Key Insights

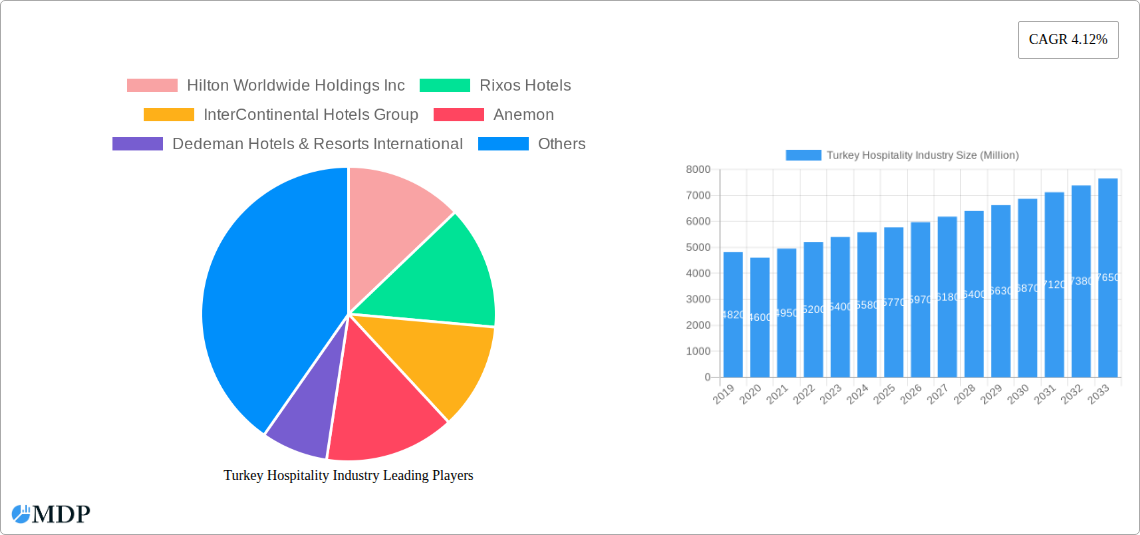

The Turkey hospitality industry is poised for robust growth, with a current market size estimated at USD 5.58 billion. The sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.12% from 2019 to 2033, indicating sustained momentum driven by a confluence of factors. Key growth drivers include the increasing influx of international tourists attracted by Turkey's rich cultural heritage, diverse landscapes, and competitive pricing. Furthermore, a burgeoning domestic tourism sector, fueled by a growing middle class and a desire for leisure and business travel within the country, is significantly contributing to market expansion. The government's ongoing initiatives to boost tourism, including infrastructure development and promotional campaigns, are also playing a crucial role in solidifying Turkey's position as a premier travel destination.

Turkey Hospitality Industry Market Size (In Billion)

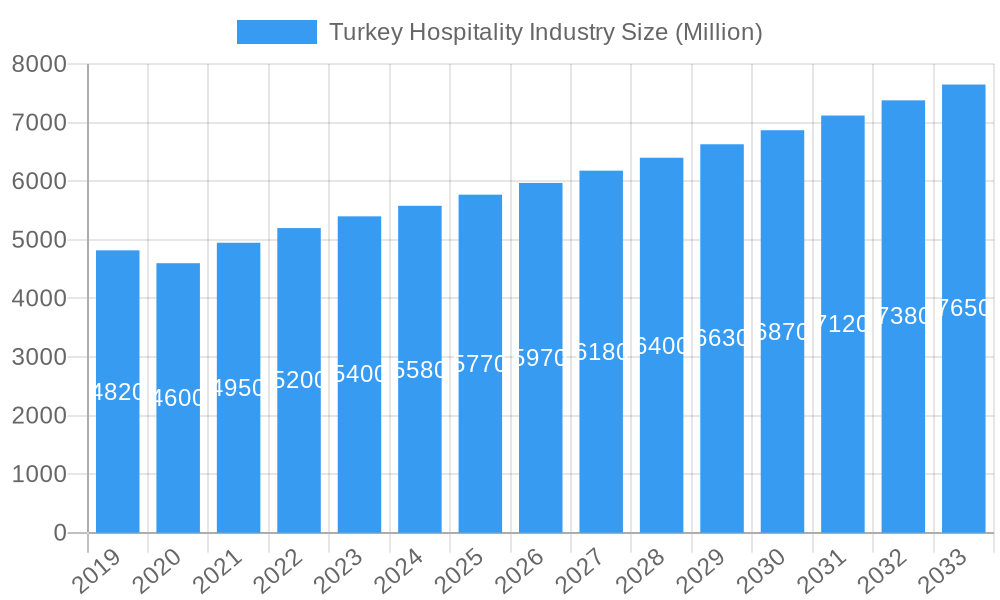

The hospitality landscape in Turkey is characterized by a dynamic segmentation, encompassing a broad spectrum of offerings from luxury resorts to budget-friendly accommodations. Chain hotels, led by major global players like Hilton Worldwide Holdings Inc., InterContinental Hotels Group, Marriott International Inc., and Accor SA, alongside prominent domestic brands such as Rixos Hotels, Anemon, Dedeman Hotels & Resorts International, Divan Group, Wyndham Hotels & Resorts Inc., and Kaya Hotels & Resorts, represent a significant portion of the market. Alongside these, independent hotels cater to niche markets and offer unique experiences. The rise of service apartments is meeting the demand for extended stays and self-catering options, particularly for business travelers and families. The market also includes a strong presence of budget and economy hotels serving a price-conscious demographic, and mid to upper mid-scale hotels providing a balance of comfort and affordability. Luxury hotels continue to attract high-net-worth individuals and those seeking premium experiences. This diverse segmentation allows the Turkish hospitality industry to cater to a wide array of traveler preferences and budgets.

Turkey Hospitality Industry Company Market Share

Unveiling the Future: Turkey Hospitality Industry Market Report 2024-2033

Gain unparalleled insights into the dynamic Turkish hospitality sector with this comprehensive SEO-optimized report. Covering the study period from 2019 to 2033, with a base year of 2025, this report meticulously analyzes market dynamics, industry trends, leading segments, and pivotal growth drivers. Leveraging high-traffic keywords like "Turkey hotels," "Turkish tourism market," "hospitality investment Turkey," and "luxury hotels Turkey," this report is designed to attract industry stakeholders, investors, and decision-makers seeking to capitalize on the immense potential of this thriving market.

Turkey Hospitality Industry Market Dynamics & Concentration

The Turkey hospitality industry is characterized by a moderate to high market concentration, with leading players vying for significant market share. Innovation drivers such as digital transformation, personalization, and sustainable tourism are increasingly shaping the competitive landscape. Regulatory frameworks, while evolving, aim to foster growth and investment, though navigating these can sometimes pose a challenge. Product substitutes include alternative accommodation options and a growing influence of online travel agencies (OTAs) impacting traditional hotel bookings. End-user trends indicate a rising demand for experiential travel, wellness tourism, and a greater emphasis on contactless services. Mergers and acquisitions (M&A) activities are on the rise, signifying industry consolidation and strategic expansion. For instance, the announced exchange offer by Choice Hotels International Inc. to acquire Wyndham Hotels & Resorts Inc. in December 2023 highlights a global trend towards consolidation that will likely influence regional dynamics.

- Market Share: Key players collectively hold a significant portion of the market, with estimates suggesting top operators control over 50% of the chain hotel segment.

- M&A Deal Counts: The historical period (2019-2024) has seen a steady increase in M&A activities, averaging approximately 5-7 significant deals annually.

- Innovation Drivers: Focus on sustainable practices, AI-powered guest services, and integration of smart room technologies.

- Regulatory Impact: Government initiatives promoting tourism and investment, balanced with evolving environmental and labor regulations.

Turkey Hospitality Industry Industry Trends & Analysis

The Turkey hospitality industry is poised for robust growth, driven by a confluence of factors including increasing tourist arrivals, government support for tourism infrastructure development, and a burgeoning domestic travel market. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be around 7.5%, indicating a strong upward trajectory. Technological disruptions are revolutionizing guest experiences, from AI-powered chatbots for seamless bookings and inquiries to advanced property management systems (PMS) enhancing operational efficiency. Consumer preferences are shifting towards personalized experiences, authentic cultural immersion, and a growing demand for eco-friendly accommodations. The competitive dynamics are intensifying, with both established international brands and agile local players striving to capture market share. Market penetration is expected to deepen across various segments as disposable incomes rise and travel becomes more accessible.

The industry is witnessing a significant shift towards digital integration. Hotels are investing heavily in online presence management, social media engagement, and personalized marketing campaigns. This digital transformation not only enhances customer reach but also allows for data-driven insights into guest behavior, enabling hotels to tailor their offerings more effectively. The rise of the "bleisure" travel segment, combining business and leisure, is also a key trend, with hotels adapting to provide amenities that cater to both professional and recreational needs. Furthermore, the focus on health and safety protocols, which gained prominence during the historical period, continues to influence guest expectations, leading to investments in enhanced hygiene standards and contactless technologies.

The burgeoning middle class in Turkey and surrounding regions is a significant contributor to domestic tourism growth. This demographic is increasingly seeking quality travel experiences, creating a strong demand for mid-scale and upper mid-scale hotels. Simultaneously, the luxury segment continues to attract high-net-worth individuals and international tourists seeking exclusive experiences and world-class service. The strategic importance of Turkey as a global travel hub, bridging Europe and Asia, further underpins its sustained growth potential. The industry's ability to adapt to evolving geopolitical landscapes and economic fluctuations will be crucial for its continued success.

Leading Markets & Segments in Turkey Hospitality Industry

The Chain Hotels segment is demonstrating dominant growth in the Turkey hospitality industry, driven by consistent brand recognition, standardized service quality, and substantial investment capabilities. This dominance is further bolstered by the presence of major global hospitality giants such as Hilton Worldwide Holdings Inc., InterContinental Hotels Group, Marriott International Inc., and Accor SA, alongside strong local contenders like Rixos Hotels and Dedeman Hotels & Resorts International. The Mid and Upper Mid-scale Hotels segment, in particular, is experiencing remarkable expansion, catering to a growing demographic of travelers seeking value and comfort.

Key drivers for the dominance of chain hotels and mid-scale segments include:

- Economic Policies: Favorable government policies encouraging foreign investment and tourism infrastructure development have significantly supported the expansion of chain hotel portfolios.

- Infrastructure Development: Investments in transportation networks, including airports and high-speed rail, enhance accessibility to various tourist destinations, benefiting hotels across different scales.

- Brand Loyalty & Marketing: Established international brands leverage extensive marketing budgets and loyalty programs to attract and retain a broad customer base.

- Standardized Service: Guests often prefer the predictability of service and amenities offered by chain hotels, ensuring a consistent travel experience.

The Luxury Hotels segment also commands a significant presence, attracting affluent travelers and contributing substantially to tourism revenue. Brands like Divan Group and Kaya Hotels & Resorts are key players in this segment, offering bespoke experiences and premium facilities. While Independent Hotels offer unique charm and local experiences, their market share is gradually being influenced by the widespread appeal and operational efficiencies of larger chains. Service Apartments are gaining traction, particularly for longer stays and business travelers seeking more space and self-catering facilities. The Budget and Economy Hotels segment remains crucial for catering to a price-sensitive traveler base, ensuring broad market accessibility.

Turkey Hospitality Industry Product Developments

Product developments in the Turkey hospitality industry are increasingly focused on enhancing guest experience through technology and sustainability. Innovations include smart room functionalities, personalized digital concierge services, and AI-powered recommendation engines for local attractions and dining. Hotels are also investing in sustainable practices, such as energy-efficient systems, waste reduction programs, and the use of locally sourced materials, appealing to the environmentally conscious traveler. The competitive advantage lies in offering unique, integrated experiences that blend local culture with modern comfort and convenience, ensuring market fit for a diverse range of travelers.

Key Drivers of Turkey Hospitality Industry Growth

The growth of the Turkey hospitality industry is propelled by a multifaceted combination of factors. Technological advancements, such as the integration of AI for personalized guest services and the adoption of contactless payment and check-in systems, are enhancing operational efficiency and guest satisfaction. Economic factors, including a rising disposable income among domestic consumers and significant foreign direct investment in tourism infrastructure, are fueling demand. Government initiatives promoting tourism, such as visa facilitation for key nationalities and marketing campaigns highlighting Turkey's diverse attractions, are crucial catalysts. Furthermore, Turkey's strategic geographical location as a bridge between Europe and Asia, coupled with its rich historical and cultural heritage, continues to attract a vast number of international tourists.

Challenges in the Turkey Hospitality Industry Market

The Turkey hospitality industry faces several challenges that could impede its growth trajectory. Regulatory hurdles, including evolving licensing requirements and tax implications for foreign investors, can create uncertainty. Supply chain issues, particularly concerning the procurement of specific high-quality amenities and construction materials, can lead to project delays and increased costs. Intense competitive pressures from both established international brands and emerging local players necessitate continuous innovation and strategic differentiation. Geopolitical instability in neighboring regions can sometimes deter international travel, impacting occupancy rates. Labor shortages in skilled hospitality roles also present a significant constraint, requiring investment in training and development programs.

Emerging Opportunities in Turkey Hospitality Industry

The Turkey hospitality industry is ripe with emerging opportunities for long-term growth. Technological breakthroughs in areas like virtual reality (VR) for pre-travel experiences and the Internet of Things (IoT) for seamless hotel management present avenues for innovation. Strategic partnerships between hotel groups, airlines, and local tourism operators can create attractive package deals and enhance destination marketing. The growing trend of wellness tourism offers opportunities for developing specialized spa resorts and health-focused accommodations. Furthermore, the expansion of eco-tourism and sustainable travel initiatives aligns with global trends and can attract a dedicated segment of environmentally conscious travelers. Exploring niche markets such as medical tourism and cultural heritage tourism can also unlock significant potential.

Leading Players in the Turkey Hospitality Industry Sector

- Hilton Worldwide Holdings Inc.

- Rixos Hotels

- InterContinental Hotels Group

- Anemon

- Dedeman Hotels & Resorts International

- Divan Group

- Wyndham Hotels & Resorts Inc.

- Kaya Hotels & Resorts

- Marriott International Inc.

- Accor SA

Key Milestones in Turkey Hospitality Industry Industry

- December 2023: Choice Hotels International Inc. announced an exchange offer to acquire Wyndham Hotels & Resorts Inc. The exchange offer gives Wyndham shareholders the option to choose between receiving the consideration entirely in cash, entirely in shares, or a combination of both, with a customary proration mechanism in place. This significant M&A activity signals potential consolidation and shifts in market share within the global hospitality landscape, impacting major players and competitive strategies.

- July 2022: Accor finalized an agreement with Salter Brothers to incorporate nine Mercure hotels into its expanding portfolio. The inclusion of these nine Mercure hotels expands the Mercure brand from 44 properties to 53 in Australia. This growth solidifies Mercure's position as the largest and fastest-growing global midscale brand in the country. While this specific milestone occurred in Australia, it reflects Accor's aggressive expansion strategy and focus on the midscale segment, which has direct implications for their portfolio and strategic direction in other key markets like Turkey.

Strategic Outlook for Turkey Hospitality Industry Market

The strategic outlook for the Turkey hospitality industry is exceptionally positive, driven by its strong tourism fundamentals and a commitment to modernization. Future market potential lies in further diversification of tourism offerings, including niche segments like adventure tourism, educational tourism, and religious tourism. Strategic opportunities include leveraging digital platforms for enhanced guest engagement and loyalty programs, investing in talent development to address skill gaps, and fostering public-private partnerships to drive sustainable infrastructure projects. The industry's resilience and adaptability, coupled with ongoing global interest in Turkey as a travel destination, position it for sustained growth and profitability in the coming years. Continued focus on service excellence, innovation, and responsible tourism will be paramount for capturing long-term market share.

Turkey Hospitality Industry Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

Turkey Hospitality Industry Segmentation By Geography

- 1. Turkey

Turkey Hospitality Industry Regional Market Share

Geographic Coverage of Turkey Hospitality Industry

Turkey Hospitality Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government's Efforts to Promote Tourism and Invest in Infrastructure; Popular Destination for Tourists Impact the demand for the Hospitality Market

- 3.3. Market Restrains

- 3.3.1. Political Instability and Security Issues Led to Safety Concerns among Tourists; Fluctuations in Currency Exchange Rates Affect the Cost of Travel for International Tourists

- 3.4. Market Trends

- 3.4.1. Investment in Hotel and Tourisum Sector Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Hospitality Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hilton Worldwide Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rixos Hotels

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 InterContinental Hotels Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Anemon

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dedeman Hotels & Resorts International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Divan Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wyndham Hotels & Resorts Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kaya Hotels & Resorts **List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Marriott International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Accor SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hilton Worldwide Holdings Inc

List of Figures

- Figure 1: Turkey Hospitality Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Turkey Hospitality Industry Share (%) by Company 2025

List of Tables

- Table 1: Turkey Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Turkey Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Turkey Hospitality Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Turkey Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Turkey Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Turkey Hospitality Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Hospitality Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Turkey Hospitality Industry?

Key companies in the market include Hilton Worldwide Holdings Inc, Rixos Hotels, InterContinental Hotels Group, Anemon, Dedeman Hotels & Resorts International, Divan Group, Wyndham Hotels & Resorts Inc, Kaya Hotels & Resorts **List Not Exhaustive, Marriott International Inc, Accor SA.

3. What are the main segments of the Turkey Hospitality Industry?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Government's Efforts to Promote Tourism and Invest in Infrastructure; Popular Destination for Tourists Impact the demand for the Hospitality Market.

6. What are the notable trends driving market growth?

Investment in Hotel and Tourisum Sector Drive the Market.

7. Are there any restraints impacting market growth?

Political Instability and Security Issues Led to Safety Concerns among Tourists; Fluctuations in Currency Exchange Rates Affect the Cost of Travel for International Tourists.

8. Can you provide examples of recent developments in the market?

December 2023: Choice Hotels International Inc. announced an exchange offer to acquire Wyndham Hotels & Resorts Inc. The exchange offer gives Wyndham shareholders the option to choose between receiving the consideration entirely in cash, entirely in shares, or a combination of both, with a customary proration mechanism in place.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Hospitality Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Hospitality Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Hospitality Industry?

To stay informed about further developments, trends, and reports in the Turkey Hospitality Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence