Key Insights

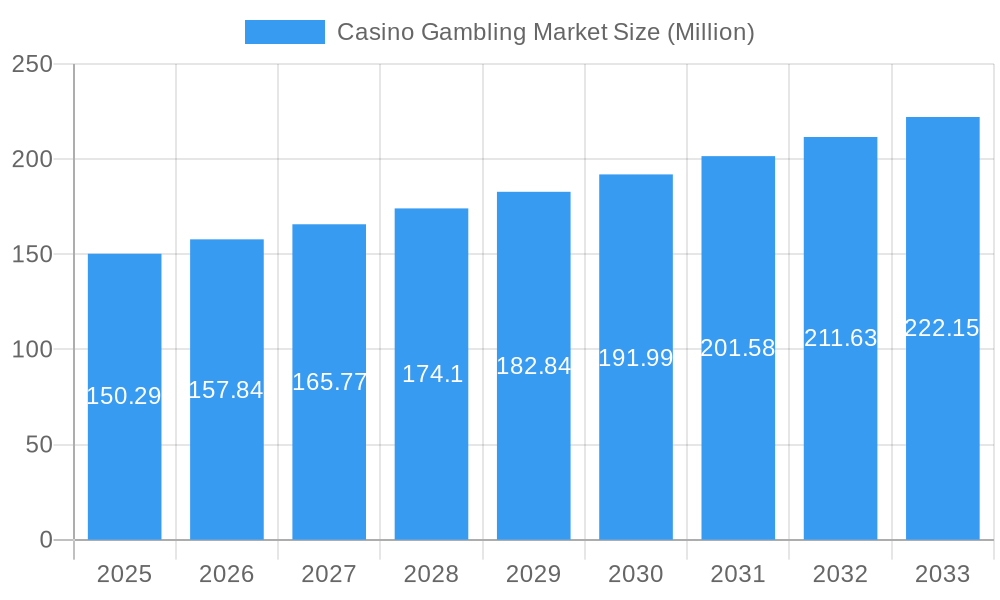

The global Casino Gambling Market is poised for substantial growth, projected to reach an impressive $150.29 million in value. This expansion is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.95% throughout the study period of 2019-2033, with the base year of 2025 serving as a crucial benchmark. The industry is experiencing dynamic shifts driven by several key factors. A primary driver is the increasing disposable income and leisure spending across emerging economies, coupled with the growing adoption of online and mobile gambling platforms, which offer unparalleled convenience and accessibility. Technological advancements, such as the integration of Artificial Intelligence (AI) in personalization and enhanced security measures, are further bolstering player engagement and trust. The expansion of integrated resorts and the increasing popularity of live dealer games, which replicate the authentic casino experience, are also significant contributors to market expansion.

Casino Gambling Market Market Size (In Million)

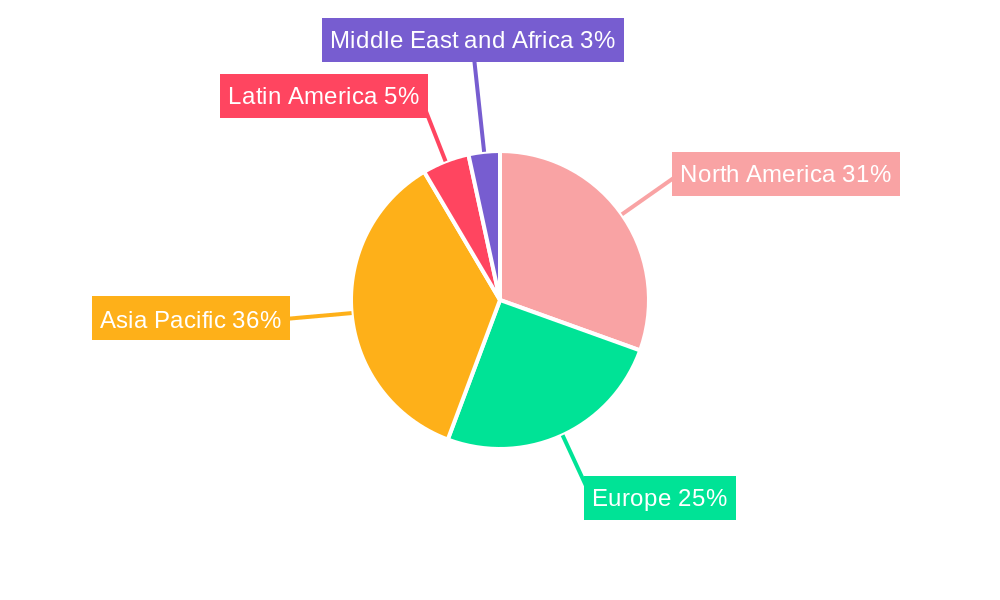

The market segmentation reveals a diverse landscape, with live casino offerings, including Baccarat and Blackjack, showing robust demand. Poker continues to hold its appeal for strategic players, while slot machines remain a perennial favorite due to their simplicity and high entertainment value. The "Others Casino Games" segment also reflects the constant innovation and introduction of new game formats. Geographically, the Asia Pacific region is anticipated to be a dominant force, driven by the rapid growth of casino tourism and the burgeoning middle class in countries like Macau and Singapore. North America and Europe represent mature markets with a consistent, albeit slower, growth trajectory, benefiting from established infrastructure and a strong existing player base. While the market is robust, potential restraints include evolving regulatory landscapes in different jurisdictions, concerns surrounding responsible gambling, and the cyclical nature of the entertainment industry, which can be influenced by economic downturns.

Casino Gambling Market Company Market Share

Unleash Lucrative Opportunities: In-depth Casino Gambling Market Report (2019-2033)

Dive deep into the burgeoning global Casino Gambling Market with this comprehensive, SEO-optimized report. Covering a critical study period from 2019 to 2033, with 2025 as the base and estimated year, this report offers an unparalleled analysis for industry stakeholders, investors, and decision-makers. Explore the dynamic landscape of online casino games, live dealer casinos, and land-based casinos, uncovering key gambling industry trends, market growth drivers, and emerging opportunities. Whether you're interested in slots, blackjack, poker, or baccarat, this report provides actionable insights and data-driven predictions to capitalize on the industry's exponential growth.

Casino Gambling Market Market Dynamics & Concentration

The Casino Gambling Market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Key companies such as Las Vegas Sands, MGM Resorts International, Caesars Entertainment, and Genting Group consistently lead the market through strategic acquisitions and expansions. Innovation is a primary driver, fueled by the integration of cutting-edge technologies like AI, VR, and blockchain to enhance player experience and security. Regulatory frameworks remain a critical factor, with varying legal landscapes across different jurisdictions influencing market entry and operational strategies. The proliferation of online platforms has also increased the threat of substitutes, with esports and fantasy sports gaining traction. End-user preferences are shifting towards more personalized and immersive gaming experiences, driving demand for live dealer options and mobile-friendly interfaces. Mergers and acquisitions (M&A) activities are prevalent, with recent deals indicating a consolidation trend and a focus on expanding digital footprints. For instance, the MGM Resorts International acquisition of Push Gaming Holding Limited in May 2023 exemplifies this trend, aimed at bolstering digital content capabilities. The overall M&A deal count is projected to remain robust throughout the forecast period, reflecting the industry's ongoing evolution.

Casino Gambling Market Industry Trends & Analysis

The global Casino Gambling Market is experiencing robust expansion, propelled by a confluence of factors including increasing disposable incomes, rising popularity of online gambling platforms, and technological advancements. The CAGR for this market is estimated to be in the high single digits, demonstrating a consistent upward trajectory. Market penetration is deepening across both developed and emerging economies, with a significant shift towards digital channels. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) for personalized player experiences, Virtual Reality (VR) for immersive gameplay, and blockchain technology for enhanced security and transparency in transactions. These innovations are not only attracting new demographics but also retaining existing players by offering more engaging and dynamic gaming environments. Consumer preferences are evolving rapidly, with a growing demand for convenience, accessibility, and social interaction. Live casino games, offering real-time interaction with dealers and other players, have witnessed a surge in popularity, contributing significantly to overall market growth. Furthermore, the gamification of traditional casino offerings and the development of sophisticated mobile applications are making casino gambling more accessible and appealing to a wider audience. Competitive dynamics are intense, with operators constantly innovating to differentiate themselves and capture market share. Strategic partnerships between technology providers and casino operators are becoming increasingly common, fostering a collaborative ecosystem that drives product development and market reach. The continued legalization and regulation of online gambling in various regions are further fueling market growth by providing a legitimate and secure environment for players.

Leading Markets & Segments in Casino Gambling Market

The Casino Gambling Market is segmented by type, with Slots currently holding the largest market share due to their widespread appeal and accessibility across both online and land-based casinos. The simplicity of gameplay and the potential for high payouts make them a perennial favorite for a broad demographic. Live Casino games are experiencing the most rapid growth, driven by the increasing demand for authentic casino experiences delivered remotely. The interactive nature of live dealer games, featuring real dealers and multi-player interaction, closely mimics the thrill of a physical casino, thereby attracting a significant user base. Baccarat and Blackjack remain core offerings, particularly in high-stakes gaming and Asian markets, demonstrating consistent revenue generation. Poker, while more skill-based, continues to attract a dedicated player base, with a growing online community and lucrative tournament circuits contributing to its sustained presence.

Key drivers for the dominance of these segments include:

- Technological Advancements: The proliferation of high-speed internet and mobile devices has been instrumental in the growth of online slots and live casino games, enabling seamless streaming and interactive gameplay.

- Economic Policies & Regulations: Favorable regulatory environments in key regions, such as the Asia-Pacific (especially Macau) and North America, have significantly boosted the revenue streams for land-based and online casino operations. Government initiatives aimed at promoting tourism and entertainment also indirectly support the casino industry.

- Infrastructure Development: Investment in modern casino resorts and integrated entertainment complexes, particularly in regions like Asia, has attracted high-roller segments and casual gamblers alike, bolstering the performance of all casino game types.

- Consumer Preferences: The convenience of playing anytime, anywhere, has propelled the popularity of online slots and live dealer games. Simultaneously, the social and competitive aspects of poker and the strategic appeal of blackjack and baccarat continue to sustain their appeal.

The Asia-Pacific region, particularly Macau, remains a dominant force in the global casino market, driven by its status as a major gambling hub and strong economic growth. North America, with the established markets of Las Vegas and the burgeoning online gambling sector in various US states, also represents a significant and growing market. The ongoing expansion of online gambling regulations in Europe further solidifies its position as a key market.

Casino Gambling Market Product Developments

Product developments in the Casino Gambling Market are heavily focused on enhancing player engagement and expanding accessibility. Innovations in live dealer technology are creating more immersive and interactive experiences, with advanced streaming capabilities and engaging dealers. The development of new slot game mechanics and themes caters to diverse player preferences, incorporating advanced graphics and bonus features. Furthermore, the integration of mobile-first design principles ensures seamless gameplay across all devices, widening the reach of casino products. Blockchain technology is being explored for secure and transparent transactions, building player trust. These developments are crucial for maintaining a competitive edge and attracting a wider audience to the online casino and live casino sectors.

Key Drivers of Casino Gambling Market Growth

The Casino Gambling Market is propelled by several key drivers. Technologically, the increasing adoption of smartphones and high-speed internet facilitates the growth of online casino gambling, including live casino games. Economically, rising disposable incomes and a growing middle class in emerging markets are increasing consumer spending on entertainment, including gambling. Regulatory shifts, with more jurisdictions legalizing and regulating online gambling, provide a more secure and accessible environment, thereby encouraging market expansion. The demand for immersive and interactive gaming experiences continues to drive innovation in game development, particularly in slots and live dealer formats.

Challenges in the Casino Gambling Market Market

Despite robust growth, the Casino Gambling Market faces significant challenges. Stringent and evolving regulatory frameworks across different regions can create compliance hurdles and limit market entry. The intense competition among operators, coupled with the threat of new entrants, puts pressure on profit margins. Supply chain issues, though less prominent in the digital realm, can impact the development and deployment of physical casino infrastructure and technology. Responsible gambling concerns and the potential for addiction necessitate continuous investment in player protection measures, which can add to operational costs. Furthermore, the perception of gambling as a vice in some societal segments can also act as a restraint on market expansion.

Emerging Opportunities in Casino Gambling Market

Emerging opportunities in the Casino Gambling Market are abundant, driven by technological breakthroughs and evolving consumer behavior. The continued expansion of live casino offerings, incorporating new game variants and enhanced interactivity, presents a significant growth avenue. Advancements in Virtual Reality (VR) and Augmented Reality (AR) are poised to revolutionize the player experience, creating truly immersive casino games. Strategic partnerships between established casino operators and innovative technology providers are fostering the development of unique gaming platforms and expanding market reach. The increasing legalization of online gambling in new territories, particularly in North America and Asia, opens up vast untapped markets for online casino operators and game developers.

Leading Players in the Casino Gambling Market Sector

- Caesars Entertainment

- Melco Resorts & Entertainment

- SJM Holdings

- Las Vegas Sands

- Genting Group

- Wynn Resorts

- Boyd Gaming

- Galaxy Entertainment Group

- MGM Resorts International

- Hard Rock International

Key Milestones in Casino Gambling Market Industry

- May 2023: MGM Resorts International announced the acquisition of most game developer Push Gaming Holding Limited and its subsidiaries by its wholly owned subsidiary, LeoVegas. This is Leo Vegas' first significant investment since joining MGM Resorts last year. Push Gaming's patented technology, intellectual property, and development experience are expected to strengthen LeoVegas' content creation capabilities and assist its expansion objectives.

- April 2023: Caesars Entertainment, Inc. has announced the reopening of Tropicana Online Casino in New Jersey. The new iCasino app and online casino experience provide users with greater functionality, including a selection of industry-leading casino games and improved connectivity with Caesars Rewards, the industry-leading reward program.

Strategic Outlook for Casino Gambling Market Market

The strategic outlook for the Casino Gambling Market is exceptionally positive, driven by sustained innovation and expanding market access. The continued growth of online casino gambling and live dealer games will remain a primary growth accelerator, catering to the demand for convenience and immersive experiences. Strategic investments in cutting-edge technologies like AI, VR, and blockchain are expected to further enhance player engagement and operational efficiency. The ongoing legalization and regulatory clarity in key global markets present significant opportunities for market expansion and increased revenue generation. Companies that focus on personalized player experiences, responsible gaming initiatives, and strategic partnerships will be best positioned to capitalize on the immense future potential of this dynamic industry.

Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Casino Games

Casino Gambling Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Casino Gambling Market Regional Market Share

Geographic Coverage of Casino Gambling Market

Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness

- 3.4. Market Trends

- 3.4.1. Growing Online Gambling Trends Is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Casino Games

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Casino Games

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Casino Games

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Casino Games

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Others Casino Games

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Others Casino Games

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caesars Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melco Resorts & Entertainment**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SJM Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Las Vegas Sands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genting Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wynn Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boyd Gaming

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Galaxy Entertainment Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MGM Resorts International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hard Rock International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caesars Entertainment

List of Figures

- Figure 1: Global Casino Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Casino Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino Gambling Market?

The projected CAGR is approximately 4.95%.

2. Which companies are prominent players in the Casino Gambling Market?

Key companies in the market include Caesars Entertainment, Melco Resorts & Entertainment**List Not Exhaustive, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, Hard Rock International.

3. What are the main segments of the Casino Gambling Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Online Gambling Trends Is Driving The Market.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness.

8. Can you provide examples of recent developments in the market?

May 2023: MGM Resorts International announced the acquisition of most game developer Push Gaming Holding Limited and its subsidiaries by its wholly owned subsidiary, LeoVegas. This is Leo Vegas' first significant investment since joining MGM Resorts last year. Push Gaming's patented technology, intellectual property, and development experience are expected to strengthen LeoVegas' content creation capabilities and assist its expansion objectives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence