Key Insights

The Asia-Pacific MICE (Meetings, Incentives, Conferences, and Exhibitions) business tourism market is poised for significant expansion. This growth is underpinned by a rising middle class, increased disposable incomes, and a surge in both international and domestic corporate events. The region's dynamic economies, coupled with its rich cultural tapestry and advanced infrastructure in leading hubs such as Singapore, Hong Kong, and Tokyo, position it as a premier MICE destination.

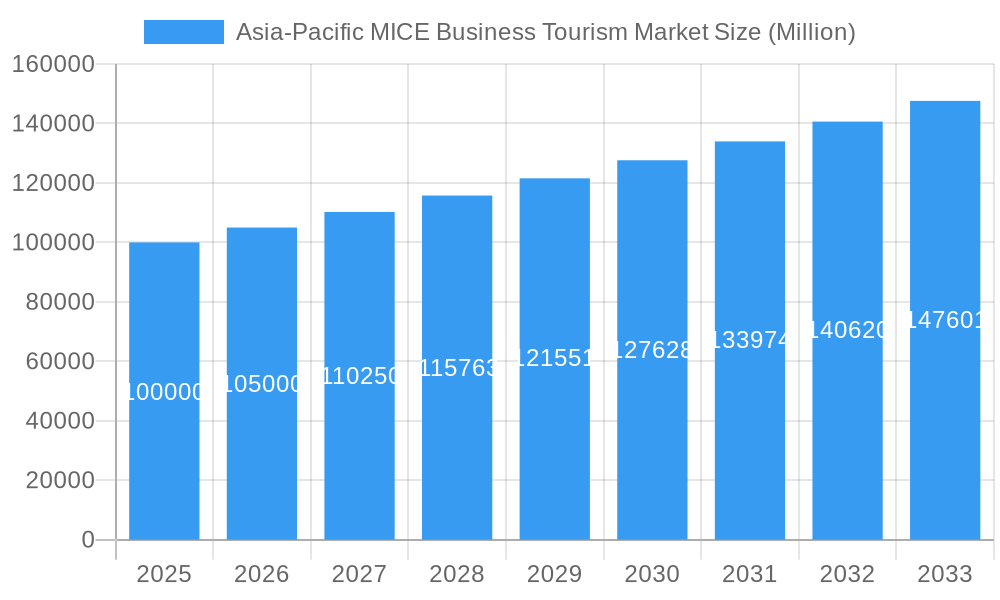

Asia-Pacific MICE Business Tourism Market Market Size (In Million)

The market is projected to reach $1226.07 billion by 2033, expanding at a compound annual growth rate (CAGR) of 10.39% from the base year 2025. This robust growth trajectory is expected to be propelled by technological innovations in event planning and management, enhanced government support for tourism infrastructure, and the increasing adoption of hybrid and virtual event solutions. These advancements, combined with a heightened focus on inter-Asia-Pacific business collaborations, innovative event technologies, and the demand for unique, experiential MICE events, will redefine the market landscape. Destinations will increasingly differentiate themselves through unique selling propositions, while sustainability will emerge as a critical factor influencing both event organizers and destination strategies. Consequently, the Asia-Pacific MICE business tourism market offers substantial opportunities for investors and stakeholders, necessitating strategic navigation of regional variations and potential economic shifts.

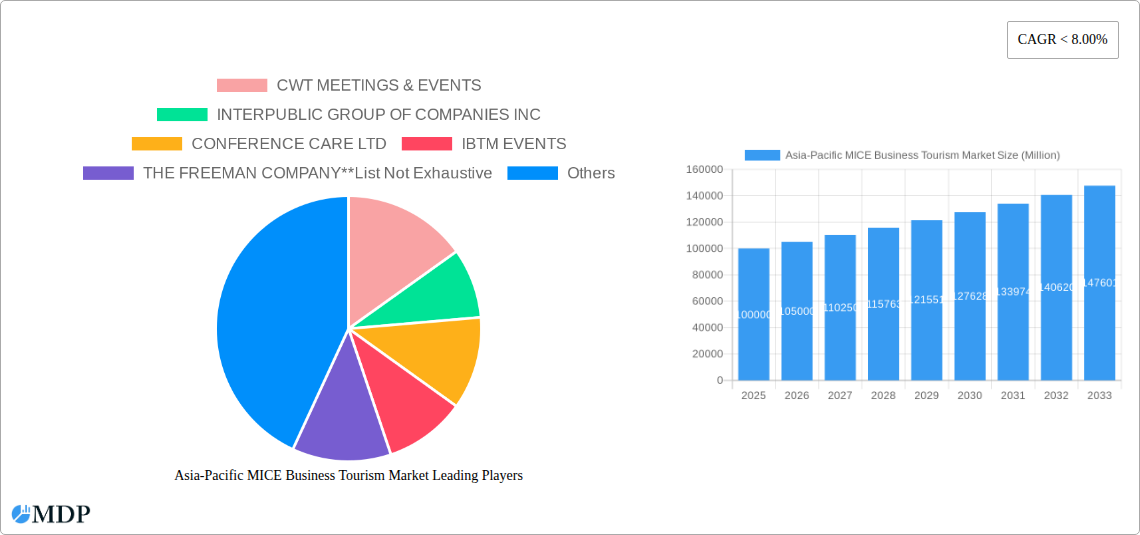

Asia-Pacific MICE Business Tourism Market Company Market Share

Asia-Pacific MICE Business Tourism Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific MICE (Meetings, Incentives, Conferences, and Exhibitions) business tourism market, offering invaluable insights for industry stakeholders, investors, and strategists. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Expect detailed market sizing (in Millions), competitive landscapes, and future growth projections.

Asia-Pacific MICE Business Tourism Market Dynamics & Concentration

The Asia-Pacific MICE market exhibits a moderately concentrated landscape, with several large players and numerous smaller specialized firms competing for market share. Market concentration is estimated at xx% in 2025, driven by the consolidation of several key players through mergers and acquisitions (M&A). Innovation is a key driver, with companies continuously introducing new technologies and services to enhance event experiences and efficiency. Stringent regulatory frameworks concerning event safety and sustainability influence market practices. The rise of virtual and hybrid events presents a significant substitute, impacting traditional MICE services. End-user trends towards sustainable and experiential events shape demand. M&A activities within the sector are expected to increase, contributing to further consolidation.

- Market Share (2025): CWT Meetings & Events (xx%), Interpublic Group of Companies Inc (xx%), BCD Meetings & Events (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx deals

- Key Innovation Drivers: Virtual/hybrid event platforms, AI-powered event management tools, sustainable event solutions.

- Regulatory Focus: Safety regulations, environmental sustainability standards.

Asia-Pacific MICE Business Tourism Market Industry Trends & Analysis

The Asia-Pacific MICE market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including rising disposable incomes, increased business travel, and the growing preference for experiential events. Technological advancements like AI and VR/AR are transforming the event landscape, offering greater personalization and engagement. Consumer preferences are shifting toward sustainable and socially responsible events. Competitive dynamics are marked by both consolidation and innovation, with large players acquiring smaller firms while startups introduce disruptive technologies. Market penetration of hybrid event solutions is steadily increasing, with xx% adoption expected by 2033.

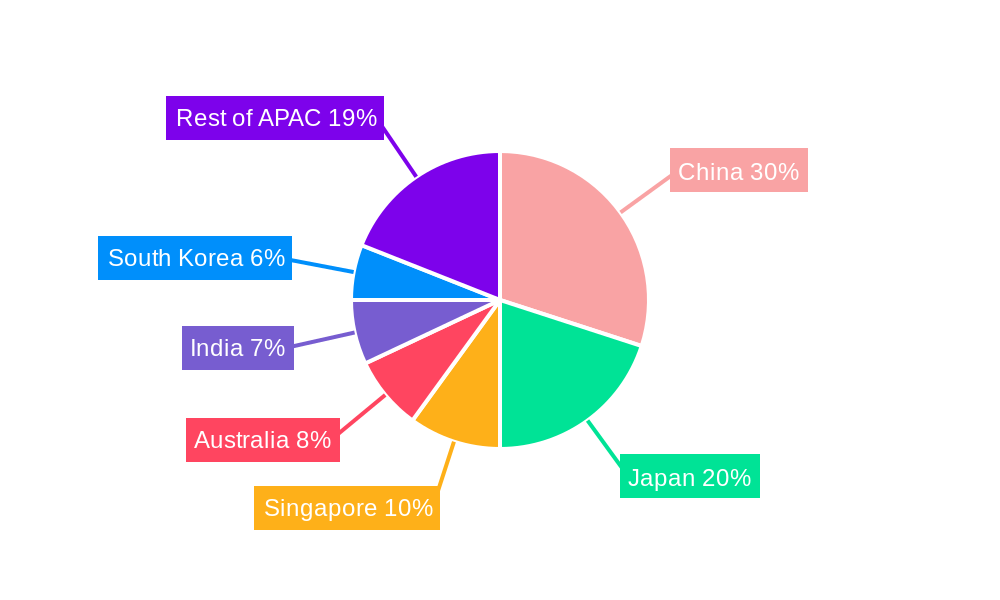

Leading Markets & Segments in Asia-Pacific MICE Business Tourism Market

China, followed by Japan, Australia, Singapore and South Korea, represent the leading markets within the Asia-Pacific MICE sector. The "Meetings" segment currently holds the largest market share, driven by a strong business environment and the need for corporate gatherings.

Key Drivers of Market Dominance:

- China: Rapid economic growth, extensive infrastructure development, and increasing business activity.

- Japan: Strong corporate culture, high levels of business travel, and well-established convention centers.

- Australia: Favorable government policies, robust tourism infrastructure, and a vibrant events calendar.

Segment Analysis:

- Meetings: Dominant segment due to high frequency of corporate events and conferences.

- Incentives: Growth potential tied to employee reward programs and team-building activities.

- Conventions: Growth driven by the expansion of industries and professional associations.

- Exhibitions: Growth influenced by trade shows and product launches.

Asia-Pacific MICE Business Tourism Market Product Developments

The market is witnessing significant product innovations, including the integration of AI-powered tools for event planning, virtual and augmented reality experiences to enhance engagement, and the development of sustainable event solutions to reduce environmental impact. These innovations are aimed at improving event efficiency, enhancing participant experiences, and addressing growing environmental concerns. The market fit for these innovative products is strong, reflecting growing demand for seamless and responsible event management.

Key Drivers of Asia-Pacific MICE Business Tourism Market Growth

Technological advancements, such as virtual and hybrid event platforms, are streamlining operations and expanding reach. Economic growth in key markets fuels increased business travel and corporate spending on events. Supportive government policies and initiatives promoting tourism boost the industry. Examples include investment in infrastructure and easing visa requirements.

Challenges in the Asia-Pacific MICE Business Tourism Market Market

Regulatory hurdles, such as complex visa processes and event licensing, can create operational challenges. Supply chain disruptions can impact event logistics and costs. Intense competition from both established players and new entrants creates pressure on pricing and profitability. The pandemic aftermath also created lasting impacts on the industry, impacting the recovery time for the industry. For example, xx Million in losses were recorded in 2020 across the region.

Emerging Opportunities in Asia-Pacific MICE Business Tourism Market

The integration of emerging technologies like AI and blockchain for enhanced security and efficiency presents substantial opportunities. Strategic partnerships between MICE companies and technology providers can create innovative solutions. Expansion into less-penetrated markets across the region will lead to significant growth.

Leading Players in the Asia-Pacific MICE Business Tourism Market Sector

- CWT Meetings & Events

- Interpublic Group of Companies Inc

- Conference Care Ltd

- IBTM Events

- The Freeman Company

- BCD Meetings & Events

- Questex LLC

- CIEvents

- ATPI Ltd

Key Milestones in Asia-Pacific MICE Business Tourism Market Industry

- October 2021: SITE Thailand Chapter partners with TCEB to launch the SITE Thailand M&I Sustainability Advocate Project, fostering sustainable practices within the sector.

- 2022: IBTM selects Singapore as its new home, launching IBTM Asia Pacific alongside the inaugural Singapore MICE Forum (SMF) X IBTM APAC, in partnership with SACEOS. This significantly boosts Singapore's profile as a MICE hub.

Strategic Outlook for Asia-Pacific MICE Business Tourism Market Market

The Asia-Pacific MICE market holds significant long-term growth potential, driven by technological innovation, economic expansion, and evolving consumer preferences. Companies that embrace sustainability, leverage technology effectively, and build strong partnerships are best positioned to capture market share and drive future growth. Focus on hybrid event models and strategic expansion into emerging markets will be crucial for success.

Asia-Pacific MICE Business Tourism Market Segmentation

-

1. Event

- 1.1. Meeting

- 1.2. Incentive

- 1.3. Conventions

- 1.4. Exhibitions

-

2. Geography

- 2.1. India

- 2.2. China

- 2.3. Singapore

- 2.4. Thailand

- 2.5. Hong Kong

- 2.6. Malaysia

- 2.7. Japan

- 2.8. Rest of AP

Asia-Pacific MICE Business Tourism Market Segmentation By Geography

- 1. India

- 2. China

- 3. Singapore

- 4. Thailand

- 5. Hong Kong

- 6. Malaysia

- 7. Japan

- 8. Rest of AP

Asia-Pacific MICE Business Tourism Market Regional Market Share

Geographic Coverage of Asia-Pacific MICE Business Tourism Market

Asia-Pacific MICE Business Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels

- 3.3. Market Restrains

- 3.3.1. Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market

- 3.4. Market Trends

- 3.4.1. Hybrid events

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Event

- 5.1.1. Meeting

- 5.1.2. Incentive

- 5.1.3. Conventions

- 5.1.4. Exhibitions

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. India

- 5.2.2. China

- 5.2.3. Singapore

- 5.2.4. Thailand

- 5.2.5. Hong Kong

- 5.2.6. Malaysia

- 5.2.7. Japan

- 5.2.8. Rest of AP

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Singapore

- 5.3.4. Thailand

- 5.3.5. Hong Kong

- 5.3.6. Malaysia

- 5.3.7. Japan

- 5.3.8. Rest of AP

- 5.1. Market Analysis, Insights and Forecast - by Event

- 6. India Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Event

- 6.1.1. Meeting

- 6.1.2. Incentive

- 6.1.3. Conventions

- 6.1.4. Exhibitions

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. India

- 6.2.2. China

- 6.2.3. Singapore

- 6.2.4. Thailand

- 6.2.5. Hong Kong

- 6.2.6. Malaysia

- 6.2.7. Japan

- 6.2.8. Rest of AP

- 6.1. Market Analysis, Insights and Forecast - by Event

- 7. China Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Event

- 7.1.1. Meeting

- 7.1.2. Incentive

- 7.1.3. Conventions

- 7.1.4. Exhibitions

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. India

- 7.2.2. China

- 7.2.3. Singapore

- 7.2.4. Thailand

- 7.2.5. Hong Kong

- 7.2.6. Malaysia

- 7.2.7. Japan

- 7.2.8. Rest of AP

- 7.1. Market Analysis, Insights and Forecast - by Event

- 8. Singapore Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Event

- 8.1.1. Meeting

- 8.1.2. Incentive

- 8.1.3. Conventions

- 8.1.4. Exhibitions

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. India

- 8.2.2. China

- 8.2.3. Singapore

- 8.2.4. Thailand

- 8.2.5. Hong Kong

- 8.2.6. Malaysia

- 8.2.7. Japan

- 8.2.8. Rest of AP

- 8.1. Market Analysis, Insights and Forecast - by Event

- 9. Thailand Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Event

- 9.1.1. Meeting

- 9.1.2. Incentive

- 9.1.3. Conventions

- 9.1.4. Exhibitions

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. India

- 9.2.2. China

- 9.2.3. Singapore

- 9.2.4. Thailand

- 9.2.5. Hong Kong

- 9.2.6. Malaysia

- 9.2.7. Japan

- 9.2.8. Rest of AP

- 9.1. Market Analysis, Insights and Forecast - by Event

- 10. Hong Kong Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Event

- 10.1.1. Meeting

- 10.1.2. Incentive

- 10.1.3. Conventions

- 10.1.4. Exhibitions

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. India

- 10.2.2. China

- 10.2.3. Singapore

- 10.2.4. Thailand

- 10.2.5. Hong Kong

- 10.2.6. Malaysia

- 10.2.7. Japan

- 10.2.8. Rest of AP

- 10.1. Market Analysis, Insights and Forecast - by Event

- 11. Malaysia Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Event

- 11.1.1. Meeting

- 11.1.2. Incentive

- 11.1.3. Conventions

- 11.1.4. Exhibitions

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. India

- 11.2.2. China

- 11.2.3. Singapore

- 11.2.4. Thailand

- 11.2.5. Hong Kong

- 11.2.6. Malaysia

- 11.2.7. Japan

- 11.2.8. Rest of AP

- 11.1. Market Analysis, Insights and Forecast - by Event

- 12. Japan Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Event

- 12.1.1. Meeting

- 12.1.2. Incentive

- 12.1.3. Conventions

- 12.1.4. Exhibitions

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. India

- 12.2.2. China

- 12.2.3. Singapore

- 12.2.4. Thailand

- 12.2.5. Hong Kong

- 12.2.6. Malaysia

- 12.2.7. Japan

- 12.2.8. Rest of AP

- 12.1. Market Analysis, Insights and Forecast - by Event

- 13. Rest of AP Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Event

- 13.1.1. Meeting

- 13.1.2. Incentive

- 13.1.3. Conventions

- 13.1.4. Exhibitions

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. India

- 13.2.2. China

- 13.2.3. Singapore

- 13.2.4. Thailand

- 13.2.5. Hong Kong

- 13.2.6. Malaysia

- 13.2.7. Japan

- 13.2.8. Rest of AP

- 13.1. Market Analysis, Insights and Forecast - by Event

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 CWT MEETINGS & EVENTS

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 INTERPUBLIC GROUP OF COMPANIES INC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 CONFERENCE CARE LTD

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 IBTM EVENTS

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 THE FREEMAN COMPANY**List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 BCD MEETINGS AND EVENTS

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 QUESTEX LLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 CIEVENTS

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 ATPI LTD

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 CWT MEETINGS & EVENTS

List of Figures

- Figure 1: Asia-Pacific MICE Business Tourism Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific MICE Business Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 2: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 5: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 8: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 11: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 14: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 17: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 20: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 23: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 26: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 27: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific MICE Business Tourism Market?

The projected CAGR is approximately 10.39%.

2. Which companies are prominent players in the Asia-Pacific MICE Business Tourism Market?

Key companies in the market include CWT MEETINGS & EVENTS, INTERPUBLIC GROUP OF COMPANIES INC, CONFERENCE CARE LTD, IBTM EVENTS, THE FREEMAN COMPANY**List Not Exhaustive, BCD MEETINGS AND EVENTS, QUESTEX LLC, CIEVENTS, ATPI LTD.

3. What are the main segments of the Asia-Pacific MICE Business Tourism Market?

The market segments include Event, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1226.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels.

6. What are the notable trends driving market growth?

Hybrid events.

7. Are there any restraints impacting market growth?

Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market.

8. Can you provide examples of recent developments in the market?

In 2022, IBTM has selected Singapore to be the home of IBTM Asia Pacific.It will be coupled with the first edition of Singapore MICE Forum (SMF) X IBTM APAC, in partnership with Singapore Association of Convention & Exhibition Organisers & Suppliers (SACEOS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific MICE Business Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific MICE Business Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific MICE Business Tourism Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific MICE Business Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence