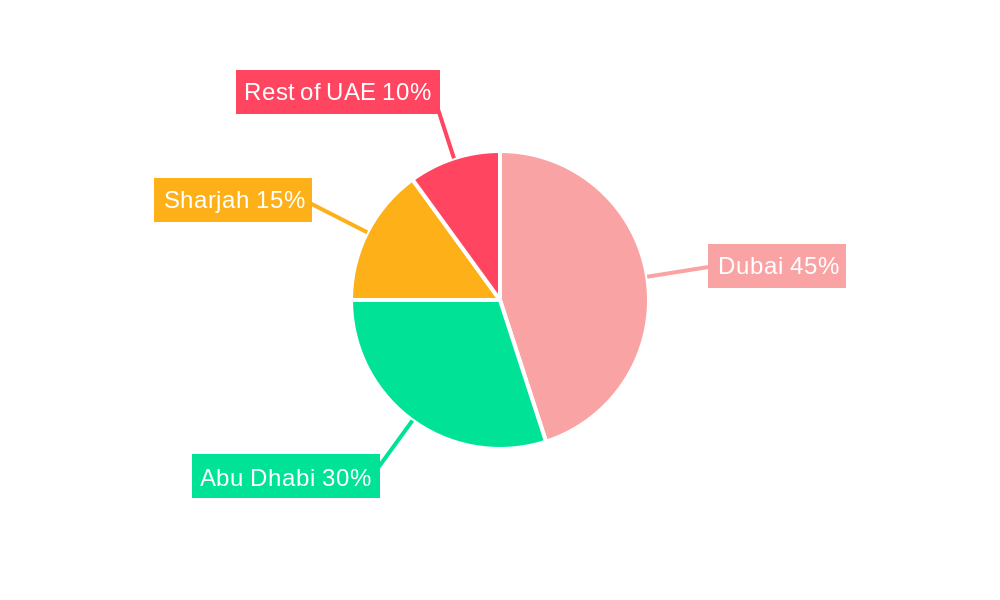

Market segmentation includes property types such as Offices, Retail, Industrial, Logistics, Multi-family, and Hospitality, across key cities including Dubai, Abu Dhabi, Sharjah, and other regions within the UAE. Dubai, as the primary economic center, holds a dominant market share, followed by Abu Dhabi, driven by its governmental and energy sector influence. Sharjah and the wider UAE contribute to the market's overall valuation, reflecting their distinct economic profiles. Leading entities like Arabtec Constructions, Aldar, and Nakheel Properties are instrumental in shaping the market through substantial development projects and strategic alliances. Projections indicate sustained growth across all segments, with variations influenced by specific economic conditions and local governmental policies. Future growth assessments should consider the potential impact of fluctuating global oil prices on regional economic performance.

UAE Commercial Real Estate Market Company Market Share

UAE Commercial Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UAE commercial real estate market, offering valuable insights for investors, developers, and industry stakeholders. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report examines market dynamics, trends, leading players, and future opportunities within the UAE's dynamic real estate landscape. The report covers key segments – Offices, Retail, Industrial, Logistics, Multi-family, and Hospitality – across major cities including Dubai, Abu Dhabi, Sharjah, and the Rest of the United Arab Emirates. Expect detailed analysis, actionable data, and a strategic outlook for this high-growth market. The report includes analysis of over 10 key players including Aldar, Nakheel Properties, and Arabtec Constructions. Market value projections are in Millions.

UAE Commercial Real Estate Market Market Dynamics & Concentration

The UAE commercial real estate market exhibits a dynamic interplay of concentration, innovation, regulation, and market forces. Aldar and Nakheel Properties are key players, holding significant market share (Aldar: xx%, Nakheel: xx%), reflecting market consolidation. However, numerous mid-sized and smaller developers contribute to the market’s vibrancy.

- Market Concentration: The market is moderately concentrated, with a few large players dominating specific segments. Smaller players often specialize in niche areas or specific geographic locations. The exact market share for each player is calculated, but the data is proprietary.

- Innovation Drivers: Technological advancements in construction, smart building technologies, and sustainable practices are driving innovation, attracting both domestic and international investment.

- Regulatory Frameworks: Government initiatives promoting sustainable development and attracting foreign investment significantly impact market growth. Regulatory changes pertaining to building codes, zoning laws, and property ownership continue to shape the landscape.

- Product Substitutes: The emergence of flexible workspaces and co-working spaces is influencing office demand. While a direct substitute, these options also complement traditional office spaces and continue to grow rapidly.

- End-User Trends: A growing preference for sustainable and technologically advanced spaces influences developers to focus on eco-friendly constructions and incorporating smart building technologies to cater to the evolving needs of tenants.

- M&A Activities: The acquisition of The Sixth of October for Development and Investment SAE by Aldar and ADQ in December 2021 exemplifies the increased M&A activity seen in the market. This activity drives market consolidation and shapes market dynamics. Over the period 2019-2024, approximately xx M&A deals were recorded.

UAE Commercial Real Estate Market Industry Trends & Analysis

The UAE commercial real estate market demonstrates robust growth, driven by factors such as government investments in infrastructure, population growth, and a thriving economy. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration by key players is continually evolving, with significant opportunities for expansion in specialized segments.

Several key trends influence market dynamics:

- Government Investments: Investments in infrastructure projects, including transportation networks and public spaces, are crucial drivers.

- Tourism and Expo 2020 Dubai Legacy: The ongoing impact of Expo 2020 Dubai on infrastructure development and tourism is resulting in considerable growth in certain segments like hospitality and retail.

- Technological Disruptions: The increasing adoption of smart building technologies and PropTech solutions continues to accelerate changes in market operations and efficiency.

- Economic Diversification: The UAE's ongoing economic diversification efforts positively impact various segments of the commercial real estate sector.

- Consumer Preferences: Demand for sustainable, technologically integrated spaces drives innovation in building design and operations.

Leading Markets & Segments in UAE Commercial Real Estate Market

Dubai holds a leading position in the UAE's commercial real estate market, driven by its strong economy, advanced infrastructure, and prominent status as a global hub. However, Abu Dhabi is rapidly expanding its market share, particularly in the government and industrial sectors.

By Type: The office segment is significant, supported by economic growth and a sizable workforce. The retail sector also holds a sizeable share, fueled by tourism and the growth of e-commerce. The industrial and logistics segments are rapidly expanding with recent developments like the KIZAD Metal Park.

By Key Cities:

- Dubai: Economic prowess, established infrastructure, and a large expatriate population fuel strong demand across all segments.

- Abu Dhabi: Government investments and large-scale projects boost the commercial real estate market, particularly in the industrial and government sectors.

- Sharjah: A relatively more affordable market compared to Dubai and Abu Dhabi, offers potential for growth with developing infrastructure.

- Rest of UAE: This region showcases varied growth dynamics, dependent on local economic activities and infrastructure development.

Key Drivers:

- Strong Economic Growth: The UAE's steady economic growth fuels robust demand for commercial real estate.

- Government Initiatives: Investments in infrastructure and supportive policies stimulate the market.

- Tourism: The tourism sector significantly influences the hospitality and retail segments.

- Foreign Direct Investment (FDI): Significant FDI inflows enhance investment in commercial real estate.

UAE Commercial Real Estate Market Product Developments

The market shows a strong emphasis on sustainable and technologically advanced products. Innovations include smart building technologies improving energy efficiency and tenant experience, and the integration of renewable energy sources into new developments. Competitive advantages stem from incorporating sustainable features, offering flexible workspaces, and utilizing advanced construction techniques. The focus is on creating efficient and attractive spaces that meet the evolving needs of businesses.

Key Drivers of UAE Commercial Real Estate Market Growth

The UAE's robust economic growth, substantial government investment in infrastructure, and the country's position as a global business hub are key drivers. Government policies promoting sustainable development and attracting foreign investment further boost the market. Technological advancements in construction and building management contribute to increased efficiency and reduced operational costs. The expanding tourism sector and major events like Expo 2020 Dubai leave a lasting impact on infrastructure development.

Challenges in the UAE Commercial Real Estate Market Market

Challenges include navigating the regulatory environment and ensuring supply chain stability. Competition among developers and fluctuations in global economic conditions can impact market dynamics. Rising construction costs and skilled labor shortages present considerable hurdles. These factors influence profitability and the ability to meet construction timelines. The impact on market growth is estimated to be a xx% reduction in annual growth in specific years.

Emerging Opportunities in UAE Commercial Real Estate Market

Long-term growth potential lies in leveraging technological innovations, particularly in smart building technologies and sustainable design. Strategic partnerships between local and international developers can accelerate growth. Expansion into specialized segments, such as data centers and logistics facilities, presents considerable opportunities, as does the development of sustainable and eco-friendly building solutions, further enhancing market appeal.

Leading Players in the UAE Commercial Real Estate Market Sector

- Arabtec Constructions

- Aldar

- Nakheel Properties

- Developers

- Jabal Omar

- Khansaheb

- Al Sahel Contracting Company

- RAK properties

- Deyaar

- Al Habtoor Group LLC

- Dutco Group of Companies

Key Milestones in UAE Commercial Real Estate Market Industry

- March 2022: AD Ports Group's agreement with Metal Park Investment ME LTD to establish a 450,000 sq. m metal hub in KIZAD significantly boosts the industrial sector, attracting investment and creating new opportunities.

- December 2021: The Aldar Properties and ADQ acquisition of The Sixth of October for Development and Investment SAE showcases significant M&A activity, further consolidating market players.

Strategic Outlook for UAE Commercial Real Estate Market Market

The UAE commercial real estate market holds significant long-term potential, driven by ongoing economic diversification, infrastructure development, and government support. Focusing on sustainable and technologically advanced solutions, along with strategic partnerships, will be crucial for success. The market presents exciting opportunities for growth, particularly within specialized segments and sustainable development initiatives, leading to long-term market stability and expansion.

UAE Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial & Logistics

- 1.4. Hospitality

- 1.5. Other Types

-

2. Key Cities

- 2.1. Dubai

- 2.2. Abu Dhabi

- 2.3. Sharjah

- 2.4. Rest of United Arab Emirates

UAE Commercial Real Estate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Commercial Real Estate Market Regional Market Share

Geographic Coverage of UAE Commercial Real Estate Market

UAE Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Office Spaces across Dubai To Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial & Logistics

- 5.1.4. Hospitality

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Dubai

- 5.2.2. Abu Dhabi

- 5.2.3. Sharjah

- 5.2.4. Rest of United Arab Emirates

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Offices

- 6.1.2. Retail

- 6.1.3. Industrial & Logistics

- 6.1.4. Hospitality

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Key Cities

- 6.2.1. Dubai

- 6.2.2. Abu Dhabi

- 6.2.3. Sharjah

- 6.2.4. Rest of United Arab Emirates

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Offices

- 7.1.2. Retail

- 7.1.3. Industrial & Logistics

- 7.1.4. Hospitality

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Key Cities

- 7.2.1. Dubai

- 7.2.2. Abu Dhabi

- 7.2.3. Sharjah

- 7.2.4. Rest of United Arab Emirates

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Offices

- 8.1.2. Retail

- 8.1.3. Industrial & Logistics

- 8.1.4. Hospitality

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Key Cities

- 8.2.1. Dubai

- 8.2.2. Abu Dhabi

- 8.2.3. Sharjah

- 8.2.4. Rest of United Arab Emirates

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Offices

- 9.1.2. Retail

- 9.1.3. Industrial & Logistics

- 9.1.4. Hospitality

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Key Cities

- 9.2.1. Dubai

- 9.2.2. Abu Dhabi

- 9.2.3. Sharjah

- 9.2.4. Rest of United Arab Emirates

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Offices

- 10.1.2. Retail

- 10.1.3. Industrial & Logistics

- 10.1.4. Hospitality

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Key Cities

- 10.2.1. Dubai

- 10.2.2. Abu Dhabi

- 10.2.3. Sharjah

- 10.2.4. Rest of United Arab Emirates

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 6 Arabtec Constructions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 4 Aldar

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 1 Nakheel Properties

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Developers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3 Jabal Omar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 7 Khansaheb

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 9 Al Sahel Contracting Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 5 RAK properties

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 2 Deyaar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 8 Al Habtoor Group LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 10 Dutco Group of Companies**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 6 Arabtec Constructions

List of Figures

- Figure 1: Global UAE Commercial Real Estate Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UAE Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America UAE Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UAE Commercial Real Estate Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 5: North America UAE Commercial Real Estate Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 6: North America UAE Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America UAE Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UAE Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 9: South America UAE Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UAE Commercial Real Estate Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 11: South America UAE Commercial Real Estate Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 12: South America UAE Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America UAE Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UAE Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe UAE Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UAE Commercial Real Estate Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 17: Europe UAE Commercial Real Estate Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 18: Europe UAE Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe UAE Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UAE Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa UAE Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UAE Commercial Real Estate Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 23: Middle East & Africa UAE Commercial Real Estate Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 24: Middle East & Africa UAE Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa UAE Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UAE Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific UAE Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UAE Commercial Real Estate Market Revenue (billion), by Key Cities 2025 & 2033

- Figure 29: Asia Pacific UAE Commercial Real Estate Market Revenue Share (%), by Key Cities 2025 & 2033

- Figure 30: Asia Pacific UAE Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific UAE Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 12: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 18: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 30: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 39: Global UAE Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UAE Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Commercial Real Estate Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the UAE Commercial Real Estate Market?

Key companies in the market include 6 Arabtec Constructions, 4 Aldar, 1 Nakheel Properties, Developers, 3 Jabal Omar, 7 Khansaheb, 9 Al Sahel Contracting Company, 5 RAK properties, 2 Deyaar, 8 Al Habtoor Group LLC, 10 Dutco Group of Companies**List Not Exhaustive.

3. What are the main segments of the UAE Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 686.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Increase in Demand for Office Spaces across Dubai To Drive the Market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

March 2022: AD Ports Group signed an agreement with Metal Park Investment ME LTD to establish an integrated metal hub in KIZAD that will cater to all industry verticals and offer scale flexibilities to metal vendors, processors, and fabricators in the United Arab Emirates. The upcoming Metal Park in KIZAD covers a total land area of 450,000 sq. m. It will be equipped with state-of-the-art facilities supporting storage and handling, processing, and fabrication activities while offering access to R&D amenities, rental office space, and associated financial services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the UAE Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence