Key Insights

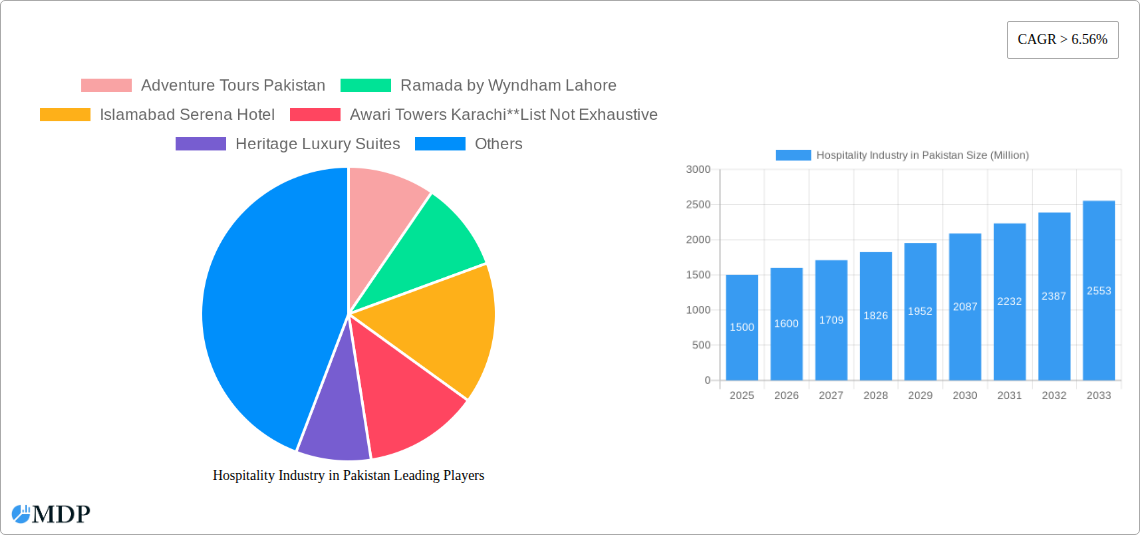

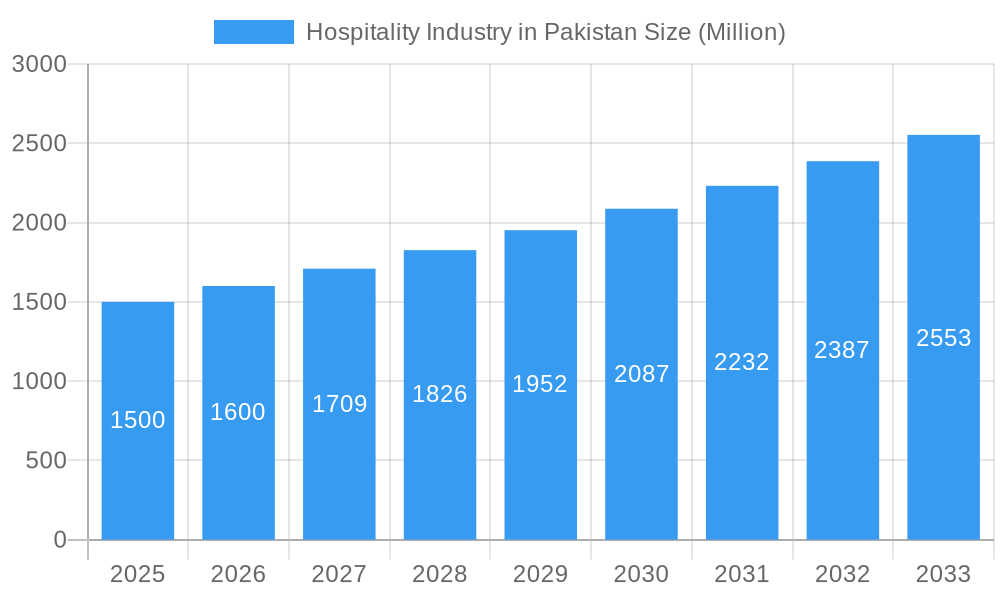

The Pakistan hospitality industry, valued at $4.26 billion in 2025, is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033. This growth trajectory is propelled by burgeoning inbound tourism, attracted by Pakistan's rich cultural heritage, diverse landscapes, and improving infrastructure. The increasing popularity of domestic tourism and the demand from budget-conscious travelers are also key drivers across all hotel segments, from economy to luxury. Government-led tourism promotion and infrastructure development initiatives are further bolstering the sector. However, the industry faces hurdles including economic volatility, potential security concerns impacting tourism flows, and a shortage of skilled hospitality professionals. The market is segmented by tourism type (inbound and outbound) and hotel category (economy, mid-scale, upper-scale, premium/luxury, and alternative accommodations). Major players like Adventure Tours Pakistan, Ramada by Wyndham Lahore, and Islamabad Serena Hotel are prominent, alongside a substantial base of independent businesses. Sustained growth will depend on addressing infrastructural deficits, enhancing security, and investing in workforce development.

Hospitality Industry in Pakistan Market Size (In Billion)

The projected market size for 2026, based on the 6.75% CAGR, is estimated to be approximately $4.54 billion (calculated from the 2025 value). This upward trend is expected to persist through the forecast period (2025-2033), with luxury segments anticipated to grow faster due to rising disposable incomes and demand for premium experiences. The "Other Hotel Types" segment, encompassing shared living spaces and serviced apartments, is also set for notable expansion, reflecting global accommodation trends. Strategic market penetration will benefit from detailed regional analysis of hotel distribution and tourism patterns. The sustained success of Pakistan's hospitality sector is contingent upon effective marketing, strategic alliances, and a steadfast commitment to enhancing service quality and the overall tourist experience.

Hospitality Industry in Pakistan Company Market Share

Pakistan Hospitality Industry Report: 2019-2033

Uncover the Untapped Potential of Pakistan's Thriving Hospitality Sector

This comprehensive report provides an in-depth analysis of the Pakistan hospitality industry, offering invaluable insights for investors, stakeholders, and industry professionals. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils the market dynamics, growth drivers, challenges, and future opportunities within this rapidly evolving sector. Discover key trends, leading players, and strategic recommendations for navigating the complexities of the Pakistani hospitality market. Expect detailed analysis on segments like inbound and outbound tourism, various hotel types (economy to luxury), and the impact of recent developments such as the Radisson Hotel Group's expansion and Valor Hospitality Partners' entry into the market. The report leverages data to project a xx Million market size by 2033.

Hospitality Industry in Pakistan Market Dynamics & Concentration

The Pakistani hospitality market, valued at xx Million in 2024, demonstrates a dynamic interplay of factors influencing its concentration and growth. Market concentration is currently moderate, with a few large players like the Karachi Marriott Hotel and Islamabad Serena Hotel commanding significant shares, but numerous smaller players, particularly in the budget and mid-scale hotel segments and tour operators such as Adventure Tours Pakistan and Sitara Travel, also contribute substantially. Innovation is driven by the adoption of technology, particularly in online booking and customer relationship management (CRM) systems. The regulatory framework, while evolving, presents both opportunities and challenges, with permits and licensing requirements impacting market entry. Product substitutes, such as Airbnb and other shared accommodation platforms, are gaining traction, particularly among budget-conscious travellers. End-user trends lean towards experiences and personalized services. The M&A landscape shows a moderate level of activity, with xx deals recorded between 2019 and 2024.

- Market Share: Major players hold approximately xx% of the market share, with the remaining xx% distributed among numerous smaller operators.

- M&A Activity: xx mergers and acquisitions recorded between 2019 and 2024.

- Innovation Drivers: Technological advancements in online booking, CRM, and personalized guest experiences.

- Regulatory Framework: Evolving regulations present both opportunities and challenges for market players.

Hospitality Industry in Pakistan Industry Trends & Analysis

Pakistan's hospitality industry exhibits robust growth potential, driven by a combination of factors. The Compound Annual Growth Rate (CAGR) from 2019-2024 was xx%, and projections indicate sustained growth, reaching a market value of xx Million by 2033. Key growth drivers include increased domestic tourism fuelled by rising disposable incomes, a growing middle class, and government initiatives to promote tourism. Technological disruptions are evident in the rise of online travel agencies (OTAs) and the increasing adoption of mobile booking platforms. Consumer preferences are shifting towards personalized experiences, unique accommodations, and sustainable tourism options. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. Market penetration of online booking systems has increased from xx% in 2019 to xx% in 2024.

Leading Markets & Segments in Hospitality Industry in Pakistan

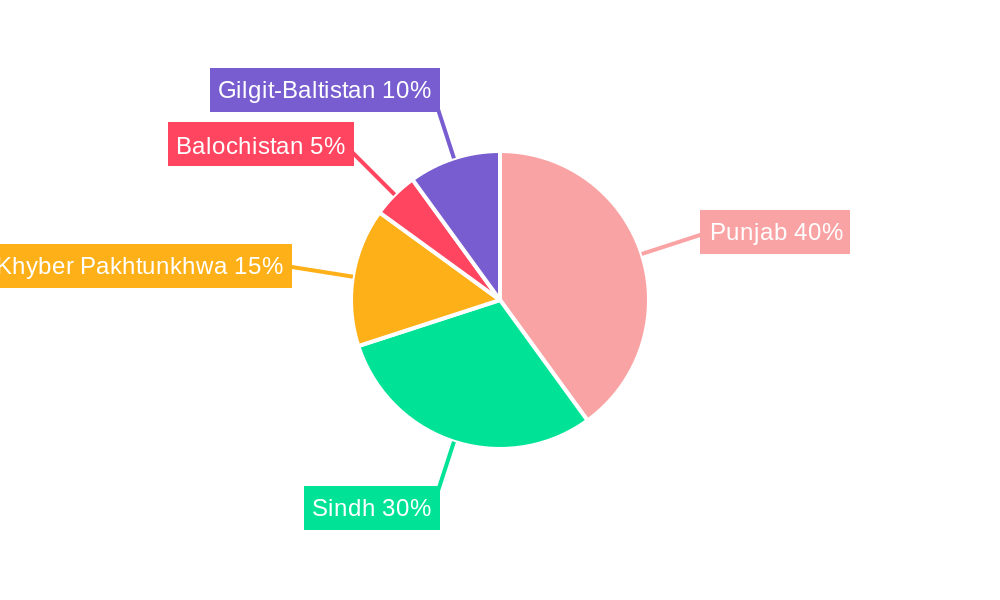

Within the Pakistan hospitality industry, several segments and regions demonstrate dominance.

- By Type of Tourism: Inbound tourism currently holds a larger market share compared to outbound tourism, driven by Pakistan’s rich cultural heritage and diverse landscapes.

- By Type of Hotel: The mid-scale hotel segment exhibits the strongest growth, driven by increased affordability and growing demand from both business and leisure travelers. Premium and luxury hotels also contribute significantly to overall revenue. The economy and budget hotel segments cater to a large market segment, especially domestic tourists.

Key Drivers:

- Economic Policies: Government initiatives to promote tourism and improve infrastructure play a crucial role.

- Infrastructure Development: Investments in transportation, communication, and accommodation facilities are instrumental in driving growth.

- Cultural Heritage: Pakistan's rich cultural heritage and natural beauty attract both domestic and international tourists.

Hospitality Industry in Pakistan Product Developments

Recent product innovations in the Pakistani hospitality sector are focused on enhancing guest experience through technological integration. This includes the adoption of smart room technology, personalized services enabled by CRM systems, and improved online booking platforms. The market is witnessing a surge in eco-friendly and sustainable practices, catering to environmentally conscious travelers. These developments aim to enhance operational efficiency and offer competitive advantages.

Key Drivers of Hospitality Industry in Pakistan Growth

Several factors fuel the growth of Pakistan's hospitality industry. Firstly, the rising disposable income of the middle class boosts domestic tourism. Secondly, government initiatives aimed at improving infrastructure and promoting tourism create a positive environment. Finally, technological advancements, like online booking platforms, enhance accessibility and efficiency. These factors combine to create a dynamic and expanding market.

Challenges in the Hospitality Industry in Pakistan Market

Despite the growth potential, several challenges hinder the industry's progress. These include infrastructural limitations in certain regions, security concerns affecting tourist confidence, and sometimes inconsistent regulatory frameworks. The lack of skilled manpower and seasonal fluctuations in tourist arrivals also pose challenges. Addressing these issues is crucial for sustainable growth.

Emerging Opportunities in Hospitality Industry in Pakistan

The future holds significant growth opportunities. Strategic partnerships between international and local hospitality chains, investment in sustainable tourism practices, and leveraging technology for enhanced customer experiences are key focus areas. Further development of tourism infrastructure and the promotion of niche segments like adventure tourism can unlock substantial growth potential.

Leading Players in the Hospitality Industry in Pakistan Sector

- Adventure Tours Pakistan

- Ramada by Wyndham Lahore

- Islamabad Serena Hotel

- Awari Towers Karachi

- Heritage Luxury Suites

- Karachi Marriott Hotel

- Pearl Continental

- Pakistan Tours Limited

- Sitara Travel

- Rakaposhi Tours (Pvt) Ltd

- Zeb Travels

- Movenpick Hotel Karachi

- Cox & Kings Pakistan (Pvt) Ltd

- Click Pakistan

Key Milestones in Hospitality Industry in Pakistan Industry

- March 2023: Radisson Hotel Group announced two new hotels in Islamabad (Radisson Blu Hotel & Residences – 432 rooms/suites/apartments; Radisson Hotel Islamabad Multi Gardens – 165 rooms), signifying its commitment to the South Asian market.

- February 2023: Valor Hospitality Partners began operating the Hyatt Regency Lahore DHA, marking its entry into Southwest Asia.

Strategic Outlook for Hospitality Industry in Pakistan Market

The Pakistan hospitality market presents significant long-term growth potential. By focusing on strategic partnerships, sustainable tourism initiatives, and technological advancements, the industry can capitalize on the increasing demand for travel and hospitality services. The development of niche tourism segments and improvements in infrastructure will play a key role in shaping the future of this dynamic sector.

Hospitality Industry in Pakistan Segmentation

-

1. Type of Tourism

- 1.1. Inbound Tourism

- 1.2. Outbound Tourism

-

2. Type of Hotel

- 2.1. Economy and Budget Hotels

- 2.2. Mid-Scale Hotels

- 2.3. Upper Scale Hotels

- 2.4. Premium and Luxury Hotels

- 2.5. Other Ty

Hospitality Industry in Pakistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Pakistan Regional Market Share

Geographic Coverage of Hospitality Industry in Pakistan

Hospitality Industry in Pakistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels

- 3.3. Market Restrains

- 3.3.1. Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market

- 3.4. Market Trends

- 3.4.1. Rising Inbound Tourism

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 5.1.1. Inbound Tourism

- 5.1.2. Outbound Tourism

- 5.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 5.2.1. Economy and Budget Hotels

- 5.2.2. Mid-Scale Hotels

- 5.2.3. Upper Scale Hotels

- 5.2.4. Premium and Luxury Hotels

- 5.2.5. Other Ty

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 6. North America Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 6.1.1. Inbound Tourism

- 6.1.2. Outbound Tourism

- 6.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 6.2.1. Economy and Budget Hotels

- 6.2.2. Mid-Scale Hotels

- 6.2.3. Upper Scale Hotels

- 6.2.4. Premium and Luxury Hotels

- 6.2.5. Other Ty

- 6.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 7. South America Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 7.1.1. Inbound Tourism

- 7.1.2. Outbound Tourism

- 7.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 7.2.1. Economy and Budget Hotels

- 7.2.2. Mid-Scale Hotels

- 7.2.3. Upper Scale Hotels

- 7.2.4. Premium and Luxury Hotels

- 7.2.5. Other Ty

- 7.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 8. Europe Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 8.1.1. Inbound Tourism

- 8.1.2. Outbound Tourism

- 8.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 8.2.1. Economy and Budget Hotels

- 8.2.2. Mid-Scale Hotels

- 8.2.3. Upper Scale Hotels

- 8.2.4. Premium and Luxury Hotels

- 8.2.5. Other Ty

- 8.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 9. Middle East & Africa Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 9.1.1. Inbound Tourism

- 9.1.2. Outbound Tourism

- 9.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 9.2.1. Economy and Budget Hotels

- 9.2.2. Mid-Scale Hotels

- 9.2.3. Upper Scale Hotels

- 9.2.4. Premium and Luxury Hotels

- 9.2.5. Other Ty

- 9.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 10. Asia Pacific Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 10.1.1. Inbound Tourism

- 10.1.2. Outbound Tourism

- 10.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 10.2.1. Economy and Budget Hotels

- 10.2.2. Mid-Scale Hotels

- 10.2.3. Upper Scale Hotels

- 10.2.4. Premium and Luxury Hotels

- 10.2.5. Other Ty

- 10.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Adventure Tours Pakistan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ramada by Wyndham Lahore

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Islamabad Serena Hotel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Awari Towers Karachi**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Heritage Luxury Suites

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Karachi Marriott Hotel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pearl Continental

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pakistan Tours Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sitara Travel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rakaposhi Tours (Pvt) Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zeb Travels

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Movenpick Hotel Karachi

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Cox & Kings Pakistan (Pvt) Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Click Pakistan

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Adventure Tours Pakistan

List of Figures

- Figure 1: Global Hospitality Industry in Pakistan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 3: North America Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 4: North America Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 5: North America Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 6: North America Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 9: South America Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 10: South America Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 11: South America Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 12: South America Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 15: Europe Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 16: Europe Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 17: Europe Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 18: Europe Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 2: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 3: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 5: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 6: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 11: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 12: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 17: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 18: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 29: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 30: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 38: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 39: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Pakistan?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Hospitality Industry in Pakistan?

Key companies in the market include Adventure Tours Pakistan, Ramada by Wyndham Lahore, Islamabad Serena Hotel, Awari Towers Karachi**List Not Exhaustive, Heritage Luxury Suites, Karachi Marriott Hotel, Pearl Continental, Pakistan Tours Limited, Sitara Travel, Rakaposhi Tours (Pvt) Ltd, Zeb Travels, Movenpick Hotel Karachi, Cox & Kings Pakistan (Pvt) Ltd, Click Pakistan.

3. What are the main segments of the Hospitality Industry in Pakistan?

The market segments include Type of Tourism, Type of Hotel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.26 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels.

6. What are the notable trends driving market growth?

Rising Inbound Tourism.

7. Are there any restraints impacting market growth?

Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market.

8. Can you provide examples of recent developments in the market?

March 2023: Radisson Hotel Group announced the signing of two new hotels in Islamabad, Pakistan, with a commitment to expanding its footprint in the South Asian market. The two new hotels, Radisson Blu Hotel & Residences (consisting of 432 rooms, suites, and serviced apartments) and Radisson Hotel Islamabad Multi Gardens, include 165 rooms, including four executive suites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Pakistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Pakistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Pakistan?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Pakistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence